Global Needles Market By Type (Conventional Needles and Safety Needles), By Product Type (Suture Needles, Blood Collection Needles, Ophthalmic Needles, Dental Needles), By Delivery Mode (Hypodermic Needle, Intravenous Needles, Intramuscular Needles) By Material (Glass Needles, Plastic Needles, Stainless Steel Needles), End-User (Hospitals and Diagnostic Centers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 96056

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

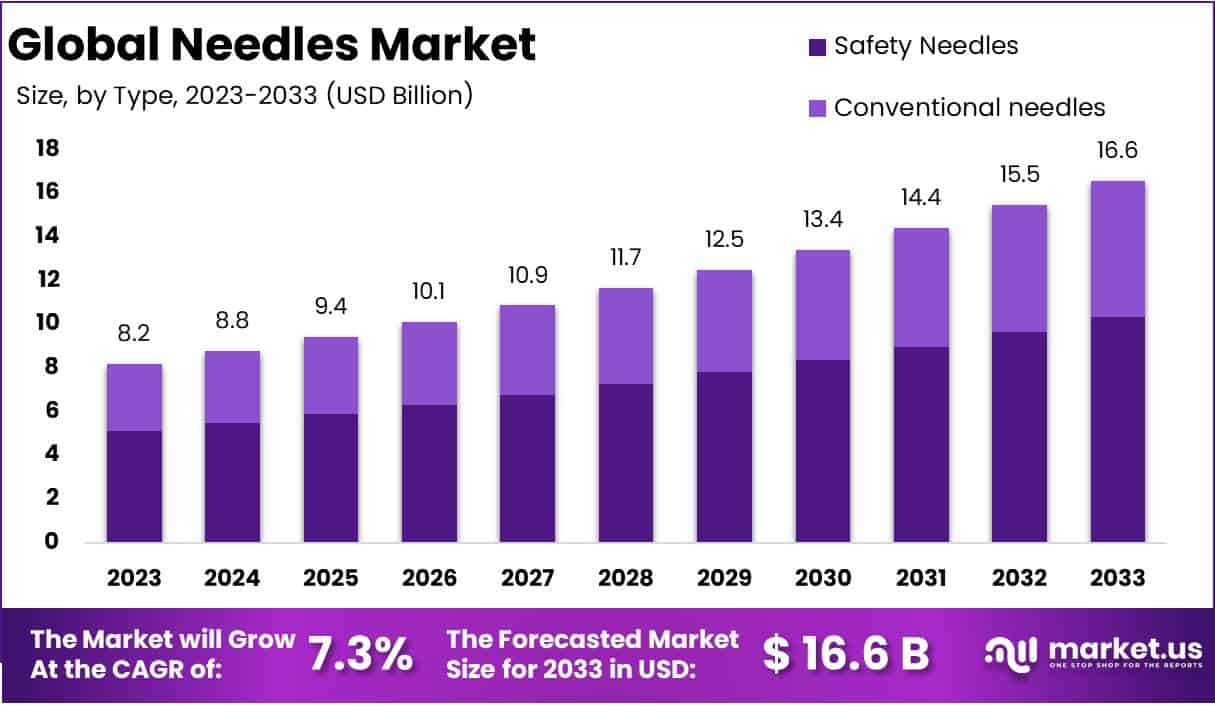

The Global Needles Market size is expected to be worth around USD 16.6 Billion by 2033, from USD 8.2 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

When medications are injected into the body, injectable devices known as needles are used. They are also adjusted in syringes to collect samples and inject various pharmaceutical drugs into the body.

One of the most important factors driving growth is the growing number of older people and the vaccine demand. During the forecast period, this market is also likely to expand due to the rising prevalence of various chronic diseases and the growing number of hospitals and clinics in developing nations.

The development of needle technology focuses on reducing injection-related anxiety and pain. Various psychological and physical factors trigger the brain’s pain receptors during specific treatment regimens linked to pain and anxiety. For instance, dental injections during procedures strongly correlate with stress and pain.

