Global Mustard Oil Market Size, Share, Growth Analysis By Type (Black Mustard, Brown Mustard, White Mustard), By Packaging Type (Pouches, Jars, Cans, Bottles), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Others), By Distribution Channel ( Hypermarkets and Supermarkets, Convenience Stores, E-Commerce, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158357

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

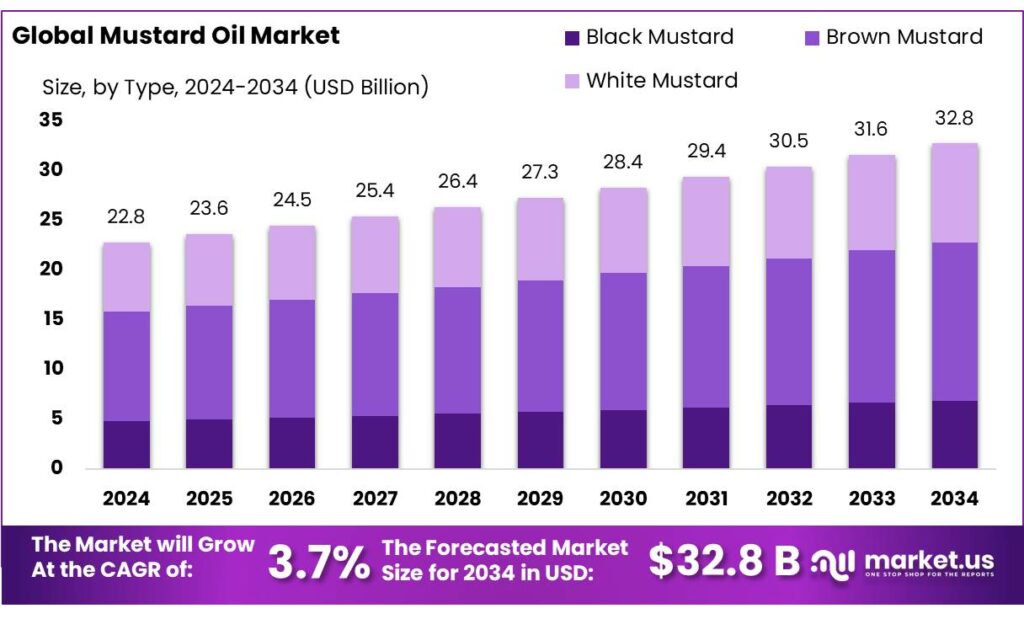

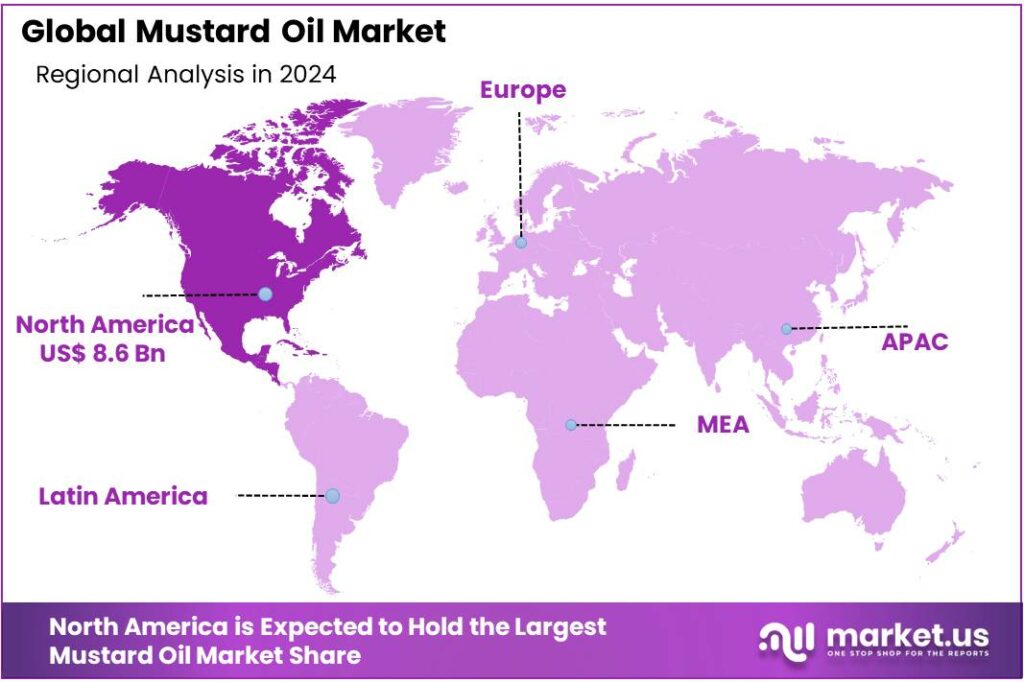

The Global Mustard Oil Market size is expected to be worth around USD 32.8 Billion by 2034, from USD 22.8 Billion in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.9% share, holding USD 8.6 Billion in revenue.

The mustard oil industry in India plays a pivotal role in the nation’s edible oil sector, characterized by significant production, consumption, and export activities. In the fiscal year 2023–2024, India produced a record 12 million metric tonnes of mustard oil, marking a 13% increase in quantity and a 35% rise in value compared to the previous year. Despite this substantial production, India remains the world’s largest importer of edible oils, fulfilling approximately two-thirds of its demand through imports.

The Indian government has recognized the need to enhance domestic oilseed production to reduce import dependency. In October 2024, the government approved a ₹10,100 crore initiative aimed at doubling the country’s edible oil output by 2030–31. This program focuses on increasing oilseed productivity through the promotion of high-yielding, high-oil content varieties and the adoption of advanced technologies such as genome editing.

