Global Natural Language Processing in Finance Market Size, Share, Statistics Analysis Report By Component (Software, Services), By Application (Sentiment Analysis, Risk Management & Fraud Detection, Customer Service & Support, Document and Contract Analysis, Other Applications), By End-User (Banks, Insurance Companies, Investment Firms, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133091

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

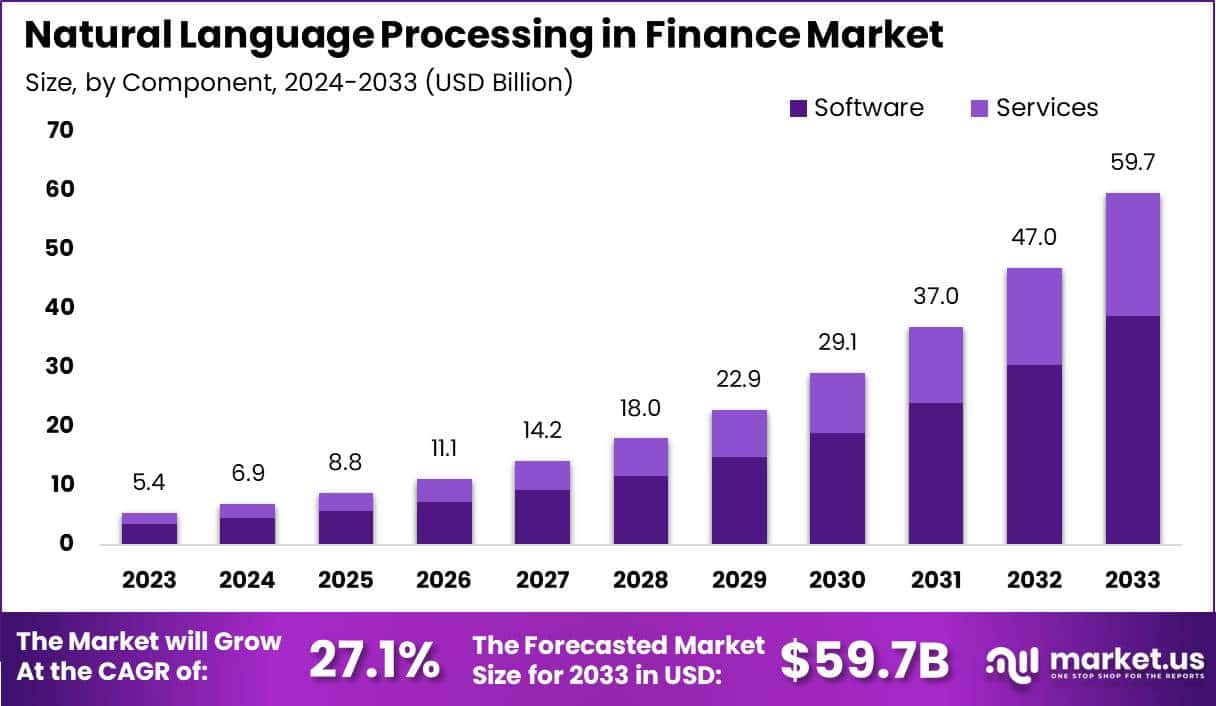

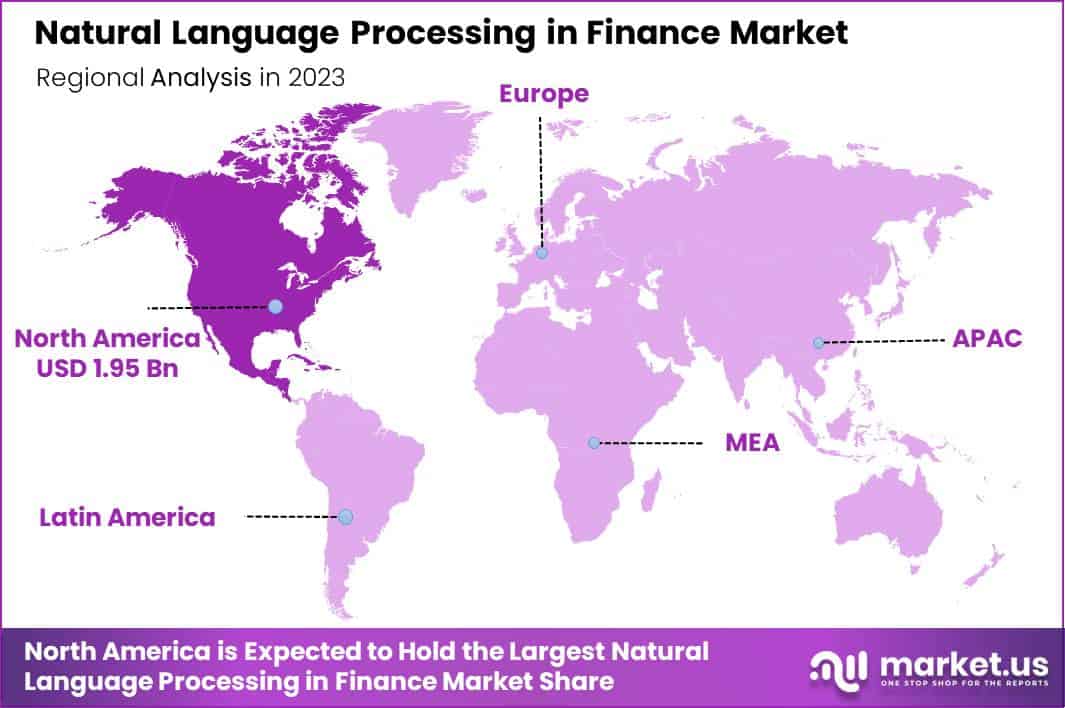

The Global NLP in Finance Market size is expected to be worth around USD 59.7 Billion By 2033, from USD 5.43 Billion in 2023, growing at a CAGR of 27.10% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 36% share, holding USD 1.95 billion revenue.

Natural Language Processing (NLP) in finance refers to the application of linguistic and computational techniques to understand and interpret human language in financial contexts. This technology is increasingly pivotal in extracting insights from vast amounts of unstructured data, such as news articles, financial reports, and social media content.

The Natural Language Processing in finance market is experiencing rapid growth, driven by the increasing digitization of financial services and the vast amount of unstructured data generated in this sector. This market segment focuses on developing solutions that facilitate effective communication between humans and computer systems, helping financial institutions gain a competitive edge.

These solutions are integral in applications such as algorithmic trading, risk management, compliance monitoring, and customer relationship management, where quick and accurate data processing is critical. The market for Natural Language Processing in finance is driven by several factors like the exponential increase in digital data creation necessitates powerful tools to analyze and leverage this data effectively.

The demand for NLP in finance is driven by the need for advanced analytics. As the volume of unstructured data continues to grow, including social media interactions, emails, and financial reports, the need for NLP solutions that can extract actionable insights becomes more pronounced. Financial institutions are also looking to reduce operational costs, further fueling the demand for sophisticated NLP tools.

