Global MOCVD Market By Type(GaN-MOCVD, GaAs-MOCVD, Others), By Application(LED Manufacturing, Semiconductor Devices, Optoelectronic Devices, Power Electronics, Others ), By End-Use(Consumer Electronics, Automotive, Telecommunications, Aerospace and Defense, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Feb 2024

- Report ID: 14279

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

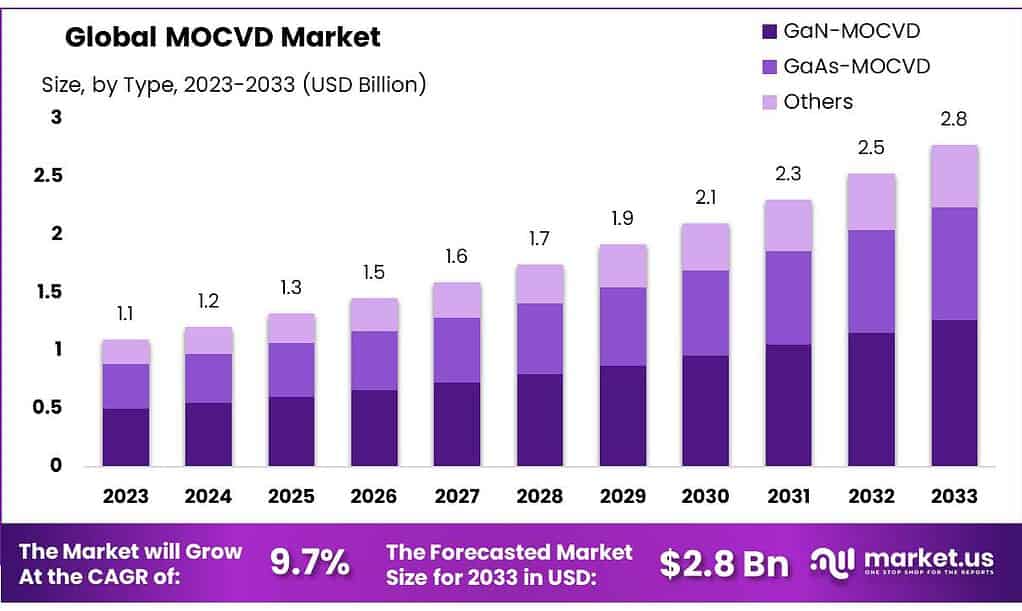

The global MOCVD Market size is expected to be worth around USD 2.8 billion by 2033, from USD 1.1 billion in 2023, growing at a CAGR of 9.7% during the forecast period from 2023 to 2033.

The Metalorganic Chemical Vapor Deposition (MOCVD) market encompasses the sale and innovation within the technology used for the deposition of thin films from organometallic compounds onto substrates, which is widely used in the production of semiconductors, LEDs, and photovoltaic cells. The market’s dynamics are influenced by technological advancements, the growing demand for high-performance electronic devices, and the expansion of the LED lighting market globally.

The industry’s growth can be attributed to the increasing application in various end-user industries such as electronics, power storage, and solar systems due to its ability to produce high-purity, high-performance layers of materials. Additionally, strategic investments in research and development, particularly in regions with significant semiconductor manufacturing, are expected to further drive market expansion.

The competitive landscape of the MOCVD market typically features a mix of large multinational corporations and specialized high-technology firms, with a focus on enhancing efficiency, scalability, and reducing production costs to achieve a competitive edge. The industry may also be characterized by significant barriers to entry due to the high level of technical expertise required and substantial capital investment.

Key Takeaways

- Market Growth: The MOCVD market is expected to reach USD 2.8 billion by 2033, with a CAGR of 9.7% from 2023.

- Segment Dominance: GaN-MOCVD captured a 45.6% market share in 2023, favored for power electronics in automotive and telecommunications.

- Application Focus: LED Manufacturing holds 41.5% market share in 2023, meeting global demand for energy-efficient lighting.

