Global Nanochemicals Market Size, Share and Report Analysis By Product Type (Metal-Based Nanochemicals, Metal Oxide Nanochemicals, Carbon-Based Nanochemicals, Polymeric Nanochemicals, and Others), By Form (Powder, Dispersion / Suspension, Coatings, Emulsions, and Others), By Application (Electronics And Semiconductors, Energy And Power, Healthcare And Pharmaceuticals, Cosmetics And Personal Care, Coatings, Paints And Inks, Packaging, Automotive And Aerospace, Construction Materials, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175269

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

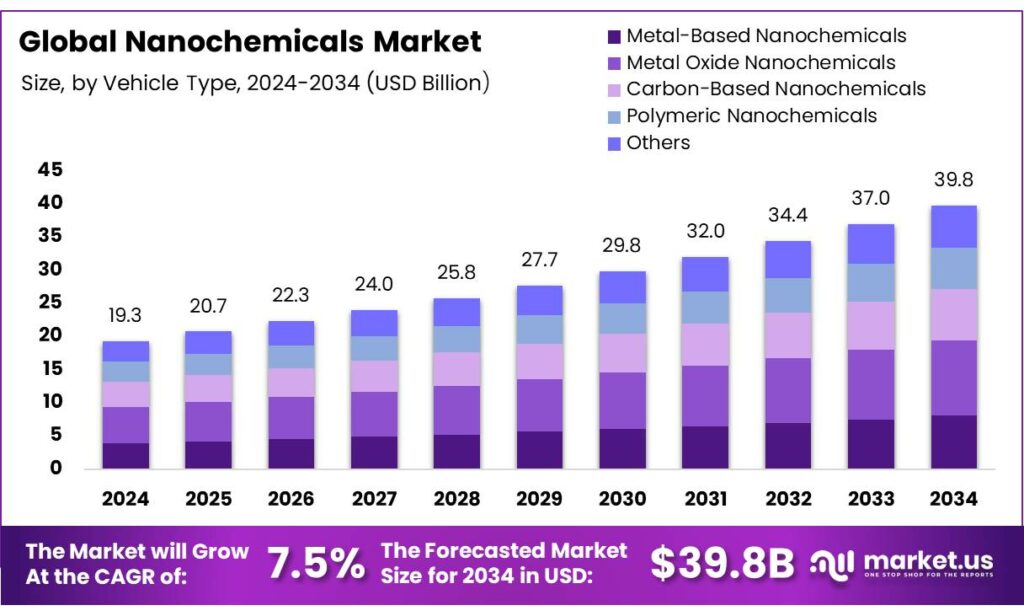

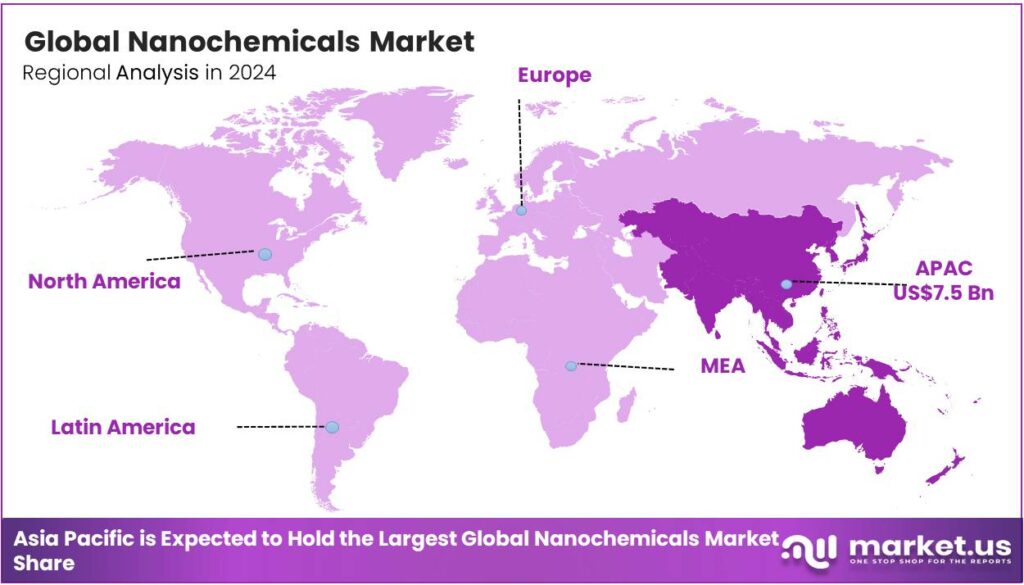

Global Nanochemicals Market size is expected to be worth around USD 39.8 Billion by 2034, from USD 19.3 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.1% share, holding USD 500.0 Million in revenue.

Nanochemicals, nanomaterials, are chemical substances or materials engineered at the nanoscale, typically between 1 and 100 nanometers in at least one dimension. At this scale, matter behaves differently than its bulk counterpart due to a massive increase in surface area and the emergence of quantum effects.

Its market is driven by the demand for advanced materials with unique properties that can enhance performance in various industrial applications. Key drivers in the market include the need for high-performance materials in electronics and semiconductors, where nanochemicals improve conductivity, miniaturization, and energy efficiency.

