Global Notebook Batteries Market Size, Share, Growth Analysis By Type (Ni-Cd Battery, Ni-MH Battery, Li-ion Battery, Li-polymer Battery), By Application (Notebook Laptop, Gaming Laptop, Mobile Workstation Laptop), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171509

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

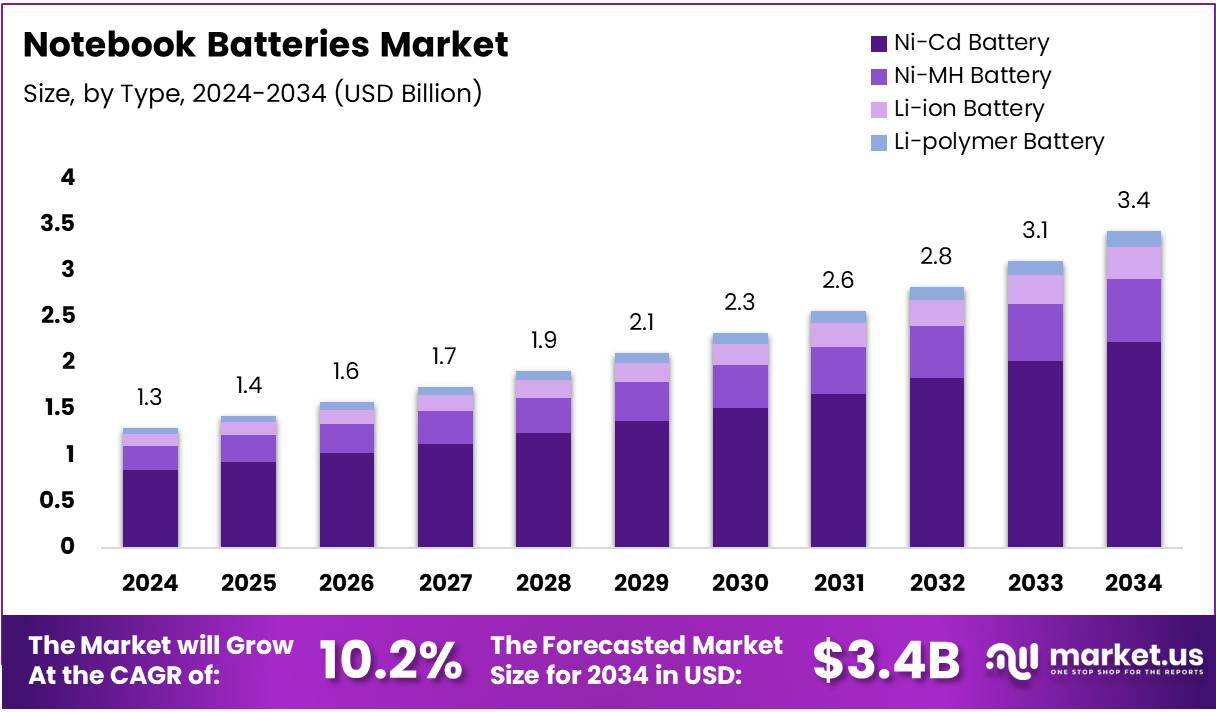

The Global Notebook Batteries Market size is expected to be worth around USD 3.4 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034.

The Notebook batteries market represents a critical component sector serving the global laptop ecosystem. These rechargeable power units enable portable computing experiences for professionals, students, and consumers. Moreover, technological advancements continuously reshape product specifications. Battery chemistry innovations, including lithium-ion and lithium-polymer variants, drive performance improvements while addressing safety concerns and environmental sustainability.

Market dynamics reveal significant growth trajectories fueled by remote work proliferation and digital transformation initiatives. Furthermore, the increasing adoption of ultrabooks and gaming notebooks creates diverse demand patterns. Premium segments particularly emphasize extended battery life capabilities. Educational institutions and corporate enterprises represent substantial procurement channels, thereby generating consistent replacement demand alongside new device purchases.

Government regulations increasingly influence market development through environmental compliance standards and recycling mandates. Consequently, manufacturers invest heavily in sustainable production processes and circular economy initiatives. Extended Producer Responsibility programs mandate proper disposal mechanisms. Additionally, safety certifications ensure consumer protection against thermal incidents. These regulatory frameworks simultaneously create compliance costs while opening opportunities for eco-friendly innovations.