Additionally, the government has implemented the Minimum Support Price (MSP) mechanism for mustard seeds, administered through the National Agricultural Cooperative Marketing Federation of India (NAFED), to ensure fair prices for farmers and stabilize the market.

Several factors are propelling the growth of the mustard oil industry. The Indian government’s initiatives, such as the National Mission on Edible Oils – Oil Palm (NMEO-OP), have allocated Rs. 11,040 crore to enhance domestic oilseed production. Additionally, the Mustard Model Farm project, initiated by the Solvent Extractors’ Association of India (SEA) in collaboration with Solidaridad, has expanded from 400 to over 3,500 farms across multiple states, achieving a 35% increase in yield per hectare compared to traditional farming method.

Key Takeaways

- Mustard Oil Market size is expected to be worth around USD 32.8 Billion by 2034, from USD 22.8 Billion in 2024, growing at a CAGR of 3.7%.

- Brown Mustard held a dominant market position, capturing more than a 48.6% share of the mustard oil market.

- Pouches held a dominant position in the mustard oil packaging segment, capturing more than a 34.2% share of the market.

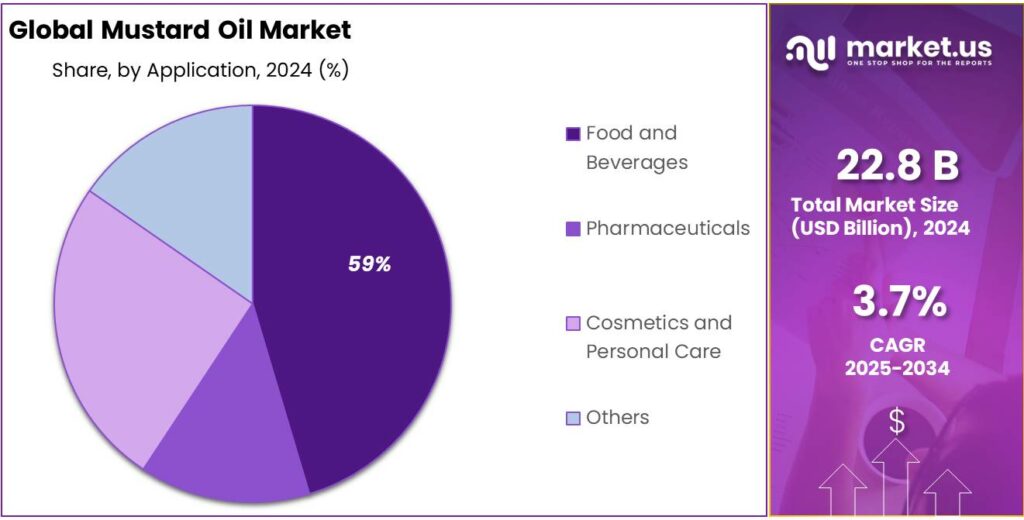

- Food and Beverages sector held a dominant position in the mustard oil market, capturing more than a 59.1% share.

