Global Mobile Payment Market By Type(B2B, B2C, B2G, Others), By Technology(Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Mobile App, Others), By Location(Remote Payment, Proximity Payment), By End-User(BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 129352

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

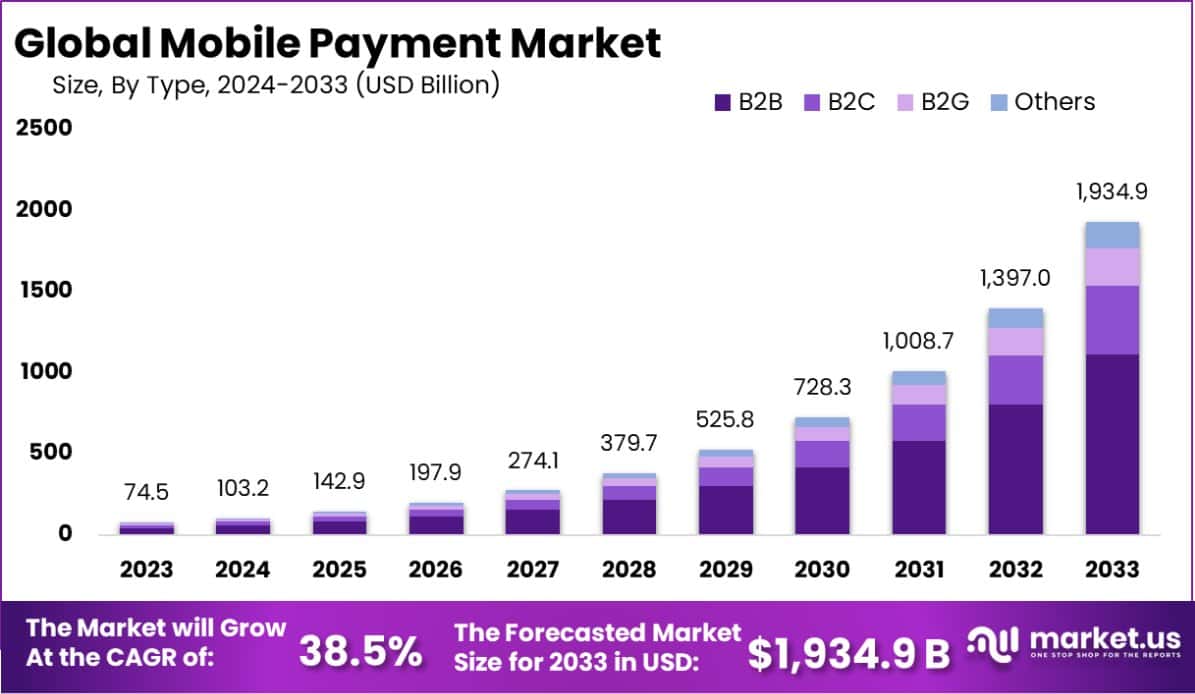

The Global Mobile Payment Market size is expected to be worth around USD 1,934.9 Billion By 2033, from USD 74.5 Billion in 2023, growing at a CAGR of 38.5% during the forecast period from 2024 to 2033. Asia Pacific dominated a 38.3% market share in 2023 and held USD 28.53 Billion in revenue from the Mobile Payment Market.

Mobile payment refers to transactions conducted via mobile devices, allowing users to make payments and manage financial operations without needing physical cash or cards. This method capitalizes on smartphone proliferation and mobile banking apps, facilitating instant and secure monetary exchanges.

The mobile payment market is experiencing substantial growth, driven by the increasing adoption of smartphones, greater internet penetration, and consumer preference for contactless transactions. The shift towards digital wallets and mobile banking applications, enhanced by secure and user-friendly interfaces, further stimulates market expansion.

Key growth factors include technological advancements, evolving consumer behaviors, and supportive government policies promoting digital payments. Top opportunities within this market lie in emerging economies where traditional banking infrastructure is limited, enabling mobile payments to bridge financial inclusion gaps.