Furthermore, the needles market expansion is anticipated to be fueled by raising public awareness of blood donation. As a result, the demand for needles and syringes rises due to voluntary blood donations, which can fill the blood supply gap.

Key Takeaways

- Market Size & Growth: USD 16.6 billion projected market by 2033, growing at 7.3% CAGR from USD 8.2 billion in 2023, driven by an aging population and vaccine demand.

- Technology Focus: Needle tech advances aim to reduce anxiety, with safety needles projected to grow rapidly, offering operation time advantages and infection resistance.

- Product Dominance: Pen needles hold over 62.3% market share in 2023, primarily due to the rising diabetic patient population worldwide.

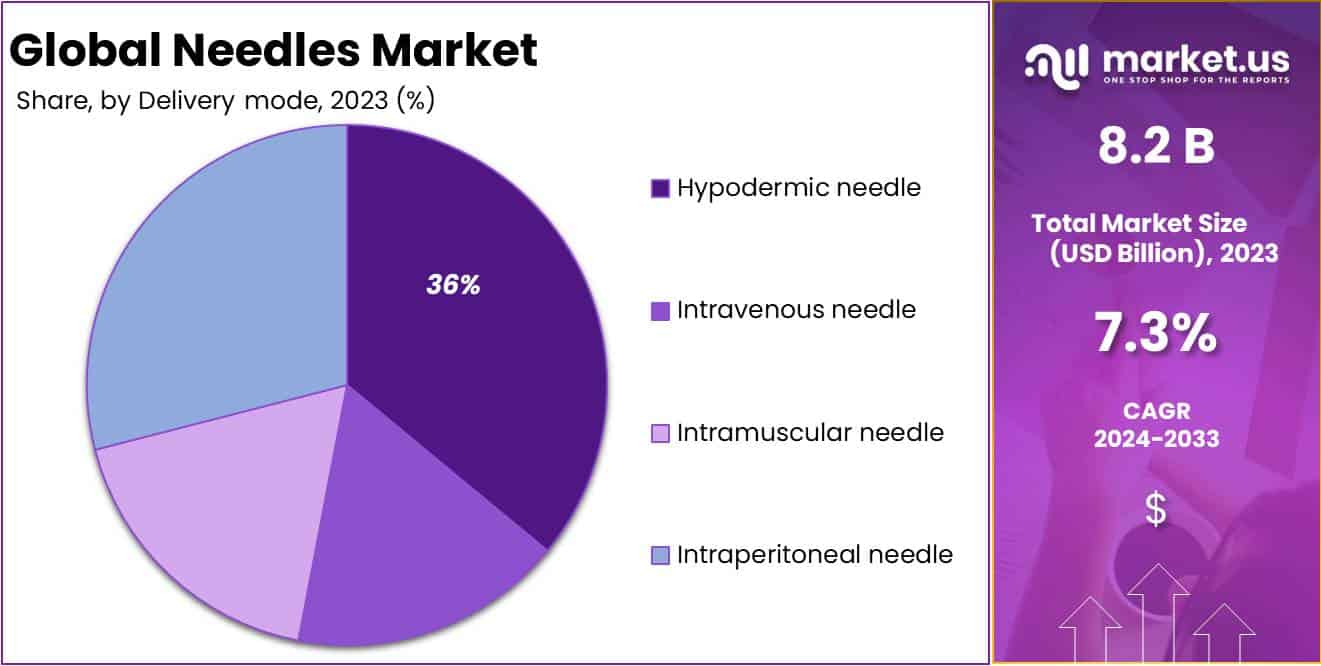

- Delivery Modes: Hypodermic needles dominate with a 36% market share in 2023, while intravenous needles are anticipated to grow rapidly.

- Material Preference: Stainless steel needles lead with a 42.3% market share in 2023, favored for durability and reusability.

- End-User Landscape: Hospitals hold 63.4% market share in 2023, aligning with WHO guidelines for safer needle use.

- Safety Needle Segment: Anticipated to be the fastest-growing segment during the forecast period, offering simplicity and reduced infection risk.

