Global Mobile Phone Packaging Market Size, Share, Growth Analysis By Packaging (Rigid Boxes, Folding Cartons, Flexible Films, Insert Trays, Thermoformed Blisters), By Material (Paperboard, Plastics, Molded Fiber), By Application (Smart Phones, Feature Phones, Refurbished Phones, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168169

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

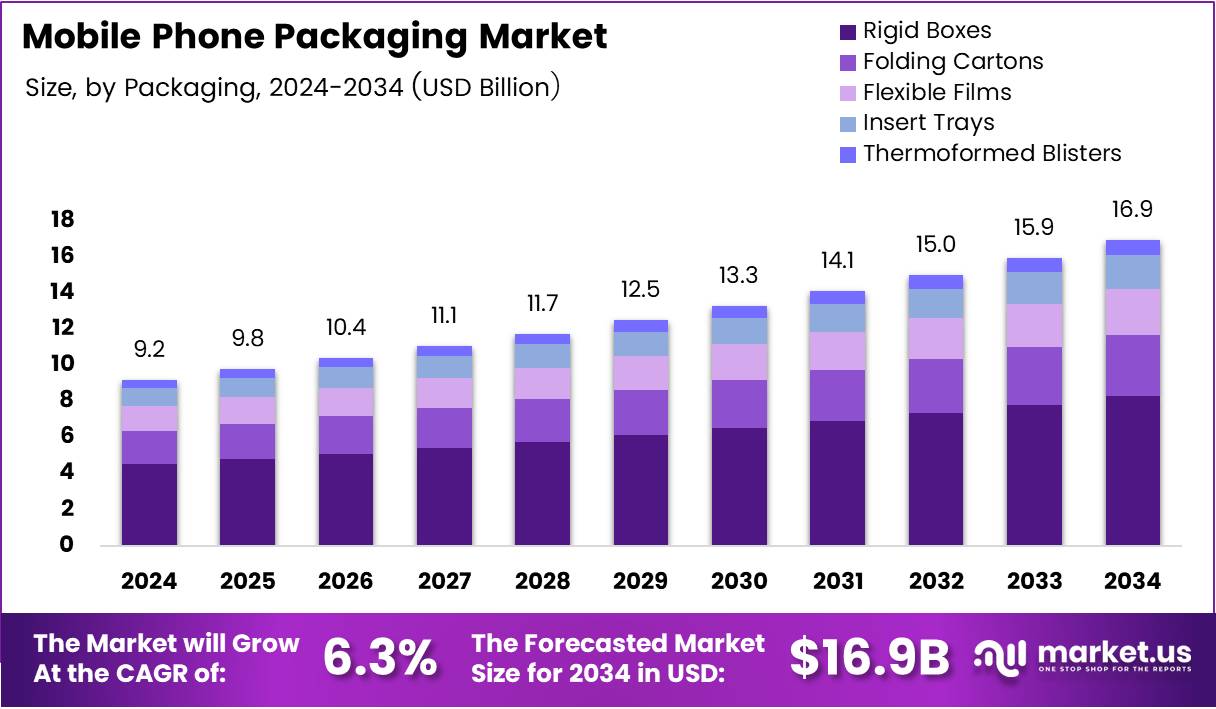

The Global Mobile Phone Packaging Market size is expected to reach approximately USD 16.9 Billion by 2034, up from USD 9.2 Billion in 2024. The market is projected to grow at a CAGR of 6.3% during the forecast period from 2025 to 2034. This growth trajectory reflects the dynamic evolution of smartphone technologies and consumer preferences worldwide.

Mobile phone packaging encompasses protective and presentational solutions designed to safeguard devices during transit and enhance brand appeal. It includes rigid boxes, folding cartons, flexible films, and molded fiber formats. These packaging types serve critical functions beyond mere protection, including authentication, user engagement, and sustainability messaging.

Consequently, the market experiences robust expansion driven by premium unboxing experiences and specialized designs for advanced devices. The proliferation of 5G and foldable smartphones necessitates innovative packaging that accommodates unique form factors. E-commerce channels continue fueling demand for damage-resistant formats that ensure product integrity during shipping.

