Global NGS Sample Preparation Market Analysis By Product & Services (Reagents & Consumables, Workstations/Instruments, Services), By Workflow (DNA Fragmentation & Library Preparation, Target Enrichment, Quality Control (QC)), By Sample Type (DNA, RNA), By Method (Manual Sample Preparation, Microfluidic Sample Preparation, Automated Liquid Handling-based Sample Preparation), By Application (Diagnostics, Drug Discovery, Agricultural & Animal Research, Others), By End-User (Academic Institutes & Research Centers, Hospitals & Clinics, Pharma & Biotech Companies, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160556

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

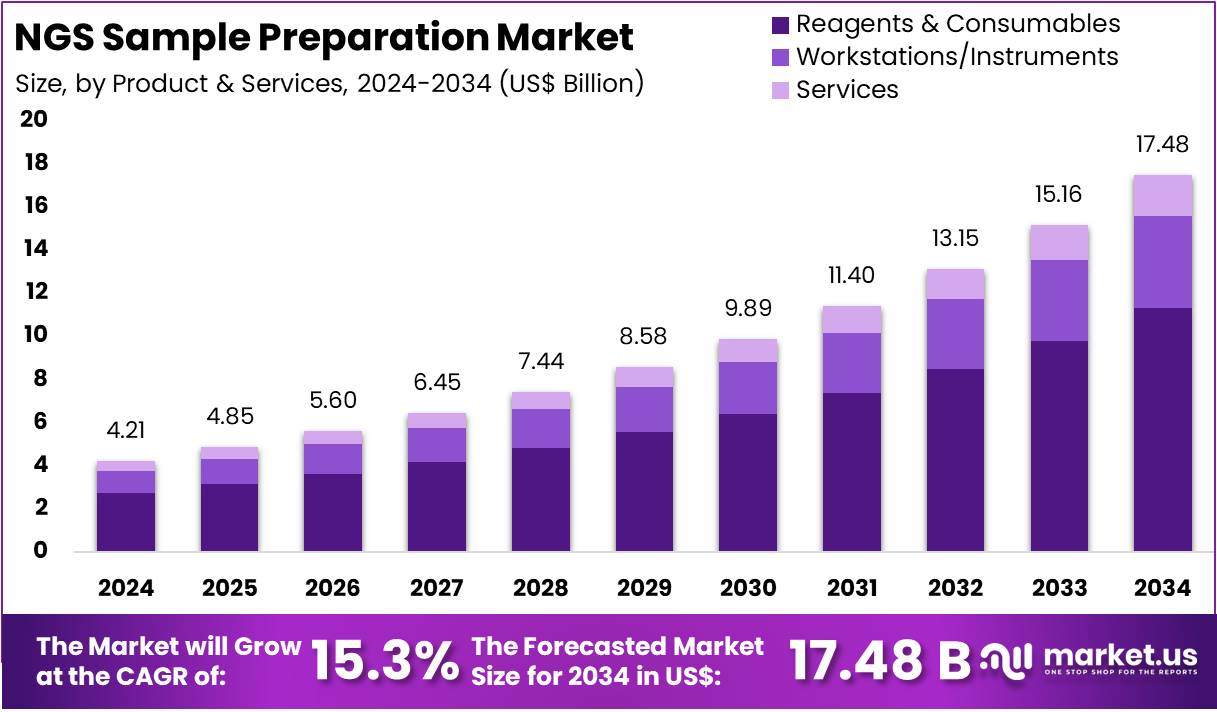

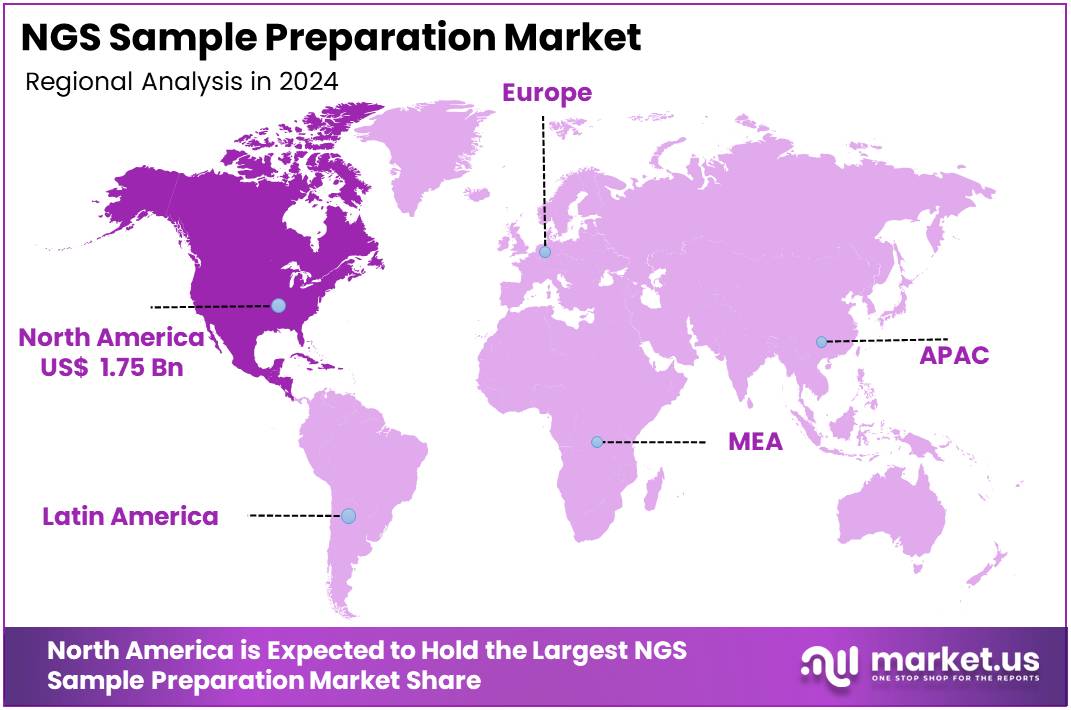

The Global NGS Sample Preparation Market size is expected to be worth around US$ 17.48 Billion by 2034, from US$ 4.21 Billion in 2024, growing at a CAGR of 15.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 41.5% share and holds US$ 1.75 Billion market value for the year.

NGS sample preparation refers to the essential processes that convert DNA or RNA into sequencing-ready formats. According to the World Health Organization, cancer continues to be a major driver for genomics adoption, with nearly 20 million new cases reported globally in 2022. Projections suggest more than 35 million new cancer cases by 2050, representing a 77% increase. This surge directly translates into greater demand for standardized and reliable sample preparation kits, reagents, and automation systems.

The growing role of clinical genomics is reinforcing this trend. For example, England’s NHS Genomic Medicine Service reported delivering about 680,000 genomic tests per year, with around 10% involving whole-genome sequencing. In March 2024 alone, 244 cancer genome sequencing reports were issued, marking an 8% rise compared to April 2023. Such year-on-year growth highlights the increasing volume of biospecimens that require robust sample extraction, fragmentation, repair, and library preparation steps.

