Global Naphtha Market Size, Share, And Business Benefits By Type (Light Naphtha, Heavy Naphtha), By Source (Crude Oil, Natural Gas, Others), By Application (Petrochemical Feedstock, Fertilizers, Energy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 14773

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

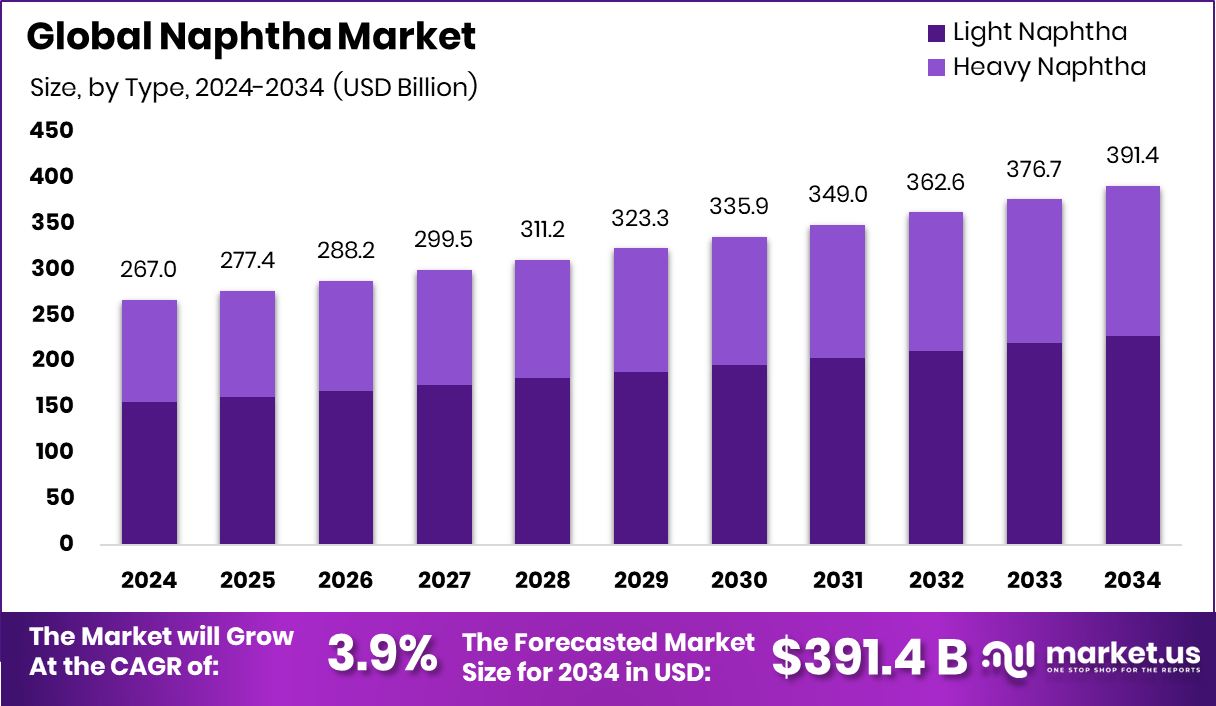

Global Naphtha Market is expected to be worth around USD 391.4 billion by 2034, up from USD 267.0 billion in 2024, and grow at a CAGR of 3.9% from 2025 to 2034. Strong petrochemical demand positioned Asia-Pacific at 53.2% as the top consumer of naphtha globally.

Naphtha is a highly flammable, volatile liquid hydrocarbon mixture derived primarily from crude oil or natural gas condensates. It is colorless and has a gasoline-like odor. Naphtha serves as a critical intermediate in producing a wide range of petrochemicals and fuels. It is commonly used as a feedstock for producing ethylene and propylene in steam crackers, and also finds application in gasoline blending, industrial solvents, and as a cleaning agent.

The Naphtha market refers to the global trade, supply, and consumption of naphtha for various industrial applications. It is deeply linked to the energy and petrochemical sectors. The market includes upstream refiners, midstream distributors, and downstream users such as plastic manufacturers and chemical producers. Its demand is closely tied to global oil production trends and the growth of industries relying on polymer and synthetic material production.

