Global Next-Generation Gaming Console Market Size, Share and Analysis Report By Type (Home Consoles, Handheld Consoles, Hybrid Consoles), By Component (Hardware, Software, Services), By Distribution Channel (Online, Offline), By End-User (Casual Gamers, Hardcore Gamers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177057

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- By Type

- By Component

- By Distribution Channel

- By End User

- Regional Perspective

- Investment and Business Benefits

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Competitive Analysis

- Recent Developments

- Key Market Segments

- Report Scope

Report Overview

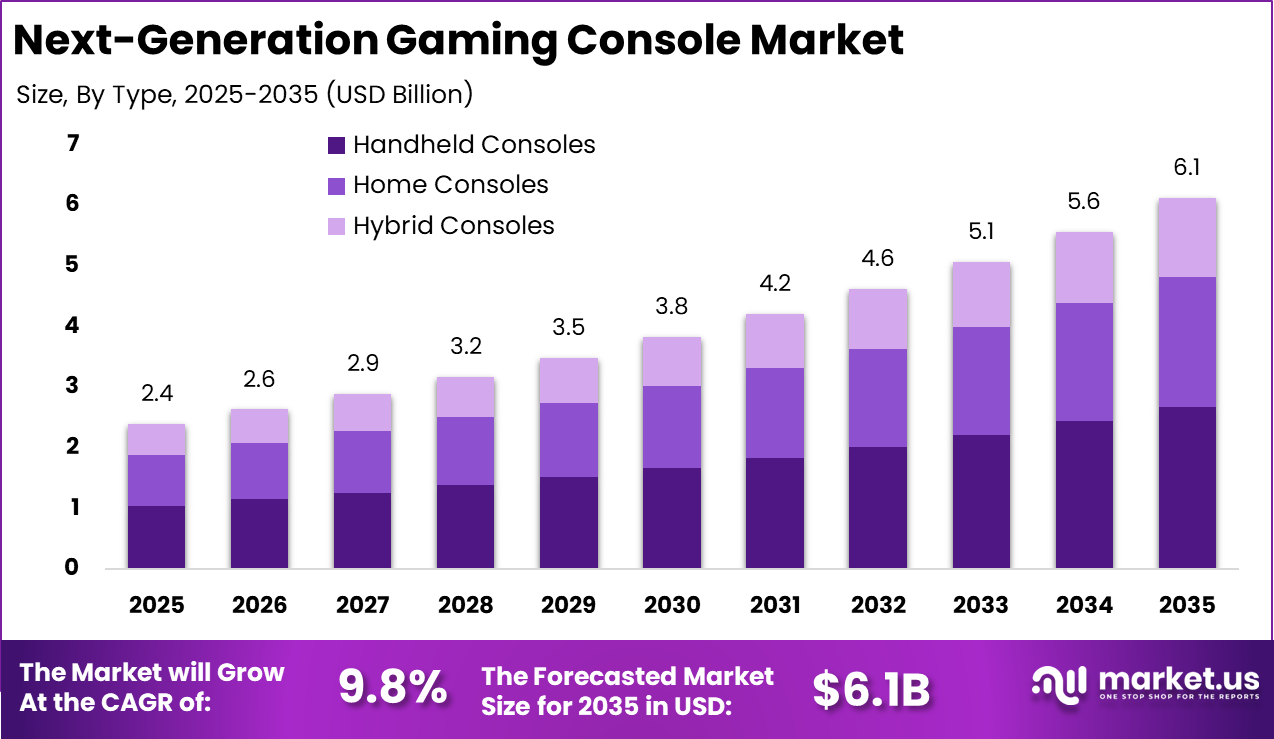

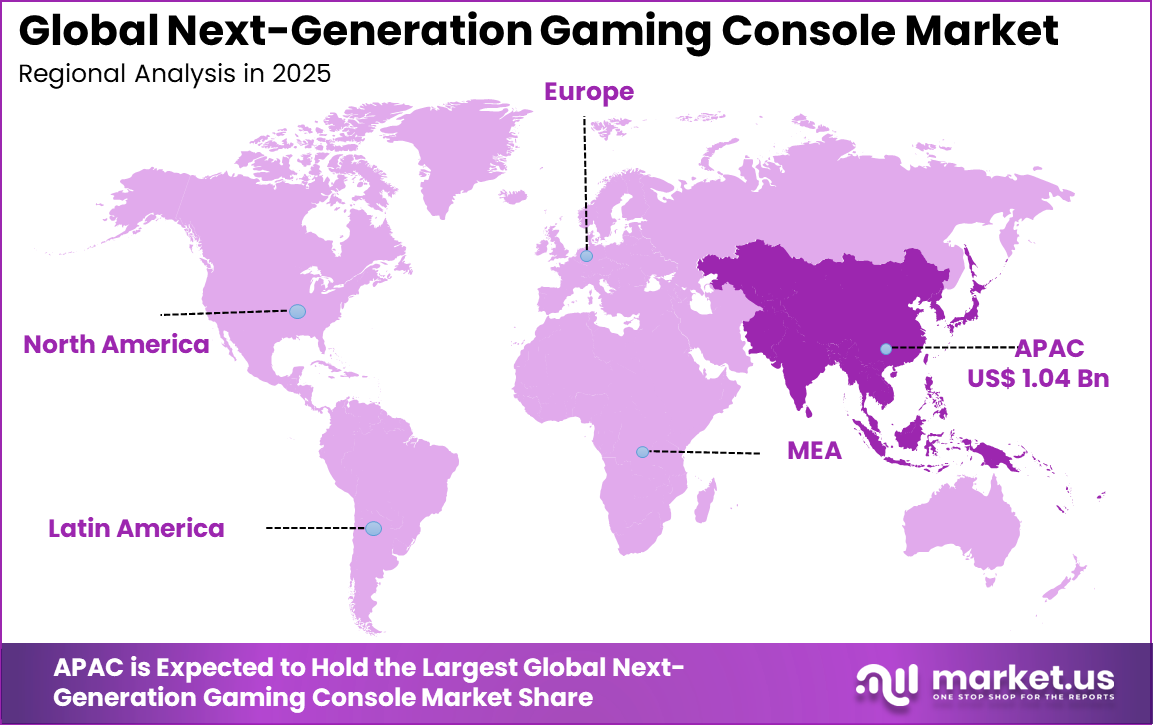

The Global Next-Generation Gaming Console Market size is expected to be worth around USD 6.1 Billion By 2035, from USD 2.4 billion in 2025, growing at a CAGR of 9.8% during the forecast period from 2026 to 2035. Asia Pacific held a dominant Market position, capturing more than a 43.6% share, holding USD 1.0 Billion revenue.

The Next Generation Gaming Console Market refers to advanced home gaming systems designed to deliver high performance gaming, immersive visuals, and integrated digital services. These consoles combine powerful processors, high speed storage, advanced graphics capabilities, and network connectivity to support modern gaming experiences. They are positioned as central entertainment hubs rather than standalone gaming devices.

