Global Nitrocellulose Market, By Product (M-Grade, E-Grade, and Other Grades), By Application(Automotive Paints, Leather Finishes, Printing Inks, Nail Varnish, Wood Coating), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 28963

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

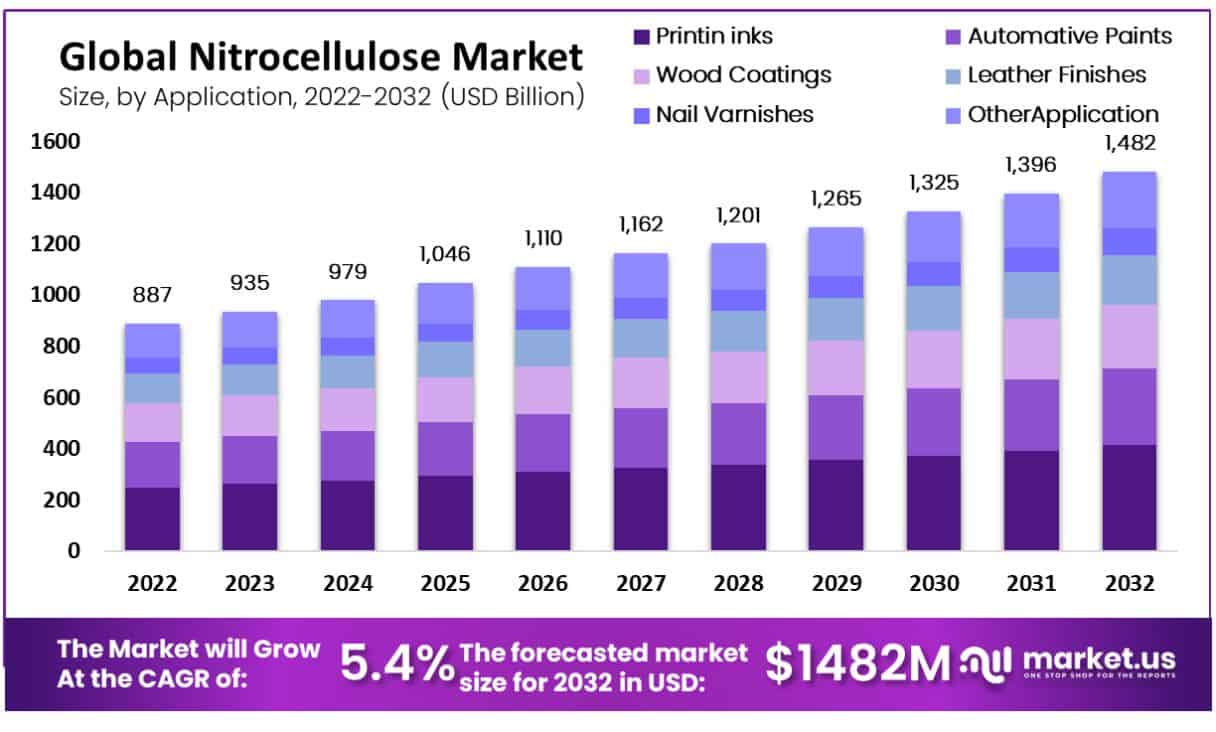

The global nitrocellulose market size was valued to be worth USD 887.24 million in 2022. From 2023 to 2032, it is estimated to reach USD 1482 million growing at a CAGR of 5.4%.

This growth in product demand can be attributed to rising demand in printing inks, paints & coatings, as well as other end-use industries. The growing demand for automotive paints, together with increasing environmental awareness and better efficacy provided by hybrid and electric vehicles, is anticipated to drive market revenue growth over the forecast period.

Nitrocellulose, also referred to as cellulose nitrate, is a combination of cellulose nitric esters and an explosive compound used in modern gunpowder. It is highly inflammable in nature. Its superior adhesion properties and non-reactivity to paints have been driving revenue growth in this market. Due to the rising global demand for printing ink in the packaging industries, there has recently been an increase in printing ink applications, which should continue to fuel market expansion over the forecast period.

Revenue growth in the automotive industry has been severely constrained due to COVID-19 outbreak-related issues such as commodity import and export restrictions. This pandemic has had a devastating effect on this sector, disrupting automobile production and resulting in huge losses across global automotive sectors. Moreover, due to a sharp decline in production levels, demand has decreased drastically and is causing massive ripple effects all over the world.

