Global Mobile learning Market Size, Share, Statistics Analysis By Solution (E-Books, Interactive Assessment, Mobile and Video-Based Courseware, Other Software), By Application (In-Class Learning, Corporate Learning, Simulation-Based Learning, Online-on-the Job Training, Independent Learning), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 133404

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Mobile Learning Statistics

- AI Impact on Mobile learning

- Solution Segment Analysis

- Application Segment Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

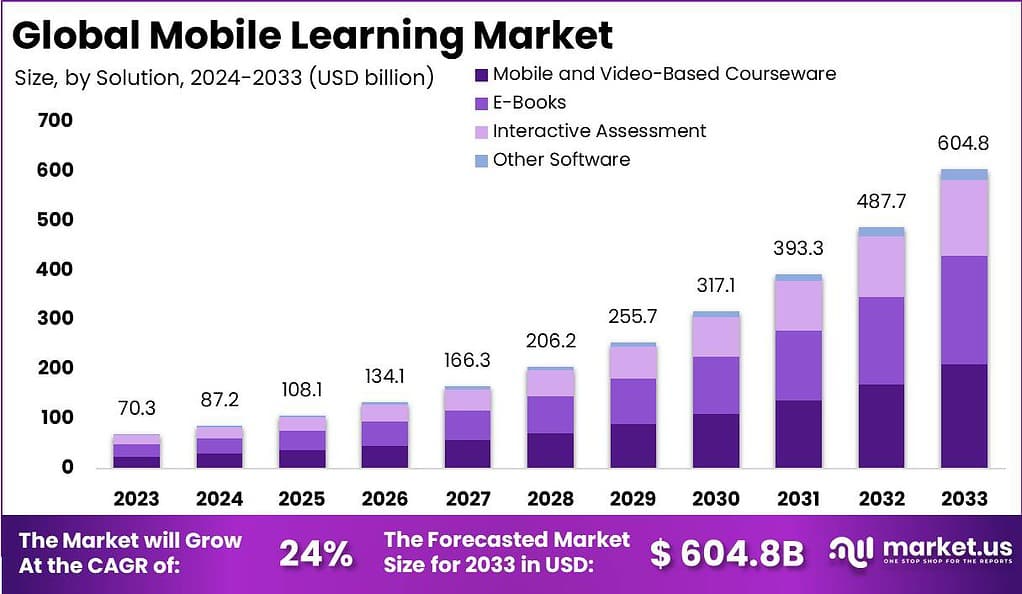

The Global Mobile Learning Market size is expected to be worth around USD 604.8 Billion by 2033, from USD 70.3 Billion in 2023, growing at a CAGR of 24.01% during the forecast period from 2024 to 2033.

Mobile learning, often abbreviated as m-learning, refers to the use of mobile devices like smartphones, tablets, and laptops to deliver educational content. This method allows learners to access learning materials from anywhere at any time, making education more flexible and accessible. Mobile learning supports a range of multimedia formats such as text, video, and interactive quizzes, and often includes apps and mobile-specific courses designed to enhance the learning experience.

The mobile learning market has been expanding significantly, driven by the growing penetration of internet services and the increasing affordability of smart mobile devices. Educational institutions and corporate organizations are increasingly adopting mobile learning as a means to provide flexible, scalable, and cost-effective education and training solutions. The market is also seeing a rise in demand for personalized learning experiences tailored to individual needs, which mobile platforms are ideally suited to provide.

The primary driver of the mobile learning market is the widespread adoption of mobile devices coupled with enhanced internet connectivity across the globe. The convenience of accessing educational content on-the-go appeals to a modern, mobile-first audience. Additionally, the integration of advanced technologies like AI and machine learning for customized learning experiences further accelerates market growth.

Demand in the mobile learning market is high among both academic institutions and businesses. For educational providers, it offers a way to extend reach and provide inclusive education beyond traditional classrooms. In the corporate sector, mobile learning is used extensively for training employees, especially in remote or dynamic work environments. The demand is also bolstered by the ongoing trend of lifelong learning and professional development, which encourages individuals to continually acquire new skills in an accessible manner.

For instance, In August 2023, a report by the Development Intelligence Unit (DIU) revealed significant insights into smartphone usage among rural students in India. 49.3% of students in these areas had access to smartphones. Among them, around 34% used their devices for downloading study materials, while only 18% engaged in online learning through tutorials.

