Global Non-Alcoholic Beverages Market By Product (Bottled Water, Soft Drinks(Carbonated Soft Drinks, Non-Carbonated Soft Drinks, Energy & Sports Drinks), Juices(Orange Juice, Apple Juice, Grapefruit Juice, Pineapple Juice, Grape Juice and Others), Ready-to-Drink (RTD) Coffee & Tea(Ready-to-Drink (RTD) Coffee, Ready-to-Drink (RTD) Tea)), By Distribution Channel (Supermarkets & Hypermarket, Convenience Stores, Online Retail, Food Service, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov. 2023

- Report ID: 26499

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

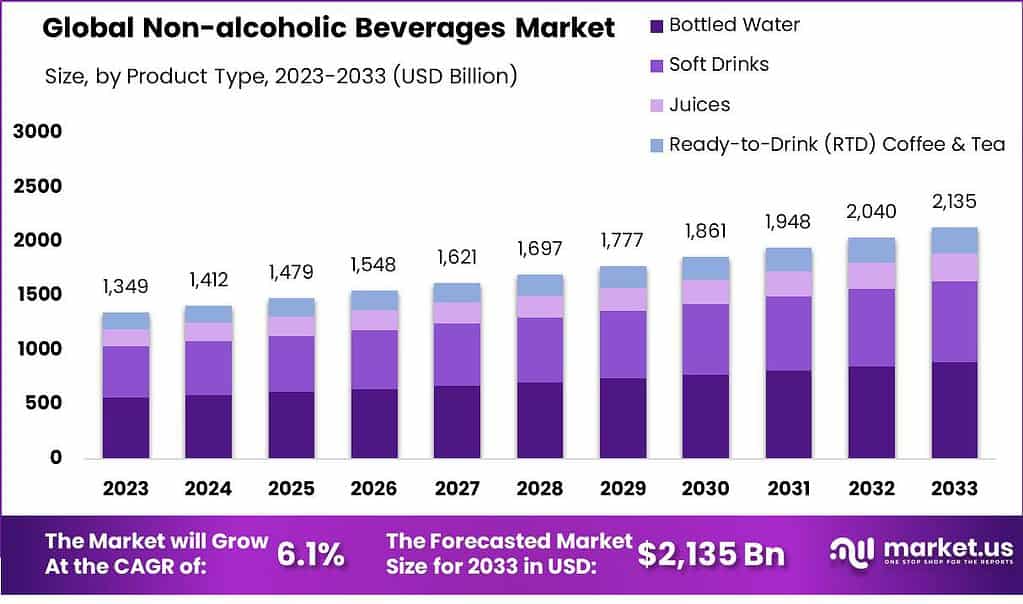

The Global Non-Alcoholic Beverages Market is anticipated to be USD 2,135 billion by 2033. It is estimated to record a steady CAGR of 6.1% in the Forecast period 2023 to 2033. It is likely to total USD 1,349 billion in 2023.

Non-alcoholic beverages are drinks that either don’t have alcohol or contain a minimal amount. People enjoy these beverages for reasons like staying refreshed, staying hydrated, enjoying the taste, and considering health factors. This category encompasses a range of beverages, including soft drinks tea, juices energy drinks, coffee flavors of water, and functional drinks.

The main driver behind these markets is growing focus on wellness and health. Consumers are constantly searching for healthier alternatives to sweet drinks, which has led to an increase in consumption of drinks like sparkling water in bottles, water with flavors fruit juices, herbal teas and plant-based milk substitutes. Manufacturers are responding to this trend with innovative products made of organic and natural ingredients, less sugar and other advantages.

Note: Actual Numbers Might Vary In The Final Report

Another important factor behind the growth of the market is the increasing popularity of functional drinks. These drinks provide many health benefits, beyond just water intake, like an increase in energy, immune support as well as digestive health. In many cases, they incorporate ingredients such as antioxidants, vitamins, minerals and probiotics. Functional drinks are formulated to meet particular needs and preferences of consumers.

The convenience factor and desire for consumption on the go contribute to the growth of the market. The demands of busy lifestyles and to have a drink that is portable has led to the rise of ready-to-drink products, including single-serve cans, bottles, and packs that can be taken with you on the go. These handy options cater to people who are looking for easy-to-access beverages that easily blend into their hectic lifestyles.

