Global Mobile Photo Printer Market Size, Share, Growth Analysis By Usage (Ink-Based, Ink-Free Mobile Photo Printers), By Product Type (Compact Photo Printer, Pocket Photo Printer), By Connectivity (Bluetooth, Wi-Fi, USB), By Application (Commercial, Individual), By Distribution Channel (Online, Offline) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173670

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

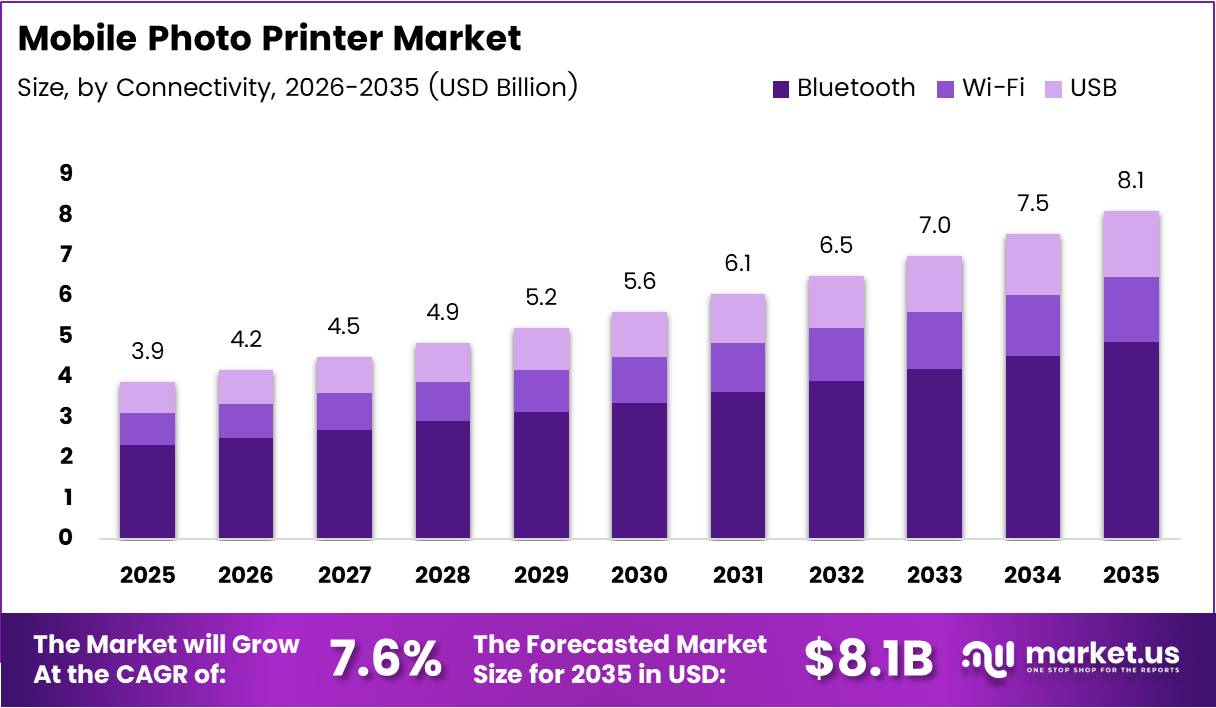

Global Mobile Photo Printer Market size is expected to reach approximately USD 8.1 Billion by 2033 from USD 3.9 Billion in 2025, expanding at a robust CAGR of 7.6% during the forecast period from 2026 to 2033. This remarkable growth trajectory reflects the evolving consumer preference for instant photo printing solutions.

The Mobile Photo Printer Market encompasses portable printing devices that connect wirelessly to smartphones and tablets. These compact solutions enable users to instantly print high-quality photographs directly from their mobile devices. The market includes various technologies such as inkjet, thermal dye-sublimation, and ZINK printing methods.

Significant expansion opportunities emerge from the increasing integration of advanced smartphone cameras and social media platforms. Modern consumers increasingly seek tangible memories from their digital collections. Furthermore, the market benefits from rising disposable incomes and growing demand for personalized gifts across demographics. Young consumers particularly drive adoption through event photography and creative applications.

The commercial segment demonstrates substantial potential as businesses leverage mobile photo printers for promotional activities and brand engagement. Event organizers, photographers, and content creators increasingly adopt these portable solutions. Additionally, technological advancements enable enhanced print quality and faster processing times. Manufacturers continuously innovate with app-based editing features and augmented reality filters.

