North America Generative AI In Insurance Market Size, Share Analysis Report Market By Component (Solutions, Services), By Deployment (On-Premise, Cloud-based), By Application (Claims Processing, Underwriting, Customer Service, Fraud Detection, Risk Assessment, Document Extraction & Classification, Others), By Enterprise Size (Large Enterprises, SMEs), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143419

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

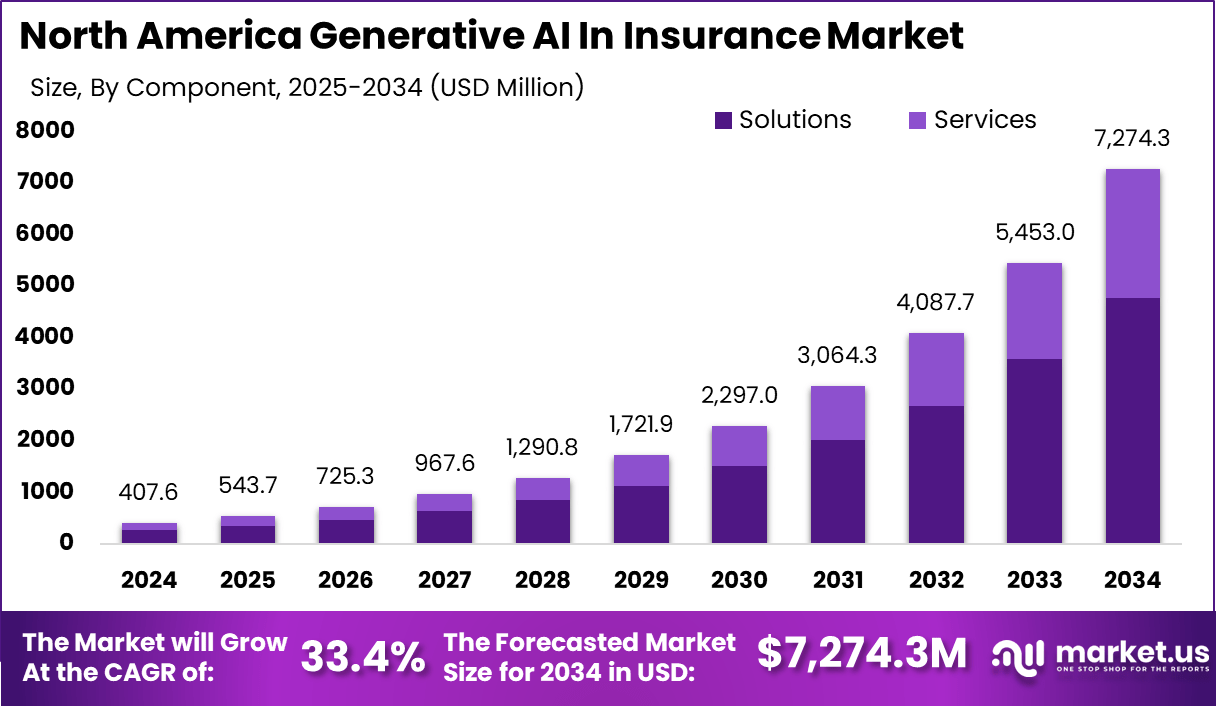

The North America Generative AI In Insurance Market size is expected to be worth around USD 7,274.3 Million By 2034, from USD 407.6 Million in 2024, growing at a CAGR of 33.4% during the forecast period from 2025 to 2034. In 2024, U.S. held a dominant market position, capturing more than a 33.2% share, holding USD 377.5 Million revenue.

In the North American insurance sector, Generative AI is emerging as a transformative force, integrating advanced algorithms to innovate and streamline operations. This technology utilizes machine learning models to generate new data instances, simulate scenarios, and automate decision-making processes.

