Global Multi-cloud Networking Market Size, Share Analysis By Component (Solutions, Services), By Deployment (Public Cloud, Private Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Vertical (IT & ITeS, BFSI, Retail & Ecommerce, Healthcare & Life Sciences, Transportation & Logistics, Manufacturing, Media & Entertainment, Energy & Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155716

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

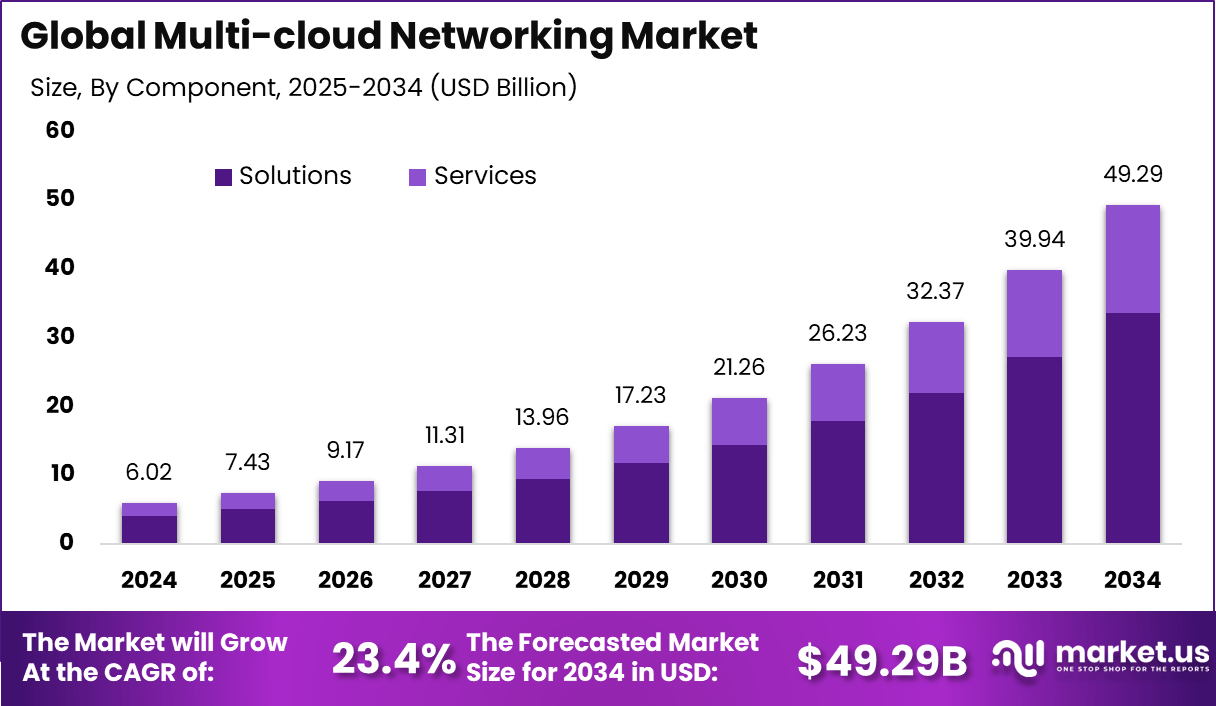

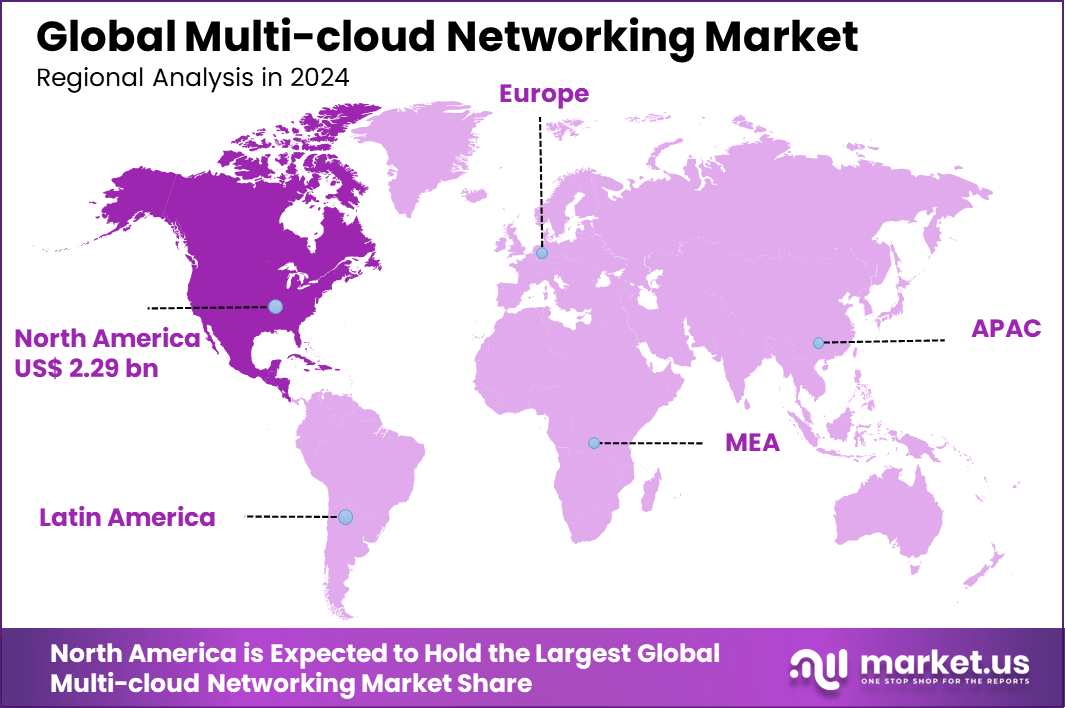

The Global Multi-cloud Networking Market size is expected to be worth around USD 49.29 billion by 2034, from USD 6.02 billion in 2024, growing at a CAGR of 23.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.1% share, holding USD 2.29 billion in revenue.

The market for multi-cloud networking is driven by the growing enterprise need to avoid vendor lock-in, enhance operational flexibility, and optimize workload performance across diverse cloud platforms. As organizations increasingly adopt hybrid and multi-cloud strategies, they require seamless, secure, and scalable interconnectivity between environments like AWS, Azure, and Google Cloud.

The rise of distributed applications, edge computing, and AI workloads further amplifies demand for dynamic, high-performance networking solutions. These drivers are compelling businesses to invest in platforms that enable centralized management, consistent policy enforcement, and real-time data flow across complex, multi-cloud ecosystems.

For instance, in April 2025, DigitalOcean introduced Partner Network Connect, a solution designed to deliver secure, high-performance multi-cloud connectivity for small and mid-sized businesses. The platform enables seamless integration with major cloud providers, allowing businesses to build and scale distributed applications without compromising on security or performance.

Key Takeaway

- The Solutions segment led the Global Multi-cloud Networking Market in 2024 with a 68.1% share, reflecting strong demand for integrated offerings.

- The Public Cloud segment dominated with a 62.3% share, highlighting its role as the preferred deployment model.

