Global Cloud Kitchen Market By Type (Independent Cloud Kitchen, and Kitchen Pods), By Product Type (Burger/Sandwich, Pizza/Pasta, and Other Product Types), By Nature, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct. 2023

- Report ID: 101312

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

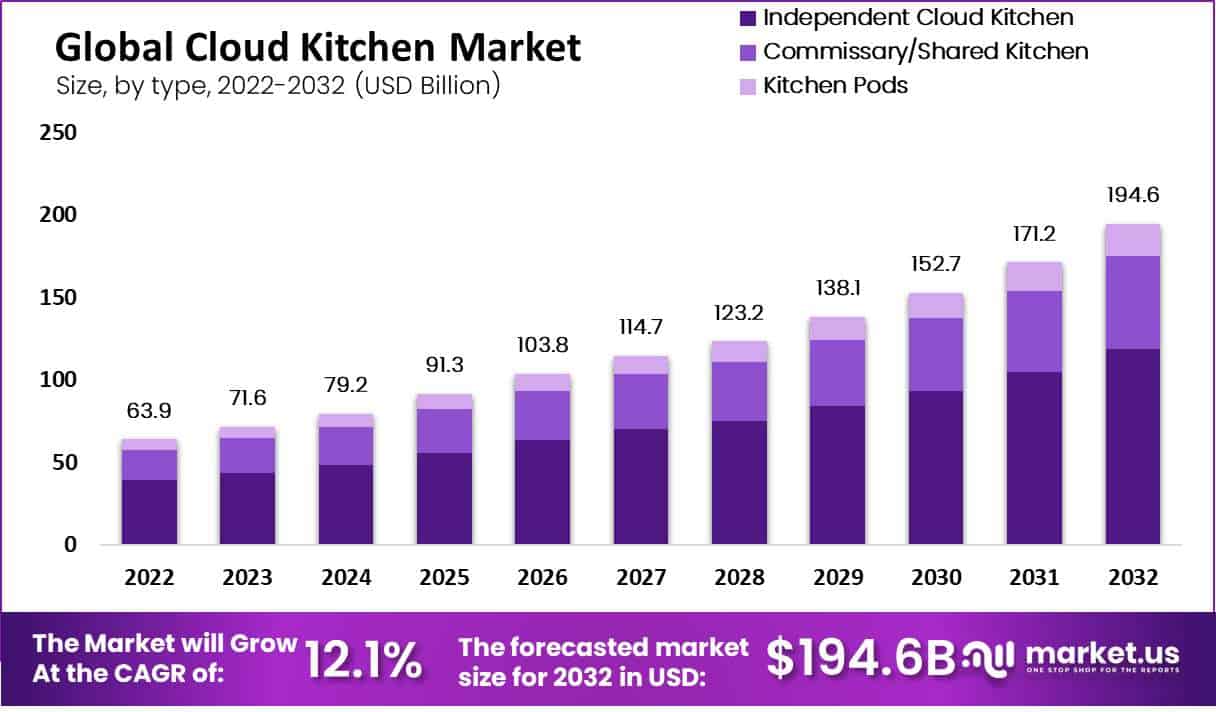

In 2023, the global cloud kitchen market was valued at USD 71.6 billion and is expected to reach USD 194.6 billion in 2032. This market is estimated to register a CAGR of 12.1% between 2023 and 2032.

A cloud kitchen, also known as a “ghost kitchen/ virtual kitchen”, is a type of marketable kitchen space that offers facilities and services to food businesses to make a menu for supply and outtake. Cloud kitchens offer food businesses to create and deliver good products with minimal overhead. Cloud kitchen helps businesses to reach a large audience with minimizing administrative hassle and logistics costs.

Key Takeaways

- Market Size and Growth: The global cloud kitchen market is expected to witness significant growth, with an estimated value of USD 194.6 billion by 2032, growing at a CAGR of 12.1% between 2023 and 2032.

- Driving Factors: The market growth is driven by several factors, including the increasing demand for online food delivery, changing lifestyles, rising disposable incomes, and technological advancements within the cloud kitchen industry.

- The independent cloud kitchen segment holds 61% of the market share.

