Global Natural & Organic Personal Care Products Market Size, Share, Growth Analysis By Product Type (Skin Care, Body Care, Hair Care, Oral Care, Cosmetics, Fragrances & Deodorants), By End User (Residential, Commercial), By Consumer Orientation (Women, Men, Kids), By Sales Channel (Hypermarkets, Specialty Stores, Drug Stores, Online Retailers, Departmental Stores, Convenience Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162727

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By End User Analysis

- By Consumer Orientation Analysis

- By Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Natural & Organic Personal Care Products Company Insights

- Recent Developments

- Report Scope

Report Overview

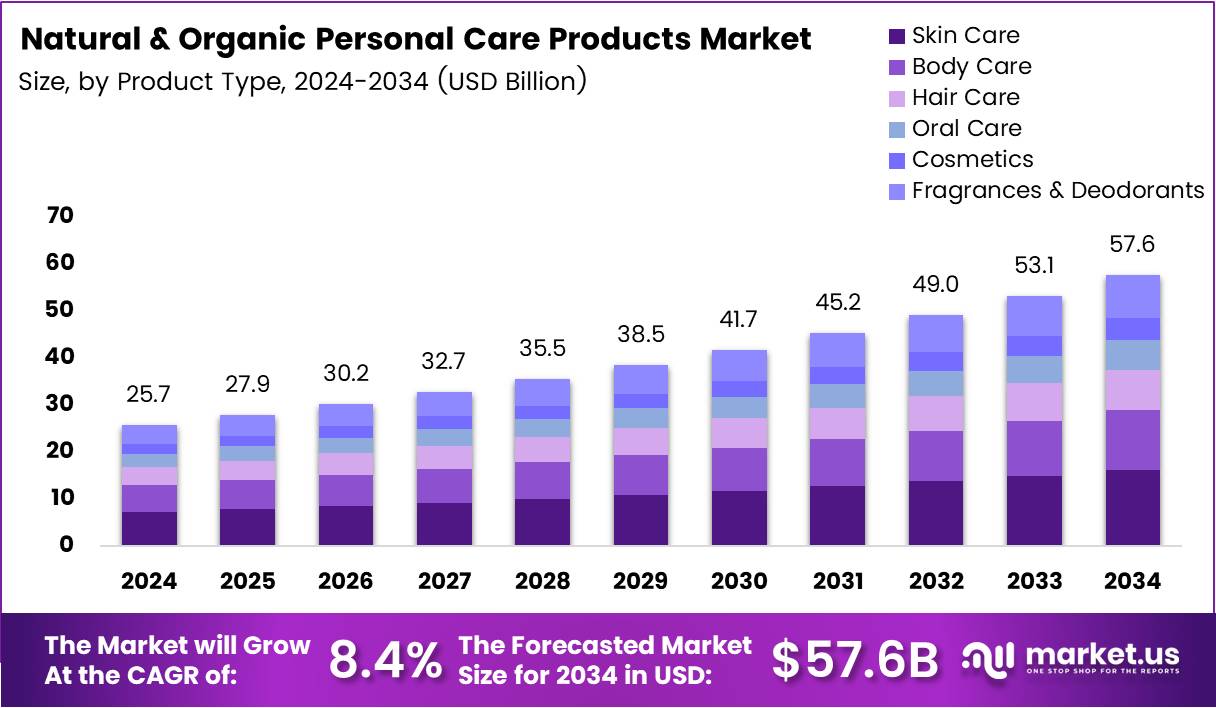

The Global Natural & Organic Personal Care Products Market size is expected to be worth around USD 57.6 Billion by 2034, from USD 25.7 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034.

The Natural & Organic Personal Care Products Market represents a growing segment within the beauty and wellness industry, focused on plant-based, chemical-free, and sustainably sourced ingredients. Consumers are increasingly shifting toward safer and eco-friendly options, driving brands to innovate with transparent formulations and ethical sourcing. This market reflects both lifestyle and environmental consciousness.