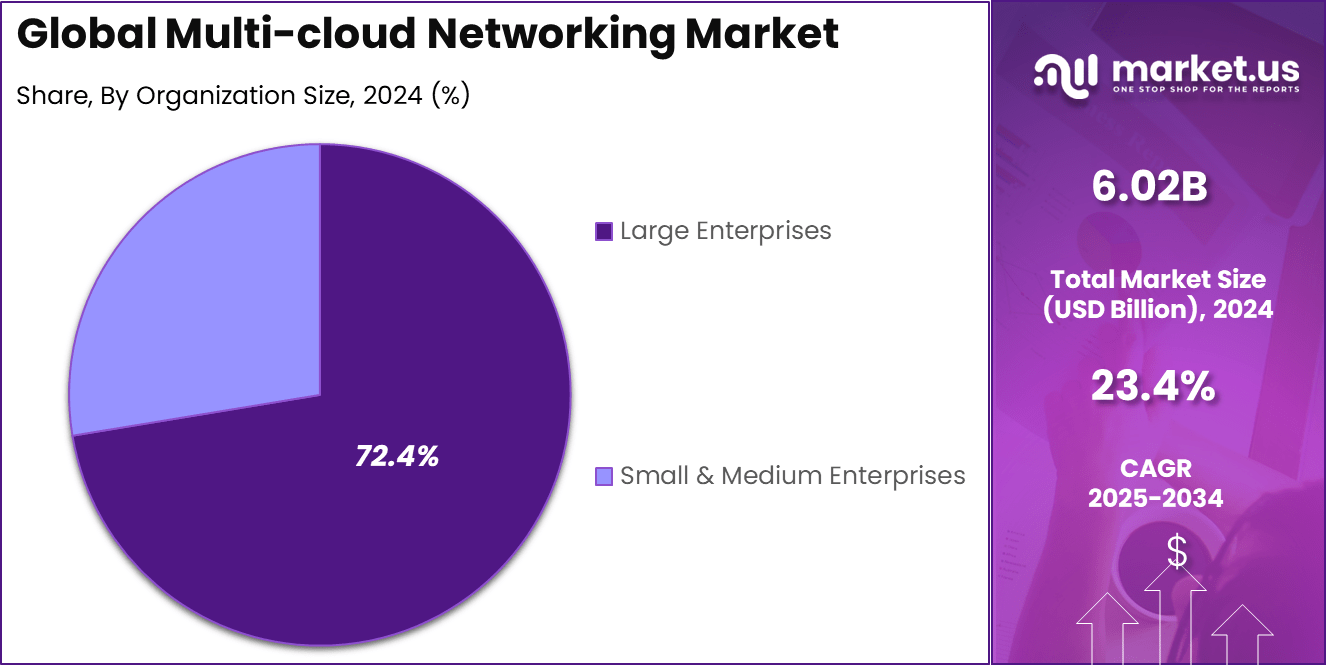

- The Large Enterprises segment captured a 72.4% share, showing significant adoption among major organizations.

- The IT & ITeS segment was the leading industry vertical, accounting for 24.5% of the market.

