Global Natural Hair Dye Market By Product Type (Temporary Hair Color, Permanent Hair Color, Semi-permanent Hair Color, Others), By Gender (Women, Men, Unisex), By Application (Residential, Commercial), By Form (Powder, Gel, Cream, Others), By Distribution Channel (Supermarkets and Hypermarkets, Pharmacies, Specialty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132473

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

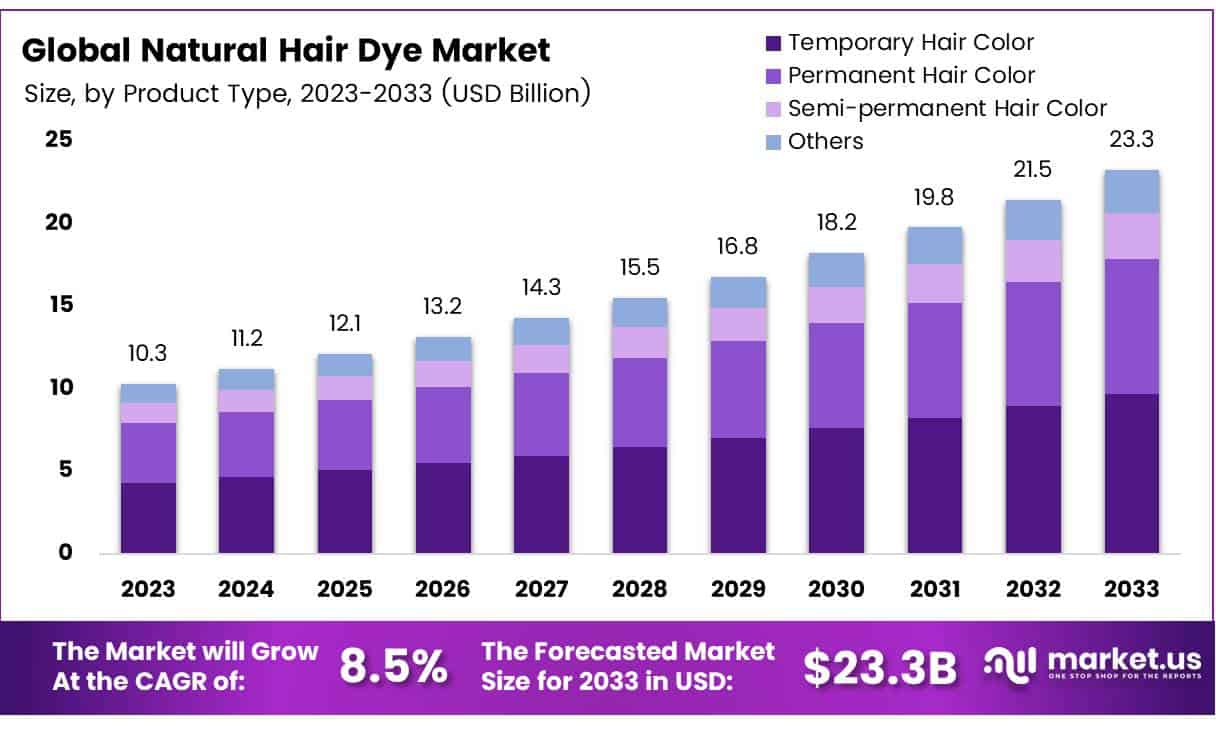

The Global Natural Hair Dye Market size is expected to be worth around USD 23.3 Billion by 2033, from USD 10.3 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

Natural hair dyes are a growing category within the hair care industry, focusing on products that use botanical extracts and natural ingredients instead of synthetic chemicals.

These dyes are designed to offer a healthier, eco-friendly alternative to traditional hair color products, aiming to reduce potential damage and minimize exposure to harsh chemicals. This shift is driven by a consumer base that is increasingly health-conscious and committed to sustainable lifestyles.

The market for natural hair dyes is expanding rapidly due to rising consumer interest in organic and natural personal care products. Innovations in product offerings, including a broader range of colors, better formulas, and easier application methods, are making these dyes more appealing to health-conscious consumers.

The trend towards natural ingredients is also fueled by concerns over allergic reactions, the environmental impact of synthetic dyes, and the demand for safer beauty products.

