Global Neural Processor Market Size, Share, Industry Analysis Report By Operation (Training, Inference), By Application (Smartphones and Tablets, Autonomous Vehicles, Robotics and Drones, Healthcare and Medical Devices, Smart Home Devices and IoT, Cloud and Data Center AI, Industrial Automation, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025–2034

- Published date: Nov. 2025

- Report ID: 159057

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

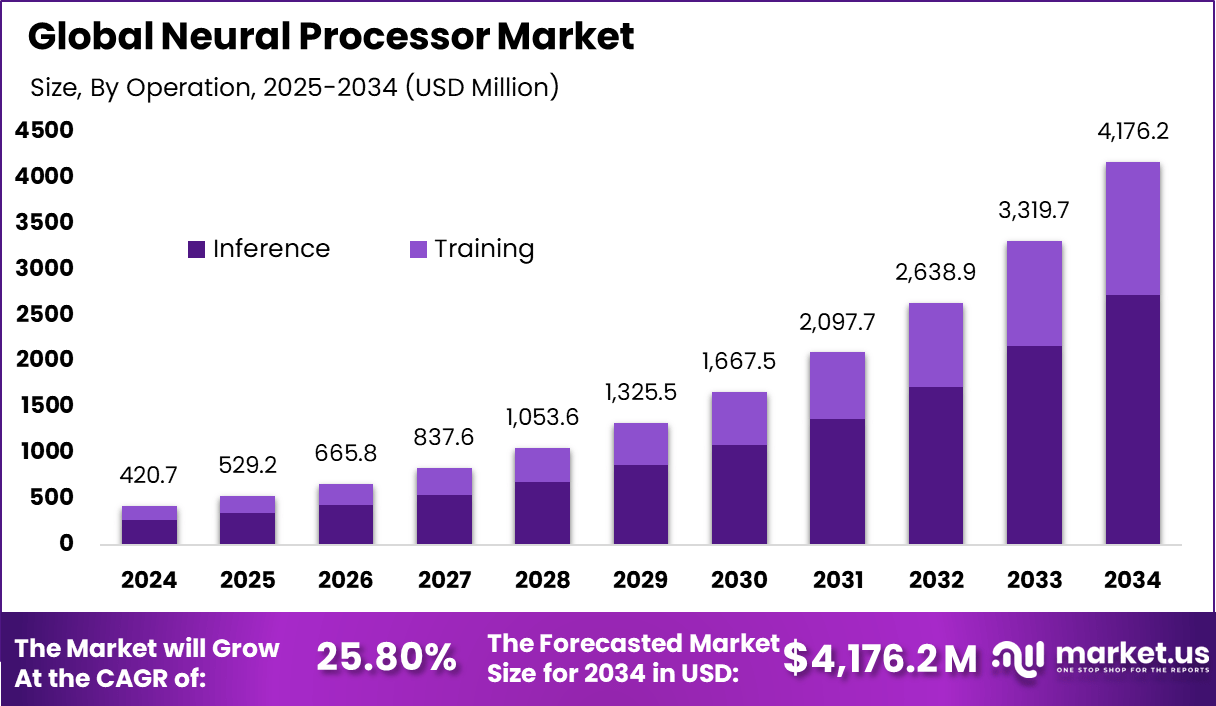

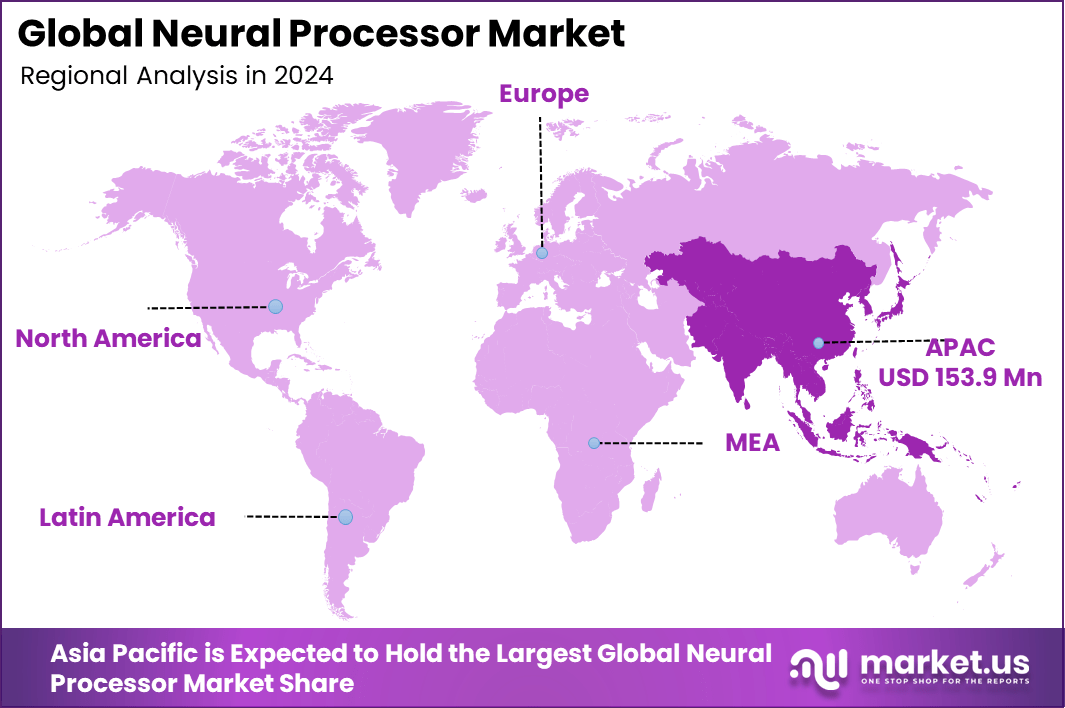

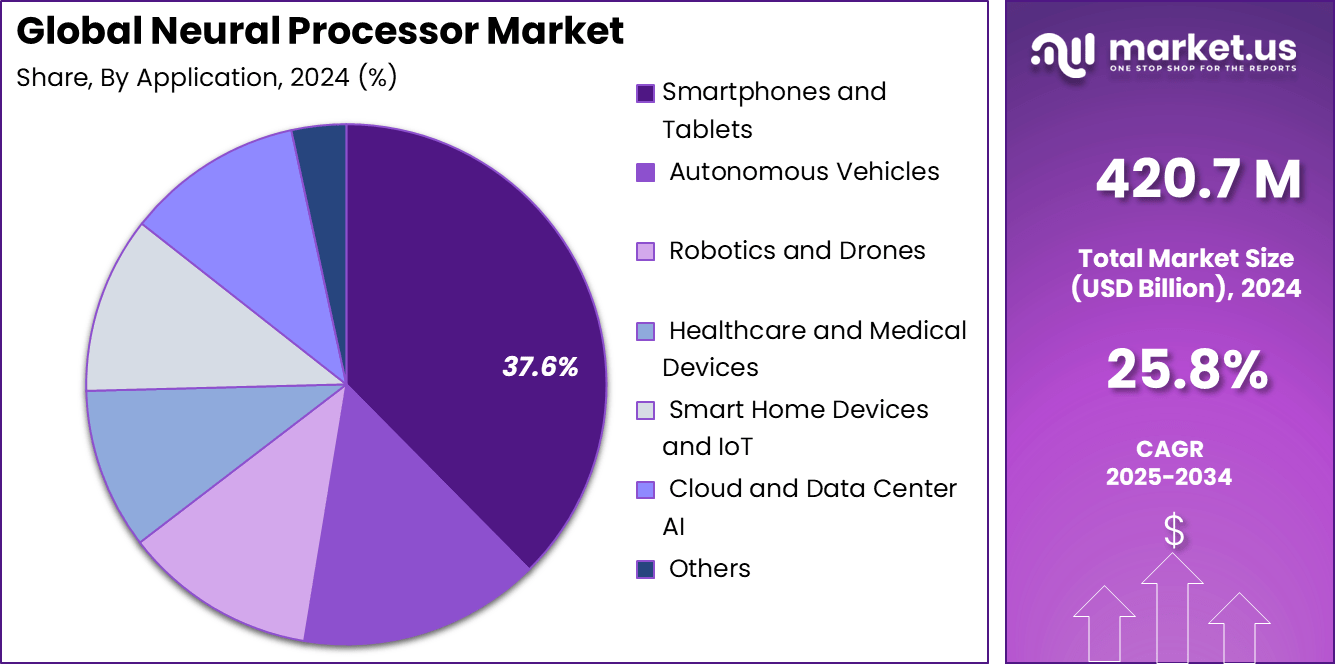

The Global Neural Processor Market generated USD 420.7 Million in 2024 and is predicted to register growth to about USD 4,176.2 Million by 2034, recording a CAGR of 25.80% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 36.6% share, holding USD 153.9 Million revenue.