Investment trends demonstrate heightened focus on next-generation battery technologies, including solid-state alternatives and fast-charging capabilities. Therefore, research and development expenditures accelerate across the value chain. Strategic partnerships between battery manufacturers and laptop OEMs foster integrated design approaches. Subsequently, performance optimization becomes achievable through hardware-software synergy, enhancing overall user satisfaction and brand differentiation.

Consumer preferences fundamentally shape market evolution, with battery longevity emerging as a decisive purchase factor. Notably, technical specifications reveal that typical laptop batteries sustain functionality between 300-500 charge cycles, translating to 2-5 years of operational life. Industry data indicates over 65% of laptop buyers prioritize battery life above other features. Average expectations now reach 10-12 hours of real-world usage, while premium segment buyers demand 16+ hours. Current laptop models deliver approximately 10 hours average operating time, with charging durations averaging 1.68 hours. These metrics underscore the competitive imperative for manufacturers to deliver superior endurance specifications.

Key Takeaways

- The global notebook batteries market is projected to grow from USD 1.3 Billion in 2024 to USD 3.4 Billion by 2034, registering a CAGR of 10.2%.

- By type, the Ni-Cd Battery segment leads the market with a dominant share of 65.3% in 2024.

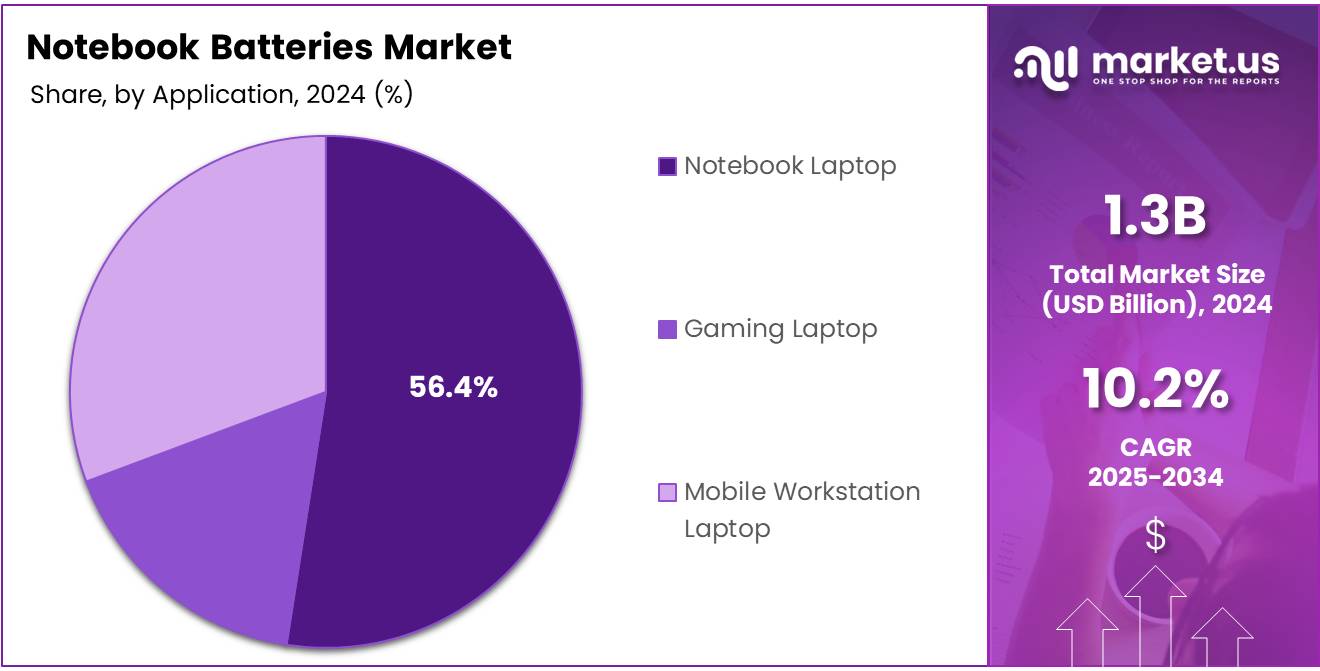

- By application, Notebook Laptops account for the largest share at 56.4% of total market demand in 2024.