- Hypermarkets and supermarkets dominated the mustard oil distribution landscape, capturing more than a 48.9% share of the market.

- North America emerged as the dominant region in the global mustard oil market, capturing a significant 37.9% share, translating to an estimated market size of approximately USD 8.6 billion.

By Type Analysis

Brown Mustard Oil Leads with 48.6% Market Share in 2024

In 2024, Brown Mustard held a dominant market position, capturing more than a 48.6% share of the mustard oil market in India. This significant share underscores its widespread acceptance and preference among consumers. The brown variety is particularly favored for its robust flavor and higher pungency, making it a staple in North and East Indian kitchens.

The popularity of Brown Mustard oil can be attributed to its traditional extraction methods, such as cold pressing, which are believed to preserve its natural nutrients and aroma. This method, often referred to as ‘Kachchi Ghani’ in India, has seen a resurgence as consumers increasingly seek natural and unrefined products. The oil’s rich content of omega-3 fatty acids and antioxidants further enhances its appeal among health-conscious individuals.

By Packaging Type Analysis

Pouches Dominate Mustard Oil Packaging with 34.2% Market Share in 2024

In 2024, pouches held a dominant position in the mustard oil packaging segment, capturing more than a 34.2% share of the market. This preference for pouches can be attributed to their convenience, cost-effectiveness, and suitability for both urban and rural consumers.

The rise in pouch packaging aligns with the growing demand for smaller, affordable pack sizes, catering to households with varying consumption needs. Pouches offer flexibility in packaging sizes, from small single-use packets to larger family packs, accommodating diverse consumer preferences.

By Application Analysis

Food and Beverages Lead Mustard Oil Market with 59.1% Share in 2024

In 2024, the Food and Beverages sector held a dominant position in the mustard oil market, capturing more than a 59.1% share. This substantial share underscores the integral role of mustard oil in culinary applications across India. The oil’s robust flavor and high smoking point make it a preferred choice for various cooking methods, including frying, sautéing, and pickling.

The widespread use of mustard oil in Indian households is driven by its deep-rooted presence in regional cuisines, particularly in the northern and eastern parts of the country. Its versatility extends beyond cooking to include its use in traditional pickles and as a base for marinades, enhancing its appeal in the food industry.

By Distribution Channel Analysis

Hypermarkets & Supermarkets Lead Mustard Oil Distribution with 48.9% Share in 2024

In 2024, hypermarkets and supermarkets dominated the mustard oil distribution landscape, capturing more than a 48.9% share of the market. This substantial share reflects the growing consumer preference for large retail outlets that offer a wide variety of mustard oil brands and packaging options under one roof. The convenience of shopping in these establishments, coupled with promotional offers and bulk purchasing options, has made them the preferred choice for many consumers.

The trend towards organized retailing in India has been bolstered by the expansion of retail chains and the increasing number of hypermarket and supermarket outlets across urban and semi-urban areas. These retail formats provide consumers with easy access to quality mustard oil products, often accompanied by additional services such as home delivery and loyalty programs. The presence of multiple brands and packaging sizes in these stores allows consumers to make informed choices based on their preferences and budget.

Key Market Segments

By Type

- Black Mustard

- Brown Mustard

- White Mustard

By Packaging Type

- Pouches

- Jars

- Cans

- Bottles

By Application

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- E-Commerce

- Others

Emerging Trends

Surge in Mustard Oil Production and Government Support

India has experienced a significant surge in mustard oil production, positioning itself as the world’s largest producer of this essential edible oil. In the 2023–24 agricultural season, the country achieved a record output of approximately 12 million metric tonnes of mustard oil, primarily sourced from states like Rajasthan, Uttar Pradesh, Haryana, and Madhya Pradesh. This achievement underscores the growing importance of mustard oil in India’s edible oil landscape, driven by both domestic consumption and export opportunities.

The rise in production can be attributed to several factors, including favorable climatic conditions, increased acreage under mustard cultivation, and the adoption of high-yielding seed varieties. For instance, the introduction of the DMH-11 hybrid mustard variety has shown promising results, offering higher yields and resistance to certain pests, thereby enhancing overall productivity.