Falling sequencing costs are further accelerating market expansion. A study by the U.S. National Human Genome Research Institute shows continuous declines in the “cost per genome,” making sequencing more accessible. As sequencing itself becomes affordable, attention shifts to bottlenecks in upstream workflows. Laboratories are now investing in automation-ready reagents, low-input chemistries, and quality control kits to process larger numbers of samples efficiently. This transition ensures that sequencing accuracy and turnaround times remain consistent at higher throughput levels.

Expansion Through Programs, Policy, and New Applications

National genomics initiatives are playing a major role in scaling NGS sample preparation demand. For instance, in the United States, the NIH All of Us Research Program has enrolled over 830,000 participants, each contributing biospecimens requiring standardized preparation. Similarly, in England, over 100,000 whole-genome equivalents have been sequenced since 2021. These system-level roll-outs create large-scale sample intake, supporting the procurement of validated, automated kits designed for consistent clinical performance.

Pathogen genomics is also adding momentum. WHO’s Global Genomic Surveillance Strategy (2022–2032) emphasizes integrated workflows from collection to sequencing, while the U.S. CDC funds advanced molecular detection programs. These initiatives strengthen the need for reliable, field-ready extraction and library preparation protocols that can handle diverse pathogens, including low-titer samples. According to the CDC, sustained investment in pathogen genomics will embed sequencing into routine public health practice, expanding markets for specialized preparation kits.