Significant opportunities exist in the mobile learning market through the development of more sophisticated and user-friendly learning applications. There is also potential for growth in emerging markets where mobile device usage is increasing but access to traditional educational resources is limited. Furthermore, partnerships between educational content providers and mobile technology companies can enhance content delivery and learner engagement.

Technological advancements play a crucial role in shaping the mobile learning landscape. The adoption of AR and VR technologies, for example, has transformed how interactive and immersive educational content can be. Cloud-based solutions facilitate seamless access to learning materials and enable data collection on user progress, which can be used to personalize the learning experience.

According to Towards Maturity, an impressive 89% of smartphone users are regular app downloaders, and about half of these apps are utilized for learning purposes. Research by Learner Events reveals that 46% of mobile learners engage with educational content right before bedtime, indicating a significant trend in how and when users prefer to learn.

The shift towards mobile learning is further underscored by its motivational impact, with 70% of learners feeling more inspired when using mobile devices over traditional desktop setups. Additionally, a Skillsoft survey in the Asia-Pacific region highlights that 72% of participants experience increased engagement through mobile learning. Generation Z, in particular, shows a strong preference for this mode of learning, with 66% favoring lessons delivered through modern, tech-driven methods.

Key Takeaways

- The global m-learning market is projected to reach USD 604.8 billion by 2033, growing from USD 70.3 billion in 2023. This impressive growth represents a CAGR of 31% during the forecast period (2024-2033).

- In 2023, the Mobile and Video-Based Courseware segment accounted for more than 35% of the market share, making it the leading segment in the industry.

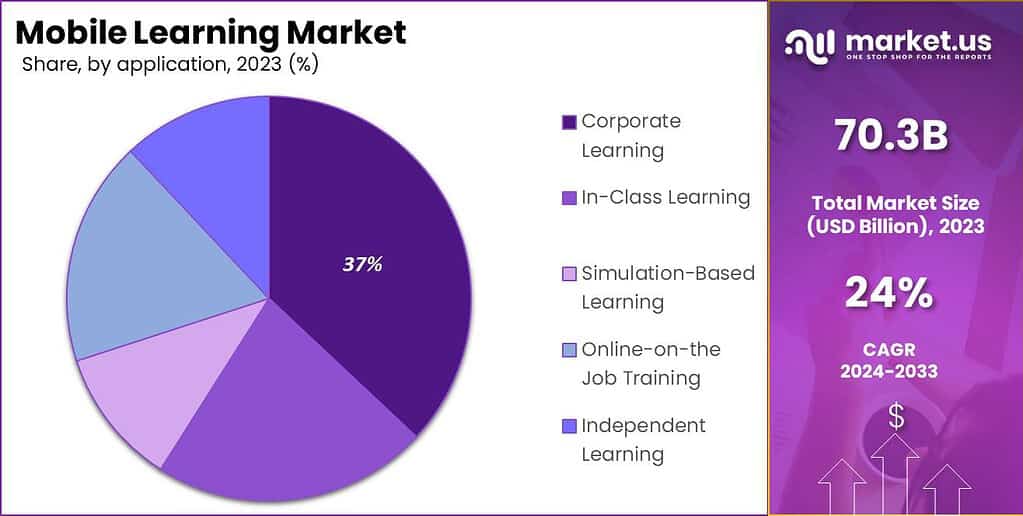

- The Corporate Learning segment emerged as a dominant force, capturing over 37% of the global market share in 2023, reflecting the increasing adoption of m-learning for employee training and upskilling.