The primary driving factors for the growth of generative AI in the North American insurance market include the management of large data sets and the automation of underwriting processes. These technologies not only enhance operational efficiencies but also provide deeper analytical insights, leading to more accurately tailored insurance products and services.

Demand for generative AI in insurance is largely driven by the need for more efficient processing capabilities and the ability to handle complex data, which is integral to underwriting and claims management. Investment opportunities are particularly prominent in cloud-based AI solutions, which dominate the market due to their scalability and flexibility.

According to Market.us, The global generative AI in insurance market is projected to grow significantly, reaching approximately USD 13,862.7 million by 2033, up from USD 731.7 million in 2023, at an impressive CAGR of 34.2% during the forecast period from 2024 to 2033.

This rapid expansion is driven by the increasing adoption of AI-driven risk assessment, personalized policy offerings, and claims automation. In 2023, North America dominated the market, accounting for over 43.75% of the total share, reflecting the region’s strong technological infrastructure and early adoption of AI in the insurance sector.

The integration of generative AI in insurance offers several business benefits, including enhanced risk management, improved fraud detection, and increased productivity. These advancements allow insurance companies to offer personalized products and improve customer engagement, thereby boosting retention and competitive advantage.

Key Takeaways

- The North America Generative AI in Insurance market is projected to reach USD 7,274.3 million by 2034, up from USD 407.6 million in 2024.

- The market is expected to grow at a CAGR of 33.4% during the forecast period from 2025 to 2034, driven by increasing adoption of AI for claims processing, underwriting automation, and fraud detection.