Significant market potential exists for natural hair dyes, as evidenced by high usage rates of hair coloring products—74% of women and 16% of men globally, according to doctor green life. This demonstrates a substantial opportunity for natural alternatives as consumers become more aware of the ingredients in their beauty products.

There are numerous opportunities for growth in this sector. Innovations such as longer-lasting natural dyes that provide a wider color range, and partnerships with salons and professional hair care providers, could broaden market reach and build consumer trust.

There is also a movement towards personalized hair dye solutions, with potential for products tailored to individual preferences and needs.

Government policies and investment are crucial in shaping this market. Stricter safety regulations for cosmetic products are pushing manufacturers towards safer, natural alternatives.

Government certification of organic products also boosts the market by helping consumers make informed choices, thus enhancing the credibility and appeal of natural hair dyes. These efforts not only ensure product safety and effectiveness but could also drive greater adoption of natural dyes across various markets.

According to world population review, the predominant hair colors in the United States are black and brown, which are preferred by 85% and 11% of the population, respectively.

This demographic data highlights a substantial market for natural dyes, especially in shades of black and brown, which are traditionally more challenging to achieve with natural formulations.

Moreover, data from scottmax indicates that 70% of women in the U.S. invest in hair coloring and styling, suggesting a robust consumer base and a significant spending power directed towards hair care products.

This statistic not only reflects the high engagement with hair dye products but also signals a substantial opportunity for market expansion into natural dye products, which can align with the evolving consumer preferences towards healthier lifestyle choices.

Key Takeaways

- The Global Natural Hair Dye Market is projected to expand from USD 10.3 Billion in 2023 to USD 23.3 Billion by 2033, at a CAGR of 8.5%.

- Temporary Hair Color led the Product Type Analysis in 2023, preferred by younger consumers for its non-committal and flexible coloring options.

- Women dominate the market, driven by their preference for safer, environmentally friendly hair dyes.

