Global Neurovascular Devices Market By Technology (Aneurysm Coiling & embolization Devices, Cerebral Balloon Angioplasty & Stenting Systems, Support Devices, Neurothrombectomy Devices, and Other Technologies), By Disease Pathology (Ischemic Strokes, Cerebral Aneurysm, Carotid Artery Stenosis, Arteriovenous Malformations and Fistuals and Other Diseases), By Size (0.027″, 0.021″, 0.071″, 0.017″, 0.019″, 0.013″, 0.058″, 0.068″ And Other Size), By Application (Stroke, Cerebral Artery, Cerebral Aneurysm, and Other Applications), By End Users (Hospitals & Surgical Centers, Ambulatory Care Centers, Research Laboratories & Academic Institutes, and Other End Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 21060

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

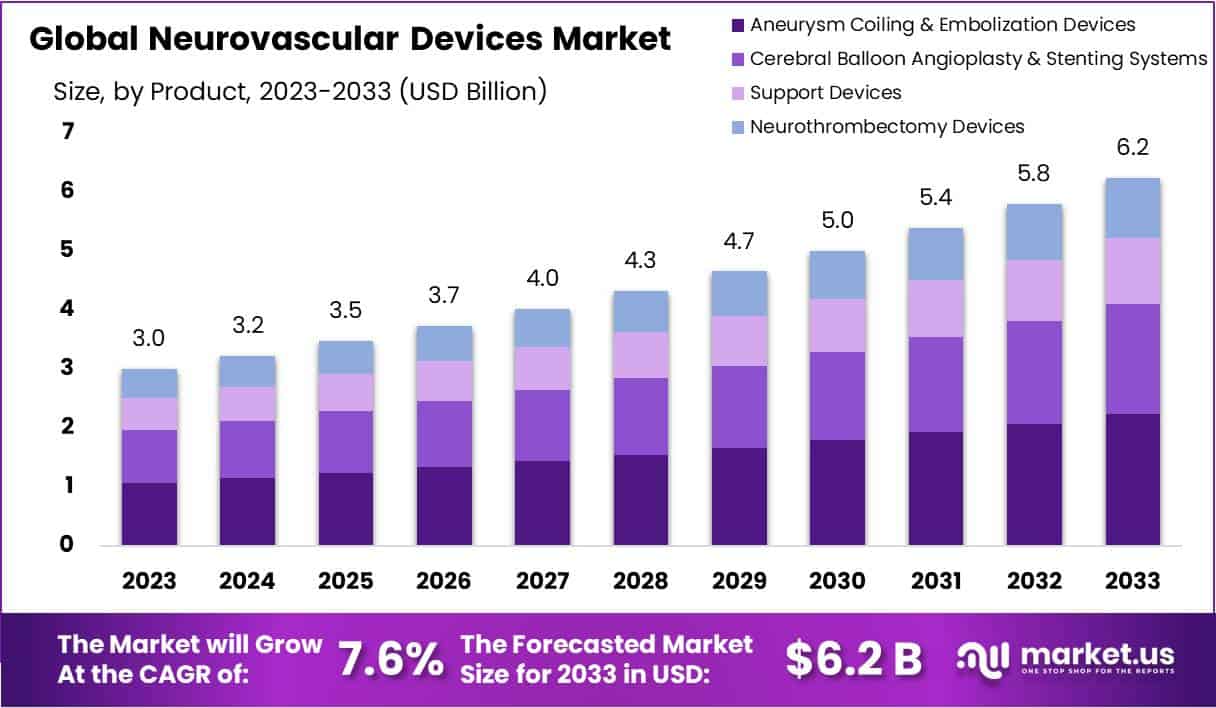

The Global Neurovascular Devices Market size is expected to be worth around USD 6.2 Billion by 2033, from USD 3 Billion in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

The market for neurovascular devices is probably being boosted by the rising incidence of neurological diseases, technical advancements, and rising interest in minimally invasive procedures. Devices used in interventional neurology are used to identify and treat diseases of the brain’s vascular system and the central nervous system.

Interventional neurology includes endovascular, catheter-based, angiography, and fluoroscopy techniques. Increased prevalence of neurological conditions, including brain/cerebral aneurysms, strokes, and epilepsy among many others, is anticipated to fuel the expansion of the neurovascular devices market.

For the release of advanced technology invasive surgical equipment, many significant firms are making R&D investments. One of the minimally invasive procedures that doctors frequently advise is endovascular coiling, which is used to repair cerebral aneurysms. In this operation, a microcatheter is placed via the aneurysm-containing artery in the groin area.