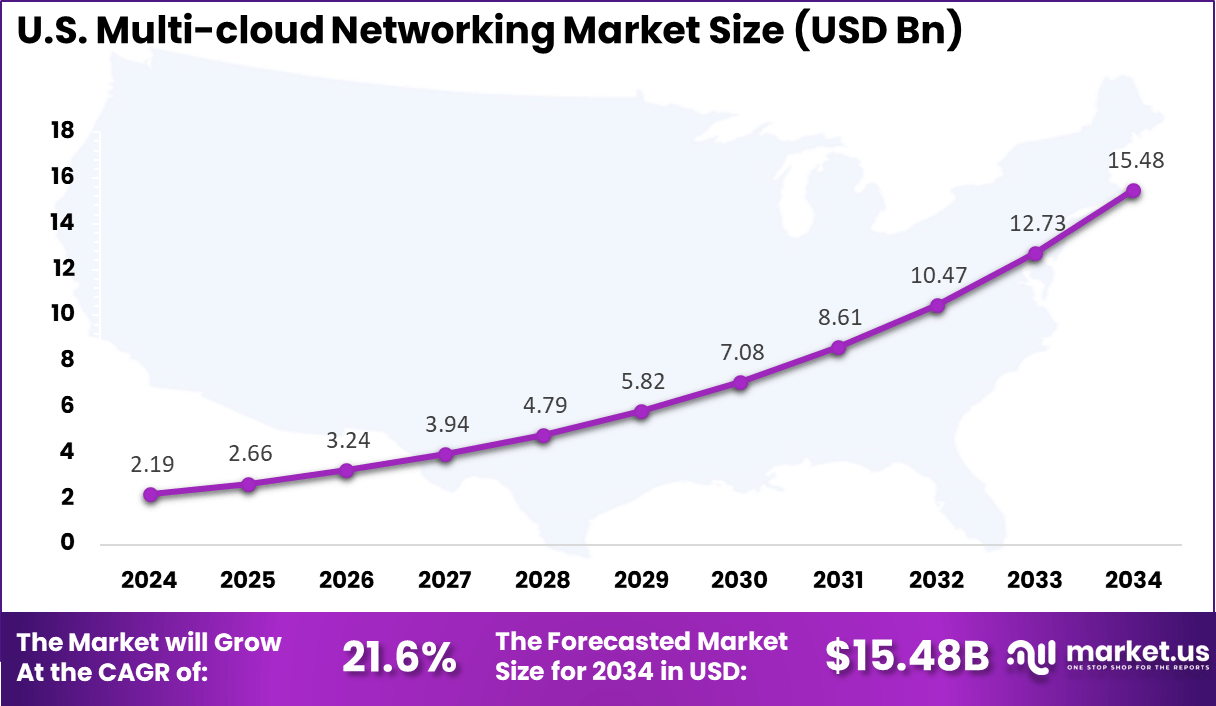

- The U.S. market was valued at USD 2.19 Billion in 2024, supported by a robust 21.6% CAGR.

- North America maintained leadership with a 38.1% share, underscoring its advanced cloud adoption and infrastructure.

U.S. Market Size

The market for Multi-cloud Networking within the U.S. is growing tremendously and is currently valued at USD 2.19 billion, the market has a projected CAGR of 21.6%. The market is growing due to the region’s rapid digital transformation, high cloud adoption rates, and increasing demand for AI-driven applications.

Enterprises are embracing hybrid and multi-cloud strategies to enhance flexibility, ensure business continuity, and meet complex regulatory requirements. The presence of major cloud providers, robust IT infrastructure, and a strong ecosystem of technology partners further accelerates innovation. Additionally, U.S.-based organizations prioritize secure, scalable networking solutions to support distributed operations and data-intensive workloads.

For instance, in June 2025, General Dynamics Information Technology (GDIT) secured a contract to modernize the U.S. Special Operations Command’s (SOCOM) networks using AI, zero-trust architecture, and multi-cloud services. This initiative highlights the U.S. government’s leadership in adopting advanced cloud and networking technologies to enhance national security and operational efficiency.

In 2024, North America held a dominant market position in the Global Multi-cloud Networking Market, capturing more than a 38.1% share, holding USD 2.29 billion in revenue. The dominant position is due to its advanced cloud infrastructure, early adoption of hybrid cloud strategies, and strong presence of leading cloud service providers such as AWS, Microsoft Azure, and Google Cloud.

The region’s enterprises increasingly adopted hybrid and multi-cloud strategies to enhance agility and reduce dependency on single vendors. Additionally, high investments in AI, edge computing, and cybersecurity, along with a mature regulatory environment, further propelled demand for robust, scalable multi-cloud networking solutions across key industries.

For instance, in February 2025, Lumen Technologies announced major investments to build next-gen network infrastructure for a multi-cloud, AI-first world. Focused on boosting capacity and reducing latency, this move reflects North America’s broader push for infrastructure modernization. Such investments strengthen the region’s leadership in the global multi-cloud networking market, driven by innovation and AI readiness.

Component Analysis

In 2024, the Solutions segment held a dominant market position, capturing a 68.1% share of the Global Multi-cloud Networking Market. This dominance is fueled by growing enterprise demand for automated, resilient, and secure networking across diverse cloud platforms. Solutions provide the tools needed to manage complex multi-cloud environments, ensuring real-time visibility, consistent connectivity, and efficient data flow.