The growth of the naphtha market is primarily driven by rising demand from the petrochemical industry. Naphtha is the primary feedstock for manufacturing key building blocks such as ethylene, propylene, and butadiene. With the increasing consumption of plastics and synthetic fibers worldwide, the reliance on naphtha continues to rise. According to an industry report, Universal Fuel Technologies Secures $3 Million to Halve Cost of Sustainable Aviation Fuel Production

Demand for naphtha remains strong in regions with fewer available alternative feedstocks like ethane. Countries with limited natural gas resources rely heavily on naphtha to maintain their petrochemical output. Additionally, the shift toward urbanization and industrialization, particularly in emerging economies, has increased the consumption of end-use products derived from naphtha, such as packaging, automotive parts, and construction materials.

Key Takeaways

- Global Naphtha Market is expected to be worth around USD 391.4 billion by 2034, up from USD 267.0 billion in 2024, and grow at a CAGR of 3.9% from 2025 to 2034.

- Light Naphtha accounted for 58.3% due to its high usage in steam cracking processes globally.

- Crude oil remained the dominant source with an 83.2% share, driven by integrated refinery operations worldwide.

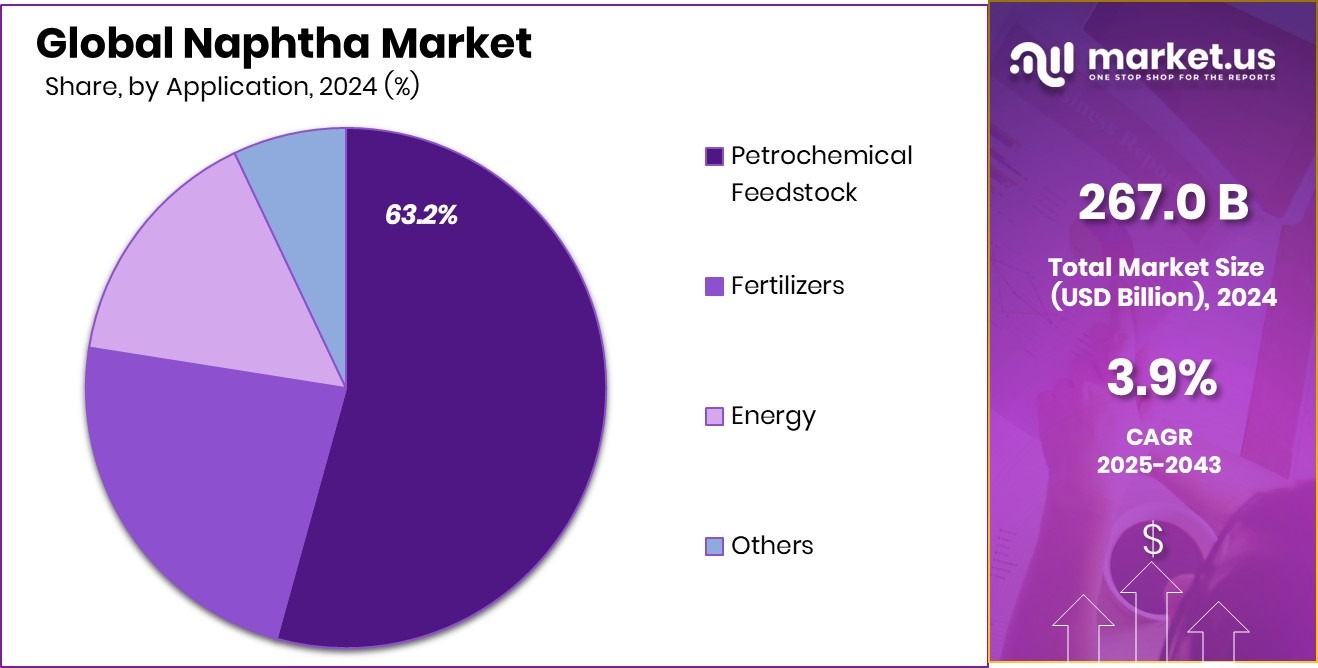

- Petrochemical feedstock led with a 63.2% share, supported by strong demand for plastics and synthetic materials.