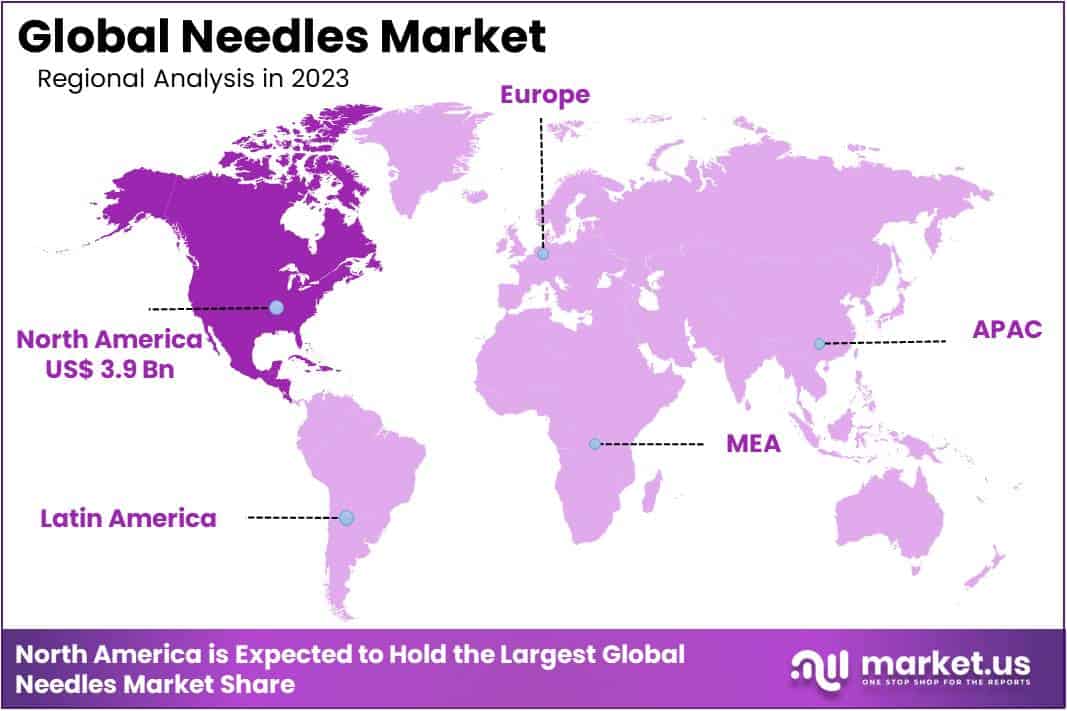

- Regional Dominance: North America dominates, contributing over 43.9% revenue share and holding a USD 3.9 billion market value in 2023.

- Consumer Trend: Growing preference for self-administration of medications enhances demand for self-injectable solutions, easing needle-related anxiety.

Type Analysis

During the forecast period, the safety needle type segment is anticipated to expand fastest. These products reduce the risk of needle stick injuries, which can transmit blood-borne pathogens like HIV, hepatitis B, and hepatitis C. This growth can be attributed to these products.

However, to better understand issues related to product limitations and the hospital environment, healthcare organizations, and stakeholders must concentrate on specific problems contributing to the ongoing risk of injury.

Safety needles are less expensive, less likely to cause an infection, and more convenient and practical. When the plunger is pressed, the NMT safety syringe’s automatic retraction technology is activated, and the medication is injected.

Starting the safety mechanism in a single step is simple in all syringe models with safety needles. Most healthcare workers favored safety needle technology over conventional devices due to advantages such as operation time, accuracy, and prompt use design.

Product Type Analysis

The market is divided into the pen, blood collection, suture needle, ophthalmic, and dental needle segments based on product. Due to factors like the rising incidence of diabetes, pen needles dominated the market position, capturing more than a 62.3% share, in 2023.

Additionally, the segment is anticipated to experience the most rapid growth over the forecast period. A wide range of lengths and widths are available for insulin pen needles. Long, sharp pen needles were typical; thin, tiny, and painless needles are widely available worldwide.

