Global Neocloud Market Size, Share, Industry Analysis Report By Deployment Model (Public Neocloud, Private Neocloud, Hybrid Neocloud, Edge Neocloud), By Service Type (Cloud-Native Infrastructure, Platform-as-a-Service (PaaS), Infrastructure as Code (IaC) and DevOps Enablement, Edge and Hybrid Cloud Services, AI/ML and Data Services, Security and Compliance as a Service), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-user Industry (IT and Telecom, BFSI, Healthcare and Life Sciences, Manufacturing, Retail and E-commerce, Government and Public Sector), By Workload Type (AI and Machine Learning, Data Management and Analytics, Web and Mobile Applications, Development and Testing, Backup and Disaster Recovery), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 163175

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Neocloud Adoption Rates

- Key Usage Statistics and Trends

- Role of Generative AI

- US Market Size

- Top 5 Use Cases

- Emerging Trends

- Growth Factors

- By Deployment Model

- By Service Type

- By Organization Size

- By End-User Industry

- By Workload Type

- Key Market Segment

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

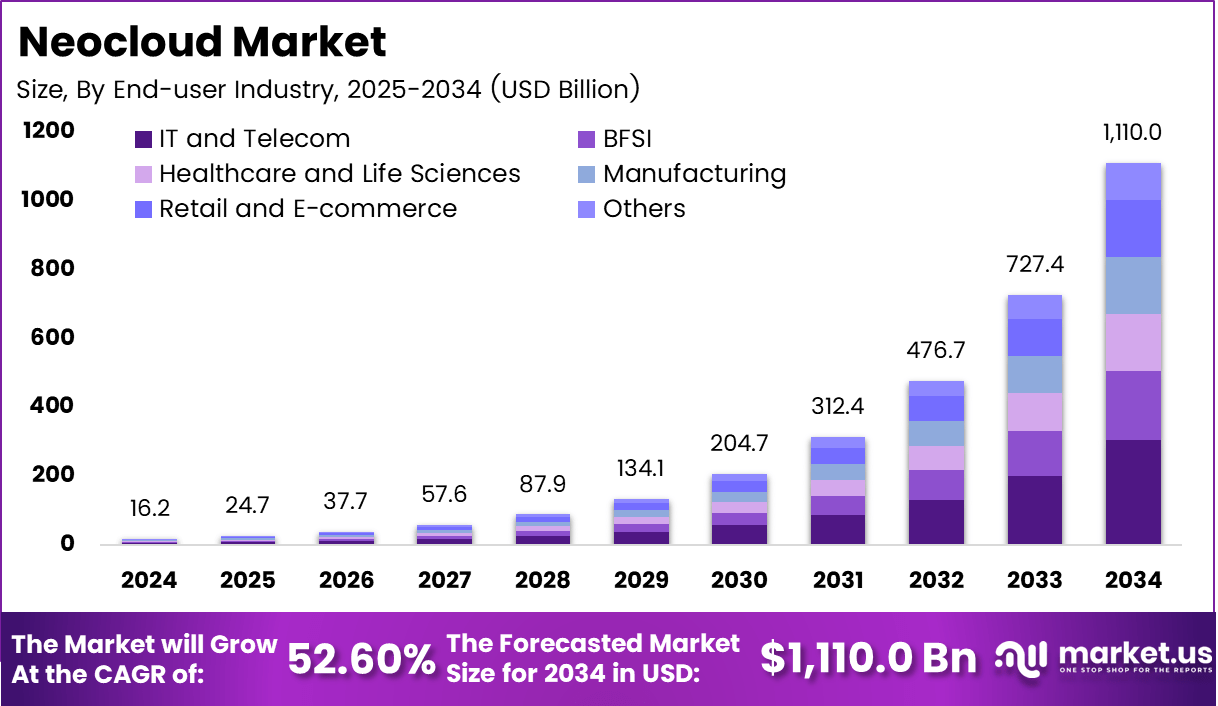

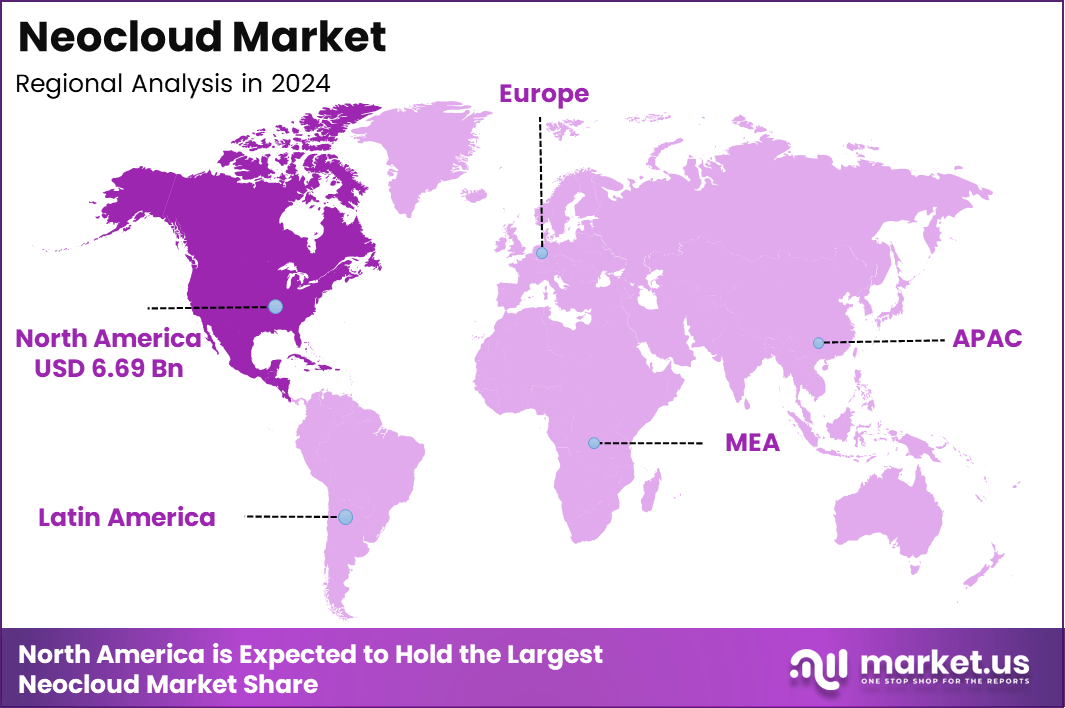

The Global Neocloud Market is entering a hyper-growth phase, projected to surge from USD 16.21 billion in 2024 to USD 1,110 billion by 2034, expanding at a CAGR of 52.6%. North America, valued at USD 6.69 billion in 2024, leads adoption owing to rapid enterprise migration toward cloud-native infrastructures and DevOps automation.

The Neocloud market represents a new wave of cloud computing focused on delivering high-performance, GPU-centric infrastructure designed specifically for AI and ML workloads. Neoclouds differentiate themselves from traditional cloud providers by specializing in GPU-as-a-service (GPUaaS), offering faster deployment, lower latency, and more cost-efficient access to powerful computing resources. This focused approach caters predominantly to AI startups, research labs, media companies, and enterprise teams that require scalable and flexible infrastructure tailored to AI demands.

Key Takeaways

- The Public Neocloud segment dominated with 53.8%, driven by high scalability, cost efficiency, and growing adoption among enterprises transitioning from traditional cloud environments.