The neural processor market has expanded as demand grows for specialised chips that accelerate AI workloads across smartphones, edge devices, servers and embedded systems. These processors are designed to handle neural network operations efficiently, allowing devices to perform tasks such as vision processing, speech understanding and predictive analytics. Growth reflects the rising integration of AI into consumer and industrial products.

One major driving force is the explosive, broad adoption of AI and ML across industries requiring rapid and energy-efficient computing capabilities. Neural processors are optimized for parallel, low-power AI calculations, unlike traditional chips, enabling faster processing with reduced energy consumption. For instance, investments exceeding US$16 billion in AI R&D by leading firms highlight the intensity of focus on enhancing neural processors.

Demand is rising across consumer electronics, automotive systems, industrial automation, healthcare devices and connected infrastructure. Mobile devices rely on neural processors for camera enhancement, biometrics and on device intelligence. Automotive applications use them for driver assistance, perception and in cabin monitoring. Industrial and medical equipment require neural processing for diagnostics, anomaly detection and predictive maintenance. This wide application base supports continuous global demand.

Key Takeaways

- The neural processor market was valued at USD 420.7 million in 2024 and is projected to reach USD 4,176.2 million by 2034 at a 25.80% CAGR.

- Inference dominated the operation segment with a 65.3% share, driven by widespread deployment of real-time AI processing in electronics.

- Smartphones and Tablets led the application landscape with 37.6%, reflecting increasing use of AI-enhanced features in mobile devices.

- Asia Pacific accounted for 36.6% of global revenue, supported by strong chip manufacturing and large-scale consumer electronics demand.