In the coming years, the pen needles category is expected to hold the largest share of the market, primarily due to the growing number of diabetic patients worldwide.

Delivery Mode Analysis

In 2023, Hypodermic needles held a dominant market position, capturing more than a 36% share. The development of needles compatible with high-power injectable technology that can withstand high pressure, as well as the rising incidence of chronic diseases like diabetes, are factors contributing to this growth.

In the coming years, the intravenous market is expected to expand fastest. Hollow intravenous needles are attached to IV syringes to inject and extract samples. In addition to inoculating a sterile substrate, they reduce contamination. Therefore, rising healthcare expenditures per capita are anticipated to drive the segment.

Material Analysis

In 2023, Stainless steel needles held a dominant market position, capturing more than a 42.3% share. Needles are made up of glass, plastic, stainless steel, and polyether ether ketone. Owing to the durability and reusability of the stainless steel needle category is expected to hold the largest share of the market.

End User Analysis

Hospitals are the Largest End-Users of Hypodermic Needles

In 2023, Hopsitals segment held a dominant market position, capturing more than a 63.4% share. Hospitals, diagnostic centers, and other facilities are included in the needle market. The World Health Organization (WHO) has advised all healthcare providers to switch to safer needles, which also aid in stopping the spread of blood-borne illnesses like HIV, hepatitis, and viral hemorrhagic fevers. Needles are most frequently used in hospitals. They are widely used in a variety of hospitals, including multinational hospitals, publicly or privately owned hospitals, specialty hospitals, and others. These hospitals include drug delivery facilities, vaccination centers, and blood specimen collection facilities.

Key Market Segments

Based on Type

- Conventional Needles

- Safety Needles

Based on Product Type

- Suture Needles

- Blood Collection Needles

- Ophthalmic Needles

- Dental Needles

- Insufflation Needles

- Pen Needles

Based on the Delivery Mode

- Hypodermic Needles

- Intravenous Needles

- Intramuscular Needles

- Intraperitoneal Needles

Based on Material

- Glass Needles

- Plastic Needles

- Stainless Steel Needles

- Polyether Ether Ketone Needles

Based on End Users

- Hospitals

- Diagnostic Centers

Drivers

The rising prevalence of cancer is a key driver for the needle market

Cancer incidence rates are rising worldwide, paving the way for the needles market’s expansion. Additionally, the market’s demand and supply have increased due to the rising number of other acute and chronic diseases. Another market determinant is the increasing prevalence of pet diseases.

Research and Development proficiency

An increased amount of money spent on research and development for medical instruments and devices, particularly in developed and developing economies, will further create lucrative market growth opportunities. In addition, the market’s growth rate is also being boosted by expertise in research and development for integrating cutting-edge technologies into healthcare facilities and detecting infectious diseases.

Government investments in healthcare infrastructure

The market growth rate will be driven by the increase in funding provided by the federal government. Also, both public and private players are driving the healthcare industry’s growth, which will open up lucrative market growth opportunities, especially in developing economies. Additionally, the market will benefit from the high investment return that the research activities promise.

The market growth rate is also positively impacted by an increase in the number of drug development activities, an increase in personal disposable income, the introduction of technologically driven products into hospitals, an increase in investment for the development of advanced medical products and devices, and an increase in the number of pharmacies.

Restraints

Strict regulations by pharmacies

On the other hand, it is anticipated that strict regulations governing the sale of needles by pharmacies and high costs associated with research and development expertise will impede market expansion.

In addition, the market is anticipated to be challenged by a lack of skilled working professionals for conducting diagnostics tests in low- and middle-income countries, rising needle stick injuries and infections, limited reimbursement policies for microbiology testing procedures, utilization of needle-free injection technology, and lack of favorable reimbursement scenarios and technology penetration in developing economies.

Risking Incidence of Needlestick injuries and infections

Over the past 30 years, universal guidelines have reduced the risk of needlestick injuries, but these injuries still occur at a much lower rate. Surgeons, laboratory professionals, emergency room personnel, and nurses are among the healthcare professionals who are most susceptible to needlestick injuries.

