Global Moving Bed Bioreactor Market Size, Share, Growth Analysis By Type (Aerobic MBBR, Anaerobic MBBR, Anoxic MBBR), By Application (Municipal Wastewater Treatment, Industrial Wastewater Treatment, Food and Beverage, Pulp and Paper, Oil and Gas, Chemical and Petrochemical, Pharmaceuticals, Textile, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178728

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

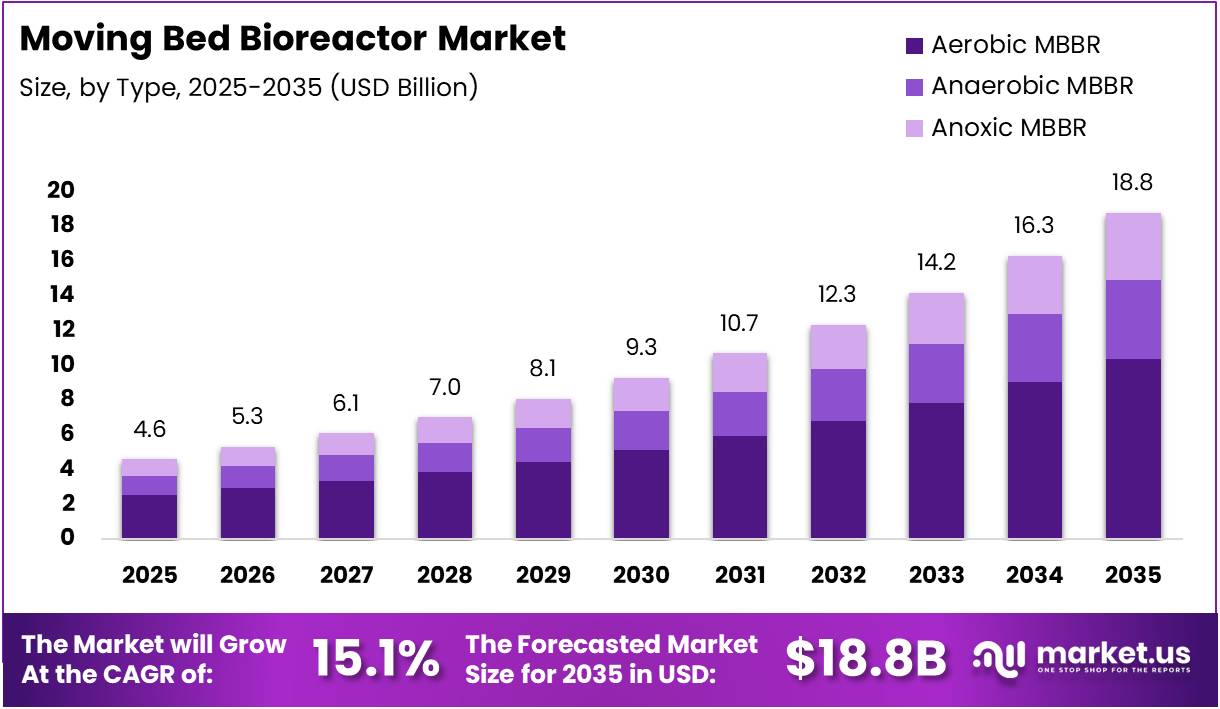

The Global Moving Bed Bioreactor Market size is expected to be worth around USD 18.8 Billion by 2035 from USD 4.6 Billion in 2025, growing at a CAGR of 15.1% during the forecast period 2026 to 2035.

Moving Bed Bioreactor (MBBR) is a biological treatment technology that uses floating plastic carriers to support biofilm growth inside a reactor. Microorganisms attached to these carriers break down organic pollutants in wastewater. Consequently, MBBR systems deliver consistent, high-performance treatment for both municipal and industrial wastewater applications worldwide.

The technology stands out for its compact design, operational flexibility, and compatibility with existing treatment infrastructure. MBBR systems require significantly less space than conventional activated sludge processes. Moreover, they can be easily scaled up or retrofitted into existing plants, making them a practical choice for utilities and industries alike.

Strong regulatory pressure on effluent quality is a key growth driver for this market. Governments across developed and developing nations are tightening discharge standards. Additionally, rising urbanization and industrial expansion are increasing wastewater volumes, pushing authorities and businesses to invest in advanced treatment technologies such as MBBR.