Furthermore, rising awareness about harmful chemical effects in conventional cosmetics has accelerated demand for organic skincare, haircare, and personal hygiene products. Manufacturers are reformulating with natural extracts and essential oils to appeal to health-focused consumers. The transition toward clean beauty is reshaping global product portfolios and marketing strategies across retail and e-commerce platforms.

In addition, growing disposable incomes and urbanization are supporting premium product adoption. Brands are investing in research and certification standards to ensure authenticity and build consumer trust. This evolution aligns with sustainability goals, as companies focus on recyclable packaging and cruelty-free testing, enhancing both consumer loyalty and regulatory compliance.

Government initiatives promoting organic farming and green manufacturing have further boosted market expansion. Regulatory bodies are implementing stricter labeling and ingredient transparency laws, supporting safer product development. These interventions not only enhance consumer protection but also open pathways for innovation in natural formulations and eco-friendly production methods.

According to an industry report, 74% of consumers value organic ingredients in skincare, soap, and shampoo, while 65% prefer clear ingredient lists for safety transparency. However, only 9% fully trust voluntary “natural/organic” labels, highlighting the need for standardized certification. This growing awareness is reshaping product labeling and influencing brand credibility across major markets.

Moreover, according to media.market.us, 59% of U.S. respondents prefer skincare made from natural or organic ingredients, and 54% actively seek sustainable or environmentally friendly options. Similarly, a UK poll of 2,000 adults (2025) revealed spending of £5.3 billion annually on organic beauty, with 47% searching for natural labels and 71% willing to pay ~28% more for “clean beauty.”

Key Takeaways

- Global Natural & Organic Personal Care Products Market valued at USD 25.7 Billion in 2024 and projected to reach USD 57.6 Billion by 2034, growing at a CAGR of 8.4%.

- Skin Care dominates the market by product type with a 32.7% share due to strong demand for natural and plant-based formulations.

- Residential End User segment leads with a 75.3% share, driven by the growing shift toward home-based self-care and personal wellness routines.

- Women dominate the consumer orientation segment with a 65.2% share owing to rising awareness and preference for sustainable beauty solutions.