Recognizing the strategic importance of mustard oil in achieving self-sufficiency in edible oils, the Indian government has initiated several measures to bolster domestic production. In 2024, the government approved a substantial investment of ₹10,100 crore (approximately $1.2 billion) aimed at doubling the country’s edible oil output by 2030–31. This initiative focuses on enhancing oilseed productivity through the promotion of high-yielding, high-oil content varieties and the application of advanced technologies such as genome editing.

Furthermore, the government’s support extends to the establishment of model farms and the provision of training to farmers on best practices in mustard cultivation. These efforts aim to improve yield per hectare and ensure the sustainable growth of mustard oil production across the country.

Drivers

Health Benefits Driving Mustard Oil Consumption in India

Mustard oil has long been a staple in Indian kitchens, particularly in the northern and eastern regions. Its popularity is not only due to its distinct flavor but also because of its perceived health benefits. Studies have shown that regular consumption of mustard oil is associated with a lower risk of heart disease compared to other oils like sunflower oil. This is attributed to its high content of monounsaturated and polyunsaturated fatty acids, which are known to reduce bad cholesterol levels and lower the risk of cardiovascular diseases.

Furthermore, mustard oil contains omega-3 fatty acids and allyl isothiocyanate, compounds that possess anti-inflammatory properties. These properties may help in reducing inflammation in the body, potentially lowering the risk of chronic diseases such as arthritis and certain types of cancer.

A national survey revealed that more than 50% of the Indian population consumes mustard oil, with a significant preference in rural areas where over 75% of consumers use it as their primary cooking oil. This widespread consumption underscores the oil’s integral role in Indian culinary traditions and its acceptance as a healthier alternative to other oils.

In response to the growing demand for healthier cooking oils, the Indian government has introduced initiatives to boost domestic production. The National Mission on Edible Oils – Oilseeds (NMEO-OS) aims to increase oilseed production from 39 million tonnes in 2022–23 to 69.7 million tonnes by 2030–31. This initiative focuses on enhancing the production of key oilseed crops, including mustard, through improved cultivation practices and the promotion of high-yielding varieties.

Restraints

Challenges in Mustard Oil Production: Yield Gaps and Import Dependence

Despite mustard oil’s prominence in Indian kitchens, the sector faces significant challenges that hinder its growth and self-sufficiency. One of the primary obstacles is the substantial yield gap in mustard cultivation compared to global standards. While India ranks among the top producers of mustard, its average yield remains lower than that of other major producers. This disparity is attributed to factors such as outdated farming practices, inadequate irrigation facilities, and limited access to quality seeds. Consequently, the country’s production falls short of meeting domestic demand, leading to increased reliance on imports to bridge the gap.

In the fiscal year 2022–23, India imported approximately 16.5 million metric tons of edible oils, with palm oil accounting for about 57% of the total imports. This import dependency not only strains the nation’s foreign exchange reserves but also exposes it to global market fluctuations and geopolitical tensions affecting supply chains. The rising import bill underscores the urgency of addressing domestic production challenges to achieve self-sufficiency in edible oil.

To combat these issues, the Indian government has launched the National Mission on Edible Oils – Oilseeds (NMEO-OS), a Centrally Sponsored Scheme under the Krishonnati Yojana. With an outlay of ₹10,103.38 crore, the mission aims to boost oilseed production, focusing on crops like rapeseed-mustard, groundnut, and soybean. The initiative seeks to enhance productivity through the adoption of high-yielding varieties, improved agronomic practices, and better irrigation techniques. By 2030–31, the mission targets increasing edible oil production to 25.45 million metric tons, fulfilling approximately 72% of the projected domestic demand.

Additionally, the government has approved a ₹10,100 crore program aimed at doubling edible oil production within seven years. This program focuses on reducing import dependence by promoting domestic cultivation of oilseeds and enhancing processing capabilities. It emphasizes the need for strategic interventions, including the development of high-yielding, high-oil content varieties and the expansion of cultivation areas. The goal is to increase production from 12.7 million metric tons to 25.45 million tons by 2030–31.

Opportunity

Export Expansion: A Key Growth Opportunity for Mustard Oil

India’s mustard oil industry is experiencing a significant growth opportunity through increased export activities. In the fiscal year 2023–24, India exported approximately 4.89 million metric tonnes of mustard oil, valued at INR 15,370 crore (approximately USD 1.85 billion). This marks a 13% increase in volume and a 35% rise in value compared to the previous year.