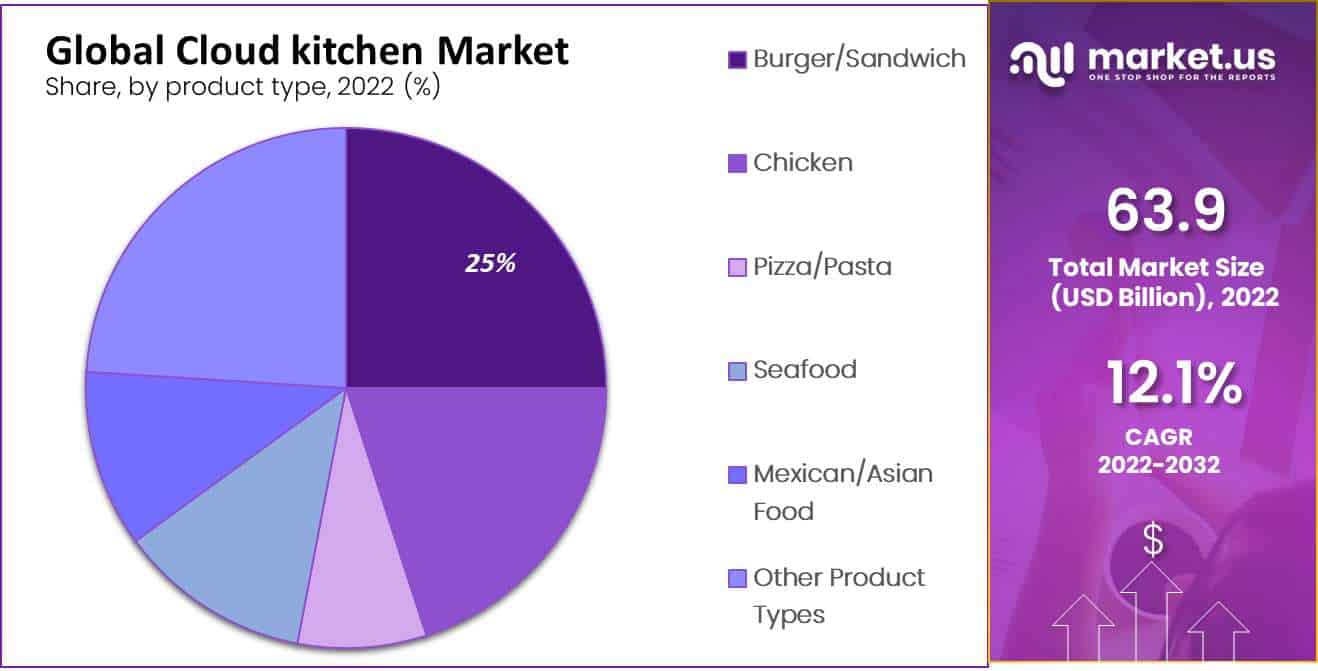

- Burger/sandwiches lead product types, contributing 25% of market revenue.

- Franchised cloud kitchens dominate with a 65% market share.

- Challenges Faced: High initial costs and trust issues are limiting market growth.

- Growth Opportunities: Rising popularity of online food orders and lower startup costs create growth opportunities.

- Key Market Players: Gustasi Chef, Faasos, Behrouz Biryani, DoorDash Inc., Kitchen United, Kitopi Catering Services LLC, Rebel Foods Private Limited, Zuul Kitchens Inc., Ghost Kitchen Orlando, CloudKitchens, Swiggy, Starbucks Coffee Company, Domino’s Pizza Inc., Firehouse Restaurant Group Inc., Yum Brands Inc., Toast Inc., and Inspire Brands Inc. are some of the key players in the cloud kitchen market.

- Trends: Busy lifestyles lead to a preference for online food orders, supported by social media and food delivery apps.