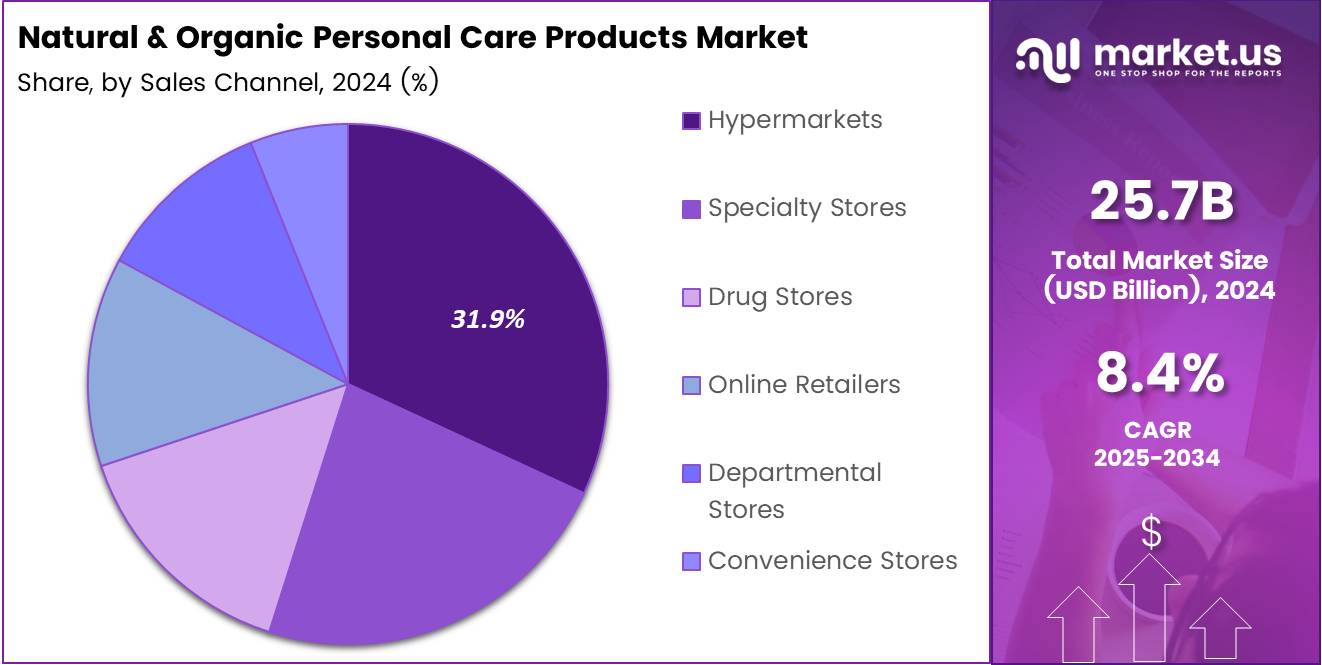

- Hypermarkets lead the sales channel segment with a 31.9% share, supported by broad product accessibility and consumer trust.

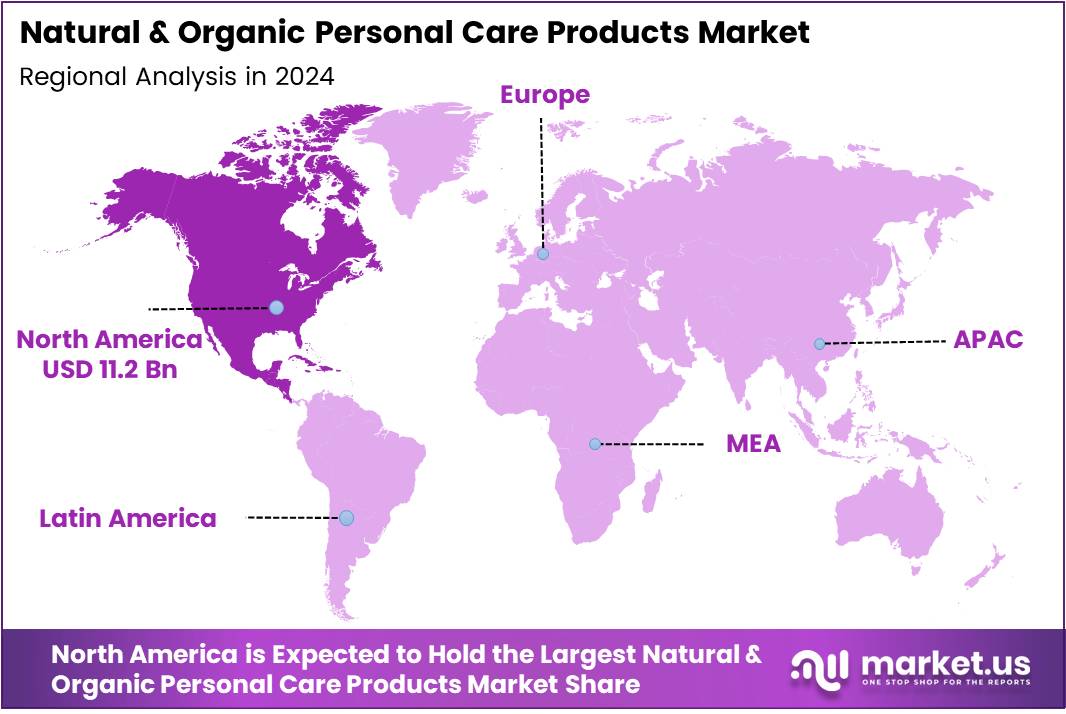

- North America dominates regionally with a 43.9% share, valued at USD 11.2 Billion, driven by clean-beauty awareness and sustainable innovation.