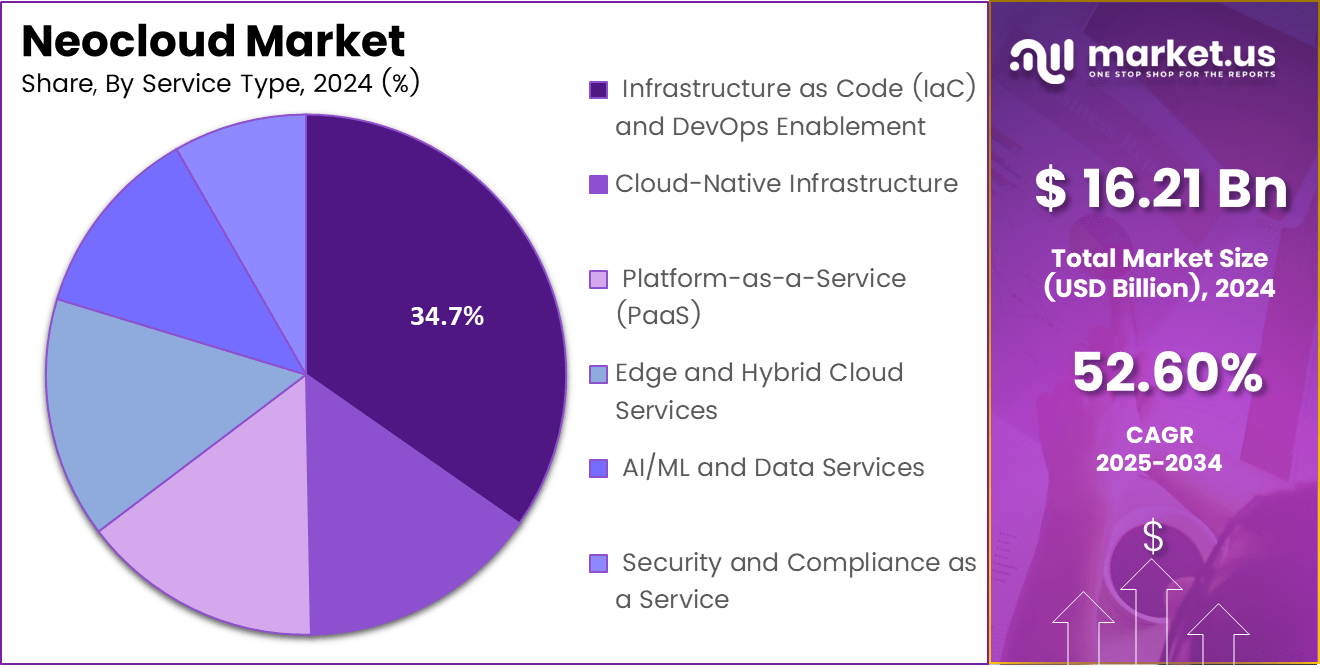

- Infrastructure as Code (IaC) and DevOps Enablement services accounted for 34.7%, reflecting their critical role in automating workflows and improving deployment agility in hybrid and multi-cloud environments.

- Large Enterprises held a strong 73.4% share, supported by increased demand for resilient, AI-driven, and flexible infrastructure to manage complex workloads.

- The IT and Telecom sector led with 27.5%, leveraging neocloud solutions for advanced data orchestration, edge computing, and AI model deployment.

- Data Management and Analytics workloads represented 27.2%, emphasizing the growing importance of real-time insights and intelligent automation.

- North America captured 41.3% of the global market, reflecting early adoption and strong ecosystem support for next-generation cloud frameworks.