- According to a 2024 report by the United States Department of Energy, the Intergovernmental Panel on Climate Change estimated that GHG emissions associated with semiconductors would quadruple by 2030. The ultimate goal is to reverse this trend by increasing the energy efficiency of semiconductor applications 1,000-fold over the next 20 years, where nanochemicals would play a crucial part.

In industries such as healthcare, energy, and coatings, while having restricted applications, the nanochemicals are expected to grow in demand due to technological advancements. Despite the potential for applications in other sectors, the complexity of scaling production, regulatory concerns, and safety issues have limited their broader adoption.

- There were over 560 nanomedicines in clinical trials or other development stages as of 2021, and over 53% of these focus on oncology applications, with another 14% targeting infectious diseases.

Key Takeaways

- The global nanochemicals market was valued at USD 19.3 billion in 2024.

- The global nanochemicals market is projected to grow at a CAGR of 7.5% and is estimated to reach USD 39.8 billion by 2034.

- On the basis of product type, metal oxide nanochemicals dominated the market, constituting 28.5% of the total market share.

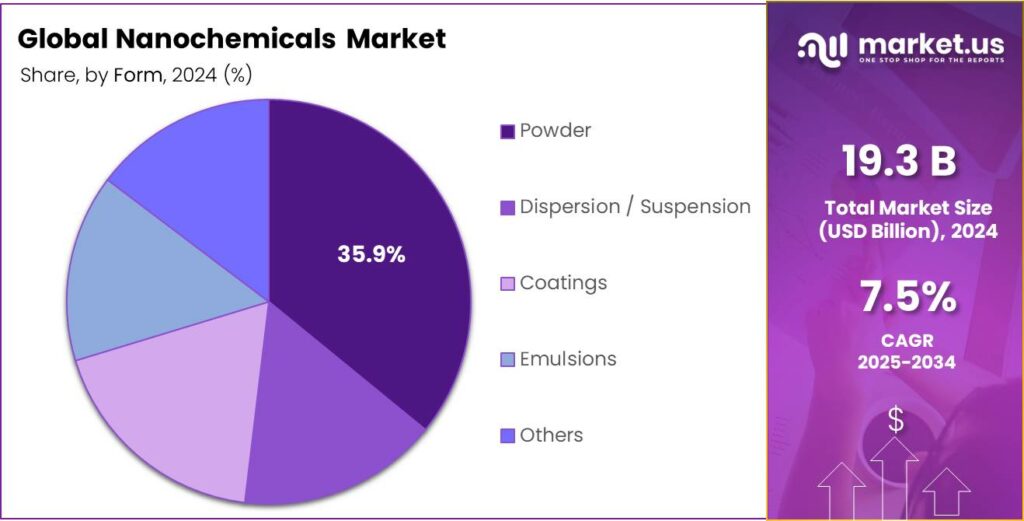

- Based on the form, powdered nanochemicals led the market, with a substantial market share of around 35.9%.

