Global Mining Drilling Services Market By Type (Surface Mining, Underground Mining), By Application (Metal, Coal, Mineral, Quarry, Others), By Drilling Type (Directional Drilling, Non-Directional Drilling), By Location (Onshore, Offshore) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130878

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

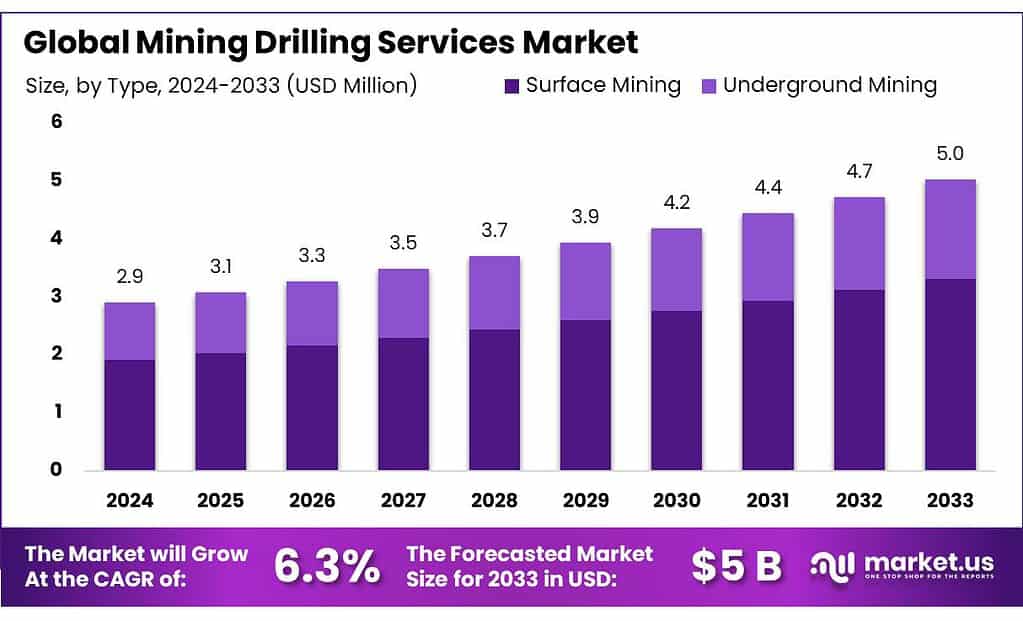

The Global Mining Drilling Services Market size is expected to be worth around USD 5.0 Bn by 2033, from USD 2.9 Bn in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

Mining drilling services refer to the range of services offered by specialized companies that focus on drilling operations in the mining industry. These services are crucial for the exploration, extraction, and management of mineral resources.

government investments and policies to support mining activities, such as the Australian Government’s $100 million allocation for mineral exploration, reflect actual initiatives being undertaken worldwide to boost the sector. In the U.S., the Department of Energy is investing $30 million to bolster domestic mining and processing of rare earth elements, creating opportunities for drilling service providers in regions with rich mineral deposits.

The demand increase for minerals such as copper, lithium, and nickel due to energy transitions are consistent with expectations from major energy organizations like the International Energy Agency (IEA). The forecasted increase in lithium production by 700% by 2030 is a commonly cited statistic reflecting the booming demand for battery-related metals driven by the renewable energy sector.

There is a noticeable increase in investment in mineral exploration and mining operations from both public and private sectors, indicating a robust market outlook for mining drilling services. These investments are often in regions with untapped resources, where professional drilling services are crucial for assessing and extracting mineral deposits.

Key Takeaways

- Mining Drilling Services Market size is expected to be worth around USD 5.0 Bn by 2033, from USD 2.9 Bn in 2023, growing at a CAGR of 6.3%.

- Surface Mining held a dominant market position, capturing more than a 66.2% share.

- Directional Drilling held a dominant market position, capturing more than a 35.3% share of the mining drilling services market.

- Onshore drilling held a dominant market position, capturing more than a 87.8% share of the mining drilling services market.