The market is shaped by evolving gamer expectations, technological progress, and changes in content consumption behavior. Next generation consoles support digital downloads, cloud connectivity, multimedia streaming, and online multiplayer ecosystems. Physical media usage continues to decline as digital distribution becomes dominant. Industry observations indicate that more than 70% of console game purchases are now made digitally, reinforcing the importance of connected platforms.

As of late 2025, PlayStation leads ecosystem engagement with approximately 116 million monthly active users, although a notable share still uses legacy PS4 hardware. By 2026, about 65% of the active console install base is expected to have shifted to ninth generation systems, reflecting a slower transition than past cycles due to extended cross generation game support.

Hardware momentum is expected to accelerate with new launches. The introduction of the Nintendo Switch 2 in 2025 is projected to see rapid uptake, with an estimated 25 million units reaching households within the first 10 months. This aggressive adoption outlook highlights continued consumer demand for new console experiences despite longer upgrade cycles.

Top Market Takeaways

- By type, handheld consoles held a leading position in the Next Generation Gaming Console Market with a 43.8% share, supported by rising demand for portable gaming.

- By component, hardware accounted for 68.4% of total market demand, reflecting continued consumer spending on advanced gaming devices.

- By distribution channel, offline sales remained dominant with a 59.7% share, driven by in store purchases and bundled offerings.