Public investment in water and sanitation infrastructure is accelerating market growth globally. Programs in Asia, Europe, and North America are supporting large-scale MBBR deployments. Therefore, the market is seeing increased adoption across sectors including food processing, pharmaceuticals, oil and gas, and chemical manufacturing.

According to Juntaienviro.com, MBBR systems can reduce BOD levels by 80% or more, making them highly effective for organic pollutant removal. These systems can also reduce facility footprint by up to 70% compared to traditional treatment methods. Furthermore, MBBR technology now aims to reduce operational costs by up to 30%.

According to a study published on PubMed, a modified MBBR with granular activated carbon achieved 81.8% carbon removal and 74.9% nitrogen removal, outperforming traditional carriers at 64.5% and 62.7% respectively. Additionally, PubMed research shows that integrating MBBR with a gravity membrane system increased stable flux by 8%–22% and reduced start-up time by 6–15 days.

Further PubMed research indicates that under high salinity MBBR conditions, bioaugmentation increased polysaccharide content in biofilm by 41.66% and protein content by 87.66%. These findings highlight ongoing innovation in MBBR biofilm science. Consequently, the technology is increasingly suited for treating complex and high-strength industrial effluents across global markets.

Key Takeaways

- The global Moving Bed Bioreactor Market was valued at USD 4.6 Billion in 2025 and is projected to reach USD 18.8 Billion by 2035.

- The market is expected to grow at a CAGR of 15.1% during the forecast period 2026 to 2035.

- By Type, the Aerobic MBBR segment dominated with a 55.4% market share in 2025.

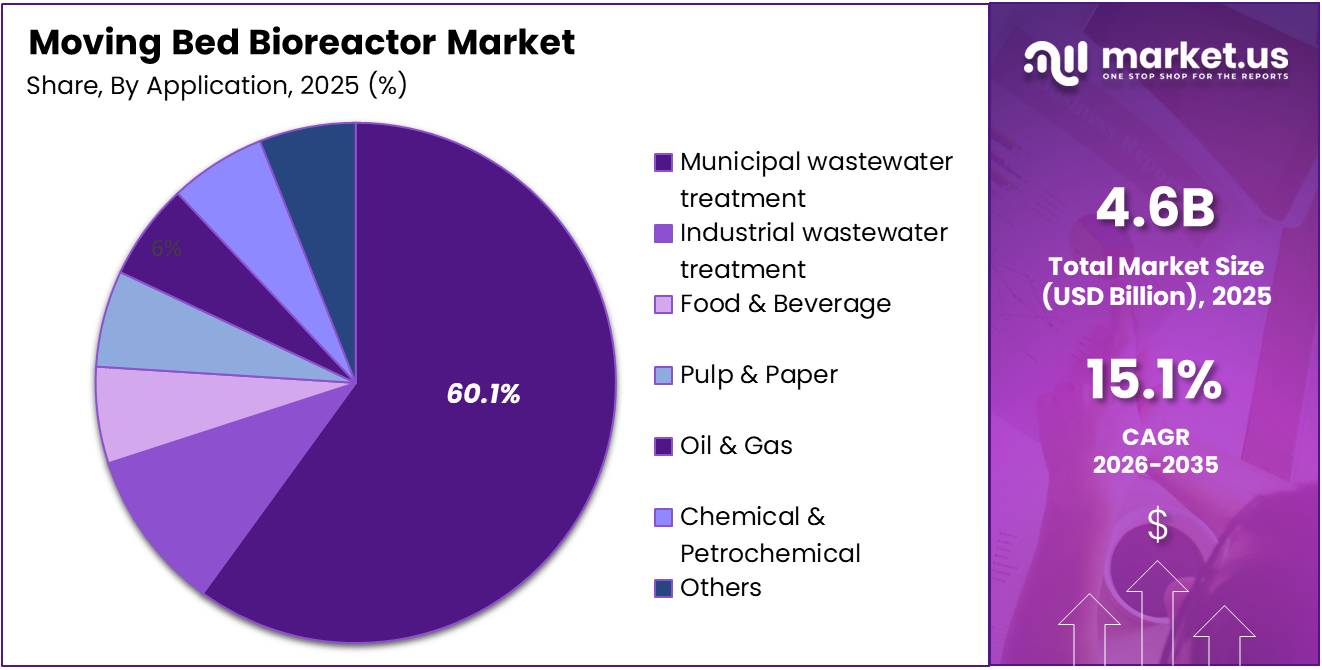

- By Application, Municipal Wastewater Treatment held the largest share at 60.1% in 2025.