- Among the applications, the electronics & semiconductors industries held a major share in the nanochemicals market, 27.6% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the nanochemicals market, accounting for 38.1% of the total global consumption.

Product Type Analysis

Metal Oxide Nanochemicals are a Prominent Segment in the Market.

The nanochemicals market is segmented based on product type into metal-based nanochemicals, metal oxide nanochemicals, carbon-based nanochemicals, polymeric nanochemicals, and others. The metal oxide nanochemicals led the market, comprising 28.5% of the market share, due to their exceptional stability, versatility, and ease of synthesis. Metal oxides exhibit strong chemical and thermal stability, making them ideal for use in a variety of harsh environments.

Additionally, their high surface area and tunable properties, such as photocatalytic activity and semiconductor characteristics, enable diverse applications in fields such as electronics, catalysis, and environmental remediation. Similarly, metal oxide nanoparticles are biocompatible and exhibit low toxicity, which is crucial for biomedical applications. These, along with relatively low cost and straightforward production methods, contribute to their broader adoption compared to other types of nanochemicals.

Form Analysis

Hydrolysis Held a Major Share of the Nanochemicals the Market.

On the basis of form, the nanochemicals market is segmented into powder, dispersion/suspension, coatings, emulsions, and others. The powdered nanochemicals held a major share in the market, comprising 35.9% of the market share. Powders are convenient for bulk production and can be directly integrated into manufacturing processes, such as in catalysis, ceramics, and electronics, without the need for additional processing steps.

In addition, they offer superior control over the material’s particle size and surface area, which are crucial for ensuring desired properties. In contrast, dispersions or suspensions require stable formulations to prevent aggregation, and emulsions or coatings may involve complex application techniques and additional equipment. Powders, within their simplicity, versatility, and stability, are more cost-effective and easier to work with, making them the preferred form for many applications.

Application Analysis

Nanochemicals are Mostly Utilized in the Electronics & Semiconductors Industries.

Based on the applications, the nanochemicals market is segmented into electronics & semiconductors, energy & power, healthcare & pharmaceuticals, cosmetics & personal care, coatings, paints & inks, packaging, automotive & aerospace, construction materials, and others. Among the applications of the nanochemicals, 27.6% of the product consumed globally is for the electronics & semiconductors industries. Nanochemicals are predominantly used in electronics and semiconductors due to their ability to enhance material properties critical for miniaturization, efficiency, and performance.

The electronics industry demands materials with high conductivity, thermal stability, and precision at the nanoscale, which are provided by nanochemicals such as metal oxide nanoparticles, quantum dots, and carbon nanotubes. These materials enable faster, smaller, and more energy-efficient devices, such as transistors and memory chips.

In contrast, while nanochemicals show promise in other industries, such as energy, healthcare, and cosmetics, their applications often face greater challenges in terms of regulatory hurdles, safety concerns, and scalability. Furthermore, the rapid pace of technological innovation and the established demand in the semiconductor sector make it the primary focus for nanochemical use.

Key Market Segments

By Product Type

- Metal-Based Nanochemicals

- Silver Nanoparticles

- Gold Nanoparticles

- Copper Nanoparticles

- Metal Oxide Nanochemicals

- Titanium Dioxide (TiO₂)

- Zinc Oxide (ZnO)

- Silicon Dioxide (SiO₂)

- Aluminum Oxide

- Carbon-Based Nanochemicals

- Carbon Nanotubes (CNTs)

- Graphene

- Fullerenes

- Others

- Polymeric Nanochemicals

- Nanopolymers

- Dendrimers

- Nanogels

- Others

By Form

- Powder

- Dispersion / Suspension

- Coatings

- Emulsions

- Others

By Application

- Electronics & Semiconductors

- Energy & Power

- Batteries

- Fuel cells

- Supercapacitors

- Healthcare & Pharmaceuticals

- Cosmetics & Personal Care

- Coatings, Paints & Inks

- Packaging

- Automotive & Aerospace

- Construction Materials

- Others

Drivers

Demand for High-Performance Materials in Electronics and Semiconductor Industries Drives the Nanochemicals Market.