Key Takeaways

- Market Growth: The Neurovascular Devices market is expected to grow significantly, with an estimated CAGR of 7.6% between 2023 and 2032, reaching USD 6.2 billion by 2033.

- Driving Factors: Factors fueling market growth include the rising incidence of neurological diseases, advancements in technology, and increased interest in minimally invasive procedures.

- Technology Dominance: Embolization devices and aneurysm-coiling devices currently dominate the market, with a market share of approximately 35.7%.

- Disease Pathology: Ischemic strokes are the dominant disease pathology segment, highlighting the importance of devices for treating blockages in brain blood vessels.

- Application Focus: Stroke treatment is the dominant application segment, accounting for 58.3% of the market share in 2023 due to the rising prevalence of strokes and hypertension.

- Size Preference: Devices with a size of 0.021″ held the largest market share in 2023, indicating a preference for specific device sizes among healthcare professionals.

- End User Impact: Hospitals and surgical centers are the primary end users, representing around 70.5% of the market share in 2023 due to the increasing number of patients with neurovascular diseases.

- Global Presence: North America and Europe are significant regions for the neurovascular market, with North America leading in 2023 and holds 29.2% market share, due to higher diagnosis rates and healthcare expenditure.

Driving Factors

Increasing research and Development spending in the biotechnology and pharmaceutical industries

Neurosurgeons and doctors are more interested in therapeutic options which can reduce a patient’s risk of dying or the severity of neurovascular disease. The need for efficient neurovascular therapies is continuously expanding across key markets as a result of an increase in the number of patients suffering from neurovascular complications and an increase in the severity of medical cases in target patients. For example, a brain aneurysm is an extensive neurovascular condition. This disorder carries a considerable risk of hemorrhage or long brain impairment.

Restraining Factors

The high cost of neurovascular devices can limit their availability, particularly in low or middle-income countries, leading to a decrease in demand for these devices. Furthermore, companies face challenges due to a stringent regulatory environment, which can be both expensive and time-consuming for obtaining approvals. Varying regulatory requirements across different regions further complicate the process of launching devices in multiple markets.

Additionally, there is a scarcity of skilled healthcare professionals proficient in performing neurovascular procedures. The success of these procedures heavily relies on the expertise and experience of the healthcare provider, but in certain areas, there is a shortage of neurologists and surgeons with the necessary skills. Moreover, the risks associated with neurovascular procedures, such as stroke, bleeding, and infection, make patients hesitant to undergo such procedures. Consequently, this reluctance can significantly impact the demand for neurovascular devices.

Technology Analysis

Embolization devices and aneurysm-coiling devices Segment Dominate the Neurovascular Devices Market

Based on technology, the Neurovascular Devices market is segmented into Aneurysm Coiling & embolization Devices, Cerebral Balloon Angioplasty and stenting Systems, Support Devices, and Neurothrombectomy Devices. Embolization devices and aneurysm-coiling devices dominate the market among these segments.

In 2023, the market share of cerebral embolization and aneurysm-coiling devices was around 35.7%. The coil embolization procedure is a minimally-invasive treatment for aneurysms. It involves using a material that closes the sac to reduce the risk of decreased blood volume. The steerable catheter is guided through the groin to the brain. The segment is expected to grow during the forecast period due to the increasing prevalence of aneurysms. These devices can be further divided into flow liquid embolic and diversion devices.

The Embolic IMPASS Device from Luidx Medical Technologies, Inc. has been declared successful following in-vivo research, including middle meningeal artery (MMA) embolization. On the surface of the brain, these persistent subdural hematomas can be treated with this device.

The Neurothrombectomy Devices segment is projected to grow over the forecast. The segment will grow in the near future due to the rising many growth strategies adopted by key players, like mergers & acquisitions, product launches, and other growth strategies.