Key Takeaways

- Market Growth: The nitrocellulose market worldwide is currently witnessing strong expansion, projected at 5.4% compound annual compound annual growth from 2023-2032.

- Overview: Nitrocellulose, an extremely adaptable compound, finds extensive usage across numerous industries due to its versatile properties and widespread applications. For instance, lacquers, explosives, films, and coatings often utilize this important element of production.

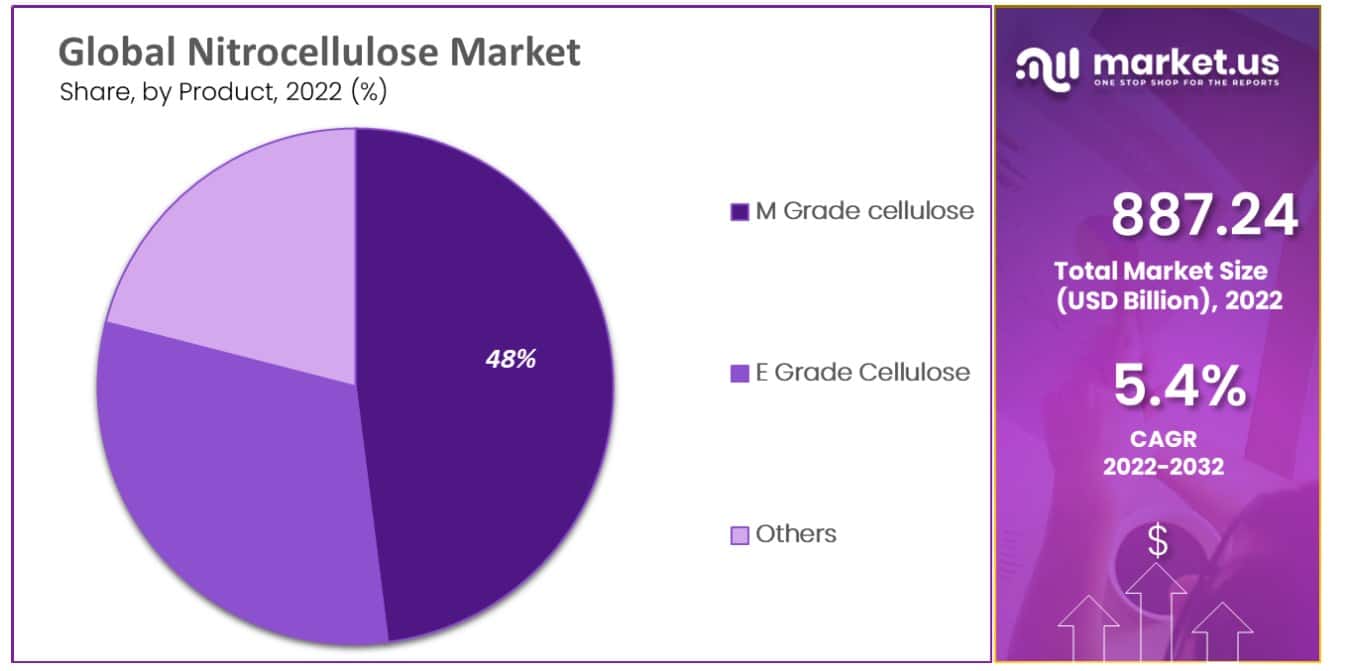

- Product Types: In terms of product types, the nitrocellulose market is segmented into M-grade, E-grade, and other variants. Among these, the M-grade segment takes the lead, commanding a significant market share of 48%.

- Applications: In the application analysis, printing ink emerges as the market leader, holding a considerable share of 28%.

- Drivers: Key drivers of market growth include the expanding automotive industry, the demand for innovative coatings and finishes, and the increasing use of nitrocellulose in the production of lacquers and adhesives. Its inherent characteristics as an effective film-forming material also fuel market growth.

- Restraints: Market challenges encompass safety concerns due to its explosive nature in certain forms, regulatory constraints regarding its use, and fluctuating raw material prices. Additionally, competition and sustainability considerations are significant restraints.

- Opportunity: Opportunities for market expansion lie in technological advancements, the development of eco-friendly nitrocellulose derivatives, and exploring novel applications in emerging industries. Meeting the demand for sustainable and efficient coatings is a notable growth avenue.

