Global NFT Trading Card Market Size, Share and Analysis Report By Content Type (Sports Cards, Gaming & Collectible Cards, Art & Utility Cards, Celebrity & Brand Cards, Others), By Platform Type (Dedicated Marketplaces, Gaming Platforms, Social & Creator Platforms), By Blockchain (Ethereum, Flow, Polygon, Solana, Others), By End-User (Collectors & Investors, Gamers, Brands & IP Holders), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174462

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

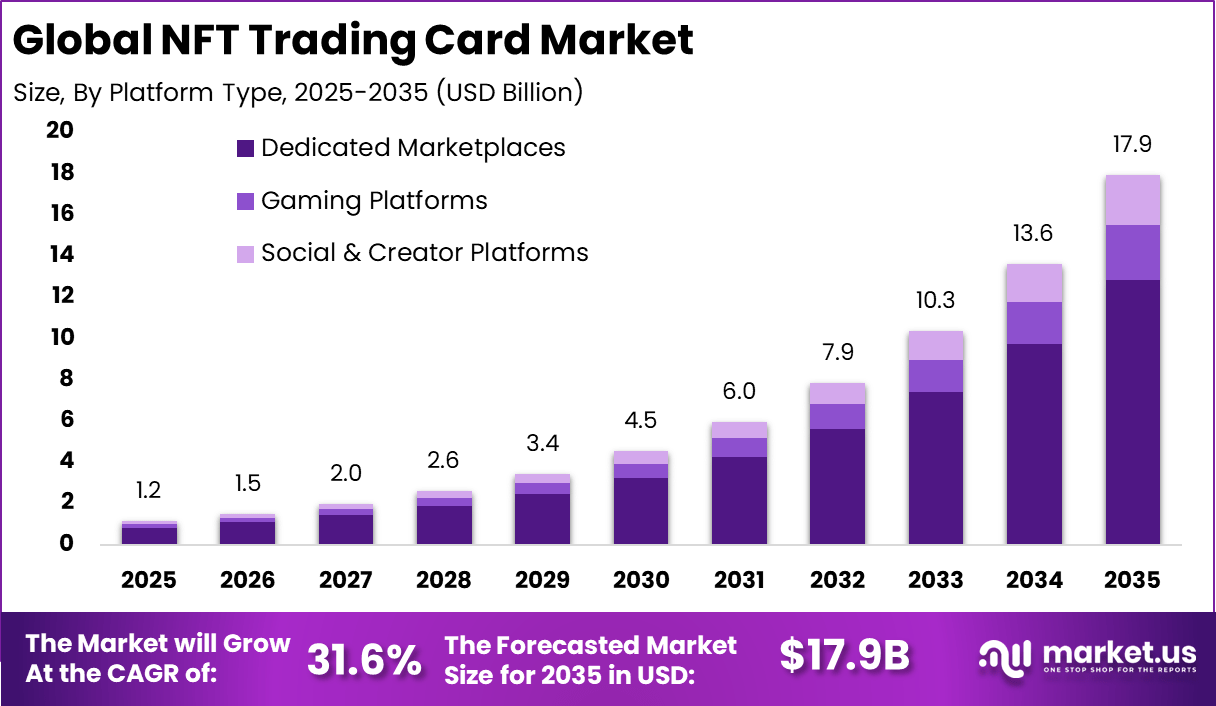

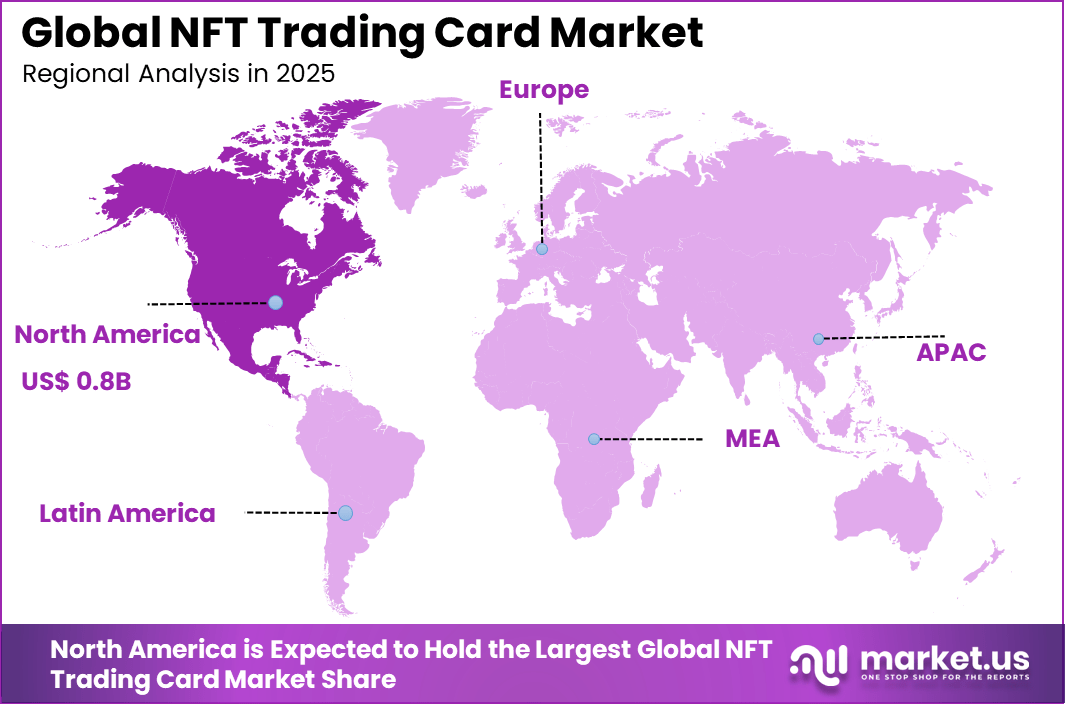

The Global NFT Trading Card Market size is expected to be worth around USD 17.9 Billion By 2035, from USD 1.2 billion in 2025, growing at a CAGR of 31.6% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 68.4% share, holding USD 0.8 Billion revenue.

The NFT trading card market refers to digital collectible cards created and owned as non-fungible tokens on blockchain networks. These cards represent unique digital assets linked to characters, sports figures, games, art, or entertainment franchises. NFT trading cards enable verified ownership, scarcity, and transferability through blockchain technology. Collectors can buy, sell, and trade these cards on digital marketplaces. Adoption includes collectors, gamers, brands, and entertainment platforms.

Demand for NFT trading cards is influenced by collector behavior and speculative interest. Some users collect cards for personal enjoyment and community status. Others view trading cards as digital assets with resale potential. Active marketplaces support liquidity and trading activity. This mix of motivations sustains demand. NFT trading cards are increasingly used as playable or utility-based assets. Cards may unlock features, characters, or rewards. Utility increases perceived value beyond collection.

Top Market Takeaways

- Sports cards led by content type with a 42.7% share, driven by strong fan engagement, athlete licensing, and growing interest in digitally verifiable collectibles.

- Dedicated marketplaces dominated platform usage with a 71.6% share, as collectors preferred specialized platforms that offer secure trading, authentication, and liquidity.

- Ethereum remained the leading blockchain with a 58.9% share, supported by its mature ecosystem, smart contract capabilities, and broad developer adoption.