Government initiatives supporting digital photography education in schools create new market avenues. Environmental regulations encourage development of eco-friendly printing technologies and cartridge-free solutions. According to Pew Research Center, approximately 91% of U.S. adults own smartphones, establishing a massive potential user base. Moreover, Fujifilm reported that cumulative global sales of instant cameras and smartphone printers exceeded 100 million units, validating strong market demand.

Distribution channels rapidly evolve with online platforms gaining prominence for product accessibility. Competitive pricing strategies and subscription models for consumables enhance market penetration. The industry witnesses growing investment in research and development for innovative printing technologies. Strategic partnerships between smartphone manufacturers and printer brands further accelerate market expansion across emerging economies.

Key Takeaways

- Global Mobile Photo Printer Market valued at USD 3.9 Billion in 2025, projected to reach USD 8.1 Billion by 2033

- Market growing at a CAGR of 7.6% during the forecast period 2026-2033

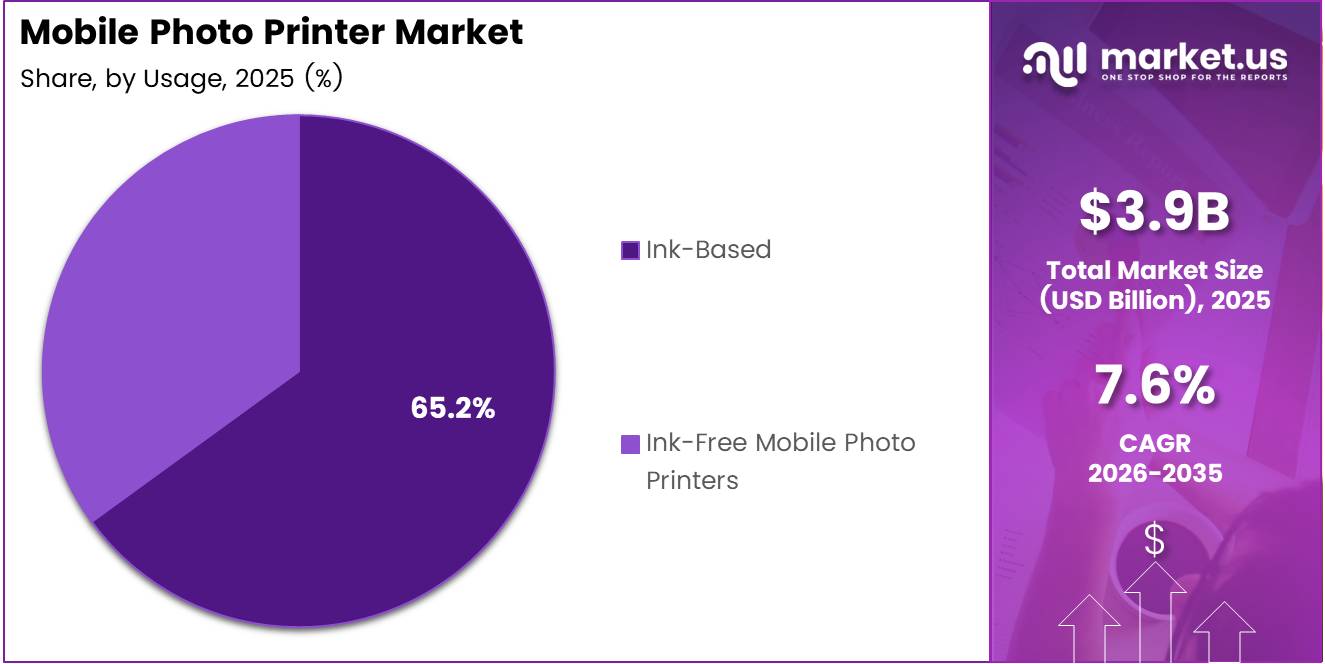

- Ink-Based segment dominates with 65.2% market share in usage category

- Compact Photo Printer leads product type segment with 59.7% share

- Bluetooth connectivity holds 52.5% market share among connectivity options

- Commercial application segment commands 67.9% of total market

- Online distribution channel captures 59.3% market share

- North America dominates regional market with 38.6% share, valued at USD 1.5 Billion

Usage Analysis

Ink-Based mobile photo printers dominate with 65.2% market share due to superior print quality and color accuracy.