Regulatory clarity and non-invasive testing are reinforcing long-term growth. For example, the U.S. FDA has issued guidelines for NGS-based diagnostics, encouraging standardized and kit-based workflows. Moreover, applications like liquid biopsy and circulating free DNA (cfDNA) testing require ultra-sensitive chemistries for fragmented, low-abundance samples. In 2024, the United States alone expects 2,001,140 new cancer cases and 611,720 cancer deaths, underscoring the clinical need for blood-based sequencing. According to industry studies, demand for cfDNA-specific extraction and repair solutions will continue to rise as plasma-based assays gain adoption.

Key Takeaways

- The global NGS sample preparation market is forecasted to reach US$ 17.48 billion by 2034, growing at a CAGR of 15.3%.

- In 2024, the Reagents & Consumables segment dominated the product & services category, holding over 64.7% of the total market share.

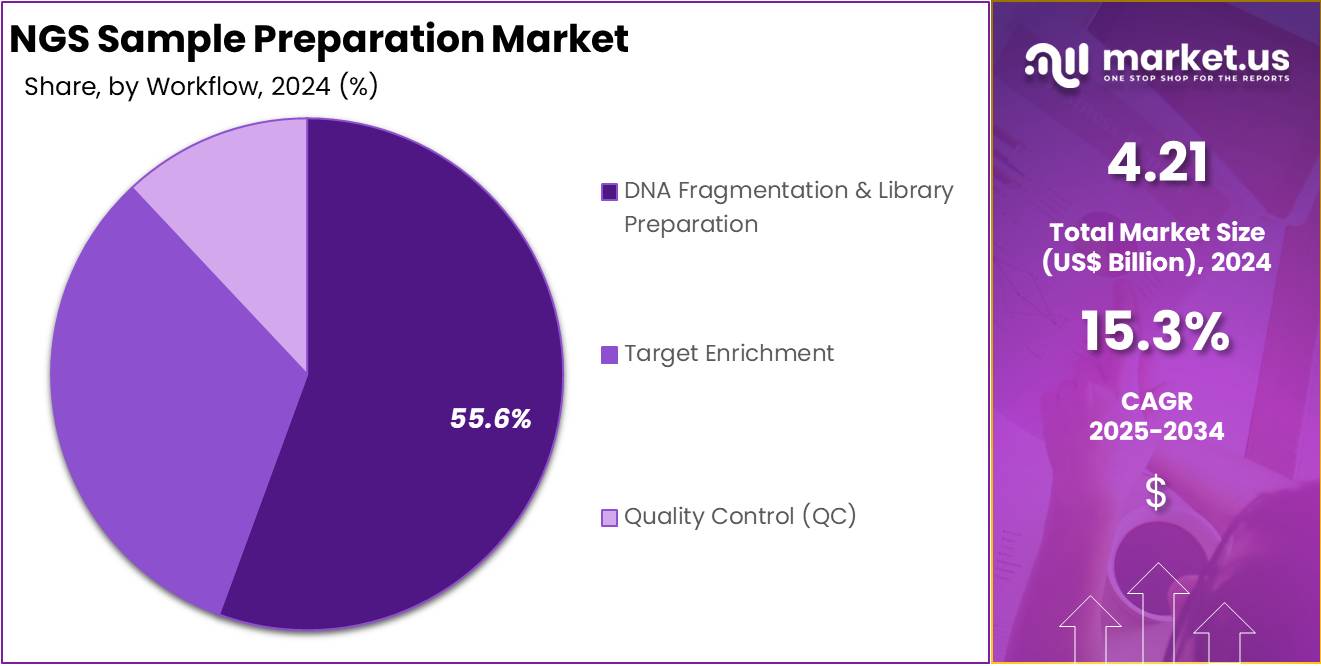

- The DNA Fragmentation & Library Preparation segment led the workflow category in 2024, capturing more than 55.6% of the total market.

- The DNA-based sample type segment accounted for the majority in 2024, securing over 69.7% share within the sample type category.

- Within the method category, manual sample preparation achieved dominance in 2024, with a significant market share of 32.9%.

- The diagnostics application segment commanded leadership in 2024, capturing more than 53.8% of the total market share.

- In terms of end users, hospitals and clinics emerged as the largest contributors in 2024, with a share of 37.7%.

- North America retained its dominant position in 2024, contributing 41.5% market share and holding an estimated value of US$ 1.75 billion.

Product & Services Analysis

In 2024, the Reagents & Consumables Section held a dominant market position in the Product & Services Segment of the NGS Sample Preparation Market, and captured more than a 64.7% share. This leadership was supported by the repeated use of consumables in every stage of sequencing workflows. The growing demand for accuracy and reliability in sequencing results further strengthened the share of this segment. Regular purchases and consistent usage made reagents and consumables the most critical drivers of revenue.