The increasing demand for high-performance materials in the electronics and semiconductor industries is a critical driver of the nanochemicals market. Advanced semiconductor devices, such as microprocessors and memory chips, require materials with superior electrical, thermal, and mechanical properties. Nanochemicals, particularly nanoparticle-based formulations, are essential for fabricating these materials, enhancing conductivity, miniaturization, and energy efficiency.

- According to the United States Department of Energy, since 2010, overall semiconductor application energy use has doubled every three years, and by 2030, the semiconductor industry could consume nearly 20% of global energy production.

For instance, the use of nano-silver in soldering materials has improved the reliability and performance of electronic components by enhancing thermal and electrical conductivity. The rare earth elements and other advanced materials are significant for the development of semiconductors. Moreover, these nanomaterials are pivotal for addressing scaling challenges in transistor development and circuit miniaturization.

- According to the United States Semiconductor Industry Association (SIA), the semiconductor industry directly employed over a third of a million workers in the United States alone, and U.S. semiconductor sales totaled US$318 billion in 2024. As these numbers grow, there is a demand for technological advancements in the industry, including nanochemicals.

Additionally, nanostructured coatings are integral to the semiconductor manufacturing process, aiding in photomask patterning and anti-reflective coatings. As manufacturers pursue 5nm and sub-5nm node technologies, the reliance on nanochemicals for photolithography and etching processes intensifies, further pushing the demand for these materials. The advancements in semiconductor fabrication and the need for high-performance materials are significantly propelling the demand for nanochemicals in these industries.

Restraints

Scalability and Production Complexity Might Hinder the Growth of the Nanochemicals Market.

Scalability and production complexity pose significant challenges for the nanochemicals market, particularly in maintaining consistency and quality during mass production. Nanomaterials, such as nanoparticles and nanocoatings, often exhibit unique properties at the nanoscale that are difficult to replicate on a large scale. The U.S. National Nanotechnology Initiative (NNI) has highlighted scalability as a primary issue, emphasizing the demand for innovative methods to produce nanomaterials with uniform size, shape, and distribution across industrial quantities.

Similarly, the complexity of synthesizing nanochemicals is illustrated by the limitations in existing manufacturing methods. For instance, in semiconductor manufacturing, atomic layer deposition (ALD) processes, essential for creating ultra-thin films, face challenges in scalability due to the high precision required at nanoscale dimensions. The small deviations in thickness or composition can lead to defects, impacting device performance.

- The U.S. National Nanotechnology Initiative (NNI) applied a budget of US$113.06 million for fiscal year 2025, specifically allocated to PCA 2 (Nanotechnology-Enabled Applications), aimed to address challenges in metrology, scale-up, and manufacturing technologies.

Additionally, scaling up production of nanomaterials requires compliance with stringent environmental health and safety regulations, which complicate large-scale manufacturing processes. While nanochemicals are integral to advancing technologies, the complexities of scaling production while maintaining material integrity and adhering to safety standards are ongoing challenges for the market.

Opportunity

Applications of Nanochemicals Across the Healthcare Industry Create Opportunities in the Market.

Nanochemicals present significant opportunities for advancement in healthcare applications, particularly in drug delivery, diagnostics, and imaging. According to a study by the U.S. National Institutes of Health (NIH), the nanoparticles, such as liposomes and dendrimers, enable targeted drug delivery, improving the bioavailability and therapeutic efficacy of treatments while reducing side effects. For instance, liposomal formulations of chemotherapeutic agents, such as Doxil, have shown enhanced targeting of cancer cells, offering more effective treatments with lower systemic toxicity.

