North America Earned Wage Access Market Size, Share, Industry Analysis Report By Model (Digital On-Demand Pay, Proprietary HCM, Card Model, Direct-to-Consumer), By Component (Solution (Cloud, On-Premise), Services), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (Retail & E-commerce, Hospitality & Construction, Healthcare, Transportation & Logistics, Manufacturing, BFSI, Others), Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164300

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- EWA Adoption and Demand

- US Market Size

- By Model: Digital On-Demand Pay

- By Component: Solution

- By Enterprise Size: Large Enterprises

- By Industry Vertical: Retail & E-commerce

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Company Market Share Analysis

- Recent Developments

- Report Scope

Report Overview

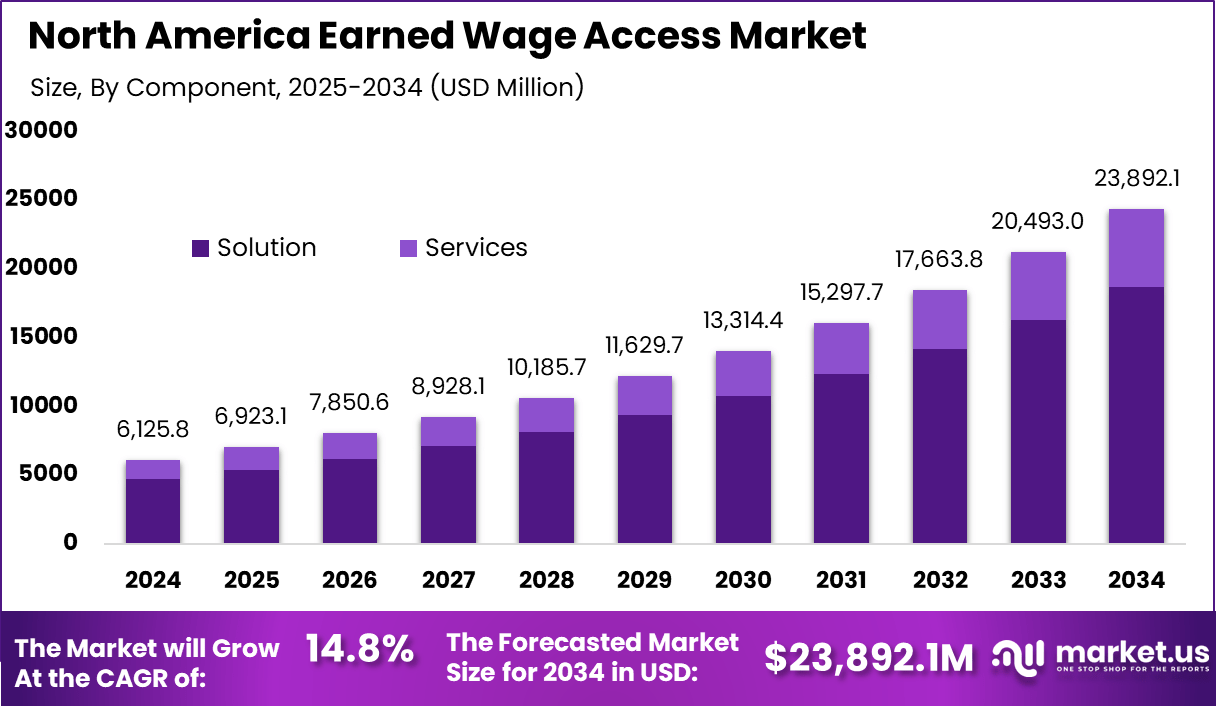

The North America Earned Wage Access Market generated USD 6,125.8 Million in 2024 and is predicted to register growth from USD 6,923.1 Million in 2025 to about USD 23,892.1 Million by 2034, recording a CAGR of 14.8% throughout the forecast span.

Earned Wage Access (EWA) is a financial service that gives employees the ability to access a portion of their earned wages before the scheduled payday. Instead of waiting for the traditional payroll cycle, employees can get paid for the hours or days they have already worked in real-time or on demand. This system is especially useful for hourly and low-wage workers who may face cash flow issues between paychecks.

