Global Mobile Content Market By Content Type(Mobile Apps, Games, Music, Others), By Revenue Model(In-App Purchases, Advertising, Subscription, Pay-per-Downloads, Others), By Platform(iOS, Android, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 127568

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

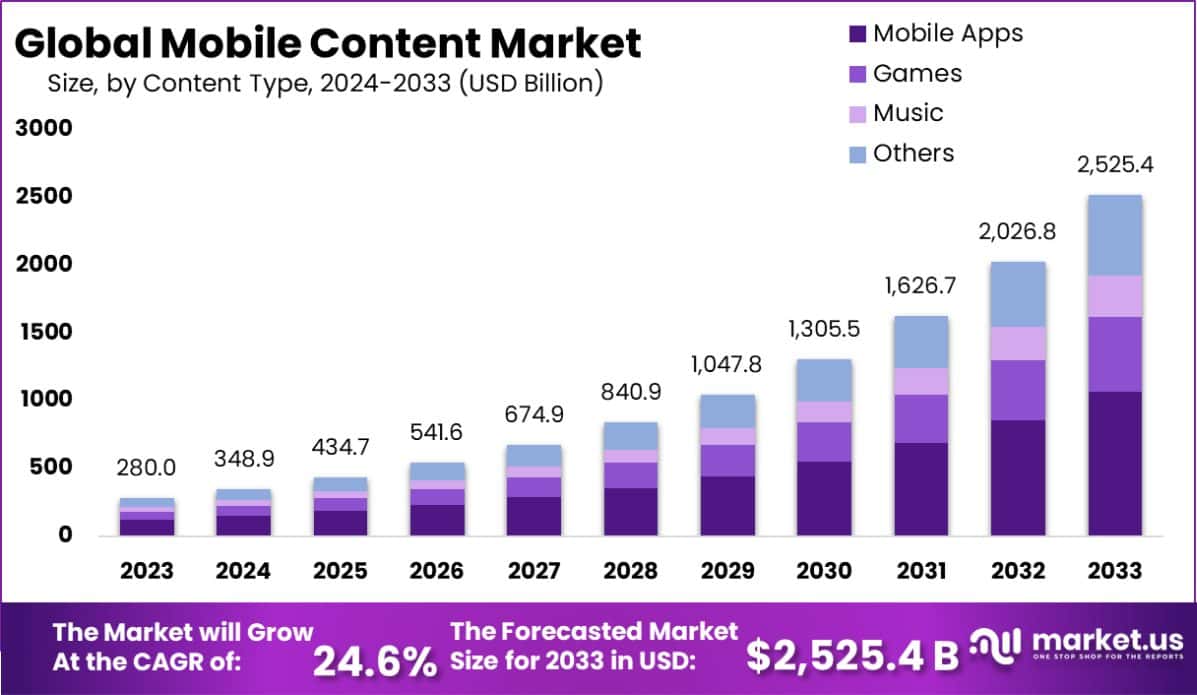

The Global Mobile Content Market size is expected to be worth around USD 2,525.4 Billion By 2033, from USD 280.0 Billion in 2023, growing at a CAGR of 24.6% during the forecast period from 2024 to 2033.

Mobile content refers to any type of digital media that is consumed on mobile devices, such as smartphones and tablets. This content includes a wide range of formats, including text, images, videos, applications, games, and music, among others. The mobile content market encompasses the creation, distribution, and monetization of this content, which has grown significantly in recent years due to the widespread adoption of mobile devices.

The mobile content market encompasses a wide array of digital content accessible through mobile devices such as smartphones and tablets. This market includes various categories like apps, games, videos, music, and e-books. The surge in mobile device adoption globally, coupled with increasing internet penetration and speed, has significantly fueled the growth of this sector.

As consumers increasingly turn to mobile devices for entertainment, information, and social interaction, the demand for diverse and engaging content has escalated. The development of advanced mobile networks, such as 5G, further enhances the user experience by enabling faster download and streaming capabilities, thus driving the market forward.