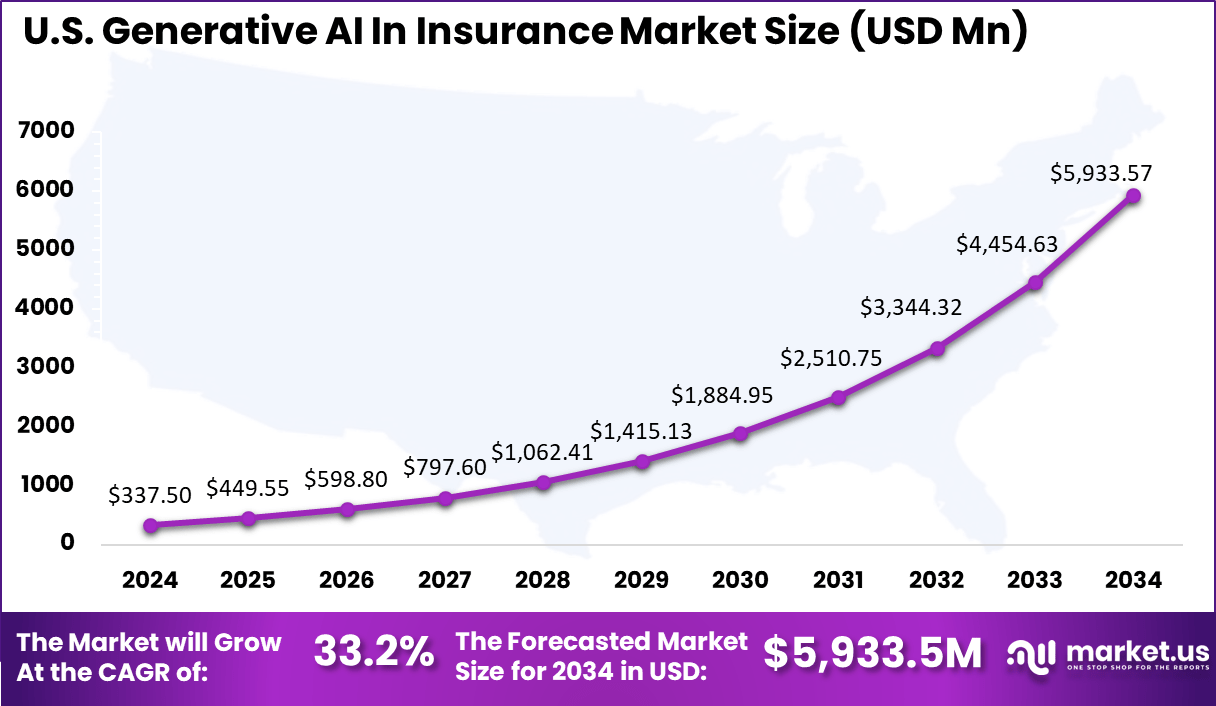

- The U.S. generative AI in insurance market was valued at USD 337.5 million in 2024 and is forecasted to expand from USD 449.5 million in 2025 to approximately USD 5,933.7 million by 2034, growing at a CAGR of 33.2%.

- In 2024, the Solutions segment held a dominant market position, capturing more than 65.7% of the total market share, driven by the demand for AI-powered chatbots, underwriting automation, and risk assessment tools.

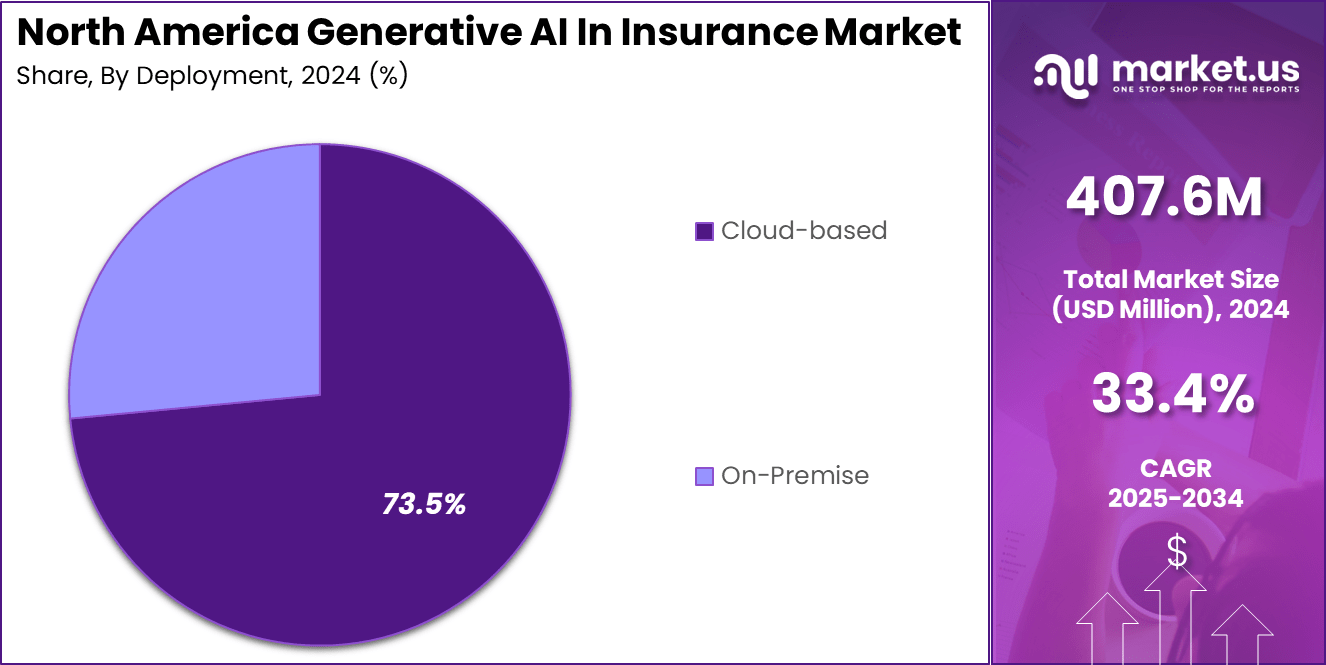

- The Cloud-based segment led the market in 2024, accounting for over 73.5% of the total share, as insurers increasingly migrated to cloud platforms for scalability, cost-effectiveness, and real-time data analysis.