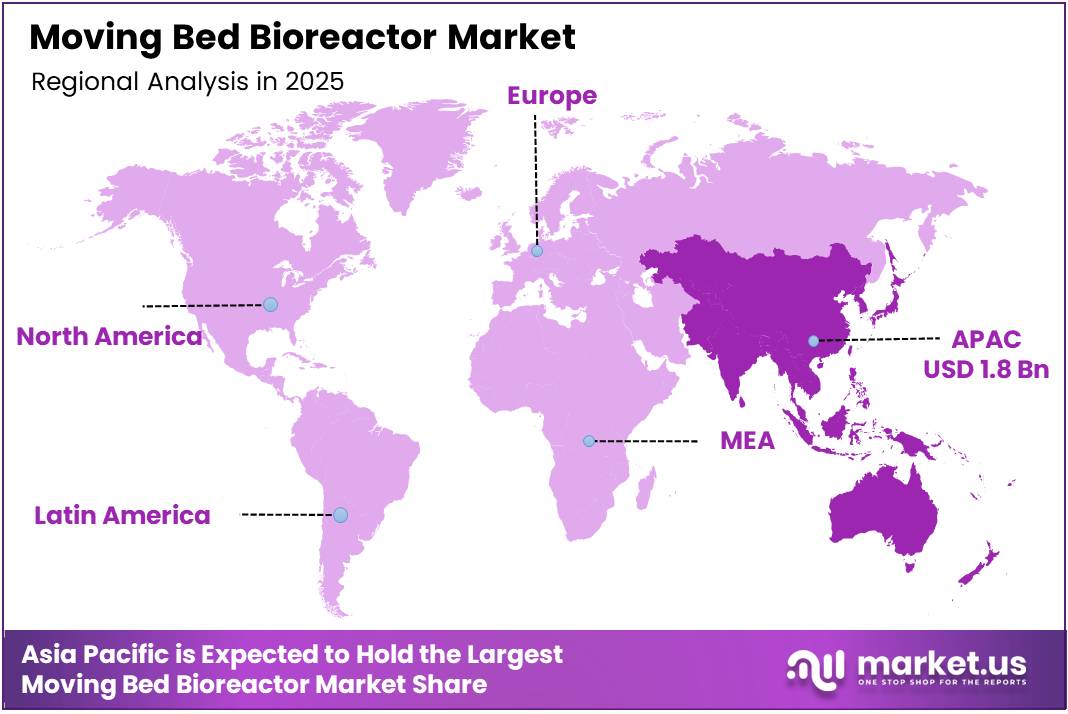

- Asia Pacific led the global market with a 40.1% share, valued at USD 1.8 Billion in 2025.

Type Analysis

Aerobic MBBR dominates with 55.4% due to its wide applicability in municipal and industrial biological wastewater treatment processes.

In 2025, Aerobic MBBR held a dominant market position in the By Type segment of the Moving Bed Bioreactor Market, with a 55.4% share. Aerobic systems support oxygen-dependent microbial activity, making them highly effective for BOD and nitrogen removal. Moreover, their compatibility with existing treatment infrastructure accelerates widespread adoption across municipal facilities globally.

Anaerobic MBBR systems operate without oxygen, making them well-suited for treating high-strength industrial effluents and enabling biogas recovery. As an advanced industrial wastewater treatment technology, these reactors are increasingly used in food processing and chemical industries where organic loads are significantly elevated.

Anoxic MBBR systems are designed for nitrogen removal through denitrification in low-oxygen environments. They are commonly integrated into multi-stage treatment trains to meet stringent nitrogen discharge standards. Consequently, anoxic configurations are gaining relevance in regions enforcing strict regulatory requirements for nutrient removal from municipal and industrial wastewater.

Application Analysis

Municipal Wastewater Treatment dominates with 60.1% due to large-scale government investment and strict effluent discharge regulations worldwide.

In 2025, Municipal Wastewater Treatment held a dominant market position in the By Application segment of the Moving Bed Bioreactor Market, with a 60.1% share. Rapid urbanization is generating increasing wastewater volumes that require efficient, scalable treatment. Moreover, government-mandated sanitation programs and strict effluent discharge standards are compelling municipalities globally to invest in advanced MBBR-based biological treatment systems.