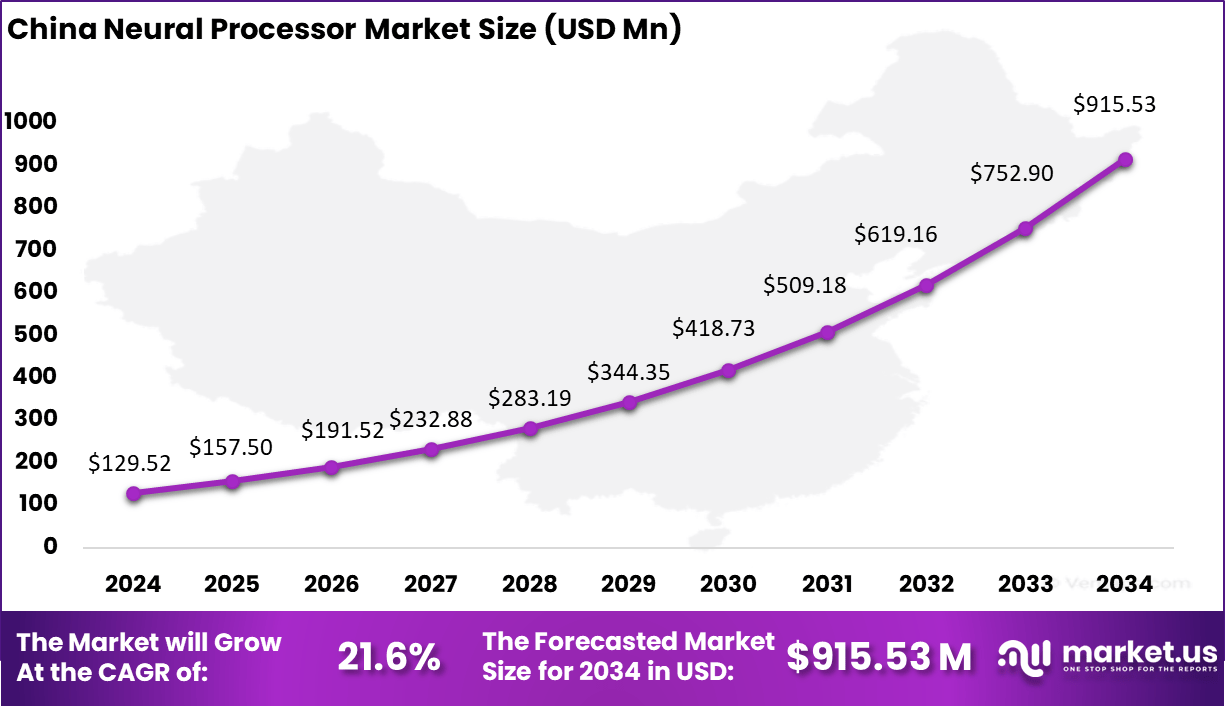

- China, valued at USD 129.52 million in 2024, recorded a 21.6% CAGR, driven by investment in AI-enabled devices and industrial automation technologies.

Performance Metrics

Neural processing unit performance is measured in trillions of operations per second (TOPS), which reflects how quickly AI workloads can be executed.

- Smartphones and PCs: Microsoft recommends over 40 TOPS for optimal Windows AI experiences. The Qualcomm Snapdragon X Elite processor used in Copilot+ PCs reaches 45 TOPS, supporting advanced on-device AI tasks.

- Autonomous vehicles: Processing needs range from tens of TOPS for Level 3 autonomy to more than 1000 TOPS for fully autonomous Level 5 systems. Tesla’s Full Self-Driving computer delivers about 72 TOPS, enabling high-speed perception and decision-making.

- Data centers: Google’s Tensor Processing Units (TPUs) significantly enhance AI model performance across services such as Google Search and Translate. Intel’s Hala Point neuromorphic system contains 1.15 billion neurons, includes 1,152 Loihi 2 processors, and consumes up to 2,600 watts in a data center configuration.

China Market Size

China plays a significant role in shaping the global neural processor market due to its large manufacturing base, rapid digitalization and strong policy support for artificial intelligence. In 2024, the Chinese market reached USD 129.52 million, fueled by widespread integration of neural processors across smartphones, smart appliances, industrial equipment and connected mobility solutions.

The country’s substantial investment in AI infrastructure and semiconductor independence has accelerated growth, enabling domestic companies to develop more advanced chip architectures and AI-optimized devices.

The Chinese market benefits from expanding consumer demand for intelligent electronics and wide-scale deployment of AI-focused technologies in retail, healthcare, transportation and manufacturing. As the country continues to prioritize self-reliance in semiconductor production, local firms are collaborating with research institutions to enhance hardware-embedded AI performance. With a strong , China is expected to remain one of the most influential regions in neural processor innovation and adoption throughout the forecast period.