The demand for mobile payment solutions is further bolstered by the rising trend of e-commerce and remote services, which require efficient and secure transaction methods.

The global mobile payment market is witnessing a significant transformation as it has become a crucial enabler of financial inclusion and economic development. The proliferation of mobile payment technologies is particularly pronounced in regions with traditionally underserved banking populations.

According to data from the International Monetary Fund (IMF), there are approximately 228 mobile money agents per 100,000 adults worldwide, which dramatically surpasses the availability of traditional banking facilities, with only 11 banks and 33 ATMs per 100,000 adults. This disparity underscores the pivotal role mobile payments play in bridging the financial access gap.

An estimated 1.7 billion people globally lack access to formal financial institutions, a gap that mobile payment platforms are effectively addressing by providing essential financial services to the unbanked population. This shift toward digital solutions has been further accelerated by the COVID-19 pandemic.

The World Bank reports that during the pandemic, 36% of adults in developing economies began receiving wages or government payments through mobile accounts, signifying a robust pivot towards digital payment methods.

Moreover, the adoption of mobile payments has been shown to influence positive financial behaviors among users. Countries that have moved towards digitizing cash transactions have observed a 40% increase in the number of individuals utilizing their accounts for purposes like savings and cash management.

This trend not only highlights the convenience and accessibility of mobile payments but also suggests a broader impact on economic behaviors, promoting greater financial security and autonomy among users.

Key Takeaways

- The Global Mobile Payment Market size is expected to be worth around USD 1,934.9 Billion By 2033, from USD 74.5 Billion in 2023, growing at a CAGR of 38.5% during the forecast period from 2024 to 2033.

- In 2023, B2B held a dominant market position in the By Type segment of the Mobile Payment Market, capturing more than a 57.5% share.

- In 2023, Mobile Web Payment held a dominant market position in the By Technology segment of the Mobile Payment Market, capturing more than a 24% share.

- In 2023, Remote Payment held a dominant market position in the By Location segment of the Mobile Payment Market, capturing more than a 61% share.

- In 2023, BFSI held a dominant market position in the end-user segment of the Mobile Payment Market, capturing more than a 25.2% share.

- Asia Pacific dominated a 38.3% market share in 2023 and held USD 28.53 Billion in revenue from the Mobile Payment Market.

By Type Analysis

In 2023, B2B held a dominant market position in the “By Type” segment of the Mobile Payment Market, capturing more than a 57.5% share. This substantial market share underscores the critical role that mobile payment solutions play in facilitating transactions between businesses, which are typically characterized by higher transaction volumes and values.

B2B mobile payments not only enhance operational efficiencies but also contribute to reduced processing times and improved cash flow management, elements that are crucial for business sustainability and growth.

The B2C segment also represents a significant portion of the market, driven by consumer demand for convenient and swift payment methods in retail and e-commerce. Mobile payments in B2C settings are enhancing customer experiences, leading to increased customer retention and satisfaction by simplifying transactions and reducing friction at points of sale.

Meanwhile, the B2G segment, which involves transactions between businesses and government entities, is progressively adopting mobile payment solutions to streamline procurement processes and improve the efficiency of government-related financial transactions.

The “Others” category, encompassing non-traditional sectors that are gradually integrating mobile payment methods, is witnessing growth as various industries recognize the benefits of mobile payment technologies in enhancing transactional efficiency and security. Each of these segments highlights the diverse applicability and transformative potential of mobile payments across different economic sectors.

By Technology Analysis

In 2023, Mobile Web Payment held a dominant market position in the “By Technology” segment of the Mobile Payment Market, capturing more than a 24% share. This prominence is largely due to the widespread adoption of smartphones and the increasing availability of mobile internet services, which facilitate easy access to web-based payment platforms.

Mobile Web Payment solutions offer consumers the convenience of making payments anytime and anywhere, driving their adoption across diverse consumer demographics and geographies.