Based on data from John Snow Labs, the financial sector is witnessing a significant surge in the generation of unstructured data, which is expanding at a robust annual rate of 55-65%. This rapid growth underscores the critical need for sophisticated NLP technologies to efficiently sift through this vast amount of data and aid in informed decision-making. By the year 2025, it is projected that nearly 30% of NLP applications will be integrated within the realms of Banking, Financial Services, and Insurance (BFSI).

NLP technology has gained significant popularity in the finance sector due to its ability to provide deeper insights and automate complex processes. It’s being integrated into various applications such as chatbots, fraud detection systems, and customer relationship management platforms. This popularity is reflected in the increasing adoption of AI-driven solutions across the banking and finance industries, where precision and efficiency are paramount.

For instance, In June 2023, Amazon Web Services (AWS) announced a significant development with Banco Bilbao Vizcaya Argentaria, S.A. (BBVA). BBVA plans to engage with Amazon Bedrock, a cutting-edge technology service. This platform offers access to foundational models developed by Amazon and top AI startups through an easy-to-use Application Programming Interface (API). BBVA’s strategy involves leveraging these models to develop innovative solutions that enhance financial services and customer experiences

The NLP market presents significant opportunities within the finance sector, particularly in regulatory compliance and risk management. By leveraging NLP, financial firms can streamline their processes to meet strict regulatory standards while effectively minimizing risks. NLP is poised to play a crucial role in shaping advanced, user-friendly customer service technologies, enhancing the overall client experience.

The expansion of the NLP market in finance is set to continue as technological advancements make NLP tools more accessible and effective. Emerging markets present new opportunities for deployment, especially in regions where digital financial services are expanding. As the global finance landscape becomes more interconnected, the need for multilingual NLP solutions that can cater to diverse markets is increasing, broadening the scope and reach of NLP applications in finance.