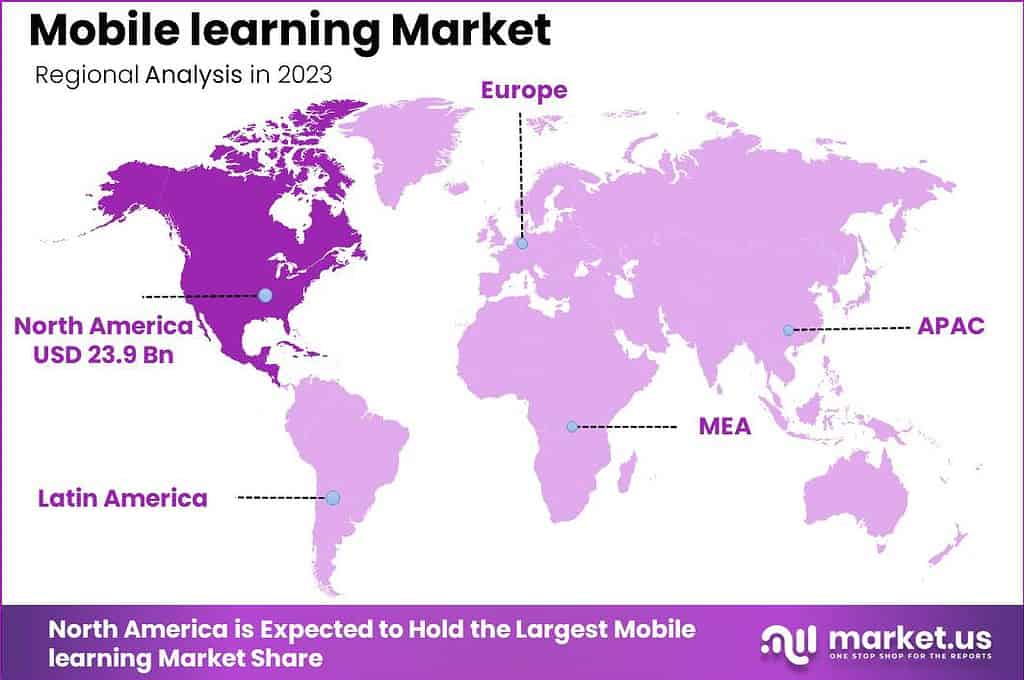

- North America held a commanding position in 2023, contributing to more than 34% of the global m-learning market share, driven by advanced technology adoption and strong investments in education and training.

Mobile Learning Statistics

Based on data from gitnux:

- Over 70% of employees use their smartphones to access mobile learning content, making it a preferred method for training.

- Mobile learning apps can increase productivity by 45%, offering businesses a substantial efficiency boost.

- Employees experience a 50% improvement in productivity when mobile learning is incorporated into training strategies.

- Completion rates for mobile learning are 45% higher than traditional e-learning, ensuring better engagement and knowledge retention.

- 61% of employees prefer self-paced learning, which is now mostly done on mobile devices.

- Mobile learning can cut study time by up to 60%, making it an efficient way to train employees.

- Training time can be reduced by 40-60% when using mobile learning methods, saving both time and resources.

- 70% of Fortune 500 companies already offer mobile learning solutions, highlighting its importance in corporate training.

- 85% of college students own smartphones, making mobile learning accessible for younger generations entering the workforce.

- Despite its benefits, only 34% of organizations include mobile learning in their training programs, signaling room for growth.

- Engagement levels with mobile learning are 3 times higher compared to e-learning, keeping learners motivated and active.

- Mobile learning saves up to 37% of training time, offering a more streamlined approach to education.

- 46% of participants say mobile device accessibility is a crucial factor in choosing learning platforms.

- Mobile learning drives a 72% increase in user engagement, creating more interactive and effective training sessions.

- Companies using eLearning, including mobile learning, report 26% higher revenue per employee, proving its direct impact on business growth.

AI Impact on Mobile learning

Artificial Intelligence (AI) is significantly transforming the mobile learning market by enhancing the personalization and accessibility of learning experiences. AI’s integration into mobile learning platforms is shaping the industry by offering adaptive learning paths, real-time tutoring via chatbots, and interactive and immersive educational experiences through Augmented Reality (AR) and Virtual Reality (VR) technologies.

The adoption of AI in mobile learning is driven by its potential to provide highly customized educational content that adapts to individual learner’s pace and style. For instance, platforms like Coursera are using AI to create personalized learning paths, which have shown to improve course completion rates. AI’s capability to analyze student data helps in offering tailored learning experiences and in identifying learning gaps, which can be addressed proactively to enhance student engagement and success.

Moreover, the integration of AI in mobile learning tools supports various learning modalities including microlearning, gamification, and video-based learning. These modalities not only make learning more engaging but also accommodate the diverse learning needs of a global audience. AI tools can assist in breaking down language barriers and cultural differences by enabling content localization, thus expanding the reach and effectiveness of mobile learning solutions globally.

