Global North America Office Supplies Market Size, Share, Growth Analysis By Product (Paper Supplies, Binding Supplies, Desk Supplies, Filing Supplies, Writing Supplies, Others), Distribution Channel (Offline, Online), By End Use (Educational Institutes, Hotels, Hospitals, Corporate, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151707

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

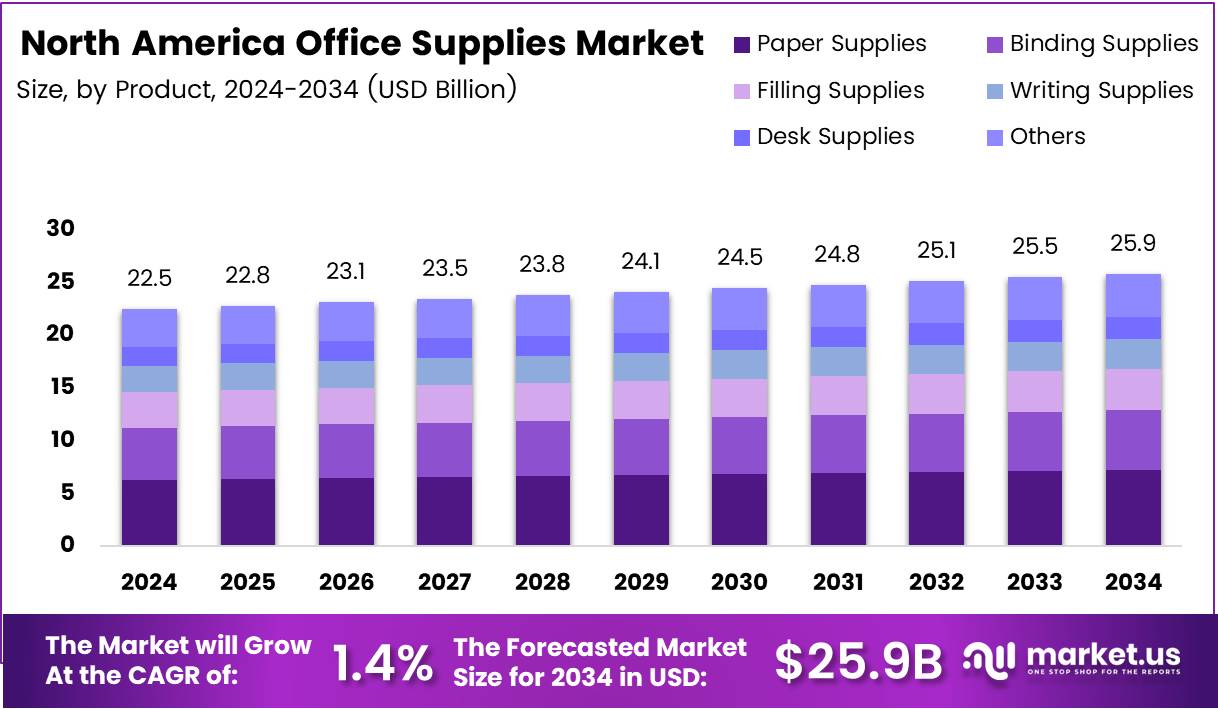

The Global North America Office Supplies Market size is expected to be worth around USD 25.9 Billion by 2034, from USD 22.5 Billion in 2024, growing at a CAGR of 1.4% during the forecast period from 2025 to 2034.

The North America Office Supplies Market reflects a dynamic blend of traditional and modern work essentials tailored to evolving workplace models. It includes stationery, desk supplies, filing products, and tech-based tools, consumed across corporate, education, and home-office sectors. The market’s maturity is driven by innovation and operational efficiency needs.

Driven by hybrid work culture, this market is undergoing a steady evolution. While digital transformation has reduced paper-based demand, new opportunities lie in ergonomic furniture, eco-friendly supplies, and tech-integrated tools. Businesses now prioritize sustainable procurement, shifting the market towards smarter, greener alternatives and higher productivity tools.

According to Unsustainable Magazine, North America ranks as the largest generator of office waste per capita, surpassing Europe and Asia. This environmental concern is pushing both public and private sectors to adopt circular economy models and greener office supply solutions, fueling a new wave of sustainable procurement practices.

Furthermore, the EPA reports the average American contributes 4.4 pounds of waste daily, amplifying the urgency for sustainable office products. This has opened doors for manufacturers offering recyclable, biodegradable, and reusable office supplies, creating fresh market segments and influencing purchase behavior.

