Global Modular Packaging Equipment Market Size, Share, Growth Analysis By Type (Primary Packaging Equipment, Shrink Wrapping Machines, Palletizing Equipment, Cartoning Machines, Case Packing Systems, Sealing Machines, Filling Machines, Labeling Machines, Coding And Marking Equipment, Secondary Packaging Equipment), By Automation Level (Automatic Systems, Semi-Automatic Systems, Manual Modular Equipment), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151481

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

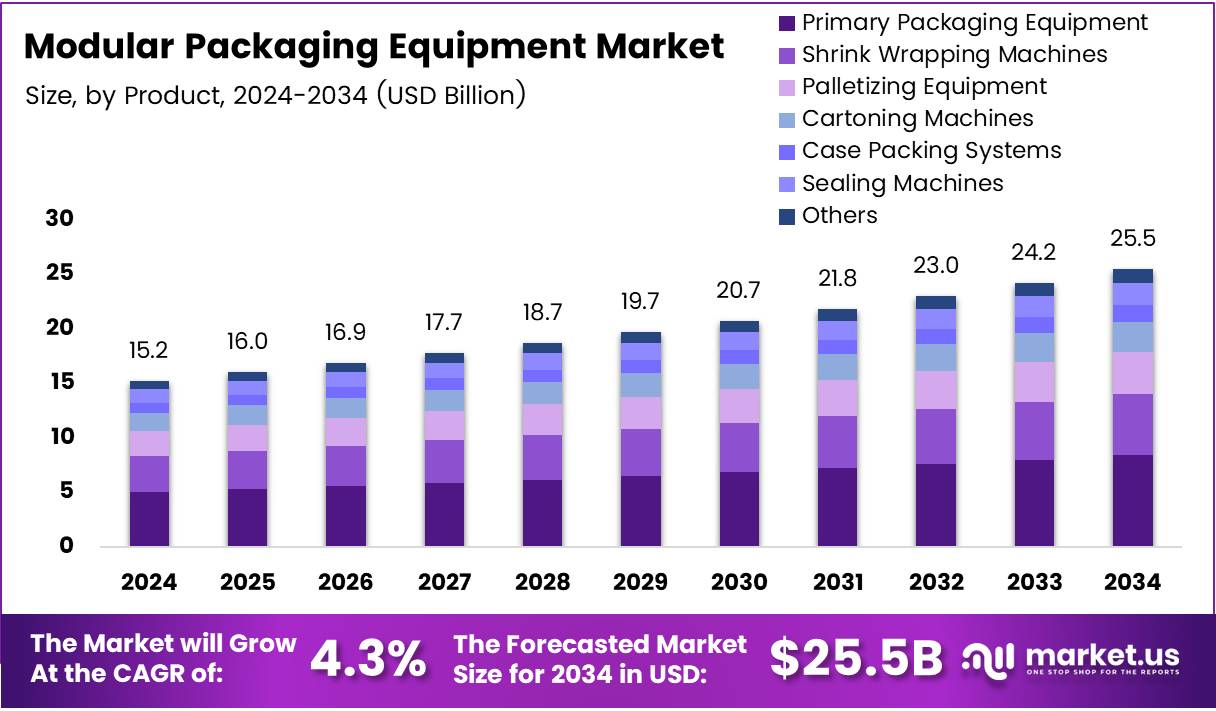

The Global Modular Packaging Equipment Market size is expected to be worth around USD 25.5 Billion by 2034, from USD 15.2 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The Modular Packaging Equipment market has witnessed substantial growth in recent years. It involves packaging solutions that are flexible, scalable, and customizable, making it ideal for industries such as food and beverage, pharmaceuticals, and consumer goods.

Modular equipment offers businesses the ability to enhance production efficiency while ensuring cost-effectiveness and adaptability. This market has gained momentum due to increasing demand for high-speed, versatile machinery that can adjust to varying packaging needs.

One of the key growth drivers for the Modular Packaging Equipment market is the constant need for faster and more efficient packaging processes. According to Record packaging, high-speed operations are a major benefit, with some models achieving output rates of 25-30 packs per minute, and even up to 100 packs per minute in specific configurations. This high-output capability makes modular equipment attractive for manufacturers aiming to meet escalating demand without compromising quality or speed.

Government investments and regulations have also played a crucial role in shaping the market. Many countries, especially in Asia-Pacific and Europe, have introduced policies aimed at improving packaging standards to ensure sustainability and food safety.