Furthermore, sustainability initiatives by original equipment manufacturers significantly influence packaging material selection. Brands increasingly transition toward plastic-free and recyclable alternatives to align with environmental commitments. Consumer preferences also shift toward eco-friendly options, creating competitive advantages for companies adopting sustainable practices.

Meanwhile, smart packaging integration emerges as a transformative opportunity, incorporating NFC and QR-based authentication technologies. These innovations enhance consumer engagement while combating counterfeit products in distribution channels. Modular packaging designs optimize multi-variant SKU management, reducing inventory complexity for manufacturers.

Additionally, regional dynamics shape market development, with Asia Pacific demonstrating particularly strong growth momentum. Government regulations regarding packaging waste management and recycling targets influence material choices across markets. Investment in biodegradable molded pulp solutions addresses both regulatory requirements and consumer expectations for environmental responsibility.

According to industry reports, 90% of consumers indicate higher purchase likelihood from brands using sustainable packaging. Similarly, 54% deliberately selected products with sustainable packaging in recent months, while 43% express willingness to pay premium prices for such options. These statistics underscore the strategic importance of sustainability in packaging development and market positioning strategies.

Key Takeaways

- Global Mobile Phone Packaging Market size projected to reach USD 16.9 Billion by 2034 from USD 9.2 Billion in 2024