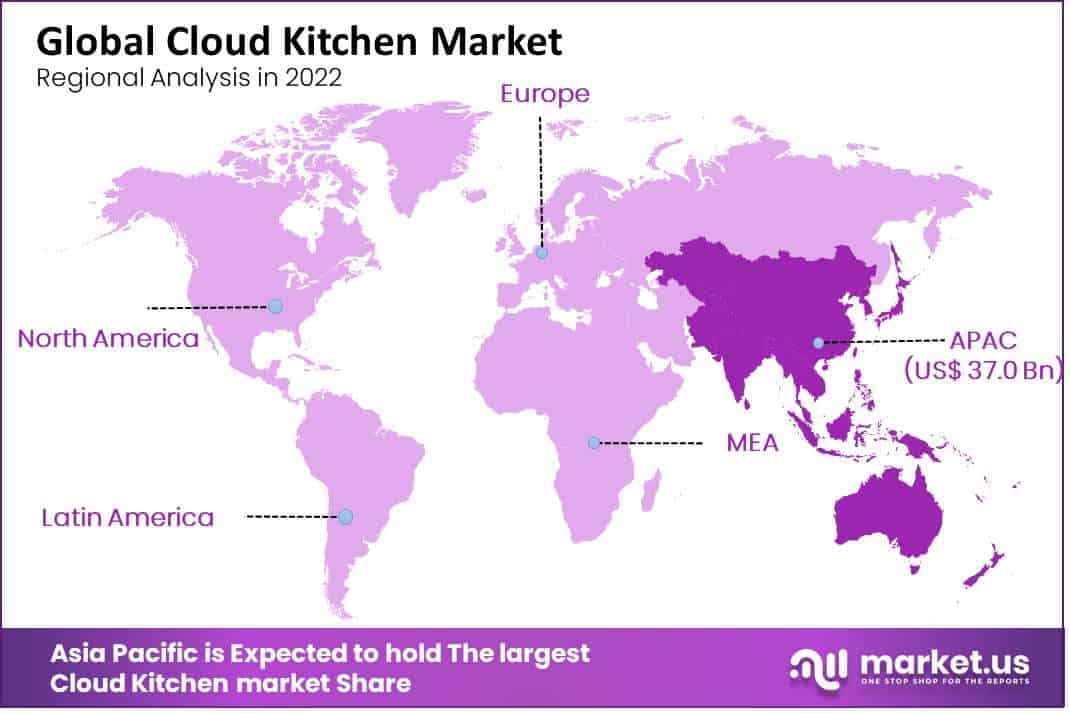

- Regional Insights: Asia Pacific holds the largest market share (58%), while North America is expected to grow the fastest.

Driving Factors

Increasing Online Delivery Food Channels Driving the Growth of the Cloud Kitchen Market

The market growth is attributed to changing lifestyles and rising disposable income among individuals worldwide due to increasing digitalization & globalization. Cloud kitchens do not require decors, dinnerware, signage, and location, which reduces the high costs and helps in the growth of the business. Traditional restaurants require labor, service staff, property taxes, and high utility costs compared to cloud kitchens, which use less labor and gain high profits.

Cloud Kitchen provides varieties of menus with the help of online delivery service channels and app-based ordering systems. This provides more freedom and options for consumers to order the food they need. Compared to physical restaurants, cloud kitchens offer the chance to enter in restaurant business easily and launch a food business for very little investment.

The rising adoption of smartphones with the emergence of online shopping and food ordering apps is driving the growth of the cloud kitchen industry. Globalization bought the world closer to the internet, television shows, and newspapers. Due to this, individuals are more aware of different cultures worldwide. Cafes and restaurants provide fast food, which is usually known for its unique taste. The increasing demand for digital ordering food solutions is driving the growth of the cloud kitchen industry. Also, technological advancements in the cloud kitchen industry driving the cloud kitchen market growth.

Restraining Factors

High Initial Costs and Trust Issues Restraining the Growth of the Cloud Kitchen Market

High initial costs for implementation of cloud kitchen is a primary key factor for impact on market growth. Trust defects, hygiene & working conditions, and lack of pricing power are some major factors restraining the market growth. In addition, increasing awareness regarding the health effects of fast foods among individuals is shifting them towards fresh foods, which is hampering the growth of the cloud kitchen industry.