These regulations push companies to adopt innovative and flexible packaging solutions. The increasing focus on environmentally friendly materials and processes also offers a significant opportunity for growth in the modular packaging sector.

According to Chinese customs statistics, the packaging machinery export market is booming. The total exports of packaging machinery exceeded 2.2 billion US dollars, accounting for more than 57% of total exports in food and packaging machinery. This underlines the global demand for advanced packaging systems, especially in emerging markets where modular systems are gaining popularity due to their efficiency and scalability.

As companies seek more cost-effective and adaptable packaging solutions, modular packaging equipment is expected to become even more prevalent. The ability to scale production without heavy investment in new machinery or reconfiguration makes it an attractive option for businesses looking to optimize their operations. This trend is expected to continue as industries increasingly demand packaging solutions that offer flexibility, efficiency, and sustainability.

Key Takeaways

- The global Modular Packaging Equipment Market is projected to reach USD 25.5 billion by 2034, growing at a CAGR of 5.3% from 2025 to 2034.

- Primary Packaging Equipment dominates the By Type Analysis segment with a 60.5% market share in 2024.

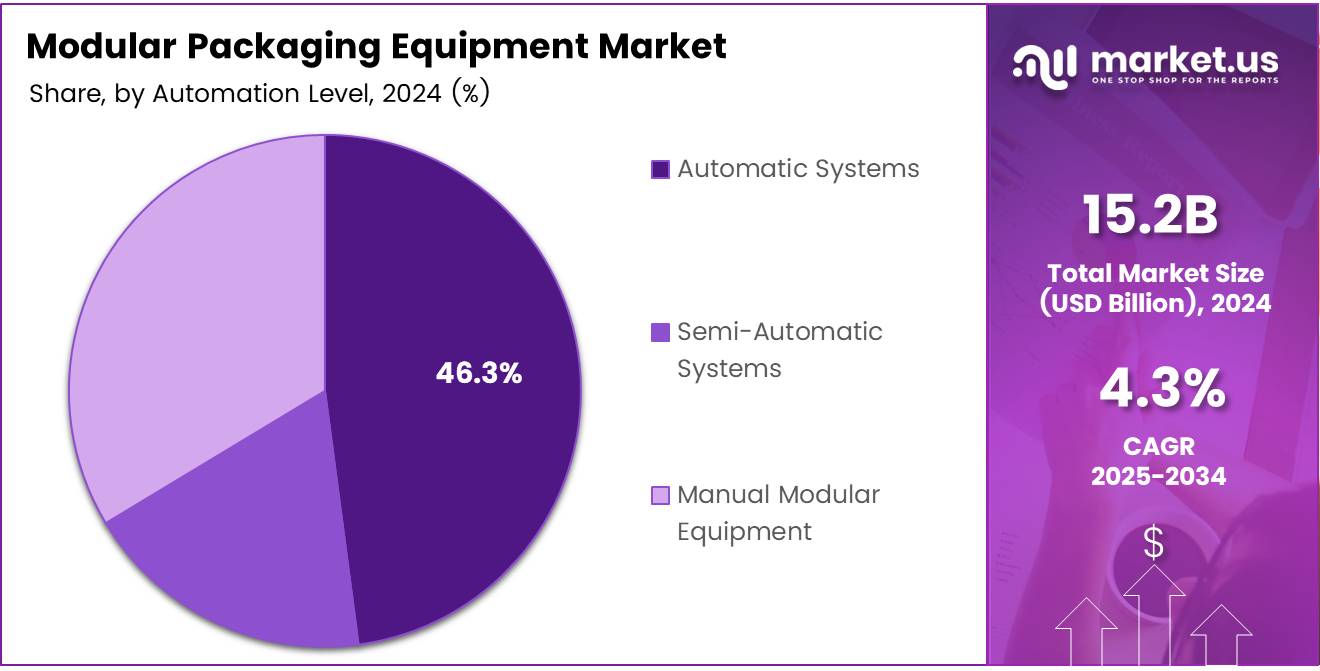

- Automatic Systems leads the By Automation Level Analysis segment, holding a 46.3% market share in 2024.