North America’s Earned Wage Access (EWA) market is growing rapidly, with the region holding the highest share globally, driven largely by the United States. Over 55 million U.S. workers had access to earned wage solutions by late 2024, reflecting widespread demand for financial flexibility, particularly among hourly, gig, and paycheck-to-paycheck employees.

The financial strain is significant, with about 97% of full-time employees experiencing stress related to money, and 80% worried about inflation and rising living costs. EWA services allow workers to access money they’ve already earned before payday, which reduces dependence on costly loans and improves financial stability.

Top driving factors for EWA adoption include the widespread financial fragility of workers and a growing desire for flexible pay options that provide immediate access to earned wages. The gig economy and hourly workforces contribute heavily to this demand. Around 28% of workers earning between $50,000 and $100,000 live paycheck to paycheck, showing a clear need for on-demand wage access.

According to Market.us, The Global Earned Wage Access Market is projected to reach approximately USD 61.06 billion by 2034, increasing from USD 6.2 billion in 2024, growing at a CAGR of 25.7% during 2025–2034. In 2024, North America dominated the market, capturing over 42.4% of the total share and generating about USD 2.62 million in revenue.

Technology adoption driving this market includes real-time payroll integration, mobile accessibility, and AI-powered financial planning. EWA platforms tap directly into payroll data, allowing workers to see and access their available wages instantly. Mobile apps simplify access, while AI tools provide personalized budgeting advice and fraud prevention.

Top Market Takeaways

- By model, Digital On-Demand Pay leads with 56.4%, driven by increased demand for flexible and real-time wage access among employees.

- By component, solutions dominate with 76.8%, reflecting strong adoption of digital platforms that enable earned wage access and payroll automation.