Key Takeaways

- The Global Natural Language Processing (NLP) in Finance Market is projected to reach a value of approximately USD 59.7 Billion by 2033, growing from USD 5.43 Billion in 2023, at a compound annual growth rate (CAGR) of 27.10% from 2024 to 2033.

- In 2023, the Software segment dominated the NLP in Finance Market, holding over 65% of the market share.

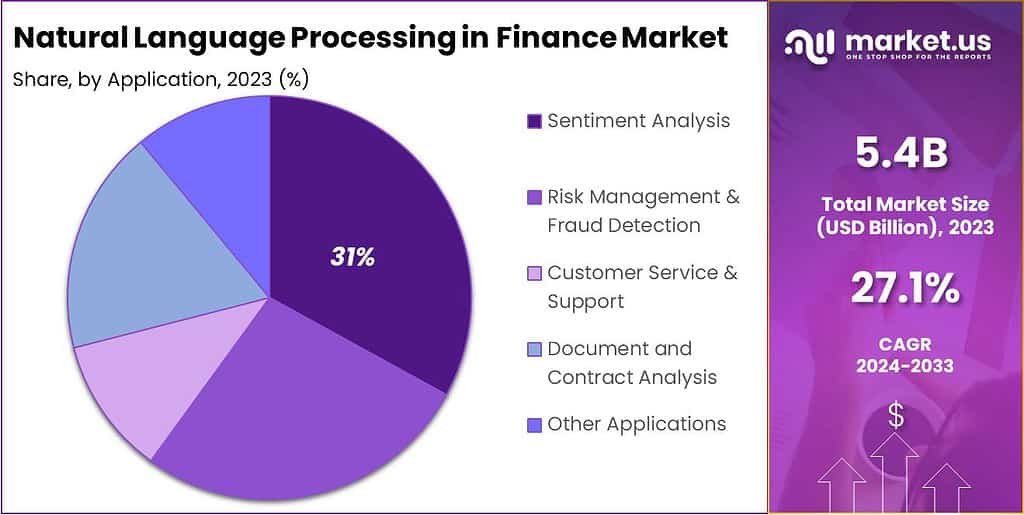

- The Sentiment Analysis segment also held a dominant position in 2023, capturing more than 31% of the market share.

- Within the NLP in Finance Market, the Banks segment led the market in 2023, accounting for over 46% of the share.

- In 2023, North America was the leading region in the NLP in Finance Market, capturing more than 36% of the market share, with total revenues amounting to approximately USD 1.95 billion.

Component Analysis

In 2023, the Software segment held a dominant market position within the Natural Language Processing (NLP) in Finance Market, capturing more than a 65% share. This segment’s leadership is primarily attributed to the critical need for sophisticated NLP software solutions that can analyze and interpret vast volumes of unstructured financial data efficiently.

Financial institutions increasingly rely on NLP software to gain valuable insights from data sources such as market reports, news articles, and client feedback, which are pivotal for making strategic decisions and maintaining competitive advantages.

The prominence of the Software segment is also bolstered by continuous advancements in artificial intelligence and machine learning technologies, which enhance the capabilities of NLP applications. These technological improvements enable more accurate sentiment analysis, risk assessment, and automated customer service interactions.

The integration of NLP software with existing financial systems has become more streamlined, encouraging wider adoption. Financial entities are investing in these integrations to leverage real-time analytics for better decision-making and to enhance regulatory compliance.

Application Analysis

In 2023, the Sentiment Analysis segment held a dominant market position, capturing more than a 31% share. This segment leads primarily due to the crucial role sentiment analysis plays in understanding customer emotions and market trends, which are vital for making informed financial decisions.

Financial firms leverage sentiment analysis not only to enhance customer interactions but also to predict market movements and potential shifts in consumer behavior. This capability allows them to stay ahead of trends and tailor their products and services to meet changing customer needs.

The increasing volume of unstructured data from diverse sources further drives the need for robust sentiment analysis tools, ensuring that financial institutions can process and analyze this data efficiently. This not only helps in risk assessment but also enhances the agility of financial services in responding to market changes.

End-User Analysis

In 2023, the Banks segment held a dominant market position within the Natural Language Processing (NLP) in Finance Market, capturing more than a 46% share.