Similarly, nanoparticles, including quantum dots and gold nanoparticles, are increasingly utilized in biosensors for early disease detection. The National Cancer Institute (NCI) has highlighted the use of gold nanoparticles in imaging agents, which enhance the contrast and resolution in molecular imaging, aiding in the detection of tumors at earlier stages.

In addition, nanomaterials are being integrated into wound care. For instance, silver nanoparticles, with antimicrobial properties, are used in dressings to prevent infections in chronic wounds. The U.S. Food and Drug Administration (FDA) has approved silver-based products for clinical use, recognizing their effectiveness in preventing infection and promoting faster healing. The nanochemicals offer transformative potential in various healthcare sectors, contributing to more efficient treatments, early detection, and better patient outcomes.

Trends

Shift Towards Green Nanochemistry.

The shift towards green nanochemistry is an emerging trend in the nanochemicals market, driven by the need for environmentally sustainable and economically viable production methods. The U.S. EPA has emphasized the importance of green chemistry principles in nanomaterial synthesis, including the reduction of toxic chemicals, energy consumption, and waste generation. Green nanochemistry focuses on using renewable resources and environmentally friendly processes, such as aqueous-based synthesis and biogenic methods, to produce nanomaterials with minimal environmental impact.

For instance, the National Nanotechnology Initiative (NNI) supported research into biosynthesis methods where plant extracts, fungi, and bacteria are used to produce nanoparticles, offering a safer alternative to traditional chemical reduction processes. Similarly, the use of green methods in nanoparticle production has been exemplified by the development of silver nanoparticles using plant extracts by NIST, which has been shown to reduce hazardous byproducts.

Additionally, the European Commission’s Joint Research Centre (JRC) explored the potential of green nanomaterials in energy applications, such as photovoltaics and batteries, which require less harmful solvents during production. This shift towards sustainable, green nanochemistry is increasingly becoming a priority, as researchers seek to mitigate the environmental impact of nanomaterial production while enhancing their functionality and efficiency in various applications.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Disruption in the Production of Nanochemicals.

The geopolitical tensions are increasingly influencing the nanochemicals market, primarily through supply chain disruptions, regulatory changes, and shifts in research collaboration. China controls over 90% of global rare earth refining capacity, which includes elements vital for nanotech applications, such as specific magnets and catalysts. The European Union imports over 98% of its REEs from China and 78% of its lithium from Chile, making its nanochemical-dependent industries vulnerable to external shocks and export restrictions. Consequently, the EU’s Critical Raw Materials Act aims to cap reliance on any single third country for strategic materials at 65% by 2030.

The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) has implemented export restrictions on advanced materials, including nanomaterials, to certain countries due to national security concerns. For instance, the U.S. had added several Chinese entities to its Entity List, restricting access to critical raw materials, leading to increased costs and delays in sourcing materials necessary for nanochemical production.

Moreover, the European Union’s Strategic Autonomy agenda stresses the need for regional self-sufficiency in critical raw materials, such as rare earth elements used in nanomaterial synthesis. This policy shift has prompted the EU to explore alternative sources and increase investment in domestic nanotechnology research to reduce reliance on geopolitically sensitive regions.

Additionally, geopolitical tensions have disrupted international research collaborations. The National Nanotechnology Initiative (NNI) in the U.S. has raised concerns over the impact of restricted international partnerships on nanomaterial innovation and development. Consequently, the geopolitical landscape is contributing to market volatility, increased production costs, and strategic shifts in nanochemical supply chains.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Nanochemicals Market.

In 2024, the Asia Pacific dominated the global nanochemicals market, holding about 38.1% of the total global consumption, driven by substantial investments in nanotechnology and the region’s growing industrial base. The region’s dominance is evident in its strategic focus on nanomaterial research and development, with countries such as China, Japan, and South Korea leading the way.

- China leads the world in nanotechnology development, with the nation accounting for more than 464,000 related patents since 2000, representing 43% of the international total.

