Global Next Generation Emergency Response System Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By End-User (Public Safety Answering Points (PSAPS), Law Enforcement Agencies, Fire Departments, Emergency Medical Services, Other End Users) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175281

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- End-User Analysis

- Regional Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

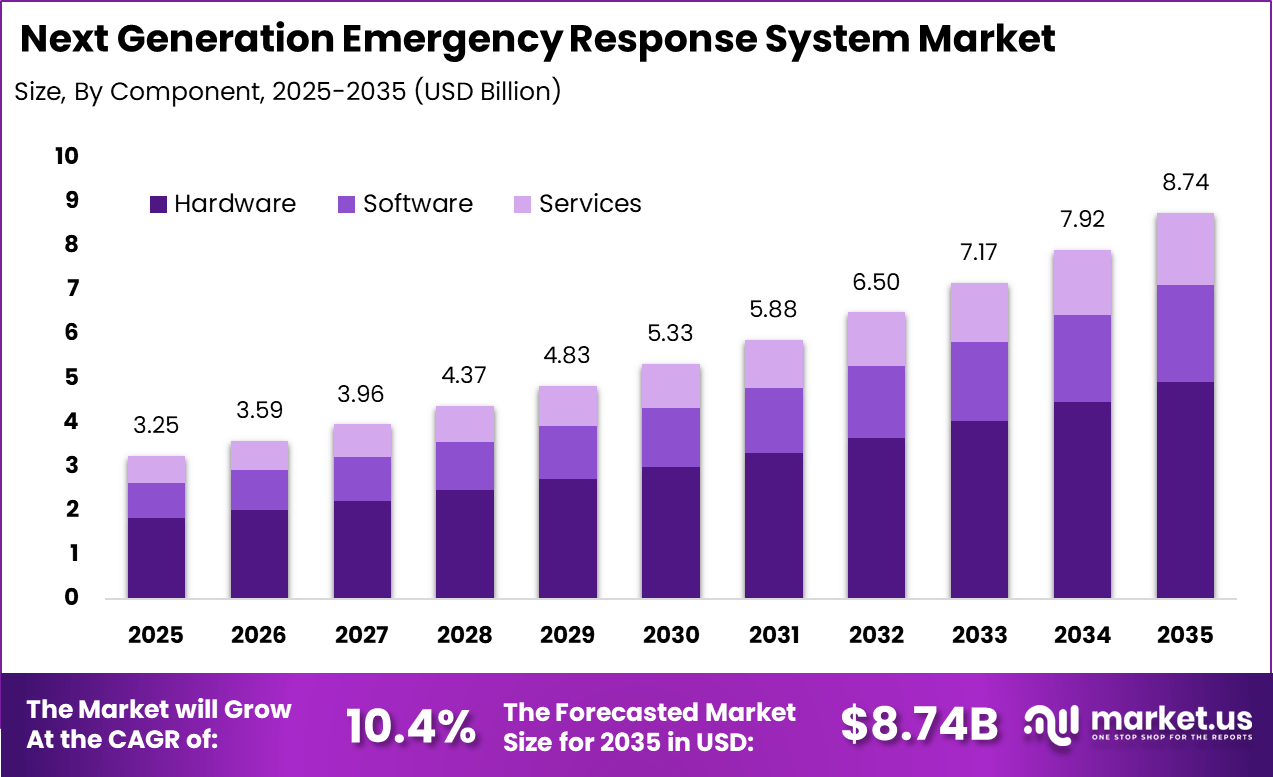

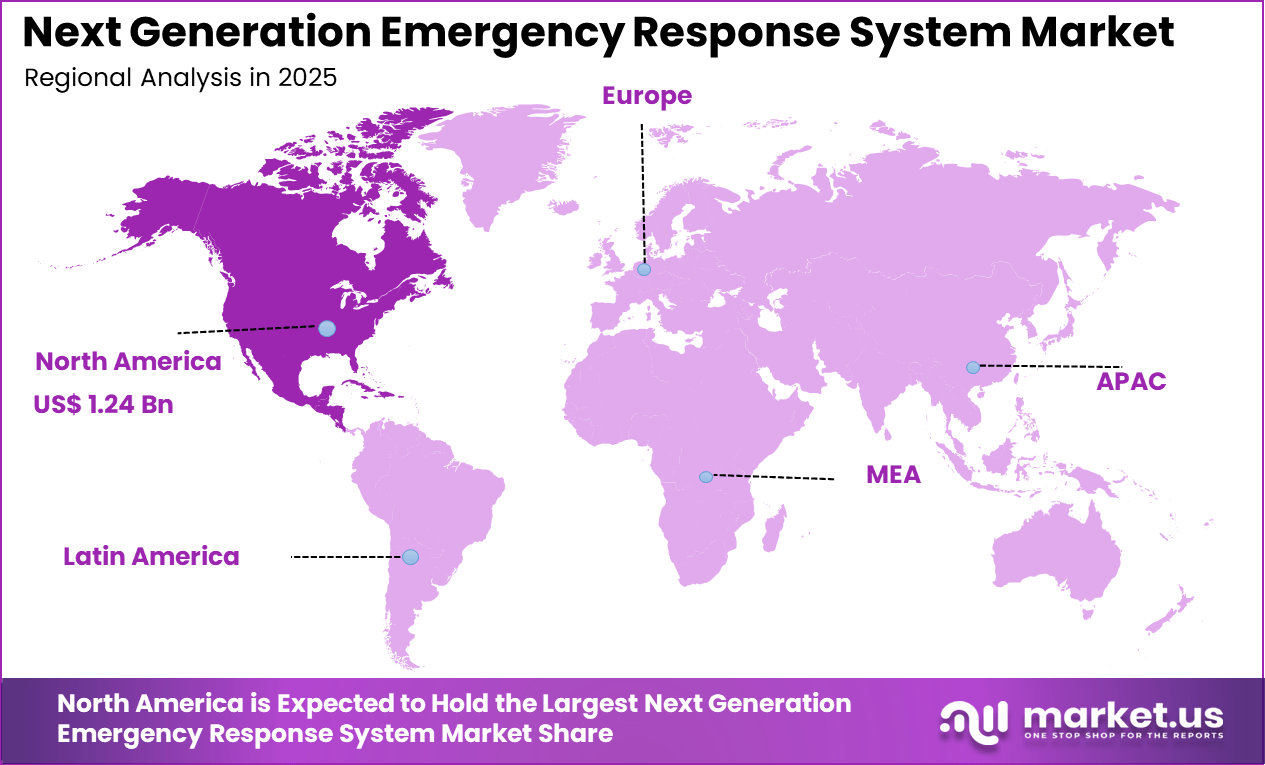

The Global Next Generation Emergency Response System Market size is expected to be worth around USD 8.74 billion by 2035, from USD 3.25 billion in 2025, growing at a CAGR of 10.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 38.2% share, holding USD 1.24 billion in revenue.

Next Generation Emergency Response System Market refers to advanced digital platforms that support faster, smarter, and more coordinated responses to emergencies such as medical incidents, natural disasters, fires, and public safety threats. These systems modernize traditional emergency response infrastructure by integrating real-time communication, location data, and intelligent decision support tools. The focus is on improving how emergency calls are received, analyzed, and acted upon by response teams.

This market has gained importance as emergency situations become more complex and time sensitive. These systems are designed to replace fragmented and manual response processes with unified digital workflows. They allow emergency operators and field responders to share accurate information instantly across agencies. By improving situational awareness and coordination, next generation systems reduce response delays and operational confusion.

For instance, in January 2026, Siemens unveiled nine new AI-powered copilots at CES 2026 for its industrial software, including fire safety and building management systems. These tools speed up emergency operations like alarm response and facility lockdowns, highlighting how smart infrastructure keeps public safety evolving.