Disease Pathology Analysis

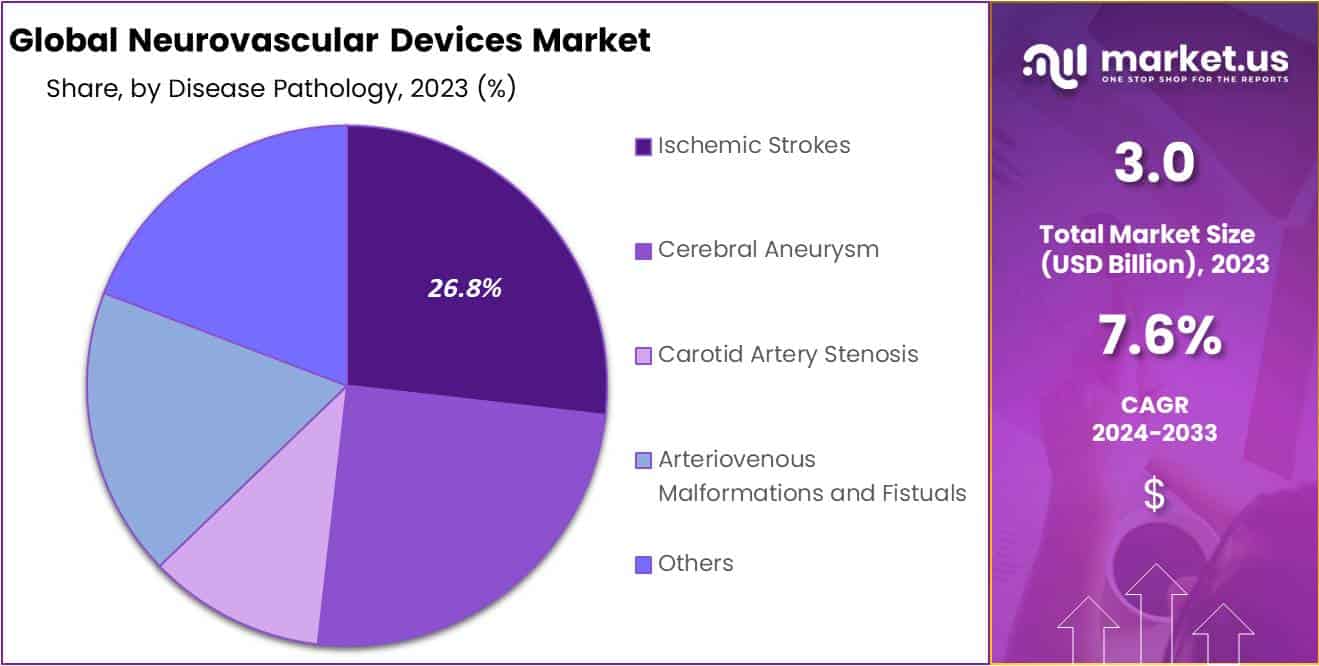

Based on Disease Pathology, the Neurovascular Devices market is segmented into Ischemic Strokes, Cerebral Aneurysms, Carotid Artery Stenosis, Arteriovenous Malformations, and Fistulas. Among these segments, Ischemic Strokes Dominate the market, and capturing more than a 26.8% mrket share. Ischemic stroke occurs when a blood vessel in the brain becomes blocked, preventing blood and oxygen from reaching the affected area of the brain.

Neurovascular devices, such as stent retrievers and thrombectomy devices, are used to remove the blood clot and restore blood flow to the affected area. A cerebral aneurysm is a bulge in a blood vessel in the brain that can potentially rupture and cause a hemorrhagic stroke. Neurovascular devices, such as coil embolization devices, are used to treat cerebral aneurysms by filling the aneurysm with coils, which block blood flow to the aneurysm and prevent it from rupturing.

Application Analysis

The stroke Segment dominates the market with a 58.3% revenue share in 2023.

Based on Application, the Neurovascular Devices market is segmented into Stroke, Cerebral Artery Cerebral Aneurysm. Among these segment Stroke Segment Dominate the market. In 2022, the stroke market will account for the highest share of 58%. This is because of factors like the rising prevalence of hypertension and strokes and other neurological diseases.

Strokes account for approximately 140,000 deaths per year in the U.S. and are the second most common cause of death globally. The advent of technologically advanced products also fuels the segment’s growth. The segment of cerebral aneurysms is expected to increase during the forecast period, primarily due to the rising prevalence of cerebral aneurism.

In the near future, also, an increasing number of clinical studies and the introduction of technologically advanced products will drive category development. In the trial, the Nautilus intravascular device from the company is being evaluated for the treatment of cerebral aneurysms.

Size Analysis

In 2023, size 0.021″ held the largest market share

Based on Size, Neurovascular Devices Market is Segmented into 0.027″, 0.021″, 0.071″, 0.017″, 0.019″, 0.013″, 0.058″, 0.068″; among these size segments, 0.021 sizes dominate the market. In 2023, 0.021″ had the biggest market share, accounting for about 29.1%. The segment’s expansion can be attributed to a number of benefits offered by 0.021″ devices, as well as a number of product releases and product approvals.

