North America Creator Economy Market Size, Share Analysis Report By Platform (Social Media Platforms, Content-Sharing Platforms, Video Streaming Platforms, Audio Platforms, Gaming Platforms, Others (E-commerce Platforms, etc.), By Content Type (Video, Written, Gaming, Music, Photography, Art, and Memes, Audio, Others (Educational, etc.), By Monetization Method (Brand Collaborations, Advertising Revenue, Subscriptions, Donations and Tips, Affiliate Marketing, Merchandise, Others), By End User (Professional Creator, Armature Creator), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150251

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

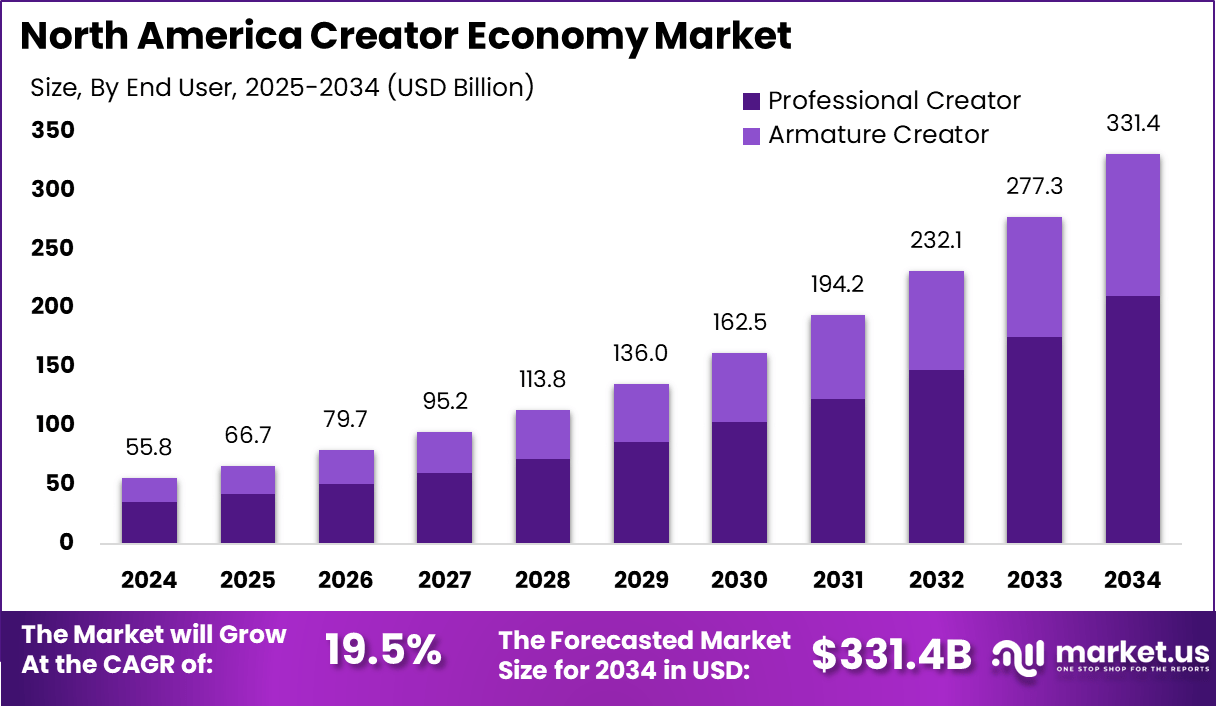

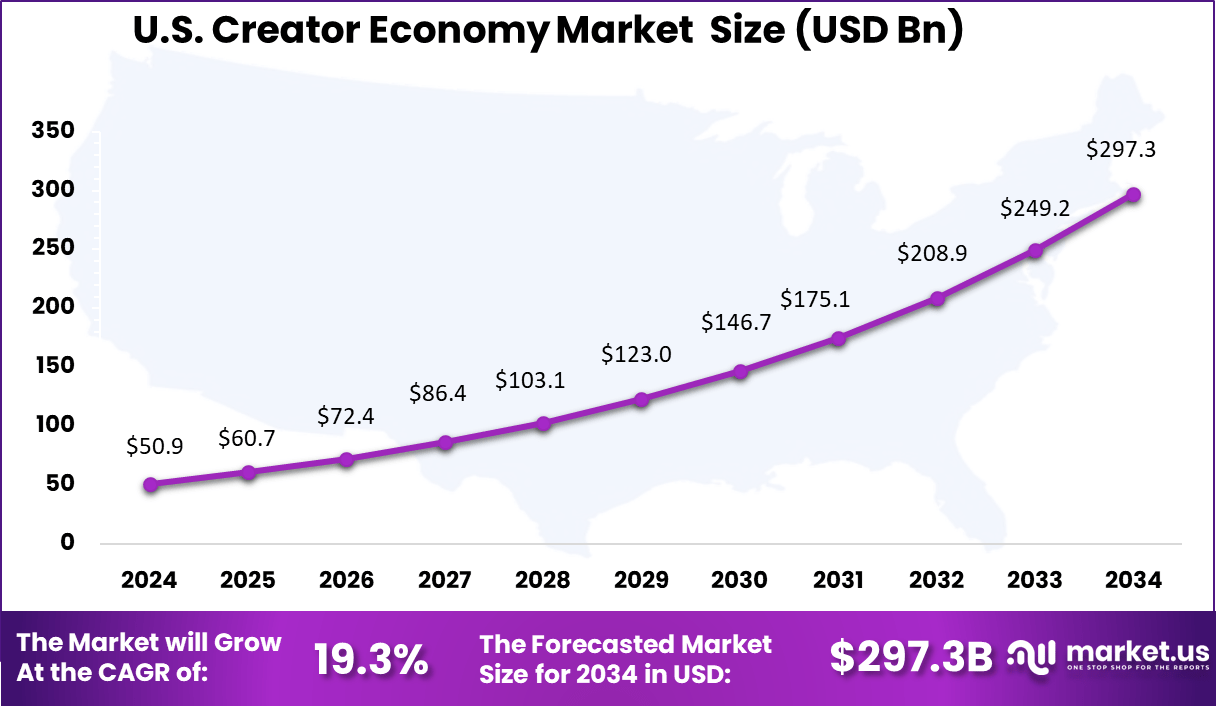

The North America Creator Economy Market size is expected to be worth around USD 331.4 Billion By 2034, from USD 55.8 billion in 2024, growing at a CAGR of 19.5% during the forecast period from 2025 to 2034. In 2024, U.S. creator economy is valued at $50.9 billion, growing at a 19.3% CAGR.

The North America Creator Economy refers to a dynamic ecosystem comprised of independent content creators, influencers, artists, bloggers, musicians, podcasters, and digital entrepreneurs who leverage online platforms to monetize their creative output. Creators engage audiences and generate revenue through sponsorships, subscription models, merchandise, tipping, crowdfunding, and advertising channels.