- Metal held a dominant market position, capturing more than a 39.2% share of the mining drilling services market.

- Asia Pacific (APAC) leading the charge, capturing 37% of the market share, valued at approximately USD 1.09 billion.

By Type

Surface Mining Captures Over 66.2% Share of Mining Drilling Services Market in 2023 Due to Cost-Effectiveness and Accessibility

In 2023, Surface Mining held a dominant market position, capturing more than a 66.2% share of the mining drilling services market. This segment benefits significantly from its cost-effectiveness and ease of access compared to underground mining.

Surface mining involves removing soil and rock that cover mineral deposits near the surface, making it less costly and technically complex. It’s preferred for minerals located close to the earth’s surface, and its extensive use across large-scale mining operations for commodities like coal and iron ore underpins its substantial market share.

On the other hand, Underground Mining, while less prominent in the overall market makeup, plays a crucial role in extracting minerals that lie deep beneath the earth’s surface. This method is more complex and requires more advanced technology and higher safety measures, which increases operational costs.

However, it is essential for accessing high-value minerals such as gold, diamond, and various rare earth elements. Despite its smaller market share, this segment is critical for the mining of resources that cannot be reached by surface mining techniques.

By Drilling Type

Directional Drilling Holds Over 35.3% Share of Mining Drilling Services Market in 2023 Due to Precision and Efficiency in Challenging Locations

In 2023, Directional Drilling held a dominant market position, capturing more than a 35.3% share of the mining drilling services market. This type of drilling is highly favored for its precision and efficiency, allowing operators to access mineral deposits in difficult-to-reach locations. Directional drilling is particularly advantageous in environments where traditional vertical drilling is not feasible, thereby minimizing environmental disruption and optimizing the extraction process.

Conversely, Non-Directional Drilling, also known as conventional drilling, continues to be essential for straightforward mining operations where minerals are directly accessible under the drill site. This method is simpler and often faster, making it suitable for projects with fewer geological challenges. Despite its lower complexity, non-directional drilling remains vital for many mining operations, particularly in large open-pit mines and when drilling shallow deposits.

By Location

Onshore Drilling Dominates with Over 87.8% Share of Mining Drilling Services Market in 2023 Due to Lower Costs and Logistical Convenience

In 2023, Onshore drilling held a dominant market position, capturing more than a 87.8% share of the mining drilling services market. This segment primarily operates in easily accessible areas where the extensive infrastructure supports larger scale and less expensive drilling operations. Onshore drilling is favored for its lower cost and logistical convenience, making it the preferred choice for many mining companies looking to maximize their investments and operational efficiencies.

Offshore drilling, although smaller in market share, is crucial for extracting minerals and oil from under the seabed. This type of drilling is technically more complex and significantly more expensive than onshore drilling, requiring specialized equipment and ships. Despite these challenges, offshore drilling is essential for accessing deposits unreachable by onshore operations, often yielding highly valuable resources that can justify the higher costs and complexities involved.

By Application

Metal Mining Holds Over 39.2% Share of Mining Drilling Services Market in 2023 Driven by Global Demand for Iron, Copper, and Gold

In 2023, Metal held a dominant market position, capturing more than a 39.2% share of the mining drilling services market. This segment benefits from the continuous global demand for metals such as iron, copper, and gold, which are essential for various industries including construction, electronics, and automotive. Metal mining typically involves both open-pit and underground drilling methods, depending on the depth and nature of the metal ores.

Coal, another significant segment, focuses on extracting coal used primarily for energy production. Despite a global shift towards renewable energy, coal remains a key energy source in many developing nations and thus maintains a substantial share in the mining drilling services market.

Mineral drilling services target a diverse range of non-metallic minerals, such as diamonds, potash, and salt, which are critical for industrial, agricultural, and consumer products. This segment adapts to various mining conditions and depths, often requiring specialized drilling techniques.

Quarry operations, which make up another segment of the market, involve extracting building materials such as limestone and sandstone. Quarry drilling is typically conducted at the surface and is integral for supporting the construction industry.