Industrial Wastewater Treatment is a high-growth application segment within the Moving Bed Bioreactor Market. Diverse industries generate complex, high-strength effluents that require reliable and adaptable treatment solutions. Additionally, tightening industrial discharge regulations are compelling manufacturing facilities to adopt MBBR systems that deliver consistent compliance with environmental quality standards across sectors.

Food and Beverage is a significant application area for MBBR technology due to the high organic load present in food processing effluents. Wastewater from dairy, brewing, and meat processing facilities carries elevated BOD and nutrient concentrations. Consequently, MBBR systems are widely deployed in this sector to achieve efficient organic removal and meet discharge compliance requirements.

Pulp and Paper industry wastewater is characterized by high lignin content, suspended solids, and chemical oxygen demand. MBBR technology provides an effective biological treatment solution for these complex effluents. Moreover, its compact footprint and ability to handle variable organic loads make it particularly suitable for pulp and paper mills operating under strict environmental discharge mandates.

Oil and Gas operations generate heavily contaminated produced water and process effluents containing hydrocarbons and toxic compounds. MBBR systems are increasingly used in this sector to treat these challenging waste streams effectively. Furthermore, the technologys operational flexibility and resilience to fluctuating influent characteristics make it a practical biological treatment choice for upstream and downstream oil and gas facilities.

Chemical and Petrochemical plants produce highly complex wastewater streams containing recalcitrant organic compounds and hazardous substances. MBBR technology supports effective biological degradation of these difficult-to-treat effluents. Additionally, the ability to engineer specific biofilm communities within MBBR reactors allows operators to target removal of particular chemical contaminants and consistently meet regulatory discharge thresholds.

Pharmaceuticals manufacturing generates effluents containing active pharmaceutical ingredients, solvents, and other trace organic contaminants. MBBR systems offer a robust biological treatment approach for breaking down these complex compounds before discharge. Moreover, pharmaceutical facilities are increasingly adopting hybrid MBBR configurations to achieve the high-quality effluent standards required by environmental regulators in this highly scrutinized industry sector.

Textile industry wastewater contains dyes, surfactants, and chemical auxiliaries that present significant treatment challenges. MBBR technology supports biological degradation of organic fractions within these complex effluents. Consequently, textile manufacturers facing stricter color and BOD discharge limits are investing in MBBR-based treatment trains as part of broader efforts to reduce environmental impact and achieve regulatory compliance.

Power Generation facilities produce cooling water blowdown and other process effluents requiring reliable biological treatment prior to discharge. MBBR systems are well-suited for managing these wastewater streams due to their operational stability and low maintenance requirements. Additionally, the compact design of MBBR units makes them practical for integration within the constrained site footprints typical of power generation facilities.

Others encompasses a range of emerging and niche industrial applications adopting MBBR technology for specialized wastewater treatment needs. Sectors such as mining, aquaculture, and hospitality are increasingly deploying MBBR systems as water reuse and recycling requirements grow. Furthermore, ongoing innovation in MBBR design and carrier materials is continuously expanding the range of industries where this technology delivers viable and cost-effective treatment performance.

Key Market Segments

By Type

- Aerobic MBBR

- Anaerobic MBBR

- Anoxic MBBR

By Application

- Municipal Wastewater Treatment

- Industrial Wastewater Treatment

- Food and Beverage

- Pulp and Paper

- Oil and Gas

- Chemical and Petrochemical

- Pharmaceuticals

- Textile

- Power Generation

- Others

Drivers

Rising Adoption of Advanced Wastewater Treatment Technologies Drives Moving Bed Bioreactor Market Growth

The growing adoption of advanced wastewater treatment technologies in urban areas is a primary driver for the MBBR market. Rapid urbanization is generating higher wastewater volumes globally. Consequently, municipalities and governments are investing in modern biological treatment systems that deliver reliable effluent quality with reduced operational complexity.

Increasing regulatory mandates for effluent quality are compelling industries to upgrade their wastewater treatment capabilities. Environmental agencies across North America, Europe, and Asia Pacific are enforcing stricter discharge standards. Therefore, compliance-driven investment in MBBR systems is rising consistently across industrial and municipal sectors worldwide.

Growing demand for compact and energy-efficient biological treatment systems is also accelerating MBBR adoption. Industries face land and energy constraints that make large-footprint conventional systems impractical. Moreover, MBBR technology offers a space-saving and lower-energy alternative, making it the preferred choice for both new installations and facility upgrades.