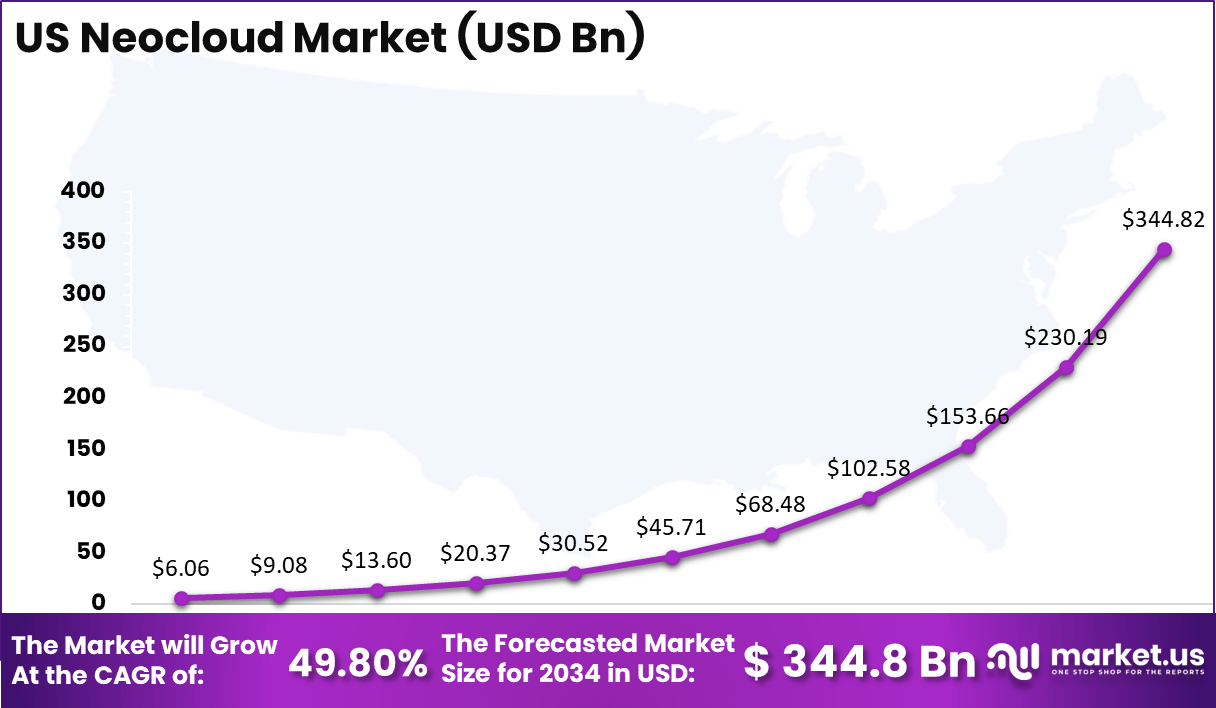

- The US market reached USD 6.06 Billion in 2024, expanding at an exceptional 49.8% CAGR, driven by enterprise modernization, AI integration, and cloud-native transformation initiatives.

Neocloud Adoption Rates

- Overall adoption: A large majority of organizations are now engaging with neocloud platforms. Recent industry surveys indicate that 90% of organizations are either actively using neoclouds, piloting them, or planning adoption within the next six months.

- Current usage:

- 25% of enterprises already use neoclouds extensively for critical workloads.

- 34% are in active pilot phases, particularly for latency-sensitive, edge computing, or AI-driven applications.

- 21% plan to adopt neocloud platforms in the next six months, signaling strong potential for continued growth.

- Enterprise focus: In 2024, large enterprises accounted for more than 70% of the neocloud market share. However, small and medium enterprises (SMEs) are the fastest-growing segment, driven by the need for more flexible, cost-effective computing resources.

Key Usage Statistics and Trends

- Primary workloads (AI/ML): Artificial intelligence and machine learning are the most dominant and fastest-growing use cases. AI/ML workloads running on neocloud platforms are projected to grow at a CAGR of 67.32% between 2025 and 2030. This contrasts with traditional data management and analytics workloads, which held a larger share in 2024 but are now expanding at a slower rate.

- GPU scarcity as a driver: Difficulty in accessing GPUs through traditional cloud providers is accelerating neocloud adoption. About 33% of enterprises report 2–4 week wait times for GPUs, while 20% face delays of three months or more. Neocloud vendors attract these customers by offering instant access to high-performance compute resources.

- Cost and efficiency: Neoclouds offer compelling cost advantages. Enterprises can save up to 66% on GPU instances compared to leading hyperscalers. In addition to lower costs, these platforms offer more transparent and predictable pricing models, appealing to organizations seeking budget clarity.

Role of Generative AI

Generative AI plays a pivotal role in transforming the Neocloud ecosystem by enabling intelligent automation, self-healing infrastructure, and adaptive resource optimization. Integrated within Neocloud platforms, Gen AI analyzes massive operational datasets to predict workloads, optimize capacity, and automate scaling with minimal human intervention.

It enhances DevOps workflows through AI-driven code generation, anomaly detection, and predictive maintenance, ensuring faster deployment cycles and reduced downtime. In data analytics and governance, Gen AI facilitates synthetic data creation, real-time model training, and improved decision accuracy across sectors such as BFSI, healthcare, and telecom.

Moreover, it strengthens cybersecurity through autonomous threat detection and dynamic policy generation. By merging AI models directly into cloud-native architectures, enterprises achieve intelligent orchestration across hybrid and edge environments. This integration not only improves efficiency and sustainability but also redefines Neocloud as a self-learning digital infrastructure, driving continuous innovation and business resilience globally.

US Market Size

The US Neocloud Market is projected to rise from USD 6.06 billion in 2024 to USD 344.8 billion by 2034, growing at a remarkable CAGR of 49.8%. This strong expansion reflects increasing adoption of AI-integrated cloud platforms, DevOps automation, and Infrastructure as Code (IaC) solutions across industries. Enterprises are prioritizing Neocloud to achieve agile scalability, optimized data workflows, and secure hybrid deployments across IT, finance, healthcare, and manufacturing ecosystems.