Drivers of growth include the proliferation of social media platforms (e.g., YouTube, TikTok, Instagram), widespread smartphone use, rising digital content consumption, and expanding digital advertising budgets. The demand for on-demand, personalized content has spurred creator tools adoption, live streaming, and direct-to-consumer brand engagement supported by emerging AI and Web3 technologies.

Demand analysis shows that digital creators in North America saw full-time equivalent roles grow 7.5× between 2020 and 2024 – from 200,000 to 1.5 million positions – reflecting a rising professionalization of content creation. Platforms increasingly offer monetization infrastructure such as creator funds, subscriptions, and tipping systems, which are attracting investment and institutional backing

As reported by Market.us, the Global Creator Economy Market is projected to reach approximately USD 1,487 billion by 2034, rising from an estimated USD 143 billion in 2024, driven by a robust CAGR of 26.4% between 2025 and 2034. In 2024, North America led the global landscape, accounting for more than 35.1% of the total market share.

As per the latest insights from Whop, the global creator economy has expanded far beyond traditional social media, branching into several high-value submarkets. The ad-based video sector currently leads with a valuation of $30.4 billion, followed by ecommerce at $15.7 billion and education at $5 billion. Esports and podcasting have also emerged as strong contributors, valued at $6.9 billion and $4.2 billion, respectively.