Near Field Communication (NFC) technology also occupies a significant portion of the market, favored for its security features and contactless transaction capabilities, particularly in retail and transit systems. Direct Mobile Billing, another notable segment, remains popular for its simplicity, allowing users to charge payments directly to their mobile phone bills, which is particularly effective in markets with low credit card penetration.

The SMS payment method, although facing declining usage due to the rise of more secure and versatile technologies, still finds relevance in regions with basic mobile phone infrastructure. Mobile Apps are rapidly gaining market share, driven by their user-friendly interfaces and the integration of advanced security measures.

The “Others” category includes emerging technologies and innovations that continue to diversify the mobile payment landscape, highlighting ongoing technological advancements and their adoption in niche markets.

By Location Analysis

In 2023, Remote Payment held a dominant market position in the “By Location” segment of the Mobile Payment Market, capturing more than a 61% share. This leadership position underscores the growing consumer preference for conducting financial transactions remotely, rather than through physical interactions.

Remote payments encompass transactions executed via internet-based services, mobile banking apps, and e-commerce platforms, where payment is made at a distance from the point of sale. The convenience, enhanced security features, and increasing consumer confidence in digital technologies drive the adoption of remote payment methods.

Conversely, Proximity Payment, which involves transactions made in close physical proximity to the point of sale, such as contactless credit cards and NFC-enabled devices, represents the remainder of the market. While proximity payment technologies are gaining traction due to their speed and convenience, particularly in urban and technologically advanced regions, they currently occupy a smaller share compared to remote payments.

The prevailing trend towards remote payments is influenced by factors such as the expansion of e-commerce, greater penetration of internet and smartphone usage, and evolving consumer habits that favor convenience and safety in transactional processes.

By End-User Analysis

In 2023, the Banking, Financial Services, and Insurance (BFSI) sector held a dominant market position in the “By End-User” segment of the Mobile Payment Market, capturing more than a 25.2% share.

This substantial market share highlights the critical integration of mobile payment solutions within the financial services industry, driven by the need for secure, efficient, and instant payment transactions. The BFSI sector leverages these technologies to enhance customer experience, streamline operations, and reduce costs associated with traditional banking methods.

Following BFSI, the Retail & E-commerce sector also commands a significant portion of the market. This segment benefits from mobile payments by offering consumers a seamless shopping experience, characterized by ease and speed of checkout, which boosts consumer satisfaction and loyalty.

The Transportation sector is another notable user of mobile payments, utilizing these systems to simplify fare collections and improve the efficiency of public transport networks. IT & Telecom, Healthcare, and Media & Entertainment sectors are increasingly adopting mobile payment solutions to address customer demand for convenience and to support new business models.

The “Others” category includes emerging markets and industries that are beginning to recognize the advantages of mobile payments, exploring their potential to innovate and enhance service delivery.

Key Market Segments

By Type

- B2B

- B2C

- B2G

- Others

By Technology

- Near Field Communication

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Mobile App

- Others

By Location

- Remote Payment

- Proximity Payment

By End-User

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Transportation

- Others

Drivers

Mobile Payment Market Drivers

The growth of the mobile payment market is primarily fueled by several key factors. Increasing smartphone penetration globally allows more consumers to access mobile payment solutions. Enhanced connectivity, including the expansion of high-speed internet, further supports this trend, enabling seamless and quick transactions.

There is also a significant shift towards digitalization in the banking and retail sectors, where businesses are adopting innovative payment methods to improve customer experience and operational efficiency. Consumer preferences are evolving, with rising demand for convenience and faster transaction capabilities, which mobile payments can offer effectively.

Additionally, supportive government policies promoting digital payments in various countries are playing a crucial role in the adoption and expansion of mobile payment technologies. These drivers collectively contribute to the robust growth of the mobile payment market, making it a critical component of today’s digital economy.

Restraint

Challenges Facing Mobile Payment Adoption

Despite its rapid growth, the mobile payment market faces several challenges that could slow its expansion. Security concerns top the list, as fears about data breaches and unauthorized transactions can deter potential users from adopting mobile payment technologies.

