Global Newborn Eye Imaging Systems Market Analysis By Disease Type (Retinopathy of Prematurity (ROP) , Retinal Disease , Strabismus , Refractive Error , Color Blindness , Others) By Device Type (Basic Device, Wireless Device) By End-User (Hospitals, Ophthalmology Diagnosis Centers, Ambulatory Surgical Centers, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155381

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

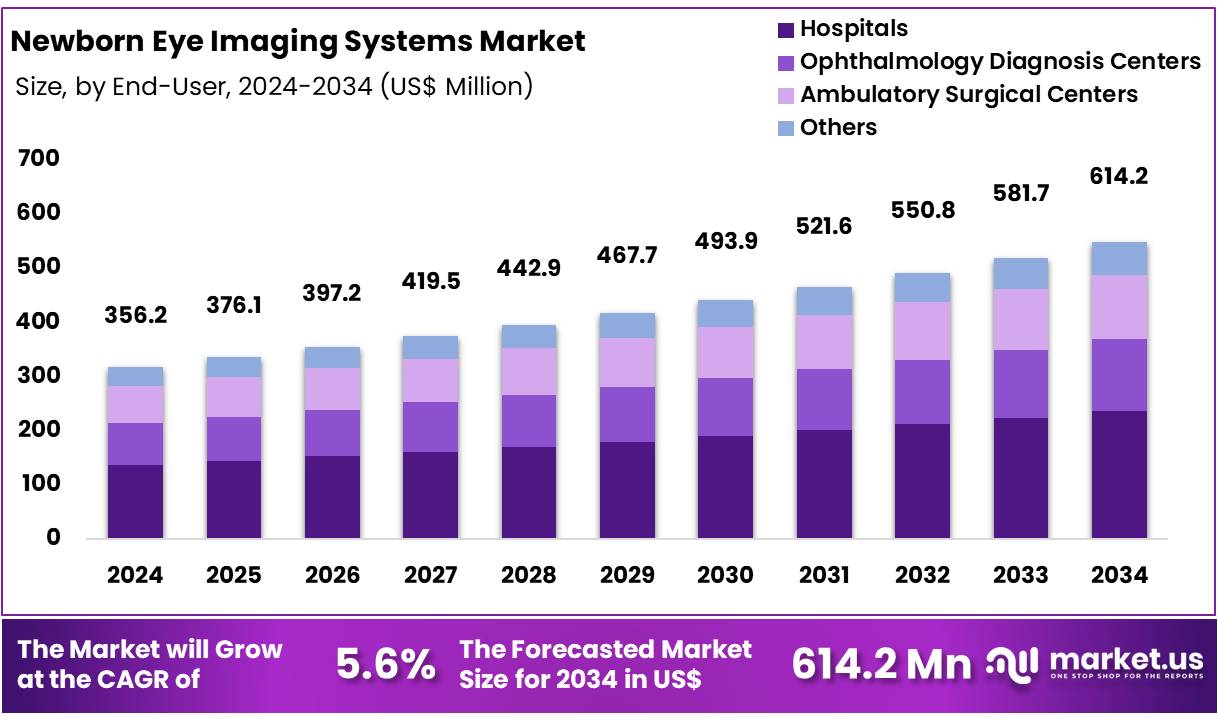

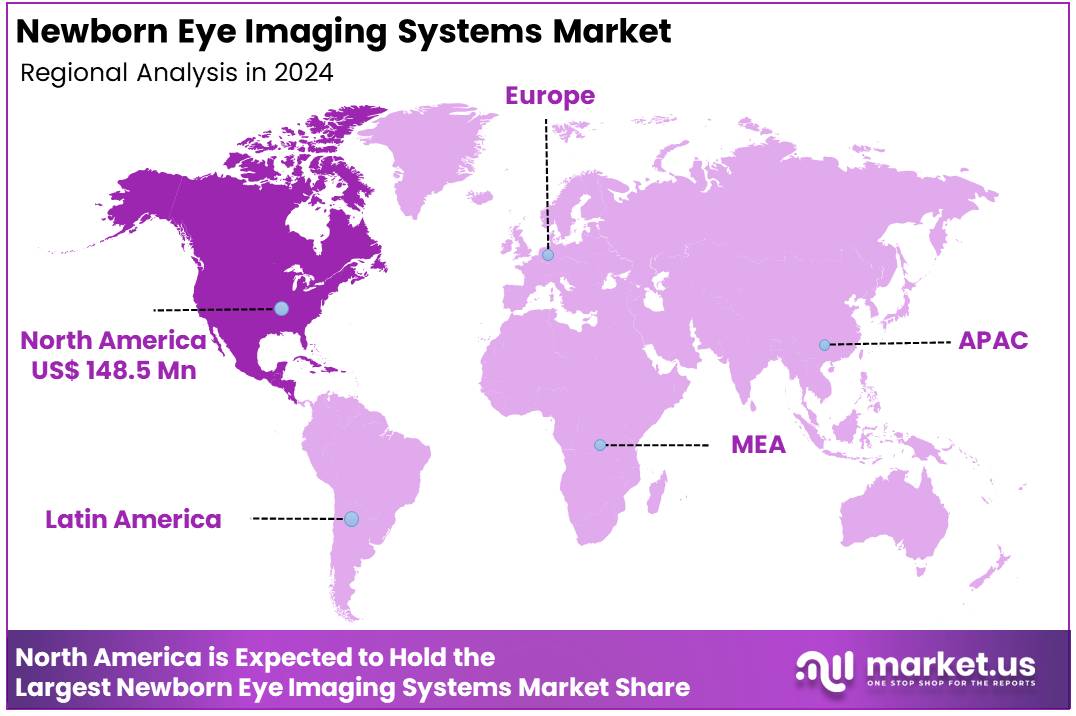

Global Newborn Eye Imaging Systems Market size is expected to be worth around US$ 614.2 Million by 2034 from US$ 356.2 Million in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 41.7% share with a revenue of US$ 148.5 Million.

The Global Newborn Eye Imaging Systems Market represents a critical segment of the healthcare industry, dedicated to the early detection, diagnosis, and management of ocular conditions in infants. This market encompasses advanced imaging technologies and specialized diagnostic tools designed to assess neonatal eye health, identify abnormalities, and enable timely medical intervention. The introduction of next-generation imaging systems has transformed neonatal care, providing healthcare professionals with precise and comprehensive insights into ocular development, visual function, and potential vision impairments from the earliest stages of life.