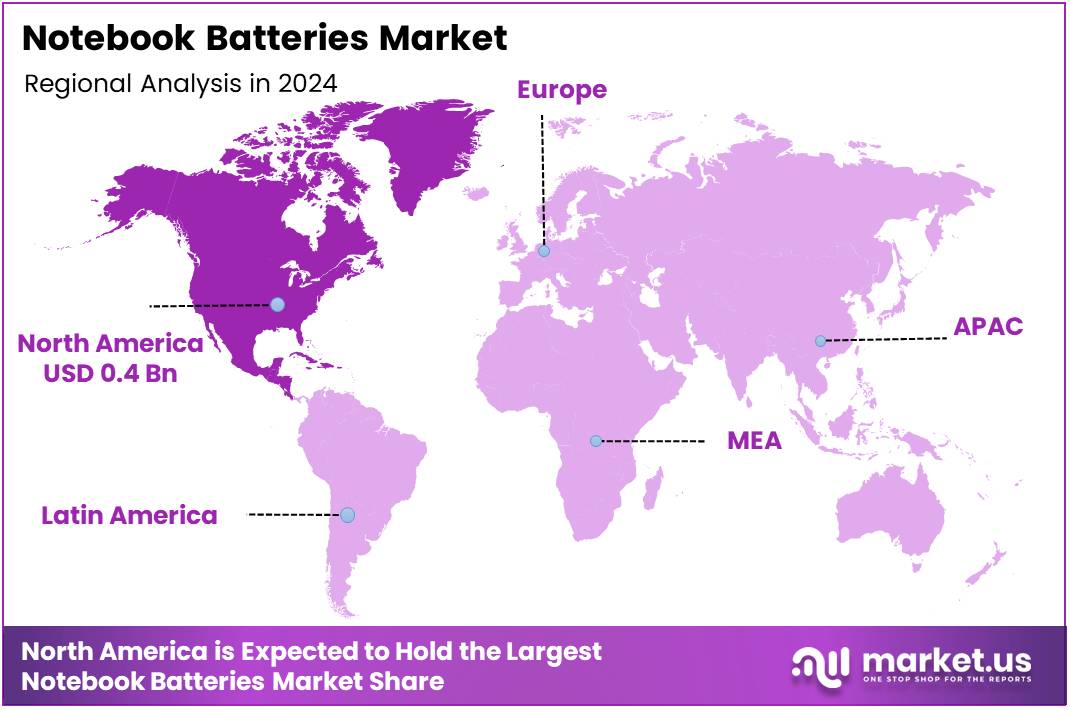

- Regionally, North America dominates with a 36.5% market share, valued at USD 0.4 Billion in 2024.

By Type Analysis

Ni-Cd Battery dominates with 65.3% due to its proven reliability and established manufacturing infrastructure.

In 2024, Ni-Cd Battery held a dominant market position in the By Type Analysis segment of Notebook Batteries Market, with a 65.3% share. This commanding presence stems from decades of refinement in production techniques and widespread consumer trust. Manufacturers prefer Ni-Cd batteries for their consistent performance across varying temperature conditions and exceptional durability during charge-discharge cycles. Additionally, the technology offers cost advantages that appeal to budget-conscious consumers and bulk purchasers in emerging markets.

Ni-MH Battery represents an environmentally conscious alternative gaining traction among sustainability-focused manufacturers. These batteries deliver improved energy density compared to Ni-Cd variants while eliminating toxic cadmium content. However, higher production costs and sensitivity to storage conditions limit broader adoption. Nevertheless, regulatory pressures regarding hazardous materials continue driving gradual market share expansion for this cleaner technology.

Li-ion Battery technology showcases superior energy-to-weight ratios that attract premium notebook manufacturers. These batteries enable sleeker device designs while extending operational runtime between charges. Despite higher initial costs, declining lithium prices and manufacturing economies of scale steadily improve market competitiveness. Furthermore, ongoing research into enhanced thermal management systems addresses safety concerns that previously hindered widespread acceptance.