Government support for sustainability has also accelerated innovation. Programs like the U.S. Federal Green Procurement Policy are encouraging businesses to comply with environmental standards. This regulation not only supports green product demand but also reshapes vendor and distribution landscapes across North America.

In response, office supply retailers are investing in online platforms, subscription models, and direct-to-consumer channels. This transition enhances customer retention and caters to changing buying preferences, especially from small and medium enterprises adapting to hybrid work models.

Meanwhile, educational institutions remain a significant segment, driving bulk purchases and long-term supply contracts. With rising student enrollments, schools are investing in digital tools alongside traditional supplies, creating dual demand and boosting revenues in both sectors.

Additionally, technological innovation is streamlining office workflows. Smart pens, cloud-based filing systems, and IoT-integrated desks are carving a niche, especially among startups and tech-forward firms. These innovations support productivity, reduce waste, and align with evolving workspace expectations.

Mergers and acquisitions are reshaping competitive dynamics. Regional consolidation among distributors improves logistical efficiency, while global players invest in North American expansion to tap into recurring demand and higher margins.

Key Takeaways

- The North America Office Supplies Market is projected to reach USD 25.9 Billion by 2034, up from USD 22.5 Billion in 2024, growing at a CAGR of 1.4% from 2025 to 2034.

- In 2024, Paper Supplies led the product segment with a 36.2% market share, driven by sustained demand across educational, corporate, and healthcare sectors.

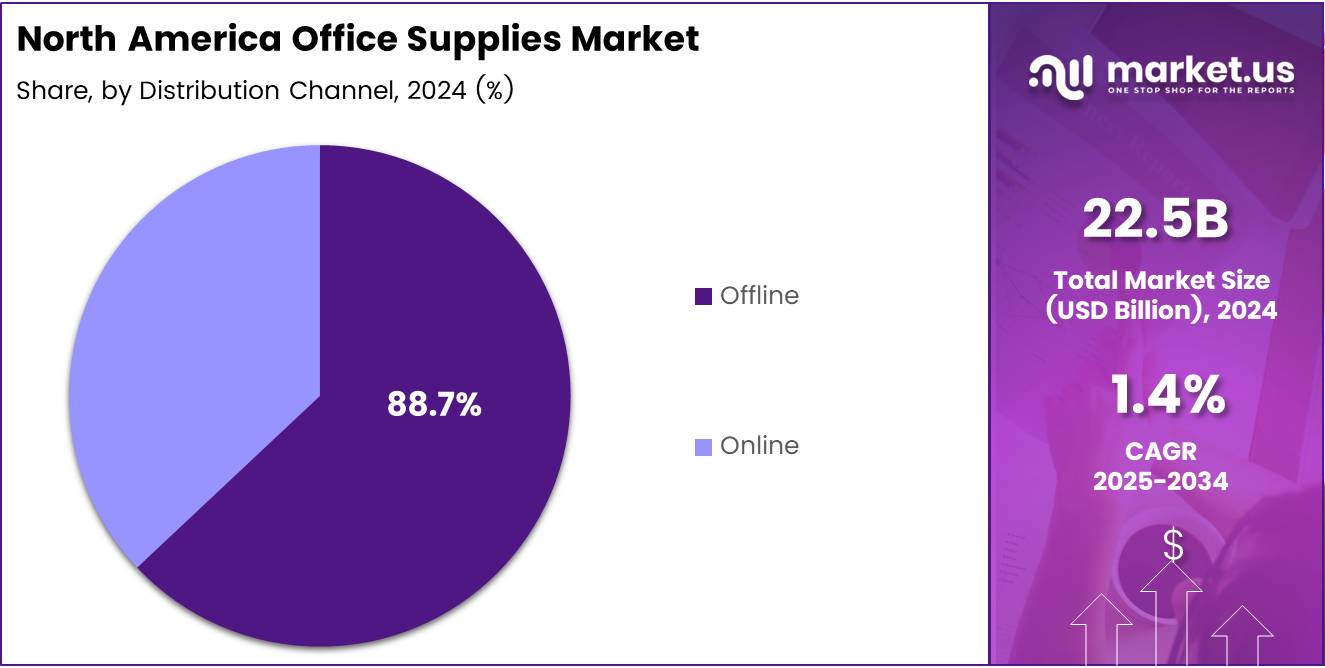

- Offline distribution dominated in 2024 with an 88.7% share, due to consumer preference for bulk purchases and in-store product inspection.

- Educational Institutes were the top end users in 2024, accounting for 31.9% of the market, owing to ongoing demand from schools, colleges, and universities.