- Trends: Trends in the nitrocellulose market include innovations in production processes, increased focus on safety measures, and research for novel applications, particularly in the healthcare and pharmaceutical sectors. Sustainable sourcing and production practices represent prominent trends.

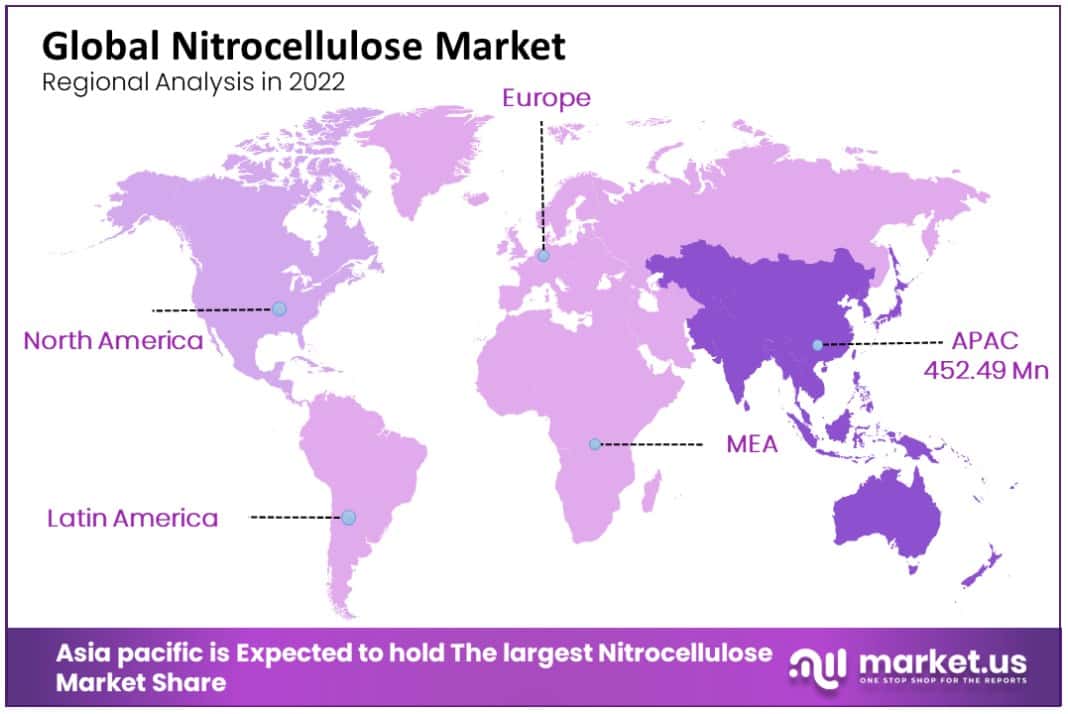

- Regional Analysis: This market analysis covers North America, Europe, South America, Asia Pacific, and the Middle East/Africa regions; with Asia Pacific holding 48% market share as of 2021.

- Key Players in the Nitrocellulose Market: There is a range of key players operating within the nitrocellulose market, both established companies and emerging startups with expertise in its production and applications. Many invest in R&D initiatives, sustainability efforts, or strategic collaborations in order to meet ever-evolving market needs and maintain an edge against their competition.

Driving Factors

Increased Demand for Paints and Coatings: Nitrocellulose is widely used in the production of paints and coatings because of its superior adhesion, durability, and chemical and abrasion resistance. As high-performance coatings become more important in industries like automotive, construction, and aerospace, nitrocellulose’s demand is expected to keep rising.

Growth of the Printing Ink Industry: Nitrocellulose is used as a binding agent in printing inks. As the printing industry, particularly in emerging economies, expands, so does the demand for nitrocellulose-based inks.

Nitrocellulose: Nitrocellulose is an integral part of explosive production, like gunpowder and smokeless powder. With the growing need for explosives in military, mining, and construction applications, nitrocellulose supply is also on the rise.

Increased Demand for Adhesives: Nitrocellulose is increasingly being utilized as a binder in adhesive production, particularly within the woodworking and paper industries. As these industries expand, so too does the need for nitrocellulose-based adhesives.

Environmental Regulations: Nitrocellulose is an environmentally hazardous material, so its production and use are subject to stringent environmental regulations. With the growing emphasis on environmental sustainability, there has been an inclination toward eco-friendly alternatives to nitrocellulose which has spurred innovation and research into developing new materials.