Key Takeaways

- Market Growth: The Global Non-Alcoholic Beverages Market is anticipated to be USD 2,135 billion by 2033. It is estimated to record a steady CAGR of 6.1% in the Forecast period 2023 to 2033. It is likely to total USD 1,349 billion in 2023.

- By Product Type Analysis: The Soft Drinks segment emerged as a dominant force, capturing an impressive market share of over 58.6%.

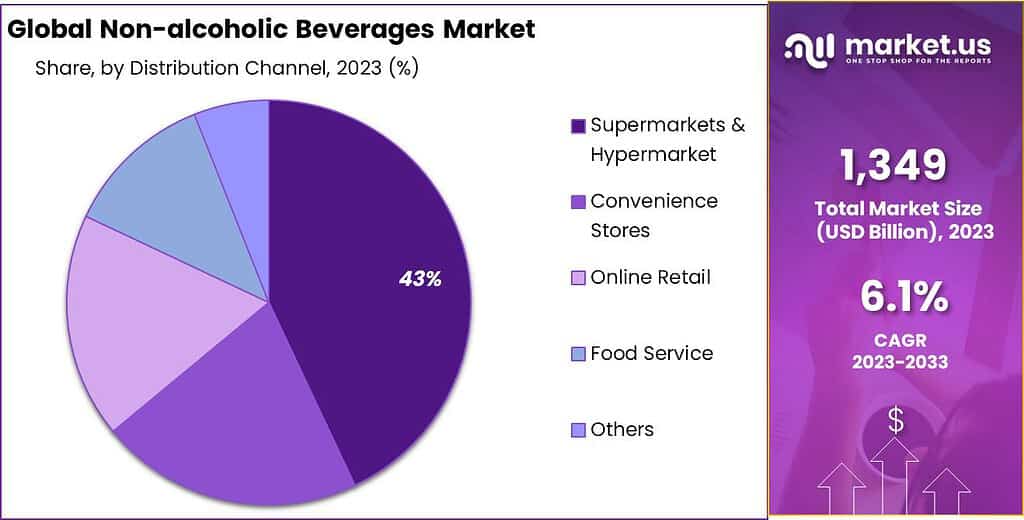

- By Distribution Channel Analysis: Supermarkets & Hypermarkets stood out as the dominant force, securing a commanding market position with a share exceeding 43%.

- Driving Factors: Consumers’ increasing focus on health and wellness is driving the demand for non-alcoholic beverages, especially those with natural components and functional ingredients.

- Restraining Factors: High sugar content in non-alcoholic drinks is a major concern for health-conscious consumers.

- Growth Opportunities: The trend towards plant-based diets offers significant growth opportunities, including dairy-free options.

- Regional Analysis: North America dominates the market, driven by a focus on health and wellness.

- Key Players: Major players include The Coca-Cola Co, PepsiCo Inc, Monster Beverage Corp, Keurig Dr Pepper Inc, and more.

By Product Type Analysis

In 2023, the Non-Alcoholic Beverages market presented a diverse landscape, segmented by product types that cater to various consumer preferences and lifestyles. Among these, the Soft Drinks segment emerged as a dominant force, capturing an impressive market share of over 58.6%. This commanding position can be attributed to the enduring popularity of soft drinks in the global beverage landscape. Soft drinks cover a broad selection of options, such as carbonated soft drink, carbonated soft drinks, energy and sports drinks that cater to a variety of taste preferences as well as functional requirements.

Soft drinks that contain carbonated, which are distinguished by their effervescence as well as their diverse flavors, have maintained a large consumer base throughout the world. The wide availability of cola, citrus, and fruit-flavored carbonated drinks, along with their refreshingly crisp attributes, has contributed significantly to this segment’s market dominance.

Non-carbonated soft drinks, often comprising fruit juices, flavored waters, and functional beverages, have gained traction among health-conscious consumers seeking refreshing alternatives with lower sugar content. The demand for these options has been bolstered by growing concerns about sugar intake and the pursuit of healthier beverage choices.

Energy and sports drinks, known for their ability to provide quick energy and hydration, have garnered a substantial share within the Soft Drinks segment. With a growing emphasis on fitness and a vigorous life style, these drinks are becoming a popular option for those who want to improve their performance.