The growth of the mobile content market can be attributed to several key factors. Firstly, the widespread availability of affordable smartphones has democratized access to mobile internet, expanding the consumer base for mobile content. Additionally, the convenience and immediacy of mobile access encourage more frequent content consumption. There is a notable demand for localized content, which resonates with the cultural and linguistic preferences of users in different regions, presenting opportunities for content creators and distributors to tap into niche markets.

Top opportunities within the mobile content market are found in developing innovative applications, expanding mobile gaming, and enhancing personalized content delivery systems. These opportunities are supported by the growing integration of artificial intelligence and machine learning development technologies, which are enhancing user experiences and engagement.

The market also presents vast opportunities for revenue generation through various monetization strategies, including advertisements, subscriptions, and in-app purchases. With the increasing consumer willingness to pay for premium content and experiences, companies are poised to explore innovative business models to capitalize on this trend.

Furthermore, as technology evolves, there is an ongoing opportunity to integrate augmented reality (AR) and virtual reality (VR) to offer immersive and interactive content, potentially opening new avenues for growth in the mobile content landscape.

According to pib.gov.in, India’s real GDP for the fiscal year 2023-24 is estimated at ₹172.90 lakh crore, marking a growth of 7.6% compared to the previous year. The nominal GDP is projected at ₹293.90 lakh crore, indicating a growth of 9.1% from the previous year. In Q3 of 2023-24, India’s GDP at constant prices shows an 8.4% growth. This economic growth reflects a burgeoning consumer market, likely bolstering the mobile content market through increased consumer spending power and heightened digital engagement.

Key Takeaways

- The Global Mobile Content Market size is expected to be worth around USD 2,525.4 Billion By 2033, from USD 280.0 Billion in 2023, growing at a CAGR of 24.6% during the forecast period from 2024 to 2033.

- In 2023, Mobile Apps held a dominant market position in the By Content Type segment of the Mobile Content Market, capturing more than a 42.3% share.

- In 2023, Advertising held a dominant market position in the By Revenue Model segment of the Mobile Content Market, capturing more than a 37.5% share.

- In 2023, Android held a dominant market position in the By Platform segment of the Mobile Content Market, capturing more than a 56.2% share.

- North America will dominate a 34.6% market share in 2023 and hold USD 96.88 Billion in revenue from the Mobile Content Market.

By Content Type Analysis

In 2023, Mobile Apps held a dominant market position in the “By Content-Type” segment of the Mobile Content Market, capturing more than a 42.3% share. This segment outperformed other categories, including Games, Music, and Others, which collectively contributed to the dynamic landscape of the market. The robust performance of Mobile Apps can be attributed to the surge in smartphone penetration globally and the increasing reliance on mobile applications for daily activities ranging from communication and productivity to health and entertainment.

The Games category also demonstrated significant traction, accounting for approximately 29.8% of the market share. This growth is driven by the escalating popularity of interactive and immersive gaming experiences among various age groups. The Music segment followed, representing 19.5% of the market, bolstered by the rising demand for streaming services and personalized music consumption. The Others category, encompassing various forms of content such as e-books, educational apps, and lifestyle applications, held the remaining 8.4%.

Collectively, these segments underscore the expansive and evolving nature of the Mobile Content Market, revealing consumer preferences and technological advancements that shape market dynamics. The continuous innovation and integration of advanced features within these applications are anticipated to propel further market expansion and diversification in the forthcoming years.

By Revenue Model Analysis

In 2023, Advertising held a dominant market position in the “By Revenue Model” segment of the Mobile Content Market, capturing more than a 37.5% share. This segment, along with In-App Purchases, Subscription, Pay-per-Downloads, and Others, defines the multifaceted revenue streams fueling the industry’s growth. Advertising’s lead can be largely attributed to its ability to generate consistent revenue across diverse platforms, appealing to a broad user base by offering free access to content with ad-based monetization.

