Global Native Advertising Market Size, Share Analaysis Report By Content Format (In-Feed Native Ads, In-Image Native Ads, In-Video Native Ads, Sponsored Content), By Platform (Closed Platforms, Open Platforms, Hybrid Platform), By End Use (Retail & eCommerce, Media & Entertainment, BFSI, Healthcare, Automotive, Telecom & IT, Travel & Hospitality, Education, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154628

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

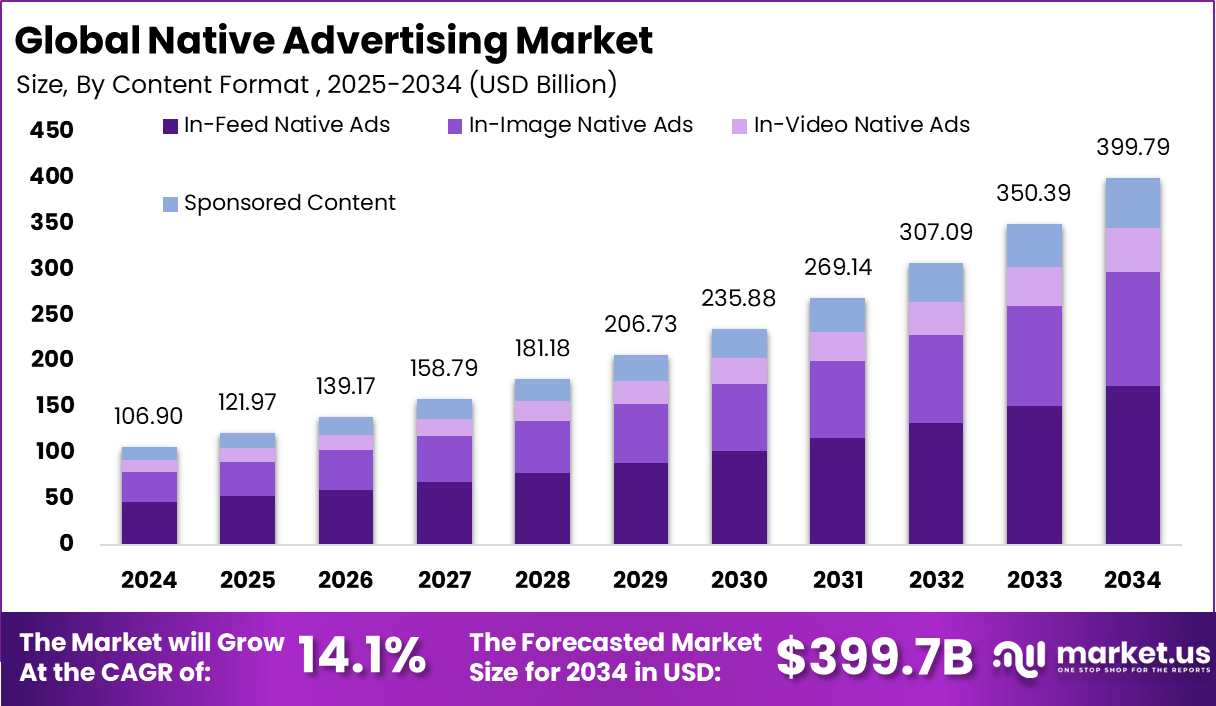

The Global Native Advertising Market size is expected to be worth around USD 399.79 Billion By 2034, from USD 106.9 billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 31.5% share, holding USD 33.67 Billion revenue.

The native advertising market can be described as a form of paid promotion that is designed to match the look, feel and function of the platform on which it appears. It typically consists of articles, videos, images or posts that blend seamlessly within editorial content in feeds, on websites or social platforms. Despite being sponsored, these ads are intended to appear native to their environment, and require clear labelling to distinguish them from editorial material.

Based on data from Meetanshi, native digital display ad spending in the U.S. rose from $35.24 billion in 2018 to $52.76 billion in 2020. Trust remains higher for editorial sites, with 68% of users trusting native ads there versus 55% on social media. Additionally, 32% of users are likely to share native ads, compared to 19% for display ads.

According to Linearity, global digital ad spending reached $517 billion by end-2023, making up 66% of total ad spend. Instagram Stories reaches over 500 million daily users, and 73% of consumers say brand videos on social media influence their purchases.