The Workstations and Instruments Section occupied a notable market share during the same period. Automated solutions were widely adopted to reduce manual errors and streamline sequencing tasks. Instruments were also utilized to handle DNA and RNA fragmentation with high precision. Growing adoption of high-throughput sequencing supported this segment further. Research facilities, clinical centers, and laboratories increasingly preferred automated workstations to achieve reproducibility, scalability, and lower turnaround times across multiple sequencing projects.

The Services Section showed steady growth in the Product & Services Segment. Outsourced sample preparation was in demand among research institutions, small biotech firms, and diagnostic laboratories. The absence of advanced infrastructure and skilled professionals encouraged outsourcing to specialized service providers. The demand was further supported by the rising preference for cost-efficient solutions. Smaller projects and academic studies often lacked in-house sequencing capacity, making external services highly relevant. This segment is expected to grow further with increasing reliance on third-party providers.

Workflow Analysis

In 2024, the DNA Fragmentation & Library Preparation Section held a dominant market position in the Workflow Segment of NGS Sample Preparation Market, and captured more than a 55.6% share. This workflow was widely used in clinical and research laboratories. It supported consistent read quality and multiple applications such as oncology, rare disease, and metagenomics. Automation reduced errors and processing times. Optimized reagent kits and standardized protocols ensured reproducibility. Vendors also expanded platform compatibility, which strengthened ecosystem integration and improved throughput efficiency.

Target Enrichment followed as the second-largest workflow segment. Its growth was supported by the adoption of focused sequencing panels. These panels reduced costs by limiting sequencing to specific regions. Both hybrid-capture and amplicon methods advanced. Customization options were expanded, and coverage improved for variant detection. Smaller laboratories adopted ready-to-use panels. Cloud pipelines simplified analysis, while improved performance on challenging samples supported clinical use. Despite growth, the overall share remained lower than library workflows due to narrower applications.

Quality Control (QC) represented an important supporting segment. It ensured sample integrity and library suitability before sequencing. Routine quantification and fragment analysis reduced repeat runs and safeguarded sequencing capacity. Bioinformatics-based QC improved acceptance criteria. Integrated QC modules in automation platforms increased workflow efficiency. Although essential, QC spending was proportional to sample volumes. This limited its share compared with core processes. However, rising clinical accreditation needs and compliance regulations boosted demand. Adoption of advanced QC tools was reinforced by traceability requirements and laboratory standardization.

Sample Type Analysis

In 2024, the DNA section held a dominant market position in the Sample Type Segment of the NGS Sample Preparation Market, and captured more than a 69.7% share. This segment’s dominance was driven by the high use of DNA sequencing in oncology research, clinical diagnostics, and agricultural genomics. The preference for DNA-based methods came from accuracy, reproducibility, and established protocols. The introduction of advanced DNA library preparation kits also improved workflow efficiency and increased adoption rates.

The DNA segment continued to expand due to growing applications in personalized medicine and targeted sequencing. Increased investments in genomic research further supported the widespread adoption of DNA-based sample preparation. Rising demand for whole-genome sequencing created strong opportunities for laboratories and research institutions. This dominance was reinforced by clinical use cases, where DNA sequencing provided reliable insights for precision treatments. As a result, DNA maintained a substantial competitive advantage over other sample types.

The RNA section accounted for a smaller but steadily rising portion of the market. Growth in this segment was supported by the adoption of transcriptome analysis and single-cell RNA sequencing. Researchers increasingly used RNA sequencing for immune profiling, biomarker identification, and infectious disease studies. In drug development and vaccine research, RNA sequencing gained more importance. The use of RNA in transcriptomics positioned this segment as promising. While smaller in size, the RNA segment demonstrated significant long-term growth potential in the NGS sample preparation market.

Method Analysis

In 2024, the Manual Sample Preparation Section held a dominant market position in the Method Segment of NGS Sample Preparation Market, and captured more than a 32.9% share. This leadership was supported by broad adoption in research and clinical labs. The low capital investment required favored smaller facilities. Manual workflows also offered flexibility for diverse assays. Researchers preferred this approach for complex or low-throughput studies. Skilled personnel and standardized operating procedures ensured accuracy. The predictable cost per run further encouraged usage.