Market expansion is supported by several key drivers, including heightened awareness of the importance of early eye screening, rapid advancements in imaging technology, and increased investment in neonatal healthcare infrastructure. Rising incidences of conditions such as retinopathy of prematurity (ROP), refractive errors, and congenital ocular anomalies further amplify demand for these systems. In addition, innovations such as wireless connectivity, AI-powered diagnostics, and telemedicine integration are redefining market capabilities, enabling remote screenings, real-time image analysis, and collaborative care approaches that enhance clinical outcomes.

Key stakeholders in this market include healthcare providers, medical device manufacturers, research institutions, regulatory authorities, and advocacy groups. Strategic collaborations among these entities drive technological progress, regulatory compliance, and the establishment of global industry standards. As the market continues to evolve, opportunities are emerging for customized imaging solutions, personalized diagnostics, and integrated care pathways. These advancements are expected to strengthen neonatal eye health management, improve patient outcomes, and contribute significantly to the long-term vision health and quality of life of newborns worldwide.

Key Takeaways

- Market Size: Global Newborn Eye Imaging Systems Market size is expected to be worth around US$ 614.2 Million by 2034 from US$ 356.2 Million in 2024.

- Market Growth: The market growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

- Disease Type Analysis: The Retinopathy of Prematurity (ROP) segment accounted for the largest share representing 36.5%.

