Global Milling Machine Market By Product (Vertical Milling Machines, Horizontal Milling Machines, Universal Milling Machines), By Axis Type (3-Axis, 4-Axis, Others), By Application (Automotive, General Machinery, Precision Engineering, Transport Machinery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 28903

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

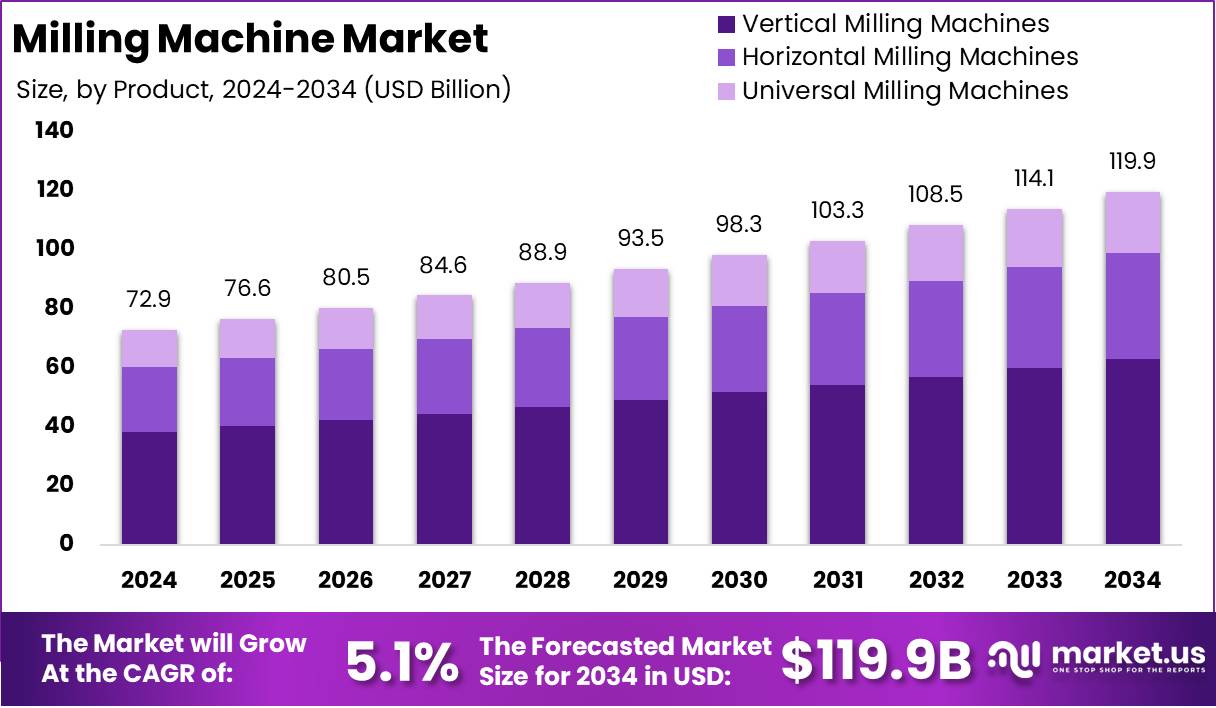

The Global Milling Machine Market size is expected to be worth around USD 119.9 Billion by 2034 from USD 72.9 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

A milling machine is a precision-engineered industrial device used to shape, cut, and drill solid materials primarily metals, composites, and plastics by removing excess material using rotary cutters. These machines are widely utilized in manufacturing and fabrication processes across diverse sectors, including automotive, aerospace, defense, electronics, and general engineering.

Milling operations may involve horizontal or vertical configurations and can be conducted manually or through computer numerical control (CNC) systems, allowing for high accuracy and repeatability in complex component production.

The milling machine market refers to the global industry landscape encompassing the design, production, distribution, and sales of various types of milling machines, including CNC milling machines, vertical milling machines, and horizontal milling machines. This market includes original equipment manufacturers (OEMs), aftermarket suppliers, automation solution providers, and end-use industries that adopt milling machines for production and prototyping tasks.

The market functions as a critical segment within the broader industrial machinery domain and plays a vital role in supporting advanced manufacturing capabilities, particularly in high-precision industries. The expansion of the milling machine market is primarily being driven by the ongoing shift toward industrial automation and precision engineering. The adoption of Industry 4.0 practices, characterized by smart factories and connected machinery, has significantly boosted the demand for CNC milling machines.