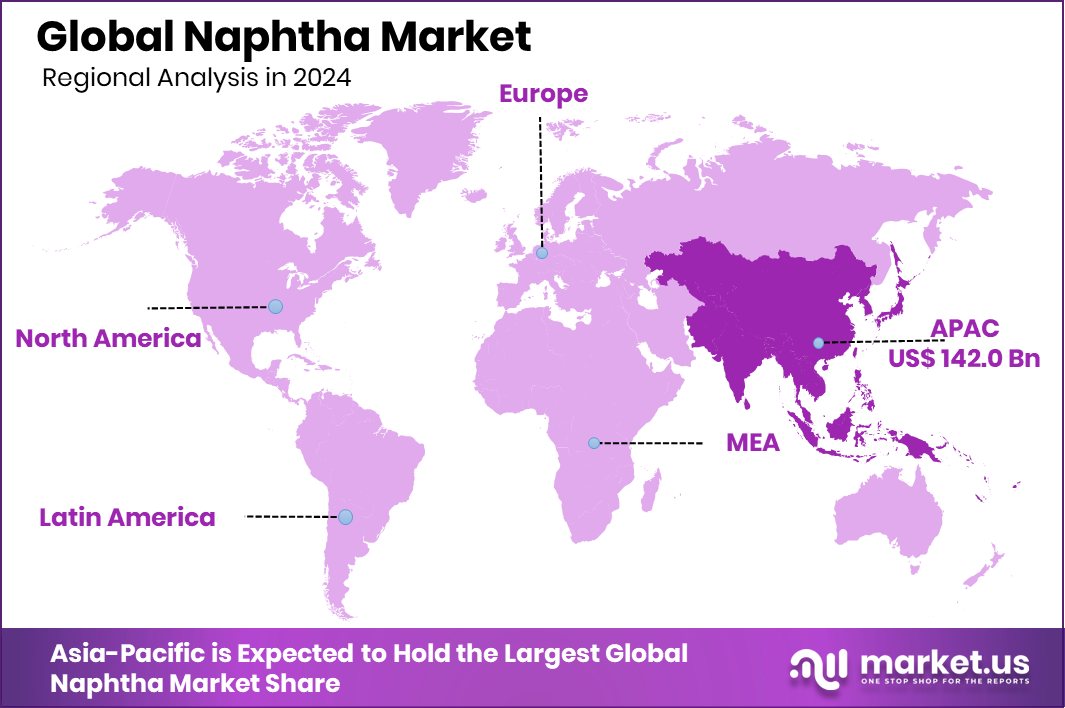

- The Asia-Pacific naphtha market reached a value of USD 142.0 billion in 2024.

By Type Analysis

Light Naphtha dominates with 58.3% due to its efficiency in petrochemical cracking.

In 2024, Light Naphtha held a dominant market position in the By Type segment of the Naphtha Market, with a 58.3% share. This leading share can be attributed to its wide-ranging industrial applications and greater compatibility with steam cracking units for olefin production.

Light naphtha, being lighter in molecular weight and containing more paraffinic hydrocarbons, is preferred by petrochemical industries, especially for producing ethylene, propylene, and other key derivatives used in plastics, resins, and synthetic materials. Its cleaner-burning nature and higher hydrogen-to-carbon ratio also make it more suitable for high-efficiency processing.

Another contributing factor to light naphtha’s dominance is its increasing utilization as a blending component in gasoline production, driven by fuel quality regulations and demand for cleaner-burning transport fuels. The rising consumption of plastic-based products across packaging, automotive, and construction industries further amplified the feedstock demand for light naphtha.

Additionally, the availability of light naphtha from both refinery distillation and condensate splitting ensures a more stable and consistent supply chain for industrial users. Overall, the segment’s strong performance in 2024 reflects the ongoing shift toward feedstock efficiency, processing flexibility, and high-output petrochemical manufacturing across global markets.

By Source Analysis

Crude oil remains the main source, contributing 83.2% of global naphtha supply.

In 2024, Crude Oil held a dominant market position in the By Source segment of the Naphtha Market, with an 83.2% share. This substantial share reflects the longstanding reliance of the refining industry on crude oil as the primary feedstock for naphtha production.

Crude oil-derived naphtha remains widely favored due to its consistent availability, well-established refining infrastructure, and compatibility with a broad range of downstream applications, particularly in the petrochemical and fuel blending sectors.

Refineries across the globe continue to process crude oil to extract naphtha fractions through atmospheric and vacuum distillation. The integrated nature of most refinery setups makes crude oil an economically viable and logistically efficient source. Moreover, with many nations expanding their refining capacities to meet domestic and export demands, the output of crude-based naphtha remains steady and scalable.

The versatility of crude oil in producing both light and heavy grades of naphtha further enhances its relevance in meeting various industry requirements. As a result, in 2024, the crude oil segment remained the cornerstone of naphtha production, underpinning its dominant position in the market with strong operational, economic, and supply chain advantages.