By Product Type Analysis

Skin Care dominates with 32.7% due to its strong consumer preference for natural ingredients and multifunctional benefits.

In 2024, Skin Care held a dominant market position in the By Product Type segment of the Natural & Organic Personal Care Products Market, with a 32.7% share. The demand for natural skin care products surged as consumers increasingly preferred plant-based formulations free from harsh chemicals. Rising awareness about sustainable beauty, coupled with the growing popularity of organic moisturizers, serums, and sunscreens, significantly boosted segment growth.

Body Care products are witnessing steady growth due to consumers’ focus on maintaining healthy, nourished skin. Organic body lotions, scrubs, and oils are gaining popularity as they provide gentle care without harmful additives. The inclusion of natural essential oils and vitamins enhances the appeal of body care lines, driving demand among eco-conscious buyers.

Hair Care products are expanding rapidly as consumers shift toward sulfate-free shampoos, conditioners, and hair masks. The use of herbal and organic ingredients to prevent hair fall and scalp irritation has fueled this trend. Brands promoting sustainable packaging and cruelty-free certifications are further influencing purchasing decisions across various demographics.

Oral Care products such as herbal toothpastes and mouthwashes are gaining attention for their natural antibacterial properties. Consumers are becoming increasingly aware of the harmful effects of artificial sweeteners and chemicals, leading to a growing preference for fluoride-free and vegan oral hygiene solutions derived from plant-based ingredients.

Cosmetics in the natural and organic category are growing as consumers look for safer alternatives to synthetic makeup. Products made with mineral pigments and organic oils are in demand for their gentle impact on the skin. Brands focusing on clean beauty and transparent labeling are capturing significant market interest.

Fragrances & Deodorants are seeing rising adoption as consumers seek alcohol-free and allergen-free options. The use of essential oils like lavender, sandalwood, and citrus blends appeals to users seeking long-lasting freshness without artificial chemicals. This segment is expected to grow as wellness trends influence personal grooming choices.

By End User Analysis

Residential dominates with 75.3% due to the growing shift toward home-based self-care and daily grooming routines.

In 2024, Residential held a dominant market position in the By End User segment of the Natural & Organic Personal Care Products Market, with a 75.3% share. Consumers increasingly adopted natural products for personal use due to health awareness and rising disposable incomes. Home users prefer organic skin, hair, and oral care items as part of their daily wellness practices, driving strong residential demand.

Commercial end users, including salons, spas, and wellness centers, are gradually expanding their adoption of organic personal care products. These establishments prioritize natural alternatives to attract eco-conscious clients and enhance their brand image. The rising number of wellness-focused outlets using plant-based beauty and hygiene solutions continues to support market growth.

By Consumer Orientation Analysis

Women dominate with 65.2% owing to high awareness and growing preference for sustainable and cruelty-free products.

In 2024, Women held a dominant market position in the By Consumer Orientation segment of the Natural & Organic Personal Care Products Market, with a 65.2% share. Female consumers increasingly prefer natural beauty solutions to maintain skin health and minimize chemical exposure. Social media influence and clean beauty trends continue to fuel women’s demand across skincare and cosmetics categories.

Men are emerging as a key consumer group due to increasing awareness of personal grooming. Natural beard oils, organic shaving creams, and chemical-free deodorants are gaining traction. Men are showing growing interest in sustainable grooming products, pushing brands to expand their product lines to cater to male-oriented organic solutions.

Kids segment is gaining attention as parents prioritize safe, toxin-free products for their children. Organic baby shampoos, lotions, and dental care products are preferred due to their gentle and hypoallergenic properties. The rise in demand for certified organic baby care lines reflects an increasing focus on child health and wellness.

By Sales Channel Analysis

Hypermarkets dominate with 31.9% owing to their wide product availability and consumer trust in organized retail.

In 2024, Hypermarkets held a dominant market position in the By Sales Channel segment of the Natural & Organic Personal Care Products Market, with a 31.9% share. These stores offer extensive product choices, competitive prices, and trusted brands. Consumers prefer hypermarkets for their convenience, product authenticity, and access to exclusive organic personal care promotions.