However, the deployment of AI in mobile learning also presents challenges such as the need for substantial initial investment in technology infrastructure and the ongoing issue of data privacy and security. Furthermore, there is a concern about the digital divide, as students in areas with limited internet access might find it challenging to benefit from AI-powered learning solutions.

Solution Segment Analysis

In 2023, the Mobile and Video-Based Courseware segment of the mobile learning market held a commanding position, capturing more than a 35% market share. This dominant status can be attributed to several pivotal factors that are reshaping the landscape of educational technology.

Firstly, the surge in mobile and video-based courseware is fueled by the growing integration of multimedia tools in education, which enhances user engagement and facilitates the retention of information. This type of courseware typically combines videos, interactive simulations, and quizzes that provide an immersive learning experience, proving especially effective in today’s digital age where visual and interactive content is king.

Additionally, the global shift towards remote learning environments, significantly accelerated by the COVID-19 pandemic, has heightened the demand for accessible and flexible learning options. Mobile and video-based courseware meets this need by allowing learners to access educational content anytime and anywhere, directly from their mobile devices.

This convenience is particularly appealing in corporate settings, where ongoing training and development are crucial and need to be delivered in a manner that fits seamlessly into the busy schedules of employees. Technological advancements have also played a crucial role in the expansion of this market segment.

Innovations in mobile technology and video content delivery have improved the quality and accessibility of courseware, making it possible to offer sophisticated learning tools on various mobile platforms. Companies are increasingly investing in mobile-first learning platforms that support video and other multimedia content to cater to the needs of a growing mobile workforce.

The combination of these factors – enhanced engagement through multimedia learning, the necessity for education that accommodates remote access, and technological enhancements in mobile and video delivery- continues to drive the growth and dominance of the Mobile and Video-Based Courseware segment in the mobile learning market

Application Segment Analysis

In 2023, the Corporate Learning segment in the mobile learning market secured a dominant position, capturing more than a 37% share. This significant market share is attributed to the increasing adoption of mobile learning solutions across various industries aimed at enhancing employee training and development.

As businesses continue to navigate rapidly changing environments, the demand for flexible, scalable, and accessible training options has surged, highlighting the critical role of mobile learning in corporate settings. The growth of the Corporate Learning segment is propelled by several key factors.

Firstly, the integration of advanced technologies such as AI and mobile apps into learning platforms has personalized the learning experience, making it more engaging and effective. These platforms allow employees to access training materials anytime and anywhere, which is ideal for supporting ongoing professional development and compliance training in a highly mobile and time-sensitive work environment.

Furthermore, the rise of remote working models has necessitated the need for training solutions that can be scaled and accessed remotely. Mobile learning platforms cater to this need by providing organizations with the tools to deliver training sessions to a geographically dispersed workforce efficiently. The ability to track and analyze learning outcomes in real-time is another advantage that drives the adoption of mobile learning in corporate sectors.

Strategic corporate initiatives, such as mergers and partnerships with tech firms, have also significantly contributed to the robust growth of this market segment. These collaborations are aimed at enhancing the mobile learning offerings and expanding their reach, thereby enriching the learning experiences and outcomes for corporate employees.

Key Market Segments

By Solution

- Mobile and Video-Based Courseware

- E-Books

- Interactive Assessment

- Other Software

By Application

- Corporate Learning

- In-Class Learning

- Simulation-Based Learning

- Online-on-the Job Training

- Independent Learning

Drivers

Increasing smartphone use and internet accessibility

The increasing use of smartphones and widespread internet accessibility serve as key drivers for the mobile learning market. smartphone provides a convenient platform for accessing educational content anytime, facilitating flexible and on the go learning.

Affordable internet and expanding 4G/5G coverage enable seamless streaming of interactive content, enhancing user engagement. This accessibility makes mobile learning an attractive option, particularly in regions where attractive option, particularly in regions where traditional educational resources are limited.

Furthermore, the integration of smartphones with advanced technologies, such as AI and AR/VR, enriches the learning experience. These developments make mobile learning more appealing to diverse audiences, from students to professionals, contributing to the rapid expansion of the market.

Restraint

Higher initial cost of advanced learning platforms

The high initial cost of advanced learning platforms restrains the market growth by limiting adoption among small businesses and educational institutions with budget constraints. Developing AI-driven, interactive, and gamified content requires significant investment in technology and skilled professionals.