Restraining Factors

Environmental Regulations: Nitrocellulose is classified as a hazardous material, and thus is subjected to stringent environmental regulations. Companies must make sure their manufacturing processes abide by these requirements – something which may prove expensive and time-consuming in the long run.

Safety Concerns: Nitrocellulose is highly flammable and can be hazardous if not handled appropriately. Companies must follow stringent safety protocols to guarantee the secure handling and storage of nitrocellulose products.

Competition from Alternative Materials: Nitrocellulose faces competition from alternative materials such as acrylics and polyurethanes, which offer similar properties but are typically easier to handle and process.

Volatility in Raw Material Prices: The cost of nitrocellulose is heavily affected by the price of raw materials such as cotton and wood pulp. Any changes in these prices can have a substantial effect on nitrocellulose’s cost, making it less competitive compared to alternative materials.

Health Concerns: Nitrocellulose can emit hazardous fumes when burned or heated, posing health risks to workers in industries that use it. Companies must take appropriate measures to safeguard their employees from such hazards.

By Product Analysis

According to the product analysis, the M-grade segment dominates the market with a 48% market share.

By product type, the nitrocellulose market is further divided into, M-grade, E-grade, and Others, in which the M-grade segment dominates the market with a 48% market share. cellulose segment dominates for a substantial share of the global nitrocellulose market. It’s used as a thickener in consumer products, as emulsifiers in oils, dietary supplements in capsules, or other applications, aerospace, and automotive industries are particularly in need of emulsifiers.

Also, market growth for this segment is forecasted to accelerate significantly during the forecast period. M-grade cellulose is mostly utilized in emulsifiers used in personal care as well as cosmetics products. With the probiotics and cosmetics market expected to experience exponential growth during the forecast period, the M-grade cellulose market will also experience considerable expansion.

By Application Analysis

By application analysis, printing ink dominates the market with a 28 % market share.

Technology advancement and growing demand for eco-friendly printing inks can explain its high share. Printing ink markets are both customer- and application-specific. Major applications can be found in the packaging and logistics sectors. Inkjet printing, outdoor signage, and digital inks are also in high demand. The government has been forced to improve the nitrocellulose industry standards due to growing environmental concerns.

For gravure and flexography printing, nitrocellulose-based lamination inks provide vibrant color paint with high quality. Because of their superior lamination strength, low odor, and minimal solvent retention, these inks are becoming more popular in the packaging industry. The uses of wood coating products vary depending on their purpose. It is commonly used for furniture decking, sliding doors and windows, carpets & color, as well as industrial purposes. Nitrocellulose lacquers are also known as wood coatings.

They are used extensively in the manufacture of steel strings for guitars and other musical instruments, especially in the U.S. As a finishing agent, nitrocellulose lacquer makes repairs and touch-ups easy. Due to their brilliance, resolution, full solvent evaporation, and the speed at which modern machines can print, the market for cellulose nitrate printing inks is expected to grow over time.

Key Market Segments

Based on Product

- M grade

- E grade

- Other

Based on Application

- Automotive Paints

- Leather Finishes

- Printing Inks

- Nail Varnish

- Wood Coating

- Others

Growth Opportunity

One opportunity in the nitrocellulose market is an increasing need for eco-friendly alternatives to traditional nitrocellulose products. As environmental regulations become stricter, there is a rising need for materials that are less damaging to the environment. This presents companies with an opportunity to develop and market nitrocellulose-based items that are more sustainable, such as water-based coatings, adhesives, and inks.

Additionally, the growing need for high-performance coatings and inks in industries like automotive and aerospace presents an opportunity for the nitrocellulose market to expand further. Nitrocellulose’s superior adhesion, durability, and resistance to chemicals and abrasion make it perfect for these uses; companies can focus on developing new nitrocellulose-based products tailored specifically to these industries’ needs and specifications.

Finally, the growing demand for explosives, particularly in the mining and construction industries, offers a potential growth path for the nitrocellulose market. Companies can focus on creating new and innovative explosives that use nitrocellulose as a key ingredient while adhering to safety and environmental regulations.

Latest Trends

Growing Demand for Water-Based Nitrocellulose Coatings: Water-based coatings are becoming more and more popular as an eco-friendly alternative to traditional solvent-based ones, leading to the development of new water-based nitrocellulose coatings with improved performance and sustainability.