Following closely, In-App Purchases accounted for 25.7% of the market share, driven by users’ willingness to pay for premium features within apps. Subscriptions, with a 20.3% share, highlighted consumer preference for continuous access to content, such as streaming services and premium app functionalities. Pay-per-downloads had a smaller impact, contributing 10.2%, reflecting a shift away from one-time payments towards more flexible and ongoing revenue models. The Others category, which includes a variety of emerging monetization strategies, held the remaining 6.3%.

These segments collectively demonstrate the evolving preferences of consumers and the strategic adaptations by content providers to maximize revenue through innovative and consumer-friendly monetization models, promising continued market evolution and expansion.

By Platform Analysis

In 2023, Android held a dominant market position in the “By Platform” segment of the Mobile Content Market, capturing more than a 56.2% share. This segment, alongside iOS and Others, forms the backbone of the operating system landscape within the mobile content arena. Android’s leading position can be attributed to its open-source framework, which allows for greater flexibility in app development and customization, thus attracting a larger base of developers and consumers globally.

iOS followed with a market share of 36.5%, driven by its strong ecosystem and the loyalty of users who appreciate its integrated user experience and security features. Despite a smaller share compared to Android, iOS continues to dominate in terms of revenue generated per user, reflecting its premium positioning in the market.

The Others category, which includes various lesser-known and niche platforms, accounted for the remaining 7.3%. This segment, although smaller, reflects the presence of alternative platforms that cater to specific demographic or technological needs, offering tailored solutions that are not widely covered by the two major players.

Collectively, these platform-based segments underscore the competitive dynamics of the Mobile Content Market, with Android leading in volume, while iOS commands significant value per user, shaping distinct strategic priorities for stakeholders in the ecosystem.

Key Market Segments

By Content Type

- Mobile Apps

- Games

- Music

- Others

By Revenue Model

- In-App Purchases

- Advertising

- Subscription

- Pay-per-Downloads

- Others

By Platform

- iOS

- Android

- Others

Drivers

Key Drivers of Mobile Content Growth

As a market analyst, it is observed that the growth of the mobile content market is primarily driven by the increasing penetration of smartphones and high-speed internet globally. This accessibility allows consumers from various demographics to engage with diverse mobile applications, streaming services, and social media platforms, fueling demand for new and innovative content.

Additionally, advancements in mobile technology, including improved graphical displays and faster processing capabilities, enhance the user experience, encouraging longer engagement times and higher content consumption.

Another significant driver is the rise of personalized content delivery, powered by sophisticated algorithms that predict user preferences, thus boosting user engagement and satisfaction. These factors collectively contribute to the dynamic expansion of the mobile content market.

Restraint

Challenges Hindering Mobile Content Expansion

As an analyst, it is evident that the mobile content market faces significant restraints, notably data privacy concerns and regulatory challenges. Users are increasingly wary of how their personal information is used by mobile apps and platforms, leading to hesitance in adopting new applications.

Moreover, stringent regulations in various countries regarding data protection and content censorship impose limits on content distribution and the operational scope of content providers. These regulations not only complicate market entry but also increase operational costs for companies as they need to ensure compliance across different regions.

Additionally, the saturation of the mobile content market leads to intense competition, making it difficult for new entrants to establish a foothold and for existing players to maintain their market share. These factors collectively pose challenges to the growth of the mobile content market.

Opportunities

Expanding Opportunities in Mobile Content

As an analyst, the mobile content market presents several opportunities that could spur further growth. The ongoing innovation in mobile technologies opens up new avenues for content delivery, such as augmented reality (AR) and virtual reality (VR), providing users with immersive and interactive experiences.

This technological shift is expected to attract a larger audience, eager to explore enhanced content formats. Moreover, the increasing trend towards mobile-first strategies in business and media sectors drives demand for mobile-optimized content, from marketing to entertainment. Emerging markets, with their growing number of mobile internet users, also offer vast potential for expansion.