By Type Analysis

The Independent Cloud Kitchen Segment is Dominant in the Market

Based on type, the market is classified into kitchen pods, commissary/shared kitchens, and independent cloud kitchens. The independent cloud kitchen segment was dominant in the market, with the largest market revenue share of 61% in 2022. The growth of the segment is propelled by the rising number of standalone brands serving customers from a single location. The demand for international cuisines such as Thai food and Chinese food globally increasing due to this market growth is driving.

The commissary/shared kitchen segment is expected to grow at the fastest CAGR during the forecast period due to the increasing popularity of shared kitchen concepts in hotels and restaurants. In addition, restaurants are increasingly renting their kitchen spaces to different food service providers to gain additional benefits. Kitchen pods are designed with lockers for order pickup, a make-line for food preparation, and provide plenty of space for employees.

By Product Type Analysis

The Burger/sandwich Segment is Dominant in Market

By product type, the market is divided into burger/sandwich, pizza/pasta, chicken, seafood, Mexican/Asian food, and other product types. The burger/sandwich segment was dominant in the market, with the largest market revenue share of 25% in 2022. The increasing demand for fast food products by millennials and Gen Z consumers worldwide drive the segment’s growth. Due to changing lifestyles and digitalization, individuals are shifting towards fast foods such as burgers and sandwiches. The number of cafes and restaurants is increasing across the globe.

Note: Actual Numbers Might Vary In The Final Report

Also, varieties of burgers and sandwiches are available in the market, with distinct tastes attracting consumers. The chicken segment is expected to grow at the fastest CAGR during the forecast period owing to the increasing non-vegetarian population. Also, big companies such as KFC Corporation are focusing on advertising their brand. For instance, in 2022, KFC Germany announced inviting its German audience to celebrate Kristallnacht with ‘cheesy chicken.’

By Nature Analysis

Franchised Segment is Dominant in the Market, with Largest Market Revenue Share

Based on nature, the market is segmented into franchised and standalone. The franchised segment was dominant, with the largest market revenue share of 65% in 2022. The segment’s growth is propelled by increasing numbers of franchised restaurants worldwide. Franchised cloud kitchen operates multiple food brands through the tech-enabled network.

Cloud-franchised kitchens are the future of the restaurant industry. Establishing franchised cloud kitchens reduces the training and support cost and helps in business expansion. The standalone segment is expected to grow at the fastest GAGR during the forecast period due low cost of starting the kitchen.

Key Market Segments:

By Type

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

By Product Type

- Burger/Sandwich

- Pizza/Pasta

- Chicken

- Seafood

- Mexican/Asian Food

- Other Product Types

By Nature

- Franchised

- Standalone

Growth Opportunity

Increasing Popularity for Online Food Order and Low Startup Costs is Expected to Create Lucrative Growth Opportunities in Global Market

The clod kitchen has a high-profit margin compared to traditional dine-in restaurants and commercial kitchens. The cloud kitchen allows industries to accommodate consumers’ demands and get feedback from them. The popularity of online food delivery among consumers is increasing due to various meal options at affordable prices.

Increasing use of social media allows kitchens to advertise their meal to attract more consumers. Also, the emergence of food delivery apps and social media rather than more narrow marketing channels is expected to create lucrative market opportunities in the cloud kitchen industry. Opening traditional restaurants requires high equipment, utilities, and furniture costs. Therefore, businesses in cloud kitchens are shifting towards cloud kitchens due to the low cost of startup.

Latest Trends

Due to Busy Lifestyles, Individuals Preferring Online Food Order

The food service providers are focusing on fast food delivery for better consumer experience and feedback. People across the globe prefer affordable and convenient food delivery services due to their busy lifestyles. Also, due to long workdays, employees prefer online food orders instead of bringing lunch to work. The cost of implementation of traditional kitchens and restaurants is increasing. Therefore, startups are shifting towards the cloud kitchen industry due to fewer funds. Major players in the cloud kitchen industry are expanding their business in respective countries to expand their footprints and geographical reach.