- On-Premise deployments are gradually declining, moving from 26.9% to 26.5%, reflecting the market’s preference for more scalable, flexible, and cost-effective cloud solutions.

- The Claims Processing segment held a leading position in 2024, securing over 25.7% of the market share, as generative AI played a crucial role in accelerating claims assessment, reducing errors, and detecting fraudulent claims.

- The Large Enterprises segment maintained dominance in 2024, capturing over 69.2% of the market share, as major insurers heavily invested in AI-driven automation and customer experience enhancement.

- SMEs are gradually increasing their market presence, rising from 30.5% to 30.8%, indicating a growing adoption of business solutions by smaller companies.

Analysts’ Viewpoint

The adoption of generative AI in insurance is transforming the industry by automating processes and enhancing customer experiences. It enables insurers to offer more personalized services and make data-driven decisions, thereby increasing efficiency and customer satisfaction. The market is set to expand as more insurance companies recognize the advantages of AI in improving service delivery and operational effectiveness.

The insurance sector is experiencing rapid technological advancements, particularly in AI-driven customer service solutions and predictive risk assessment tools. These innovations are crucial for maintaining regulatory compliance and enhancing the precision of policy pricing and risk management.

The regulatory environment in North America is conducive to the growth of AI technologies. Regulatory bodies have established frameworks that not only facilitate AI research but also ensure that these technologies are implemented in a way that protects consumer rights and promotes data security, which is paramount in the insurance industry.

U.S. Market Size

The U.S. generative AI in insurance market was valued at USD 337.5 million in 2024 and is projected to grow from USD 449.5 million in 2025 to approximately USD 5,933.7 million by 2034, expanding at a CAGR of 33.2% from 2025 to 2034.

The United States leads the global market in the adoption and integration of generative AI within the insurance sector. This leadership can be primarily attributed to the region’s highly developed technological infrastructure and the presence of major tech companies that are at the forefront of AI research and development.

Furthermore, the U.S. benefits from a regulatory environment that is conducive to the adoption of new technologies. Regulatory bodies have been proactive in establishing frameworks that encourage AI research while ensuring consumer protection and data security. This not only reassures insurers about integrating AI into their operational processes but also fosters a climate where technological advancements can thrive.

Moreover, the U.S. market exhibits a strong demand for insurance services that are both efficient and personalized, which generative AI can provide. Insurance companies in the U.S. are increasingly utilizing AI to enhance customer satisfaction and streamline operations, from claims processing to risk assessment and customer interaction. The focus on improving these areas through technology has led to a quicker adoption rate compared to other regions.

Component Analysis

In 2024, the Solutions segment held a dominant market position within the North American generative AI in insurance market, capturing more than a 65.7% share. This significant market share can be attributed to the comprehensive integration of AI-driven solutions across various insurance operations.

These solutions include automated claim processing, fraud detection, and personalized insurance services, which not only streamline operations but also enhance customer satisfaction and operational efficiency. The preeminence of the Solutions segment is further underscored by the increasing demand for advanced analytical capabilities and predictive modeling in insurance processes.

North America generative AI in insurance market, By Component Analysis, 2022-2024 (%)

By Component 2022 2023 2024 Solutions 66.3% 65.9% 65.7% Services 33.7% 34.1% 34.3% Insurers are leveraging generative AI to analyze vast arrays of data, thereby gaining insights that help in risk assessment and decision-making. This has led to more accurate underwriting processes and pricing models, fundamentally transforming traditional insurance practices.

Moreover, the integration of generative AI solutions facilitates real-time data processing and interaction, enabling insurers to offer innovative products and services tailored to individual customer needs. This customization enhances customer engagement and retention, driving further growth in the segment.

Additionally, the ongoing advancements in AI technology, such as machine learning and natural language processing, continue to expand the potential applications of generative AI solutions in the insurance sector, promising sustained growth and innovation in the coming years.