Top Driving Factors include the rising need for faster response times and improved coordination during emergencies. Traditional systems often rely on voice-only communication and manual dispatching, which can slow down decision making. Modern emergency environments require real-time data sharing to handle incidents involving multiple agencies and locations. Next generation systems address these challenges by enabling instant access to location, incident, and responder data.

Demand Analysis shows strong demand from public safety agencies, emergency medical services, disaster management authorities, and critical infrastructure operators. These organizations require systems that can manage high volumes of emergency interactions without delays or data loss. Demand is especially strong in regions experiencing frequent natural disasters or rapid urban growth. Reliable emergency response systems are viewed as essential public service assets rather than optional technology upgrades.

Key Takeaway

- Hardware led the market with a 56.4% share in the Global Next Generation Emergency Response System Market in 2025.

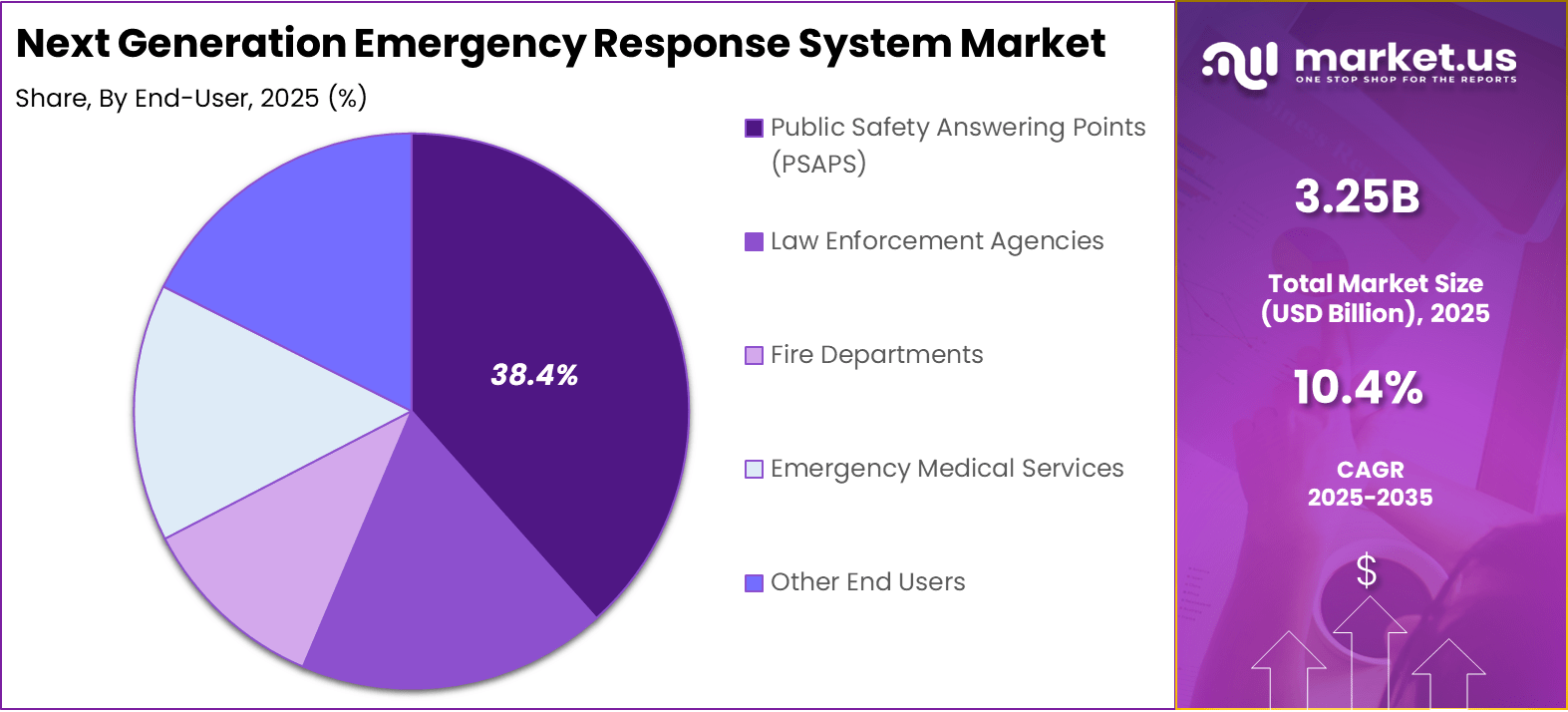

- Public Safety Answering Points (PSAPS) accounted for 38.4%, reflecting their central role in emergency response systems.

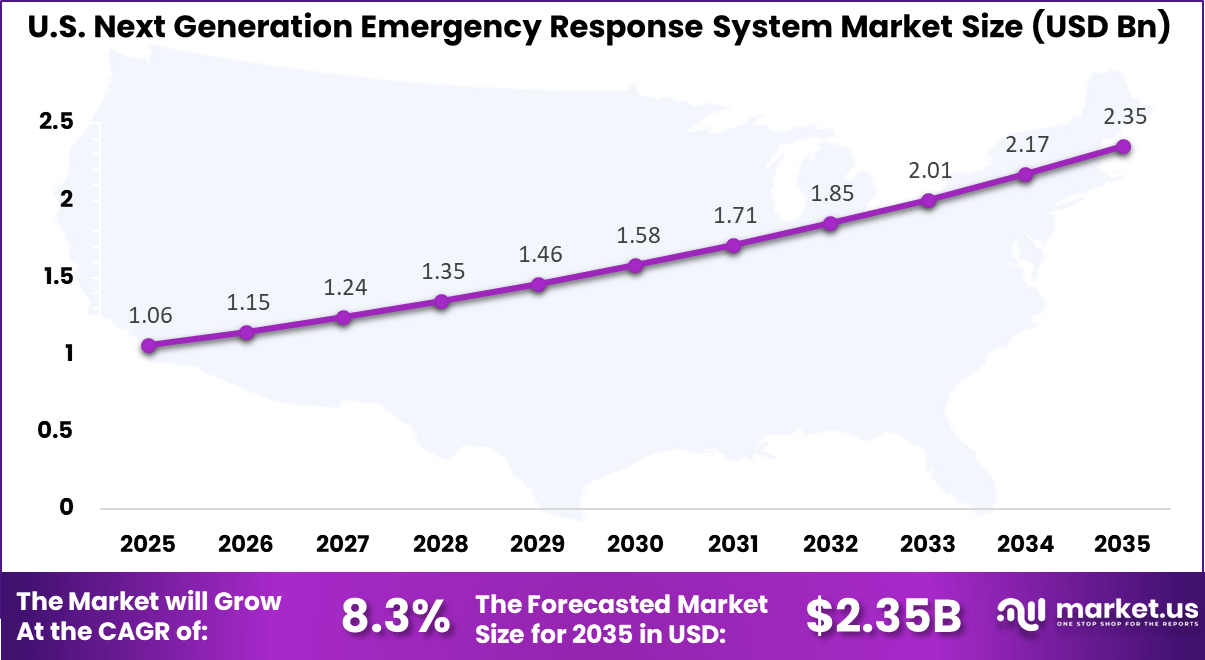

- The U.S. market was valued at USD 1.06 billion in 2025, expanding at a strong CAGR of 8.3%.

- North America captured 38.2% of the global market in 2025, maintaining a dominant position driven by advanced emergency response infrastructure.

Key Insights

Adoption & Implementation

- 95% U.S. population covered by Next Generation Emergency Response Systems by 2026.

- California begins PSAP migration in 2026, with full decommissioning by 2030.

- 86% of emergency professionals are comfortable with AI-assisted call-taking.

- Georgia mandates Next Generation standards by July 2025, with $5.7 million funding.

Usage & Performance

- 60% of emergency calls originate indoors, requiring advanced indoor mapping.