Additionally, partnerships between content creators and mobile network operators can lead to bundled services that enhance user engagement and revenue streams. These elements highlight significant growth prospects in the mobile content market.

Challenges

Navigating Mobile Content Market Challenges

From an analyst’s perspective, the mobile content market faces several challenges that can impact its growth trajectory. The high level of market competition forces content providers to continually innovate, often requiring substantial investments in digital content creation and technology upgrades. This can strain resources, especially for smaller players.

Additionally, maintaining user attention in an oversaturated market is increasingly difficult, as users have a vast array of choices, leading to lower engagement rates for individual content providers. Another significant challenge is adapting to the rapid changes in consumer preferences and technology, which can render existing content formats obsolete quickly.

Lastly, issues related to content security and copyright protection continue to pose risks, deterring content development and distribution. These challenges require strategic planning and adaptability to navigate successfully.

Growth Factors

Driving Growth in Mobile Content

Analyzing the mobile content market, several factors contribute to its growth. The widespread adoption of smartphones globally provides a vast base of users continuously seeking new and diverse content, ranging from apps and games to video streaming and e-books.

This is complemented by the ever-improving network infrastructure, allowing faster and more reliable internet access that enhances the mobile user experience. Additionally, the integration of advanced technologies like AI and machine learning has enabled personalized content recommendations, significantly boosting user engagement and retention.

Social media platforms also play a crucial role by facilitating the viral spread of mobile content, effectively lowering marketing costs and increasing reach. Together, these factors create a dynamic environment for sustained growth in the mobile content market, tapping into new demographics and tech innovations.

Emerging Trends

Emerging Trends Shaping Mobile Content

As an analyst, it’s clear that emerging trends are significantly shaping the mobile content market. There is a notable shift towards streaming services and on-demand content, allowing users to access a wide range of entertainment and educational materials anytime. This convenience is driving consumer preferences and content consumption habits.

Additionally, the proliferation of 5G technology is enhancing mobile connectivity, enabling faster and more stable access to high-quality content, including HD video and interactive applications. The rise of user-generated content on platforms like TikTok and Instagram continues to democratize content creation, fostering a vibrant community of content producers and consumers.

Furthermore, augmented reality (AR) and virtual reality (VR) are gaining traction, offering immersive experiences that enrich user interaction with mobile content. These trends are broadening the scope and appeal of mobile content, positioning the market for innovative expansions.

Regional Analysis

The Mobile Content Market demonstrates robust growth across various global regions, each exhibiting unique characteristics and trends. North America remains the dominant region, commanding a 34.6% market share with a valuation of USD 96.88 billion.

This leadership is driven by high smartphone penetration, advanced network infrastructure, and a culture of rapid technology adoption among consumers and businesses. In Europe, market expansion is fueled by increased mobile device usage and strong regulatory support for digital innovation, making it a significant player in the mobile content landscape.

Asia Pacific is witnessing the fastest growth, attributed to its vast, tech-savvy youth population and improving internet connectivity. This region is quickly becoming a hotspot for mobile gaming and educational content. Meanwhile, the Middle East & Africa, though smaller in market size, is experiencing growth due to increasing mobile adoption and digital transformation initiatives.

Latin America is also emerging as a promising market, driven by social media consumption and mobile commerce. Collectively, these regional dynamics underscore the global appeal and scalability of mobile content, with North America leading but other regions rapidly catching up in influence and market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Mobile Content Market, key players such as Huawei Technologies Co. Ltd., Nintendo Co., Ltd., and Alphabet Inc. play pivotal roles in shaping industry trends and driving innovation.

Huawei Technologies Co. Ltd., primarily known for its telecommunications equipment and consumer electronics, has made significant strides in mobile content through its development of Huawei Mobile Services (HMS). HMS offers a variety of apps and services designed to compete with Google’s Play Store, aiming to create a self-sufficient ecosystem amidst geopolitical tensions that restrict its access to U.S.-based services. Despite challenges, Huawei’s commitment to R&D and its strong market presence in Asia ensure it remains a significant player in the mobile content domain.