Neocloud platforms represent a major shift toward intelligent, automated, and software-defined cloud environments that integrate AI, edge computing, and containerized operations. Businesses across the US are investing heavily in cloud-native architectures to accelerate digital transformation, reduce latency, and improve compliance within multi-cloud frameworks.Neocloud delivers a unified infrastructure that connects public, private, and hybrid environments, enabling real-time data access and continuous deployment for modern enterprises.

North America dominates the global Neocloud market, valued at USD 6.69 billion in 2024, owing to the strong presence of cloud hyperscalers, AI-driven infrastructure providers, and large-scale enterprise adoption across the US and Canada. The region benefits from mature IT ecosystems, government-backed digital transformation programs, and advanced cybersecurity frameworks, positioning it as the most lucrative market for Neocloud services.

The global Neocloud market demonstrates strong regional diversity, with each area contributing uniquely to its expansion. North America leads due to its advanced IT ecosystem, cloud innovation, and enterprise-scale adoption of AI-integrated infrastructure. Europe follows with significant growth driven by data governance and hybrid cloud adoption, while APAC emerges as the fastest-growing region supported by government digitalization initiatives. Latin America and MEA are steadily evolving with rising investments in public cloud infrastructure and smart transformation projects.

Top 5 Use Cases

- AI-Driven Infrastructure Automation: Neocloud enables intelligent orchestration, self-healing networks, and automated provisioning using AI and machine learning, improving uptime and reducing manual intervention.

- Hybrid and Multi-Cloud Management: Enterprises use Neocloud to unify operations across private, public, and edge environments, ensuring seamless data mobility and cost optimization.

- DevOps and Continuous Integration/Deployment (CI/CD): Automated pipelines in Neocloud accelerate software delivery, enhance scalability, and support agile product innovation.

- Data Management and Analytics: Advanced data orchestration tools process vast datasets in real time, empowering businesses to derive actionable insights and predictive analytics.

- Security and Compliance Automation: Integrated policy-based frameworks detect anomalies, automate compliance checks, and strengthen data protection in regulated sectors like BFSI and healthcare.

Emerging Trends

- Rise of Edge Neocloud Deployments, enhancing low-latency performance for IoT and 5G-enabled applications.

- Integration of Generative AI for automated coding, predictive maintenance, and dynamic workload optimization.

- Sustainability-Focused Cloud Models adopting green data centers and energy-efficient workloads.

- Increased Adoption of Industry-Specific Neocloud Solutions in sectors like healthcare, automotive, and finance.

- Expansion of AI-Powered Security-as-a-Service frameworks to address evolving cyber threats and ensure continuous compliance.

Growth Factors

The growth of the Neocloud market, expanding at an exceptional CAGR of 52.6%, is driven by rapid enterprise adoption of AI-embedded cloud architectures, automation frameworks, and scalable hybrid infrastructures.

Organizations are projected to increase their Neocloud spending by 46.3% over the next five years as they modernize IT environments to meet real-time analytics and compliance demands. The growing implementation of DevOps enablement and Infrastructure as Code (IaC) is expected to enhance operational efficiency by 38.7%, reducing manual workloads and accelerating deployment timelines.

Large enterprises continue to dominate adoption as they leverage hybrid and edge-based models for intelligent data processing and agile workload distribution. Rising investments in predictive analytics, AI governance, and zero-trust security architectures are further accelerating the integration of adaptive Neocloud platforms.

Additionally, supportive government initiatives promoting digital transformation and sustainability-focused data centers are strengthening market momentum. Collectively, these factors are positioning Neocloud as the cornerstone of intelligent enterprise ecosystems, enabling secure, self-optimizing, and high-performance digital infrastructure worldwide.

By Deployment Model

In 2024, Public neocloud platforms represent the majority of the market with a 53.8% share. These platforms appeal to enterprises looking for on-demand, scalable AI infrastructure without the burden of managing their own data centers. Public neoclouds offer easy access to powerful GPU-based computing resources suitable for training and deploying AI models.