Li-polymer Battery offers unmatched design flexibility through its malleable form factor and lightweight construction. This segment serves niche ultra-portable notebook categories where space optimization remains paramount. Although production complexity maintains premium pricing, growing consumer demand for thinner devices gradually expands market opportunities. Moreover, superior discharge characteristics benefit high-performance applications requiring sustained power delivery.

By Application Analysis

Notebook Laptop dominates with 56.4% due to widespread corporate adoption and educational institution demand.

In 2024, Notebook Laptop held a dominant market position in the By Application Analysis segment of Notebook Batteries Market, with a 56.4% share. This substantial dominance reflects the universal requirement for portable computing across business, education, and personal productivity sectors. Organizations prioritize reliable battery performance to support remote work arrangements and mobile business operations. Consequently, standardized battery specifications across mainstream notebooks drive bulk purchasing and replacement demand that sustains market leadership.

Gaming Laptop applications demand high-capacity batteries capable of sustaining intensive graphics processing and processor loads. These specialized devices require advanced thermal management and rapid charging capabilities that distinguish them from conventional notebooks. Although representing a smaller market segment, gaming laptops command premium pricing that attracts battery manufacturers seeking higher profit margins. Furthermore, enthusiast communities drive continuous innovation in battery longevity and performance optimization.

Mobile Workstation Laptop serves professional users requiring desktop-class performance in portable formats for engineering, design, and content creation applications. These systems necessitate robust batteries supporting extended operation of powerful processors and dedicated graphics cards. Consequently, manufacturers develop specialized high-capacity solutions balancing weight considerations against runtime requirements. Additionally, enterprise procurement cycles generate steady replacement demand supporting consistent segment growth.

Key Market Segments

By Type

- Ni-Cd Battery

- Ni-MH Battery

- Li-ion Battery

- Li-polymer Battery

By Application

- Notebook Laptop

- Gaming Laptop

- Mobile Workstation Laptop

Drivers

Continued Growth in Remote Work and Mobile Computing Usage Drives Market Expansion

The notebook batteries market is experiencing strong momentum due to the sustained rise in remote work and hybrid work arrangements. As more professionals work from home or flexible locations, the demand for reliable portable computing devices has increased significantly. This shift has made battery performance a critical factor for users who need all-day computing power without constant access to electrical outlets.

Digital education has emerged as another powerful driver for the market. Schools, colleges, and universities worldwide have adopted online learning platforms, requiring students to use notebooks for extended hours. This trend has created consistent demand for high-quality batteries that can support lengthy virtual classes and study sessions without interruption.

Original equipment manufacturers are responding by prioritizing battery life as a key selling point. Companies now compete on how many hours their devices can run on a single charge. This focus has pushed manufacturers to invest in better battery technology and more efficient power management systems.

The enterprise segment continues to expand as businesses upgrade their IT infrastructure. Organizations are purchasing notebooks in bulk for their workforce, driving steady shipment volumes. Meanwhile, consumer demand remains robust as people replace older devices with newer models offering improved battery performance and longer lifespan.

Restraints

Tightening Lithium-Ion Safety and Compliance Requirements Limit Market Flexibility

The notebook batteries market faces significant challenges from increasingly strict safety regulations. Lithium-ion batteries, while efficient, carry inherent safety risks including overheating and fire hazards. Regulatory bodies worldwide have implemented stringent testing and certification requirements that manufacturers must meet before bringing products to market. These compliance processes add time and cost to product development cycles.

Transport regulations present another major hurdle for the industry. Shipping lithium-ion batteries involves complex documentation and handling procedures due to their classification as hazardous materials. Airlines and shipping companies have imposed strict limitations on battery quantities and packaging standards. These restrictions increase logistics costs and complicate international supply chains for manufacturers and distributors.

Recycling compliance is becoming more demanding as governments push for environmental responsibility. Companies must now establish proper collection and recycling programs for end-of-life batteries. The costs associated with building these infrastructure systems impact profit margins, especially for smaller manufacturers.