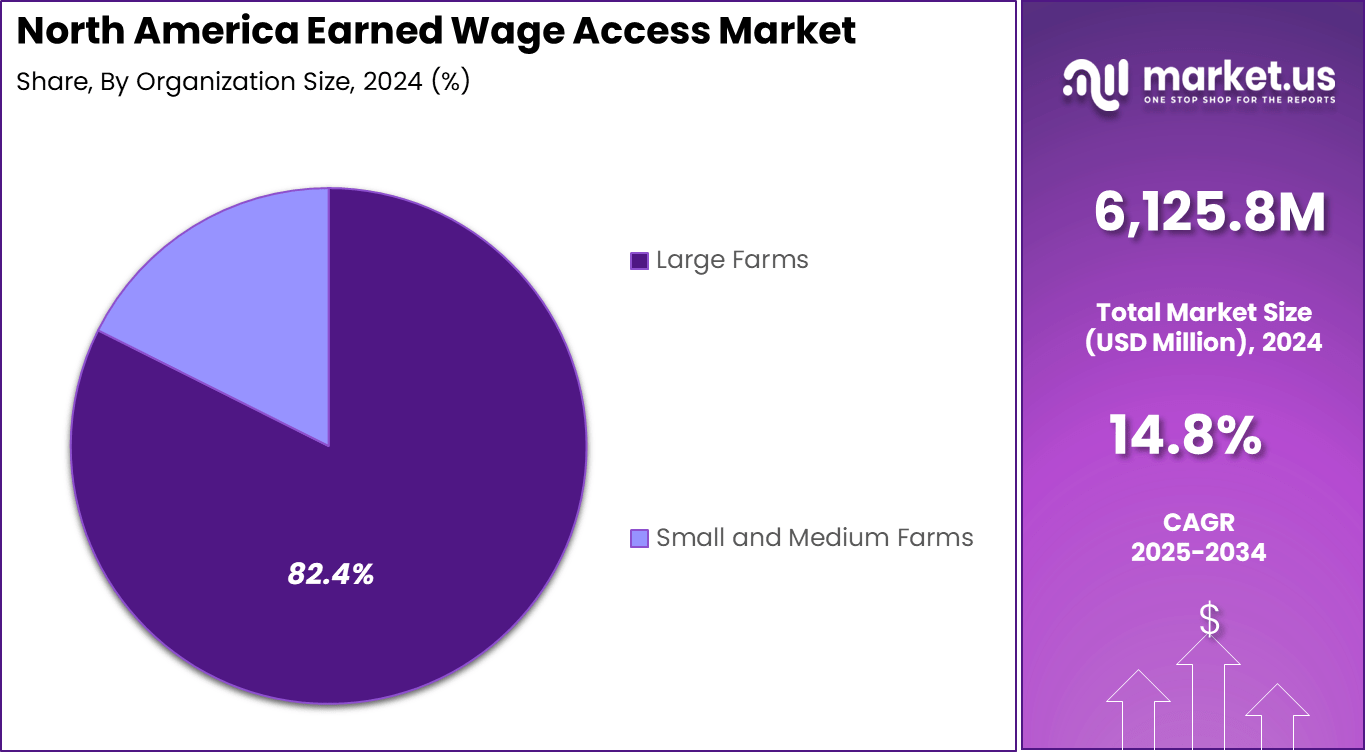

- By enterprise size, large enterprises account for 82.4%, as they implement on-demand pay systems to enhance employee satisfaction and retention.

- By industry vertical, retail and e-commerce represents 29.4%, supported by high turnover workforces seeking more financial flexibility.

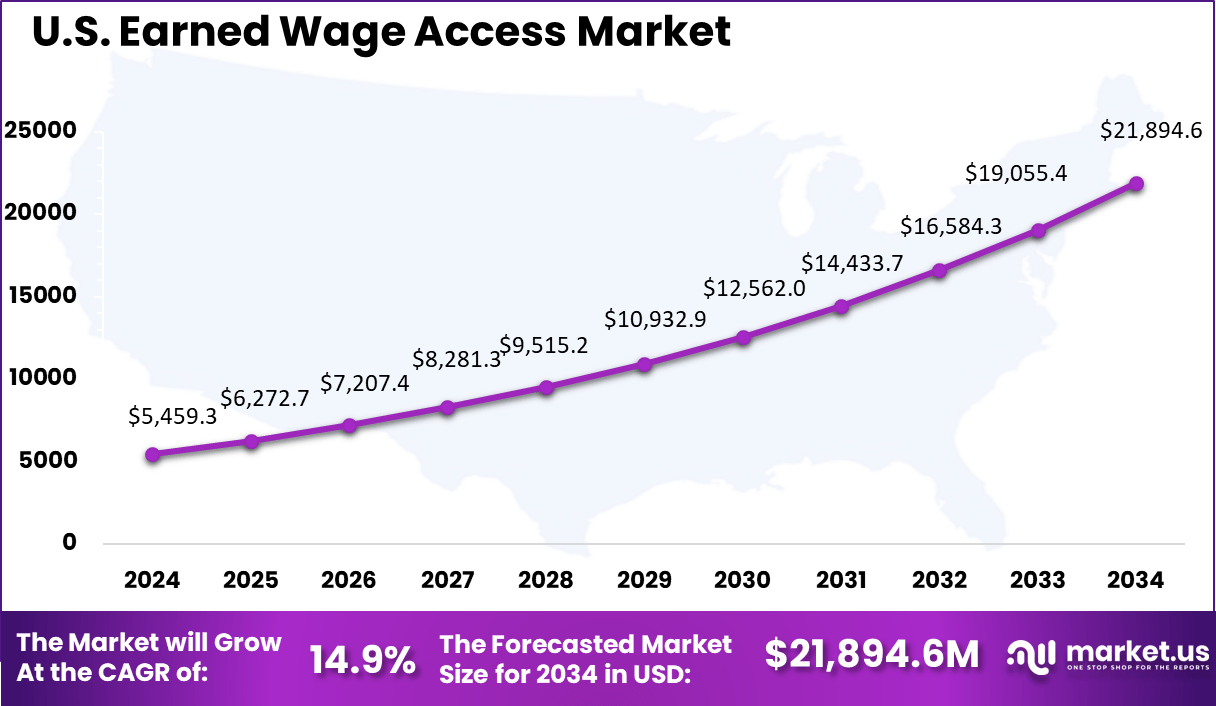

- The US market reached USD 5,459.3 million and is expanding at a CAGR of 14.9%, underscoring rapid growth in employee-centric financial solutions.