By Distribution Channel Analysis

In 2023, the distribution channels within the non-alcoholic beverages market played a pivotal role in reaching consumers and shaping market dynamics. Among these channels, Supermarkets & Hypermarkets stood out as the dominant force, securing a commanding market position with a share exceeding 43%. These retail stores have become the most popular location for people looking to purchase an array of non-alcoholic drinks. Their ability to provide the convenience of one stop shopping, coupled with competitive pricing and special offers have made them the preferred option for buying drinks. Additionally, the convenience of bulk shopping in supermarkets and the diverse product range in hypermarkets have contributed to their stronghold in the market.

Convenience Stores also played a significant role in the distribution landscape, catering to consumers’ need for quick and accessible beverage options. These small-format stores, known for their extended operating hours and convenient locations, captured a considerable market share. They excel in providing on-the-go beverage solutions, particularly for impulse purchases and immediate consumption. Convenience stores have successfully capitalized on the demand for snacks and beverages during commutes and short breaks, making them an integral part of the non-alcoholic beverages distribution network.

Online Retail emerged as a notable player in 2023, with a growing market share fueled by the increasing adoption of e-commerce platforms. Consumers’ inclination toward online shopping, coupled with the convenience of doorstep delivery, has boosted the online retail channel’s presence. This channel caters to a diverse customer base and allows for easy comparison of product offerings and prices, contributing to its market appeal.

Food Service establishments, including restaurants, cafes, and eateries, also played a role in the non-alcoholic beverages market. While their market share may not have rivaled that of supermarkets and convenience stores, food service outlets offered specialty beverage experiences and contributed to the overall market’s diversity.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Health and Wellness Trends: The growing consciousness of health and wellness by consumers is a key factor driving the non-alcoholic beverage market. People who are concerned about their health seek out beverages that provide nutritional benefits including the absence of sugar and natural components and functional ingredients like antioxidants and vitamins.

- Diverse Product Innovation: The market benefits from continuous product innovation, with companies introducing a wide range of non-alcoholic beverages, including plant-based options, functional drinks, and exotic flavors. Consumers are drawn to novel and unique beverage choices, driving market growth.

- Changing Consumer Lifestyles: The busy lifestyles of today and the desire for convenience on the go have resulted in the rise of drinks that are ready to drink (RTD) and take-and-go non-alcoholic drinks.

- Global Health Challenges: Health issues such as diabetes and obesity have forced consumers to switch away from high-calorie and sugary drinks. This shift in health-related habits has led to the development of healthier, low-calorie alternatives to alcohol in the non-alcoholic beverage market.

Restraining Factors

- Sugar and Calorie Concerns: The high sugar content in non-alcoholic drinks is a major concern for health-conscious consumers. The popularity of drinks that are sugary may deter some people from buying these items and lead to a need to find healthier options.

- Regulatory Measures: Government regulations that aim at decreasing drinks that are sugar-based drinks like sugar taxes as well as labeling regulations, may present challenges to the industry of non-alcoholic drinks. The compliance with these regulations could raise costs and restrict offerings of products.

- Environmental Impact: The usage of single-use plastic packaging within the non-alcoholic beverages industry has caused environmental issues. The public is increasingly looking for environmentally friendly and sustainable packaging options and they can be costly to implement for businesses.

- Competition from Other Categories: Non-alcoholic drinks face the challenge of other categories of beverages such as ready-to-drink coffee, energy drinks and alternative milk products made of plant-based sources. The wide variety of beverages available could make the market more fragmented and present challenges to traditional brands of non-alcoholic beverages.

Growth Opportunities

- Plant-Based Beverages: The growing trend toward plant-based diets offers significant growth opportunities. Plant-based non-alcoholic beverages, including almond milk, soy milk, and fruit juices, cater to consumers looking for dairy-free and sustainable options.

- Functional and Health-Enhancing Drinks: The demand for functional beverages with added health benefits, such as probiotics, vitamins, and antioxidants, presents growth prospects. These beverages align with consumers’ desires for improved well-being.

- E-Commerce Expansion: The proliferation of e-commerce platforms provides an avenue for non-alcoholic beverage companies to reach a wider audience. Online sales and direct-to-consumer models can boost market accessibility and sales.

