Global Nisin Market Size, Share, And Business Benefits By Type (Nisin A, Nisin Z, Others), By Form (Powder, Liquid, Encapsulated), By Application (Meat, Poultry And Seafood Products, Dairy Products, Beverages, Bakery And Confectionery Products, Canned And Frozen Food Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153622

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

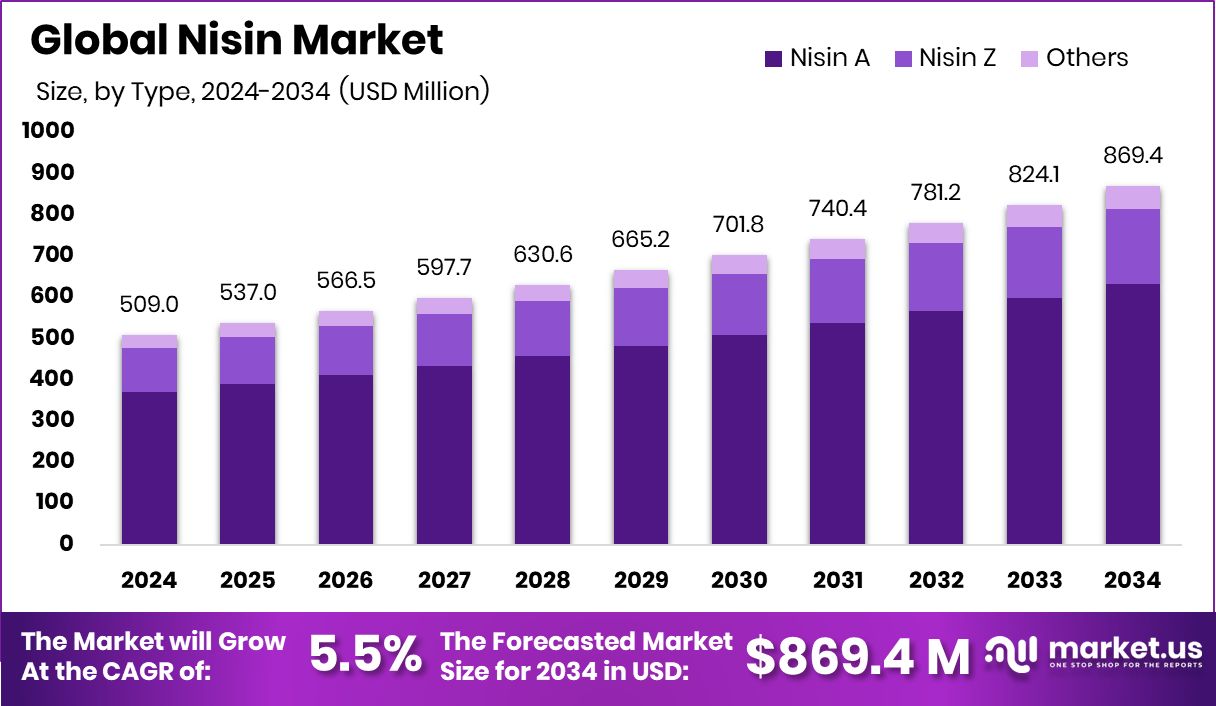

Global Nisin Market is expected to be worth around USD 869.4 million by 2034, up from USD 509.0 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. This dominance reflects rising demand for natural preservatives across North American 46.1% food processing industries.

Nisin is a naturally occurring antimicrobial peptide produced by Lactococcus lactis, widely used as a food preservative. It is effective against a broad spectrum of Gram-positive bacteria, including Listeria and Clostridium species. Approved by food safety authorities like the FDA and EFSA, Nisin is commonly added to processed cheese, dairy, canned vegetables, and meats to extend shelf life without altering taste or texture.

The Nisin market refers to the global trade and application of Nisin across various industries, particularly in food and beverages, pharmaceuticals, and cosmetics. Its use is largely driven by rising demand for natural and effective food preservatives. Manufacturers are adopting Nisin to replace synthetic additives, especially in ready-to-eat and minimally processed foods.