According to the Chinese Ministry of Science and Technology (MOST), China has become a global leader in nanomaterial research, with significant government funding directed toward advancing nanotechnology in sectors such as electronics, energy, and healthcare. In Japan, the National Institute for Nanotechnology (NIN) and other government agencies have been promoting the development and application of nanochemicals, particularly in semiconductors and pharmaceuticals, which are pivotal sectors for the country’s economy.

- In fiscal year 2025 (April 2025-March 2026), the Japanese government is set to allocate approximately 332.8 billion yen (about US$2.1 billion) to support the research, development, and production of semiconductors.

Additionally, South Korea’s Ministry of Science and ICT (MSIT) has invested heavily in nanomaterials for the electronics and automotive industries, highlighting the importance of advanced nanotechnologies in supporting its manufacturing capabilities. Similarly, the region’s leading position is supported by a robust regulatory framework and regional cooperation, which fosters cross-border research and standardization of nanomaterials across the Asia Pacific.

- India ranks third globally in research publications on nanotechnology, with the successful creation of advanced nanomaterials such as nanoshells and nano phosphors.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of nanochemicals invest heavily in R&D to develop innovative nanomaterials with enhanced properties, such as higher stability, conductivity, and biocompatibility, which can meet the evolving needs of sectors such as electronics, healthcare, and energy. In addition, they emphasize cost-effective and scalable production methods, particularly through green nanochemistry techniques, which reduce environmental impact and improve manufacturing efficiency.

Furthermore, there is a focus on strategic partnerships with research institutions and universities for cutting-edge advancements and access to new technologies. Similarly, these companies focus on building strong intellectual property portfolios to protect innovations. Moreover, they prioritize regulatory compliance and safety standards to address concerns around nanomaterials, ensuring faster market entry and broader acceptance in regulated industries, such as healthcare and pharmaceuticals.

The Major Players in The Industry

- Cabot Corporation

- NanoComposix

- American Elements

- Strem Chemicals

- SkySpring Nanomaterials

- Nanocs Inc.

- Sigma-Aldrich/Merck

- NanoLab Inc.

- Arkema

- Evonik Industries

- Elementis Specialties

- PlasmaChem GmbH

- NanoIntegris

- Haydale Graphene Industries

- Nanostructured & Amorphous Materials Inc.

- Other Key Players

Key Development

- In September 2025, Nano One Materials collaborated with Sumitomo Metal Mining to commercialize its nanomaterial technology for battery cathode materials, focusing on cost-competitive and sustainable production.

- In January 2025, Evonik announced the strategic merger of its silica and silane business lines into a company called Smart Effects to supply high-purity silica, metal oxides, and silanes essential for lithium-ion batteries, semiconductors, and displays, supporting the industry’s green transformation.

Report Scope

Report Features Description Market Value (2024) US$19.3 Bn Forecast Revenue (2034) US$39.8 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Metal-Based Nanochemicals, Metal Oxide Nanochemicals, Carbon-Based Nanochemicals, Polymeric Nanochemicals, and Others), By Form (Powder, Dispersion / Suspension, Coatings, Emulsions, and Others), By Application (Electronics & Semiconductors, Energy & Power, Healthcare & Pharmaceuticals, Cosmetics & Personal Care, Coatings, Paints & Inks, Packaging, Automotive & Aerospace, Construction Materials, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Cabot Corporation, NanoComposix, American Elements, Strem Chemicals, SkySpring Nanomaterials, Nanocs, Sigma-Aldrich/Merck, NanoLab Inc., Arkema, Evonik Industries, Elementis Specialties, PlasmaChem GmbH, NanoIntegris, Haydale Graphene Industries, Nanostructured & Amorphous Materials Inc., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Cabot Corporation

- NanoComposix

- American Elements

- Strem Chemicals

- SkySpring Nanomaterials

- Nanocs Inc.

- Sigma-Aldrich/Merck

- NanoLab Inc.

- Arkema

- Evonik Industries

- Elementis Specialties

- PlasmaChem GmbH

- NanoIntegris

- Haydale Graphene Industries

- Nanostructured & Amorphous Materials Inc.

- Other Key Players