Restraints

Integration Complexity and Skilled Operator Shortage Restrain Moving Bed Bioreactor Market Expansion

The complexity of integrating MBBR systems with existing wastewater infrastructure poses a significant challenge for market growth. Many older treatment plants use conventional activated sludge processes that require substantial modification for MBBR compatibility. Consequently, high retrofitting costs and technical barriers limit adoption among budget-constrained operators in developing regions.

Limited availability of skilled operators is another key restraint affecting MBBR market performance. Optimizing MBBR systems requires expertise in biofilm management, carrier loading, and advanced process control. However, many regions, particularly in developing countries, face a shortage of trained professionals capable of managing these advanced biological treatment systems effectively.

These combined challenges slow market penetration, especially in regions with aging water infrastructure. The cost of training operators and modifying existing facilities adds significantly to the total investment burden. Therefore, market growth may remain uneven across regions, with developed economies adopting MBBR technology at a considerably faster pace.

Growth Factors

Hybrid Systems, Emerging Markets, and Carrier Innovation Accelerate Moving Bed Bioreactor Market Growth

The development of hybrid MBBR systems combined with membrane bioreactors (MBR) is creating significant new growth opportunities. These integrated configurations deliver superior effluent quality and higher treatment efficiency. Moreover, hybrid systems enable facilities to meet increasingly stringent water reuse and discharge standards, expanding MBBR applications in advanced treatment projects.

Increasing MBBR adoption in emerging markets affected by water scarcity is a strong growth catalyst. Countries across Asia, Africa, and Latin America are investing in decentralized water treatment solutions. Additionally, international development organizations are funding water infrastructure projects in these regions, driving sustained demand for compact and cost-effective MBBR systems.

Innovation in biofilm carrier materials is enhancing MBBR treatment efficiency and broadening its application scope. New carrier designs offer higher specific surface areas and improved biofilm retention performance. Consequently, advanced carrier technology is reducing required reactor volumes and lowering capital costs, making MBBR an increasingly competitive biological treatment solution globally.

Emerging Trends

IoT Integration, Modular Solutions, and Energy Recovery Are Reshaping the Moving Bed Bioreactor Market

The integration of IoT and automation for real-time monitoring of MBBR systems is a major emerging trend. Smart sensors and connected control platforms allow operators to optimize process parameters remotely and efficiently. Moreover, data-driven management improves system reliability, reduces unplanned downtime, and supports predictive maintenance for cost-effective MBBR operations.

A growing shift toward decentralized and modular wastewater treatment solutions is reshaping the MBBR market. Modular MBBR units can be rapidly deployed in remote or space-constrained locations without major civil construction. Additionally, decentralized systems reduce the need for long-distance conveyance infrastructure, lowering both capital expenditure and ongoing operational costs significantly.

Focus on energy recovery and resource-efficient MBBR operations is gaining strong momentum across the global water sector. Operators are integrating biogas recovery and heat exchange into MBBR-based treatment trains. Consequently, these energy-positive approaches reduce the overall carbon footprint of wastewater facilities and align with global sustainability and net-zero emission objectives.

Regional Analysis

Asia Pacific Dominates the Moving Bed Bioreactor Market with a Market Share of 40.1%, Valued at USD 1.8 Billion

Asia Pacific leads the global Moving Bed Bioreactor market, holding a dominant share of 40.1% and a market valuation of USD 1.8 Billion in 2025. Rapid industrialization, population growth, and strong government investment in water and sanitation infrastructure are driving this leadership. Countries such as China and India are scaling up MBBR deployments at a significant pace.

North America Moving Bed Bioreactor Market Trends

North America represents a mature and highly regulated market for MBBR technology. Stringent federal and regional environmental regulations are compelling municipalities and industries to upgrade wastewater treatment capacity. Moreover, strong adoption of advanced biological treatment systems and ongoing infrastructure reinvestment programs continue to support stable and consistent market growth across the region.

Europe Moving Bed Bioreactor Market Trends

Europe is a key market driven by the EU Water Framework Directive and strict nutrient discharge standards. Member states are investing in MBBR upgrades to comply with phosphorus and nitrogen discharge limits. Additionally, Europe’s focus on circular water economy principles and water reuse initiatives is creating new demand for advanced MBBR-based treatment solutions.

Middle East and Africa Moving Bed Bioreactor Market Trends

The Middle East and Africa region is experiencing rising MBBR adoption driven by severe water scarcity and rapid urbanization. GCC countries are investing in industrial and municipal wastewater treatment to support sustainable water resource management. Furthermore, international aid programs and public-private partnerships are funding water infrastructure projects across sub-Saharan Africa.