Their flexibility and pay-as-you-go structure help businesses optimize costs and quickly adapt to changing project needs. The dominance of public deployments also reflects a broader shift toward cloud usage in AI and machine learning workflows.

Organizations prioritize rapid deployment and resource scalability, which public neoclouds readily provide. Additionally, public platforms often benefit from a large ecosystem of tools and services, enabling developers and data scientists to build and test models efficiently. This trend underlines the market’s preference for accessible and versatile compute capabilities.

By Service Type

In 2024, Infrastructure as Code (IaC) and DevOps enablement comprise the largest service segment at 34.7%. These services automate the provisioning and management of cloud resources through code, making infrastructure deployment faster and more predictable. IaC facilitates efficient collaboration among development teams while ensuring infrastructure consistency and repeatability, which is crucial in AI and data-centric environments.

The rising adoption of DevOps practices combined with cloud-native development has accelerated demand for programmable infrastructure. IaC enables enterprises to manage complex AI workflows and large-scale GPU clusters effortlessly, reducing manual errors and operational overhead. As AI projects grow in size and complexity, the need for such automation and orchestration tools continues to increase.

By Organization Size

In 2024, Large enterprises dominate with a 73.4% share of the neocloud market. These organizations often have significant AI workloads that require scalable, high-performance computing power that neocloud providers specialize in. Large enterprises benefit from neocloud services by avoiding upfront capital expenditure and focusing on operational efficiency and speed to market.

Their scale also allows them to leverage flexible GPU allocations and advanced monitoring capabilities, optimizing AI project costs and outcomes. The neocloud value proposition is particularly compelling for large organizations with diverse workloads, enabling them to experiment with AI innovations while maintaining control over budgets and infrastructure.

By End-User Industry

In 2024, The IT and telecom sector holds a 27.5% share as the largest end-user industry for neocloud services. These industries require massive compute and fast data processing to support AI-driven network automation, 5G deployment, and cloud-native services. Neocloud platforms help telecom providers launch AI-enhanced services and improve network efficiency with distributed compute nodes and low-latency infrastructure.

In IT, neocloud supports rapid AI model development and software delivery cycles with high GPU availability and flexible compute environments. As digital transformation accelerates in these sectors, the integration of neocloud infrastructure becomes critical to maintaining competitive intelligence and operational agility.

By Workload Type

In 2024, Data management and analytics workloads constitute 27.2% of usage in the neocloud market. These workloads involve processing large datasets, applying AI and machine learning models, and generating actionable insights in real time. Neoclouds optimize performance for these tasks by providing GPU-accelerated compute and high-bandwidth storage, reducing bottlenecks in data handling.

Organizations handling big data rely on neocloud platforms to manage scalable analytics pipelines without investing heavily in physical infrastructure. The ability to quickly spin up and scale data processing environments allows businesses to gain faster insights and iterate AI models more effectively, boosting operational efficiency.

Key Market Segment

By Deployment Model

- Public Neocloud

- Private Neocloud

- Hybrid Neocloud

- Edge Neocloud

By Service Type

- Cloud-Native Infrastructure

- Platform-as-a-Service (PaaS)

- Infrastructure as Code (IaC) and DevOps Enablement

- Edge and Hybrid Cloud Services

- AI/ML and Data Services

- Security and Compliance as a Service

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By End-user Industry

- IT and Telecom

- BFSI

- Healthcare and Life Sciences

- Manufacturing

- Retail and E-commerce

- Government and Public Sector

By Workload Type

- AI and Machine Learning

- Data Management and Analytics

- Web and Mobile Applications

- Development and Testing

- Backup and Disaster Recovery

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for AI Workloads

The surge in AI development has driven the need for specialized computing infrastructure that can handle intensive GPU workloads. Neoclouds meet this demand by offering high-performance GPU resources designed specifically for AI and machine learning tasks. This allows businesses to access needed computing power quickly and at competitive prices, accelerating their AI project timelines.

Because AI workloads require powerful, scalable GPU setups, neoclouds have become essential partners for industries pushing AI innovation. Additionally, neoclouds optimize infrastructure for AI’s unique needs, including faster networking and tailored software stacks. Their focused approach enables better performance and cost savings compared to traditional clouds that are less specialized, driving strong adoption in sectors like healthcare, finance, and automotive, where AI use is rapidly growing.