Trends

Demand for blood equipment products

Many developed countries, like Europe, have strict regulations that require blood donors to undergo HIV and HBV infection testing. As a result, the number of people using needles for blood testing and donation has significantly increased over the past few years. The Red Cross says there is a lot of demand for blood and blood products because more complex surgeries like chemotherapy, heart surgery, and organ transplants need a lot of blood.

Extensive R&D efforts

In addition, the market expansion is anticipated to be aided by extensive R&D efforts by major global corporations to introduce needle technology with maximum precision and safety. For example, a biopsy needle attached to a small imaging probe was developed in January 2017 by a team of researchers from the University of Adelaide to prevent fatal bleeding and allow surgeons to evaluate the specific blood vessels at risk while inserting the needle. In addition, the development of needle technology focuses on reducing injection-related anxiety and pain.

Opportunities

Increase in private-public funding

Profitable opportunities for market players are expected to increase during the forecast period due to an increase in public-private funding for favorable regulatory policies, targeted research activities, favorable regulatory policies, and an expanding geriatric population base for the approval of new injectables.

In addition, the market’s growth rate will also be further accelerated in the future by an increase in the number of strategic collaborations, an increase in the number of hospitals and laboratories, an increase in the rate of internet penetration, an increase in the self-administration of medications, an increase in the use of safety needles, and an increase in the amount of money spent on health care per capita.

Patient’s preference for self-administration of medications

Patient’s preference for self-administration of medications has increased demand for simple, self-injectable injections. These self-injecting devices often treat emergencies like allergies or chronic diseases like diabetes. In addition, the use of self-administered injections helps users feel less anxious about needles.

Females increasingly turn to the self-administration of injectable contraceptives to avoid the cost and inconvenience of clinic visits. Contraceptives that are injected are safer than other types. When used correctly, they keep women from getting pregnant 99% of the time. Additionally, these injections can be given during the menstrual cycle to protect against pelvic inflammatory diseases and womb cancer.

Patients with diabetes, osteoporosis, liver tumors, breast cancer, or any other condition necessitating self-administration are likelier to choose these injections. Companies are focusing on developing novel self-management tools in line with this. The demand for needles will rise as more people use injectables that can be administered by themselves, contributing to the global market expansion.

Regional Analysis

North America is the one that dominates the global needles market.

The rising investment from key players in the growth of advanced devices, a strong base of healthcare facilities, an increasing number of research activities, and established distribution channels for needle product manufacturers in this region all contribute to North America’s dominance of the needles market. North America dominates the market by over 43.9% of the revenue share and holds USD 3.9 Billion market value for the year.

The rise in medical tourism, the rising demand for high-quality healthcare, and the expansion of research activities in the region are all contributing factors that are anticipated to drive significant growth in the Asia-Pacific region.

There is an increasing demand for blood components due to the rising number of surgical procedures and the high prevalence of various diseases, including blood disorders, that necessitate diagnostic blood tests.

The Needles Market is expanding in China primarily due to rising demand for plasma derivatives and increasing awareness of therapeutic apheresis. Additionally, the primary driver of the needles market is the rising number of cases of neoplasms.

Key Regions

North America

-

- The US

- Canada

Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

-

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Mexico

- Costa Rica

- Rest of Latin America

Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Introducing needles with improved drug delivery is the primary focus of medical device manufacturers and research institutes. For example, an eyepatch made of dissolvable needles for treating eye diseases was developed in Singapore by a group of researchers working with several institutions in the country.

The two-layered device has been tried out on mice with good results. The first layer gives the first dose in 30 seconds, and the second provides the amount over several days.

The factors that strengthen the needles market position of Key players are growth strategies and a strong product portfolio. The major players focus on enhancing their research and development process to meet the demand of the patient population. Additionally, growing collaborations and other factors, such as acquiring players to strengthen their portfolio, drives the market’s future growth.