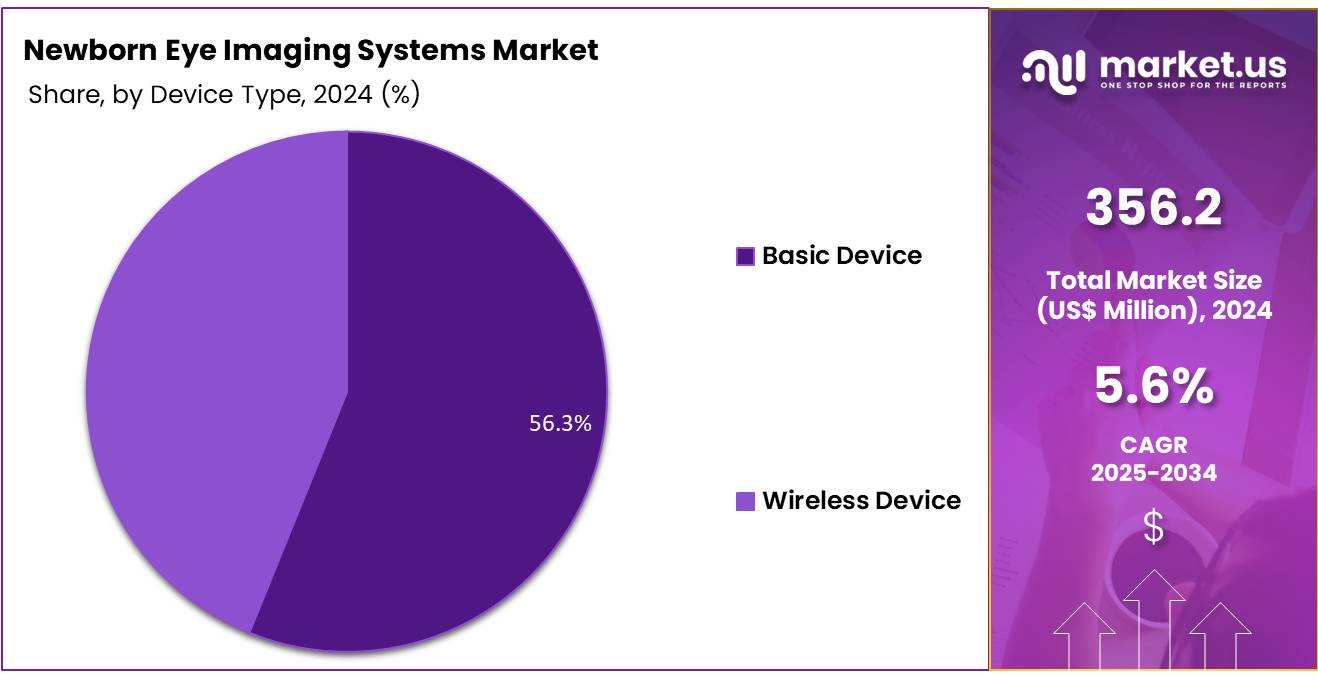

- Device Type Analysis: The Basic Device segment dominated accounting for 56.3% of total market share.

- End-Use Analysis: Hospitals accounted for the largest share of the Global Newborn Eye Imaging Systems Market, representing 38.5% of total revenue.

- Regional Analysis: North America accounted for 41.7% of the Global Newborn Eye Imaging Systems Market, maintaining its position as the leading regional segment.

Disease Type Analysis

In 2024, the Retinopathy of Prematurity (ROP) segment accounted for the largest share of the Global Newborn Eye Imaging Systems Market, representing 36.5% of total revenue. The dominance of this segment is attributed to the rising prevalence of ROP, particularly among premature infants, and the critical need for early detection to prevent long-term vision impairment or blindness. Advanced imaging systems enable precise visualization of retinal vasculature, supporting timely diagnosis and treatment.

The Retinal Disease segment holds a significant market share, driven by increasing detection of congenital retinal anomalies and inherited retinal disorders in neonates. Strabismus, characterized by misalignment of the eyes, is another important segment, with early diagnosis contributing to effective corrective interventions.

Refractive Errors in newborns, though less frequently diagnosed at birth, are gaining attention due to the expanding use of comprehensive screening programs. Color Blindness represents a smaller share, as it is typically diagnosed later in life; however, early detection technologies are emerging. The Others category includes rare ocular disorders, which, though limited in incidence, benefit from advanced imaging for accurate identification and management.

Device Type Analysis

The Basic Device segment dominated the Global Newborn Eye Imaging Systems Market, accounting for 56.3% of total market share. This dominance is largely driven by the widespread availability, cost-effectiveness, and ease of use of basic imaging systems in hospital and clinic settings. These devices are widely adopted in both developed and developing regions, particularly where budget constraints and limited technological infrastructure favor conventional, reliable solutions. Basic devices remain the preferred choice for routine neonatal eye screenings and early-stage diagnostic assessments.