Market Size and Growth

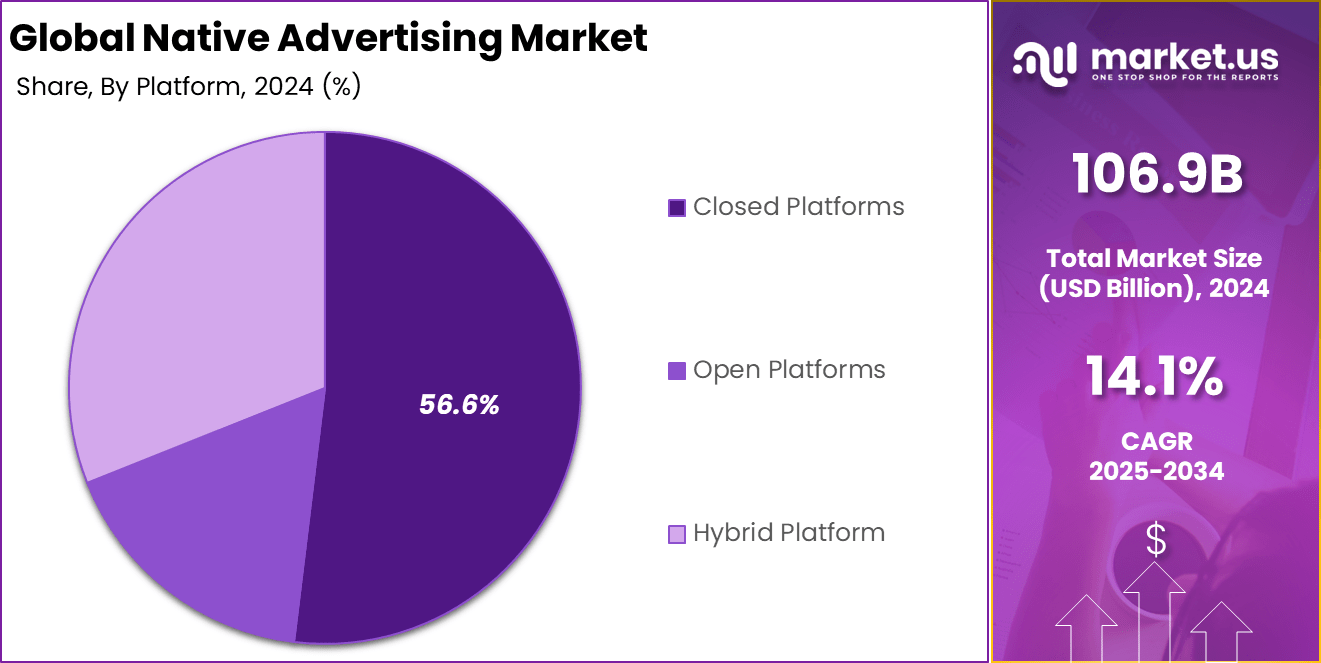

Metric Statistic / Value Market Value (2024) USD 106.9 Bn Forecast Revenue (2034) USD 399.7 Bn CAGR(2025-2034) 14.1% Leading Segment Closed Platforms: 56.6% Region with Largest Share North America [31.5% Market Share] Several powerful factors drive the growth of the native advertising market. The expanding consumption of digital media, especially through smartphones and mobile apps, stands out as a top driver. Advertisers are compelled to move budgets from traditional formats to native approaches as consumers show clear preferences for non-disruptive and contextually relevant brand messages.

Demand for native advertising rises steadily as brands and agencies realize its measurable benefits. As audiences increasingly ignore conventional banners, there is a growing push for more creative and integrated advertising experiences. Personalized native ads, powered by artificial intelligence, not only gain higher engagement rates but also foster trust and credibility with audiences.

Key Insight Summary

- The market is projected to grow from USD 106.9 billion in 2024 to approximately USD 399.79 billion by 2034, advancing at a strong CAGR of 14.1%, driven by the demand for non-disruptive, contextually aligned digital content.

- North America led the global landscape with a 31.5% share, generating USD 33.67 billion in revenue, fueled by mature digital ecosystems and strong advertiser spending across sectors.

- In-Feed Native Ads dominated by content format, holding a 43.2% share, due to their seamless integration within social media feeds and editorial streams, enhancing user engagement.

- Closed Platforms accounted for the largest share at 56.6%, as brands increasingly rely on walled ecosystems (such as social networks and mobile apps) for targeted and data-driven ad placements.