Automated liquid handling–based methods gained strong traction during the period. Their growth was driven by improved throughput and reproducibility. Reduced hands-on time and higher consistency made them suitable for large-scale testing. Integration with laboratory information systems supported better traceability. However, high instrument costs limited adoption in smaller labs. Return on investment was more evident in high-volume environments. These systems were increasingly selected for clinical-grade applications. Scalability and efficiency were key factors influencing uptake.

Microfluidic sample preparation advanced as a niche solution. The technology enabled very low input volumes and supported single-cell studies. Reduced contamination risk, due to closed systems, enhanced performance in sensitive assays. Despite these strengths, limited standardization restricted wider adoption. Cartridge availability and per-sample costs remained variable. Growth was more visible in translational and specialized research programs. The method complemented other approaches rather than replacing them. Its adoption trajectory was tied to innovation in rare-cell and precision medicine fields.

Application Analysis

In 2024, the Diagnostics Section held a dominant market position in the Application Segment of the NGS Sample Preparation Market, and captured more than a 53.8% share. This leadership was explained by the rising use of NGS in clinical testing and precision medicine. Increased adoption in oncology, rare disease studies, and infectious disease diagnostics supported this dominance. The market also gained strength from regulatory approvals for sequencing-based diagnostic panels, which accelerated adoption across hospitals and laboratories worldwide.

The Drug Discovery segment accounted for a considerable portion of the market. NGS methods were used widely for biomarker identification, pharmacogenomics, and candidate screening. Pharmaceutical companies applied sequencing to optimize drug discovery pipelines and reduce research timelines. The segment’s growth was also explained by the rising demand for clinical trial applications. Increased adoption by biotechnology firms further supported expansion. The trend is expected to strengthen over the forecast period, as sequencing becomes an integral part of drug development.

The Agricultural & Animal Research segment recorded healthy progress. NGS was increasingly applied to crop improvement, livestock breeding, and pathogen resistance studies. Rising global investment in agricultural genomics helped broaden application scope in this field. Genome editing and breeding initiatives also contributed to the segment’s adoption. The Others segment, including academic research and basic studies, held a smaller share but remained relevant. These applications supported genetic knowledge expansion, although their contribution was lower compared to diagnostic and drug discovery segments.

End-User Analysis

In 2024, the Hospitals & Clinics Section held a dominant market position in the End-User Segment of the NGS Sample Preparation Market, and captured more than a 37.7% share. This leadership was linked to the increased use of NGS in clinical diagnostics. Growing demand for precision medicine and targeted therapies played a central role. Hospitals were also investing in advanced testing facilities. The rising prevalence of cancer and infectious diseases created higher adoption of sequencing-based diagnostic solutions.

Pharma and Biotech Companies represented another vital segment within this market. Their adoption was influenced by greater investment in drug discovery and molecular research. Continuous reliance on sequencing technologies in clinical trials strengthened their position. Partnerships between biotech firms and sequencing solution providers added to the expansion. This segment also benefited from increasing focus on biomarker development. It became an important contributor to both therapeutic innovation and translational research, driving significant utilization of NGS sample preparation workflows.

Academic Institutes and Research Centers accounted for a strong portion of the overall share. This was associated with an emphasis on genomics research and gene expression studies. Funding from government bodies and research programs encouraged wide adoption. Universities and research labs applied sequencing tools to multiple fields, including epigenetics and molecular diagnostics. The Others segment, which included diagnostic laboratories and CROs, showed steady activity. Growth in outsourcing of sequencing services to specialized facilities supported this share. Their role added flexibility and accessibility within the market.

Key Market Segments

By Product & Services

- Reagents & Consumables

- Workstations/Instruments

- Services

By Workflow

- DNA Fragmentation & Library Preparation

- Target Enrichment

- Quality Control (QC)

By Sample Type

- DNA

- RNA

By Method

- Manual Sample Preparation

- Microfluidic Sample Preparation

- Automated Liquid Handling-based Sample Preparation

By Application

- Diagnostics

- Drug Discovery

- Agricultural & Animal Research

- Others

By End-User

- Academic Institutes & Research Centers

- Hospitals & Clinics

- Pharma & Biotech Companies

- Others

Drivers

Declining Cost Of Sequencing Enabling Broader Adoption

The declining cost of genome sequencing has been a major driver for the growth of next-generation sequencing (NGS) sample preparation. According to the National Human Genome Research Institute, sequencing a human genome cost millions of dollars in the early 2000s. By 2022, this cost had fallen to under USD 1,000. This rapid cost reduction has removed significant financial barriers, making sequencing more feasible for a broader range of applications. As a result, NGS is now accessible to academic, clinical, and industrial research institutions globally.