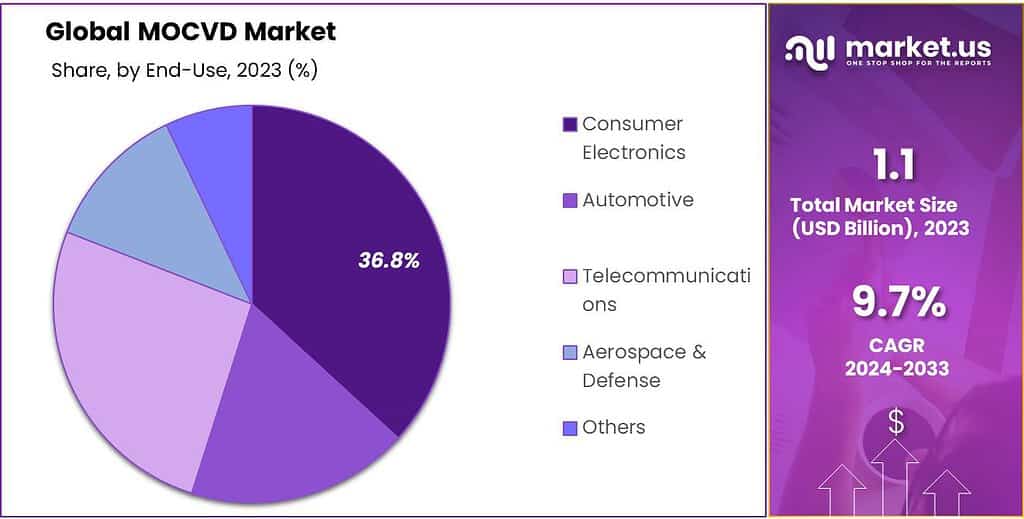

- Consumer Electronics: Leads MOCVD usage with 36.8% market share in 2023, driven by demand for advanced electronics like smartphones.

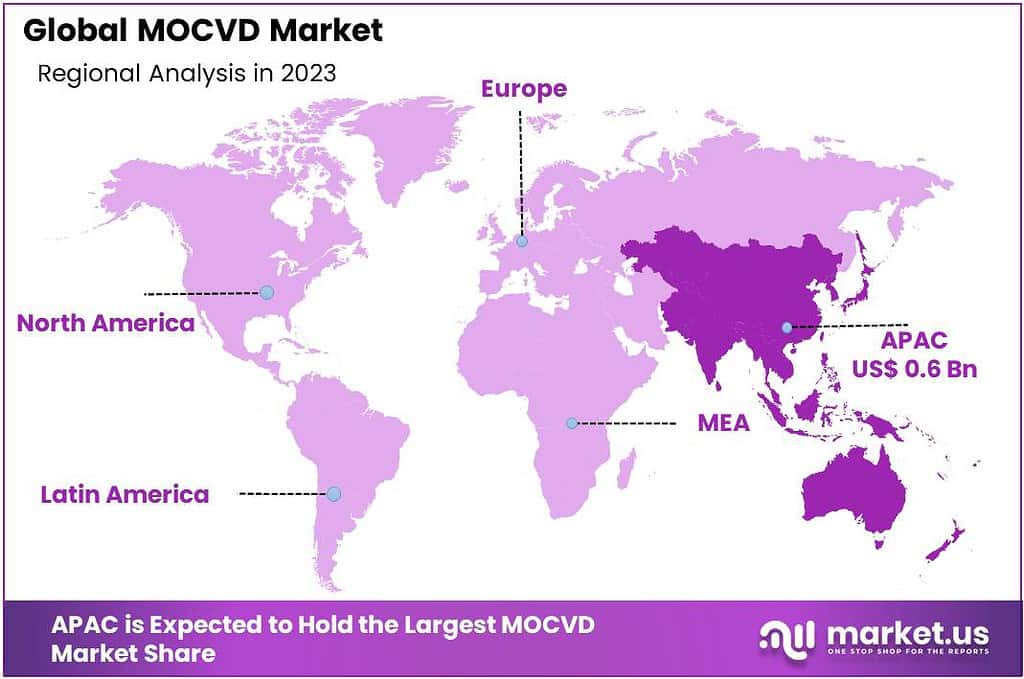

- Regional Trends: Asia Pacific leads with a 55.4% market share in 2023, driven by demand from consumer electronics and automotive sectors.

By Type

In 2023, GaN-MOCVD held a dominant market position, capturing more than a 45.6% share. This segment’s prominence is driven by the widespread adoption of GaN-based devices in power electronics and the escalating demand for efficient and compact devices in the automotive and telecommunications sectors.