Meanwhile, newer categories such as the metaverse ($3.3 billion), video games ($1.5 billion), and digital publishing ($300 million) are steadily gaining ground. This diversification reflects the shift in how digital creators monetize their audiences across multiple platforms and business models.

Between 2023 and 2024, creator economy startups globally raised over $767 million, reflecting a 49% year-over-year growth in funding activity. In the U.S. alone, creator-focused startups secured more than $692 million in Q2 2024, more than doubling the amount raised in Q1 and representing a 68% increase from the same quarter in 2023.

Key Takeaways

- The North America Creator Economy Market is projected to reach USD 331.4 Billion by 2034, expanding from USD 55.8 Billion in 2024, with a strong CAGR of 19.5% during 2025–2034.

- The U.S. Creator Economy Market alone is set to grow from USD 50.9 Billion in 2024 to about USD 297.3 Billion by 2034, reflecting a robust CAGR of 19.3%.

- In 2024, Social Media Platforms emerged as the leading channel in North America, accounting for over 29% of the total market share due to their wide user reach and monetization flexibility.

- The Video Content type led the market by content format in 2024, securing a share of more than 24% in total content revenue, driven by high user engagement and visual storytelling appeal.

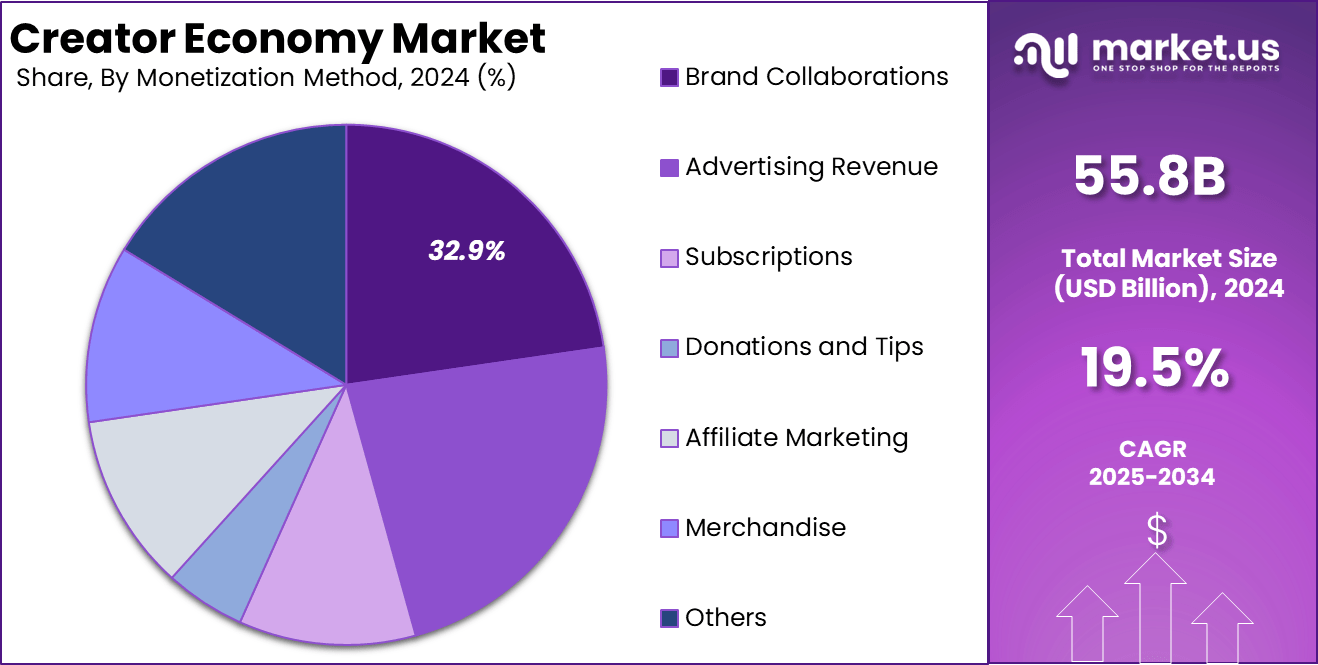

- Brand Collaborations held the top position in monetization channels, capturing over 22.7% of revenue in 2024, supported by rising influencer partnerships with consumer brands.