Many consumers also show a strong preference for traditional payment methods like cash and credit cards, particularly in regions with less developed digital infrastructures. Technological disparities and the lack of standardized protocols across different regions and systems can hinder the seamless integration of mobile payment solutions, complicating user experience.

Additionally, regulatory challenges and the need for compliance with diverse financial laws across countries can impose significant barriers to entry for new players and limit market growth. These factors collectively create substantial headwinds for the wider acceptance and use of mobile payment services.

Opportunities

Expanding Opportunities in Mobile Payments

The mobile payment market presents numerous opportunities for growth and innovation. As technology advances, there is a significant potential for mobile payment providers to integrate emerging technologies like blockchain and artificial intelligence, enhancing security and user experience.

The increasing trend of e-commerce and online shopping provides a fertile ground for mobile payments to become the preferred transaction method, driven by the convenience they offer. Additionally, the untapped markets in developing regions, where traditional banking infrastructure is limited, represent a vast opportunity for mobile payments to establish a strong foothold.

Collaborations between financial institutions and technology companies can also accelerate market growth by creating more robust and user-friendly payment solutions. Moreover, the rising interest in contactless payments, spurred by health concerns from the COVID-19 pandemic, further boosts the adoption of mobile payment technologies. These factors together position the mobile payment market on a trajectory of continued expansion.

Challenges

Navigating Mobile Payment Market Challenges

The mobile payment market encounters significant challenges that could impact its growth trajectory. Foremost among these is the issue of cybersecurity, where concerns over data privacy and the risk of fraud pose considerable obstacles to consumer adoption.

The fragmentation of the market due to a multitude of platforms and technologies also complicates interoperability and user convenience. Additionally, varying regulatory environments across different countries create complex compliance requirements that can stifle innovation and restrict market entry.

There is also notable resistance among certain demographic groups who are less tech-savvy, preferring traditional payment methods due to their familiarity and perceived reliability. Finally, the dependence on internet connectivity means that in areas with unreliable internet access, mobile payments cannot be consistently relied upon, limiting their usability. Addressing these challenges is crucial for the sustained growth and acceptance of mobile payment solutions.

Growth Factors

Key Growth Drivers in Mobile Payments

The mobile payment market is witnessing significant growth, driven by several influential factors. The widespread adoption of smartphones globally, coupled with increasing internet penetration, provides a solid foundation for mobile payments to flourish. Consumers are increasingly seeking convenience and speed in transactions, which mobile payments can deliver effectively.

The rise of e-commerce and digital services further boosts the demand for mobile payment solutions, as they offer a seamless checkout process. Financial technology advancements also play a crucial role, with innovations such as near-field communication (NFC) and QR codes enhancing the security and ease of mobile transactions.

Additionally, supportive government initiatives aimed at promoting digital payments are accelerating the adoption of mobile payment systems, especially in emerging economies. These dynamics are fostering a robust environment for the expansion of the mobile payment sector.

Emerging Trends

Emerging Trends in Mobile Payments

The mobile payment market is shaped by emerging trends that highlight its dynamic evolution. One significant trend is the integration of biometric technologies, such as fingerprint and facial recognition, to enhance security and user verification processes. There’s also a growing inclination towards contactless payments, which have surged in popularity due to their convenience and the hygiene concerns accelerated by the COVID-19 pandemic.

The expansion of mobile wallet services into new areas like loyalty programs and ticketing offers additional convenience, driving consumer adoption further. Another noteworthy trend is the collaboration between traditional banks and fintech companies, which combines the strengths of both to offer innovative payment solutions.

Additionally, the push towards financial inclusion in underserved regions is expanding the user base, as mobile payments provide accessible financial services to those without traditional banking facilities. These trends are crucial in steering the future direction of the mobile payment industry.

Regional Analysis

The global mobile payment market exhibits distinct characteristics and growth patterns across various regions. Asia Pacific is the dominating region, holding a significant 38.3% market share, with revenues reaching USD 28.53 billion. This dominance is largely due to widespread adoption in countries like China and India, where mobile payments are supported by robust digital infrastructure and a large consumer base increasingly shifting towards mobile-first solutions.