Moreover, integrating these platforms with existing systems can incur additional expenses for hardware upgrades, software customization, and staff training. Such costs deter organizations from transitioning to mobile learning, especially in cost sensitive markets.

This challenge is further compounded in emerging economies, where affordability remains a critical factor. Despite the long term benefits, the substantial upfront expenditure often leads to reliance on traditional or low cost alternatives, slowing the widespread adoption of advanced mobile learning solutions.

Opportunities

Development of industry specific learning solutions

Developing industry specific learning solutions is a key opportunity in the mobile learning market, addressing the unique needs of sectors like healthcare, IT, finance and manufacturing. Tailored courses help professionals gain job specific skills, ensuring relevance and practical applications.

These solutions leverage AI and analytics to create customized learning paths, enhancing workforce productivity and bridging skill gaps. For example, compliance in healthcare can be delivered efficiently through interactive mobile platforms.

Industry specific solutions also appeal to businesses seeking scalable and cost effective training methods. By addressing sector specific challenges, such as regulatory requirements or technical advancements, these offerings attract a broad audience, driving market growth and fostering long term partnerships with organizations.

Challenges

Ensuring consistent engagement in self-paced learning models

Ensuring consistent engagement in self-paced learning is a significant challenge due to the lack of direct supervision. Learners often struggle with motivation, leading to incomplete courses or minimal retention of knowledge.

The absence of structured schedules in self-paced learning can result in procrastination, especially when learners face distractions or complex topics. Additionally, limited interaction with peer or instructors reduces the collaborative and immersive aspects of learning, impacting engagement levels.

To address this, mobile learning platforms must integrate interactive tools like gamification, AI-driven personalized feedback, and regular progress tracking. However, creating such engaging systems requires continuous technological upgrades and substantial investment, posing hurdles for providers in ensuring sustained learner interest and success in the self-paced learning model.

Growth Factors

The mobile learning market is experiencing robust growth, driven by several key factors. One of the primary growth drivers is the increasing adoption of mobile devices, such as smartphones and tablets, which offer the flexibility to learn anywhere and anytime. This convenience is particularly appealing in today’s fast-paced world where learners demand access to education outside traditional classroom settings.

Furthermore, advancements in mobile technology have made it possible to deliver interactive and engaging content, which enhances learning outcomes and user engagement. The corporate sector also plays a significant role in the growth of the mobile learning market. Companies are increasingly investing in mobile learning for employee training and development to enhance productivity and efficiency.

The ability to provide training on-demand, tailored to individual learning paces and needs, allows organizations to keep up with rapid changes in the business environment and technology. This trend is supported by the integration of artificial intelligence and adaptive learning technologies, which personalize the learning experience and optimize the educational content for individual learners.

Another significant growth driver is the rising trend of Bring Your Own Device (BYOD), which has been adopted by many organizations. BYOD policies encourage employees to use their personal devices for work and learning, reducing costs for employers and increasing the adoption of mobile learning solutions that are compatible with a wide range of devices.

Emerging Trends

Emerging trends in the mobile learning market include gamification, social learning, and the use of augmented and virtual reality (AR/VR) technologies. Gamification incorporates game design elements in educational content to increase engagement and motivation by making learning more fun and competitive. Social learning platforms leverage social media features to facilitate knowledge sharing and collaboration among users, enhancing the learning process through community support and peer interactions.

AR and VR technologies are being increasingly utilized to provide immersive learning experiences that simulate real-life scenarios. These technologies are particularly useful in fields that require hands-on training, such as medicine, engineering, and vocational training, as they allow learners to practice skills in a controlled, virtual environment.

Business Benefits

The adoption of mobile learning brings numerous business benefits, including increased accessibility, flexibility, and cost-effectiveness. Mobile learning platforms enable learners to access educational materials from anywhere, which is crucial for remote teams and individuals with busy schedules. This flexibility improves learning outcomes as users can engage with content at their own pace and revisit materials as needed.

From a cost perspective, mobile learning reduces the need for physical training materials and in-person sessions, which can be expensive and logistically challenging. It also minimizes downtime, as employees do not need to take time away from work to attend training sessions.

Moreover, the data collected through mobile learning platforms can provide valuable insights into employee performance and learning progress, helping organizations to continuously improve their training programs and address gaps in skills and knowledge.