Key Market Segments

By Type

- Surface Mining

- Underground Mining

By Drilling Type

- Directional Drilling

- Non-Directional Drilling

By Location

- Onshore

- Offshore

By Application

- Metal

- Coal

- Mineral

- Quarry

- Others

Driving Factors

Technological Advancements Drive Efficiency and Sustainability in Mining Drilling Services

In recent years, technological advancements have emerged as a major driving factor in the mining drilling services market, significantly influencing market dynamics and operational strategies. In 2023, a substantial portion of mining and metals executives identified changes in technology as the most crucial factor affecting their companies’ demand projections over the next five years. This focus is largely directed towards enhancing the cost-efficiency of operations through investments in new technologies.

The rapid progress in technologies such as artificial intelligence (AI), the Internet of Things (IoT), and advanced data analytics is revolutionizing the mining sector. These technologies are not only optimizing exploration and extraction processes but are also pivotal in increasing the supply of minerals critical to the global transition to a cleaner energy future. For instance, AI and data analytics are particularly noted for their potential to significantly boost mineral supplies by improving the precision and efficiency of mining operations.

Moreover, the integration of 5G technology is expected to further enhance operational efficiencies in mining by enabling more reliable and faster data transfer, which is crucial for real-time monitoring and decision-making processes. The emphasis on technology extends to its role in meeting environmental, social, and governance (ESG) goals, with a notable focus on reducing the carbon footprint and improving energy consumption efficiency across mining operations.

This technological shift is also reflected in the financial strategies of mining companies. There is a growing trend towards the issuance of green bonds and other sustainability-linked financial instruments. For example, in recent years, there has been a significant increase in the volume of green bonds, which grew from about $150 billion in 2017 to an estimated $450 billion in 2022, highlighting the mining industry’s commitment to sustainable practices.

Technological advancements are not only enhancing operational efficiencies and expanding mineral supplies but are also playing a crucial role in helping the mining sector meet its ESG objectives and adapt to a rapidly changing global energy landscape. The integration of these advanced technologies is poised to continue shaping the future of the mining drilling services market, making it more efficient, sustainable, and responsive to the demands of the modern world.

Restraining Factors

Geopolitical Tensions and Regulatory Complexity Limit Mining Drilling Services

Geopolitical tensions and increasing regulatory demands are major restraining factors for the mining drilling services market. These factors create significant challenges for mining companies, impacting everything from operational decisions to long-term strategic planning.

In 2023, the mining industry continues to face heightened geopolitical risks, including trade disputes and conflicts that disrupt global supply chains. For instance, the ongoing geopolitical tension, such as the conflict between Ukraine and Russia, directly affects the trade of minerals and metals, adding layers of complexity to mining operations and influencing global market dynamics.

These tensions not only affect the physical flow of materials but also impact the investment climate, as companies must navigate the uncertainties of international relations and national policies that can alter the business landscape overnight.

Regulatory demands are also increasing, as governments worldwide push for stricter environmental, social, and governance (ESG) standards. This shift is driven by a global consensus on the need for sustainable and responsible mining practices. Companies are required to comply with a broad spectrum of regulations that govern environmental impact, community engagement, and corporate governance. The need to adapt to these evolving regulations can slow down projects, increase costs, and complicate compliance efforts.

Moreover, the push towards decarbonization and the transition to green energy sources put additional pressure on mining companies. As the world moves towards a net-zero future, the demand for critical minerals required for renewable energy technologies increases, but so does the scrutiny over how these minerals are extracted.

Mining companies must balance the need to ramp up production of essential minerals like lithium, cobalt, and nickel, which are pivotal for technologies such as batteries and electric vehicles, with the imperative to reduce their environmental footprint.

The combination of geopolitical instability and stringent regulatory frameworks creates a challenging environment for mining companies. Navigating these issues requires robust risk management strategies and a flexible approach to adapt to rapid changes in the global landscape. These factors significantly restrain the growth potential of the mining drilling services market, as companies must continually adjust their operations and strategies to address external pressures and maintain compliance with international standards.