Features like AI-driven traffic management, adaptive routing, and unified policy control enhance agility and performance. As hybrid and multi-cloud strategies become more prevalent, organizations increasingly rely on these advanced solutions to streamline operations and support scalable, secure digital transformation.

For Instance, in February 2025, XENON Systems partnered with Netris to deliver multi-tenant GPU cloud networking solutions tailored for AI/ML cloud providers. This collaboration enables seamless, scalable, and automated network management across multi-cloud environments, optimized for high-performance computing workloads.

Deployment Analysis

In 2024, the Public Cloud segment held a dominant market position, capturing a 62.3% share of the Global Multi-cloud Networking Market. The dominance is due to the widespread use of SaaS applications across major cloud platforms, creating complex connectivity needs. As organizations advanced digital transformation efforts, they turned to public clouds for their robust infrastructure, scalability, and seamless integration capabilities.

This deployment model simplified network access, lowered adoption barriers, and enabled efficient management of multi-cloud environments. The ability to support dynamic workloads and ensure flexible, secure routing made public cloud the preferred choice across diverse industry verticals.

For instance, in January 2025, Ververica announced the public availability of its Bring Your Own Cloud (BYOC) deployment option on AWS Marketplace, reinforcing the growing role of public cloud in multi-cloud networking. This offering allows enterprises to deploy Ververica’s data streaming platform directly within their cloud environments, ensuring greater control, scalability, and security.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 72.4% share of the Global Multi-cloud Networking Market. This dominance is due to the complex IT infrastructures, vast data volumes, and need for secure, scalable connectivity across multiple cloud providers.

Large organizations are at the forefront of digital transformation, adopting hybrid and multi-cloud strategies to enhance agility, ensure business continuity, and reduce vendor dependency. Their significant budgets and strong focus on advanced technologies, such as AI, edge computing, and automation, further fuel demand for robust multi-cloud networking solutions to optimize performance and governance.

For Instance, in June 2025, Cisco and Tech Mahindra launched a managed service offering built on Cisco’s Multicloud Defense platform, aimed at large enterprises adopting complex multi-cloud strategies. The service delivers unified security policy management, advanced threat protection, and seamless connectivity across public and private cloud environments.

Vertical Analysis

In 2024, the IT & ITeS segment held a dominant market position, capturing a 24.5% share of the Global Multi-cloud Networking Market. This dominance is due to the rapid adoption of cloud-native technologies and distributed infrastructure. Service providers embraced multi-cloud strategies to deliver secure, scalable, and high-performance solutions to global clients.

Growing use of SaaS and PaaS applications across diverse cloud platforms amplified the need for seamless, secure networking. Additionally, demands for real-time processing, efficient application delivery, and cost optimization accelerated adoption. With strong digital transformation initiatives, IT & ITeS has established itself as the key vertical driving market growth.

For Instance, in March 2025, Truewatch partnered with Tencent Cloud to launch Indonesia’s first multi-cloud monitoring platform, enhancing IT sector capabilities in managing distributed environments. The platform delivers real-time visibility, performance optimization, and security across providers, helping organizations tackle hybrid cloud complexity.

Key Trends and Innovations

Trend / Innovation Description SD-WAN and SASE Integration Secure, scalable SD-WAN combined with cloud-delivered security architectures Native Kubernetes Networking Multi-cloud networking solutions embedded within container orchestration AI-Driven Network Monitoring Automated traffic analysis, anomaly detection, and policy enforcement Hybrid Cloud Connectivity Seamless integration of public clouds, private clouds, and on-premises environments Zero Trust Architecture Multi-cloud networks adopting zero trust models to enhance security Network as a Service (NaaS) Subscription-based networking services facilitating faster cloud scale and complexity management Top Growth Factors