Raw material volatility creates ongoing uncertainty for the market. Lithium, cobalt, and nickel prices fluctuate significantly based on mining output and geopolitical factors. The supply of these critical materials is concentrated in specific regions, making the market vulnerable to disruptions. When prices spike unexpectedly, manufacturers face difficult decisions about absorbing costs or passing them to consumers, either option affecting market dynamics negatively.

Growth Factors

Rising Demand for High-Energy-Density Batteries in Premium Notebooks Creates New Market Opportunities

The premium notebook segment presents substantial growth potential for battery manufacturers. Ultra-thin laptops and high-performance devices require batteries that pack more energy into smaller spaces. Consumers purchasing premium notebooks expect exceptional battery life without adding weight or thickness to their devices. This demand is pushing manufacturers to develop advanced high-energy-density battery solutions that can meet these requirements.

Circular economy models are opening new revenue streams within the industry. Battery refurbishment services allow companies to extend the life of existing batteries through reconditioning processes. This approach reduces electronic waste while providing cost-effective alternatives for budget-conscious consumers. Second-life applications for notebook batteries are also gaining traction, where retired batteries with reduced capacity find use in less demanding applications like backup power systems or energy storage.

Artificial intelligence integration in notebooks is creating demand for sophisticated battery solutions. AI-powered devices require more computational power, which increases energy consumption. However, AI-optimized power management systems can intelligently allocate resources and reduce unnecessary power drain. This trend requires batteries with advanced monitoring capabilities and communication protocols.

Manufacturers who can develop batteries specifically designed for AI workloads stand to capture significant market share. These batteries must support rapid power delivery during intensive tasks while maintaining efficiency during lighter operations, representing a technical challenge with substantial commercial rewards.

Emerging Trends

Shift Toward Fast-Charging and Extended Cycle-Life Designs Shapes Market Direction

Fast-charging technology is becoming a standard expectation rather than a premium feature in notebook batteries. Users want to quickly power up their devices during short breaks rather than waiting hours for full charges. Manufacturers are responding by developing batteries that can safely accept higher charging currents without degrading. This trend is driving innovation in battery chemistry and thermal management systems to handle the increased heat generation during rapid charging.

Extended cycle life has become a major focus area as consumers keep their notebooks longer. Traditional lithium-ion batteries degrade after several hundred charge cycles, but newer designs aim to double or triple this lifespan. Longer-lasting batteries reduce replacement frequency, improving user satisfaction and reducing environmental impact.

Smart battery management systems are being integrated into more notebook models. These systems monitor individual cell voltages, temperatures, and charge states in real-time. By actively balancing cells and preventing overcharging or deep discharge, these management systems significantly extend battery life and improve safety.

The industry is gradually moving away from cobalt-heavy battery formulations due to ethical sourcing concerns and price volatility. Research into cobalt-reduced and cobalt-free chemistries is advancing rapidly. Alternative materials like lithium iron phosphate are being explored for notebook applications. Sustainable battery chemistries also address growing consumer and regulatory pressure for environmentally responsible products, making this transition both a technical and marketing priority for manufacturers.

Regional Analysis

North America Dominates the Notebook Batteries Market with a Market Share of 36.5%, Valued at USD 0.4 Billion

North America holds the dominant position in the global notebook batteries market with 36.5% market share, valued at USD 0.4 billion. The region’s leadership is driven by widespread adoption of portable computing devices due to remote work trends, digital learning initiatives, and robust enterprise spending. Strong consumer preference for premium, long-lasting lithium-ion battery solutions, coupled with the presence of major technology companies and a well-established consumer electronics ecosystem, continues to reinforce North America’s market leadership.

Asia Pacific Notebook Batteries Market Trends

Asia Pacific emerges as the fastest-growing and most dynamic region in the global notebook batteries market. The region’s expansion is propelled by large-scale manufacturing facilities in China, Japan, and South Korea, combined with surging demand from emerging economies like India. Rising urbanization, expanding middle-class populations, and proliferation of e-commerce platforms have significantly enhanced notebook adoption, positioning Asia Pacific as a critical growth engine with strong investments in battery technology innovation and cost-effective manufacturing capabilities.