- Global Market Penetration: Expanding into emerging markets with rising disposable incomes and urbanization offers growth potential. These regions present opportunities for non-alcoholic beverage companies to tap into new customer bases.

Key Market Trends

- Premiumization: Consumers are willing to pay more for premium and artisanal non-alcoholic beverages that offer unique flavors, ingredients, and packaging. This trend has led the rise of specialty and craft beer brands.

- Low-Alcohol and Alcohol-Free Alternatives: Free and low-alcohol drinks Markets have seen the increase in low-alcohol as well as alcohol-free drinks that cater to those who want the flavor and enjoyment of alcohol-based drinks, but without alcohol.

- Sustainability and Packaging Innovation: Non-alcoholic beverage companies are increasingly adopting sustainable packaging practices, such as recyclable materials and reduced plastic usage. Eco-friendly packaging is becoming a key differentiator and a response to consumer environmental concerns.

- Local and Authentic Ingredients: Consumers are drawn to non-alcoholic beverages featuring local and authentic ingredients, reflecting a desire for transparency and connection to the source. Brands that highlight their ingredient origins and production methods are gaining traction in the market.

Key Market Segments

By Product Type

- Bottled Water

- Soft Drinks

- Carbonated Soft Drinks

- Non-Carbonated Soft Drinks

- Energy & Sports Drinks

- Juices

- Orange Juice

- Apple Juice

- Grapefruit Juice

- Pineapple Juice

- Grape Juice

- Others

- Ready-to-Drink (RTD) Coffee & Tea

- Ready-to-Drink (RTD) Coffee

- Ready-to-Drink (RTD) Tea

By Distribution Channel

- Supermarkets & Hypermarket

- Convenience Stores

- Online Retail

- Food Service

- Others

Regional Analysis

In 2023, North America held a dominant market position in the Non-Alcoholic Beverages sector, capturing more than a 35.6% share. The dominance of this region can be due to the growing healthy population, which has resulted in a rise in the demand for healthier and natural beverage alternatives. In addition the presence of significant companies in the sector that are constantly introducing new products has greatly contributed to the dominance of North America’s market.

In Europe, the Non-Alcoholic Beverages market also exhibited robust growth in 2023. The region accounted for a substantial market share, driven by consumer preferences shifting towards non-alcoholic options. This trend aligns with the region’s increasing focus on health and wellness, leading to an expanding market for organic and natural beverages. European consumers are showing a preference for beverages that offer unique flavors and functional benefits.

Moving on to the APAC region, it emerged as a promising market for Non-Alcoholic Beverages in 2023.The market share for the region experienced significant growth, driven by the growing living standards of its population as well as growing awareness of the harmful consequences of drinking too much alcohol. The consumers of Asia-Pacific are turning to non-alcoholic beverages that have a the taste of a healthy beverage, health benefits and cultural significance.

The market in Latin America, the Non-Alcoholic Beverages market grew steadily in 2023, though at a slower rate as other areas. Factors like stability in the economy and changing consumer preferences are a major factor in shaping the market. Latin American consumers are increasingly seeking out beverages that incorporate indigenous ingredients, highlighting the rich cultural diversity of the region.

In the Middle East and Africa, the Non-Alcoholic Beverages market exhibited potential for growth in 2023. The region is experiencing a shift towards healthier beverage choices, driven by rising concerns about lifestyle-related diseases. The market in this region is characterized by the demand for natural and traditional beverages like hibiscus tea and date-based drinks.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Additionally, the growth of this market has been also influenced by the branding and marketing strategies employed by the beverage industry. Marketing campaigns that are successful and emphasize the health benefits and natural characteristics of non-alcoholic drinks, along with targeted advertisements targeted at particular segments of the population are crucial in creating brand awareness and encouraging consumer involvement.

Key participants in the non-alcoholic beverages market comprise major multinational corporations, regional entities, and specialized beverage brands. The market exhibits high competitiveness, with companies such as Coca-Cola Co, PepsiCo Inc, Monster Beverage Corp, and more.