Restraint Analysis

Intense Competition from Hyperscalers

Neocloud providers face stiff competition from large hyperscale cloud companies that operate massive global infrastructures. These hyperscalers benefit from significant scale advantages, allowing them to offer lower prices and a full suite of cloud services under one roof, which appeals to many large enterprises. This broad service ecosystem challenges neoclouds that specialize narrowly in AI infrastructure by limiting their ability to compete on price and convenience.

Furthermore, enterprises often prefer integrated cloud environments where compute, storage, and networking are seamlessly bundled. Neoclouds must continually differentiate themselves in performance and pricing to survive because hyperscalers can erode their market share by extending AI-focused services within their broader platforms.

Opportunity Analysis

Cost-Effective AI Infrastructure

Neoclouds have a strong opportunity to capture market share by providing more affordable, dedicated AI infrastructure than traditional hyperscale clouds. Users often report cost savings of up to 66% on GPU-driven AI workloads compared to major cloud providers. Simplified pricing models and faster deployment options offer additional financial benefits, making neoclouds appealing to startups, research, and businesses targeting rapid AI growth.

Moreover, neoclouds’ flexibility in infrastructure deployment helps meet localized and specialized needs, such as regulatory compliance and sensitive data handling. This agility combined with attractive pricing positions neoclouds as a compelling choice for evolving AI markets worldwide.

Challenge Analysis

Data Sovereignty and Compliance

Meeting strict data sovereignty and regulatory compliance requirements remains a significant challenge for neocloud providers. Many customers in highly regulated industries demand that their data remains within certain geographic boundaries, which requires neoclouds to build or partner with regionally compliant data centers. This increases complexity and cost for neoclouds compared to global hyperscalers with extensive international infrastructure.

Failing to address these regulations risks losing business from sectors like government, healthcare, and finance that prioritize data security and legal compliance. Successfully navigating this challenge is crucial for neoclouds to build trust and grow their presence within regulated markets.

SWOT Analysis

Strengths

- Strong scalability through AI-driven automation, Infrastructure as Code (IaC), and containerized deployment.

- High adoption across large enterprises, 73.4% due to flexibility in managing hybrid and multi-cloud environments.

- Superior performance for data analytics, AI training, and real-time workloads with GPU-accelerated infrastructure.

- Advanced security and compliance capabilities integrated with zero-trust and data governance models.

- Strong ecosystem partnerships with leading semiconductor, software, and data center providers, ensuring seamless deployment.

Weaknesses

- Heavy capital expenditure requirements for high-density GPU infrastructure and cooling systems.

- Limited accessibility in developing regions due to power, network, and regulatory constraints.

- Dependence on major enterprise clients creates revenue concentration risks.

- Talent shortages in AI-driven cloud operations and DevOps automation.

- Rising energy consumption is leading to sustainability challenges and operational cost escalation.

Opportunities

- Growing demand for edge computing and latency-sensitive applications in automotive, healthcare, and retail sectors.

- Expansion of AI-as-a-Service and GPU-as-a-Service models, enhancing monetization opportunities.

- Rapid growth of data analytics and AI workloads expected to drive 52.6% CAGR through 2034.

- Integration of generative AI for predictive infrastructure management and workflow optimization.

- Increasing investments in digital transformation and green data centers by governments and enterprises.

Threats

- Intensifying competition from hyperscale cloud providers entering the neocloud segment.

- Global semiconductor shortages are affecting GPU supply and cost stability.

- Regulatory pressures around data sovereignty and cross-border data transfer.

- Market volatility due to over-reliance on AI infrastructure demand cycles.

- Cybersecurity risks and potential vulnerabilities in multi-tenant environments are impacting client trust.

Key Players Analysis

Company Key Statistics & Highlights CoreWeave The largest neocloud provider, with quarterly revenue of over $1 billion as of Q2 2025. Backed by over $7 billion in funding, clients include Microsoft, OpenAI, and Google. Lambda Offers both cloud and on-premise GPU solutions. Secured $480 million in Series D funding to deploy 65,000 NVIDIA H100 GPUs across data centers. Crusoe Cloud Focuses on sustainability by using stranded energy sources (like flare gas) to power data centers. Raised $600 million in 2023. Nebius Amsterdam-based, targets the European market with GDPR compliance. Secured $700 million in funding in 2024 and an additional $1 billion in 2025. Top Key Players

- CoreWeave, Inc.