Europe Notebook Batteries Market Trends

Europe maintains a substantial market presence, characterized by stringent environmental regulations and growing consumer awareness regarding sustainable battery solutions. The region demonstrates strong demand for eco-friendly lithium-ion batteries, with Western European countries, particularly Germany, leading due to robust manufacturing capabilities and high consumer spending on quality electronics. European consumers prioritize high-quality, long-lasting battery technologies with advanced battery management systems to enhance product lifespan and performance efficiency.

Latin America Notebook Batteries Market Trends

Latin America showcases promising growth potential as an emerging market segment driven by increasing digitalization and expanding internet penetration. The market is fueled by growing demand for affordable computing devices among educational institutions and small-to-medium enterprises, with Brazil leading regional consumption. Rising disposable incomes, government initiatives promoting digital education, and the shift toward remote work are contributing to increased notebook adoption, with particular interest in cost-effective battery solutions that balance quality with affordability.

Middle East and Africa Notebook Batteries Market Trends

The Middle East and Africa region exhibits steady growth momentum in the notebook batteries market landscape. Limited access to constant power supply in certain areas has created sustained demand for reliable, high-capacity battery solutions. The region is witnessing growing awareness regarding sustainable battery disposal practices and increasing investment in local assembly networks, with particular focus on affordable batteries that maintain quality standards while bridging digital infrastructure gaps.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Notebook Batteries Company Insights

The global notebook batteries market in 2024 is characterized by intense competition among leading manufacturers who are driving innovation in energy density, charging efficiency, and battery longevity. The market landscape is dominated by established players with extensive research and development capabilities, robust manufacturing infrastructure, and strong relationships with major laptop manufacturers worldwide.

Amperex Technology Limited (ATL) has emerged as a formidable force in the notebook battery sector, leveraging its expertise in lithium-ion and lithium-polymer battery technologies. The company’s focus on high energy density solutions and its ability to customize battery packs for premium laptop manufacturers have strengthened its market position significantly.

LG Chem continues to maintain its leadership position through continuous investment in next-generation battery chemistries and sustainable manufacturing practices. The company’s vertically integrated operations and commitment to quality have made it a preferred supplier for numerous global notebook brands, particularly in the mid to high-end segments.

Tianjin Lishen has carved out a substantial market share by offering cost-competitive solutions without compromising on performance standards, making it particularly attractive to manufacturers targeting price-sensitive segments. The company’s expanding production capacity and growing international presence have positioned it well for future growth.

Murata distinguishes itself through specialized battery solutions that emphasize safety features and thermal management technologies. The company’s reputation for reliability and its focus on compact, high-performance batteries have secured its position among tier-one laptop manufacturers seeking premium components for their flagship products.

Top Key Players in the Market

- Amperex Technology Limited (ATL)

- LG Chem

- Tianjin Lishen

- Murata

- Panasonic

- BYD

- Zhuhai CosMX

Recent Developments

- In December 2025, HP launched the OmniBook 5 14, setting a new benchmark in notebook endurance with over 28 hours of continuous battery runtime on a single charge.This milestone strengthens demand for high-density batteries and raises consumer expectations for all-day and multi-day notebook usage.

- In March 2025, Rio Tinto completed a $6.7 billion all-cash acquisition of Arcadium Lithium, securing long-term access to battery-grade lithium carbonate.The deal directly stabilizes raw material supply for premium notebook batteries and advanced consumer electronics manufacturing.

- In May 2025, CATL introduced an ultra-fast charging LFP battery capable of reaching high charge levels in under 15 minutes.This innovation is expected to transition into premium notebook segments, significantly reducing charging downtime for mobile users.

- In June 2024, Sila Nanotechnologies raised $375 million in Series G funding to scale silicon-anode battery material production.These materials enable 20–40% higher capacity than conventional lithium-ion cells, supporting thinner and longer-lasting next-generation notebooks.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 3.4 Billion CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ni-Cd Battery, Ni-MH Battery, Li-ion Battery, Li-polymer Battery), By Application (Notebook Laptop, Gaming Laptop, Mobile Workstation Laptop) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amperex Technology Limited (ATL), LG Chem, Tianjin Lishen, Murata, Panasonic, BYD, Zhuhai CosMX Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amperex Technology Limited (ATL)

- LG Chem

- Tianjin Lishen

- Murata

- Panasonic

- BYD

- Zhuhai CosMX