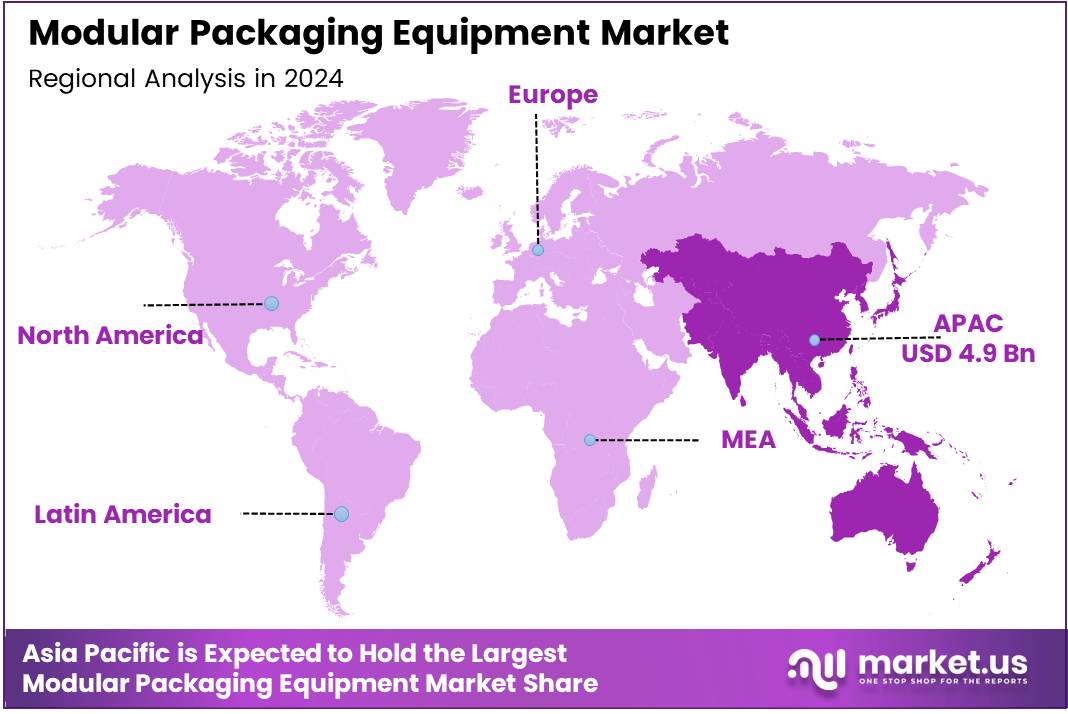

- The Asia Pacific region holds the largest market share of 32.5%, valued at USD 4.9 billion in 2024.

Type Analysis

Primary Packaging Equipment leads with 60.5% due to high demand in initial product containment stages.

In 2024, Primary Packaging Equipment held a dominant market position in the By Type Analysis segment of the Modular Packaging Equipment Market, with a 60.5% share. This dominance is largely driven by its critical role in preserving product integrity and ensuring safe delivery during the first stage of packaging.

Shrink Wrapping Machines are gaining notable traction for their ability to provide tamper-evident, compact packaging. These machines offer versatility across industries and contribute significantly to packaging efficiency.

Palletizing Equipment continues to be a vital solution in automating end-of-line processes. It supports high throughput and minimizes labor requirements, which makes it a preferred choice for bulk handling.

Cartoning Machines are witnessing increased adoption owing to their capacity to streamline box folding, filling, and sealing processes. Their flexibility across product sizes adds to their market appeal.

Case Packing Systems are essential in secondary containment, offering sturdy and protective outer packaging, especially useful in transport and storage logistics.

Sealing Machines, crucial for maintaining product shelf life, remain in demand across sectors due to their reliability in producing airtight closures.

Filling Machines, a staple in liquid and semi-liquid product lines, are integral to operational efficiency and accuracy.

Labeling Machines and Coding And Marking Equipment play vital roles in brand visibility and traceability, ensuring compliance with packaging regulations.

Secondary Packaging Equipment, while essential, holds a smaller portion compared to primary equipment, focusing more on bundling and final presentation.

Automation Level Analysis

Automatic Systems dominate with 46.3% driven by demand for speed and operational efficiency.

In 2024, Automatic Systems held a dominant market position in the By Automation Level Analysis segment of the Modular Packaging Equipment Market, with a 46.3% share. The growing emphasis on reducing manual intervention and increasing output precision has accelerated the adoption of fully automated solutions.

Automatic Systems offer seamless integration into high-speed production lines and are favored for their ability to minimize errors and operational downtime. Their deployment helps manufacturers meet stringent throughput targets with greater consistency.

Semi-Automatic Systems remain relevant, especially for mid-scale operations where partial automation allows flexibility without the cost of full automation. They serve as a transitional solution for manufacturers moving from manual to automated processes.