The growing preference for clean-label ingredients and rising awareness of foodborne illnesses are key factors boosting Nisin demand. Consumers are actively choosing products that offer natural preservation, pushing manufacturers to reformulate with safe antimicrobials like Nisin.

The rising consumption of convenience and packaged foods globally is driving demand. Nisin’s role in maintaining freshness and preventing spoilage, especially in dairy, meat, and bakery items, supports its expanding presence in the food processing sector.

Key Takeaways

- Global Nisin Market is expected to be worth around USD 869.4 million by 2034, up from USD 509.0 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- Nisin A dominates the market with 72.6%, driven by its superior antimicrobial effectiveness and regulatory acceptance.

- Powdered Nisin holds a 69.4% share due to its longer shelf life and easy incorporation in formulations.

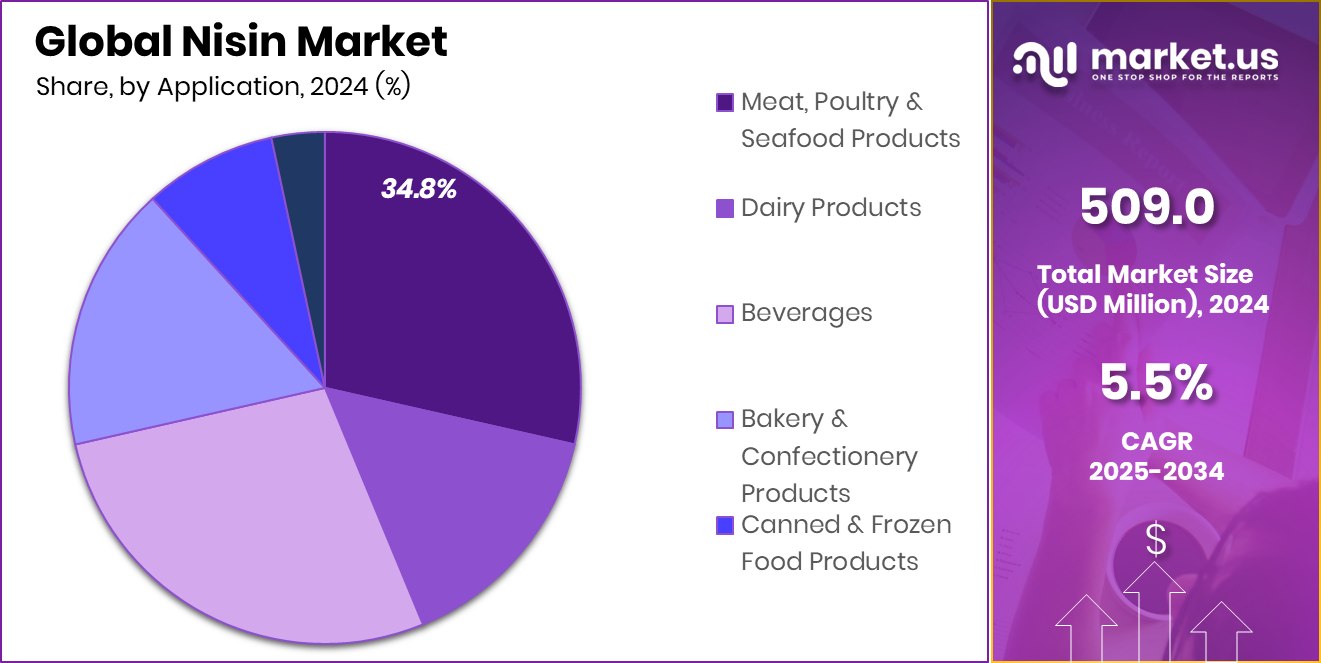

- Meat, poultry, and seafood account for 34.8%, where nisin is used to prevent spoilage and contamination.