Product Analysis

Paper Supplies lead with 36.2% due to their essential role in daily office operations.

In 2024, Paper Supplies held a dominant market position in the By Product Analysis segment of the North America Office Supplies Market, with a 36.2% share. This dominance can be attributed to the persistent demand for printing paper, sticky notes, and copy paper across educational, corporate, and healthcare sectors.

Binding Supplies continue to support organizational needs, contributing to improved efficiency in managing office documentation. Their structured use makes them indispensable, particularly in educational and corporate environments.

Desk Supplies also see consistent demand, providing everyday functionality for office workers. Items like organizers, staplers, and scissors remain integral to productivity.

Filing Supplies help streamline documentation and record-keeping. Their use spans industries where physical storage remains important, reinforcing their market presence.

Writing Supplies play a crucial role in environments that require quick note-taking and manual annotation. Despite digital alternatives, pens, pencils, and markers maintain a loyal user base.

The Others segment captures a variety of miscellaneous but necessary office items that support overall workflow, ensuring continuity and convenience in workplace setups.

Distribution Channel Analysis

Offline dominates with 88.7% due to traditional purchasing behavior and bulk procurement preferences.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the North America Office Supplies Market, with a 88.7% share. This is largely driven by the preference for bulk buying, product inspection before purchase, and long-standing relationships with brick-and-mortar retailers.

Many institutional buyers, including schools and offices, favor in-person transactions, especially for larger orders where logistics and immediate availability are critical. Offline stores also enable negotiations and supplier loyalty programs, further reinforcing this channel’s stronghold.

While Online channels are emerging due to growing e-commerce convenience, their penetration remains limited in this sector. Most businesses still prefer established procurement protocols involving physical vendors.

The trust factor and ability to verify product quality on the spot remain key reasons buyers gravitate toward Offline channels. This traditional purchasing method is especially prevalent among educational institutes and government offices, where fixed supplier contracts are common.

Despite digitalization, the offline distribution channel maintains its significance through reliability, established networks, and instant access to supplies.

End Use Analysis

Educational Institutes lead with 31.9% driven by high-volume, recurring usage of office supplies.

In 2024, Educational Institutes held a dominant market position in the By End Use Analysis segment of the North America Office Supplies Market, with a 31.9% share. Schools, colleges, and universities generate continuous demand for paper, writing tools, and organizational supplies to support academic activities.

Frequent bulk purchases, government funding, and semester-based supply cycles contribute to this segment’s stronghold. The need for classroom materials, administrative documentation, and student handouts fuels ongoing consumption.

Hotels follow with consistent demand for front-desk and back-office supplies, ranging from guest registration pads to scheduling documents. Though not as extensive as the educational sector, the hospitality industry still represents a steady stream of usage.

Hospitals require various office supplies to manage patient records, prescriptions, and administrative forms, making them a reliable consumer segment.

Corporate offices depend on these supplies for internal operations, meetings, and communication processes. However, some digital adoption has slightly reduced dependency.

The Others category captures smaller end-user groups like NGOs and public service offices, which also require a dependable stock of essential supplies, albeit in lesser volumes.

Key Market Segments

By Product

- Paper Supplies

- Binding Supplies

- Desk Supplies

- Filling Supplies

- Writing Supplies

- Others

Distribution Channel

- Offline

- Online

By End Use

- Educational Institutes

- Hotels

- Hospitals

- Corporate

- Others

Drivers

Rising Demand for Ergonomic and Wellness-Oriented Office Products

Many companies are investing more in ergonomic chairs, standing desks, and wellness-friendly office setups. This is helping employees stay healthy and work comfortably, boosting demand in the market.

Small and medium businesses (SMEs) are spending more on modernizing their office infrastructure. This includes updated desks, digital accessories, and new supplies, helping to drive growth in the office supply sector.

With the rise of remote and hybrid work, workers need home setups that mimic office environments. This is pushing sales of monitors, keyboards, desks, and even lighting, making this a strong growth area.

E-commerce has made it easier for businesses and individuals to buy office supplies. Online platforms allow quick delivery, better deals, and access to a wider variety of products, supporting market expansion.

Restraints

Growing Digitalization Reducing Need for Traditional Supplies

Digital tools are replacing traditional items like paper, pens, and folders. As businesses go paperless, the demand for many basic office supplies is falling.

Environmental rules are getting stricter, especially regarding plastic and paper use. This is forcing manufacturers to rethink their products and invest in eco-friendly options, which can increase costs.