The affordability of sequencing has directly increased the demand for NGS workflows, where sample preparation plays a central role. Every sequencing run requires high-quality and consistent preparation of DNA or RNA samples. As more laboratories adopt sequencing technologies, the demand for sample preparation consumables, kits, and automation systems rises proportionally. This trend reflects how falling sequencing costs act as a catalyst, expanding the user base and driving higher utilization of sample preparation products.

Clinical applications of NGS, including genetic testing, cancer diagnostics, and personalized medicine, have also benefitted from lower sequencing costs. The affordability of sequencing encourages more diagnostic labs and healthcare providers to adopt these technologies. Consequently, the need for standardized, reliable, and scalable sample preparation solutions increases. This creates a robust market opportunity for manufacturers of consumables and workflow products. The declining cost of sequencing is therefore not only enabling adoption but also sustaining growth in NGS sample preparation demand.

Restraints

Protocol Complexity, Variability, and Biases in Sample Preparation

The process of NGS sample preparation is highly complex, involving several stages such as DNA or RNA extraction, fragmentation, adapter ligation, and amplification. Each of these steps introduces variability that can affect the quality of the final library. Errors or inefficiencies during these steps may lead to uneven representation of sequences. As a result, the outcomes are often inconsistent across experiments, creating a barrier for standardization and reliable downstream analysis in large-scale or clinical research applications.

A significant restraint is the amplification bias that arises, especially in low-input or single-cell samples. When the nucleic acid material is limited, additional amplification is required to generate sufficient material for sequencing. This amplification process often introduces skewed representation, leading to PCR duplicates and inaccurate reflection of the original sample. Such biases reduce the reliability of sequencing results and limit the use of NGS for sensitive applications like single-cell genomics or rare mutation detection.

Furthermore, manual workflows used in sample preparation increase the risk of contamination and handling errors. These errors reduce reproducibility and add to the burden of quality control in clinical laboratories. In regulated environments, ensuring consistent results is critical, and variability in sample preparation protocols poses a significant restraint. This limitation hinders scalability, increases costs, and impacts the broader adoption of NGS technologies in diagnostic and therapeutic applications.

Opportunities

Automation And High-Throughput Workflows For Reproducible, Scalable Sample Prep

Automation in next-generation sequencing (NGS) sample preparation offers a strong opportunity to improve reproducibility and efficiency. Automated systems are designed to reduce manual handling, which in turn minimizes variability introduced by operators. This reduction in human error supports higher consistency in library preparation workflows. As NGS becomes increasingly applied in both research and clinical settings, the ability to maintain uniformity across samples is a crucial advantage that drives adoption of automation technologies.

The use of high-throughput and automated platforms also enables significant time savings. Evidence shows a 75% reduction in hands-on time for single-cell RNA sequencing library preparation when automation is applied. This improvement allows laboratories to process larger sample volumes without increasing workforce requirements. By accelerating turnaround time and scaling throughput, laboratories can address rising demand for sequencing while maintaining operational efficiency, which is a vital driver in both academic research and diagnostic applications.

Clinical laboratories are focusing on enclosed and automated modules to meet strict regulatory and consistency requirements. These systems not only ensure compliance but also strengthen reliability in patient-related sequencing workflows. Automation supports traceability, standardization, and reproducibility that are critical for clinical diagnostics. The integration of such advanced systems positions laboratories to align with regulatory frameworks, improve outcomes, and gain competitive advantages in the rapidly expanding NGS sample preparation market.

Trends

Miniaturized and Automated Workflows in NGS Sample Preparation

The growth of single-cell sequencing and spatial transcriptomics is driving demand for next-generation sample preparation methods. These applications require workflows that can efficiently process extremely small input amounts without introducing bias. Traditional preparation protocols are not optimized for such conditions. Therefore, innovations in low-input sample handling have become essential. This has created a shift toward highly sensitive, miniaturized systems that preserve data quality while enabling more detailed biological insights at the cellular and tissue level.