A few major companies that held the dominant position in the needles market in the healthcare sector include Cardinal Health Inc., B. Braun Melsungen AG, Smiths Medical, Becton Dickinson And Company, NIPRO Medical Corporation, Connecticut Hypodermics Inc., Terumo Corporation, Thermo Fisher Scientific, and Medtronic among others.

Below are some of the most prominent global needle market players.

Market Key Players

- Dickinson and Company

- Johnson & Johnson

- Stryker Corp.

- Medtronic PLC

- Ethicon, Inc.

- Novo Nordisk A/S

- Boston Scientific Corporation

- Smith’s Medical, Inc.

- Hilgenberg GmbH

- Other Key Players.

Recent Developments

- In December 2023, Dickinson and Company made a significant move by acquiring Phoenix Medical, a company known for producing disposable medical devices such as needles and syringes. This strategic acquisition not only broadens their product range but also solidifies their position in the single-use needle market.

- In October 2023, Johnson & Johnson, on the other hand, introduced a new product called the “AccuVac” needle safety system. This system is designed with a retractable needle, aiming to minimize the potential for needlestick injuries. Additionally, they forged a collaboration with the World Health Organization (WHO) in November 2023, with the shared goal of enhancing access to safe and effective needles and syringes in low- and middle-income countries.

- In July 2023, Smith’s Medical, Inc. introduced a noteworthy product – the “Deltec Safety Plus” hypodermic needle. This particular needle features a breakaway design, aiming to decrease the risk of needlestick injuries and improve safety for users.

- In March 2023, Stryker Corp. made waves in the industry through the acquisition of Inomed, a manufacturer specializing in minimally invasive surgical tools, including needles and syringes. This strategic move is expected to enhance Stryker’s presence in the surgical needle market.

Report Scope

Report Features Description Market Value (2023) US$ 8.2 Bn Forecast Revenue (2033) US$ 16.6 Bn CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product type- Suture Needles, Blood Collection Needles, Ophthalmic Needles, Dental Needles, Insufflation Needles, and Pen Needles; By Delivery Mode- Hypodermic Needles, Intravenous Needles, Intramuscular Needles, and Intraperitoneal Needles; By Material- Glass Needles, Plastic Needles, Stainless Steel Needles, and Polyether Ether Ketone Needles; and By End User- Hospitals and Diagnostic Centers. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Dickinson and Company, Johnson & Johnson, Stryker Corp., Medtronic PLC, Ethicon, Inc., Novo Nordisk A/S, Boston Scientific Corporation, Smith’s Medical, Inc., Hilgenberg GmbH, and Other Key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Needles market in 2023?The Needles market size is USD 8.2 billion in 2023.

What is the projected CAGR at which the Needles market is expected to grow at?The Needles market is expected to grow at a CAGR of 7.3% (2024-2033).

List the segments encompassed in this report on the Needles market?Market.US has segmented the Needles market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Conventional Needles and Safety Needles. By Product Type the market has been segmented into Suture Needles, Blood Collection Needles, Ophthalmic Needles, Dental Needles. By Delivery Mode the market has been segmented into Hypodermic Needle, Intravenous Needles, Intramuscular Needles. By Material the market has been segmented into Glass Needles, Plastic Needles, Stainless Steel Needles. End-User the market has been segmented into Hospitals and Diagnostic Centers.

List the key industry players of the Needles market?Dickinson and Company, Johnson & Johnson, Stryker Corp., Medtronic PLC, Ethicon, Inc., Novo Nordisk A/S, Boston Scientific Corporation, Smith's Medical, Inc., Hilgenberg GmbH, Other Key Players.

Which region is more appealing for vendors employed in the Needles market?North America is expected to account for the highest revenue share of 43.9% and boasting an impressive market value of USD 3.9 billion. Therefore, the Needles industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Needles?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Needles Market.

-

-

- Dickinson and Company

- Johnson & Johnson

- Stryker Corp.

- Medtronic PLC

- Ethicon, Inc.

- Novo Nordisk A/S

- Boston Scientific Corporation

- Smith's Medical, Inc.

- Hilgenberg GmbH

- Other Key players.