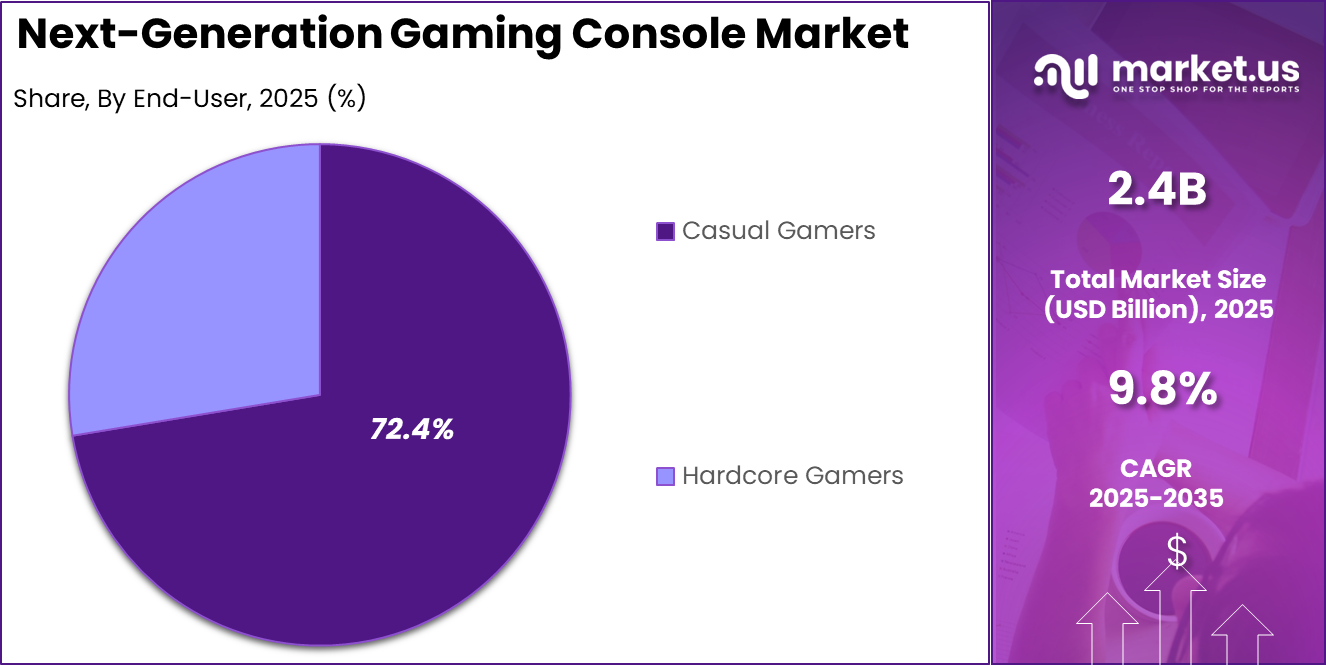

- By end user, casual gamers represented the largest consumer group, capturing 72.4% of overall market adoption.

- Regionally, Asia Pacific led the market with a 43.6% share, supported by a strong gaming culture and high device adoption.