Manual Modular Equipment, although limited in share, continues to find use in low-volume settings or specialty packaging applications where customization and low capital investment are priorities.

Key Market Segments

By Type

- Primary Packaging Equipment

- Shrink Wrapping Machines

- Palletizing Equipment

- Cartoning Machines

- Case Packing Systems

- Sealing Machines

- Filling Machines

- Labeling Machines

- Coding And Marking Equipment

- Secondary Packaging Equipment

By Automation Level

- Automatic Systems

- Semi-Automatic Systems

- Manual Modular Equipment

Drivers

Rising Demand for Customization in Packaging Drives Market Growth

The modular packaging equipment market is growing due to the rising demand for customized packaging. Businesses want packaging that fits specific products and branding, and modular systems allow easy adjustments. This flexibility makes them ideal for companies with varied product lines.

Sustainability is another key factor pushing the market forward. Modular packaging machines often support eco-friendly materials and reduce waste during the packaging process. This helps companies meet green goals and consumer expectations.

With more brands focusing on product uniqueness and environmental impact, modular equipment becomes a smart investment. The ability to scale or modify packaging setups quickly supports changing market needs.

This trend is especially strong in industries like food, cosmetics, and electronics, where product variety and sustainability matter most. As companies look to stand out and cut waste, the demand for modular packaging systems continues to grow steadily.

Restraints

High Initial Investment Costs for Modular Systems Slow Market Adoption

One major challenge in the modular packaging equipment market is the high upfront cost. These systems offer flexibility, but setting them up requires significant investment, especially for small and medium businesses. This cost barrier can limit adoption.

Another issue is the difficulty of integrating modular systems with existing packaging lines. Many companies already have traditional setups, and switching or upgrading can disrupt operations and require technical expertise.

Because of this complexity, businesses may hesitate to adopt modular equipment, even if it offers long-term benefits. Compatibility with older systems is not always easy, and reconfiguring production lines takes time and planning.

These challenges create a slower pace of adoption, especially in industries where budgets are tight. Without easier integration and lower costs, the market may face delays in reaching its full potential.

Growth Factors

Expansion of Modular Solutions in Emerging Markets Offers New Opportunities

The modular packaging equipment market has strong growth potential in emerging markets. As manufacturing increases in countries like India, Brazil, and Southeast Asia, the need for flexible packaging solutions rises. These regions are ideal for modular systems due to growing industrial demand.

Smart packaging technologies also open up new possibilities. Modular machines can integrate with sensors and data tools to improve efficiency and quality control. This makes them attractive to companies adopting Industry 4.0 practices.

Another growth opportunity lies in flexible packaging trends. Consumers prefer packaging that is easy to open, resealable, and space-saving. Modular systems support these demands by allowing quick design changes and production flexibility.

As global supply chains become more complex, companies are looking for adaptable solutions. Modular packaging equipment fits this need and is well-positioned to expand into new and fast-growing markets.

Emerging Trends

Customization and Personalization Trends in Packaging Design Drive Market Trends

One of the key trends in the modular packaging equipment market is the push for customization and personalization. Brands want unique packaging designs to stand out, and modular machines make it easier to adjust and create different styles quickly.

Artificial intelligence (AI) is also playing a role in packaging operations. AI helps improve efficiency, reduce downtime, and predict maintenance needs. When combined with modular systems, AI can make packaging lines smarter and more responsive.

There is also a noticeable shift toward smaller and more efficient packaging systems. Companies want to save space, reduce waste, and lower shipping costs. Modular machines are well-suited for these goals, allowing companies to scale and modify setups based on need.

These trends reflect a broader move toward smart, flexible, and customer-focused packaging. Modular equipment continues to grow in popularity as it meets these modern packaging demands.

Regional Analysis

Asia Pacific Dominates the Modular Packaging Equipment Market with a Market Share of 32.5%, Valued at USD 4.9 Billion

The Asia Pacific region leads the modular packaging equipment market, capturing 32.5% of the market share, valued at USD 4.9 billion. This dominance is driven by the robust demand for efficient packaging solutions across industries like food and beverages, pharmaceuticals, and consumer goods. Furthermore, rapid industrialization and increased consumer demand for packaged goods are key factors contributing to the growth of the region.

North America Modular Packaging Equipment Market Trends

North America is a significant player in the modular packaging equipment market, contributing a substantial share to the overall market growth. The region’s market growth is fueled by advanced packaging technologies, government regulations promoting sustainability, and a highly developed retail sector that demands efficient and cost-effective packaging solutions. The U.S. is the primary market within North America, with a high adoption rate of automated and modular packaging systems.