EWA Adoption and Demand

User and Demand Statistics

- Financial stress and paycheck dependency: More than 60% of U.S. workers live paycheck to paycheck, and 97% of full-time employees report experiencing some level of financial stress. This highlights a strong demand for financial wellness solutions like earned wage access (EWA).

- Appeal among younger workers: EWA is especially attractive to younger generations. About 84% of Millennials and 87% of Gen Z workers would apply for jobs that include same-day pay options, reflecting shifting expectations around real-time compensation.

- Desire for faster access: Around 60% of U.S. workers want direct daily access to earned wages instead of waiting for traditional payday cycles.

- Impact on users: Among current EWA users, 77% report lower financial anxiety, and 72% feel they have more control over their money, indicating a strong positive personal impact.

Employer Adoption and Impact

- Adoption gap: Only about 10% of U.S. employers offer EWA as a benefit, suggesting vast untapped growth potential in the employer market.

- Industry concentration: The Retail & E-commerce sector accounts for 21% of EWA market adoption by industry, driven by large hourly workforces and high employee turnover.

- Business outcomes: Companies that offer EWA frequently see improvements in employee retention and productivity, as financial stability helps reduce absenteeism and disengagement.

Technology and Regulation

- Cloud-based deployment: Cloud platforms dominate EWA delivery with an 81% market share, largely due to their scalability and seamless payroll system integration.

- Regulatory concerns: Despite lower fees than payday loans, regulatory scrutiny of EWA is increasing. Some studies find that the implicit APR of certain EWA services can exceed 300%, raising questions about consumer protection and transparent cost structures.

US Market Size

North America captures a leading share of the earned wage access market, reflecting broad technology adoption and financial inclusion initiatives. Specifically, the U.S. market is valued at about USD 5,459.3 million, supported by regulatory frameworks encouraging pay flexibility.

The region is experiencing a steady CAGR of about 14.9%, fueled by rising demand among workers for financial wellness tools. This market growth is combined with technological advancements and a shift towards more employee-centric compensation models, establishing North America as a key industry hub.

Market Share By Country (%), 2020-2024

By Country 2020 2021 2022 2023 2024 U.S. 88.7% 88.8% 88.9% 89.0% 89.1% Canada 11.3% 11.2% 11.1% 11.0% 10.9%

By Model: Digital On-Demand Pay

Digital on-demand pay is the leading model in the North American Earned Wage Access market, accounting for a significant 56.4% share. This model allows employees to access wages they have already earned ahead of payday, which has become particularly important for hourly workers and those living paycheck to paycheck. It offers greater financial flexibility and reduces reliance on costly payday loans or credit alternatives.

Many businesses adopt digital on-demand pay to improve employee satisfaction and retention. The convenience of instant wage access aligns well with the growing gig economy and the needs of a modern, flexible workforce, strengthening this model’s dominance.

Market Share By Model (%), 2020-2024

Key Segments 2020 2021 2022 2023 2024 Digital On-Demand Pay 56.4% 56.4% 56.4% 56.4% 56.4% Proprietary HCM 22.0% 22.3% 22.6% 22.9% 23.2% Card Model 15.4% 15.2% 15.0% 14.8% 14.6% Direct-to-Consumer 6.3% 6.2% 6.1% 5.9% 5.8% By Component: Solution

In the EWA market, solutions make up the largest component segment at 76.8%. This segment includes software platforms and applications that facilitate earned wage access, delivering core functions such as wage tracking, payroll integration, and funds disbursement to employees.

The high share of solutions reflects businesses’ increasing investment in technology that supports financial wellness. These platforms are critical as they enable seamless connection between employers’ payroll systems and employees seeking early access to earned wages.

Market Share By Component (%), 2020-2024

Key Segments 2020 2021 2022 2023 2024 Solution 76.1% 76.3% 76.4% 76.6% 76.8% - Cloud

71.4% 71.7% 71.9% 72.2% 72.4% - On-Premise

28.6% 28.3% 28.1% 27.8% 27.6% Services 23.9% 23.7% 23.6% 23.4% 23.2% By Enterprise Size: Large Enterprises

Large enterprises dominate the market segment with an 82.4% share, driven by their substantial workforce and better resources to implement EWA solutions at scale. These organizations use EWA as a strategic tool for boosting employee morale, reducing turnover, and enhancing recruitment in competitive labor markets.