Specialty Stores are growing rapidly as they focus on curated organic and natural beauty products. Personalized consultations and sampling opportunities enhance customer engagement. These stores are popular among consumers seeking expert recommendations and premium organic brands that align with their sustainability values.

Drug Stores serve as essential distribution points for natural and organic personal care products. With an emphasis on health and wellness, they attract consumers seeking dermatologist-approved and clinically tested formulations. The credibility of pharmacy chains boosts consumer confidence in purchasing natural alternatives.

Online Retailers have become a major growth channel due to convenience and access to global organic brands. Digital platforms enable detailed product comparisons and customer reviews, enhancing purchase confidence. Subscription models and influencer collaborations further drive the adoption of natural personal care products online.

Departmental Stores continue to hold significance as they offer premium organic product lines in a luxury retail environment. Consumers often purchase these products as gifts or during seasonal promotions. The combination of high-end branding and trusted sourcing supports the segment’s steady growth.

Convenience Stores are gaining gradual momentum as they provide quick access to everyday personal care essentials. Small organic product ranges and travel-friendly packaging attract on-the-go consumers. As awareness increases, convenience stores are expanding their natural product shelves to cater to evolving consumer preferences.

Key Market Segments

By Product Type

- Skin Care

- Body Care

- Hair Care

- Oral Care

- Cosmetics

- Fragrances & Deodorants

By End User

- Residential

- Commercial

By Consumer Orientation

- Women

- Men

- Kids

By Sales Channel

- Hypermarkets

- Specialty Stores

- Drug Stores

- Online Retailers

- Departmental Stores

- Convenience Stores

Drivers

Rising Consumer Preference for Clean Label and Chemical-Free Skincare Products Drives Market Growth

The demand for natural and organic personal care products is rising as consumers increasingly prefer clean label and chemical-free skincare solutions. People are becoming more aware of the potential side effects of synthetic ingredients and are choosing products with transparent ingredient lists and natural formulations.

Growing awareness of sustainable and cruelty-free manufacturing practices is also fueling market expansion. Consumers now value brands that follow ethical production methods, such as using biodegradable materials and avoiding animal testing, which strengthens brand loyalty.

In addition, rising disposable incomes are enabling more consumers to invest in premium organic beauty products. This shift is particularly visible in urban markets where customers prioritize high-quality and safe personal care options.

Furthermore, the expansion of retail and e-commerce channels has made certified organic brands more accessible to a broader audience. Online platforms and specialty stores now feature a wide range of eco-friendly and chemical-free skincare products, driving consistent market growth worldwide.

Restraints

Limited Shelf Life and Product Stability of Natural Formulations Restrains Market Growth

Despite growing popularity, the natural and organic personal care market faces challenges due to limited shelf life and product stability. Since these products often lack synthetic preservatives, they can degrade faster, leading to higher costs and inventory management issues for manufacturers.

Another major restraint is the lack of standardized global certification and regulatory frameworks. Different countries have varying definitions of natural and organic, which creates confusion for both consumers and producers. This inconsistency makes it difficult for brands to achieve universal recognition.

Consumer skepticism also acts as a barrier to market growth. Misleading marketing practices, where brands falsely label products as organic, have reduced consumer trust. Customers are becoming more cautious and tend to prefer brands that provide verifiable certifications and transparency in sourcing.

Overall, these factors create challenges for market expansion, requiring stronger regulation, better preservation technologies, and improved communication to maintain consumer confidence.

Growth Factors

Technological Innovation in Bio-Based and Plant-Derived Ingredient Extraction Creates Growth Opportunities

The natural and organic personal care market offers vast opportunities through technological innovation in bio-based and plant-derived ingredient extraction. Advancements in biotechnology are improving the quality, safety, and effectiveness of organic formulations, making them more appealing to modern consumers.