The primary export destinations for Indian mustard oil include countries in the Middle East, North America, and Europe. For instance, the United Arab Emirates (UAE) imported 1.26 million kg, Canada 1.37 million kg, and the United States 1.26 million kg of crude mustard oil in 2023. These regions have a substantial demand for mustard oil due to its culinary uses and health benefits.

The Indian government’s initiatives have further bolstered this export growth. Under the National Mission on Edible Oils – Oilseeds (NMEO-OS), the government aims to increase domestic oilseed production, including mustard, to reduce import dependency. The mission targets enhancing edible oil production to 25.45 million metric tonnes by 2030–31, fulfilling approximately 72% of the projected domestic demand.

Additionally, the government’s approval of a ₹10,100 crore (approximately USD 1.2 billion) program aims to double edible oil production within seven years. This program focuses on reducing import dependence by promoting domestic cultivation of oilseeds and enhancing processing capabilities.

Regional Insights

North America Leads Mustard Oil Market with 37.9% Share in 2024

In 2024, North America emerged as the dominant region in the global mustard oil market, capturing a significant 37.9% share, translating to an estimated market size of approximately USD 8.6 billion. This commanding position underscores the region’s growing preference for mustard oil, driven by increasing health consciousness and the rising demand for plant-based cooking oils.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Adani Wilmar, now operating as AWL Agri Business, is a leading player in India’s edible oil market. In the fourth quarter of 2024, the company reported a 22% rise in net profit, reaching ₹1.9 billion, driven by a 45% surge in revenue from its core edible oils segment, which includes mustard oil. This growth underscores the company’s strong presence and consumer trust in its products.

Emami Agrotech, part of the Emami Group, is a significant player in the Indian edible oil industry. The company aims to achieve ₹2,000 crore in revenue from its foods business within the next three years, indicating its aggressive expansion plans. Emami Agrotech’s mustard oil offerings, under the ‘Emami Healthy & Tasty’ brand, contribute to this growth trajectory.

Established in 1965, B P Oil Mills is a pioneer in the mustard oil and linseed oil industry in India. The company’s flagship brand, ‘Hathi,’ has been catering to the Indian market for over 100 years, providing premium quality edible oils. With a turnover exceeding ₹1,000 crore, B P Oil Mills continues to be a trusted name in the industry.

Top Key Players Outlook

- Adani Wilmar Limited

- Emami Agro Ltd

- Mother Dairy Fruit & Vegetable Pvt. Ltd

- B P Oil Mills Limited

- Pansari Group

- Kriti Nutrients

- Manishankar Oils Pvt. Ltd.

- Ajanta Soya Limited

- Medikonda Nutrients

- Vigon International, LLC. (Azelis)

Recent Industry Developments

In January 2025, AWL Agri Business commenced operations at its integrated food processing plant in Gohana, Haryana. This facility, with an annual production capacity of 200,000 metric tons for edible oils, including mustard oil, marks a significant expansion in the company’s production capabilities

In January 2024, B P Oil Mills reported an operating revenue exceeding ₹1,000 crore, reflecting its significant presence in the Indian edible oil market.

Report Scope

Report Features Description Market Value (2024) USD 22.8 Bn Forecast Revenue (2034) USD 32.8 Bn CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Black Mustard, Brown Mustard, White Mustard), By Packaging Type (Pouches, Jars, Cans, Bottles), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Others), By Distribution Channel ( Hypermarkets and Supermarkets, Convenience Stores, E-Commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adani Wilmar Limited, Emami Agro Ltd, Mother Dairy Fruit & Vegetable Pvt. Ltd, B P Oil Mills Limited, Pansari Group, Kriti Nutrients, Manishankar Oils Pvt. Ltd., Ajanta Soya Limited, Medikonda Nutrients, Vigon International, LLC. (Azelis) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adani Wilmar Limited

- Emami Agro Ltd

- Mother Dairy Fruit & Vegetable Pvt. Ltd

- B P Oil Mills Limited

- Pansari Group

- Kriti Nutrients

- Manishankar Oils Pvt. Ltd.

- Ajanta Soya Limited

- Medikonda Nutrients

- Vigon International, LLC. (Azelis)