The ability to integrate EWA solutions across large employee bases also leads to cost efficiencies and administrative ease. This segment’s growth is supported by increasing recognition of the business benefits of financial flexibility programs in large workforces.

Market Share By Enterprise Size (%), 2020-2024

Key Segments 2020 2021 2022 2023 2024 Large Enterprises 81.6% 81.8% 82.0% 82.2% 82.4% SMEs 18.4% 18.2% 18.0% 17.8% 17.6%

By Industry Vertical: Retail & E-commerce

The Retail and E-commerce industry holds a major share of 29.4% in the EWA market. This industry employs many hourly and gig workers who benefit most from access to earned wages ahead of payday. The high staff turnover rates and reliance on flexible staffing in retail make EWA solutions particularly valuable.

Retailers and e-commerce companies use these solutions to improve worker satisfaction and decrease financial stress, which can translate into better productivity and customer service. The sector’s dynamic labor needs continue to drive adoption of EWA services.

Market Share By Industry Vertical (%), 2020-2024

Key Segments 2020 2021 2022 2023 2024 Retail & E-commerce 29.8% 29.7% 29.6% 29.5% 29.4% Hospitality & Construction 22.9% 22.7% 22.5% 22.3% 22.1% Healthcare 15.1% 15.5% 15.9% 16.3% 16.7% Transportation & Logistics 11.5% 11.5% 11.6% 11.6% 11.6% Manufacturing 7.2% 7.1% 6.9% 6.8% 6.7% BFSI 5.6% 5.5% 5.3% 5.2% 5.1% Emerging Trends

Emerging trends in the North American EWA market show rapid adoption of cloud and mobile platforms, which now account for over 42% of market activity by enabling workers to access wages through digital wallets and prepaid cards. EWA services are no longer just a payroll add-on but a core employee benefit that increases retention and satisfaction.

Regulatory frameworks are also evolving, with over 20 states introducing laws to oversee and regulate earned wage access, boosting consumer trust. This shift is driven by a growing desire among employees for financial flexibility and the increasing presence of gig and hourly workers who rely heavily on on-demand pay solutions. These trends point to EWA developing into a mainstream financial tool supporting workforce well-being.

Growth Factors

Growth in this market is fueled by widespread financial stress, with 97% of full-time U.S. employees experiencing it and 87% saying it impacts their everyday life. Rising living costs push many to seek immediate wage access to manage bills and unexpected expenses. Around 28% of employees between $50,000 and $99,999 annual income live paycheck to paycheck, creating steady demand for EWA options.

Employers also see the value in offering these services as a way to reduce staff stress, improve work performance, and lower attrition rates. Cloud-based payroll tech and mobile payment systems facilitate wide deployment, supporting ongoing growth. Together, these factors illustrate how EWA meets the needs of a changing workforce demanding greater financial control and support.

Key Market Segments

By Model

- Digital On-Demand Pay

- Proprietary HCM

- Card Model

- Direct-to-Consumer

By Component

- Solution

- Cloud

- On-Premise

- Services

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- Retail & E-commerce

- Hospitality & Construction

- Healthcare

- Transportation & Logistics

- Manufacturing

- BFSI

- Others

Driver

Rising Focus on Employee Financial Wellness

A key driver for the North America Earned Wage Access market is the growing importance employers place on supporting their employees’ financial health. Many workers, especially those paid hourly, live paycheck to paycheck and often face unexpected bills before payday.

EWA allows these employees to access wages they have already earned ahead of pay cycles, providing critical financial relief. This reduces dependence on expensive payday loans and increases overall employee satisfaction.

Employers in sectors like retail, hospitality, and healthcare see positive effects from offering EWA, including lower turnover and higher productivity. It helps reduce financial stress which can otherwise hurt work performance. This increasing emphasis on employee well-being is steadily boosting demand for EWA solutions in North America and attracting more companies to integrate these services.

Restraint

Regulatory Uncertainty Limits Market Growth

One major restraint slowing EWA market expansion is the lack of clear regulatory guidelines. Earned wage access operates in a space between wage payment and credit, creating ambiguity in how it should be regulated.