Another promising area is the growing adoption of organic personal care products among men. The male grooming segment is increasingly embracing natural products, such as organic shaving creams, moisturizers, and beard oils, which is opening new growth avenues for brands.

Expansion into emerging markets presents further opportunities as health-conscious populations in Asia-Pacific, Latin America, and the Middle East show rising interest in clean beauty solutions. Local brands and global players alike are targeting these regions with affordable and authentic organic options.

Additionally, collaboration with dermatologists and skincare experts for clinically proven organic formulations is helping brands gain credibility. Such partnerships enhance consumer trust and ensure product effectiveness, strengthening long-term market prospects.

Emerging Trends

Surge in Demand for Vegan and Zero-Waste Beauty Product Lines Shapes Market Trends

The natural and organic personal care market is witnessing strong trends driven by the rising demand for vegan and zero-waste beauty lines. Consumers are favoring products free from animal-derived ingredients and packaged in sustainable materials, aligning with their eco-friendly lifestyles.

Social media and celebrity endorsements are also playing a vital role in influencing consumer behavior. Well-known influencers and public figures promote organic beauty routines, helping niche brands gain visibility and driving mass adoption.

The integration of AI-based skin diagnostic tools into organic skincare solutions is another emerging trend. These technologies allow consumers to receive personalized skincare recommendations, improving product effectiveness and enhancing customer satisfaction.

Finally, the increasing popularity of refillable and eco-friendly packaging formats supports sustainability goals. Brands offering reusable containers and minimal plastic use are gaining preference, reinforcing their commitment to environmental responsibility and attracting loyal customers.

Regional Analysis

North America Dominates the Natural & Organic Personal Care Products Market with a Market Share of 43.9%, Valued at USD 11.2 Billion

In the North American region, the natural and organic personal care products segment commands a commanding position, accounting for approximately 43.9% of the global market and representing an estimated USD 11.2 billion in value. This dominance is driven by advanced consumer awareness of clean-beauty and sustainability trends, strong regulatory frameworks favouring certified organic claims, and mature retail and e-commerce channels that facilitate premium product adoption. Moreover, robust infrastructure for ingredient research and established distribution networks give the region a structural advantage. Growth in this region is now focused on innovation in sustainable packaging, plant-based formulations, and an increasing shift to digital-first channels.

Europe Natural & Organic Personal Care Products Market Trends

Europe has emerged as a significant market for natural and organic personal care, underpinned by stringent regulatory standards (such as ECOCERT and COSMOS), high consumer eco-consciousness and strong demand for premium, certified products. While it trails North America in overall share, the region continues to grow steadily, driven by mature distribution channels, a high willingness to pay for sustainability credentials, and an increasing focus on zero-waste packaging and ingredient transparency.

Asia Pacific Natural & Organic Personal Care Products Market Trends

Asia Pacific is rapidly evolving as a key growth region for the natural and organic personal care products market. Strong growth is fuelled by rising disposable incomes, accelerating urbanisation, a growing middle class, and increasing penetration of e-commerce platforms. Countries such as China, India, Japan and South Korea are witnessing an uptick in demand for clean-label and botanically-derived personal care. Although the absolute share remains below the leading regions, Asia Pacific is anticipated to deliver the fastest growth rate in coming years.

Latin America Natural & Organic Personal Care Products Market Trends

In Latin America, the natural and organic personal care segment is gaining traction, albeit from a smaller base. Growing health and wellness awareness among consumers, coupled with rising interest in natural ingredient sourcing and regional biodiversity, are positively influencing market uptake. Challenges remain around distribution infrastructure, price sensitivity and certification awareness, but niche brands and local initiatives are increasingly nurturing the organic personal care trend.