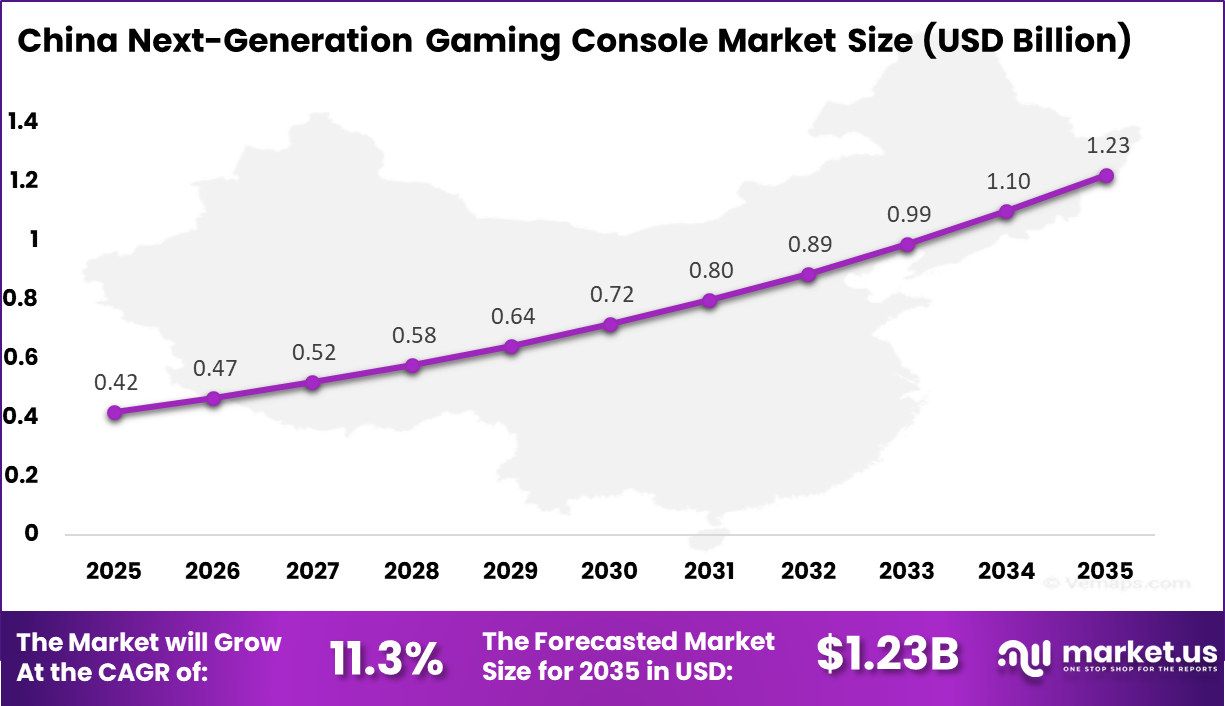

- China recorded a market value of USD 0.42 billion and registered a CAGR of 11.3%, driven by expanding digital entertainment consumption.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising consumer demand for immersive and high-performance gaming +2.6% North America, Europe Short to medium term Growth of digital game distribution and subscription services +2.1% Global Medium term Advancements in graphics processing, ray tracing, and AI upscaling +1.9% Global Medium term Expansion of esports, online multiplayer, and streaming ecosystems +1.7% North America, Asia Pacific Medium term Increasing integration of consoles with entertainment and media platforms +1.5% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High upfront cost of next-generation consoles -2.3% Emerging Markets Short to medium term Competition from cloud gaming and high-end PC gaming -1.9% North America, Europe Medium term Supply chain constraints and semiconductor dependency -1.6% Global Short to medium term Longer console refresh and replacement cycles -1.3% Global Medium term Limited differentiation across console hardware generations -1.1% Global Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Gaming hardware manufacturers High Medium Global Stable platform-driven revenue Game publishers and platform ecosystem players High Medium North America, Asia Pacific Content-led growth leverage Semiconductor and chip suppliers Medium Medium Asia Pacific, North America Demand linked to console cycles Private equity firms Medium Medium North America, Europe Selective platform and accessory plays Venture capital investors Low to Medium High North America Focus on peripherals and services Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Advanced GPUs and custom gaming processors +2.8% High-fidelity graphics and performance Global Short to medium term AI-based upscaling and performance optimization +2.2% Enhanced visual quality Global Medium term High-speed storage and memory architectures +1.9% Faster load times Global Medium term Cloud connectivity and hybrid cloud gaming support +1.6% Extended gaming experiences North America, Europe Medium to long term Integration with VR, AR, and immersive accessories +1.3% Next-level gameplay Asia Pacific, North America Long term By Type

Handheld consoles account for 43.8% of total adoption in the Next Generation Gaming Console Market. This dominance reflects growing consumer preference for portable gaming experiences that support flexible play environments. Handheld devices allow users to engage with games without being tied to fixed locations.

The popularity of handheld consoles is also influenced by lifestyle changes and mobile entertainment habits. Casual and semi core gamers value convenience and accessibility. This strengthens demand for handheld gaming formats.

Advancements in processing power and display quality further support this segment. Modern handheld consoles now deliver immersive experiences comparable to traditional systems. These improvements sustain their leading position by type.

By Component

Hardware represents 68.4% of total market adoption by component. This reflects the central role of physical devices such as processors, controllers, displays, and storage units in console performance. Hardware quality directly impacts gaming experience and system longevity.

Frequent hardware refresh cycles also support strong demand. New console generations introduce improved graphics, speed, and functionality. Consumers upgrade systems to access enhanced gaming capabilities.

Hardware investment is further driven by backward compatibility and ecosystem expansion. Improved hardware supports broader game libraries and accessories. This reinforces hardware dominance within the market.