By Application Analysis

Petrochemical feedstock accounts for 63.2% due to demand for plastics and polymers.

In 2024, Petrochemical Feedstock held a dominant market position in the By Application segment of the Naphtha Market, with a 63.2% share. This leadership is primarily driven by the extensive use of naphtha in steam crackers for the production of key petrochemicals such as ethylene, propylene, and butadiene.

These building blocks are essential in manufacturing plastics, synthetic rubbers, and other chemical derivatives, which are in high demand across industries like packaging, construction, automotive, and textiles.

The preference for naphtha as a petrochemical feedstock stems from its superior performance in generating higher yields of light olefins, especially in regions where alternative feedstocks like ethane are limited. Additionally, the growing industrialization and urbanization in developing economies have accelerated demand for plastic-based consumer goods and infrastructure materials, further reinforcing the role of naphtha in petrochemical synthesis.

Refineries have also adapted operations to align with this rising demand, prioritizing naphtha output specifically for downstream petrochemical use. With its ability to serve as a reliable and high-yield raw material, the petrochemical feedstock segment retained its leading position in the naphtha market in 2024, reflecting a strong and stable consumption pattern globally.

Key Market Segments

By Type

- Light Naphtha

- Heavy Naphtha

By Source

- Crude Oil

- Natural Gas

- Others

By Application

- Petrochemical Feedstock

- Fertilizers

- Energy

- Others

Driving Factors

High Petrochemical Demand Drives Naphtha Consumption Growth

One of the major driving factors of the naphtha market is the rising demand from the petrochemical industry, which heavily depends on naphtha as a raw material. Naphtha is widely used in steam crackers to produce ethylene, propylene, and other important building blocks for plastics, synthetic fibers, and industrial chemicals. As global demand for plastic products continues to grow—especially in packaging, automotive parts, and consumer goods—more naphtha is required to support production.

Countries in Asia, especially China and India, are expanding their petrochemical capacity, which further fuels naphtha consumption. This strong industrial demand ensures that naphtha remains a key input in chemical manufacturing, making petrochemical growth a leading factor behind the steady rise of the global naphtha market.

Restraining Factors

Rising Use of Alternatives Limits Naphtha Demand

One of the key restraining factors in the naphtha market is the increasing use of alternative feedstocks like ethane, propane, and bio-based materials in the petrochemical industry. These alternatives are often more cost-effective, environmentally friendly, and efficient in producing specific chemicals such as ethylene and propylene. In regions like North America and the Middle East, where natural gas liquids (NGLs) like ethane are easily available, companies prefer them over naphtha for economic reasons.

Additionally, with the global focus shifting toward sustainability and lower carbon emissions, industries are exploring greener substitutes that reduce dependence on oil-based naphtha. As a result, this shift in feedstock preference is slowing down the overall demand growth for naphtha in some key global markets.

Growth Opportunity

Cleaner Fuel Demand Creates New Naphtha Opportunities

A major growth opportunity for the naphtha market lies in its potential use as a cleaner-burning alternative fuel, especially in developing countries. As governments and industries aim to reduce emissions and shift away from coal and heavy oils, naphtha offers a more environmentally friendly option for power generation and industrial heating.

Its lower sulfur content and cleaner combustion make it suitable for countries with rising energy needs but limited access to natural gas infrastructure. Additionally, naphtha’s role as a transitional fuel supports global energy security while cleaner technologies are being developed. This shift toward cleaner fuel sources is expected to open new markets for naphtha, creating future demand beyond its traditional role in petrochemicals and gasoline blending.

Latest Trends

Shift Toward Heavy Naphtha for Aromatics Production

One of the latest trends in the naphtha market is the increasing shift toward heavy naphtha for aromatics production, especially in regions with growing demand for chemicals like benzene, toluene, and xylene. These aromatics are essential for producing everyday items such as detergents, paints, plastics, and textiles. Heavy naphtha, with its higher content of naphthenes and aromatics precursors, is better suited for catalytic reforming processes that extract these valuable chemicals.

As demand for aromatics rises globally—driven by packaging, consumer products, and construction—refiners are adjusting their operations to increase the output of heavy naphtha. This trend reflects a broader market adjustment where producers are optimizing feedstock quality based on downstream needs, especially in countries focused on expanding petrochemical output.