Growth Factor Description Digital Transformation Enterprises adopting hybrid & multi-cloud for flexibility, resilience, and operational agility Edge Computing Expansion Growth of edge that requires low latency and distributed networking across cloud environments Increase in Containerized Workloads Kubernetes & microservices drive need for dynamic multi-cloud networking solutions Regulatory Compliance & Security Data sovereignty laws (GDPR, etc.) pushing secure multi-cloud connectivity Cloud Provider Competition Enterprises leverage best-of-breed services across AWS, Azure, Google Cloud, etc., creating demand for inter-cloud networking integration AI & Big Data Integration Demand for AI-driven network automation, monitoring, and self-healing Key Market Segments

By Component

- Solutions

- Multi-Cloud Management

- Others

- Services

- Training & Support

- Integration & Implementation

- Consulting

By Deployment

- Public Cloud

- Private Cloud

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Vertical

- IT & ITeS

- BFSI

- Retail & ECommerce

- Healthcare & Life Sciences

- Transportation & Logistics

- Manufacturing

- Media & ENtertainment

- Energy & Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Adoption of Multi‑Cloud Strategies

Organizations are increasingly adopting multi-cloud strategies, leveraging services from multiple providers like AWS, Azure, and GCP. This approach enables them to mitigate vendor lock-in risks, enhance operational agility, and optimize infrastructure costs.

As enterprises scale and diversify cloud workloads, the demand for seamless interconnectivity, unified management, and policy enforcement across environments grows. This foundational shift is accelerating the development and deployment of multi-cloud networking solutions to ensure performance, availability, and compliance across distributed architectures.

For instance, In May 2025, Aviatrix’s CEO highlighted how CIOs can gain strategic benefits by unifying security and networking in multi-cloud environments. With enterprises adopting multi-cloud strategies for agility and to avoid vendor lock-in, a unified architecture is seen as vital. Aviatrix promotes an approach that streamlines connectivity, ensures consistent security policies, and strengthens visibility across AWS, Azure, and GCP.

Restraint

Skill Shortages

The complexity of managing multi-cloud environments demands specialized skills in areas like SDN, automation, cloud orchestration, and cross-platform security. However, many enterprises face significant talent gaps, lacking professionals proficient in navigating heterogeneous cloud infrastructures.

This skills deficit limits the speed and scale of multi-cloud adoption and increases reliance on external consultants or managed services. Organizations must invest in workforce development and training to bridge this competency gap and enable effective multi-cloud network operations and governance.

For instance, In March 2025, ITPro reported that skill shortages continue to hinder effective cloud deployment, especially in multi-cloud environments. Although demand for hybrid and multi-cloud strategies is rising, many enterprises and IT partners lack professionals with expertise in cross-platform orchestration, cloud-native networking, and security integration

Opportunities

AI‑Enabled Networking Tools

AI and machine learning are transforming multi-cloud networking by enabling intelligent traffic routing, predictive analytics, and automated anomaly detection. These technologies empower enterprises to proactively manage performance, security, and resource allocation across heterogeneous cloud environments.

As network complexity grows, AI-driven solutions offer a path to greater efficiency and resilience by reducing manual intervention and enabling adaptive, self-optimizing networks. This evolution presents significant opportunities for vendors to differentiate through cognitive capabilities embedded in multi-cloud platforms.

For instance, in August 2025, Riverbed launched AI-powered intelligent network observability solutions to enhance visibility and performance across complex multi-cloud environments. These tools leverage machine learning to proactively detect anomalies, optimize traffic flows, and provide predictive insights for network operations.

Challenges

Managing Fragmentation & Interoperability

Multi-cloud environments are highly fragmented, with each provider offering unique APIs, security models, and management tools. This heterogeneity complicates integration, inhibits visibility, and creates operational silos. Ensuring seamless data flow, policy enforcement, and service orchestration across disparate platforms remains a formidable challenge.