A few months prior to the clearance, the Bendit21 microcatheter was successfully utilized in two life-saving procedures in the United States. The third iteration of Evasc Neurovascular’s eCLIPs device, the eCLIPs Bifurcation Flow Diverter, has been released.

In order to treat bifurcation cerebral aneurysms more successfully, the most recent generation of eCLIPs has a shapeable delivery wire, a smaller size that is compatible with 0.027″ and 0.021″ ID microcatheters, and electrolytic detachment. Throughout the projected period, the others section is anticipated to increase at the highest rate. Devices with dimensions of 0.015″, 0.060″, 0.84″, 0.091″, and 0.074″ are included in the others sector.

End User Analysis

In Neurovascular Devices Market Hospital Segment held 70.5% share in 2023

Based on End Users, the Neurovascular devices market is segmented into Hospitals & Surgical Centers, Ambulatory Care Centers, Research Laboratories & Academic Institutes; among these, the Hospital segment held the largest share of the market in 2023, at around 70.5%. This segment’s growth can be attributed to an increasing number of patients suffering from neurovascular diseases, including ischemic and hemorrhagic Stroke, brain aneurysms, Traumatic Brain Injury (TBI), and Arteriovenous malformation (AVM).

Each year, it is expected that 13.7 million people will suffer their first stroke. Of these, 5.4 million may die. If nothing is done, the death toll could rise to 6.7 million per year. The neurovascular devices market is also expected to benefit from the increasing number of hospitalized patients due to therapies, surgeries, and treatments. The subsequent rise in the number of patients around the world, the launch of technologically-advanced products, and favorable policies for reimbursement are all contributing to the increasing demand for hospital treatments.

The Other segment is projected to grow at the fastest rate during the predicted period. Other segment includes Ambulatory Surgical Centers, emergency care centers, long-term care facilities, and other healthcare modern facilities. The segment is expected to grow due to the increase in ASCs, and other modern healthcare facilities.

Key Market Segments

Based on Technology

- Aneurysm Coiling & Embolization Devices

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Cerebral Balloon Angioplasty & Stenting Systems

- Carotid Artery stents

- Embolic Protection devices

- Balloon Catheters

- Support Devices

- Microcatheters

- Guidewires

- Neurothrombectomy Devices

- Clot Retrievals

- Suction & Aspiration Devic

- Snares

- Other Technologies

Based On Disease Pathology

- Ischemic Strokes

- Cerebral Aneurysm

- Carotid Artery Stenosis

- Arteriovenous Malformations and Fistuals

- Other Diseases

Based on Size

- 027″

- 021″

- 071″

- 017″

- 019″

- 013″

- 058″

- 068″

- Other Size

Based On Application

- Stroke

- Cerebral Artery

- Cerebral Aneurysm

- Aneurysmal Subarachnoid hemorrhage

- Others

- Other Applications

Based On End User

- Hospitals & Surgical Centers

- Ambulatory Care Centers

- Research Laboratories & Academic Institutes

- Other End Users

Growth Opportunity

Rise in demand for minimally invasive neurosurgical procedures

The Minimally Invasive Medical Procedures offer many advantages over traditional Surgical procedures. These include shorter hospital stays, quicker patient recovery, greater procedural safety, and efficacy, as well as more affordable prices. The acceptance of endoscopic surgery and other minimally-invasive procedures by medical professionals around the world is increasing.

Geriatric patients are more susceptible than younger people to neurological and neurovascular diseases. They prefer treatments that provide easy diagnosis, simple procedures, greater safety, a shorter hospital stay, improved efficacy, and affordable prices. Aging also rising the risk of adverse thrombotic conditions such as stroke, epilepsy, and pulmonary embolism. These can be treated with neurosurgical intervention.

Arteriovenous malformations can also cause hemorrhages, seizures, and other symptoms in individuals over 40 years of age. The growing geriatric market and the demand for minimally-invasive procedures will offer growth opportunities to both established as well as emerging players in the field.

Latest Trends

Advancements in minimally invasive procedures

The demand for innovative devices is driven by the growing trend of minimally invasive procedures to treat neurovascular disorders. Minimally-invasive procedures are less invasive and require a shorter recovery time. They also cause less trauma for the patient.

Increasing use of flow diversion devices

The use of flow diversion devices such as Pipeline Embolization Devices is becoming more popular for treating complex aneurysms. These devices divert the blood flow away, which promotes the formation of a blood clot inside the aneurysm.