- Professional Creators represented the largest end-user group in 2024, contributing more than 63.3% of the total revenue, owing to their higher production quality and stronger audience loyalty.

Role of AI

The integration of artificial intelligence into the creator economy has initiated a transformative shift in content creation, monetization, and market dynamics. Creators in North America and worldwide now harness generative AI tools to streamline ideation, production, and personalization processes. According to a recent survey, 59 % of creators have adopted AI to enhance efficiency and revenue strategies.

Analysts report that 94 % of brands are either using or planning to use generative AI in creator collaborations, and 62 % of creators expect to leverage AI–powered tools over the next year. The result has been a significant rise in output quality, with 81 % of creators noting improved engagement thanks to AI-generated content.

From an economic standpoint, the AI-driven creator market segment – spanning music, video, and audiovisual media – is anticipated to grow dramatically. The value of generative AI in music and film is projected to rise from around €3 billion today to approximately €64 billion by 2028.

On a macroeconomic level, AI is expected to contribute nearly 14.5 % to North America’s GDP growth by 2030, indicating widespread productivity gains that include creator-driven innovation. Industry commentary supports a measured yet optimistic outlook: while AI could displace certain creative jobs, it may augment productivity, democratize content creation, and enable creators from diverse backgrounds to enter the market.

Therefore, the impact of AI within the creator economy encompasses accelerated efficiency, improved content quality, and expanded market opportunities, while simultaneously introducing revenue displacement for human creators and prompting regulatory and ethical considerations. Balanced adoption and equitable frameworks will be essential to ensure sustainable, inclusive growth in this evolving digital domain.

US Market Expansion

The US Creator Economy Market is valued at approximately USD 50.9 Billion in 2024 and is predicted to increase from USD 123 Billion in 2029 to approximately USD 297.3 Billion by 2034, projected at a CAGR of 19.3% from 2025 to 2034.

Platform Analysis

In 2024, the Social Media Platforms segment held a dominant position within the North America creator economy, capturing a market share exceeding 29 %, and maintaining its leadership through various intrinsic advantages. This sub‐segment encompasses major applications such as Instagram, TikTok, Facebook, and Snapchat, which remain the default ecosystems for content creators.

These platforms are renowned for their vast user reach, seamless content creation tools, and diverse content formats – including short videos, images, and written posts. The robust performance of these platforms is supported by data indicating a 36 %+ share in recent years, underscoring the effectiveness of algorithm-driven content distribution and in-built monetization mechanisms (e.g., ad revenue sharing, tipping, subscriptions).

North America Creator Economy Market Share By Platform Analysis Share, 2019-2024

Platform 2019 2020 2021 2022 2023 2024 Social Media Platforms 31.7% 31.2% 30.6% 30.1% 29.2% 29.0% Content-Sharing Platforms 15.3% 15.2% 15.2% 15.1% 15.1% 15.0% Video Streaming Platforms 22.2% 22.6% 22.9% 23.2% 23.8% 23.9% Audio Platforms 12.0% 12.1% 12.2% 12.4% 12.5% 12.6% Gaming Platforms 10.9% 11.2% 11.5% 11.9% 12.3% 12.5% Others (E-commerce Platforms, etc.) 7.9% 7.7% 7.5% 7.3% 7.1% 7.0% The leadership of social media in the creator economy can be attributed to multiple reinforcing factors. High user engagement levels, coupled with sophisticated recommendation systems, amplify content visibility and virality potential. These platforms offer creators immediate access to audience feedback, streamlined community building, and integrated commerce features – thus enabling creators to monetize through merchandise, affiliate links, and brand partnerships.

Content Type

In 2024, the Video segment held a dominant market position within the North American creator economy, capturing more than 24 % share of total content type revenues. High consumer preference for visual storytelling has been observed, as a majority of creators focus on producing video-based material across platforms such as YouTube, TikTok, and Instagram Reels.