Asia Pacific held 36.6% of the total market in 2024 and generated USD 153.9762 million in regional revenue, making it the largest contributor to neural processor demand. The region’s dominance is supported by widespread production of consumer electronics, strong semiconductor manufacturing capabilities and rapid digital transformation across major economies. Increased adoption of AI-enabled smartphones, IoT devices and automation systems further strengthens the region’s influence.

Countries including Japan, South Korea, China and India continue to invest heavily in hardware innovation and AI research, creating a strong foundation for neural processor development. Industrial automation, smart mobility and telemedicine technologies are becoming key drivers of demand across Asia Pacific. With governments promoting AI adoption and companies expanding their investment in advanced chip design, the region is expected to sustain its leadership in both production capacity and technological innovation over the coming decade.

By Operation

The Inference segment led the market with a 65.3% share in 2024, reflecting its importance in powering real-time AI workloads across consumer and industrial applications. Inference processors enable devices to analyze and interpret data instantly, supporting tasks such as facial recognition, object detection, voice commands and predictive modeling. Their low power consumption and high efficiency make them ideal for mobile devices, IoT sensors and autonomous systems, where reliability and speed are essential.

The Training segment represents a smaller portion of the market but remains crucial for enterprises developing and refining machine learning models. This category is more prominent in data centers and enterprise computing environments, where large-scale AI training requires specialized processors capable of handling intensive workloads. Growing investment in AI model development and decentralized training systems is expected to support steady growth for this segment in the forecast period.

By Application

Smartphones and Tablets dominated the application landscape with a 37.6% share in 2024, enabled by rising demand for advanced features such as high-resolution photography, intelligent voice assistants and real-time translation. Neural processors enhance performance in these devices by enabling complex AI functions to run directly on-device, improving speed and reducing dependence on cloud services. This shift toward on-device intelligence is expected to continue as smartphone manufacturers integrate more AI-driven capabilities into their flagship and mid-range products.

Other segments such as Autonomous Vehicles, Robotics and Drones, Healthcare Devices, Industrial Automation and Cloud and Data Center AI also exhibit strong growth. These applications depend on neural processors to enhance situational awareness, automate repetitive tasks, improve diagnostic accuracy and support high-performance computing environments. As AI adoption increases across industries, demand for neural processors in these categories is expected to accelerate.

Key Market Segments

- By Operation

- Training

- Inference

- By Application

- Smartphones and Tablets

- Autonomous Vehicles

- Robotics and Drones

- Healthcare and Medical Devices

- Smart Home Devices and IoT

- Cloud and Data Center AI

- Industrial Automation

- Others

Driver Analysis

Growing AI and Edge Computing Demand

The primary driver behind the neural processor market is the rapid rise in artificial intelligence workloads combined with the expanding adoption of edge computing. More devices like autonomous drones, AR/VR wearables, and surveillance systems require fast, local AI processing to reduce latency and avoid cloud dependence.

Neural processors efficiently handle these complex AI tasks on-device, significantly improving performance while maintaining energy efficiency compared to traditional CPUs and GPUs. This makes them essential in sectors such as autonomous vehicles, healthcare, and consumer electronics where real-time decision-making is critical. Rising demand for energy-efficient AI hardware further boosts neural processor adoption as these chips offer superior performance per watt.

Restraint Analysis

High Development and Manufacturing Costs

A significant restraint for the neural processor market is the high cost involved in designing and producing these specialized chips. Developing neural processors demands advanced expertise in AI algorithms, chip architecture, and semiconductor fabrication. The complexity drives up research and development expenses, making the barrier to entry particularly high for smaller companies.

Additionally, fabricating NPUs often requires access to cutting-edge semiconductor foundries with the most advanced process nodes, which are costly to operate and limited in number worldwide. These high costs limit competition to a few major players capable of sustaining heavy investments, thereby slowing innovation and market expansion. Furthermore, geopolitical trade restrictions and export controls on advanced chipmaking technology raise additional cost and supply risks.