Growth Opportunity

Renewable Energy and Technological Advancements Propel Growth in Mining Drilling Services

The mining drilling services market is poised for significant growth, driven by the global shift towards renewable energy and the incorporation of advanced technologies in mining operations. As countries and industries worldwide accelerate their transition to a low-carbon economy, the demand for minerals crucial for renewable energy technologies—such as copper, lithium, and cobalt—has surged. This shift is not only increasing the demand for mining services but also pushing the industry towards more sustainable practices.

Technological advancements in drilling equipment and techniques are key growth opportunities within the sector. Innovations such as automated drilling, real-time data monitoring, and the integration of the Internet of Things (IoT) and artificial intelligence (AI) are enhancing efficiency, reducing environmental impact, and improving safety in mining operations. These technologies allow for more precise exploration and resource extraction, which is critical in minimizing the environmental footprint and enhancing the cost-effectiveness of mining projects.

Asia-Pacific is currently the largest market for mining drilling services, driven by extensive mining activities in countries like China, Australia, and India. This region is expected to continue its dominance due to its significant deposits of essential minerals and ongoing investments in mining technologies. The expansion of mining activities in this region is supported by both a rise in demand for minerals and advancements in mining technology that make extraction more feasible and efficient.

In North America and Europe, the focus is on modernizing existing infrastructure and adopting new technologies to revitalize the mining sector and reduce its environmental impact. These regions are seeing a growing adoption of green mining practices, which include the use of renewable energy sources in mining operations to decrease greenhouse gas emissions and reliance on fossil fuels.

Latest Trends

Automation and Advanced Technologies Transforming Mining Drilling Services

A prominent trend in the mining drilling services market is the significant integration of automation and advanced technologies, such as artificial intelligence (AI), Internet of Things (IoT), and real-time data analytics. These technologies are revolutionizing the industry by enhancing drilling accuracy, improving safety measures, and boosting operational efficiencies.

Automation in drilling operations minimizes human error and increases productivity by allowing remote and continuous operations, which is crucial in challenging and hazardous environments. The use of AI and IoT in mining drills helps in predictive maintenance, monitoring equipment health in real-time, and optimizing drilling parameters for better performance and minimal downtime.

Furthermore, advanced data analytics plays a crucial role in analyzing geological data, which helps in making informed decisions about drilling locations and techniques. This technological trend not only drives efficiency but also supports sustainable mining practices by reducing environmental impact and operational costs.

The adoption of these advanced technologies is being fueled by the growing demand for minerals necessary for the global transition to renewable energy sources, as well as by the industry’s need to improve safety and compliance with increasingly stringent environmental regulations.

This trend is expected to continue growing as the benefits of technological integration become more evident, leading to more investments and innovations within the sector. Companies are increasingly recognizing the potential of these technologies to provide strategic advantages, including better resource management, reduced operational risks, and enhanced ability to meet the global demand for critical minerals.

Regional Analysis

The mining drilling services market is characterized by significant regional diversity, with Asia Pacific (APAC) leading the charge, capturing 37% of the market share, valued at approximately USD 1.09 billion. This dominance is attributed to extensive mining activities in countries like China, Australia, and India, driven by substantial mineral reserves and increasing infrastructural developments.

In North America, the market is propelled by advanced technological integration within the mining sector, particularly in the United States and Canada. This region focuses on enhancing efficiency and safety in mining operations through innovative drilling solutions, contributing significantly to the market’s overall growth.

Europe’s mining drilling services market benefits from a mix of traditional mining activities and a strong regulatory framework that emphasizes sustainable mining practices. Countries such as Russia, Poland, and Sweden are key contributors, with a focus on extracting a diverse range of minerals including industrial metals.

The Middle East and Africa region shows promising growth potential, particularly due to the rich mineral resources in countries like South Africa and Saudi Arabia. The market in this region is expected to expand as infrastructure development and industrialization continue to rise, increasing the demand for mined materials.