In North America, the market is driven by high smartphone penetration and the presence of major technology firms that are innovating in mobile wallet applications and payment technologies. Europe, meanwhile, shows strong growth due to stringent regulations supporting secure and efficient payment systems, coupled with high consumer trust in mobile payment solutions.

The Middle East & Africa region is experiencing rapid growth thanks to efforts towards financial inclusion and the rise of mobile connectivity, which allows mobile payments to serve as a primary means of financial transaction for unbanked populations. In contrast, Latin America is witnessing a slower adoption rate, though the potential remains high due to increasing internet penetration and growing fintech investments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the mobile payment market continues to be significantly shaped by key players such as Google, Alibaba Group Holdings Limited, and Amazon.com Inc. Each of these companies leverages its extensive technological capabilities and vast user bases to drive innovation and expand market share.

Google stands out with its Google Pay platform, which benefits from seamless integration across Google’s services and devices. With the proliferation of Android devices globally, Google Pay capitalizes on its built-in advantage of accessibility. Google’s ongoing investments in security technologies and partnerships with financial institutions worldwide further enhance its competitive edge.

The platform’s ability to integrate loyalty programs and offer personalized experiences based on user data positions Google strongly in diverse markets, particularly in North America and Europe where digital payment infrastructures are well-developed.

Alibaba Group Holdings Limited, through its affiliate Ant Group’s Alipay, dominates the mobile payment sector in Asia, particularly in China. Alipay’s ecosystem approach, integrating payments with e-commerce, social media, and other services, creates a comprehensive user experience that locks in consumer loyalty and encourages frequent transactions.

Alibaba’s strategic expansions into emerging markets across Asia and partnerships with local payment systems underline its efforts to capture growth outside its domestic market.

Amazon.com Inc. leverages its vast e-commerce network to push its mobile payment solution, Amazon Pay. By offering a familiar and trusted payment gateway, Amazon encourages adoption among its massive customer base, enhancing user convenience and trust.

Amazon Pay’s integration with Alexa further facilitates voice-activated transactions, reflecting Amazon’s innovative edge in incorporating next-generation technologies.

Top Key Players in the Market

- Alibaba Group Holdings Limited

- Amazon.com Inc.

- Apple Inc.

- American Express Company

- M Pesa

- Money Gram International

- PayPal Holdings Inc.

- Samsung Electronics Co. Ltd.

- Visa Inc.

- Mastercard

- PayU

Recent Developments

- In September 2023, Apple Inc. launched an enhanced version of Apple Pay that incorporates augmented reality for more interactive shopping experiences, aiming to blend digital smart payments with immersive technology.

- In August 2023, M Pesa announced a significant expansion in East Africa with a new cross-border payment feature, facilitating easier and faster transactions between multiple countries in the region. This development aims to strengthen its presence and utility in emerging markets.

- In July 2023, American Express acquired a fintech startup specializing in blockchain technology to secure and streamline mobile transactions, reflecting a strategic move to bolster its digital payment solutions.

Report Scope

Report Features Description Market Value (2023) USD 74.5 Billion Forecast Revenue (2033) USD 1,934.9 Billion CAGR (2024-2033) 38.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(B2B, B2C, B2G, Others), By Technology(Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Mobile App, Others), By Location(Remote Payment, Proximity Payment), By End-User(BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google, Alibaba Group Holdings Limited, Amazon.com Inc., Apple Inc., American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc., Samsung Electronics Co. Ltd.; Visa Inc., Mastercard, PayU Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Payment MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Mobile Payment MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alibaba Group Holdings Limited

- Amazon.com Inc.

- Apple Inc.

- American Express Company

- M Pesa

- Money Gram International

- PayPal Holdings Inc.

- Samsung Electronics Co. Ltd.

- Visa Inc.

- Mastercard

- PayU