Microfluidics-based solutions are emerging as a response to these challenges. These platforms integrate multiple preparation steps into continuous, closed systems, reducing manual handling and sample loss. Miniaturized systems also support precise fluid control, making them highly suited for single-cell and spatial genomics. By enabling researchers to perform complex tasks with minimal input material, microfluidic systems provide scalability and reproducibility. This trend is strengthening the alignment of sample preparation with advanced sequencing technologies, ensuring data integrity across increasingly sophisticated applications.

Automation has become another critical focus area for next-generation sample preparation. Standardization and reproducibility are vital in high-throughput sequencing workflows, particularly for single-cell studies. Automated platforms minimize human error, accelerate processing, and enable laboratories to scale experiments without compromising data quality. As demand for large-scale, single-cell, and spatial analyses increases, automated solutions will remain central to ensuring reliability and efficiency. The convergence of miniaturization, microfluidics, and automation is shaping the future of NGS sample preparation.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 41.5% share and reaching a market value of US$ 1.75 billion. According to the CDC, the region’s strength in NGS sample preparation is strongly linked to very large public-health sequencing programs. For example, by the week ending January 22, 2022, a total of 1,469,400 SARS-CoV-2 genomes were included in national surveillance. Public-health laboratories sequenced 521,658 samples in 2021 and 690,000 samples in 2022, creating high weekly throughput that sustained consistent demand for extraction and library-prep kits.

Regulatory clarity and reimbursement policies further supported clinical adoption. For instance, Medicare’s National Coverage Determination for NGS in oncology created national coverage for eligible cancer patients while delegating other uses to Medicare Administrative Contractors. This framework lowered adoption risks for hospitals and reference laboratories. In addition, the U.S. FDA established clear pathways by approving Illumina’s MiSeqDx and cystic fibrosis assays in 2013, followed by NGS-specific guidance in 2018. Such defined review structures encouraged standardization around validated sample-prep chemistries and reagents.

Large-scale U.S. cohort programs also contributed to predictable demand. A study by the NIH’s All of Us Research Program reported whole-genome sequences from over 414,000 participants as of February 24, 2025, compared with around 245,000 in 2023. This rapid increase highlights sustained activity in DNA extraction, normalization, and library construction. These volumes ensured continuous use of consumables across partner laboratories, thereby reinforcing North America’s reliance on standardized preparation workflows.

Canada’s investments further strengthened regional capacity. For example, the Government of Canada invested CA$40 million to establish the Canadian COVID-19 Genomics Network (CanCOGeN) in April 2020, followed by an additional CA$53 million to expand variant surveillance. Health Canada’s continued backing and Genome Canada’s “All for One” initiative, focused on rare disease genomics, have expanded intake and readiness across provinces. These initiatives significantly boosted the usage of prep kits and automation systems in provincial and federal labs.

In conclusion, North America’s leadership in the NGS sample preparation market can be attributed to three key drivers: large-scale genomic surveillance programs, regulatory and reimbursement stability, and federal-provincial investments in clinical genomics. Together, these factors created repeatable high-throughput workflows. The steady use of extraction reagents, clean-up kits, and library-prep materials is expected to sustain the region’s leading position in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Next-Generation Sequencing (NGS) sample-preparation market is shaped by a group of leading players that drive innovation, workflow integration, and clinical adoption. Competition is focused on reagent quality, automation compatibility, and validated workflows that ensure reliability for clinical and research use. Major suppliers such as Illumina, Thermo Fisher Scientific, QIAGEN, Agilent, and F. Hoffmann-La Roche dominate the landscape, while smaller specialists provide niche chemistries. This analysis highlights their competitive strengths, limitations, and strategies that define positioning in this evolving market.

Illumina holds a strong position through its sequencers, proprietary kits, and broad consumables portfolio. Its strengths include recurring reagent sales, service capabilities, and continuous R&D investment. However, risks from regulatory scrutiny, platform dependency, and pricing pressure remain. Thermo Fisher capitalizes on its wide product range, automation platforms, and validated workflows in regulated markets. Global reach and strong diagnostics presence reinforce its position. Yet, diluted focus and competitive pressures on margins are ongoing challenges. Both prioritize clinical workflow validation, automation integration, and end-to-end workflow solutions.

