Global Natural Zeolite Market By Product Type (Clinoptilolite, Mordenite, Phillipsite, and Others), By Applications (Construction Material, Wastewater Treatment, Animal Feed, Soil Remediation, Agriculture, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: September 2025

- Report ID: 157529

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

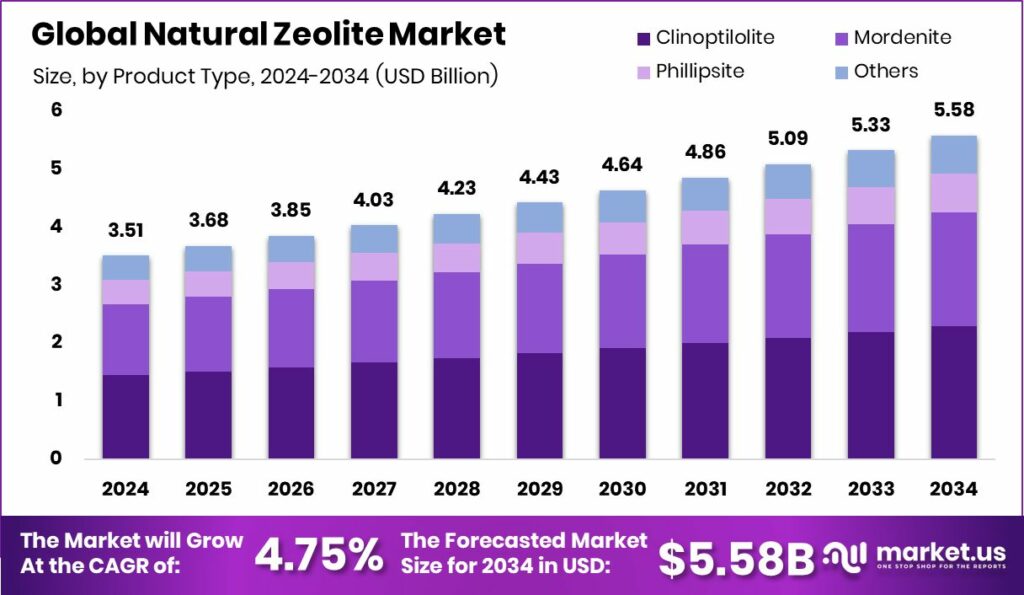

In 2024, the Global Natural Zeolite Market was valued at US$3.51 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 4.75%, reaching about US$5.6 billion by 2034.

Zeolites are solid, crystalline minerals with a regular, internal framework structure. Natural zeolites are formed over long geological periods from the alteration of volcanic rocks and ash in the presence of alkaline groundwater. They are found in various geological settings, including sedimentary rocks and volcanic deposits, and are widely available through open-pit mining.

They are composed of aluminum (Al), silicon (Si), and oxygen (O) atoms, known as silicates, forming a tetrahedral structure. This structure contains microscopic, uniform-sized pores and cavities, making it microporous. Water molecules and alkali or alkaline-earth metals, such as sodium, potassium, or magnesium, are trapped within the open spaces of this framework.

They can adsorb various molecules and materials onto their surface, making them useful for removing substances from liquids or gases. The most used natural zeolite is clinoptilolite, which is mostly used in wastewater treatment plants. One of the major drivers of the market is its demand for the construction industry.

As natural zeolites are experimented with across various industries, it is anticipated that their use as feed additives will create more opportunities in the market. Despite its versatility and advantages, the natural zeolite faces challenges from its low purity and poor crystallinity.

- According to the United States Geological Survey, in 2023, the production of natural zeolite accounted for approximately 1.1 million metric tons, led by Slovakia, which produced around 220 thousand tons of natural zeolite, followed by China with around 200 thousand tons.

Key Takeaways

- The global natural zeolite market was valued at US$3.5 billion in 2024.

- The global natural zeolite market is projected to grow at a CAGR of 4.8% and is estimated to reach US$5.6 billion by 2034.

- Based on product types, clinoptilolite natural zeolite dominated the market in 2024, comprising about 41.2% share of the total global market.