- Market expected to grow at a CAGR of 6.3% during forecast period 2025-2034

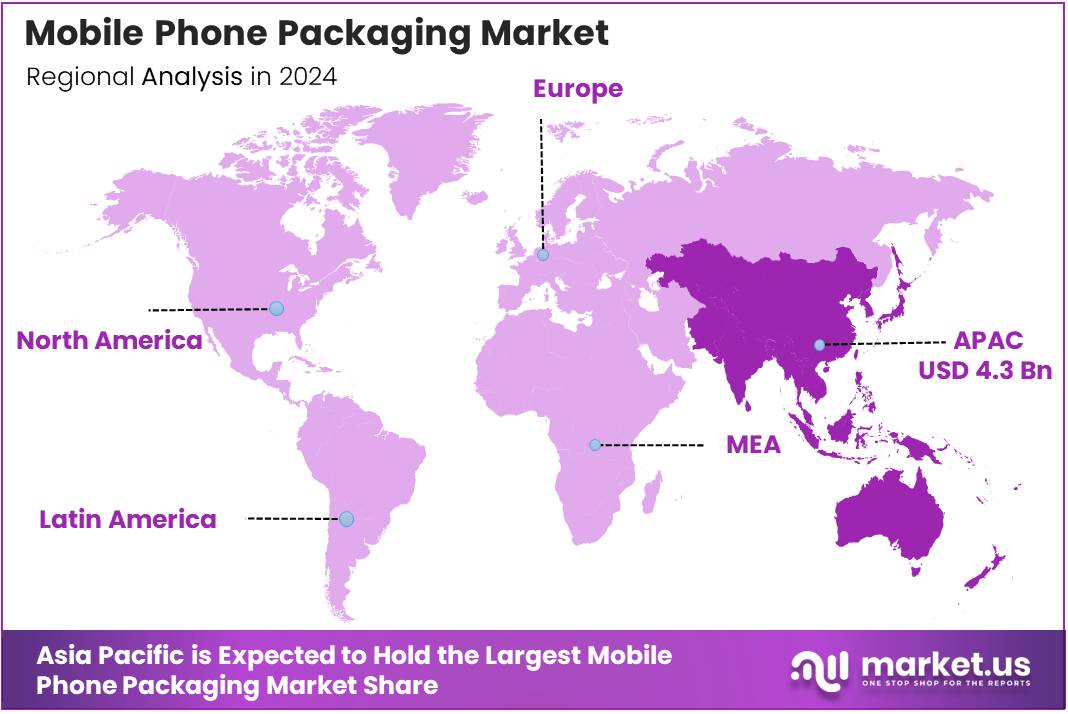

- Asia Pacific dominates with 47.80% market share, valued at USD 4.3 Billion

- Rigid boxes segment leads packaging type with 43.8% market share

- Paperboard material holds dominant position with 56.3% share

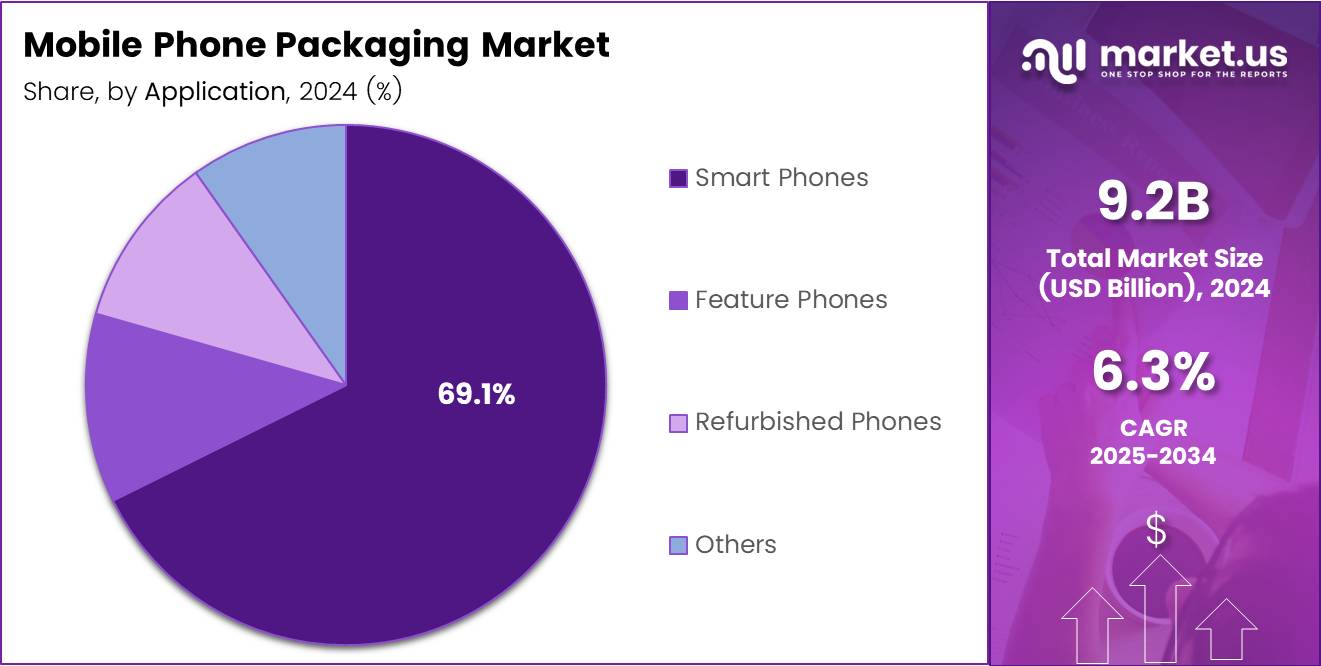

- Smartphones application segment accounts for 69.1% of total market

By Packaging Analysis

Rigid Boxes dominate with 43.8% due to superior protection and premium brand positioning capabilities.

In 2024, Rigid Boxes held a dominant market position in the By Packaging Analysis segment, capturing 43.8% share. These packaging solutions provide exceptional structural integrity and aesthetic appeal for premium smartphone brands. Manufacturers prefer rigid boxes for flagship devices requiring elevated unboxing experiences. The format accommodates custom inserts and compartments for accessories effectively.

Folding cartons represent cost-effective alternatives for mid-range smartphone packaging requirements. They offer flexibility in design customization while maintaining adequate protection during distribution. Brands utilize folding cartons for feature phones and budget segments. The format enables efficient storage and transportation logistics.

Flexible films serve niche applications in component packaging and protective wrapping solutions. They provide moisture barriers and scratch protection for display screens and accessories. Manufacturers combine flexible films with other packaging formats for comprehensive protection strategies.

Insert trays ensure organized placement of devices and accessories within packaging structures. They prevent movement during transit and create visually appealing product presentations. Molded fiber and plastic variants address different sustainability and cost considerations.