In 2025, Ink-Based held a dominant market position in the By Usage Analysis segment of Mobile Photo Printer Market, with a 65.2% share. These printers utilize traditional ink cartridge technology to deliver professional-grade photographs with vibrant colors and excellent durability. The segment benefits from widespread consumer familiarity and trust in ink-based printing methods. Major manufacturers continue investing in advanced ink formulations that enhance photo longevity and resist fading.

Ink-Free Mobile Photo Printers represent an innovative alternative leveraging ZINK and thermal printing technologies. These devices eliminate the need for ink cartridges, reducing ongoing operational costs for users. The segment appeals to travelers and outdoor enthusiasts seeking lightweight, maintenance-free solutions. Additionally, environmental concerns drive adoption as these printers generate less waste. However, print quality limitations compared to ink-based solutions currently constrain broader market acceptance.

Product Type Analysis

Compact Photo Printer dominates with 59.7% market share due to balanced portability and enhanced printing capabilities.

In 2025, Compact Photo Printer held a dominant market position in the By Product Type Analysis segment of Mobile Photo Printer Market, with a 59.7% share. These devices offer larger print sizes, typically ranging from 4×6 to 5×7 inches, satisfying consumer demand for standard photograph dimensions. The segment combines portability with superior print quality, making it ideal for semi-professional photographers and event coverage. Furthermore, compact printers accommodate higher paper capacities, reducing frequent refills during extended usage sessions.

Pocket Photo Printer segment targets ultra-portability enthusiasts preferring credit-card-sized prints for instant sharing. These miniature devices easily fit in bags and pockets, enabling spontaneous printing anywhere. The segment particularly resonates with younger demographics attending social gatherings and festivals. However, smaller print sizes and limited battery capacity present functional constraints. Despite these limitations, continuous technological improvements gradually enhance performance and user convenience.

Connectivity Analysis

Bluetooth connectivity dominates with 52.5% market share due to universal smartphone compatibility and seamless pairing.

In 2025, Bluetooth held a dominant market position in the By Connectivity Analysis segment of Mobile Photo Printer Market, with a 52.5% share. This wireless technology offers hassle-free connections without requiring internet access or complex network configurations. The segment benefits from energy-efficient data transmission and reliable performance across diverse environments. Moreover, Bluetooth connectivity enables quick device pairing, enhancing user experience significantly. Manufacturers increasingly incorporate advanced Bluetooth versions supporting faster data transfer rates.

Wi-Fi connectivity provides advantages for simultaneous multi-device connections and cloud printing capabilities. This technology enables users to print photographs directly from online storage platforms and social media accounts. The segment appeals to professional photographers managing multiple devices during events. USB connectivity maintains relevance for specific applications requiring stable, high-speed data transfer. However, physical cable requirements limit mobility and convenience compared to wireless alternatives.

Application Analysis

Commercial application dominates with 67.9% market share due to extensive adoption across event management and promotional activities.

In 2025, Commercial held a dominant market position in the By Application Analysis segment of Mobile Photo Printer Market, with a 67.9% share. Businesses leverage mobile photo printers for on-site event photography, promotional campaigns, and customer engagement initiatives. The segment experiences robust growth from wedding photographers, party planners, and corporate event organizers. Additionally, retail stores utilize these devices for instant product demonstrations and personalized marketing materials. Commercial users prioritize durability, print volume capacity, and consistent output quality.

Individual application segment encompasses personal use for home entertainment, travel documentation, and creative hobbies. Consumers purchase mobile photo printers for scrapbooking, gift customization, and preserving special memories. The segment benefits from declining device prices making technology accessible to broader audiences. Furthermore, social media integration encourages individuals to transform digital content into tangible keepsakes. However, intermittent usage patterns result in lower per-unit print volumes compared to commercial applications.

Distribution Channel Analysis

Online distribution channel dominates with 59.3% market share due to competitive pricing and extensive product variety.

In 2025, Online held a dominant market position in the By Distribution Channel Analysis segment of Mobile Photo Printer Market, with a 59.3% share. E-commerce platforms provide comprehensive product information, customer reviews, and convenient home delivery options. The segment benefits from frequent promotional offers and bundle deals attracting price-conscious consumers. Moreover, online channels enable manufacturers to reach geographically dispersed markets without extensive physical infrastructure. Digital marketing campaigns effectively target specific demographic segments through social media and search platforms.