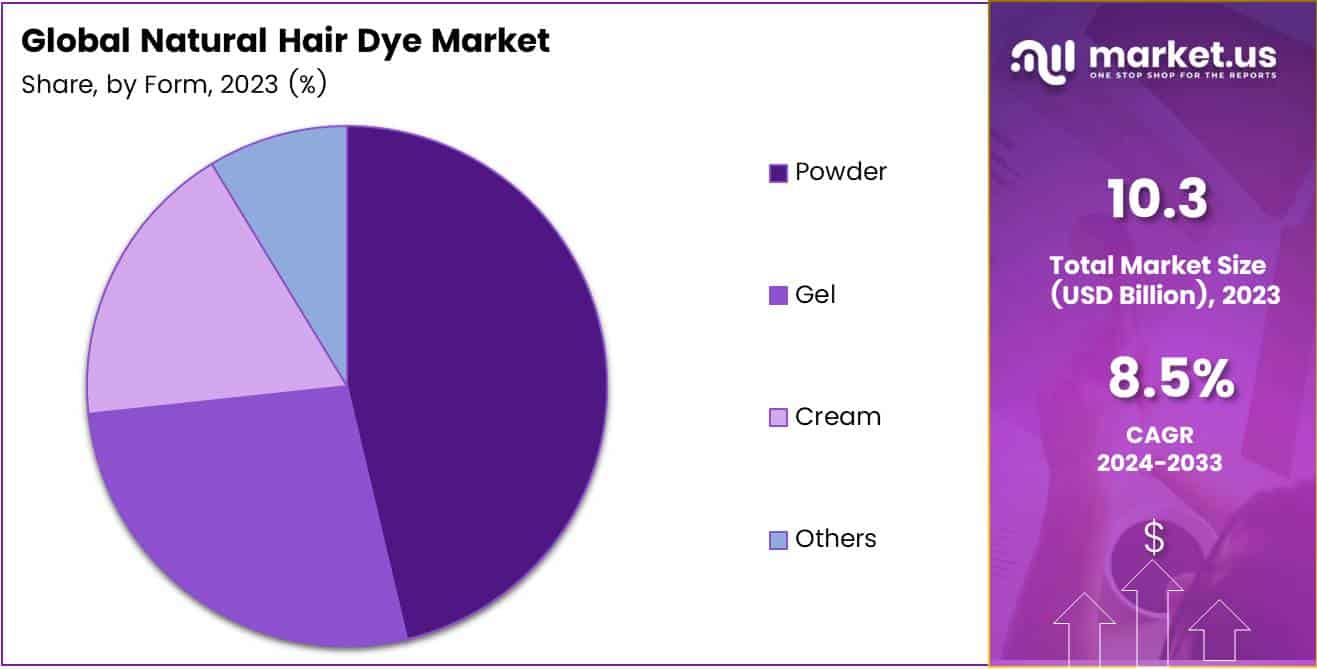

- The powder form leads in the Form Analysis due to its longer shelf life and ease of application, appealing to both individuals and businesses.

- Supermarkets and hypermarkets are the leading distribution channels, offering wide product ranges through robust inventory management.

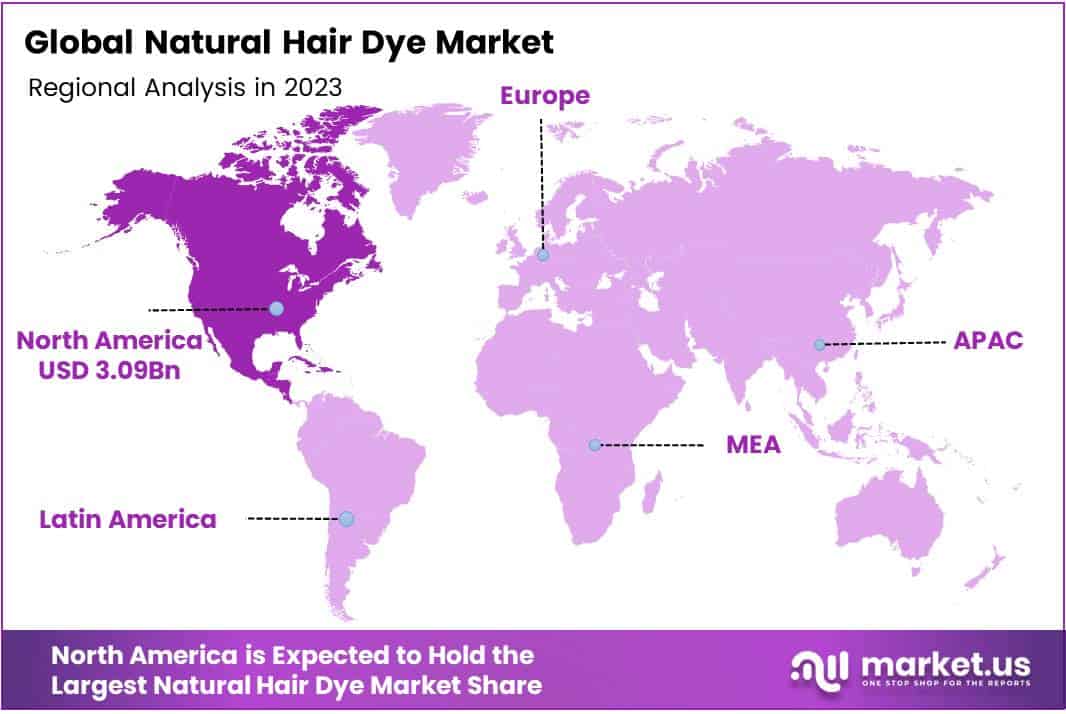

- North America holds a 30% market share, led by consumer awareness and strict regulations promoting natural ingredients in the U.S. and Canada.

By Product Type

Temporary Hair Color Leads in 2023 Natural Hair Dye Market with Robust Share

In 2023, Temporary Hair Color held a dominant market position in the By Product Type Analysis segment of the Natural Hair Dye Market, capturing a significant market share.

This segment’s prominence is attributed to the increasing consumer preference for non-committal color changes, which allow for flexibility and experimentation without long-term commitment. Temporary hair color products are especially popular among younger demographics who seek variety and the ability to frequently change their appearance.

The Permanent Hair Color category, known for offering long-lasting results and grey coverage, maintained a stable market share, reflecting a consistent demand among users who prioritize durability in color and are less inclined to change their hair color frequently.