- The Education sector emerged as a key end-use vertical, leveraging native advertising to boost online course enrollments, promote learning apps, and enhance brand credibility in digital learning environments.

Analysts’ Viewpoint

Investment opportunities are emerging in AI‑powered native ad platforms, contextual recommendation engines and hybrid publishing models. These areas are attractive to investors seeking scalable, privacy‑friendly formats that deliver stronger user engagement. Emerging markets, especially in Asia Pacific, are projected to offer high opportunity due to rising digital consumption and advertiser interest in personalised content strategies.

Business benefits associated with native advertising include stronger consumer trust, improved brand recall and reduced ad avoidance. When ads deliver value within contextual environments, users view them more favorably and engage more deeply. Publishers benefit from monetization without disrupting user experience; advertisers benefit from higher click‑through rates and conversion efficiency.

The regulatory environment is shaped by global privacy laws such as the EU’s GDPR and U.S. FTC guidelines. Ad networks and platforms must provide transparency about ad sponsorship and avoid deceptive practices. Recent legislation, such as the EU Digital Services Act, introduces requirements for ad transparency, bans on behavioural targeting for sensitive user groups, and mandates repositories of displayed ads by major platforms.

Role of AI

Role/Function Description Advanced Targeting AI analyzes user data for precise demographic and behavioral targeting Personalization Algorithms customize ad experiences based on context and user preferences Automated Content Creation AI generates headlines, copy, and visuals tailored to audience and platform Real-Time Optimization AI auto-adjusts campaigns for placements, bids, audiences, and performance goals Performance Analytics Machine learning provides actionable insights and attribution for continuous campaign improvement Emerging Trends

Trend/Innovation Description Programmatic Native Advertising Automated, real-time buying and optimization for scale and targeting precision Mobile-First and Video Formats Growth in vertical video, in-app, and shoppable native ads tailored to mobile experience Gamification and Interactivity Use of quizzes, polls, and interactive content to boost engagement Contextual and Influencer Content Sponsored editorial, influencer-driven, and long-form content integrated into publisher/editorial environments Transparent & Measurable Solutions Third-party verification (e.g. MGID + IAS) and improved attribution measure campaign performance and trust By Content Format

In 2024, In-feed native ads hold a leading share of 43.2% in the native advertising market. These ads seamlessly blend with the organic content within social media feeds, news sites, and other digital platforms, making them less intrusive and more engaging for users.

Their non-disruptive nature helps brands improve click-through rates and user interaction by delivering relevant ads that match the look and feel of the hosting environment. As consumers increasingly prefer smooth and natural browsing experiences, in-feed native ads have become a preferred choice for advertisers aiming to capture attention without disrupting user engagement.

By Platform Analysis

In 2024, Closed platforms account for 56.6% of the native advertising market share. These platforms, which include major social media networks and proprietary content ecosystems, offer advertisers controlled, highly targeted environments.

Closed platforms provide access to rich user data, enabling precise audience segmentation and personalized ad delivery. This results in higher engagement and conversion rates, making them particularly attractive for native ad campaigns. The increased trust and safety offered by these platforms also reassures advertisers about content brand safety and compliance.

By End Use Analysis

Education is emerging as a significant end-use sector for native advertising. With growing digitization of learning and the rising number of online education providers, native ads are being increasingly used to attract students, promote courses, and build brand awareness in this space.

Education-focused native advertising blends educational content with promotional messages, which helps institutions connect authentically with prospective learners. This targeted approach supports lead generation and student engagement, positioning native advertising as an effective channel for education marketers.

Key Market Segments

By Content Format

- In-Feed Native Ads

- In-Image Native Ads

- In-Video Native Ads

- Sponsored Content

By Platform

- Closed Platforms

- Open Platforms

- Hybrid Platform

By End Use

- Retail & eCommerce

- Media & Entertainment

- BFSI

- Healthcare

- Automotive

- Telecom & IT

- Travel & Hospitality

- Education

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Growth Factors

Key Factors Description Mobile Device Proliferation Continued global smartphone adoption drives native ad impressions Shift to Non-Intrusive Advertising Users and brands prefer content that integrates naturally instead of disruptive banners Social Media Engagement Native formats excel on newsfeeds and platforms like Facebook, Instagram, TikTok Regulatory Compliance & Privacy Contextual targeting and ad formats comply better with GDPR, CCPA, and data privacy trends AI-Powered Personalization Improved results from AI-driven campaign personalization, automation, and optimization Driver Analysis

Personalization Fuels Native Advertising Success

A primary driver behind native advertising’s rise is the increasing demand for personalized and relevant user experiences. As people consume more digital media on mobile and social platforms, they naturally become more selective about what captures their attention. Marketers have shifted from generic messaging to highly tailored content that resonates with individual preferences, behaviors, and demographics.