Offline distribution channels maintain importance for consumers preferring hands-on product evaluation before purchase. Electronics retailers and specialty camera stores offer expert consultation and immediate product availability. The segment serves customers requiring urgent replacements or last-minute event preparations. Additionally, physical stores facilitate accessory purchases and after-sales service support. However, higher operational costs and limited inventory space constrain product variety compared to online alternatives.

Key Market Segments

By Usage

- Ink-Based

- Ink-Free Mobile Photo Printers

By Product Type

- Compact Photo Printer

- Pocket Photo Printer

By Connectivity

- Bluetooth

- Wi-Fi

- USB

By Application

- Commercial

- Individual

By Distribution Channel

- Online

- Offline

Drivers

Rapid Smartphone Camera Resolution Upgrades Boosting On-Demand Photo Printing Demand

Continuous advancements in smartphone camera technology fundamentally transform mobile photography capabilities. Modern devices feature multi-lens systems, computational photography, and artificial intelligence enhancements producing professional-quality images. Consequently, consumers accumulate vast digital photo libraries seeking physical preservation options. Mobile photo printers perfectly address this need by enabling instant, high-resolution prints directly from smartphones.

The proliferation of high-megapixel cameras in mid-range smartphones democratizes quality photography. Users no longer require expensive professional equipment to capture stunning images. This accessibility drives demand for complementary printing solutions that match digital quality standards. Additionally, social media platforms encourage constant photo sharing, reinforcing the desire for tangible memories. The convergence of superior camera technology and portable printing solutions creates sustained market momentum.

Restraints

High Cost of Proprietary Ink Cartridges and Photo Paper Refills

Ongoing consumable expenses significantly impact total ownership costs for mobile photo printer users. Manufacturers often employ proprietary cartridge designs preventing third-party alternatives, maintaining premium pricing. Specialized photo paper requirements further increase per-print costs, discouraging frequent usage. Budget-conscious consumers hesitate purchasing devices when recurring expenses exceed initial hardware investment over time.

Limited print size capability compared to conventional home printers restricts application versatility. Most mobile photo printers produce maximum 4×6 inch prints, inadequate for larger format requirements. Professional photographers and businesses often need diverse print dimensions for various purposes. This functional limitation forces users to maintain multiple printing solutions, reducing mobile printer appeal. Consequently, some potential customers opt for traditional multi-function printers despite sacrificing portability advantages.

Growth Factors

Integration of AI-Based Photo Enhancement Features in Companion Mobile Apps

Artificial intelligence integration revolutionizes mobile photo printing by offering automated image optimization. Companion applications analyze photographs, adjusting brightness, contrast, and color saturation for optimal print results. Advanced algorithms detect faces, remove blemishes, and enhance background elements without manual intervention. These intelligent features democratize professional-quality printing, attracting users lacking technical editing skills.

Expansion into corporate branding, promotional merchandise, and event marketing segments unlocks substantial revenue opportunities. Businesses recognize mobile photo printers as powerful engagement tools for trade shows, product launches, and customer appreciation events. Increasing demand from educational institutions for creative learning tools further accelerates adoption. Emerging sales potential across tier-2 and tier-3 cities through online retail channels democratizes access, reaching previously underserved markets with growing purchasing power.

Emerging Trends

Rising Adoption of ZINK and Dye-Sublimation Printing Technologies

Advanced printing technologies reshape the mobile photo printer landscape by eliminating traditional ink cartridges. ZINK technology embeds color-forming crystals within specialized paper, activating through heat application. This innovation removes ink cartridge expenses and simplifies device maintenance significantly. Dye-sublimation methods deliver superior color gradients and photographic realism, appealing to quality-conscious consumers.

Growing launch of Bluetooth-enabled compact and pocket-sized printers addresses portability demands. Manufacturers prioritize ergonomic designs fitting comfortably in bags while maintaining robust functionality. Increasing preference for app-based editing and augmented reality print filters enhances creative possibilities. Eco-friendly photo paper and cartridge-free printing technology development responds to environmental sustainability concerns. These combined trends position the market for continued innovation and diversification across consumer segments.

Regional Analysis

North America Dominates the Mobile Photo Printer Market with a Market Share of 38.6%, Valued at USD 1.5 Billion

North America leads the global mobile photo printer market, capturing a commanding 38.6% share valued at USD 1.5 Billion in 2025. The region benefits from high smartphone penetration rates and strong consumer electronics adoption. Advanced retail infrastructure and robust e-commerce platforms facilitate widespread product availability. Additionally, early technology adoption and higher disposable incomes drive premium product segment growth.