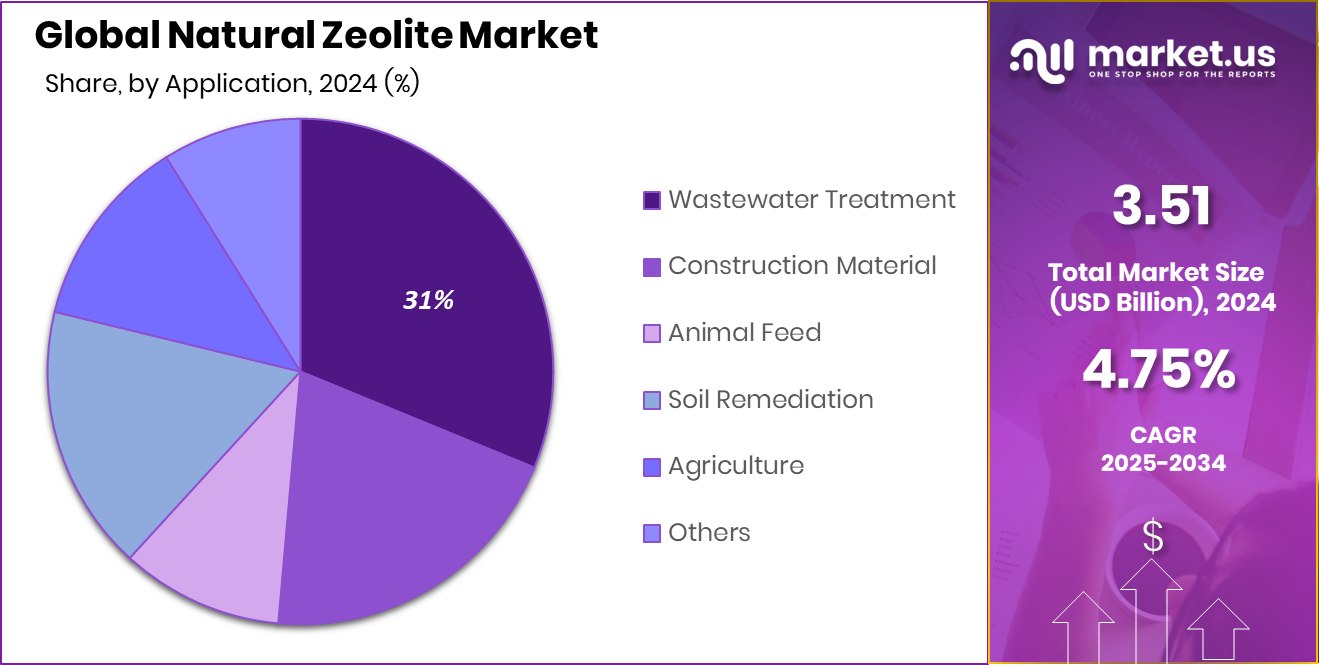

- Among the applications of natural zeolite, the wastewater treatment industry dominated the market in 2024, accounting for around 31.2% of the market share.