- ECA achieves 92.7% to 97.34% accuracy in emergency categorization.

- 2.13 seconds average speech-to-text and classification latency.

- Handling real-time video, photos, and IoT alerts.

- 63% of PSAPs report 50%-80% non-emergency call volume.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Increasing frequency of natural disasters Need for faster and more efficient emergency response ~6.2% Global Short Term Government initiatives for disaster preparedness Investments in modernized emergency response systems ~5.3% North America, Europe Short Term Advancements in AI and data analytics Real time decision making for crisis management ~4.6% Global Mid Term Integration of IoT and connectivity Enhanced communication during emergencies ~3.9% Global Mid Term Rising concerns over public safety Increasing focus on safety systems for urban areas ~3.2% North America, Europe Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High implementation costs Expensive setup for advanced emergency response systems ~4.9% Emerging Markets Short to Mid Term Data privacy and security concerns Handling of sensitive data during emergencies ~4.1% Europe, North America Short Term Technological integration challenges Compatibility with legacy systems in some regions ~3.6% Global Mid Term Regulatory delays Delays in government approval and standardization ~3.2% Global Mid Term Dependence on real time data Performance issues with unreliable data sources ~2.8% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High cost of deployment Initial setup costs and ongoing maintenance of systems ~6.2% Emerging Markets Short to Mid Term Lack of skilled professionals Shortage of personnel trained in AI and emergency management technologies ~5.4% Global Mid Term Integration complexity Issues with merging new systems with existing emergency infrastructures ~4.8% Global Mid Term Data security and compliance issues Managing sensitive information during emergencies ~4.1% Europe, North America Long Term Resistance to change Reluctance to adopt new technologies in traditional emergency response models ~3.3% Global Long Term Component Analysis

Hardware accounts for 56.4% of the next generation emergency response system market, reflecting its foundational role in emergency communications. Devices such as call-handling equipment, servers, network infrastructure, and location-tracking systems enable reliable emergency response operations. Public safety agencies prioritize robust hardware to ensure continuous availability during high-demand situations.

The demand for hardware is driven by the need for upgraded infrastructure that supports voice, data, video, and text communications. Modern emergency systems rely on interoperable devices that can handle multi-channel inputs. Hardware reliability directly impacts response speed and system resilience.

As emergency services modernize legacy systems, investment in advanced hardware continues. Improved durability and performance support long-term deployment. This keeps hardware as the dominant component in the market.

For Instance, in February 2025, Motorola Solutions bought RapidDeploy to strengthen hardware-cloud links in NG911 systems. The deal adds location tech to hardware setups, aiding precise tracking. PSAPs gain reliable devices for video and sensor data. This move supports hardware’s lead by making networks tougher against outages.

End-User Analysis

Public Safety Answering Points account for 38.4% of market demand, making them the primary end users of next generation emergency response systems. PSAPs serve as the first point of contact for emergency calls and digital alerts. Advanced systems help operators manage increased call volumes and diverse data inputs.

Next generation platforms enable PSAPs to receive multimedia information such as text messages, images, and real-time location data. This improves situational awareness and decision accuracy. Enhanced data access supports faster dispatch and coordination.

As emergency communication expectations evolve, PSAPs continue to upgrade systems. Regulatory standards and public safety requirements support adoption. This sustains strong demand from this end-user segment.

For instance, in January 2025, AT&T earned praise from Frost & Sullivan for its NG911 work with PSAPs. The ESInet handles texts, videos, and calls for over 80 million people. PSAPs use it to route emergencies faster with better location data. This as-a-service model eases upgrades for busy centers nationwide.

Regional Analysis

North America holds a 38.2% share of the next generation emergency response system market, supported by early adoption of advanced public safety technologies. Agencies across the region invest in digital communication upgrades to improve emergency handling. Strong institutional frameworks support modernization.