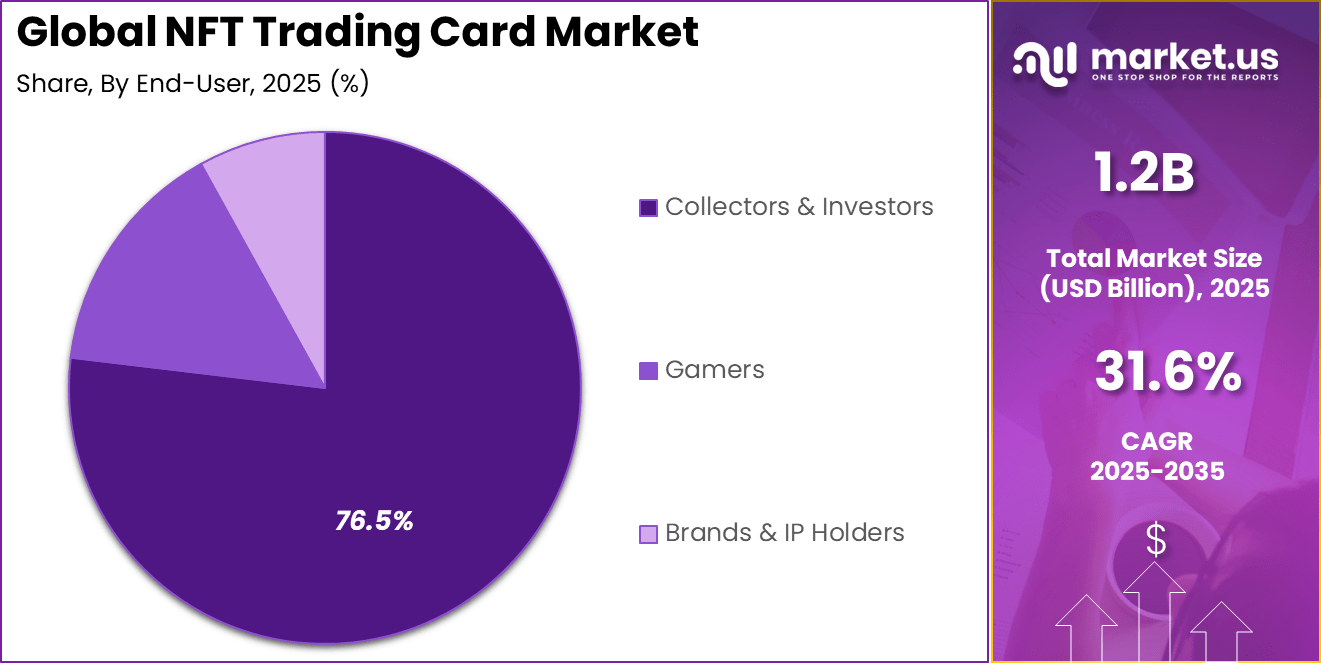

- Collectors and investors represented the largest end user group with a 76.5% share, reflecting strong participation from users seeking both long term value and active trading opportunities.

- North America held a dominant 68.4% share, backed by high digital asset awareness, strong sports licensing activity, and early adoption of NFT based collectibles.

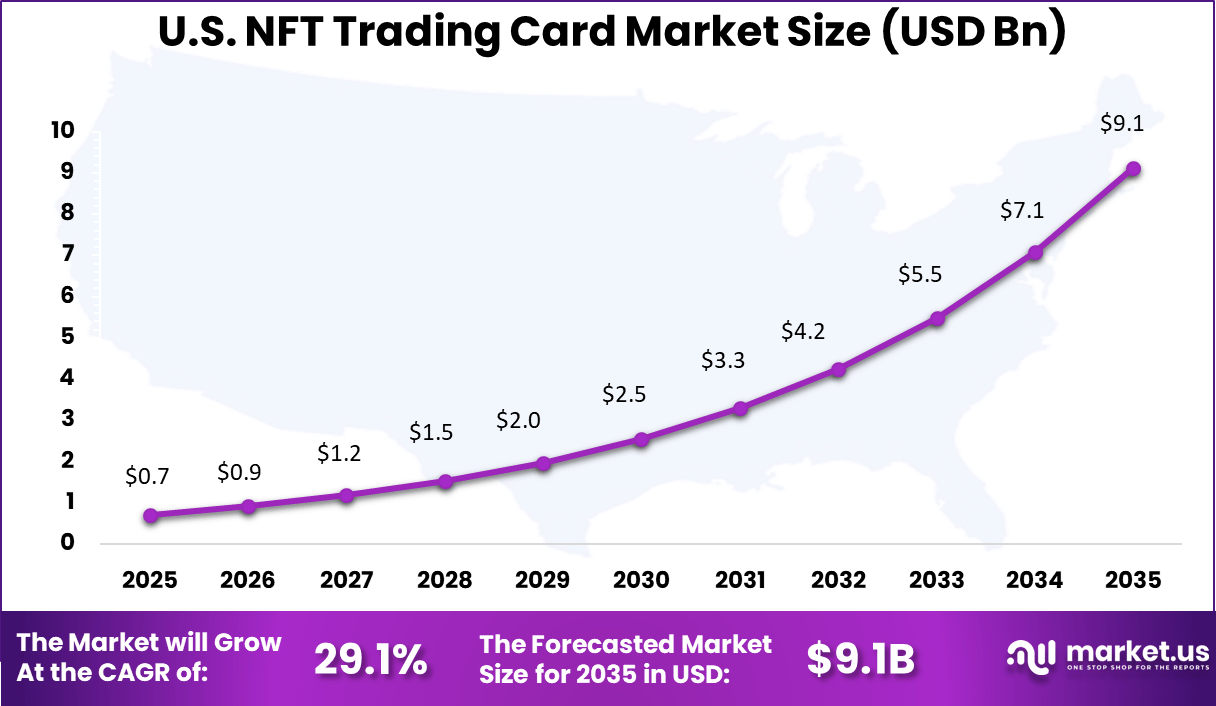

- The U.S. market reached USD 0.71 billion, expanding at a robust 29.15% growth rate, supported by rising trading volumes, expanding marketplaces, and increasing mainstream acceptance of NFT trading cards.