Growth in emerging markets

A growing incidence of aneurysms and strokes is expected to drive significant growth in the Asia-Pacific region. China and India, two emerging markets in the Asia-Pacific region, are expected to drive growth.

Focus on research and development

Companies are investing heavily in research and development to develop innovative devices that will improve patient outcomes. Some companies, for example, are developing devices that use artificial intelligence to diagnose and treat neurological disorders.

Regional Analysis

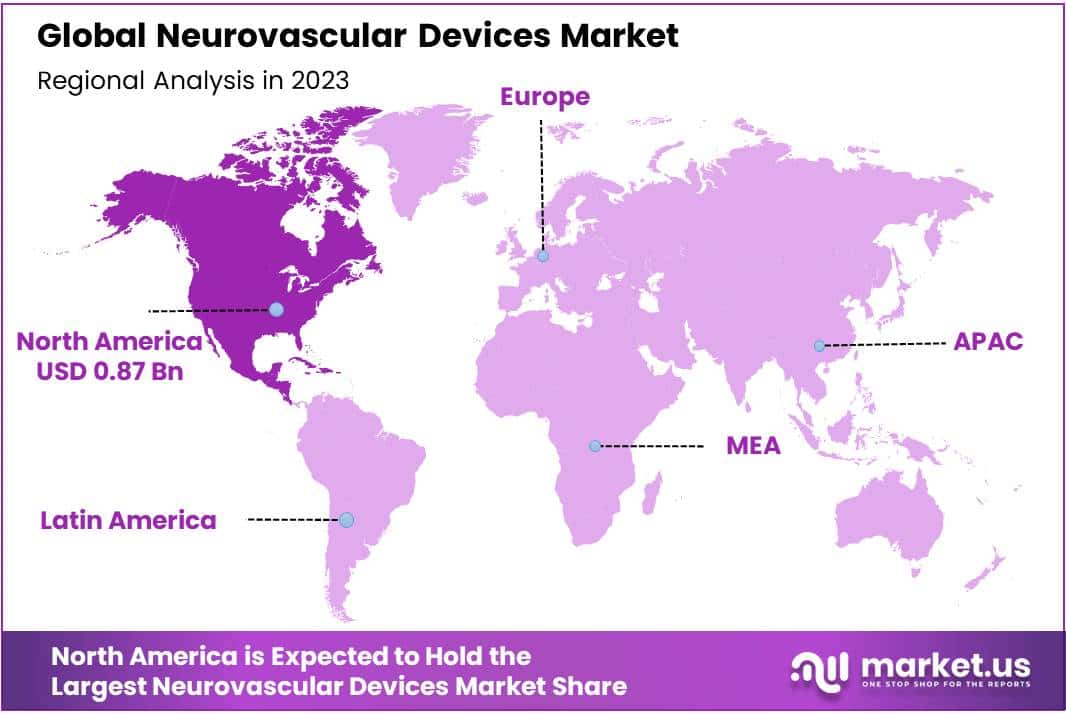

North America will dominate the market for neurovascular devices in 2023 with a share of 29.2% and holds USD 0.87 Billion market value for the year, due to the rising prevalence and higher diagnosis and treatment rates of various neurological conditions in this region, as well as rising healthcare expenditure supporting neurological care services and adequate reimbursement, advanced and novel treatment solutions may gain more acceptance among residents there in the coming years.

Europe will likely account for a sizable market share of the neurovascular market, because of factors like rising awareness about managing neurovascular conditions properly, product launches explicitly designed to treat them, and efforts by crucial market players seeking to broaden their geographic presence.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Competitors focus on the launch and advancement of new medical devices. In April 2023, MicroVention, Inc., Terumo Corporation’s wholly-owned subsidiary, introduced that it had completed its initial enrolment into STRAIT, an EU multi-center prospective observational study. The objective of STRAIT was to assess the safety and performance of the BOBBY ball guide catheter used for the endovascular treatment of acute ischemic stroke.

BOBBY Balloon guide catheter is approved in North America and Europe. The BOBBY Balloon Guide Catheter was developed to enhance compatibility and navigation with the SOFIA 6Fr Aspiration catheter while also simplifying balloon prep. The market is expected to grow during the Predicted period due to these advancements.

Market Key Players

- Medtronic plc

- Johnson and Johnson Services Inc.

- Penumbra, Inc

- Microport Scientific Corporation,

- Stryker

- Microvention Inc.

- Codman Neuro

- Abbott

- Terumo Corporation

- Medilit Co. Ltd.