The segment’s preeminence is supported by quantitative findings indicating that video content remains the largest share within this market by content type. This dominance can be attributed to several reinforcing factors. Enhanced monetization avenues – including ad-sharing models, branded content, subscription-based channels, and live-stream tipping – have bolstered creators’ earnings from video.

North America Creator Economy Market Share by Content Type (%), 2019-2024

Content Type 2019 2020 2021 2022 2023 2024 Video 21.9% 22.5% 23.0% 23.5% 24.3% 24.4% Written 9.9% 9.7% 9.4% 9.2% 8.9% 8.7% Gaming 17.2% 17.2% 17.2% 17.2% 17.1% 17.2% Music 19.6% 19.4% 19.3% 19.2% 18.9% 19.0% Photography, Art, and Memes 11.2% 11.0% 10.9% 10.7% 10.6% 10.4% Audio 13.3% 13.4% 13.6% 13.7% 13.9% 14.0% Others (Educational, etc.) 6.9% 6.8% 6.6% 6.5% 6.3% 6.2% Additionally, the proliferation of short-form video – featuring rapid editing, algorithmic recommendations, and mobile-friendly formats – has driven consumer consumption and creator output. Consequently, video content has emerged as the structural backbone of North America’s creator economy, reinforcing its leadership position through scalable monetization and deep user engagement.

Monetization Method

In 2024, the Brand Collaborations segment held a dominant market position within the North American creator economy, capturing more than 22.7% of total monetization revenue. This segment encompasses partnerships between creators and brands in formats such as sponsored content, influencer campaigns, product launches, and co-developed merchandise.

These collaborations have gained preeminence due to the substantial US influencer marketing expenditure, which is projected to reach $5.9 billion in 2024, highlighting the strategic shift of marketers toward creator-driven promotion models.

North America Creator Economy Market Share by Monetization Method (%), 2019-2024

Monetization Method 2019 2020 2021 2022 2023 2024 Advertising Revenue 24.8% 24.3% 23.8% 23.3% 22.4% 22.1% Subscriptions 17.1% 17.7% 18.3% 18.9% 19.8% 20.0% Donations and Tips 7.5% 7.2% 7.0% 6.7% 6.5% 6.3% Affiliate Marketing 12.2% 12.3% 12.3% 12.4% 12.4% 12.5% Brand Collaborations 21.0% 21.3% 21.7% 22.1% 22.6% 22.7% Merchandise 11.6% 11.6% 11.5% 11.5% 11.3% 11.4% Others 5.8% 5.6% 5.4% 5.2% 5.0% 4.9% The segment’s leadership can be attributed to several reinforcing mechanisms. First, brand-sponsored collaborations offer creators both financial stability and high visibility through multi-platform integration across YouTube, Instagram, TikTok, and other channels. Second, the authenticity and direct engagement potential of creator-to-audience messaging have elevated brand trust and return on investment, prompting brands to increase spending on long-term partnerships.

Finally, data indicates that creator revenues from brand deals remain the largest single income stream -qualitatively and quantitatively – surpassing other income methods and continuing to drive segment dominance in the creator economy.

End User

In 2024, the Professional Creator segment held a dominant market position within the North American creator economy, capturing more than 63.3 % share of total end‑user revenue. This leadership is attributable to the growing number of professional content creators – roughly 45 million globally – whose higher levels of skill, consistency, and follower engagement enable them to generate substantial income from multiple revenue streams, including brand partnerships, subscriptions, merchandise, and advertising.

North America Creator Economy Market Share by End user (%), 2019-2024

End User 2019 2020 2021 2022 2023 2024 Professional Creator 65.4% 65.0% 64.5% 64.1% 63.5% 63.3% Armature Creator 34.6% 35.0% 35.5% 35.9% 36.5% 36.7% This dominance is reinforced by several key factors. Professional creators typically maintain larger, more engaged audiences, which increases their appeal to brands and sponsors seeking targeted exposure. Their ability to deliver consistently high-quality content across diverse platforms fosters trust and audience loyalty, leading to successful monetization through premium offerings such as Patreon, online courses, and exclusive content.