Thus, the dominance of the Solutions segment in the North American generative AI in insurance market is well-founded, given its role in enhancing operational efficiencies, risk management, and customer relationships. This trend is expected to persist as more insurers recognize the value of AI-driven solutions in maintaining competitiveness and adapting to changing market dynamics.

Deployment Analysis

In 2024, the Cloud-based segment held a dominant market position within the North American generative AI in insurance market, capturing more than a 73.5% share. This dominance is primarily driven by the flexibility, scalability, and cost-effectiveness that cloud-based solutions offer to insurance companies.

By utilizing cloud infrastructure, insurers can deploy generative AI tools and applications with greater ease and lower upfront costs compared to traditional on-premise solutions. The substantial share of the Cloud-based segment is also reinforced by the enhanced data management capabilities it provides.

Insurance companies deal with vast amounts of data, and cloud-based platforms facilitate efficient data storage, processing, and analysis. This is crucial for the deployment of AI technologies, which require substantial computational resources to process and generate insights from large datasets.

North America generative AI in insurance market, By Deployment Analysis, 2022-2024 (%)

By Deployment 2022 2023 2024 On-Premise 26.9% 26.6% 26.5% Cloud-Based 73.1% 73.4% 73.5% The cloud enables insurers to leverage these capabilities on-demand, without the need for significant investment in physical hardware. Additionally, cloud-based generative AI applications promote innovation in the insurance sector by allowing for continuous updates and integration of the latest AI advancements.

This agility ensures that insurers can quickly adapt to changes in the market and regulatory environment, thereby maintaining a competitive edge. Furthermore, cloud platforms enhance collaboration among teams by providing tools that support remote access and real-time data sharing.

Consequently, the leadership of the Cloud-based segment in the North American generative AI in insurance market is well-justified. Its ability to provide a robust, scalable, and cost-efficient infrastructure for deploying AI technologies continues to make it the preferred choice for insurance companies looking to innovate and improve their operational efficiencies.

Application Analysis

In 2024, the Claims Processing segment held a dominant market position within the North American generative AI in insurance market, capturing more than a 25.7% share. This leadership can be attributed to the critical role that generative AI technologies play in transforming traditional claims handling processes.

By integrating AI, insurers are able to automate the claims handling process, reducing the time and manpower typically required, which directly enhances operational efficiencies and customer satisfaction. The prominence of the Claims Processing segment is further emphasized by the ability of generative AI to reduce errors and enhance decision-making accuracy.

AI-driven systems can analyze and process claims data with high precision, identifying patterns that may indicate fraudulent activities or inconsistencies. This capability not only speeds up the processing of legitimate claims but also helps in mitigating the risks and losses associated with fraudulent claims.

North America generative AI in insurance market, By Application Analysis, 2022-2024 (%)

By Application 2022 2023 2024 Claims Processing 25.9% 25.9% 25.7% Underwriting 15.9% 16.1% 16.2% Customer Service 14.1% 14.3% 14.4% Fraud Detection 11.3% 11.4% 11.5% Risk Assessment 13.0% 13.1% 13.2% Document Extraction & Classification 8.5% 8.3% 8.2% Additionally, generative AI enables personalized customer service experiences during the claims process. AI systems can interact with claimants through chatbots and virtual assistants, providing real-time updates and handling inquiries. This level of engagement is crucial for maintaining customer trust and loyalty, particularly during the often stressful period following a claim.

Therefore, the dominant position of the Claims Processing segment in the North American generative AI in insurance market is well-justified. Its impact on improving the speed, accuracy, and customer experience of claims handling continues to drive substantial investment and adoption of AI technologies across the insurance industry.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position within the North American generative AI in insurance market, capturing more than a 69.2% share. This segment’s leadership stems from its capacity to invest significantly in advanced AI technologies and infrastructure.