By Content Type

In 2025, Sports cards account for 42.7%, making them the leading content type in the NFT trading card market. Sports-related NFTs attract strong fan interest and emotional attachment. Digital cards allow ownership, trading, and collection without physical limitations. Authenticity and scarcity improve perceived value. This segment benefits from regular sports seasons and events.

The dominance of sports cards is driven by established collector behavior. Fans are familiar with traditional trading cards and adapt easily to digital formats. NFTs enable instant transactions and global access. Digital ownership also supports long-term preservation. This sustains strong demand for sports card NFTs.

By Platform Type

In 2025, Dedicated marketplaces represent 71.6%, highlighting their importance in NFT trading. These platforms are built specifically for NFT discovery and transactions. They offer tools for listing, bidding, and verification. User-friendly interfaces improve trading efficiency. Centralized access supports liquidity.

The preference for dedicated marketplaces is driven by trust and convenience. Buyers and sellers rely on specialized platforms for secure transactions. Marketplaces provide visibility for creators and collectors. Integrated wallets simplify asset management. This keeps dedicated platforms dominant.

By Blockchain

In 2025, Ethereum accounts for 58.9%, making it the most widely used blockchain for NFT trading cards. The blockchain supports smart contracts and transparent ownership records. Its established ecosystem supports interoperability. Security and reliability remain key strengths. Many NFT platforms operate on this network.

The dominance of Ethereum is driven by early adoption and developer support. A large user base supports active trading. Standardization improves compatibility across platforms. Network familiarity builds confidence among users. This sustains Ethereum’s leading position.

By End-User

In 2025, Collectors and investors account for 76.5%, making them the primary end-user group. These users seek digital assets with long-term value. NFT trading cards appeal due to scarcity and uniqueness. Investors also track resale potential. Market activity remains strong.

Adoption among collectors and investors is driven by portfolio diversification. NFTs provide alternative digital assets. Trading cards combine nostalgia with technology. Transparent ownership improves confidence. This sustains strong participation from this group.

By Region

In 2025, North America accounts for 68.4%, reflecting strong adoption of digital collectibles. The region has a mature digital asset ecosystem. High awareness supports market growth. Platforms and communities are well established. The region remains dominant.

The United States reached USD 0.71 Billion with a CAGR of 29.15%, indicating rapid expansion. Growth is driven by collector interest and digital investment trends. NFT adoption continues to rise. Market activity remains strong. Momentum is expected to continue.

Driver Analysis

The NFT trading card market is being driven by a convergence of digital collectibles and blockchain-enabled ownership that appeals to both traditional collectors and digital enthusiasts. NFT trading cards embed unique identifiers on blockchain networks, enabling users to verify authenticity, trace provenance, and securely trade assets without intermediaries.

This transparency and security elevate confidence in transaction integrity and support broader engagement in digital asset communities. The rise of digital fandom cultures, combined with increased interest in gamified and scarce digital items, has amplified demand for NFT trading cards, as they offer novel avenues for ownership and social interaction across gaming, entertainment, and sports domains.

Restraint Analysis

A significant restraint in the NFT trading card market stems from fluctuating market interest and value volatility, which can deter prospective collectors and traders seeking stable investment or long-term engagement. NFT asset prices are subject to rapid changes based on sentiment, hype cycles, and broader digital asset market dynamics, creating uncertainty for participants.

Additionally, the technical complexity of blockchain interactions, including wallet setup and transaction costs, may limit user adoption outside of technologically experienced communities. These factors can constrain participation among mainstream audiences who may view digital collectibles as niche or speculative.

Opportunity Analysis

Emerging opportunities in the NFT trading card market are linked to enhanced interoperability and utility within digital ecosystems. Projects are increasingly exploring integration of NFT cards with gaming platforms, virtual worlds, and loyalty programs, creating functional value beyond mere ownership.

NFT cards can serve as in-game assets, unlock exclusive experiences, or confer membership benefits, broadening their appeal to active digital consumers. As ecosystems evolve, linking NFT trading cards to tangible incentives or cross-platform utilities can elevate user engagement and create diversified value propositions for collectors and brands alike.

Challenge Analysis

A central challenge confronting the NFT trading card market is balancing creative innovation with sustainability and accessibility. Blockchain networks that support NFT minting and trading consume energy and incur transaction costs, which raises concerns about environmental impact and user affordability.

Addressing these concerns requires adoption of more efficient blockchain protocols and fee-optimised networks to make participation more sustainable and inclusive. Moreover, ensuring that digital collectibles maintain long-term relevance and do not become ephemeral trends demands consistent developer investment in platform features, community management, and engaging use cases.