Thermoformed blisters deliver transparent display capabilities for retail environments and aftermarket accessories. They enable product visibility while maintaining tamper-evident sealing properties. The segment serves refurbished phone markets and replacement component packaging needs effectively.

By Material Analysis

Paperboard dominates with 56.3% driven by recyclability and brand printing versatility.

In 2024, Paperboard held a dominant market position in the By Material Analysis segment, with 56.3% share. This material preference reflects industry-wide sustainability commitments and consumer environmental consciousness. Paperboard offers excellent printability for brand messaging and visual differentiation. It provides adequate structural strength for protecting mobile devices during shipping.

Plastics continue serving specific functional requirements despite environmental concerns and regulatory pressures. They deliver superior moisture resistance and transparency for certain packaging applications. However, brands increasingly limit plastic usage to comply with corporate sustainability goals. Recycled plastic content gains adoption where plastic remains necessary for performance.

Molded fiber emerges as a sustainable alternative combining environmental benefits with functional performance. Made from recycled paper and agricultural waste, it appeals to eco-conscious manufacturers. The material provides cushioning properties comparable to plastic foam inserts. Brands leverage molded fiber for differentiating packaging strategies in competitive markets.

By Application Analysis

Smartphones dominate with 69.1% reflecting segment’s market volume and premium packaging requirements.

In 2024, Smartphones held a dominant market position in the By Application Analysis segment, capturing 69.1% share. This dominance correlates with global smartphone sales volumes and premium packaging investments. Flagship devices require sophisticated packaging reflecting their technological innovation and price positioning. Brands utilize packaging as critical touchpoint for consumer experience differentiation.

Feature phones maintain presence in developing markets and as secondary devices for specific demographics. Their packaging requirements emphasize cost efficiency over premium aesthetics and elaborate unboxing experiences. Manufacturers adopt simplified designs reducing material usage and production costs. The segment serves price-sensitive consumers prioritizing functionality over brand experience.

Refurbished phones represent growing market segment driven by sustainability awareness and affordability considerations. Packaging for these devices balances cost constraints with quality assurance and brand credibility. Sellers utilize packaging to communicate device condition and warranty information effectively.

Others category includes accessories, tablets, and emerging device formats requiring specialized packaging solutions. These applications demand flexible packaging approaches accommodating diverse product dimensions and protection requirements. The segment grows alongside ecosystem expansion beyond traditional phone categories.

Key Market Segments

By Packaging

- Rigid Boxes

- Folding Cartons

- Flexible Films

- Insert Trays

- Thermoformed Blisters

By Material

- Paperboard

- Plastics

- Molded Fiber

By Application

- Smart Phones

- Feature Phones

- Refurbished Phones

- Others

Drivers

Premium Unboxing Experience Demanding High-Quality Aesthetic Packaging Drives Market Growth

Consumer expectations for memorable unboxing experiences significantly influence mobile phone packaging development strategies. Smartphone manufacturers recognize packaging as the first physical brand interaction, investing heavily in premium materials and design. This trend intensifies in competitive markets where differentiation extends beyond device specifications to holistic brand experiences.

Consequently, brands incorporate sophisticated printing techniques, textured finishes, and custom structural designs. Social media amplification of unboxing videos motivates companies to create visually striking packaging. Premium segments particularly emphasize this aspect, with packaging costs representing notable portions of product pricing.

Additionally, rapid adoption of 5G and foldable smartphones necessitates specialized packaging accommodating unique form factors. These advanced devices require protective solutions addressing specific engineering challenges. Manufacturers develop innovative cushioning systems and structural reinforcements for fragile foldable displays.

Furthermore, e-commerce channel growth demands robust damage-resistant packaging formats ensuring product integrity during shipping. Direct-to-consumer models eliminate retail display requirements but increase transit protection needs. Brands optimize packaging for both protection and reduced dimensional weight to minimize shipping costs.

Restraints

Volatility in Raw Material Prices Impacting Paperboard and Molded Fiber Packaging Cost

Fluctuating prices for paperboard and molded fiber raw materials create cost uncertainty for packaging manufacturers. These variations stem from supply chain disruptions, changing pulp availability, and energy cost fluctuations. Manufacturers face challenges maintaining competitive pricing while absorbing material cost increases without compromising quality standards.