Regional Analysis

In 2024, Asia-Pacific held a 53.2% share, dominating the global naphtha market significantly.

In 2024, Asia-Pacific emerged as the dominant region in the global naphtha market, accounting for 53.2% of the total share and reaching a market value of USD 142.0 billion. This strong leadership is primarily supported by the region’s high consumption in the petrochemical sector, especially in countries like China, India, South Korea, and Japan, where demand for plastics and synthetic materials continues to rise rapidly.

The presence of large-scale refineries and steam cracker units further strengthens the region’s position in the global supply chain. In contrast, North America and Europe maintained moderate shares, driven by established refining operations and steady demand in industrial and fuel applications.

Meanwhile, the Middle East & Africa region continued to utilize its upstream production strengths, contributing to the export supply, while Latin America showed limited market traction, reflecting smaller-scale industrial demand and infrastructure.

Overall, Asia-Pacific’s industrial growth, refinery integration, and strong downstream consumption patterns have firmly positioned it as the leading market for naphtha in 2024, outpacing other global regions by a wide margin in both volume and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Chevron continued to play a pivotal role in the global naphtha market through its integrated refining and petrochemical operations. The company’s robust refining capacity across North America and Asia-Pacific supports stable naphtha production, especially for downstream applications like gasoline blending and olefin production. Chevron’s strategic focus on operational efficiency and optimizing feedstock output has allowed it to maintain relevance in a market increasingly shaped by shifting demand patterns and evolving fuel specifications.

Exxon Mobil Corporation, with its expansive global footprint and deep investments in chemical and refining infrastructure, remains one of the key suppliers of high-quality naphtha. The company benefits from a well-balanced portfolio that spans both light and heavy naphtha outputs. In 2024, its continued investments in petrochemical integration, especially in Asia and the U.S. Gulf Coast, ensured steady production and supply alignment with regional demand trends.

UPM, traditionally focused on bio-based products, represents a distinct approach to naphtha market participation. Through its innovation in bio-naphtha production, UPM offers a renewable alternative that aligns with growing environmental and sustainability standards. Its contribution, though smaller in scale, highlights a long-term trend toward diversification and low-emission solutions within the market.

Neste, recognized for its expertise in renewable fuels, has established a clear position in the bio-naphtha space, especially within Europe. In 2024, its operations continued to reflect a growing market interest in sustainable naphtha substitutes, supported by policy incentives and demand from eco-conscious industries. Neste’s output serves niche, high-value applications such as bioplastics and green chemicals.

Top Key Players in the Market

- Chevron

- Exxon Mobil Corporation

- UPM

- Neste

- LG Chem

- Mangalore Refinery and Petrochemicals Limited

- Dakota Gasification Company

- SABIC

- Formosa Petrochemical Corporation

- Sasol Limited

- Sinopec

- Lotte Chemical Corporation

- Saudi Aramco

- QatarEnergy

- Shell plc

- Other Key Players

Recent Developments

- In June 2025, Chevron began soliciting non-binding bids to sell its 50% stake in the Singapore Refining Company (SRC) refinery, which processes approximately 290,000 barrels per day. While not exclusive to naphtha, this refinery supports naphtha production for petrochemical and blending applications.

- In February 2025, Exxon Mobil arranged at least three shipments of around 55,000 metric tons each of naphtha to its new petrochemical complex in Huizhou, Guangdong, China, ahead of commercial operations.

Report Scope

Report Features Description Market Value (2024) USD 267.0 Billion Forecast Revenue (2034) USD 391.4 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Light Naphtha, Heavy Naphtha), By Source (Crude Oil, Natural Gas, Others), By Application (Petrochemical Feedstock, Fertilizers, Energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Chevron, Exxon Mobil Corporation, UPM, Neste, LG Chem, Mangalore Refinery and Petrochemicals Limited, Dakota Gasification Company, SABIC, Formosa Petrochemical Corporation, Sasol Limited, Sinopec, Lotte Chemical Corporation, Saudi Aramco, QatarEnergy, Shell plc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Chevron

- Exxon Mobil Corporation

- UPM

- Neste

- LG Chem

- Mangalore Refinery and Petrochemicals Limited

- Dakota Gasification Company

- SABIC

- Formosa Petrochemical Corporation

- Sasol Limited

- Sinopec

- Lotte Chemical Corporation

- Saudi Aramco

- QatarEnergy

- Shell plc

- Other Key Players