The Wireless Device segment, while holding a smaller market share, is experiencing rapid growth due to technological advancements and the increasing adoption of telemedicine. Wireless imaging systems enable real-time data transfer, remote consultations, and integration with cloud-based storage platforms, enhancing accessibility and efficiency in neonatal care.

Their portability makes them especially valuable for rural and underserved regions, where access to specialized ophthalmic services is limited. As connectivity improves and healthcare providers seek more efficient, integrated workflows, wireless devices are expected to gain significant traction, narrowing the gap with basic devices in the coming years.

End User Analysis

In 2024, Hospitals accounted for the largest share of the Global Newborn Eye Imaging Systems Market, representing 38.5% of total revenue. This dominance is attributed to hospitals’ comprehensive neonatal care infrastructure, availability of specialized ophthalmologists, and the integration of advanced imaging technologies within neonatal intensive care units (NICUs). Hospitals serve as primary centers for newborn screenings, enabling early detection and management of conditions such as retinopathy of prematurity (ROP) and congenital eye disorders.

Ophthalmology Diagnosis Centers hold a significant share of the market, driven by their specialized focus on eye health, advanced diagnostic capabilities, and ability to offer detailed evaluations for complex neonatal cases. Ambulatory Surgical Centers contribute notably to market growth by providing cost-effective, same-day procedures, including laser treatments or minor surgeries for conditions identified during imaging. The Others category includes community health clinics, research institutions, and non-profit organizations engaged in neonatal eye health programs, particularly in underserved regions.

While hospitals remain the dominant end-user segment, rising demand for accessible and specialized care is expected to drive growth across all categories, fostering broader adoption of newborn eye imaging technologies worldwide.

Key Market Segments

By Disease Type

- Retinopathy of Prematurity (ROP)

- Retinal Disease

- Strabismus

- Refractive Error

- Color Blindness

- Others

By Device Type

- Basic Device

- Wireless Device

By End-User

- Hospitals

- Ophthalmology Diagnosis Centers

- Ambulatory Surgical Centers

- Others

Driving Factors

The primary driver of the Newborn Eye Imaging Systems Market is the rising prevalence of retinopathy of prematurity (ROP) globally, especially in middle-income nations. In India, about 490,000 preterm infants (<32 weeks gestation) are born annually, with approximately 5,000 requiring ROP treatment. The improved survival of premature infants due to expanded neonatal care infrastructure including over 800 Special Newborn Care Units (SNCUs) established since 2008 has increased the population at risk for ROP.

As ROP remains a leading cause of preventable childhood blindness, there is an urgent need for early diagnosis via imaging systems in neonatal care. This unmet medical requirement has been central to driving adoption and public health investments in newborn eye imaging technologies.

Trending Factors

An emerging trend shaping the market is the integration of telemedicine and digital imaging for neonatal eye screening. Tele ROP programs such as the large scale KIDROP initiative in India deploy wide-field imaging and trained non-physician graders to screen infants in remote areas. In the U.S., the e-ROP Cooperative Group, funded by the National Eye Institute, validated telemedicine for ROP screening demonstrating that images captured by non-physician staff can be reliably evaluated remotely by specialists.

These developments reflect a shift toward decentralized screening models, allowing broader geographic coverage, increased screening frequency, and more efficient use of scarce specialist resources. Tele-ophthalmology is increasingly recognized as a cost-effective, scalable approach to ensure early identification and management of neonatal ocular disorders.

Restraining Factors

A significant restraint on market expansion is the scarcity of trained specialists, especially in rural and underserved regions. In India despite a large at-risk neonatal population there are fewer than 150 ophthalmologists managing ROP programs, with fewer than 1,000 trained retinal surgeons overall. This shortage limits screening capacity and slows the deployment of imaging systems.

Moreover, established clinical protocols may rely on indirect ophthalmoscopic examination, which requires specialized training and cannot easily scale in low-resource settings. The lack of awareness among healthcare providers and inconsistencies in screening guidelines further hinder adoption. These barriers collectively reduce utilization of advanced imaging technologies, even where they could dramatically improve neonatal ocular outcomes.

Opportunity

An important opportunity lies in the expansion of tele-neonatal imaging networks and governmental public health initiatives. In India, national programs such as the Rashtriya Bal Swasthya Karyakram (RBSK) and the National Programme for Control of Blindness (NPCB & VI) have integrated ROP screening into broader neonatal care frameworks. Digital imaging systems, combined with telemedicine platforms, offer the potential to amplify these programs’ reach especially in underserved regions.