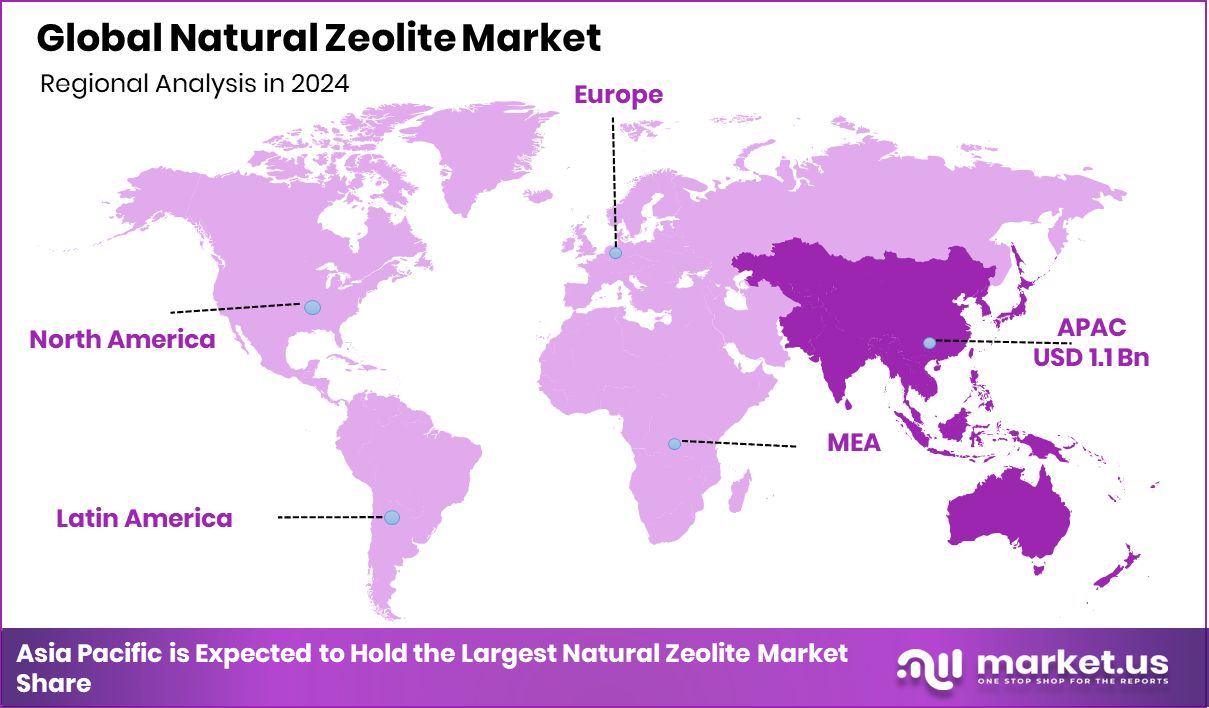

- Asia Pacific was at the forefront of the natural zeolite market in 2024, constituting about 32.5% of the total global market.

Product Type Analysis

Clinoptilolite Natural Zeolite Dominated the Market Due to Its Abundance in Nature.

On the basis of product type, the natural zeolite market is segmented into clinoptilolite, mordenite, phillipsite, and others. Clinoptilolite natural zeolite dominated the market in 2024 with a market share of 41.2%.

It is the most widely used natural zeolite due to its abundance, cost-effectiveness, and chemical properties that are suitable for various applications, including high absorption and cation exchange capacities, making it effective for agriculture and environmental cleanup, such as removing heavy metals.

Clinoptilolite is found worldwide in various geological formations, making it a readily available and affordable natural material for diverse applications. The unique two-dimensional channel system and flexibility of clinoptilolite’s framework allow it to be adapted for various uses by tuning its properties for specific tasks.

Being a natural, abundant mineral, clinoptilolite is often more cost-effective than synthetic zeolites, which require energy-intensive chemical processes for their production.

Application Analysis

The Wastewater Treatment Industry Dominated the Natural Zeolite Market in 2024.

In 2024, the wastewater treatment industry emerged as the largest end-use sector for natural zeolite, accounting for nearly 31.2% of the product’s global consumption, among applications such as construction material, animal feed, soil remediation, and agriculture.

Natural zeolites are used in wastewater treatment due to their low cost, high ion-exchange capacity for cations like heavy metals and ammonium, and porous structure that provides a large surface area and supports bacterial growth for biological processes. These properties make them effective, inexpensive adsorbents and biological filters for removing various contaminants from wastewater, enhancing treatment plant efficiency.

Their microporous, crystalline structure with a large surface area allows them to adsorb a range of contaminants, including dyes, organic compounds, and phenolic compounds. In addition, zeolitic materials can act as weighting agents, helping to favor the settling of sludge in the treatment process.

Key Market Segments

By Product Type

- Clinoptilolite

- Mordenite

- Phillipsite

- Others

By Application

- Wastewater Treatment

- Construction Material

- Animal Feed

- Soil Remediation

- Agriculture

- Others

Drivers

Demand for Natural Zeolite from the Construction Industry Drives the Market.

The construction industry significantly drives demand for natural zeolite due to its versatile properties, such as high porosity, ion-exchange capacity, and environmental safety. Natural zeolite is increasingly used as a lightweight aggregate in concrete and pozzolanic material to improve strength and durability.

Substitution of up to 10% of cement with natural zeolite increases the compressive strength of concrete by 15%, reduces water absorption by 2.3 times, and increases density and ultrasonic pulse velocity. In road construction, zeolite-modified asphalt mixtures have demonstrated improved thermal stability and lower emissions, making them ideal for eco-friendly infrastructure projects.

Zeolite’s ability to absorb and neutralize heavy metals and ammonia also supports its use in sustainable building materials, especially in green-certified construction. Furthermore, its insulating properties contribute to energy-efficient building designs, aligning with global trends in reducing carbon footprints. As construction sectors across regions prioritize durability, cost-efficiency, and sustainability, natural zeolite continues to gain traction as a functional and eco-conscious material.