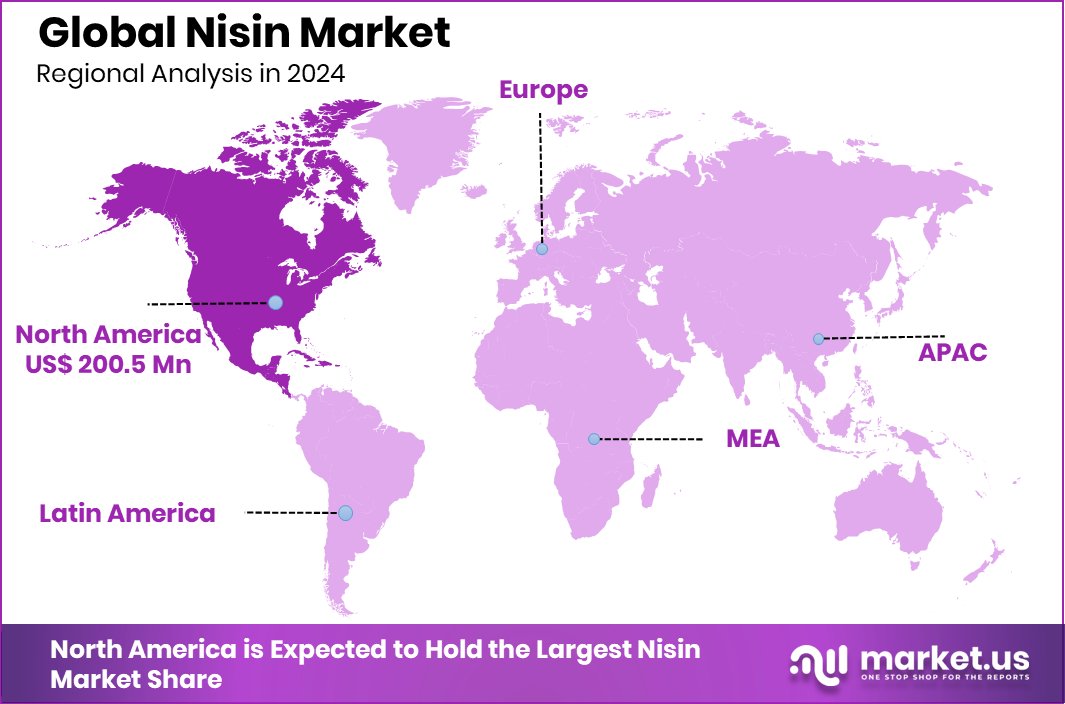

- The market in North America was valued at USD 200.5 million in 2024.

By Type Analysis

Nisin A dominates the Nisin market with a 72.6% share.

In 2024, Nisin A held a dominant market position in the By Type segment of the Nisin Market, with a 72.6% share. This strong lead can be attributed to its high efficacy in inhibiting a wide range of Gram-positive bacteria and its approval for use in numerous food categories across global regulatory frameworks. Nisin A is particularly favored in processed cheese, canned foods, and dairy-based applications due to its excellent thermal stability and compatibility with other preservation techniques.

The wide adoption of Nisin A in food processing is further driven by its ability to extend shelf life without altering product taste or texture, aligning with consumer demand for natural and clean-label preservatives. Food manufacturers prefer Nisin A for its consistent performance, especially in high-moisture and protein-rich environments where microbial spoilage is a concern.

As the food industry continues to move toward natural ingredient solutions, the proven effectiveness and regulatory ease of Nisin A are expected to maintain its leading market share. The segment’s dominance is projected to remain steady amid rising demand for minimally processed and preservative-free food options.

By Form Analysis

Powder form leads due to ease in industrial applications, 69.4%.

In 2024, Powder held a dominant market position in the By Form segment of the Nisin Market, with a 69.4% share. The preference for powder form is largely driven by its extended shelf life, ease of handling, and superior stability during storage and transportation. Powdered Nisin is widely used by food manufacturers due to its convenience in formulation and uniform distribution across different food matrices, particularly in dry and semi-moist products.

Its application flexibility allows manufacturers to blend it directly into seasonings, mixes, or food batches without additional processing. The powder form is also known for its consistent antimicrobial activity, which makes it a dependable choice in quality-sensitive food production environments. Furthermore, its compatibility with various food types and ability to retain effectiveness after heat treatment make it highly suitable for processed and packaged goods.