Large enterprises often have the resources to implement comprehensive AI solutions that streamline various aspects of insurance operations, from claims processing to customer service and risk management. The dominance of Large Enterprises is further bolstered by their ability to leverage economies of scale.

These companies can spread the high costs of AI integration across a larger operational base, making it more cost-effective. Additionally, large enterprises frequently have access to vast amounts of data, which is essential for training and refining AI models. This data advantage enables them to deploy more effective and sophisticated AI solutions that can drive significant improvements in efficiency and decision-making.

North America generative AI in insurance market, By Enterprise Size Analysis, 2022-2024 (%)

By Enterprise Size 2022 2023 2024 Large Enterprises 69.5% 69.3% 69.2% SMEs 30.5% 30.7% 30.8% Moreover, large enterprises in the insurance industry often operate across multiple markets and have a diverse customer base, which necessitates robust systems that can manage complex and varied demands. Generative AI supports these demands by providing dynamic tools for data analysis, customer interaction, and personalized service offerings. This technological capability is crucial for maintaining competitiveness in a rapidly evolving industry.

Hence, the leading position of the Large Enterprises segment in the North American generative AI in insurance market is well-founded. The segment’s ability to effectively utilize AI technology to enhance operational efficiencies and customer engagement continues to drive its growth and dominance in the market.

Key Market Segments

By Component

- Solutions

- Services

By Deployment

- On-Premise

- Cloud-based

By Application

- Claims Processing

- Underwriting

- Customer Service

- Fraud Detection

- Risk Assessment

- Document Extraction & Classification

- Others

By Enterprise Size

- Large Enterprises

- SMEs

Driver

Autonomous Claims Processing

A pivotal driver in the North American Generative AI in Insurance market is the shift towards autonomous claims processing. This transition is powered by the integration of sophisticated AI capabilities like computer vision and natural language processing, which allow for the efficient and accurate handling of claims without human intervention.

Such technology not only accelerates the claims process but also enhances accuracy in settlements, substantially reducing the time and effort typically required in claims filing and management. The implementation of these AI-driven systems simplifies the intricate web of claims management, providing quicker responses to basic claim inquiries and expediting the overall claims resolution process.

Restraint

Data Management and Regulatory Compliance

One significant restraint in the market is the challenge of data management and regulatory compliance. Insurers often deal with fragmented and inconsistent data from multiple sources, which can complicate the integration and effective management of AI systems. Robust data governance and stringent cleaning processes are crucial to maximize the potential of AI.

Additionally, the insurance industry is subject to strict data privacy and usage regulations. Navigating these regulations is essential to avoid legal penalties and protect customer data. This involves continuous monitoring and adjustments to ensure compliance with evolving laws. Moreover, integrating AI with legacy systems that are often not compatible with modern technologies presents both a technical and financial challenge, requiring significant investment.

Opportunity

Enhanced Customer Interactions and Operational Efficiency

The opportunity for generative AI in the insurance market lies in its potential to redefine customer interactions and enhance operational efficiency. Advanced AI-powered chatbots and virtual assistants can handle routine queries and engage in sophisticated conversations, understanding complex customer needs and offering personalized policy recommendations.

To harness the full potential of generative AI, insurers are increasingly collaborating with technology companies, data providers, and insurtech startups. These partnerships provide access to cutting-edge technologies and extensive data sources, enabling insurers to accelerate innovation and maintain a competitive edge in the market.

Challenge

Addressing Biases in AI Models

A critical challenge in the deployment of generative AI within the insurance industry is addressing inherent biases in AI models. These biases can reflect historical inequalities and manifest in unfair pricing, coverage decisions, or discriminatory practices against certain demographics.

Ensuring fairness involves using diverse and representative training data, employing advanced algorithms for bias detection and mitigation, and implementing measures to increase the transparency and explainability of AI decisions. Additionally, maintaining human oversight in sensitive decisions is crucial to align AI-generated outcomes with ethical standards and regulatory requirements.