Key Market Segments

By Platform

- Social Media Platforms

- Content-Sharing Platforms

- Video Streaming Platforms

- Audio Platforms

- Gaming Platforms

- Others (E-commerce Platforms, etc.)

By Content Type

- Video

- Written

- Gaming

- Music

- Photography, Art, and Memes

- Audio

- Others (Educational, etc.)

By Monetization Method

- Brand Collaborations

- Advertising Revenue

- Subscriptions

- Donations and Tips

- Affiliate Marketing

- Merchandise

- Others

By End User

- Professional Creator

- Armature Creator

Emerging Trends

Rapid Expansion Into New Formats and Channels

The creator economy is transitioning beyond short-form social posts into serialized video podcasts, live shopping events, and TV-style productions. Major platforms such as YouTube and Spotify are investing in influencer-tool sets to support longer-form content, while e‑commerce channels are integrating live‑sell formats, reshaping how creators generate revenue.

Professionalization and AI-Enabled Growth

Over The industry is undergoing professional maturation. Brands now demand refined ROI metrics, while AI tools are increasingly leveraged for talent discovery and content targeting. Over $15 billion will be earned by social media creators in 2025, driven by long-tail identification and measurement rigor.

Business Benefits

Enhanced brand performance and measurable ROI

Brands are intensifying investments in creator partnerships, with 44% of advertisers increasing their spend on influencer collaborations in 2024 and marketing budgets rising around 25% year over year. Pay transparency in creator compensation is bolstering trust, enabling more predictable budgeting and improved cost-effectiveness for brand campaigns. The shift toward data-driven influencer marketing, with analytical benchmarks and affiliate models, supports optimized return on investment through measurable outcomes .

Scalable creator-enabled commerce and talent development

North America is witnessing a strong uptick in creator monetization across direct-to-consumer formats, affiliate sales, membership programs, and branded products. This scalable commerce model allows creators to develop robust personal brands while enabling brands to access niche communities at scale.

Notably, full-time digital creator roles in the U.S. have increased from 200,000 in 2020 to 1.5 million in 2024, illustrating the significant scale and economic impact of this secto. The resulting shift supports a dynamic creator-driven supply chain of content, products, and services that benefits both creators and brands.

Driver

Rising Internet Penetration & Social Media Adoption

The growth of North America’s creator economy has been significantly propelled by the ubiquity of social media platforms and the widespread availability of high-speed internet. With over 90 % of the U.S. population connected online, entry barriers for content creation have been drastically reduced.

These platforms facilitate direct monetization pathways – such as ad revenue sharing, tipping, and subscriptions – which have democratized content production and enabled creators to reach global audiences effortlessly. Consequently, content creation has transitioned from fringe activity to a viable economic endeavor for many individuals.

Smartphone and 5G proliferation further reinforce this driver. As mobile internet adoption deepens, creators from previously underserved regions have been empowered, fueling a surge in user-generated content. Platforms optimized for mobile enable creators to craft and distribute content in real time, fostering engagement and community growth. In turn, this trend supports scalable monetization and drives continuous ecosystem expansion.

Restraint

Oversaturation and Income Instability

Despite rapid expansion, the creator economy faces oversaturation and resultant income disparities. With the proliferation of creators, standing out becomes increasingly difficult, leading to diminishing returns in early career stages. A significant share of creators struggle to generate substantial income, risking burnout and disillusionment.

Moreover, earnings volatility presents a critical challenge. Adjacent issues like demonetization, inconsistent platform policies, and copyright takedowns exacerbate income instability. Creators frequently report unpredictable revenue flows due to shifting algorithms and policy changes, hindering their ability to sustain content as a full-time pursuit.

Opportunity

Technological Innovation & Monetization Expansion

Emerging technologies such as generative AI, VR, and analytics platforms present untapped growth potential. AI-driven content tools reduce production costs and time, enabling creators to focus on strategy and engagement. Platform improvements in creator analytics and operations further support professional content management at scale.