Regional Analysis

In 2023, North America maintained a dominant position in the mobile learning market, capturing over a 34% market share with revenues reaching approximately USD 23.9 billion. This leadership can be attributed to several compelling factors unique to the region.

North America’s forefront in the mobile learning sector is significantly driven by its advanced technological infrastructure, which facilitates widespread access to mobile learning platforms. The region’s high smartphone penetration rate underpins a culture where digital tools are readily adopted in educational and corporate settings, enhancing the delivery and accessibility of mobile learning solutions.

Moreover, the North American market benefits from substantial investments in educational technology by both private enterprises and government bodies. For instance, the U.S. government’s ongoing support for digital learning initiatives has catalyzed further market growth, ensuring a supportive environment for educational innovations.

Companies in the region, such as Coursera and LinkedIn Learning, are key players that continuously evolve their offerings, reflecting the dynamic nature of the industry and contributing to the sustained market dominance.

Corporate training programs in North America also play a crucial role in driving the demand for mobile learning. Organizations across the U.S. and Canada increasingly rely on mobile solutions to provide flexible, efficient, and scalable training to their employees, integrating mobile learning into their development strategies to boost productivity and engagement.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Mobile Learning market has seen significant activity from top players, notably in the areas of mergers, acquisitions, and new product launches. Here’s a look at the recent developments involving three leading companies in this sector:

Upside Learning is recognized for its comprehensive solutions in the mobile learning space. Recently, they have focused on expanding their digital offerings and improving user engagement through enhanced learning platforms that are accessible via mobile devices. Their commitment to integrating innovative educational technologies keeps them at the forefront of the market.

Dell Known primarily for its hardware, Dell has made substantial inroads into the mobile learning market by leveraging its technological prowess to offer educational solutions. Dell’s involvement in mobile learning includes developing applications and platforms that facilitate remote learning, making education more accessible to a broader audience. This strategy not only diversifies Dell’s portfolio but also positions it strongly within the educational technology space.

SAP, through its SAP Litmos platform, continues to lead with robust mobile learning solutions that cater to corporate training needs. SAP Litmos is designed to provide a seamless learning experience across devices, which is crucial for today’s mobile-first approach in professional development. Their recent updates have focused on enhancing features that support interactive and engaging learning experiences, further solidifying their position in the market.

Top Key Players in the Market

- Promethean World Ltd

- NetDimensions Limited (Learning Technologies Group)

- Upside Learning Solutions Pvt. Ltd.

- SAP SE

- Skillsoft

- Citrix Systems Inc.

- Cisco Systems Inc.

- Dell Inc.

- IBM Corporation

- AT&T Inc.

- Other Key Players

Recent Developments

- In June 2024, Adobe launched Adobe Learning Manager, which supports seamless access to training materials, courses, and assessments on mobile devices. The app enables offline access, allowing learners to continue their education without an internet connection. It also highlights features such as bookmarking, progress tracking, and multimedia support, ensuring a user-friendly interface tailored for mobile learning convenience.

- In May 2024, Skillsoft introduced Interactive Skill Benchmarks (ISBs), a pioneering feature in its Skill Benchmarks suite, aimed at transforming skill assessment through hands-on, dynamic learning experiences. The company’s solution initially focuses on critical technology fields such as artificial intelligence, machine learning, programming, and data science, with plans for future expansion into leadership and business domains.

Report Scope

Report Features Description Market Value (2023) USD 70.3 Bn Forecast Revenue (2033) USD 604.8 Bn CAGR (2024-2033) 24% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Solution (E-Books, Interactive Assessment, Mobile and Video-Based Courseware, Other Software), By Application (In-Class Learning, Corporate Learning, Simulation-Based Learning, Online-on-the Job Training, Independent Learning) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Promethean World Ltd, NetDimensions Limited (Learning Technologies Group), Upside Learning Solutions Pvt. Ltd., SAP SE, Skillsoft, Citrix Systems Inc., Cisco Systems Inc., Dell Inc., IBM Corporation, AT&T Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Promethean World Ltd

- NetDimensions Limited (Learning Technologies Group)

- Upside Learning Solutions Pvt. Ltd.

- SAP SE

- Skillsoft

- Citrix Systems Inc.

- Cisco Systems Inc.

- Dell Inc.

- IBM Corporation

- AT&T Inc.

- Other Key Players