Top Key Players

- The Coca-Cola Co

- PepsiCo Inc

- Monster Beverage Corp

- Keurig Dr Pepper Inc

- Fomento Economico Mexicano SAB de CV

- Arizona Beverage Company

- Asahi Group Holdings Ltd

- Danone S.A

- Nestle SA

- Unilever Plc

- Red Bull GmbH

- Dr. Pepper Snapple Group Inc

Recent Development

- In July 2022, PepsiCo inaugurated its largest bottling plant in the United States, located in Colorado. The proposed facility aims to achieve 100% renewable electricity, top-notch water efficiency, and a substantial reduction in the use of virgin plastic.

- In March 2022, Red Bull introduced a limited-edition extension featuring strawberry and apricot flavors. The Red Bull Summer Edition Strawberry Apricot hit Walmart shelves in the United States on April 4, 2022, and is available in single cans in both 8.4oz (25cl) and 12oz (35cl) formats.

Report Scope

Report Features Description Market Value (2023) US$ 1,349 Bn Forecast Revenue (2032) US$ 2,135 Bn CAGR (2023-2032) 6.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Bottled Water, Soft Drinks(Carbonated Soft Drinks, Non-Carbonated Soft Drinks, Energy & Sports Drinks), Juices(Orange Juice, Apple Juice, Grapefruit Juice, Pineapple Juice, Grape Juice and Others), Ready-to-Drink (RTD) Coffee & Tea(Ready-to-Drink (RTD) Coffee, Ready-to-Drink (RTD) Tea)), By Distribution Channel (Supermarkets & Hypermarket, Convenience Stores, Online Retail, Food Service, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Coca-Cola Co, PepsiCo Inc, Monster Beverage Corp, Keurig Dr Pepper Inc, Fomento Economico Mexicano SAB de CV, Arizona Beverage Company, Asahi Group Holdings Ltd, Danone S.A, Nestle SA, Unilever Plc, Red Bull GmbH, Dr. Pepper Snapple Group Inc Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are non-alcoholic beverages?Non-alcoholic beverages are drinks that do not contain alcohol or have a very low alcohol content. They include a wide range of products such as sodas, juices, tea, coffee, energy drinks, flavored water, and functional beverages.

What factors contribute to the growth of the non-alcoholic beverages market?The growth of the non-alcoholic beverages market is influenced by changing consumer preferences, increasing health consciousness, demand for diverse beverage options, and effective marketing strategies by beverage companies. Additionally, trends like health and wellness, the popularity of functional beverages, and on-the-go consumption play significant roles.

How big is Non-Alcoholic Beverages Market?The Global Non-Alcoholic Beverages Market is anticipated to be USD 2,135 billion by 2033. It is estimated to record a steady CAGR of 6.1% in the Forecast period 2023 to 2033. It is likely to total USD 1,349 billion in 2023.

What are the top 5 non-alcoholic beverage companies?Top 5 Non-Alcoholic Beverage Companies:

- The Coca-Cola Company: A global leader in the beverage industry, offering a wide range of non-alcoholic beverages.

- PepsiCo: Another major player in the beverage industry, known for its diverse portfolio of non-alcoholic beverages, including Pepsi, Mountain Dew, and various juice brands.

- Nestlé: While known for its food products, Nestlé is also a significant player in the non-alcoholic beverage market with brands like Nesquik and Nestea.

- Dr Pepper Snapple Group (now part of Keurig Dr Pepper): Known for a variety of non-alcoholic beverages, including Dr Pepper, Snapple, and 7UP.

- Red Bull GmbH: Recognized for its energy drinks, Red Bull has become a prominent player in the non-alcoholic beverage market.

What is the market research for non-alcoholic beverages?Market research for non-alcoholic beverages involves studying market trends, consumer preferences, competitive landscapes, and factors influencing the industry's growth. This research helps companies make informed decisions regarding product development, marketing strategies, and business expansion.

Non-Alcoholic Beverages MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Non-Alcoholic Beverages MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- The Coca-Cola Co

- PepsiCo Inc

- Monster Beverage Corp

- Keurig Dr Pepper Inc

- Fomento Economico Mexicano SAB de CV

- Arizona Beverage Company

- Asahi Group Holdings Ltd

- Danone S.A

- Nestle SA

- Unilever Plc

- Red Bull GmbH

- Dr. Pepper Snapple Group Inc