Emerging Trends

Emerging trends within the NFT trading card landscape include the rise of dynamic and programmable NFTs that evolve based on user interactions, achievements, or external data feeds. These advancements enable cards to change attributes, unlock new abilities, or adapt rarity levels, creating deeper engagement cycles for collectors and gamers.

Another trend is the collaboration between digital artists, brands, and franchises to produce limited-edition drops that blend cultural relevance with collectible scarcity. Integration of secondary-market analytics and rarity scoring tools also supports more informed trading and price discovery for users.

Growth Factors

Growth in the NFT trading card market is supported by expanding digital collector communities and increased mainstream interest in blockchain-based entertainment formats. As awareness of and access to NFT platforms improve, more creators and brands are entering the space to offer distinctive digital assets.

Technological improvements that simplify wallet interaction, reduce transaction costs, and enhance user security further strengthen market participation. The broader shift toward digital ownership models and virtual asset economies reinforces interest in trading cards as engaging, verifiable, and tradable digital collectibles.

Key Market Segments

By Content Type

- Sports Cards

- Gaming & Collectible Cards

- Art & Utility Cards

- Celebrity & Brand Cards

- Others

By Platform Type

- Dedicated Marketplaces

- Gaming Platforms

- Social & Creator Platforms

By Blockchain

- Ethereum

- Flow

- Polygon

- Solana

- Others

By End-User

- Collectors & Investors

- Gamers

- Brands & IP Holders

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Dapper Labs, OpenSea, and Sorare lead the NFT trading card market by enabling large scale minting, trading, and ownership of digital sports and collectible cards. Their platforms support licensed content, blockchain based scarcity, and active secondary markets. These companies focus on user friendly interfaces, strong brand partnerships, and liquidity. Rising interest in digital collectibles among sports fans and gamers continues to reinforce their leadership.

NBA Top Shot, Topps, Candy Digital, and Sky Mavis strengthen the market through officially licensed trading cards and play to earn ecosystems. Their offerings combine real world franchises with interactive digital ownership. These providers emphasize authenticity, limited editions, and community engagement. Growing acceptance of blockchain collectibles in mainstream sports supports wider adoption.

Animoca Brands, Larva Labs, Autograph, Recur, and Nifty Gateway expand the landscape with celebrity driven NFTs, premium collectibles, and cross media IP integration. Their platforms target collectors seeking exclusivity and long term value. These companies focus on innovation and brand led growth. Increasing convergence of entertainment, gaming, and digital ownership continues to drive steady growth in the NFT trading card market.

Top Key Players in the Market

- Dapper Labs

- OpenSea

- Sorare

- NBA Top Shot

- Gods Unchained

- Topps

- Candy Digital

- Sky Mavis

- Animoca Brands

- Larva Labs

- Autograph

- Recur

- Ethernity

- Nifty Gateway

- Others

Recent Developments

- In March 2026, Dapper Labs further strengthened NBA Top Shot by adding interactive features tied to live games and player milestones. The platform focused on improving transaction stability and reducing friction for new collectors. This development supported higher retention among existing users while attracting first-time buyers. The approach reflected a steady shift toward utility-driven digital sports collectibles.

- In February 2026, OpenSea expanded its creator and brand collaboration tools for licensed digital collectibles. New features enabled verified partners to manage drops with better control over supply and timing. This supported higher trust among collectors and rights holders. The development reinforced OpenSea’s role as a central hub for NFT trading card transactions.

Report Scope

Report Features Description Market Value (2025) USD 1.2 Bn Forecast Revenue (2035) USD 17.9 Bn CAGR(2026-2035) 31.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Content Type (Sports Cards, Gaming & Collectible Cards, Art & Utility Cards, Celebrity & Brand Cards, Others), By Platform Type (Dedicated Marketplaces, Gaming Platforms, Social & Creator Platforms), By Blockchain (Ethereum, Flow, Polygon, Solana, Others), By End-User (Collectors & Investors, Gamers, Brands & IP Holders) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dapper Labs, OpenSea, Sorare, NBA Top Shot, Gods Unchained, Topps, Candy Digital, Sky Mavis, Animoca Brands, Larva Labs, Autograph, Recur, Ethernity, Nifty Gateway, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dapper Labs

- OpenSea

- Sorare

- NBA Top Shot

- Gods Unchained

- Topps

- Candy Digital

- Sky Mavis

- Animoca Brands

- Larva Labs

- Autograph

- Recur

- Ethernity

- Nifty Gateway

- Others