This substantial market share can primarily be attributed to the increasing adoption of NLP technologies by banks to enhance customer experience and streamline their operations. Banks are leveraging NLP to automate customer service interactions, analyze customer feedback, and provide personalized banking advice, which significantly improves operational efficiency and customer satisfaction.

Banks are integrating NLP solutions to better monitor and analyze transactions and communications to detect anomalies that may suggest fraudulent activities. This capability not only aids in protecting against losses due to fraud but also helps in adhering to stringent regulatory requirements, thereby fostering trust and reliability among consumers.

The advent of digital banking platforms has necessitated the incorporation of advanced technological solutions like NLP. These platforms utilize NLP to offer sophisticated features such as voice-activated banking and real-time customer support via chatbots.

Key Market Segments

By Component

- Software

- Services

By Application

- Sentiment Analysis

- Risk Management & Fraud Detection

- Customer Service & Support

- Document and Contract Analysis

- Other Applications

By End-User

- Banks

- Insurance Companies

- Investment Firms

- Others

Driver

Automation of Routine Tasks

Natural Language Processing (NLP) in finance is driven by the increasing need for automation of routine tasks. Natural Language Processing (NLP) enables the automation of repetitive and time-consuming processes, such as extracting data from financial reports, analyzing customer interactions, and conducting sentiment analysis of market news.

Financial institutions, like banks and investment firms, often deal with large volumes of unstructured data, including emails, customer chats, and regulatory documents. NLP tools can quickly process and extract insights from this data, reducing human labor and enhancing decision-making accuracy. By automating mundane tasks, finance professionals can redirect their focus towards strategic activities, such as risk management and investment analysis.

Restraint

Regulatory Compliance and Data Privacy

One key restraint for NLP adoption in finance is the issue of data privacy and regulatory compliance. The financial industry is highly regulated, with strict rules governing data sharing, storage, and usage to protect customer privacy and ensure security. When implementing NLP systems, financial institutions must navigate complex compliance requirements that vary by region and jurisdiction.

NLP models often require vast amounts of data for training and processing, raising concerns about data security breaches, misuse, or inadvertent exposure of sensitive information. Ensuring that NLP systems comply with regulations like the General Data Protection Regulation (GDPR) and financial data security standards can be challenging, adding layers of complexity and cost.

Opportunity

Personalized Financial Services

The growing demand for personalized financial services presents a major opportunity for Natural Language Processing (NLP) in finance. Consumers are increasingly seeking tailored solutions that align with their unique financial needs and preferences.

NLP can play a pivotal role by analyzing customer interactions, transaction histories, and financial behavior to deliver highly personalized insights and recommendations. For instance, chatbots powered by NLP can provide customers with instant support and advice based on their past activities.

This personalization enhances the customer experience, driving satisfaction and loyalty. Financial institutions can differentiate themselves from competitors by leveraging NLP-driven solutions to create customized products and services, capturing a broader market share.

Challenge

High Implementation Costs

A significant challenge facing the adoption of Natural Language Processing (NLP) in finance is the high cost of implementation. Integrating NLP solutions into existing systems requires substantial investment in technology infrastructure, software, and skilled personnel.

Developing, deploying, and maintaining NLP models often necessitates hiring data scientists, engineers, and specialized IT staff, which can be prohibitively expensive for smaller financial institutions. NLP models must be continuously refined to ensure accuracy, especially when dealing with complex financial data. This refinement process can be resource-intensive, involving ongoing data labeling, model retraining, and algorithmic adjustments.

Emerging Trends

Natural Language Processing (NLP) is transforming the finance sector by enabling computers to understand and interpret human language, leading to more efficient and insightful operations.

One emerging trend is the use of sentiment analysis to gauge market moods. By analyzing news articles, social media posts, and financial reports, NLP tools can assess public sentiment, providing investors with real-time insights into market dynamics.

Another significant development is the integration of NLP in risk management. Financial institutions are employing NLP to monitor and analyze vast amounts of unstructured data, such as regulatory filings and market news, to identify potential risks and ensure compliance with evolving regulations.

In the realm of investment strategies, NLP is being utilized to analyze financial documents and earnings calls, extracting valuable information that informs decision-making. This capability enables investors to process large volumes of data quickly, identifying trends and opportunities that might be missed through manual analysis.

Business Benefits

- Automating Routine Tasks: NLP streamlines repetitive processes like data entry and report generation, allowing financial professionals to focus on more strategic activities.