Regional Analysis

Asia Pacific Region is Dominant in the Market with Largest Market Share

The Asia Pacific region was dominant in the market, with the largest market size of 58% in 2022. A high number of ghost kitchens in China and Japan propels the regional growth of Asia Pacific. Also, the increasing population and consumer buying power drive market growth. For example, about 28% of consumers ordered their food through virtual restaurants and cloud kitchens in China. Additionally, the increasing adoption of smartphones and the prevalence of online food service channels are driving regional growth. In 2020, China accounted for more than 7,500 ghost kitchens.

North America is expected to grow at the fastest CAGR during the forecast period owing to increasing buying power and a rise in demand for fast foods due to busy lifestyles. Europe, Latin America, and Middle East & Africa region are expected to show steady growth during the forecast period.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Key players in the cloud kitchen industry are operating restaurants using delivery-only services. Cloud kitchen industries provide a wide range of purchase options for better services.

Market Key Players:

Listed below are some of the most prominent players in the cloud kitchen market

- Gustasi Chef

- Faasos

- Behrouz Biryani

- DoorDash Inc.

- Kitchen United

- Kitopi Catering Services LLC

- Rebel Foods Private Limited

- Zuul Kitchens Inc.

- Ghost Kitchen Orlando

- CloudKitchens

- Swiggy

- Zuul Kitchens

- Starbucks Coffee Company

- Domino’s Pizza Inc.

- Firehouse Restaurant Group Inc.

- Yum Brands Inc.

- Toast Inc.

- Inspire Brands Inc.

- Other Key Players

Recent Developments

- In September 2022, Dominos company launched an “Inflation Relief Deal” that offered a 20% discount on online food orders for a limited time.

- In September 2021, Yum Brands Inc. completed its acquisition of Australian kitchen order management and delivery technology company Dragontail Systems.

Report Scope

Report Features Description Market Value (2022) USD 63.9 Bn Forecast Revenue (2032) USD 194.6 Bn CAGR (2023-2032) 12.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Independent Cloud Kitchen, Commissary/Shared Kitchen, and Kitchen Pods; By Product Type- Burger/Sandwich, Pizza/Pasta, Chicken, Seafood, Mexican/Asian Food, and Other Product Types; By Nature- Franchised and Standalone Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Gustasi Chef, Faasos, Behrouz Biryani, DoorDash Inc., Kitchen United, Kitopi Catering Services LLC, Rebel Foods Private Limited, Zuul Kitchens Inc., Ghost Kitchen Orlando, CloudKitchens, Swiggy, Starbucks Coffee Company, Domino’s Pizza Inc.Firehouse Restaurant Group Inc., Yum Brands Inc., Toast Inc., Inspire Brands Inc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Cloud kitchen Market in 2032?In 2032, the Cloud kitchen Market will reach USD 194.6 billion.

What CAGR is projected for the Cloud kitchen Market?The Cloud kitchen Market is expected to grow at 12.1% CAGR (2023-2032).

List the segments encompassed in this report on the Cloud kitchen Market?Market.US has segmented the Cloud kitchen Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Independent Cloud Kitchen, Commissary/Shared Kitchen and Kitchen Pods. By Product Type, the market has been further divided into Burger/Sandwich, Pizza/Pasta, Chicken, Seafood, Mexican/Asian Food and Other Product Types.

Which segment dominate the Cloud kitchen industry?With respect to the Cloud kitchen industry, vendors can expect to leverage greater prospective business opportunities through the Burger/Sandwich segment, as this dominate this industry.

Name the major industry players in the Cloud kitchen Market.Gustasi Chef, Faasos, Behrouz Biryani, DoorDash Inc., Kitchen United, Kitopi Catering Services LLC and Other Key Players are the main vendors in this market.

-

-

- Gustasi Chef

- Faasos

- Behrouz Biryani

- DoorDash Inc.

- Kitchen United

- Kitopi Catering Services LLC

- Rebel Foods Private Limited

- Zuul Kitchens Inc.

- Ghost Kitchen Orlando

- CloudKitchens

- Swiggy

- Zuul Kitchens

- Starbucks Coffee Company

- Domino’s Pizza Inc.

- Firehouse Restaurant Group Inc.

- Yum Brands Inc.

- Toast Inc.

- Inspire Brands Inc.

- Other Key Players