Middle East & Africa Natural & Organic Personal Care Products Market Trends

The Middle East and Africa region is emerging as a frontier for natural and organic personal care products, driven by evolving consumer lifestyles, increased exposure to global beauty standards and growing interest in sustainability and clean-beauty credentials. Although the share of the market remains modest compared to more established regions, the growth potential is significant. Investment in certification, retail expansion and culturally-adapted formulations will be key to accelerating uptake.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Natural & Organic Personal Care Products Company Insights

The global Natural & Organic Personal Care Products Market in 2024 is witnessing strong competition driven by innovation, sustainability initiatives, and evolving consumer preferences for clean beauty.

Loreal SA continues to dominate the market through its strategic investments in eco-friendly formulations and sustainable sourcing. The company’s focus on biotechnology and plant-based ingredients, coupled with transparent labeling, has positioned it as a leader in clean beauty innovation across multiple product categories.

Amway Corporation leverages its direct-selling network to promote its natural personal care lines, emphasizing organic ingredients and environmentally responsible packaging. Its Nutrilite-inspired approach, integrating wellness and skincare, allows the brand to appeal to health-conscious consumers seeking holistic beauty solutions.

Beiersdorf has been strengthening its portfolio by reformulating existing products under brands like Nivea and Eucerin to align with organic standards. The company’s dedication to research-backed natural ingredients and its sustainable packaging initiatives are enhancing its reputation in the green personal care segment.

Benefit Cosmetics LLC focuses on expanding its natural and cruelty-free offerings to meet rising consumer demand for ethical beauty. Its marketing approach combines playful branding with sustainability messaging, enabling the company to attract younger consumers interested in eco-conscious yet trendy cosmetics.

Overall, these key players are reshaping the market landscape by investing heavily in sustainable product development, ethical sourcing, and transparency. Their collective efforts are driving innovation and reinforcing the global shift toward natural, organic, and environmentally friendly personal care products.

Top Key Players in the Market

- Loreal SA

- Amway Corporation

- Beiersdorf

- Benefit Cosmetics LLC

- Chanel S.A.

- Clarins Group

- Estee Lauder Companies Inc.

- Johnson & Johnson

- Kao Corporation

- Laverana GmbH & Co. KG

Recent Developments

- In April 2024, Clariant, a Switzerland-based specialty chemicals company, completed the acquisition of Lucas Meyer Cosmetics (Canada) for approximately USD 810 million. This acquisition strengthens Clariant’s position in the personal care segment by integrating Lucas Meyer’s expertise in active and functional cosmetic ingredients.

- In May 2024, Wildcraft (Canada) launched its “Pure Radiance Vitamin C Eye Cream” on 28 May, emphasizing a 100% natural, vegan, and certified cruelty-free formulation. The launch highlights Wildcraft’s commitment to clean beauty trends and its expansion in the premium skincare segment across North America.

- In December 2024, Granado Group (Brazil) completed the acquisition of Care Natural Beauty on 11 December, a move aimed at expanding its organic and natural cosmetics portfolio. This acquisition reinforces Granado’s sustainability-driven growth strategy and enhances its footprint in Latin America’s clean beauty market.

Report Scope

Report Features Description Market Value (2024) USD 25.7 Billion Forecast Revenue (2034) USD 57.6 Billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Skin Care, Body Care, Hair Care, Oral Care, Cosmetics, Fragrances & Deodorants), By End User (Residential, Commercial), By Consumer Orientation (Women, Men, Kids), By Sales Channel (Hypermarkets, Specialty Stores, Drug Stores, Online Retailers, Departmental Stores, Convenience Stores) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Loreal SA, Amway Corporation, Beiersdorf, Benefit Cosmetics LLC, Chanel S.A., Clarins Group, Estee Lauder Companies Inc., Johnson & Johnson, Kao Corporation, Laverana GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural & Organic Personal Care Products MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Natural & Organic Personal Care Products MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Loreal SA

- Amway Corporation

- Beiersdorf

- Benefit Cosmetics LLC

- Chanel S.A.

- Clarins Group

- Estee Lauder Companies Inc.

- Johnson & Johnson

- Kao Corporation

- Laverana GmbH & Co. KG