Semi-permanent Hair Color also carved out a considerable portion of the market. These products appeal to those seeking a middle ground between temporary and permanent dyes, offering a longer-lasting color than temporary options without the commitment of permanent dyes.

The Others category, which includes natural and organic formulations, highlighted a growing segment driven by increasing consumer awareness and preference for health-conscious alternatives in hair care and styling products.

Gender Analysis

Women Take the Lead in 2023 Natural Hair Dye Market

In 2023, women held a dominant market position in the By Gender Analysis segment of the natural hair dye market, commanding a significant percentage share. This predominance can be attributed to increased consumer awareness and a growing preference among women for products that are perceived as safer and environmentally friendly.

Conversely, the market share for men, while smaller, has shown steady growth. This increase is driven by a rising interest in personal grooming coupled with a greater acceptance of men using hair coloring products as a regular part of their grooming routines.

Products specifically formulated for men are gradually carving out a niche, which may predict a more balanced market distribution in the future.

Unisex products are rapidly gaining traction and expanding their market presence. This segment benefits from the universal appeal of natural formulations, appealing to all genders and thereby broadening the consumer base.

The flexibility and inclusivity of unisex products make them a strong contender, likely to disrupt traditional gender-specific market shares as they cater to a wider audience seeking natural hair care solutions.

Form Analysis

Powder Leads the Way in Natural Hair Dye Forms for 2023

In 2023, Powder held a dominant market position in the By Form Analysis segment of the Natural Hair Dye Market. This form’s superiority can be attributed to its longer shelf life and ease of application, which appeal to both end consumers and commercial entities.

Moreover, powder hair dyes are perceived as more natural and less chemically intensive, aligning with the growing consumer demand for organic and chemical-free products.

The segment’s robust performance is further bolstered by its widespread availability and cost-effectiveness, making it a preferred choice in both developed and emerging markets.

The gel form also captured a significant share, favored for its ease of use and ability to provide more consistent color results compared to other forms.

Cream-based dyes followed, appreciated for their moisturizing properties, which cater to consumers seeking dual benefits of coloring and hair care.

Other forms, including but not limited to sprays and foam, hold a niche but growing segment of the market. These alternatives are gradually gaining traction, driven by innovations that promise convenience and reduced application times.

As the market evolves, these newer forms may disrupt traditional preferences, potentially reshaping market dynamics in the coming years.

Distribution Channel Analysis

Supermarkets/Hypermarkets Lead in Natural Hair Dye Distribution with Significant Market Share

In 2023, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Natural Hair Dye Market, with a significant percentage share.

This channel’s prominence can be attributed to its widespread accessibility and the robust inventory management systems that ensure a diverse array of product offerings.

Supermarkets and hypermarkets are strategically located to maximize consumer footfall, which has effectively leveraged the growing consumer preference for natural and organic products.

Pharmacies accounted for the next largest share, benefiting from consumer trust and the provision of professional health-related advice. Specialty stores also captured a considerable market share, driven by their ability to offer specialized products and personalized customer service.

The online segment, while smaller, showed rapid growth due to the convenience of e-commerce platforms and the increasing penetration of internet services. Other distribution channels, though smaller in scale, remained vital in reaching niche markets where specific consumer needs could be met more directly.

Key Market Segments

By Product Type

- Temporary Hair Color

- Permanent Hair Color

- Semi-permanent Hair Color

- Others

By Gender

- Women

- Men

- Unisex

By Application

- Residential

- Commercial

By Form

- Powder

- Gel

- Cream

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies

- Specialty Stores

- Online

- Others

Drivers

Growth Driven by Enhanced Consumer Awareness

The natural hair dye market is expanding, primarily driven by heightened consumer awareness of the adverse impacts associated with chemical hair dyes, prompting a shift towards natural and organic alternatives.

As awareness grows, health and safety concerns also become more pronounced, with consumers increasingly seeking out natural hair dyes perceived as safer options compared to their synthetic counterparts.

This demand is further catalyzed by continuous innovations from manufacturers aiming to enhance the effectiveness of natural hair dyes and broaden the spectrum of available colors.