Opportunity Analysis

Rapid Growth of AIoT (Artificial Intelligence of Things)

The merging of AI with everyday connected devices, known as AIoT, opens up huge opportunities for neural processors. AIoT devices operate in environments where constant connectivity cannot be guaranteed, and power efficiency is key. Neural processors bring intelligence and autonomy to these devices, enabling smarter industrial machines, healthcare monitors, and city infrastructure sensors.

As industries embrace AIoT to improve automation, monitoring, and user experiences, the value of specialized, energy-efficient neural processors grows. These chips help deliver AI functions where conventional processors struggle, positioning them for broad adoption as AIoT expands.

Challenges

Limited Software and Development Ecosystem

A major hurdle for neural processor adoption is the lack of standardized software tools and frameworks that can support different chip designs. Developers face difficulties integrating neural processors into end applications without robust, easy-to-use platforms. This fragmentation slows the deployment of AI solutions and complicates work for software engineers.

Overcoming this challenge requires the creation of common software standards and development kits that streamline programming across various neural processor families. Addressing the software gap is critical to help industries realize the full benefits of neural processors efficiently and at scale.

Key Players Analysis

Advanced Micro Devices, Arm, Intel, NVIDIA, Qualcomm, and Samsung shape the neural processor market with strong capabilities in edge AI acceleration and efficient neural compute architectures. Their chips support advanced inference workloads across mobile devices, PCs, and embedded systems. These companies focus on improving parallel processing, lowering power use, and increasing real-time responsiveness.

Aspinity, Bitbrain Technologies, BrainChip, BrainCo, and General Vision contribute to market growth with specialized neuromorphic and event-based processing technologies. Their architectures are designed to mimic biological neural behavior, enabling ultra-low-power computing and continuous learning at the edge. These providers support applications in wearables, IoT sensors, robotics, and brain–computer interfaces.

Google, Halo Neuroscience, and other major participants broaden the landscape with advanced AI hardware platforms and neural processing tools that integrate deeply with software ecosystems. Their solutions support speech recognition, image processing, personalized computing, and human-performance enhancement systems. Strong focus on optimized AI workloads and hardware–software co-design strengthens user experience.

Top Key Players in the Market

- Advanced Micro Devices, Inc.

- Arm Limited

- Aspinity, Inc.

- Bitbrain Technologies

- BrainChip, Inc.

- BrainCo, Inc.

- General Vision, Inc.

- Google LLC

- Halo Neuroscience

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- Other Major Players

Recent Developments

- In May 2025, Semidynamics introduced Cervell, a programmable RISC-V-based Neural Processing Unit that combines tensor and vector processing in one architecture. It delivers up to 256 TOPS and supports configurations from C8 to C64, making it suitable for edge AI and large-scale model workloads.

- In March 2025, Allegro DVT launched the NVP300, its first AI-based Neural Video Processing IP, designed for real-time 4K video processing with low power use. The solution strengthens the company’s move toward AI-enhanced video quality for embedded applications.

Report Scope

Report Features Description Market Value (2024) USD 420.7 Mn Forecast Revenue (2034) USD 4,176.2 Mn CAGR(2025-2034) 25.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Operation (Training, Inference), By Application (Smartphones and Tablets, Autonomous Vehicles, Robotics and Drones, Healthcare and Medical Devices, Smart Home Devices and IoT, Cloud and Data Center AI, Industrial Automation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advanced Micro Devices Inc., Arm Limited, Aspinity Inc., Bitbrain Technologies, BrainChip Inc., BrainCo Inc., General Vision Inc., Google LLC, Halo Neuroscience, Intel Corporation, NVIDIA Corporation, Qualcomm Inc., Samsung Electronics Co. Ltd., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advanced Micro Devices, Inc.

- Arm Limited

- Aspinity, Inc.

- Bitbrain Technologies

- BrainChip, Inc.

- BrainCo, Inc.

- General Vision, Inc.

- Google LLC

- Halo Neuroscience

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- Other Major Players