Enterprises often resort to complex workarounds or vendor-specific solutions, which undermine the core value proposition of multi-cloud flexibility. Addressing these interoperability barriers is critical for unlocking the full potential of distributed cloud strategies.

For instance, in May 2025, Google expanded its multi-cloud networking capabilities by launching Cross-Cloud Interconnect, a service designed to address fragmentation and interoperability challenges across cloud environments. This solution enables organizations to establish secure, high-performance connections between Google Cloud and third-party cloud providers like AWS and Azure.

Key Players Analysis

In the multi-cloud networking market, companies such as Cisco Systems, Inc., VMware, Inc., Fortinet, Inc., Palo Alto Networks, Inc., and Juniper Networks, Inc. play a leading role. Their solutions are designed to enable secure, scalable, and automated connectivity across multiple cloud environments. These providers have built strong portfolios in software-defined networking, cloud firewalls, and hybrid integration, which are crucial for enterprises aiming to reduce complexity.

Another group of key players includes Hewlett Packard Enterprise, Equinix, Inc., IBM Corporation, Cato Networks Ltd., and Megaport Ltd. These companies focus on delivering cloud interconnection, managed network services, and enterprise-grade solutions that address latency, cost efficiency, and operational flexibility. Their offerings are essential for businesses that require seamless data transfers, cross-border compliance, and reliable connectivity between different cloud providers.

Additionally, Akamai Technologies, F5, Inc., Citrix Systems Inc., Nutanix, Cloudflare, Inc., and Oracle are shaping the market with specialized solutions that strengthen performance, security, and workload optimization. Their platforms provide advanced features such as application delivery, edge networking, and distributed cloud services, which are becoming vital for enterprises managing global operations.

Top Key Players in the Market

- Cisco Systems, Inc.

- VMware, Inc.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Juniper Networks, Inc.

- Hewlett Packard Enterprise Company

- Equinix, Inc.

- IBM Corporation

- Cato Networks Ltd.

- Megaport Ltd

- Akamai Technologies

- F5, Inc.

- Citrix Systems Inc

- Nutanix, F5, Inc.

- Cloudflare, Inc.

- Oracle

- Others

Recent Developments

- In June 2025, Hewlett Packard Enterprise’s $14 billion acquisition of Juniper Networks gained U.S. Department of Justice approval, marking one of the largest networking deals in recent years. The merger strengthens HPE’s position in multi-cloud and AI-driven networking by integrating Juniper’s advanced routing, security, and AI-native networking capabilities with HPE’s edge-to-cloud portfolio.

- In March 2024, Cloudflare acquired Nefeli Networks, a provider of multi-cloud networking solutions, to strengthen its cloud connectivity and orchestration capabilities. The acquisition enhances Cloudflare’s ability to simplify networking across heterogeneous cloud environments by offering enterprises unified visibility, automation, and secure interconnectivity.

Report Scope

Report Features Description Market Value (2024) USD 6.02 Bn Forecast Revenue (2034) USD 49.29 Bn CAGR (2025-2034) 23.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment (Public Cloud, Private Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Vertical (IT & ITeS, BFSI, Retail & Ecommerce, Healthcare & Life Sciences, Transportation & Logistics, Manufacturing, Media & Entertainment, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., VMware, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Juniper Networks, Inc., Hewlett Packard Enterprise Company, Equinix, Inc., IBM Corporation, Cato Networks Ltd., Megaport Ltd, Akamai Technologies, F5, Inc., Citrix Systems Inc, Nutanix, F5, Inc., Cloudflare, Inc., Oracle, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multi-cloud Networking MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Multi-cloud Networking MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- VMware, Inc.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Juniper Networks, Inc.

- Hewlett Packard Enterprise Company

- Equinix, Inc.

- IBM Corporation

- Cato Networks Ltd.

- Megaport Ltd

- Akamai Technologies

- F5, Inc.

- Citrix Systems Inc

- Nutanix, F5, Inc.

- Cloudflare, Inc.

- Oracle

- Others