These innovations not only improve product quality but also appeal to a broader consumer base eager for variety in natural dye options. This confluence of consumer awareness, safety priorities, and product innovation underscores the market’s ongoing growth trajectory.

Restraints

Shorter Lasting Results Challenge Natural Hair Dye Adoption

In the context of the natural hair dye market, several restraints are impacting its broader adoption, notably the shorter lifespan of coloration results and the elevated costs associated with natural ingredients.

Unlike their chemical counterparts, natural hair dyes often deliver color that fades more quickly, necessitating more frequent applications to maintain desired hues. This requirement for increased usage can deter consumers who prioritize convenience and long-lasting results.

Furthermore, the market faces additional challenges due to the high cost of sourcing authentic natural ingredients, which subsequently raises the retail prices of these products.

This price premium can alienate budget-conscious consumers, limiting the market’s penetration to primarily those who are less sensitive to price fluctuations. These factors collectively restrain the growth of the natural hair dye market, as potential customers opt for more durable and cost-effective chemical alternatives.

Growth Factors

Technological Innovations Boost Natural Hair Dye Market

In the realm of natural hair dyes, the integration of technological advancements offers substantial growth prospects. By developing innovative formulas that enhance the performance, color spectrum, and durability of these dyes, companies can address consumer demands for quality and variety.

Additionally, forging partnerships with hair salons to offer specialized natural dye services can significantly increase product visibility and build consumer trust. This strategy not only expands market reach but also enhances the brand’s reputation by associating with trusted local businesses.

Moreover, committing to eco-friendly packaging solutions can cater to the growing segment of environmentally conscious consumers, further differentiating products in the competitive market. This approach aligns with broader consumer trends towards sustainability and could leverage consumer preference for green products to gain a stronger foothold in the market.

Emerging Trends

Trending Factors Influencing the Natural Hair Dye Market

The natural hair dye market is witnessing a shift towards products emphasizing holistic hair health, reflecting a broader consumer preference for wellness-oriented beauty solutions. This trend is driven by the growing awareness and desire among consumers to not only change hair color but also to nourish and protect their hair.

As a result, manufacturers are increasingly developing formulations that go beyond mere coloring, incorporating natural ingredients that offer hydration, strength, and damage repair. This approach caters to the needs of consumers looking for multifunctional products that deliver both aesthetic appeal and health benefits.

The integration of vitamins, plant-based proteins, and natural oils into hair dyes is becoming prevalent, aligning with the market demand for hair care products that contribute to long-term hair wellness while ensuring vibrant and lasting color.

Regional Analysis

North America Region Leading with 30% Market Share, Valued at USD 3.09 Billion

The natural hair dye market exhibits varying trends and growth patterns across different regions, each influenced by local consumer preferences, regulatory landscapes, and market maturity. The analysis below provides a segmental overview of the market across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America, as the dominating region, holds a 30% market share, valued at USD 3.09 billion. This leadership can be attributed to the high consumer awareness of the benefits of natural ingredients and the presence of stringent regulations regarding chemical hair dyes. The U.S. and Canada exhibit a robust demand for natural and organic personal care products, driving substantial growth in this segment.

Regional Mentions:

Europe follows closely, characterized by a mature market with a well-established consumer base seeking sustainable and eco-friendly beauty solutions. The region’s strict regulatory standards on cosmetic ingredients significantly fuel the adoption of natural alternatives. European consumers’ strong preference for ethical products is driving manufacturers to innovate and expand their natural hair dye offerings.

In the Asia Pacific, rapid market expansion is driven by increasing disposable incomes and growing awareness about the harmful effects of chemical products. Countries like China, Japan, and India are witnessing a surge in demand for natural and herbal-based hair dyes, supported by a rich heritage of using natural substances for hair care.

The Middle East & Africa region shows promising growth potential, albeit from a smaller base. The increasing influence of Western beauty standards, coupled with a rising expatriate population, supports the growth of the natural hair dye market. Urbanization and the expansion of retail infrastructure also play crucial roles in making these products more accessible to consumers.