- Improving Customer Service: By leveraging natural language processing (NLP), businesses can significantly enhance customer service by deploying chatbots and virtual assistants that deliver swift, accurate responses, leading to higher satisfaction and reduced wait times.

- Enhancing Risk Management: NLP plays a crucial role in strengthening risk management by analyzing large volumes of textual data, helping to detect potential risks and fraudulent activities, and allowing for proactive measures to protect valuable assets.

- Facilitating Sentiment Analysis: NLP tools assess market sentiment by evaluating news articles, social media, and other sources, offering valuable insights for investment strategies.

- Streamlining Document Processing: NLP simplifies the handling of complex financial documents, making information retrieval faster and more accurate, which is crucial for compliance and reporting.

Regional Analysis

In 2023, North America held a dominant position in the Natural Language Processing (NLP) in Finance Market, capturing more than a 36% share, with revenues reaching approximately USD 1.95 billion.

This leading stance is primarily driven by the robust financial sector in the region, particularly in the United States, where a significant concentration of global financial institutions invests heavily in advanced technologies like NLP to enhance operational efficiency and customer service.

The presence of major technology firms and startups focusing on AI and NLP innovations in North America further fuels the region’s market dominance. These companies continually develop and refine NLP solutions tailored for the financial sector, ensuring that North American financial institutions have cutting-edge tools to process and analyze large volumes of unstructured data.

The regulatory environment in North America demands high compliance standards, which necessitates sophisticated tools for monitoring and reporting. NLP technology plays a crucial role in helping financial entities meet these demands by automating the extraction of relevant information from a plethora of documents and communications.

Additionally, the growing trend of digital transformation across the financial industry in North America acts as a catalyst for the adoption of NLP technologies. As banks and financial institutions push towards digital channels for customer interaction, the need for NLP to manage, understand, and respond to customer communications efficiently increases.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the Natural Language Processing (NLP) in finance market, Intel Corporation stands out as a key player. Known for its powerful computing solutions, Intel has ventured deeply into artificial intelligence, optimizing its hardware to support intensive NLP applications. Their advanced processors enable financial institutions to analyze large datasets quickly, a critical factor when dealing with real-time financial information.

Nvidia Corporation is another prominent force in the NLP in finance landscape. Renowned for their GPU technology, which is essential for AI and machine learning tasks, Nvidia’s products significantly enhance the performance of NLP models that require high computation power.

Nuance Communications brings a specialized focus to the NLP in finance market, offering tailored solutions that improve customer interaction and automate routine tasks. Their expertise in speech recognition and natural language understanding allows financial services to enhance their customer experience, offering more intuitive and responsive communication options.

Top Key Players in the Market

- Intel Corporation

- Nvidia Corporation

- Nuance Communications

- IBM Corporation

- Lexalytics

- Yseop

- Verint Systems

- Numenta

- Luminoso Technologies

- OpenText

- NLP Logix

- Megvii Technologies

- DigitalGenius

- Other Key Players

Recent Developments

- In June 2023, Natural Language Processing and Recognition Market Giants Spending is Going to Boom with Google, Microsoft, Baidu.This boost in spending is aimed at advancing the development of algorithms and models that enable computers to process and analyze text and speech data more effectively.

- In February 2024, Databricks acquired Einblick, a pioneer in NLP technology. This acquisition is poised to enhance the Databricks Data Intelligence Platform, expanding its query capabilities and making it accessible to a broader audience of users.

Report Scope

Report Features Description Market Value (2023) USD 5.43 Bn Forecast Revenue (2033) USD 59.7 Bn CAGR (2024-2033) 27.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Application (Sentiment Analysis, Risk Management & Fraud Detection, Customer Service & Support, Document and Contract Analysis, Other Applications), By End-User (Banks, Insurance Companies, Investment Firms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intel Corporation, Nvidia Corporation, Nuance Communications, IBM Corporation, Lexalytics, Yseop, Verint Systems, Numenta, Luminoso Technologies, OpenText, NLP Logix, Megvii Technologies, DigitalGenius, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Language Processing in Finance MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Natural Language Processing in Finance MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- Nvidia Corporation

- Nuance Communications

- IBM Corporation

- Lexalytics

- Yseop

- Verint Systems

- Numenta

- Luminoso Technologies

- OpenText

- NLP Logix

- Megvii Technologies

- DigitalGenius

- Other Key Players