The recent Tele-SNCU initiative by AIIMS-Nagpur in Maharashtra’s tribal areas demonstrates this potential: digital monitoring, IoT-enabled devices, and remote expert guidance halved neonatal mortality and improved outcomes for very low-birth-weight infants Scaling similar models nationally can elevate early detection, standardize care, and significantly enhance neonatal eye health across diverse populations.

Regional Analysis

In 2024, North America accounted for 41.7% of the Global Newborn Eye Imaging Systems Market, maintaining its position as the leading regional segment. This dominance is driven by the region’s advanced neonatal healthcare infrastructure, high awareness of early eye screening, and widespread adoption of cutting-edge imaging technologies.

The presence of specialized neonatal care units, well-established screening protocols for conditions such as retinopathy of prematurity (ROP), and strong reimbursement frameworks support sustained market growth. Additionally, significant investments in teleophthalmology and AI-powered diagnostic tools enhance screening efficiency and accessibility, even in remote areas. Collaboration between hospitals, research institutions, and government health agencies further strengthens the region’s capacity to provide comprehensive newborn eye care, ensuring early detection and improved long-term visual outcomes.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key stakeholders in the Newborn Eye Imaging Systems Market are characterized by robust contributions in product innovation, diagnostic precision, and sector leadership. Across the industry, firms with strengths in wide-field retinal imaging and integrated artificial intelligence have shaped clinical adoption by enhancing early detection capabilities. Others emphasize modular, user-friendly systems that facilitate seamless integration into neonatal workflows, particularly in resource-limited environments.

Strategic differentiators include strong research collaborations with academic and clinical institutions, enabling validation of imaging accuracy, and the establishment of service-oriented models that support training, support, and cloud-based data solutions. Collectively, these players uphold industry standards, drive continuous usability improvements, and ensure that imaging systems remain responsive to evolving clinical requirements and regulatory expectations.

Market Key Players

- Visunex Medical Systems

- Eye Photo Systems

- MergeHealthcare

- D-EYE

- Imagine Eyes

- Natus Medical

- Servicom Medical

- Siloam Vision

- NeoLight

- Soft Imaging & Medical Solutions

- Genuine Medica Private Limited

Recent Developments

- Regulatory Approvals – The U.S. FDA has cleared advanced platforms such as Natus RetCam Envision and Visunex PanoCam Pro, both offering wide-field neonatal retinal imaging with improved workflow and connectivity features.

- Portable & Tele-Enabled Devices – Newer models like Phoenix ICON GO emphasize portability, direct illumination optics, and integration into teleophthalmology workflows for remote screening.

- AI Integration – Peer-reviewed studies (2024–2025) show deep-learning algorithms accurately detecting retinopathy of prematurity (ROP) stages, supporting clinical decision-making.

- Telemedicine Expansion – Real-time telescreening programs, such as India’s KIDROP, demonstrate high sensitivity for treatment-warranting ROP while reducing specialist workload.

- Policy Momentum – WHO and AAP/AAO guidelines now call for universal newborn eye screening, including fundal (red) reflex testing within the first weeks after birth.

Report Scope

Report Features Description Market Value (2024) US$ 356.2 Million Forecast Revenue (2034) US$ 614.2 Million CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Disease Type (Retinopathy of Prematurity (ROP) , Retinal Disease , Strabismus , Refractive Error , Color Blindness , Others) By Device Type (Basic Device, Wireless Device) By End-User (Hospitals, Ophthalmology Diagnosis Centers, Ambulatory Surgical Centers, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Visunex Medical Systems, Eye Photo Systems, MergeHealthcare, D-EYE, Imagine Eyes, Natus Medical, Servicom Medical, Siloam Vision, NeoLight, Soft Imaging & Medical Solutions, Genuine Medica Private Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Newborn Eye Imaging Systems MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Newborn Eye Imaging Systems MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Visunex Medical Systems

- Eye Photo Systems

- MergeHealthcare

- D-EYE

- Imagine Eyes

- Natus Medical

- Servicom Medical

- Siloam Vision

- NeoLight

- Soft Imaging & Medical Solutions

- Genuine Medica Private Limited