By Distribution Channel

Offline distribution accounts for 59.7% of total market activity. Physical retail stores continue to play an important role in console sales. Consumers often prefer in store purchasing for high value electronics. Offline channels also provide opportunities for product demonstrations and bundled offers.

These factors influence purchasing decisions, especially among first time buyers. Retail presence strengthens brand visibility and trust. Retail partnerships and launch events further support offline sales. Consoles are frequently introduced through physical stores. This maintains the strength of offline distribution.

By End User

Casual gamers represent 72.4% of total end user demand. This segment includes users who engage in gaming for entertainment rather than competitive play. Accessibility and ease of use are key priorities. The expansion of casual gaming is supported by broader demographic participation.

Gaming is increasingly adopted across age groups and skill levels. User friendly consoles attract non traditional gamers. Casual gamers also drive demand for affordable and versatile consoles. Handheld and hybrid systems appeal strongly to this segment. This sustains their dominant share among end users.

Regional Perspective

Asia Pacific holds a leading position in the Next Generation Gaming Console Market, accounting for 43.6% of total activity. The region benefits from a large gaming population and strong digital entertainment culture. Gaming consoles are widely adopted across urban and semi urban areas. Rising disposable income and youth demographics further support regional demand.

China Market Overview

China represents a major contributor within the Asia Pacific region, with a market value of USD 0.42 Bn and a growth rate of 11.3% CAGR. Expansion is supported by growing interest in console gaming and improved access to licensed gaming content. Hardware adoption continues to rise.

Consumer demand in China is influenced by evolving gaming regulations and rising acceptance of console platforms. Casual gaming remains a strong driver. These dynamics collectively support steady growth in the China market segment.

Investment and Business Benefits

Investment opportunities in this market exist in ecosystem expansion rather than hardware alone. Services related to digital content delivery, subscriptions, and online engagement generate recurring revenue. Investors focus on platforms that demonstrate strong user retention and service attachment. This service oriented model increases long term value.

Opportunities also exist in peripheral and accessory integration. Advanced controllers, storage expansions, and immersive accessories complement console usage. These extensions enhance user experience and create additional revenue streams. Innovation beyond the core console remains an attractive investment area.

For platform owners, next generation consoles provide stable revenue through a combination of hardware sales and ongoing digital services. Strong ecosystems increase customer lifetime value. Consoles also support cross media entertainment, broadening their role in households. This diversification improves resilience against content cycles.

From a consumer perspective, consoles offer consistent performance and simplified gaming experiences. Standardized hardware reduces compatibility issues. This reliability builds user trust and long term platform loyalty. The benefits extend beyond gaming into broader digital entertainment usage.

Driver Analysis

A primary driver of the next generation gaming console market is rising demand for immersive and high performance gaming experiences. Players increasingly expect realistic visuals, fast load times, and smooth gameplay. Advanced hardware capabilities enable features such as ray traced graphics and higher frame rates, which enhance realism and engagement. This demand pushes adoption of newer console generations.

Another important driver is growth in digital game distribution and online gaming ecosystems. Consoles now function as connected platforms that support multiplayer gaming, downloadable content, and regular software updates. These ecosystems increase user engagement and extend console usage beyond traditional physical game discs. Continuous content availability strengthens long term console adoption.

Restraint Analysis

A key restraint in the next generation gaming console market is high upfront cost for consumers. Advanced hardware components increase manufacturing costs, which can translate into higher retail prices. Price sensitivity may delay purchases among casual gamers or households with budget constraints. This can slow adoption during early product cycles.

Another restraint is supply chain complexity and component availability. Gaming consoles rely on advanced chips and memory components. Disruptions in semiconductor supply can limit production and availability. Limited supply may affect market penetration and customer satisfaction.

Opportunity Analysis

A significant opportunity in the next generation gaming console market lies in expanding cloud connected and subscription based gaming services. Consoles increasingly support digital libraries, game streaming, and subscription access to large game catalogs. These services reduce dependence on individual game purchases and improve value perception. Subscription models create recurring revenue opportunities and enhance customer retention.

Another opportunity is integration of gaming with broader entertainment functions. Consoles are used for streaming media, social interaction, and live content consumption. This multifunctional role increases household relevance and usage time. Expanding non gaming features can attract a wider consumer base.