Additionally, expanding monetization channels – like live commerce, exclusive course offerings, and NFTs—provide avenues for differentiated revenue and closer audience relationships. These innovations encourage creators to build business models less reliant on ad algorithms and more focused on niche audience monetization. As platforms integrate commerce, analytics, and AI, creators can focus on content quality and direct-to-fan experiences, marking a strategic shift in ecosystem development.

Challenge

Regulatory Hurdles & Platform Dependence

Regulatory uncertainties around taxation, copyright, and data privacy pose significant complications. Tax liabilities for creators remain ambiguous and burdensome, particularly for those navigating cross-border revenue streams. Copyright disputes – often resulting in demonetization – continue to impede creator income and disrupt workflows. These legal pressures can discourage innovation and limit broader participation.

Simultaneously, high dependency on dominant platforms introduces systemic risk. Creators often lack autonomy over visibility, monetization, and policy enforcement, making them vulnerable to algorithm shifts, feature removals, or policy changes. This reliance suppresses long-term bargaining power and makes the ecosystem susceptible to disruptions from platform strategy shifts or regulatory intervention.

Key Player Analysis

Spotify accelerated its transformation from audio-only podcast platform to a comprehensive multimedia creator hub. In January 2025, it launched the “Spotify Partner Program” to enable video podcast monetization, resulting in payouts exceeding USD 100 million in Q1 2025. The rollout expanded to nine markets by March 2025, with notable user and creator traction – hundreds of creators reportedly earning over USD 10,000 monthly, and top performers reaching six figures in a single month.

ByteDance’s momentum was bolstered by TikTok’s global expansion and creator‑centric monetization advances. The company reported USD 155 billion in revenue for 2024, a 29 % year‑on‑year increase, largely attributed to TikTok’s performance; a further 20 % revenue growth was forecast for 2025, projecting USD 186 billion. TikTok continued to introduce monetization formats such as Affiliate Creatives, Creator Marketplace, and virtual gifting, contributing to a broader strategy to drive global creator engagement

Top Key Players Covered

- Alphabet Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Note (*): Similar analysis will be provided for other companies as well.

- Amazon.com, Inc.

- ByteDance

- Meta Platforms

- Spotify AB

- Netflix Inc.

- Snap Inc.

- Pinterest, Inc.

- X Corp.

- Canva

- Roblox Corporation

- Etsy, Inc.

- Patreon, Inc.

- Discord Inc.

- Substack Inc.

Recent Developments

- In early 2025, Meta Platforms expanded its support for digital creators by announcing a USD 50 million fund dedicated to Horizon Worlds. This move builds on its previous USD 500,000 reward program rolled out in 2024. The company also hired Shadi Nayyer, formerly with TikTok, to lead creator strategy for its metaverse efforts.

- Alphabet continues to support its YouTube creator ecosystem through internal investment and product support. In March 2025, Alphabet confirmed through its financial statements that over USD 150 billion had been spent in R&D over the past five years, indirectly supporting innovations in YouTube’s monetization and AI content tools.

- May 2025: ByteDance disclosed 29 % YoY revenue growth to US $155 billion (2024), with TikTok driving a worldwide creator‑economy expansion.

Report Scope

Report Features Description Market Value (2024) USD 55.8 Bn Forecast Revenue (2034) USD 331.4 Bn CAGR (2025-2034) 19.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Social Media Platforms, Content-Sharing Platforms, Video Streaming Platforms, Audio Platforms, Gaming Platforms, Others (E-commerce Platforms, etc.), By Content Type (Video, Written, Gaming, Music, Photography, Art, and Memes, Audio, Others (Educational, etc.), By Monetization Method (Brand Collaborations, Advertising Revenue, Subscriptions, Donations and Tips, Affiliate Marketing, Merchandise, Others), By End User (Professional Creator, Armature Creator) Competitive Landscape Alphabet Inc., Amazon.com, Inc., ByteDance, Meta Platforms, Spotify AB, Netflix Inc., Snap Inc., Pinterest, Inc., X Corp., Canva, Roblox Corporation, Etsy, Inc., Patreon, Inc., Discord Inc., Substack Inc., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Creator Economy MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

North America Creator Economy MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-