Nitrocellulose’s growing use in 3D printing: Nitrocellulose is finding new applications as a binding material for 3D-printed objects, though this technology is still developing and could revolutionize manufacturing practices.

Advancements in Explosives Technology: Nitrocellulose is an integral part of many explosives, and advances in explosive technology are driving demand for nitrocellulose-based products. This trend can be particularly observed in the mining and construction industries where new and innovative explosives are being created to enhance safety and efficiency.

Growing Demand for Eco-Friendly Materials: With environmental issues becoming more pressing, there is an increasing demand for materials that are less harmful to the environment. This trend has spurred innovation in the development of eco-friendly nitrocellulose products such as biodegradable coatings and adhesives.

Nitrocellulose’s increasing use in the electronics industry: Nitrocellulose is finding new applications within electronic components and as protective coatings on devices, spurring the development of products utilizing this nitrocellulose-based material with improved performance and dependability.

Regional Analysis

By regional analysis, Asia Pacific dominates the market with a 48% market share.

The regions examined for this market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. Asia Pacific emerged as the leading region in 2021, accounting for 48% of the total market share. Asia Pacific currently dominates the nitrocellulose market due to an increase in residential and commercial construction activities due to rapid urbanization.

Europe, meanwhile, is expected to experience growth during the forecast period due to the demand for automotive paints to meet the needs of various automobile MNCs in that region that are developing hybrid and electric vehicle technologies. Furthermore, European consumers are driving demand for both types of vehicles as well.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competition in the nitrocellulose market is highly dependent on product quality, the number of manufacturers & distributors, and their geographical locations. Top producers and companies operating globally are employing various corporate growth strategies such as mergers & acquisitions, and increasing R&D activities to create inventive goods and solutions, among other things.

Furthermore, some key industry participants and stakeholders are focused on expanding their manufacturing capacities. Some prominent names operating within this global nitrocellulose market include:

Market Key Players

- Nitro Chemical Industry Co., Ltd.

- N.C. Industrial Co., Ltd.

- Hubei Xufei Chemical Co., Ltd.

- Jiangsu Tailida Group

- Sichuan North Nitrocellulose Corporation (SNC)

- Nitrex Chemicals India Pvt. Ltd.

- Nobel NC

- Synthesia A.S.

- IVM Chemicals

- Other Key Players

Recent Developments

- In April 2023, SNPE said it made a deal with a big car maker to supply nitrocellulose for a long time. It will start in 2024.

- In May 2023, Hubei Xuefei Chemical expanded its nitrocellulose production in China. It will finish in 2024 and will increase its production by 30%.

- In June 2023, Dow created a new kind of nitrocellulose that is safer and less likely to catch fire. It will be used in cars, clothes, and buildings.

Report Scope:

Report Features Description Market Value (2022) USD 887.24 Mn Forecast Revenue (2032) USD 1482 Mn CAGR (2023-2032) 5.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product, Application Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nitro Chemical Industry Co. Ltd.; T.N.C. Industrial Co., Ltd.; Hubei Xufei Chemical Co., Ltd.; Jiangsu Tailida Group; Sichuan North Nitrocellulose Corp. (SNC); Nitrex Chemicals India Pvt. Ltd.; Nobel NC; Synthesia A.S.; IVM Chemicals,Other companies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is nitrocellulose?Nitrocellulose is a highly flammable compound derived from cellulose, commonly found in plants. It is often used in various industries for its explosive and binding properties, especially in manufacturing paints, coatings, and explosives.

What are the key applications of nitrocellulose?Nitrocellulose is widely used in industries such as automotive, textile, pharmaceuticals, and printing. It is a crucial component in producing lacquers, inks, adhesives, and as a propellant in ammunition.

Which regions are leading in nitrocellulose production?As of the latest data, regions like Asia-Pacific, particularly China and India, are leading in nitrocellulose production. The low manufacturing costs and the presence of a robust industrial infrastructure in these regions contribute to their prominence in the global market

-

-

- Nitro Chemical Industry Co., Ltd.

- N.C. Industrial Co., Ltd.

- Hubei Xufei Chemical Co., Ltd.

- Jiangsu Tailida Group

- Sichuan North Nitrocellulose Corporation (SNC)

- Nitrex Chemicals India Pvt. Ltd.

- Nobel NC

- Synthesia A.S.

- IVM Chemicals

- Other Key Players