QIAGEN positions itself as a specialist in end-to-end workflows, with strengths in nucleic acid extraction, enrichment, and clinical diagnostics support. Its companion diagnostic expertise and differentiated technologies reduce variability in sequencing outcomes. Limitations stem from its smaller scale and the need for continuous innovation to keep pace with larger platform vendors. Agilent focuses on high-quality enrichment and target-capture chemistries, as well as quality control tools. While niche positioning may limit scale, its reputation for reproducibility and strong OEM partnerships reinforce competitive strength.

Roche leverages its diagnostics leadership, clinical trial networks, and healthcare relationships to advance genomics solutions. Its ability to bundle reagents with assays supports demand, though dependence on collaborations limits autonomy. Specialists and startups add dynamism, offering unique chemistries for single-cell prep, cfDNA, and FFPE repair. Automation suppliers and OEM partners expand workflow efficiency and throughput for service providers. This ecosystem of major players and niche innovators strengthens competitive dynamics, with smaller firms often serving as valuable acquisition targets for large diagnostics companies.

Competitive advantages in NGS sample preparation remain focused on automation, validated clinical workflows, and performance with challenging samples. Large players aim to expand integrated, regulatory-compliant solutions, while smaller specialists emphasize innovation in niche applications. Buyers in clinical laboratories prioritize validated workflows and reproducibility. High-throughput sequencing centers seek automation compatibility and supply stability. Research labs increasingly turn to niche kits for improved yield and quality. Vendors that combine chemistry strength with automation and clinical support are well positioned to capture higher-margin clinical and service-provider markets.

Market Key Players

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Agilent Technologies Inc.

- F. Hoffmann-La Roche Ltd.

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Eurofins Scientific

- BGI Genomics

- Danaher Corporation

- Pacific Biosciences of California Inc.

- Oxford Nanopore Technologies plc

- 10x Genomics

- New England Biolabs Inc.

- Takara Bio Inc.

- Other key players

Recent Developments

- July 2024: Illumina acquired Fluent BioSciences, adding a highly scalable single-cell sample-prep technology (PIPseq) to expand Illumina’s multi-omics/sample-preparation capabilities and broaden access to single-cell analysis.

- May 2024: Launch of QIAseq Multimodal DNA/RNA Library Kit, enabling seamless preparation of DNA and RNA libraries from a single sample for WGS/WTS and hybrid-capture target enrichment; positioned to streamline NGS sample preparation and multi-omics workflows.

- December 2023: Thermo Fisher introduced new sample-preparation solutions designed to simplify and automate upstream NGS workflows, notably the MagMAX™ Dx Viral/Pathogen NA Isolation Kit, which features an updated chemistry to maximize nucleic-acid yield and supports higher-throughput, greener operations.

- August 2022: Thermo Fisher launched the Oncomine™ Dx Express Test (CE-IVD, IVDD) together with Oncomine™ Reporter Dx, enabling rapid, distributable NGS testing and analysis for clinical laboratories with turnaround times as short as ~24 hours; the launch expanded access to precision-oncology workflows and strengthened Thermo Fisher’s integrated NGS sample-to-report offering.

Report Scope

Report Features Description Market Value (2024) US$ 4.21 Billion Forecast Revenue (2034) US$ 17.48 Billion CAGR (2025-2034) 15.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product & Services (Reagents & Consumables, Workstations/Instruments, Services), By Workflow (DNA Fragmentation & Library Preparation, Target Enrichment, Quality Control (QC)), By Sample Type (DNA, RNA), By Method (Manual Sample Preparation, Microfluidic Sample Preparation, Automated Liquid Handling-based Sample Preparation), By Application (Diagnostics, Drug Discovery, Agricultural & Animal Research, Others), By End-User (Academic Institutes & Research Centers, Hospitals & Clinics, Pharma & Biotech Companies, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Illumina Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., Agilent Technologies Inc., F. Hoffmann-La Roche Ltd., PerkinElmer Inc., Bio-Rad Laboratories Inc., Eurofins Scientific, BGI Genomics, Danaher Corporation, Pacific Biosciences of California Inc., Oxford Nanopore Technologies plc, 10x Genomics, New England Biolabs Inc., Takara Bio Inc., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  NGS Sample Preparation MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

NGS Sample Preparation MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Agilent Technologies Inc.

- F. Hoffmann-La Roche Ltd.

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Eurofins Scientific

- BGI Genomics

- Danaher Corporation

- Pacific Biosciences of California Inc.

- Oxford Nanopore Technologies plc

- 10x Genomics

- New England Biolabs Inc.

- Takara Bio Inc.

- Other key players