Different states and agencies in North America are still working on appropriate legal frameworks, leading to hesitation among providers and employers. This regulatory uncertainty can restrict investments and slow the adoption pace.

Because providers must navigate a complex landscape of potential licensing, transparency requirements, and consumer protection rules, many are cautious about fully expanding their services. The risk of changing laws or added compliance burdens poses a real barrier to market growth. Until regulations become more standardized, wide-scale adoption may remain limited.

Opportunity

Expanding Integration with Employer Payroll Systems

A significant opportunity in the North America EWA market lies in deeper integration with employer payroll and HR systems. By embedding EWA services within existing payroll platforms, providers can offer seamless and automated wage access to large employee bases. This creates smoother user experiences, reduces administrative overhead, and makes EWA more attractive to employers.

As mobile and cloud-based payroll technologies advance, this integration trend enables rapid scaling of EWA offerings. Sophisticated analytics and personalized financial wellness tools can be bundled, increasing the value proposition. Large enterprises stand to benefit greatly from this as it helps them recruit and retain workers by providing more flexible pay options.

Challenge

Ensuring Data Security and Privacy

A pressing challenge in the market is safeguarding sensitive employee financial data. EWA platforms handle personal and payroll information, making them targets for cybersecurity threats. Ensuring robust data protections consistent with laws like CCPA in California or GDPR is critical but complicated. Any breach risks damaging consumer trust and triggering costly regulatory penalties.

Providers need to implement strong encryption, regular security audits, and transparent privacy policies. Balancing user convenience with tight security controls remains a complex task. The challenge intensifies as more companies and workers adopt EWA, increasing the volume of sensitive data processed. Maintaining trust while scaling is a vital hurdle for market players.