Growth Factors

The growth of the Generative AI in Insurance market in North America is predominantly driven by the increasing need for efficient data management and the automation of insurance processes. Insurance companies are leveraging machine learning algorithms to handle vast amounts of both structured and unstructured data, which significantly streamlines operations such as underwriting and claims processing.

These AI-driven systems not only enhance accuracy but also improve the speed of service delivery, leading to higher customer satisfaction. Additionally, the adoption of AI technologies helps in reducing the workload on human agents by automating routine tasks and optimizing the decision-making processes. Another substantial growth driver is the ongoing digital transformation in the insurance sector.

The shift from traditional methods to digital platforms allows for more personalized and rapid service delivery. Insurers are adopting generative AI to develop systems that can offer tailored insurance products based on individual customer data. This level of customization is becoming a critical factor in competitive differentiation and customer retention in the insurance industry.

Emerging Trends

Emerging trends in the North American Generative AI in Insurance market include the integration of AI with cloud computing, which provides insurers with scalable and flexible solutions that support the rapid deployment of AI technologies.

The cloud-based AI platforms facilitate advanced analytics and real-time data processing, enhancing the insurers’ ability to make informed decisions quickly. Furthermore, there is a noticeable trend towards the adoption of explainable AI (XAI).

XAI allows stakeholders to understand and trust AI decisions by making the processes behind AI-generated outcomes transparent. This is particularly important in an industry like insurance, where decisions can significantly affect customers’ lives and must adhere to regulatory standards.

Business Benefits

The implementation of generative AI in insurance offers numerous business benefits, including enhanced operational efficiency and improved risk management. AI enables insurers to automate complex processes such as claims handling and risk assessment, leading to cost reductions and faster service times.

Additionally, AI-driven analytics help in identifying and mitigating potential risks before they become costly problems. Generative AI also plays a pivotal role in personalizing customer interactions. By analyzing extensive customer data, AI can help insurers design products that more closely match the needs and preferences of individual customers, thereby improving customer engagement and loyalty.

Key Player Analysis

North America is leading the way in the generative AI in insurance market, holding more than 43.75% of the total share in 2023. The region’s strong position comes from early AI adoption, advanced technology infrastructure, and a highly competitive insurance industry.

Companies are using generative AI to streamline claims processing, detect fraud, and create personalized insurance plans. The growing demand for automation and data-driven decision-making is pushing insurers to invest heavily in AI-powered solutions.

Top Key Players in the Market

- Hexaware

- AWS marketplace

- Shift Technology

- Lemonade

- GEICO

- Sixfold

- Snorkel

- Appian

Recent Developments

- February 2025: Allianz emphasized its dedication to ethical AI usage by adhering to five core principles: transparency, data protection, human oversight, shared responsibility, and fairness. The company has implemented advanced models to detect data drift and bias, ensuring non-discriminatory practices in its AI applications within the insurance sector.

- January 2025: Hexaware Technologies entered into a collaboration with Amazon Web Services (AWS) to enhance its offerings in migration, modernization, data, and AI. This partnership aims to deliver tailored solutions, backed by generative AI, to help customers improve productivity, insights, and value.

Report Scope

Report Features Description Market Value (2024) USD 407.6 Mn

Forecast Revenue (2034) USD 7,274.3 Mn CAGR (2025-2034) 33.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment (On-Premise, Cloud-based), By Application (Claims Processing, Underwriting, Customer Service, Fraud Detection, Risk Assessment, Document Extraction & Classification, Others), By Enterprise Size (Large Enterprises, SMEs) Competitive Landscape Hexaware, AWS marketplace, Shift Technology, Lemonade, GEICO, Sixfold, Snorkel and Appian Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Generative AI In Insurance MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

North America Generative AI In Insurance MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hexaware

- AWS marketplace

- Shift Technology

- Lemonade

- GEICO

- Sixfold

- Snorkel

- Appian