Challenge Analysis

A major challenge for the next generation gaming console market is balancing performance advancement with energy efficiency. High performance components generate more heat and power consumption. Managing thermal output while maintaining quiet operation is technically demanding. Failure to optimize efficiency can affect reliability and user experience.

Another challenge is intense competition from alternative gaming platforms. Cloud gaming, mobile gaming, and high end gaming PCs offer different value propositions. Consoles must continue to differentiate through exclusive content, optimized performance, and ease of use. Maintaining relevance in a diverse gaming landscape requires constant innovation.

Emerging Trends Analysis

An emerging trend in the next generation gaming console market is deeper integration with online communities and social features. Consoles are evolving into social hubs that support live streaming, voice chat, and shared gameplay experiences. Social connectivity enhances engagement and drives longer session times. This trend aligns gaming with broader digital interaction habits.

Another trend is increasing support for virtual reality and augmented experiences. Next generation consoles are being designed to accommodate immersive peripherals and interactive environments. This capability expands gameplay formats and attracts users seeking novel experiences. Immersive technology integration is gradually shaping future console design.

Growth Factors Analysis

One of the key growth factors for the next generation gaming console market is the expanding global gaming population. Gaming is increasingly accepted as mainstream entertainment across regions and demographics. Growing participation supports sustained demand for advanced console platforms.

Another growth factor is continuous investment in game development and content innovation. High quality games drive console adoption and lifecycle extension. As developers leverage advanced hardware features, demand for next generation consoles strengthens. Content driven growth remains a core factor supporting long term market expansion.

Competitive Analysis

Major platform owners such as Sony, Microsoft, and Nintendo dominate the next-generation gaming console market through strong first-party ecosystems. Their consoles combine high-performance hardware with exclusive game content and online services. Continuous upgrades in graphics, storage, and cloud integration support immersive gameplay. These players benefit from large installed user bases and developer partnerships.

Hardware innovation and performance-focused companies such as NVIDIA, AMD, and Qualcomm play a critical role in powering next-generation consoles and handheld devices. Valve contributes through hybrid console-PC designs and software ecosystems. These firms focus on advanced GPUs, AI upscaling, and energy-efficient architectures. Their technologies enable smoother gameplay, ray tracing, and portable console formats.

Emerging console and gaming hardware brands such as ASUS, Alienware, Razer, and Logitech expand the market beyond traditional consoles. Zotac, AYANEO, GPD, and Panic address niche and portable gaming segments. Other players increase competition and innovation across form factors and price points.

Top Key Players in the Market

- Sony

- Microsoft

- Nintendo

- Valve

- Logitech

- Razer

- ASUS

- Alienware

- NVIDIA

- AMD

- Qualcomm

- Zotac

- AYANEO

- GPD

- Panic

- Others

Recent Developments

- June, 2025 – Nintendo launched the Switch 2, backward‑compatible with Switch games and featuring enhanced hybrid portable/home capabilities, dominating the handheld segment with strong third‑party support including GTA 6.

- Microsoft pushed cloud gaming forward in March 2025. Xbox teamed with Samsung, LG, and FireTV to reach over 100 million devices. Players can stream titles without powerful hardware. This widens access for more users around the world.

Key Market Segments

By Type

- Home Consoles

- Handheld Consoles

- Hybrid Consoles

By Component

- Hardware

- Software

- Services

By Distribution Channel

- Online

- Offline

By End-User

- Casual Gamers

- Hardcore Gamers

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Report Scope

Report Features Description Market Value (2025) USD 2.4 Bn Forecast Revenue (2035) USD 6.1 Bn CAGR(2026-2035) 9.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Home Consoles, Handheld Consoles, Hybrid Consoles), By Component (Hardware, Software, Services), By Distribution Channel (Online, Offline), By End-User (Casual Gamers, Hardcore Gamers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sony, Microsoft, Nintendo, Valve, Logitech, Razer, ASUS, Alienware, NVIDIA, AMD, Qualcomm, Zotac, AYANEO, GPD, Panic, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next-Generation Gaming Console MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Next-Generation Gaming Console MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sony

- Microsoft

- Nintendo

- Valve

- Logitech

- Razer

- ASUS

- Alienware

- NVIDIA

- AMD

- Qualcomm

- Zotac

- AYANEO

- GPD

- Panic

- Others