Gallium Nitride (GaN) devices are renowned for their superior performance at high frequencies and high temperatures, making them ideal for critical applications.

Moving to GaAs-MOCVD, this segment also signifies a substantial portion of the market, given its critical role in the manufacturing of high-speed electronic and optoelectronic components. The utility of GaAs-MOCVD in producing devices that operate effectively at high frequencies has bolstered its adoption in wireless communication and advanced radar systems.

The “Others” category in the MOCVD market comprises several emerging and specialized materials, such as InP (Indium Phosphide) and AlN (Aluminum Nitride), which are gaining traction due to their unique properties that are suitable for novel applications in the semiconductor industry.

This segment’s growth is nurtured by continuous research and innovation aimed at expanding the applicability of MOCVD in various advanced technologies.

By Application

In 2023, LED Manufacturing held a dominant market position, capturing more than a 41.5% share. This sector’s leadership stems from the booming global demand for LEDs, driven by their energy efficiency and longer lifespan compared to traditional lighting solutions. The push for energy-saving initiatives across both developed and developing regions has further stimulated the growth of this segment.

Semiconductor Devices come next, leveraging MOCVD technologies to meet the increasing need for high-performance chips used in a variety of electronics. The surge in smart devices, alongside advancements in computing technology, has amplified this segment’s expansion.

Optoelectronic Devices also represent a key application of MOCVD, given their critical use in communication systems, sensors, and medical equipment. The precision and quality required for these devices underscore the importance of advanced manufacturing techniques provided by MOCVD.

By End-Use

In 2023, Consumer Electronics held a dominant market position, capturing more than a 36.8% share. This segment’s strength is largely due to the ongoing demand for advanced electronics such as smartphones, smartwatches, and other personal devices that rely on components manufactured through MOCVD processes.

The Automotive sector is also a significant end-user of MOCVD, particularly for the fabrication of LEDs and power electronics used in vehicles. Enhanced safety features and the shift towards electric vehicles drive the need for reliable and efficient semiconductor components.

Telecommunications has emerged as another key segment, with MOCVD playing a vital role in creating the high-performance semiconductor devices required for high-speed communication infrastructure. This includes applications in 5G technology, where reliability and efficiency are paramount.

Aerospace & Defense is a niche yet crucial segment that benefits from MOCVD’s ability to produce components capable of withstanding extreme conditions. The precision and quality of semiconductors in critical missions and operations make MOCVD indispensable in this sector.

Market Key Segments

By Type

- GaN-MOCVD

- GaAs-MOCVD

- Others

By Application

- LED Manufacturing

- Semiconductor Devices

- Optoelectronic Devices

- Power Electronics

- Others

By End-Use

- Consumer Electronics

- Automotive

- Telecommunications

- Aerospace & Defense

- Others

Drivers

Miniaturization of Electronic Devices:

The ongoing trend towards smaller, more powerful electronic devices is driving the demand for MOCVD technology. As components shrink in size, the precision required in semiconductor fabrication increases, making MOCVD an essential process in creating the necessary high-quality thin films.

Energy Efficiency:

There is a global push towards energy-efficient solutions, particularly in lighting and power electronics. MOCVD is critical in producing components for LEDs and power devices that offer superior performance with lower energy consumption, thus driving market growth.

Restraints

Cost Intensive Equipment:

One of the main restraints in the MOCVD market is the high cost of MOCVD equipment, which requires significant initial investment. This can be a barrier for new entrants and may limit market expansion, particularly in cost-sensitive regions.

Complex Operation and Maintenance:

The complexity of operating and maintaining MOCVD equipment necessitates skilled personnel and can lead to higher operational costs. These factors can restrain the growth of the MOCVD market by affecting the total cost of ownership.

Opportunity

Adoption in Developing Regions:

There is a substantial opportunity for the MOCVD market to expand in emerging economies, where the electronics manufacturing sector is growing rapidly. As these regions invest in local semiconductor production, the demand for MOCVD is anticipated to rise.

Diversification of Applications:

The versatility of MOCVD technology allows it to be used in various applications beyond traditional sectors. Opportunities lie in the expansion into new fields such as flexible electronics, photovoltaics, and advanced sensor technology, which can open up new market segments.