- Nebius International B.V.

- Lambda Labs, Inc.

- Genesis Cloud GmbH

- Vast.ai, Inc.

- RunPod, Inc.

- G-Core Labs S.A.

- Crusoe Cloud (Crusoe Energy Systems LLC)

- The Constant Company, LLC (Vultr)

- Paperspace, Inc.

- LeptonTogether AI

- Amazon Web Services Inc.

- Microsoft Azure (Microsoft Corporation)

- Google Cloud Platform (Google LLC)

- Oracle Cloud (Oracle Corporation)

- Sustainable Metal Cloud (Firmus Metal International Pte. Ltd.)

- Together AI (Together Computer Inc.)

- Hyperstack (NexGen Cloud Limited)

- Scaleway (Scaleway SAS)

- DataCrunch (DataCrunch Oy)

- Whitefiber, Inc.

- Others

Recent Developments

- CoreWeave reported a strong start to 2025 with accelerating demand for its AI-centric cloud platform. The company expanded its contracted data center capacity significantly from 600 megawatts to 2.2 gigawatts, aiming to reach 900 megawatts by year-end, benefiting from soaring AI compute needs. It secured major partnerships including a strategic deal with OpenAI and acquired Weights & Biases, underscoring its leadership in high-performance AI cloud services.

- Lambda Labs hit a $500 million revenue run rate by mid-2025, driven by rapid adoption of its competitively priced GPU cloud rental business. It nearly doubled year-over-year rental revenues in H1 2025, focusing on cost-efficient AI compute for developers and enterprises. The company posted gross margins around 50%, with net losses shrinking as scale improves.

Report Scope

Report Features Description Market Value (2024) USD 16.2 Bn Forecast Revenue (2034) USD 1,110.0 Bn CAGR(2025-2034) 52.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Model (Public Neocloud, Private Neocloud, Hybrid Neocloud, Edge Neocloud), By Service Type (Cloud-Native Infrastructure, Platform-as-a-Service (PaaS), Infrastructure as Code (IaC) and DevOps Enablement, Edge and Hybrid Cloud Services, AI/ML and Data Services, Security and Compliance as a Service), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-user Industry (IT and Telecom, BFSI, Healthcare and Life Sciences, Manufacturing, Retail and E-commerce, Government and Public Sector), By Workload Type (AI and Machine Learning, Data Management and Analytics, Web and Mobile Applications, Development and Testing, Backup and Disaster Recovery) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CoreWeave, Inc., Nebius International B.V., Lambda Labs, Inc., Genesis Cloud GmbH, Vast.ai, Inc., RunPod, Inc., G-Core Labs S.A., Crusoe Cloud (Crusoe Energy Systems LLC), The Constant Company, LLC (Vultr), Paperspace, Inc., LeptonTogether AI, Amazon Web Services Inc., Microsoft Azure (Microsoft Corporation), Google Cloud Platform (Google LLC), Oracle Cloud (Oracle Corporation), Sustainable Metal Cloud (Firmus Metal International Pte. Ltd.), Together AI (Together Computer Inc.), Hyperstack (NexGen Cloud Limited), Scaleway (Scaleway SAS), DataCrunch (DataCrunch Oy), Whitefiber, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CoreWeave, Inc.

- Nebius International B.V.

- Lambda Labs, Inc.

- Genesis Cloud GmbH

- Vast.ai, Inc.

- RunPod, Inc.

- G-Core Labs S.A.

- Crusoe Cloud (Crusoe Energy Systems LLC)

- The Constant Company, LLC (Vultr)

- Paperspace, Inc.

- LeptonTogether AI

- Amazon Web Services Inc.

- Microsoft Azure (Microsoft Corporation)

- Google Cloud Platform (Google LLC)

- Oracle Cloud (Oracle Corporation)

- Sustainable Metal Cloud (Firmus Metal International Pte. Ltd.)

- Together AI (Together Computer Inc,)

- Hyperstack (NexGen Cloud Limited)

- Scaleway (Scaleway SAS)

- DataCrunch (DataCrunch Oy)

- Whitefiber, Inc.

- Others