Europe Modular Packaging Equipment Market Overview

Europe holds a key share in the modular packaging equipment market, supported by stringent regulations on packaging waste management and increasing focus on sustainability. The European market is poised for growth due to rising consumer preferences for eco-friendly packaging solutions. Furthermore, the region’s established manufacturing and consumer goods industries continue to drive demand for advanced packaging technologies, particularly in the food and beverage sector.

Middle East and Africa Modular Packaging Equipment Market Trends

The Middle East and Africa (MEA) region is witnessing steady growth in the modular packaging equipment market, driven by the expansion of the food and beverage sector. Increasing investments in manufacturing infrastructure and technological advancements in packaging are anticipated to fuel market growth. Additionally, rising demand for packaged goods in both emerging and developed economies in this region further enhances the adoption of modular packaging solutions.

Latin America Modular Packaging Equipment Market Insights

The Latin American modular packaging equipment market is evolving, supported by the increasing demand for cost-effective packaging solutions in consumer goods and food industries. The region’s market growth is driven by rising urbanization and a growing middle-class population that is demanding more packaged goods. Additionally, increased foreign investments and a shift toward modern packaging technologies are expected to drive future growth in the Latin American market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Modular Packaging Equipment Company Insights

In 2024, Unipak Machinery continues to be a key player in the modular packaging equipment market with its innovative solutions for high-speed packaging operations. The company has strategically positioned itself to meet the growing demand for automation and efficiency across various industries, particularly in food and beverage sectors.

Tetra Pak remains a dominant force, offering packaging solutions that emphasize sustainability and operational efficiency. Known for its state-of-the-art technology in liquid food packaging, Tetra Pak’s systems are pivotal in maintaining high hygiene standards while reducing environmental impact through eco-friendly solutions.

Sidel Group is strengthening its presence by developing advanced packaging lines that focus on both flexibility and efficiency. Its solutions cater to the food and beverage industry, allowing companies to enhance production capabilities while ensuring quality and consistency in packaged products.

Rockwell Automation has been a significant contributor to the modular packaging equipment market by integrating cutting-edge automation systems. The company’s innovations allow manufacturers to streamline their operations, optimize production lines, and adapt quickly to changes in demand while maintaining high product quality standards.

These companies are spearheading growth in the modular packaging sector, driven by the increasing need for automation, sustainability, and efficiency across various industries. Their contributions to technological advancements and operational enhancements ensure that the market remains dynamic and adaptable to the changing demands of global production.

Top Key Players in the Market

- Unipak Machinery

- Tetra Pak

- Sidel Group

- Rockwell Automation

- ProMach

- Packaging Automation

- NJM Packaging

- Multivac

- Marel

- Krones

- IMA Group

- Combi Packaging Systems

- Coesia

Recent Developments

- In March 2025, Massman acquired ADCO, a well-known manufacturer of packaging machinery specializing in cartoning and case packing solutions. This acquisition strengthens Massman’s capabilities and market position in the secondary packaging space.

- In May 2024, ATS Corporation agreed to acquire Paxiom Group, a provider of automated packaging machines. The deal expands ATS’s footprint in food and consumer goods automation markets.

- In August 2024, IMA Group completed the acquisition of Sarong’s Packaging Machinery and Packaging Materials divisions. The acquisition enhances IMA’s offerings in the healthcare and food packaging sectors.

Report Scope

Report Features Description Market Value (2024) USD 15.2 Billion Forecast Revenue (2034) USD 25.5 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Primary Packaging Equipment, Shrink Wrapping Machines, Palletizing Equipment, Cartoning Machines, Case Packing Systems, Sealing Machines, Filling Machines, Labeling Machines, Coding And Marking Equipment, Secondary Packaging Equipment), By Automation Level (Automatic Systems, Semi-Automatic Systems, Manual Modular Equipment) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Unipak Machinery, Tetra Pak, Sidel Group, Rockwell Automation, ProMach, Packaging Automation, NJM Packaging, Multivac, Marel, Krones, IMA Group, Combi Packaging Systems, Coesia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Modular Packaging Equipment MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Modular Packaging Equipment MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Unipak Machinery

- Tetra Pak

- Sidel Group

- Rockwell Automation

- ProMach

- Packaging Automation

- NJM Packaging

- Multivac

- Marel

- Krones

- IMA Group

- Combi Packaging Systems

- Coesia