The dominant position of the powder segment is reinforced by its cost-efficiency in bulk production and favorable logistics. It enables producers to meet large-scale demand while maintaining product integrity and safety standards.

By Application Analysis

Meat, poultry, and seafood products account for 34.8% of demand.

In 2024, Meat, Poultry and Seafood Products held a dominant market position in the By Application segment of the Nisin Market, with a 34.8% share. This leadership is primarily attributed to the rising demand for effective natural preservatives in high-protein, perishable food categories. Nisin is widely utilized in meat, poultry, and seafood processing due to its strong antimicrobial properties, which help prevent the growth of spoilage organisms and pathogenic bacteria, particularly Listeria monocytogenes and Clostridium botulinum.

The segment’s dominance is further supported by the increased consumption of ready-to-eat and packaged protein products, where maintaining food safety and extending shelf life without synthetic preservatives has become a top priority. Nisin enables processors to meet stringent regulatory standards while responding to consumer preferences for clean-label and minimally processed options.

Moreover, the thermal stability of Nisin allows it to remain effective through various cooking and processing methods commonly used in meat and seafood preparation. This reliability, combined with its recognition as a safe and natural additive, reinforces its widespread adoption in this segment. The 34.8% market share highlights its critical role in ensuring product safety, freshness, and compliance in the global meat, poultry, and seafood industry during 2024.

Key Market Segments

By Type

- Nisin A

- Nisin Z

- Others

By Form

- Powder

- Liquid

- Encapsulated

By Application

- Meat, Poultry, And Seafood Products

- Dairy Products

- Beverages

- Bakery And Confectionery Products

- Canned And Frozen Food Products

- Others

Driving Factors

Rising Demand for Natural Food Preservatives Worldwide

One of the key driving factors for the Nisin market is the growing global demand for natural food preservatives. As consumers become more health-conscious, there is a clear shift away from synthetic additives toward clean-label, plant-based, and safe food ingredients. Nisin, being a naturally derived antimicrobial compound, fits well into this trend. It helps extend shelf life and ensures food safety without altering the taste or nutritional value.

Food manufacturers are responding by replacing chemical preservatives with Nisin in meat, dairy, and ready-to-eat products. This shift is especially strong in North America and Europe, where regulations and consumer preferences are aligned with clean-label trends. The demand is also growing steadily in Asia due to rising urban consumption.

Restraining Factors

High Production Costs Limit Market Growth Potential

One major restraining factor for the Nisin market is its high production cost. Nisin is produced through fermentation using Lactococcus lactis, which requires controlled conditions, specialized equipment, and quality raw materials. This makes the manufacturing process expensive compared to synthetic preservatives. As a result, food companies operating on tight margins, especially in developing regions, may hesitate to adopt Nisin widely.

Additionally, the cost factor can impact small and medium-sized food processors, who often look for more affordable alternatives. While demand for natural preservatives is rising, the higher price of Nisin can slow its adoption in price-sensitive markets. Overcoming this challenge may require advances in production technology and economies of scale to make Nisin more affordable.

Growth Opportunity

Expanding Use in Pharmaceuticals and Personal Care Products

A significant growth opportunity for the Nisin market lies in its expanding use within pharmaceutical and personal care products. Beyond food preservation, Nisin’s safe and natural antimicrobial properties make it an excellent candidate for applications such as topical creams, oral hygiene products, and wound-care formulations.

As consumers increasingly seek chemical-free and gentle solutions, formulators are exploring Nisin as an effective preservative in sensitive products. Additionally, its ability to target harmful bacteria without fostering resistance adds to its appeal in health-related sectors. Regulatory approval for medical and cosmetic uses would further validate this potential.

Capitalizing on this opportunity would require collaboration between food science experts and pharmaceuticals or personal care manufacturers to develop new, Nisin-based formulations aligned with trends toward safer, cleaner products.

Latest Trends

Clean-Label Food Products Drive Nisin Demand Globally

A key trend shaping the Nisin market is the growing popularity of clean-label food products. Consumers today are carefully reading ingredient lists and prefer foods that contain natural, simple, and recognizable components. Nisin fits this demand perfectly as a naturally derived preservative that helps keep food fresh without the use of synthetic chemicals.