Latin America is experiencing gradual growth in this market. The increase in consumer spending power and the growing popularity of natural personal care products fuel demand. However, the region faces challenges such as economic variability which can impact consumer spending patterns on non-essential goods.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

NATULIQUE Ltd. emerges as a pivotal player, distinguished by its commitment to certified organic ingredients. The company’s strategic focus on environmentally sustainable practices and non-toxic formulations significantly enhances its competitive edge in a market increasingly driven by consumer preferences for health-conscious beauty solutions.

Aubrey Organics Inc., with its established brand heritage, leverages its expertise in natural personal care to cater to a demographic seeking gentle and effective hair coloring alternatives. The brand’s reputation for integrity and ingredient purity helps in maintaining a loyal customer base and attracting new consumers looking for reliable organic options.

Antica Erboristeria S.p.A., known for its Herbatint brand, capitalizes on its European craftsmanship and herbal-focused research. This approach positions it well within markets that prioritize product efficacy and sophisticated natural ingredient profiles, catering particularly to the premium segment.

Organic Salon Systems LLC, with its professional salon-grade products, provides a robust solution for stylists and consumers aiming to align beauty routines with health-oriented lifestyles. Their commitment to non-toxic, salon-quality products appeals to a niche market that values professional results alongside ingredient safety.

Among emerging companies, Khadi Natural Health Care Pvt. Ltd and Radico Ltd. stand out with their use of traditional Ayurvedic ingredients, which appeals to both domestic and international markets looking for holistic approaches to hair care. These companies’ use of authentic, time-tested ingredients offers a unique selling proposition amid the growing clutter of natural claims.

Top Key Players in the Market

- NATULIQUE Ltd.

- Aubrey Organics Inc.

- Antica Erboristeria S.p.A.

- Organic Saloon Systems LLC.

- Khadi Natural Health Care Pvt. Ltd

- Radico Ltd.

- V.J.S Pharmaceuticals Pvt. Ltd

- TVAM Ltd.

- Bio Veda Action Research Co.

- Indus Valley Couple and Twins SAS.

Recent Developments

- In October 2024, Fresha, a premier marketplace platform for beauty and wellness services, announced its strategic investment and partnership with Yuv, an innovator in AI-powered hair color technology. This alliance will enable Fresha to enhance its offerings to salons and beauty professionals worldwide, reinforcing its reputation as a leader in providing cutting-edge solutions and increasing operational efficiency in the beauty industry.

- In May 2023, Cleverman, a brand specializing in customizable beard and hair color products for men, successfully secured seed funding amounting to $1.8 million. This financial injection was led by L’Attitude Ventures, with additional contributions from Fab Co-Creation Studio Ventures and several angel investors, aiming to boost product development and market reach.

- In June 2024, L’Oréal Paris introduced the Colorsonic, a revolutionary development in permanent hair coloring technology. This product exemplifies L’Oréal’s commitment to innovation, offering consumers a new way to achieve professional-grade hair coloring results through an advanced, user-friendly device.

- In January 2023, Clairol responded to evolving consumer preferences by launching three new at-home hair coloring products, each inspired by the latest styling trends. These innovations aim to provide users with more personalized and trend-forward hair coloring options, enhancing user experience and satisfaction with at-home products.

Report Scope

Report Features Description Market Value (2023) USD 10.3 Billion Forecast Revenue (2033) USD 23.3 Billion CAGR (2024-2033) 8.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Temporary Hair Color, Permanent Hair Color, Semi-permanent Hair Color, Others), By Gender (Women, Men, Unisex), By Application (Residential, Commercial), By Form (Powder, Gel, Cream, Others), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NATULIQUE Ltd., Aubrey Organics Inc., Antica Erboristeria S.p.A., Organic Saloon Systems LLC., Khadi Natural Health Care Pvt. Ltd, Radico Ltd., V.J.S Pharmaceuticals Pvt. Ltd, TVAM Ltd., Bio Veda Action Research Co., Indus Valley Couple and Twins SAS. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NATULIQUE Ltd.

- Aubrey Organics Inc.

- Antica Erboristeria S.p.A.

- Organic Saloon Systems LLC.

- Khadi Natural Health Care Pvt. Ltd

- Radico Ltd.

- V.J.S Pharmaceuticals Pvt. Ltd

- TVAM Ltd.

- Bio Veda Action Research Co.

- Indus Valley Couple and Twins SAS.