Moreover, limited standardization due to frequent smartphone model redesign cycles increases packaging complexity significantly. Each new device generation often requires completely redesigned packaging solutions. This constant evolution prevents economies of scale and increases development costs for packaging suppliers.

Consequently, tooling investments for short production runs reduce profitability margins across the supply chain. Brands launching multiple variants simultaneously multiply these challenges exponentially. Packaging suppliers must balance customization demands with operational efficiency requirements.

Additionally, regulatory requirements and sustainability standards add compliance costs without immediate revenue benefits. Companies invest in certifications, testing, and material sourcing verification processes. These necessary expenditures impact smaller packaging suppliers more severely than larger competitors with established infrastructure.

Growth Factors

Smart Packaging Integration with NFC and QR-Based Authentication Drives Innovation

Integration of smart technologies into mobile phone packaging creates significant growth opportunities. NFC and QR-based systems enable product authentication, combating counterfeiting in global distribution networks. These technologies also facilitate consumer engagement through interactive content and warranty registration processes.

Furthermore, expansion of biodegradable molded pulp solutions addresses growing demand for sustainable accessory-inclusive packaging. These materials provide environmental benefits while maintaining necessary protective properties. Manufacturers develop advanced molding techniques improving surface finish and structural performance of pulp-based packaging.

Additionally, contract manufacturing growth for third-party phone packaging solution providers expands market accessibility. Smaller brands and regional players leverage specialized packaging manufacturers without significant capital investments. This model enables rapid market entry and flexible production scaling based on demand fluctuations.

Meanwhile, lightweight composite protective packaging for ultra-thin device box innovation reduces material usage. Advanced engineering creates stronger structures with less material, addressing both cost and sustainability objectives. These innovations particularly benefit e-commerce channels where shipping weight directly impacts profitability margins.

Emerging Trends

Minimalist Retail Packaging Transition with Reduced In-Box Components Gains Momentum

Industry-wide transition toward minimalist packaging reflects environmental consciousness and cost optimization strategies. Brands eliminate non-essential accessories like charging adapters and earphones from packaging. This approach reduces box sizes, material usage, and shipping costs while aligning with sustainability messaging.

Simultaneously, adoption of modular packaging for multi-variant SKU optimization improves inventory management efficiency. Standardized base components accommodate different device models through interchangeable inserts and sleeves. Manufacturers reduce storage requirements and production complexity through this strategic approach.

Moreover, digital-first printed packaging with AR-enabled interactive covers enhances consumer engagement beyond physical unboxing. Augmented reality features provide setup instructions, promotional content, and brand storytelling experiences. These innovations bridge physical and digital brand interactions effectively.

Furthermore, carbon-neutral packaging tracking and labeling mandates by global brands increase transparency requirements. Companies implement lifecycle assessment methodologies quantifying environmental impacts accurately. Third-party certifications verify sustainability claims, building consumer trust in environmental commitments throughout supply chains.

Regional Analysis

Asia Pacific Dominates the Mobile Phone Packaging Market with 47.80% Share, Valued at USD 4.3 Billion

Asia Pacific holds the dominant position in the mobile phone packaging market, accounting for 47.80% market share valued at USD 4.3 Billion. This leadership reflects the region’s role as global smartphone manufacturing hub and largest consumer market. Countries like China, India, and Vietnam host major production facilities for international and domestic brands. Additionally, rapid smartphone adoption across emerging economies drives packaging demand growth. The region benefits from established supply chains and competitive manufacturing costs.

North America Mobile Phone Packaging Market Trends

North America demonstrates mature market characteristics with emphasis on premium packaging and sustainability innovations. The region’s consumers exhibit high willingness to pay for eco-friendly packaging solutions. Major brands headquartered here drive global packaging standards and environmental initiatives. Regulatory frameworks increasingly mandate recyclability and reduced plastic usage in packaging materials.

Europe Mobile Phone Packaging Market Trends

Europe maintains stringent environmental regulations influencing packaging material selection and design approaches. The region leads in circular economy initiatives and extended producer responsibility programs. Brands operating here prioritize biodegradable materials and minimalist packaging designs. Consumer environmental consciousness drives demand for transparent sustainability reporting and certified materials.