Using advanced data analysis and artificial intelligence, advertisers now craft campaigns that reach specific target groups, making ads more engaging and less intrusive. The seamless integration of such advertising within feeds and articles means it feels more like helpful content rather than a disruptive pitch, strengthening trust and conversion rates.

Restraint Analysis

Transparency and Trust Issues Loom Large

One of the most pressing restraints for native advertising is transparency. The blurred line between content and advertisement can sometimes mislead users, causing trust issues if people feel deceived. Regulators and experts have raised concerns about the need for clear labeling so that users can distinguish between sponsored and editorial content.

When ads are not adequately marked, they risk reducing the credibility of both the publisher and the advertiser, potentially causing damage to brand trust over time. Recognizing these risks, platforms and regulators are increasingly enforcing rules that mandate visibility and clarity in native ad disclosures.

Opportunity Analysis

Privacy Shifts Open New Doors

With the decline of third-party cookies and tightening privacy regulations, brands are being forced to rethink digital advertising strategies. Native advertising – by relying more on contextual relevance and first-party data – presents a privacy-forward opportunity.

Because these ad formats focus on delivering messages that match the context of the platform, rather than tracking users across the web, they align well with evolving legal frameworks and consumer expectations around privacy. Marketers can now harness their own audience insights to execute campaigns that are both effective and compliant, further solidifying native ads’ role in the digital future.

Challenge Analysis

Ethical and Regulatory Dilemmas

Native advertising faces significant hurdles related to ethics and regulation. Since its content often closely mimics editorial or organic posts, consumers might not immediately recognize material as advertising, raising concerns about manipulation or subtle persuasion.

Regulatory bodies are closely scrutinizing these practices, and advertisers must adapt by ensuring clear disclosures and upholding ethical marketing standards. As scrutiny increases, brands operating without transparency risk fines, negative publicity, and erosion of public trust, making this challenge crucial to long-term success.

Competitive Landscape

In the Native Advertising Market, Taboola, Outbrain, and Teads have emerged as key leaders. Their platforms enable content discovery and native ad placements across top publisher networks. These companies focus on enhancing user engagement through personalized content recommendations.

MGID, RevContent, and Nativo Inc. have also secured notable positions in this space. These platforms are recognized for offering advanced native formats and demand-side solutions tailored for performance marketers. Their real-time bidding, fraud detection tools, and transparent reporting systems have strengthened client retention.

TripleLift, Media.net, Sharethrough, and Verizon Media (Yahoo Native) bring strong programmatic capabilities into the native space. These companies emphasize header bidding, dynamic creative optimization, and omnichannel delivery. Their solutions align with both brand and performance marketing goals. Integration of video and commerce-driven content has boosted their platform value.

Top Key Players in the Market

- RevContent

- MGID

- Taboola

- Outbrain

- TripleLift

- Nativo Inc

- Media.net

- Sharethrough

- Verizon Media (Yahoo Native)

- Teads

Recent Developments

- In April 2025, Taboola expanded its partnership with Gannett to enhance its AI-powered Realize platform. The integration provides access to Gannett’s full display inventory, including USA TODAY and 200+ local sites, improving targeting and campaign outcomes through advanced first-party data use.

- In April 2025, MGID partnered with Integral Ad Science (IAS) to boost third-party ad measurement, offering real-time insights into viewability, attention, and brand safety. This collaboration supports more transparent and reliable native ad campaigns.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Content Format (In-Feed Native Ads, In-Image Native Ads, In-Video Native Ads, Sponsored Content), By Platform (Closed Platforms, Open Platforms, Hybrid Platform), By End Use (Retail & eCommerce, Media & Entertainment, BFSI, Healthcare, Automotive, Telecom & IT, Travel & Hospitality, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape RevContent, MGID, Taboola, Outbrain, TripleLift, Nativo Inc, Media.net, Sharethrough, Verizon Media (Yahoo Native), Teads Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Native Advertising MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Native Advertising MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- RevContent

- MGID

- Taboola

- Outbrain

- TripleLift

- Nativo Inc

- Media.net

- Sharethrough

- Verizon Media (Yahoo Native)

- Teads