For instance, in October 2025, Cisco expanded its public safety portfolio with AI-enhanced networking solutions for next-generation 911 systems, improving data sharing across emergency response networks. These advancements support resilient communications infrastructure, strengthening North America’s position in unified emergency operations centers.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Government funding for advanced emergency systems 38.2% USD 1.24 Bn Advanced Europe Strong regulatory support for disaster management technologies 29.5% USD 0.96 Bn Advanced Asia Pacific Increasing disaster response needs in densely populated areas 19.6% USD 0.64 Bn Developing Latin America Rising investment in public safety infrastructure 6.3% USD 0.21 Bn Developing Middle East and Africa Early adoption in smart city initiatives 6.4% USD 0.21 Bn Early

The United States contributes USD 1.06 billion in market value, driven by large-scale PSAP infrastructure and public safety investment. Federal and local initiatives encourage system upgrades. Emergency agencies prioritize reliability and interoperability.

A CAGR of 8.3% reflects steady growth across the region. Ongoing system upgrades and technology integration support expansion. North America remains a key region for next generation emergency response systems.

For instance, in June 2025, AT&T enhanced its ESInet Next Generation 9-1-1 platform with picture/video messaging, automatic vehicle crash alerts from 2026 Toyota models, and secure cloud data access for PSAPs. These features deliver real-time incident details to first responders, accelerating response effectiveness and solidifying U.S. dominance in advanced emergency communications.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Government agencies Very High ~53.7% Enhancing disaster preparedness and response Long term strategic funding Technology providers High ~30.4% Platform development and market expansion R and D intensive Telecom providers Moderate ~10.2% Supporting communication infrastructure during emergencies Partnership with government VC investors Moderate ~5.7% Investment in emerging technologies for disaster management Early stage funding NGOs and international bodies Low ~2.3% Supporting humanitarian efforts during disasters Program based funding Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status AI and machine learning Real time decision making for emergency response ~7.8% Growing Cloud based platforms Data storage and real time analytics for emergencies ~6.5% Mature IoT sensors and connectivity Enhanced situational awareness through data collection ~5.3% Mature Real time communication tools Instant data transmission during critical events ~4.9% Growing Blockchain for data integrity Ensuring data security and transparency ~3.5% Developing Driver Analysis

The next generation emergency response system market is being driven by the increasing need to improve public safety, reduce response times, and enhance coordinated action across emergency services. Urbanisation, population growth, and more frequent natural disasters have placed heightened pressure on first responders to manage complex incidents efficiently.

Next generation systems integrate advanced communication networks, real‑time data analytics, location tracking, and interoperable platforms to support rapid situation assessment and decision making. These capabilities enable emergency management agencies to route resources, share critical information instantly, and maintain situational awareness across multiple response teams, strengthening overall community resilience and safety outcomes.

Restraint Analysis

A significant restraint in the next generation emergency response system market relates to the complexity and cost of upgrading legacy communication infrastructure. Many public safety agencies continue to rely on outdated radio networks and isolated dispatch platforms that require substantial investment to modernise.

Transitioning to integrated, IP‑based systems often demands hardware upgrades, software customisation, and staff training, which can be resource intensive for municipalities and small jurisdictions with constrained budgets. Ensuring interoperability among diverse agencies and across different technology standards adds further technical and organisational complexity, which may slow deployment.

Opportunity Analysis

Emerging opportunities in the next generation emergency response system market are linked to the integration of artificial intelligence, machine learning, and predictive analytics that enhance situational understanding and proactive response planning. AI‑enabled systems can analyse historical incident data, real‑time sensor feeds, and environmental conditions to forecast potential risks, prioritise calls for assistance, and optimise resource allocation.

There is also potential in mobile‑centric and cloud‑based solutions that support field personnel with critical information, maps, and communication tools on demand. Enhanced public alerting services, integrated telematics, and cross‑agency data sharing platforms further broaden value by improving decision quality and coordination during complex emergencies.

Challenge Analysis

A central challenge confronting this market involves ensuring data security, privacy, and continuity of operations under stress conditions. Emergency response systems handle sensitive personal information, location data, and critical communications that must be protected from unauthorised access, tampering, or cyber threats.