Nintendo Co., Ltd. continues to leverage its intellectual property by expanding into mobile gaming, capitalizing on the nostalgia and strong fan base of its established franchises. By launching mobile versions of popular games and new titles designed specifically for smartphones, Nintendo not only enhances its brand presence but also taps into the lucrative mobile gaming market. This strategy has proved beneficial, allowing Nintendo to reach a broader audience beyond traditional console gamers.

Alphabet Inc., through its subsidiary Google, dominates the mobile content landscape with its Android operating system and Google Play Store. Alphabet’s continuous innovation in-app services and mobile advertising solutions not only strengthens its market position but also sets industry standards for mobile content. With vast data analytics capabilities and advanced AI technologies, Alphabet offers highly personalized content, thereby increasing user engagement and retention.

Top Key Players in the Market

- Huawei Technologies Co. Ltd.

- Nintendo Co., Ltd.

- Alphabet Inc.

- Apple Inc.

- Meta Platforms, Inc.

- Amazon.com Inc.

- Samsung Electronics Co. Ltd

- ByteDance

- Microsoft Corporation

- Sony Group Corporation

Recent Developments

- In June 2023, Meta acquired a virtual reality content startup to expand its VR offerings on the Oculus platform.

- In March 2023, Apple launched a new gaming subscription service, offering over 100 exclusive games for a monthly fee.

- In January 2023, Amazon introduced a new feature to its Prime Video service allowing users to buy merchandise within the streaming platform.

Report Scope

Report Features Description Market Value (2023) USD 280.0 Billion Forecast Revenue (2033) USD 2,525.4 Billion CAGR (2024-2033) 24.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Content Type(Mobile Apps, Games, Music, Others), By Revenue Model(In-App Purchases, Advertising, Subscription, Pay-per-Downloads, Others), By Platform(iOS, Android, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Huawei Technologies Co. Ltd., Nintendo Co., Ltd., Alphabet Inc., Apple Inc., Meta Platforms, Inc., Amazon.com Inc., Samsung Electronics Co. Ltd, ByteDance, Microsoft Corporation, Sony Group Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Mobile Content?Mobile content refers to any digital media accessed or consumed on mobile devices such as smartphones and tablets. This includes many content types such as videos, applications, games, music, and social media services.

How big is Mobile Content Market?The Global Mobile Content Market size is expected to be worth around USD 2,525.4 Billion By 2033, from USD 280.0 Billion in 2023, growing at a CAGR of 24.6% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Mobile Content Market?The mobile content market grows due to widespread smartphone use, faster internet, advanced mobile technology, and personalized content delivery, enhancing user engagement and satisfaction.

What are the emerging trends and advancements in the Mobile Content Market?Emerging trends in the mobile content market include the shift to streaming, enhanced by 5G, growth in user-generated content, and increasing use of AR and VR technologies.

What are the major challenges and opportunities in the Mobile Content Market?Opportunities in the mobile content market include innovations like AR/VR, mobile-first strategies, and emerging markets' growth. Challenges include intense competition, rapid technological changes, and issues with content security and copyright.

Who are the leading players in the Mobile Content Market?Huawei Technologies Co. Ltd., Nintendo Co., Ltd., Alphabet Inc., Apple Inc., Meta Platforms, Inc., Amazon.com Inc., Samsung Electronics Co. Ltd, ByteDance, Microsoft Corporation, Sony Group Corporation

-

-

- Huawei Technologies Co. Ltd.

- Nintendo Co., Ltd.

- Alphabet Inc.

- Apple Inc.

- Meta Platforms, Inc.

- Amazon.com Inc.

- Samsung Electronics Co. Ltd

- ByteDance

- Microsoft Corporation

- Sony Group Corporation