Food manufacturers are actively reformulating their products to replace artificial preservatives with safer, natural options like Nisin. This trend is especially strong in packaged meat, dairy, and ready-to-eat foods, where safety and shelf life are critical. As awareness grows about the link between food additives and health, clean-label trends are expected to push Nisin usage further in global food processing industries.

Regional Analysis

In 2024, North America led the Nisin Market with 46.1% regional share.

In 2024, North America emerged as the dominant region in the global Nisin Market, capturing a significant 46.1% share and reaching a market value of USD 200.5 million. This leadership is largely driven by the region’s strong demand for clean-label food preservatives and strict food safety regulations, especially in the United States and Canada.

The widespread use of processed and packaged food products, along with increasing consumer preference for natural antimicrobial agents, has further fueled regional market growth.

Europe followed with a notable presence, supported by growing health-consciousness and stringent EU food safety standards that favor natural additives. In the Asia Pacific region, market expansion is being encouraged by rapid urbanization, a growing middle-class population, and rising awareness of food quality in countries such as China, Japan, and India.

While Middle East & Africa and Latin America hold comparatively smaller shares, these regions are gradually adopting Nisin in response to increasing demand for safe, shelf-stable food products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DSM was observed to leverage its robust global distribution infrastructure and advanced biotech capabilities. The company’s focus on high-purity Nisin and tailor-made formulations for processed foods enabled stronger engagement with major food processors. Its integrated supply chain ensured stability in raw material availability, which remains critical in maintaining quality standards.

Cayman Chemicals distinguished itself through niche specialization. While operating on a smaller scale, the firm is recognized for its flexible production capacity and rapid customer response. By offering custom Nisin grades for research and industrial applications, they have fostered deep relationships with specialized food manufacturers and research institutions, reinforcing their reputation for service agility.

Siveele B.V. emerged as a value-driven provider, emphasizing cost-effective, food-grade Nisin. Their lean production processes have supported competitive pricing without compromising quality. Focused primarily on the European market, Siveele has established itself among mid-sized food producers seeking natural preservatives aligned with clean-label trends.

Zhejiang Silver-Elephant Bioengineering has capitalized on its strong fermentation capabilities in Asia-Pacific. As production volumes have scaled, the company has enhanced its export potential and strengthened its presence across key regional markets. Continued investments in process optimization and capacity expansion offer opportunities to grow market share, especially across emerging economies where demand is expanding.

Top Key Players in the Market

- DSM

- Cayman Chemicals

- Siveele B.V.

- Zhejiang Silver-Elephant Bioengineering

- Shandong Freda Biotechnology

- Chihon Biotechnology

- Mayasan Biotech

- Handary S.A.

Recent Developments

- In April 2025, the company received kosher certification for its Nisin/Niprosin® products, valid through April 2026. This certification assures compliance with kosher dietary standards and can facilitate broader consumer acceptance in markets requiring such approvals.

- In February 2025, DSM (under its joint venture DSM-Firmenich) sold its share in the Feed Enzymes Alliance to its partner Novonesis for a total consideration of €1.5 billion. Although this deal focuses on the enzymes business, it reflects DSM’s broader strategy to streamline its portfolio and concentrate resources on higher-growth areas such as Nisin and other food-related technologies.

Report Scope

Report Features Description Market Value (2024) USD 509.0 Million Forecast Revenue (2034) USD 869.4 Million CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Nisin A, Nisin Z, Others), By Form (Powder, Liquid, Encapsulated), By Application (Meat, Poultry And Seafood Products, Dairy Products, Beverages, Bakery And Confectionery Products, Canned And Frozen Food Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DSM, Cayman Chemicals, Siveele B.V., Zhejiang Silver-Elephant Bioengineering, Shandong Freda Biotechnology, Chihon Biotechnology, Mayasan Biotech, Handary S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DSM

- Cayman Chemicals

- Siveele B.V.

- Zhejiang Silver-Elephant Bioengineering

- Shandong Freda Biotechnology

- Chihon Biotechnology

- Mayasan Biotech

- Handary S.A.