Implementing robust encryption, access controls, and redundancy protocols is essential to maintain public trust and system reliability, yet it introduces technical and governance demands. Balancing openness for interoperability with strict safeguards against misuse requires clear policy frameworks, rigorous testing, and continuous monitoring.

Emerging Trends

Emerging trends in the next generation emergency response system landscape include the adoption of real‑time situational dashboards that consolidate inputs from 911/112 calls, IoT sensors, CCTV feeds, and social media signals to provide comprehensive operational awareness. Systems increasingly leverage geographic information systems (GIS) and dynamic mapping to visualise incident evolution, resource positions, and hazard zones.

Another trend involves mobile‑first engagement tools that enable citizens to transmit multimedia incident reports, receive tailored alerts, and access guidance during emergencies. Integration of wearable devices and connected vehicles into response ecosystems further expands data sources and responsiveness.

Growth Factors

Growth in the next generation emergency response system market is supported by policy emphasis on public safety modernisation, regulatory mandates for interoperable communications, and investment in smart city infrastructure. Rising expectations for faster, more coordinated responses from citizens and stakeholders reinforce the strategic importance of advanced emergency systems.

Technological advances in broadband networks, edge computing, AI, and secure cloud services improve the scalability, resilience, and accessibility of next generation solutions for agencies of varied sizes. As disruptions and emergencies become more complex, emergency response systems that facilitate rapid situational insight, decision support, and cross‑agency collaboration continue to be prioritised within public safety strategies.

Key Market Segments

By Component

- Hardware

- Switching & Routing Equipment

- Call Handling Systems

- Network Infrastructure Equipment

- Other Hardware

- Software

- Call Management Software

- Location-Based Services Software

- Text Messaging Software

- Multimedia Support Software

- Other Software

- Services

- Professional Services

- Managed Services

By End-User

- Public Safety Answering Points (PSAPS)

- Law Enforcement Agencies

- Fire Departments

- Emergency Medical Services

- Other End Users

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in December 2025, Motorola Solutions advanced AI-powered emergency responses through collaboration with Google, letting Android users share live video directly with 911 dispatchers. Research shows growing trust in AI tech across Australia and New Zealand. This partnership boosts situational awareness for responders, potentially saving lives by providing instant visual intel during crises.

Top Key Players in the Market

- Motorola Solutions

- Siemens

- Honeywell

- Cisco Systems

- AT&T

- Verizon Communications

- Thales Group

- General Dynamics

- Northrop Grumman

- Others

Recent Developments

- In July 2025, Honeywell secured a major project to upgrade Phoenix Airport’s fire alarm system with thousands of new automated devices meeting the latest UL standards. The revamp includes a digital dashboard for better insights, cutting maintenance costs and manpower needs. This move highlights Honeywell’s edge in automated fire safety, making airports safer and more efficient for emergencies.

- In September 2024, Strategic Innovation Group (SIG) acquired Excelicon to expand its homeland security capabilities, adding expertise in cyber policy and IT modernization. While not a direct match to the listed players, this bolsters the competitive landscape where Northrop Grumman and General Dynamics lead. It shows ongoing consolidation driving next-gen emergency management solutions.

Report Scope

Report Features Description Market Value (2025) USD 3.2 Bn Forecast Revenue (2035) USD 8.7 Bn CAGR (2025-2035) 10.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By End-User (Public Safety Answering Points (PSAPS), Law Enforcement Agencies, Fire Departments, Emergency Medical Services, Other End Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Motorola Solutions, Siemens, Honeywell, Cisco Systems, AT&T, Verizon Communications, Thales Group, General Dynamics, Northrop Grumman, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next Generation Emergency Response System MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Next Generation Emergency Response System MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Motorola Solutions

- Siemens

- Honeywell

- Cisco Systems

- AT&T

- Verizon Communications

- Thales Group

- General Dynamics

- Northrop Grumman

- Others