Restraints

Low Purity and Poor Crystallinity Might Hamper the Growth of the Natural Zeolite Market.

Low purity and poor crystallinity are major concerns in the natural zeolite market, as they directly affect performance in industrial applications. Natural zeolites often contain impurities such as clay, quartz, or feldspar, which can dilute their ion-exchange capacity and adsorption efficiency.

In high-performance applications, such as wastewater treatment, gas separation, or catalysis, zeolites with poor crystallinity may show lower adsorption capacity compared to high-purity alternatives. Additionally, inconsistent crystal structures reduce thermal and chemical stability, limiting their suitability in processes that involve high temperatures or corrosive substances.

For instance, in petrochemical refining, low-crystallinity zeolites fail to provide the consistent catalytic performance needed for cracking reactions. Similarly, variability in purity across deposits makes it difficult for manufacturers to standardize products, increasing processing costs and lowering end-user confidence.

As industries demand more reliable and efficient materials, these quality limitations could hinder broader adoption of natural zeolites in key sectors. Due to these challenges, its utilization becomes less optimal compared with synthetic zeolite.

Opportunity

Natural Zeolite as a Feed Additive Creates Opportunities in the Market.

Natural zeolite is gaining prominence as a feed additive in the livestock industry due to its ion-exchange capacity, high surface area, and adsorption properties. When added to animal feed, natural zeolite can improve nutrient absorption, reduce ammonia levels, and enhance overall gut health.

Zeolites are beneficial feed additives for ruminants due to their high affinity for nutritionally vital species. Additionally, through their ion-exchange selectivity, zeolite minerals may act as sinks for the adsorption of excess rumen ammonia after feeding and gradually release it as the zeolites are regenerated to their natural state by cations from the saliva.

They provide a more stable rumen environment with respect to N availability, which is beneficial to both rumen microbial fermentation and animal performance. Similarly, zeolites have a quantitative effect on digestion by influencing rumen retention time, alteration of rumen turnover of fluid and/or particulate phases of digestion.

Furthermore, it can improve the physical properties of the feed by increasing flowability, reducing moisture levels, or acting as an anti-caking agent.

Trends

Shift Towards Sustainable Practices.

The shift toward sustainable practices is increasingly influencing the natural zeolite market, as industries seek eco-friendly and low-impact materials. Natural zeolite is a non-toxic, reusable, and biodegradable mineral, making it ideal for applications aligned with sustainability goals. In agriculture, its use as a soil conditioner reduces the need for chemical fertilizers by enhancing nutrient retention by up to 30%, thereby minimizing runoff and groundwater pollution.

In wastewater treatment, zeolite replaces synthetic resins and chemicals, efficiently removing heavy metals and ammonia with removal efficiencies exceeding 80%. Additionally, green construction projects are adopting zeolite-based materials for their thermal insulation and lightweight properties, contributing to energy-efficient buildings.

Similarly, the mining and processing of zeolite typically involve fewer emissions and less water usage compared to synthetic alternatives. This growing preference for natural, low-impact materials across sectors reflects a broader trend toward environmental responsibility, positioning natural zeolite as a valuable resource in sustainable development.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Natural Zeolite Market.

Geopolitical tensions significantly impact the natural zeolite market by disrupting supply chains, trade routes, and access to raw materials. Many high-quality natural zeolite reserves are located in politically sensitive regions, such as parts of Eastern Europe, Asia, and the Middle East.

Conflicts or trade restrictions in these areas can lead to supply shortages and increased transportation costs. For instance, during periods of regional conflict, export restrictions or sanctions can reduce zeolite exports, affecting industries reliant on a consistent supply.

Additionally, rising energy costs due to geopolitical instability can inflate mining and processing expenses, especially since zeolite purification often involves high-temperature treatment. Import-dependent countries face delays and higher prices, pushing industries to seek alternative sources or synthetic substitutes.

Moreover, uncertainty in cross-border policies can discourage investment in new zeolite mining projects, further limiting global availability. As geopolitical risks persist, the market remains vulnerable to fluctuations in both supply and logistics.

Regional Analysis

Asia Pacific was the Vanguard in the Global Natural Zeolite Market in 2024.