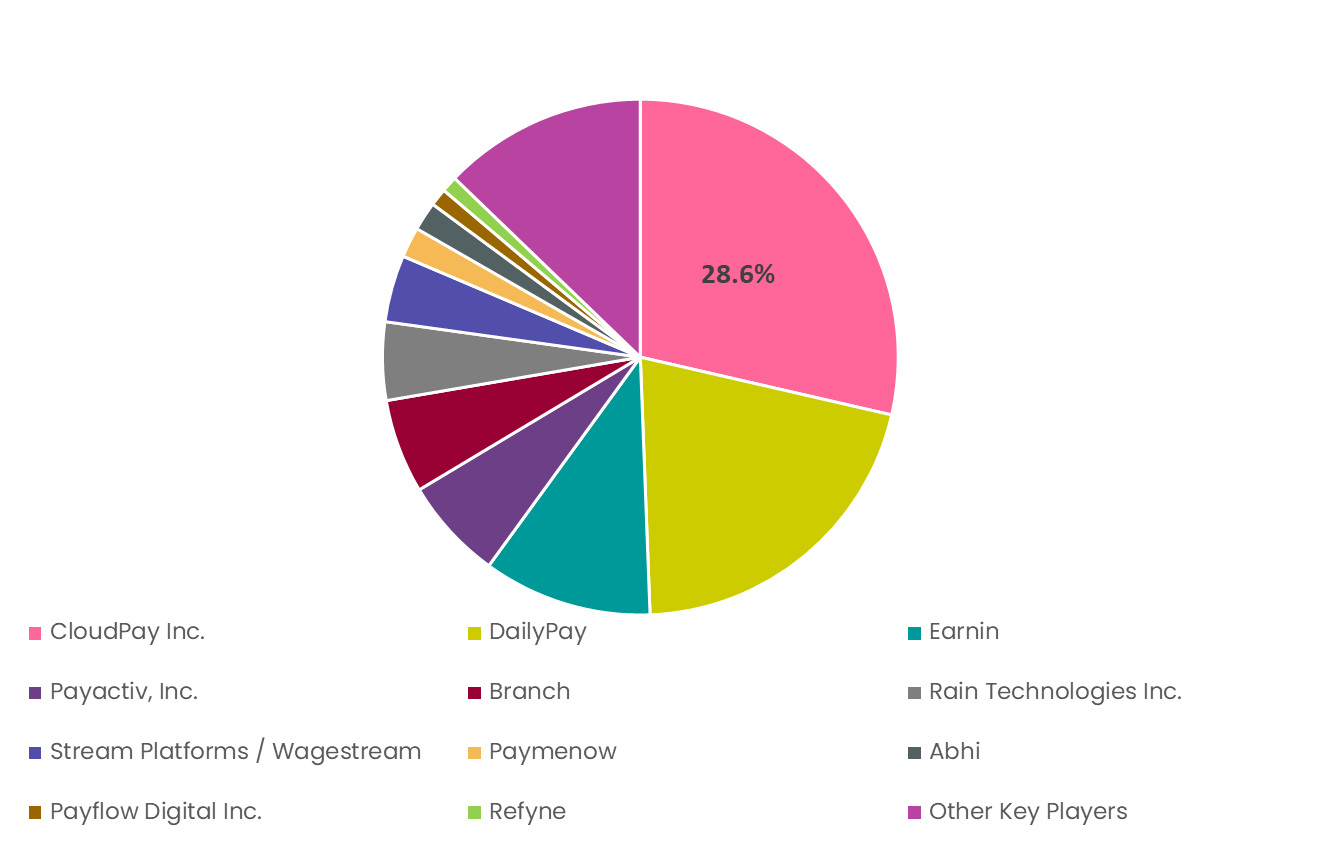

The North America Earned Wage Access Market is dominated by leading providers such as CloudPay Inc., DailyPay, Earnin, and Payactiv Inc.. These companies are redefining payroll flexibility by allowing employees to access earned wages before payday. Their platforms integrate seamlessly with employer payroll systems, improving financial wellness, reducing employee turnover, and enhancing engagement across enterprises in the United States and Canada.

Prominent participants including Branch, Rain Technologies Inc., and Stream Platforms / Wagestream are expanding the reach of EWA services through AI-based analytics and fintech partnerships. Their models emphasize compliance, transaction security, and seamless user experience, ensuring that employees can manage short-term liquidity without relying on high-interest credit options.

Emerging contributors such as Paymenow, Abhi, Payflow Digital Inc., Refyne, and other key players are strengthening the ecosystem through innovative APIs and cross-border payment solutions. Their offerings align with growing demand for financial inclusion and responsible payroll access, positioning North America as a hub for sustainable, employee-centric financial technology solutions.

Market Share Analysis, Revenue (USD Mn), 2024

Top Key Players in the Market

- CloudPay Inc.

- DailyPay

- Earnin

- Payactiv Inc.

- Branch

- Rain Technologies Inc.

- Stream Platforms / Wagestream

- Paymenow

- Abhi

- Payflow Digital Inc.

- Refyne

- Other Key Players

Recent Developments

- June 2025, DailyPay, a major EWA provider, continues to expand its service, including integration with public sector employers like Duke University, helping employees receive early pay access smoothly through an app. DailyPay offers flexible transfer options including free next-day transfers and instant pay for a small fee, emphasizing ease of use and improved financial control.

- January 2025, CloudPay announced the global launch of its Earned Wage Access solution, CloudPay NOW, allowing multinational firms to offer early wage access worldwide. This innovation supports employee financial wellness by providing flexible pay access and has been field-tested globally with strong positive outcomes. The product aims to help companies attract and retain talent amid financial stress challenges faced by workers.

Report Scope

Report Features Description Market Value (2024) USD 6,125.8 Mn Forecast Revenue (2034) USD 23,892.1 Mn CAGR(2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Model (Digital On-Demand Pay, Proprietary HCM, Card Model, Direct-to-Consumer), By Component (Solution (Cloud, On-Premise), Services), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (Retail & E-commerce, Hospitality & Construction, Healthcare, Transportation & Logistics, Manufacturing, BFSI, Others) Competitive Landscape CloudPay Inc., DailyPay, Earnin, Payactiv Inc., Branch, Rain Technologies Inc., Stream Platforms / Wagestream, Paymenow, Abhi, Payflow Digital Inc., Refyne, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Earned Wage Access MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

North America Earned Wage Access MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CloudPay Inc.

- DailyPay

- Earnin

- Payactiv Inc.

- Branch

- Rain Technologies Inc.

- Stream Platforms / Wagestream

- Paymenow

- Abhi

- Payflow Digital Inc.

- Refyne

- Other Key Players