Latin America Moving Bed Bioreactor Market Trends

Latin America is an emerging MBBR market driven by expanding urban populations and underdeveloped sanitation infrastructure across many countries. Brazil and Mexico are leading investment in wastewater treatment upgrades. Additionally, growing industrial activity in food processing, mining, and petrochemicals is increasing demand for compact and efficient biological treatment systems in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Aqseptence Group is a global provider of water and wastewater treatment equipment, including MBBR media and biological filtration systems. The company serves municipal and industrial clients across multiple continents with comprehensive treatment solutions. Its strong engineering expertise and diverse product portfolio make it a reliable partner for large-scale MBBR installations in key growth markets.

Aquapoint Inc. specializes in decentralized wastewater treatment solutions utilizing MBBR and biofilm-based technologies. The company focuses on compact systems suitable for commercial, residential, and small municipal applications. Its patented multi-stage MBBR process is recognized for delivering consistent effluent quality. Aquapoint addresses growing demand for energy-efficient, small-footprint systems in underserved markets across North America.

Aquatech is an internationally recognized water treatment company offering MBBR-based solutions for industrial and municipal clients globally. The company serves sectors including semiconductor, pharmaceutical, and energy industries with integrated water and wastewater systems. Its technology portfolio combines MBBR with advanced filtration and reuse. Aquatech’s global project execution capability and focus on water recycling position it as a key market player.

Biowater Technology AS is a Norwegian company specializing in MBBR and hybrid MBBR-MBR systems for industrial and municipal wastewater treatment. It is known for proprietary carrier technology that provides high specific surface area for efficient biofilm development. Biowater serves global markets with innovative biological treatment designs. Its strong commitment to research and engineering excellence supports consistent and long-term market positioning.

Key Players

- Aqseptence Group

- Aquapoint Inc.

- Aquatech

- Biowater Technology AS

- EnviroChemie GmbH

- Fluence Corporation Limited

- Genesis Water Solution Pvt. Ltd.

- Headworks International

- Kubota Corporation

- Kurita Water Industries Ltd.

- Mitsubishi Chemical Group Corporation

- OVIVO USA LLC

- SUSBIO

- Veolia

- Wock-Oliver Inc.

- World Water Works

- Xylem

- Other Key Players

Recent Developments

- May 2025 – Veolia announced the acquisition of CDPQ’s 30% stake in Water Technologies and Solutions, achieving full ownership of the business. This strategic move is designed to accelerate value creation and strengthen Veolia’s global leadership position in water treatment technology and services.

- June 2025 – Aquatech announced the acquisition of Century Water, establishing a global center of excellence for semiconductor and pharmaceutical water services. This move expands Aquatech’s technical capabilities and reinforces its commitment to delivering high-purity water solutions across critical industrial sectors worldwide.

Report Scope

Report Features Description Market Value (2025) USD 4.6 Billion Forecast Revenue (2035) USD 18.8 Billion CAGR (2026-2035) 15.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Aerobic MBBR, Anaerobic MBBR, Anoxic MBBR), By Application (Municipal Wastewater Treatment, Industrial Wastewater Treatment, Food and Beverage, Pulp and Paper, Oil and Gas, Chemical and Petrochemical, Pharmaceuticals, Textile, Power Generation, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aqseptence Group, Aquapoint Inc., Aquatech, Biowater Technology AS, EnviroChemie GmbH, Fluence Corporation Limited, Genesis Water Solution Pvt. Ltd., Headworks International, Kubota Corporation, Kurita Water Industries Ltd., Mitsubishi Chemical Group Corporation, OVIVO USA LLC, SUSBIO, Veolia, Wock-Oliver Inc., World Water Works, Xylem, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Moving Bed Bioreactor MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Moving Bed Bioreactor MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Aqseptence Group

- Aquapoint Inc.

- Aquatech

- Biowater Technology AS

- EnviroChemie GmbH

- Fluence Corporation Limited

- Genesis Water Solution Pvt. Ltd.

- Headworks International

- Kubota Corporation

- Kurita Water Industries Ltd.

- Mitsubishi Chemical Group Corporation

- OVIVO USA LLC

- SUSBIO

- Veolia

- Wock-Oliver Inc.

- World Water Works

- Xylem

- Other Key Players