The prices of raw materials such as paper, plastic, and metals often fluctuate. This makes it hard for office supply producers to manage costs and keep prices stable for customers.

Urban areas have become saturated with office supply vendors. With many options available, it is becoming difficult for new companies to enter the market or for existing ones to grow quickly in these areas.

Growth Factors

Integration of Smart Technology in Office Equipment

More office tools now include smart features like touchscreens, automation, and connectivity. This makes tasks easier and more efficient, attracting tech-focused buyers and pushing market growth.

Customized office supply models and subscription services are becoming popular. Businesses enjoy receiving regular supplies tailored to their needs, which helps suppliers build lasting customer relationships.

The growth of home offices is opening new doors. Many people working from home now need printers, chairs, and desk organizers, leading to higher demand in this segment.

Schools and universities need large volumes of office supplies. Partnering with these institutions for bulk orders is a big opportunity for suppliers to gain consistent business.

Emerging Trends

Surge in Demand for Eco-Friendly and Sustainable Office Products

More customers want office supplies made from recycled or biodegradable materials. Companies are responding with eco-friendly options, which are becoming a major market trend.

AI is now being used to manage inventory more efficiently. Businesses use smart systems to track stock and restock automatically, which is changing how supplies are managed and sold.

Co-working spaces are on the rise. These spaces often need special kinds of supplies for shared use, such as multi-user printers and flexible furniture, driving niche product demand.

Subscription-based office supply models are trending. They make it easy for businesses to get what they need regularly without manual reordering, saving time and ensuring constant availability.

Key North America Office Supplies Company Insights

In 2024, the North America Office Supplies Market continues to evolve amid digital transformation and hybrid work trends. Among the key players, Crayola remains a dominant force in the educational and creative supplies segment. The brand’s strong association with school supplies and its consistent innovation in arts and crafts tools keep it relevant despite increasing digital learning tools.

Office Depot, LLC. is adapting to changing work environments by expanding its digital services and business solutions. The company is leveraging its vast distribution network and retail footprint to cater to both small businesses and remote workers across North America.

Staples, Inc. continues to reposition itself as more than a retail supplier by offering tech services, coworking solutions, and B2B logistics. Its focus on integrating sustainable practices and diversified services enhances its market competitiveness.

Deluxe Enterprise Operations is strengthening its presence in the business solutions space, particularly through offerings like promotional products, checks, and marketing services. Its emphasis on small business support provides a stable niche in a market shifting away from traditional office supplies.

These companies, among others, are navigating supply chain adjustments and consumer behavior shifts, balancing between traditional products and digital solutions. While core office supplies still hold value, the companies’ ability to diversify and innovate will shape their long-term impact on the market.

Top Key Players in the Market

- BYD Company

- Crayola

- Office Depot, LLC.

- Staples, Inc.

- Deluxe Enterprise Operations

- 3M

- Newell Brands

- Faber-Castell

- Costco

- ACCO Brands

- BIC

- Pentel Co., Ltd.

- Grand & Toy Limited

- Shoplet

Recent Developments

- In date: Jun 2025, big news from the North American office products sector — TOPS has announced the acquisition of Smead, a renowned office products manufacturer. This strategic union brings together two industry leaders to better serve customers with broader product offerings and innovation.

- In date: Dec 2024, news from the sustainable design front — MillerKnoll becomes the first office furniture manufacturer to eliminate PFAS from its North American brand portfolio. This major step reflects a growing commitment to healthier, environmentally responsible products across the industry.

Report Scope

Report Features Description Market Value (2024) USD 22.5 Billion Forecast Revenue (2034) USD 25.9 Billion CAGR (2025-2034) 1.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Paper Supplies, Binding Supplies, Desk Supplies, Filing Supplies, Writing Supplies, Others), Distribution Channel (Offline, Online), By End Use (Educational Institutes, Hotels, Hospitals, Corporate, Others) Competitive Landscape BYD Company, Crayola, Office Depot, LLC., Staples, Inc., Deluxe Enterprise Operations, 3M, Newell Brands, Faber-Castell, Costco, ACCO Brands, BIC, Pentel Co., Ltd., Grand & Toy Limited, Shoplet Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Office Supplies MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

North America Office Supplies MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BYD Company

- Crayola

- Office Depot, LLC.

- Staples, Inc.

- Deluxe Enterprise Operations

- 3M

- Newell Brands

- Faber-Castell

- Costco

- ACCO Brands

- BIC

- Pentel Co., Ltd.

- Grand & Toy Limited

- Shoplet