Latin America Mobile Phone Packaging Market Trends

Latin America shows growing smartphone penetration creating expanding opportunities for packaging suppliers. Economic development in major markets like Brazil and Mexico supports premium device adoption. However, cost sensitivity influences packaging material choices toward efficient yet economical solutions. E-commerce growth necessitates robust protective packaging for emerging distribution channels.

Middle East and Africa Mobile Phone Packaging Market Trends

Middle East and Africa exhibit diverse market dynamics with premium segments in Gulf nations and value-focused markets elsewhere. Smartphone adoption accelerates driven by improving telecommunications infrastructure and affordability. Packaging requirements vary significantly across sub-regions based on economic development and consumer preferences. Import-dependent markets face challenges with packaging standardization and supply chain costs.

Key Mobile Phone Packaging Company Insights

The global mobile phone packaging market in 2024 features diverse players offering specialized solutions across material types and formats. Khosla Printers provides comprehensive packaging solutions leveraging advanced printing technologies and customization capabilities for smartphone brands. Their expertise in rigid box manufacturing supports premium segment requirements effectively.

Mosco Prints India Private Limited specializes in high-quality paperboard packaging with focus on sustainable material sourcing and innovative design. They serve both domestic and international clients with scalable production facilities.

Arrow Media delivers integrated packaging solutions combining traditional formats with smart packaging technologies. Their offerings include NFC-enabled authentication systems and interactive consumer engagement features.

Jainpack India focuses on eco-friendly packaging alternatives utilizing molded fiber and recycled materials. They address growing demand for sustainable packaging from environmentally conscious smartphone manufacturers across market segments.

These companies alongside others contribute to market innovation through material advancements, design optimization, and sustainability initiatives. The competitive landscape emphasizes customization capabilities, rapid prototyping, and supply chain integration. Manufacturers increasingly partner with packaging suppliers early in product development cycles ensuring optimal packaging solutions. Technology integration, sustainable materials, and cost efficiency remain critical differentiators in this evolving market landscape.

Key Companies

- Khosla Printers

- Mosco Prints India Private Limited

- Arrow Media

- Jainpack India

- Mickeyfone Technologies Private Limited

- RK Packaging

- Ushaa Enterprises

- Paramount Box Manufactures

- Paramount Enterprise

- Prime Packaging Industries

- Shri Ganesh Packaging

Recent Developments

- In February 2024, Corplex, Packeta, and Slovak Telekom announced a collaboration launching reusable e-commerce boxes for mobile phone delivery in Slovakia. The initiative utilizes Corplex’s AkyPak containers, promoting circular economy principles in smartphone distribution channels. This development addresses environmental concerns while maintaining product protection standards throughout delivery processes.

- In August 2024, Google announced achieving its 2025 goal of making all new hardware packaging plastic-free ahead of schedule. Products including Pixel, Fitbit, and Nest devices now utilize plastic-free materials such as specialized paper and molded fiber made partly from recycled newspaper. This milestone demonstrates industry leadership in sustainable packaging commitments and influences broader market practices.

Report Scope

Report Features Description Market Value (2024) USD 9.2 Billion Forecast Revenue (2034) USD 16.9 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging (Rigid Boxes, Folding Cartons, Flexible Films, Insert Trays, Thermoformed Blisters), By Material (Paperboard, Plastics, Molded Fiber), By Application (Smart Phones, Feature Phones, Refurbished Phones, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Khosla Printers, Mosco Prints India Private Limited, Arrow Media, Jainpack India, Mickeyfone Technologies Private Limited, RK Packaging, Ushaa Enterprises, Paramount Box Manufactures, Prime Packaging Industries, Shri Ganesh Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Phone Packaging MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Phone Packaging MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Khosla Printers

- Mosco Prints India Private Limited

- Arrow Media

- Jainpack India

- Mickeyfone Technologies Private Limited

- RK Packaging

- Ushaa Enterprises

- Paramount Box Manufactures

- Paramount Enterprise

- Prime Packaging Industries

- Shri Ganesh Packaging