- Evasc

- Rapid Medical

- Other Market Players

Recent Developments

- In January 2024, Penumbra introduced the Penumbra Indigo System, tailored for carotid revascularization. With enhanced features like a smoother workflow and catheter stability, the system aims to improve outcomes in carotid artery-related stroke interventions.

- In December 2023, Stryker finalized its acquisition of Mobius Medical, a company specializing in embolic protection devices for neurovascular procedures, reinforcing Stryker’s neurovascular offerings and stroke intervention capabilities.

- In November 2023, Medtronic obtained FDA approval for its Solitaire XP Stent Retriever, a next-gen device designed for improved clot engagement and retrieval during ischemic stroke interventions, further advancing neurovascular treatment options.

- In October 2023, Johnson & Johnson’s JJDC Innovation partnered with MicroVention to expedite the development and market entry of MicroVention’s Pipeline Flex Embolization Device, focusing on addressing complex intracranial aneurysms.

Report Scope

Report Features Description Market Value (2023) USD 3.0 Bn Forecast Revenue (2033) USD 6.2 Bn CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Aneurysm Coiling & embolization Devices, Cerebral Balloon Angioplasty & Stenting Systems, Support Devices, Neurothrombectomy Devices, and Other Technologies);

By Disease Pathology (Ischemic Strokes, Cerebral Aneurysm, Carotid Artery Stenosis, Arteriovenous Malformations and Fistuals and Other Diseases);

By Size (0.027″, 0.021″, 0.071″, 0.017″, 0.019″, 0.013″, 0.058″, 0.068″ And Other Size);

By Application (Stroke, Cerebral Artery, Cerebral Aneurysm, and Other Applications);

End Users (Hospitals & Surgical Centers, Ambulatory Care Centers, Research Laboratories & Academic Institutes, and Other End Users)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic plc, Johnson and Johnson Services Inc., Penumbra, Inc, Microport Scientific Corporation, Stryker, Microvention Inc., Codman Neuro, Abbott, Terumo Corporation, Medilit Co. Ltd., Evasc, Rapid Medical, and Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are the driving factors contributing to the growth of the neurovascular devices market?Factors such as the increasing incidence of neurological diseases, advancements in technology, and the growing interest in minimally invasive procedures are driving the growth of the neurovascular devices market.

What is an example of recent advancements in neurovascular devices?MicroVention, Inc., a subsidiary of Terumo Corporation, has completed initial enrollment into a multi-center study called STRAIT, evaluating the safety and performance of the BOBBY balloon guide catheter for the treatment of acute ischemic stroke.

How does the lack of skilled healthcare professionals impact the neurovascular devices market?The skill and experience of healthcare professionals performing neurovascular procedures are critical to their success. The shortage of skilled neurologists and surgeons in some areas can limit the adoption of these procedures.

Are there risks associated with neurovascular procedures?Neurovascular procedures carry risks such as stroke, bleeding, and infection, which may make patients reluctant to undergo these procedures, potentially impacting the demand for neurovascular devices.

Which technology segment dominates the neurovascular devices market?Embolization devices and aneurysm-coiling devices are the dominant technology segments in the neurovascular devices market.

What are the primary disease pathologies addressed by neurovascular devices?Neurovascular devices cater to disease pathologies such as ischemic strokes, cerebral aneurysms, carotid artery stenosis, arteriovenous malformations, and fistulas.

What growth opportunities exist in the neurovascular devices market?The rise in demand for minimally invasive neurosurgical procedures presents growth opportunities in the neurovascular devices market, along with an aging population and increasing preference for easy diagnosis and simpler procedures.

What are the primary applications of neurovascular devices?Neurovascular devices are primarily used in applications such as stroke treatment, cerebral artery interventions, cerebral aneurysm repair, and other specific applications.

Which end-users benefit from neurovascular devices?End-users of neurovascular devices include hospitals and surgical centers, ambulatory care centers, research laboratories and academic institutes, and other healthcare facilities.

What is the size of the Neurovascular Devices market in 2023?The Neurovascular Devices market size is USD 3 billion in 2023.

What is the projected CAGR at which the Neurovascular Devices market is expected to grow at?The Neurovascular Devices market is expected to grow at a CAGR of 7.6% (2024-2033).

Neurovascular Devices MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Neurovascular Devices MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic plc

- Johnson and Johnson Services Inc.

- Penumbra, Inc

- Microport Scientific Corporation,

- Stryker

- Microvention Inc.

- Codman Neuro

- Abbott

- Terumo Corporation

- Medilit Co. Ltd.

- Evasc

- Rapid Medical