Asia Pacific held the major share of the global natural zeolite market, valued at around US$1.15 billion. The region emerged as the frontrunner in the global natural zeolite market, commanding an estimated 32.5% of total revenue share.

The dominance of the region is attributed to the heavy production and the growing industrialization in the region. According to the United States Geological Survey, in 2023, apart from Slovakia, the top five producers of natural zeolite, namely, China, South Korea, Indonesia, and New Zealand, belong to the Asia Pacific.

Most of the natural zeolite is utilized in wastewater treatment plants, construction, and as feed additives. As the urbanization and population in the region grow, there is a high demand for natural zeolites from the construction industry.

Similarly, Asia Pacific is known for its large number of domesticated animals, which serves as the major driver for the feed additives, creating high demand for natural zeolites. Furthermore, rapid industrial expansion and stricter environmental regulations in the region create opportunities in the wastewater treatment industry in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the natural zeolite market, companies are adopting a mix of product innovation, capacity expansion, and sustainability-driven strategies to strengthen their competitive position. Many players are investing in advanced processing technologies to improve the purity and functionality of zeolites, tailoring them for high-value applications.

Additionally, companies are focusing on R&D collaborations with universities and research institutes to explore new uses of natural zeolites in green technologies, including carbon capture, renewable energy storage, and sustainable agriculture. There are several global key players in the natural zeolite market, such as International Zeolite Corp., ZEOCEM a.s., Imerys, KMI Zeolite Inc., Zeotech Corporation, Bear River Zeolite Co., Rota Mining Corporation, Maruti Mineral Industries, Blue Pacific Minerals, Castle Mountain Zeolites, Gordes Zeolite, and Grupo Coypus.

International Zeolite Corp. manufactures, distributes, and supplies bulk natural zeolite and value-added zeolite-infused products. The company is known for its focus on expanding its zeolite product lines through R&D or acquisitions to introduce new products to the market.

ZEOCEM a.s. is a leading European manufacturer of natural zeolite products, with a history of over 60 years in processing natural materials. The company’s main focus is the mining and processing of natural zeolite and manufacturing products from it.

Imerys mines one of the highest purity clinoptilolite zeolites in the world from its Beli Plast operation in Bulgaria. The company mines and processes over 30 different minerals from diverse deposits worldwide, combining its mineral resources with application know-how to create specialized solutions for its customers.

Top Key Players in the Market

- International Zeolite Corp.

- ZEOCEM a.s.

- Imerys

- KMI Zeolite Inc.

- Zeotech Corporation

- Bear River Zeolite Co.

- St. Cloud Mining

- Rota Mining Corporation

- Maruti Mineral Industries

- Apostolico e Tanagro

- Agricola Metals Corporation

- Blue Pacific Minerals

- Castle Mountain Zeolites

- Gordes Zeolite

- Grupo Coypus

- Other Key Players

Recent Developments

- In September 2025, Blue Pacific Minerals announced the launch of an operating facility in Tokoroa to meet growing demand for its zeolite-based solutions, which enhance soil, plant, and animal health, while reducing environmental impact.

- In November 2022, International Zeolite Corp. and CoTec Holdings Corp. announced that CoTec had agreed to make a US$2 million strategic investment in IZ to support its go-to-market activities in the agricultural and green tech segments.

Report Scope

Report Features Description Market Value (2024) USD 3.51 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 4.75% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Clinoptilolite, Mordenite, Phillipsite, and Others), By Applications (Construction Material, Wastewater Treatment, Animal Feed, Soil Remediation, Agriculture, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape International Zeolite Corp., ZEOCEM a.s., Imerys, KMI Zeolite Inc., Zeotech Corporation, Bear River Zeolite Co., St. Cloud Mining, Rota Mining Corporation, Maruti Mineral Industries, Apostolico e Tanagro, Agricola Metals Corporation, Blue Pacific Minerals, Castle Mountain Zeolites, Gordes Zeolite, Grupo Coypus, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Zeolite MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Natural Zeolite MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- International Zeolite Corp.

- ZEOCEM a.s.

- Imerys

- KMI Zeolite Inc.

- Zeotech Corporation

- Bear River Zeolite Co.

- St. Cloud Mining

- Rota Mining Corporation

- Maruti Mineral Industries

- Apostolico e Tanagro

- Agricola Metals Corporation

- Blue Pacific Minerals

- Castle Mountain Zeolites

- Gordes Zeolite

- Grupo Coypus

- Other Key Players