Latin America, with its vast reserves of copper, iron ore, and gold, particularly in countries like Brazil and Chile, also plays a crucial role in the global mining drilling services market. The region benefits from direct foreign investments and an increasing number of projects that enhance extraction capabilities and market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global mining drilling services market is highly competitive, featuring a diverse array of companies that specialize in various aspects of drilling operations. Key players such as Aban Offshore, Action Drill & Blast, Ausdrill, and Boart Longyear are renowned for their extensive service portfolios that cover everything from exploratory to production drilling. These companies have a strong global presence and are known for leveraging advanced technologies to enhance drilling efficiency and safety.

Companies like Atlas Copco and Epiroc stand out for their innovation in drilling equipment, contributing significantly to advancements in automation and environmental sustainability within the industry. Similarly, Major Drilling and DDH1 Drilling provide specialized services that are crucial for complex and deep-sea operations, which are increasingly in demand due to the deepening of mineral exploration activities.

firms such as Sandvik and Caterpillar are pivotal in manufacturing drilling equipment, with a focus on integrating cutting-edge technology to support the mining industry’s drive towards more sustainable and efficient practices.

The market also includes regional players like PT United Tractors Tbk and Byrnecut Group, which cater to specific geographical markets and requirements, enhancing local market dynamics through tailored services and regional expertise. These companies collectively drive innovation and competitive strategies within the mining drilling services market, shaping industry standards and fostering growth in various mining regions around the world.

Top Key Players in the Market

- Aban Offshore

- Action Drill & Blast

- Atlas Copco

- Ausdrill

- Boart Longyear

- Boodee Drilling

- Byrnecut Group

- Capital Drilling

- Dando Drilling International

- DDH1 Drilling

- Epiroc, Caterpillar

- Foraco

- Geodrill

- Gregg Drilling LLC

- Helmerich & Payne

- HMR Drilling Services

- JS Redpath Corporation

- Layne Christensen Company

- Major Drilling

- NRW Holdings

- Orbit Garant Drilling

- Orica Mining Services

- Perenti Group

- PT United Tractors Tbk

- Sandvik

- Schlumberger

Recent Developments

In 2023 Atlas Copco reported revenues increasing by 12% to reach 44,954 MSEK, reflecting a robust organic growth of 10%.

Aban Offshore operates a versatile fleet of rigs, including jack-up rigs and drill ships, equipped to handle a variety of drilling activities in challenging offshore environments.

Report Scope

Report Features Description Market Value (2023) USD 2.9 Bn Forecast Revenue (2033) USD 5.0 Bn CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Surface Mining, Underground Mining), By Application (Metal, Coal, Mineral, Quarry, Others), By Drilling Type (Directional Drilling, Non-Directional Drilling), By Location (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aban Offshore, Action Drill & Blast, Atlas Copco, Ausdrill, Boart Longyear, Boodee Drilling, Byrnecut Group, Capital Drilling, Dando Drilling International, DDH1 Drilling, Epiroc, Caterpillar, Foraco, Geodrill, Gregg Drilling LLC, Helmerich & Payne, HMR Drilling Services, JS Redpath Corporation, Layne Christensen Company, Major Drilling, NRW Holdings, Orbit Garant Drilling, Orica Mining Services, Perenti Group, PT United Tractors Tbk, Sandvik, Schlumberger Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mining Drilling Services MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Mining Drilling Services MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Aban Offshore

- Action Drill & Blast

- Atlas Copco

- Ausdrill

- Boart Longyear

- Boodee Drilling

- Byrnecut Group

- Capital Drilling

- Dando Drilling International

- DDH1 Drilling

- Epiroc, Caterpillar

- Foraco

- Geodrill

- Gregg Drilling LLC

- Helmerich & Payne

- HMR Drilling Services

- JS Redpath Corporation

- Layne Christensen Company

- Major Drilling

- NRW Holdings

- Orbit Garant Drilling

- Orica Mining Services

- Perenti Group

- PT United Tractors Tbk

- Sandvik

- Schlumberger