Trends

Rise of LED Lighting:

The LED sector’s growth, buoyed by its energy efficiency and longer lifespan compared to traditional lighting solutions, is a significant trend impacting the MOCVD market. As LEDs become the standard for lighting solutions, the need for MOCVD in their production scales up correspondingly.

Adoption in Power Electronics:

Power electronics are vital for the operation of renewable energy systems, electric vehicles, and smart power grids. The use of MOCVD in creating semiconductor devices for these applications is trending upwards, aligned with the shift towards sustainable energy and smarter infrastructure.

Regional Analysis

The Asia Pacific region is projected to hold a commanding position in the MOCVD market, with the largest market share of 55.4%, and is anticipated to achieve a CAGR of 7.9% during the forecast period. The region’s growth is primarily driven by an increase in demand for high-performance electronics and energy-efficient lighting solutions in critical end-use industries such as consumer electronics, automotive, and telecommunications.

Substantial investments in semiconductor production in countries like China, India, and in Southeast Asia, including Korea, Thailand, Malaysia, and Vietnam, are poised to propel the growth of the MOCVD market within the region throughout the forecast period.

In North America, economic advancements are expected to bolster the MOCVD market, particularly due to the expansion of the automotive sector, which is increasingly adopting LED lighting and power electronics. Similarly, the burgeoning semiconductor and electronics manufacturing industries in this region are projected to significantly drive the demand for MOCVD.

Europe is set to exhibit noteworthy growth in the MOCVD market during the forecast period, fueled by robust demand from the automotive and aerospace industries, which are continuously integrating advanced electronics into their products. Additionally, the region’s push towards renewable energy sources is likely to spur the growth of power electronics, thereby increasing the need for MOCVD in the production of related semiconductor devices.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the MOCVD market, the analysis of key players is essential to understanding the competitive landscape and the dynamics that drive innovation and market growth.

Market Key Players

- AIXTRON SE

- Veeco Instruments Inc.

- ASM International N.V.

- Taiyo Nippon Sanso Corporation

- CVD Equipment Corporation

- Tokyo Electron Limited

- Jusung Engineering Co., Ltd.

- Applied Materials, Inc.

- Intelligent Epitaxy Technology, Inc.

- Northrop Grumman

- IQE plc

- EpiGaN nv

- Xiamen Powerway Advanced Material Co., Ltd.

- Okmetic Oy

Recent Developments

- 2023 AIXTRON SE: Announced a strategic partnership with a leading Chinese LED manufacturer to supply MOCVD systems for micro LED production.

- 2023 Veeco Instruments Inc.: Launched its next-generation MOCVD platform, designed for advanced GaN and GaAs applications.

- 2023 ASM International N.V.: Entered the MOCVD market with the acquisition of Evonik’s epitaxial deposition business, expanding its portfolio in the compound semiconductor space.

Report Scope

Report Features Description Market Value (2022) US$ 1.1 Bn Forecast Revenue (2032) US$ 2.8 Bn CAGR (2023-2032) 9.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(GaN-MOCVD, GaAs-MOCVD, Others), By Application(LED Manufacturing, Semiconductor Devices, Optoelectronic Devices, Power Electronics, Others

), By End-Use(Consumer Electronics, Automotive, Telecommunications, Aerospace & Defense, Others)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AIXTRON SE, Veeco Instruments Inc., ASM International N.V., Taiyo Nippon Sanso Corporation, CVD Equipment Corporation, Tokyo Electron Limited, Jusung Engineering Co., Ltd., Applied Materials, Inc., Intelligent Epitaxy Technology, Inc., Northrop Grumman, IQE plc, EpiGaN nv, Xiamen Powerway Advanced Material Co., Ltd., Okmetic Oy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AIXTRON SE

- Veeco Instruments Inc.

- ASM International N.V.

- Taiyo Nippon Sanso Corporation

- CVD Equipment Corporation

- Tokyo Electron Limited

- Jusung Engineering Co., Ltd.

- Applied Materials, Inc.

- Intelligent Epitaxy Technology, Inc.

- Northrop Grumman

- IQE plc

- EpiGaN nv

- Xiamen Powerway Advanced Material Co., Ltd.

- Okmetic Oy