Europe Mobile Photo Printer Market Trends

Europe demonstrates steady market expansion supported by strong photography culture and creative industries. The region emphasizes sustainable printing solutions aligned with stringent environmental regulations. Professional photographers and event management companies represent significant customer segments. Furthermore, cross-border e-commerce facilitates market access across diverse European nations with varying consumer preferences.

Asia Pacific Mobile Photo Printer Market Trends

Asia Pacific exhibits the fastest growth potential driven by massive population base and rising middle-class prosperity. Smartphone adoption accelerates across emerging economies, expanding the addressable market significantly. Local manufacturers introduce competitively priced products targeting cost-sensitive consumers. Additionally, growing social media influence and youth demographics fuel demand for instant photo printing solutions.

Middle East and Africa Mobile Photo Printer Market Trends

Middle East and Africa represent emerging opportunities with gradual technology adoption across urban centers. Growing tourism industry and event photography businesses drive commercial segment demand. However, economic disparities and limited distribution infrastructure constrain market penetration. Increasing internet connectivity and smartphone accessibility gradually improve market conditions for future expansion.

Latin America Mobile Photo Printer Market Trends

Latin America shows promising growth supported by young population demographics and cultural emphasis on celebrations. Economic volatility influences purchasing patterns, creating preference for affordable product options. Online retail channels overcome geographical distribution challenges across diverse terrains. Moreover, growing social media engagement encourages consumers to transform digital content into physical keepsakes.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Mobile Photo Printer Company Insights

Fujifilm Holdings Corporation maintains a prominent position through its successful instax brand combining instant cameras and smartphone printers. The company leverages decades of imaging expertise to deliver reliable, user-friendly printing solutions. Fujifilm’s extensive distribution network and brand recognition provide significant competitive advantages.

Canon Inc. capitalizes on its established reputation in professional photography equipment to penetrate the mobile photo printer market. The company offers SELPHY series printers featuring compact designs and professional-grade output quality. Canon integrates proprietary dye-sublimation technology ensuring long-lasting, fade-resistant prints.

The Hewlett-Packard Company brings extensive printing industry experience to the mobile photo printer segment. HP develops innovative solutions combining portability with advanced printing technologies. The company’s Sprocket series targets younger demographics with colorful, customizable designs and intuitive mobile applications.

LG Electronics leverages its consumer electronics ecosystem to offer integrated mobile photo printing solutions. The company focuses on Bluetooth connectivity and wireless convenience appealing to smartphone-centric consumers. LG incorporates sleek, modern designs aligning with contemporary aesthetic preferences.

Key Market Players:

- Fujifilm Holdings Corporation

- LG Electronics

- The Hewlett-Packard Company

- Canon Inc.

- Brother International Corporation

- Eastman Kodak Company

- Polaroid Corporation

- Seiko Epson Corporation

- Sony Corporation

- HiTi Digital, Inc.

Recent Developments

- December 2025: Mimeo Ltd. acquired KnowledgePoint Print Services Ltd, strengthening its leadership position in training materials and learning fulfillment. This strategic acquisition expands service capabilities and geographic reach across educational sectors.

- December 2024: Xerox announced plans to acquire rival printer maker Lexmark for USD 1.53 Billion. The acquisition aims to consolidate market position and enhance product portfolio through complementary technology integration.

Report Scope

Report Features Description Market Value (2025) USD 3.9 Billion Forecast Revenue (2035) USD 8.1 Billion CAGR (2026-2035) 7.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Usage (Ink-Based, Ink-Free Mobile Photo Printers), By Product Type (Compact Photo Printer, Pocket Photo Printer), By Connectivity (Bluetooth, Wi-Fi, USB), By Application (Commercial, Individual), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fujifilm Holdings Corporation, LG Electronics, The Hewlett-Packard Company, Canon Inc., Brother International Corporation, Eastman Kodak Company, Polaroid Corporation, Seiko Epson Corporation, Sony Corporation, HiTi Digital, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Photo Printer MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Mobile Photo Printer MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Fujifilm Holdings Corporation

- LG Electronics

- The Hewlett-Packard Company

- Canon Inc.

- Brother International Corporation

- Eastman Kodak Company

- Polaroid Corporation

- Seiko Epson Corporation

- Sony Corporation

- HiTi Digital, Inc.