Robust demand for milling machines is being observed in sectors such as automotive, aerospace, medical devices, and electronics, where component accuracy and productivity are paramount. The automotive industry, for example, relies heavily on CNC milling to produce high-precision engine and transmission components. According to TOPS, milling machines, used for over 300 years, remain vital in machining.

Significant opportunity exists in the integration of artificial intelligence and machine learning into CNC milling systems, enabling predictive analytics, real-time performance monitoring, and autonomous machining. Emerging economies in Asia-Pacific and Latin America are presenting fertile ground for market growth, driven by industrialization, government-led manufacturing initiatives, and the rise of small and medium-sized enterprises (SMEs) investing in digital manufacturing tools.

Additionally, the ongoing global trend toward reshoring of manufacturing operations and supply chain localization is expected to further stimulate demand for modern milling solutions over the forecast period.

According to Davis Polk, Nidec’s ¥257 billion ($1.6 billion) tender offer to acquire Makino Milling Machine highlights strategic consolidation in the global Milling Machine Market, reflecting rising investor interest and anticipated sector growth. The acquisition offer subject to Makino’s review and set to commence April 4, 2025 underscores increased M&A activity aimed at securing advanced milling technologies and market share in a maturing but steadily expanding industrial segment.

Key Takeaways

- The Global Milling Machine Market size is projected to reach USD 119.9 Billion by 2034, growing from USD 72.9 Billion in 2024, with a compound annual growth rate (CAGR) of 5.1% during the forecast period from 2025 to 2034.

- Vertical Milling Machines are expected to dominate the market, accounting for over 52.6% of the total market share.

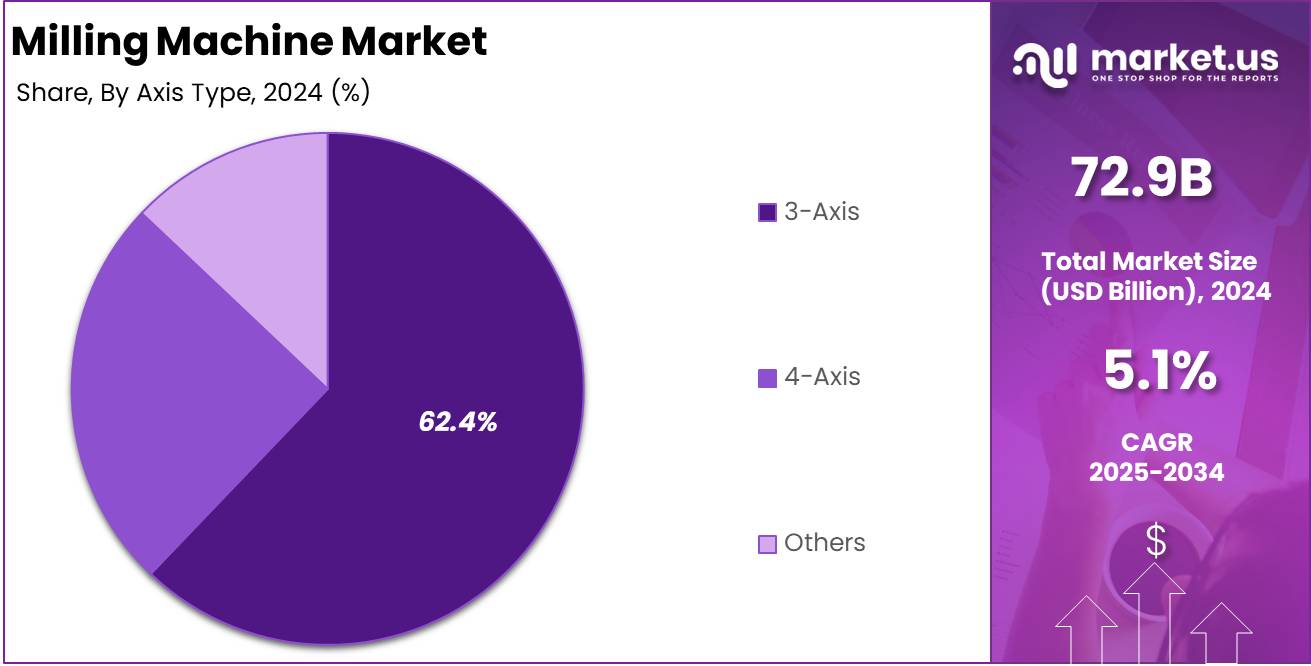

- The 3-axis milling machines are leading the market, holding a significant share of over 62.4%.

- Precision Engineering is a key segment in the Milling Machine Market, contributing to over 35.4% of the market share.

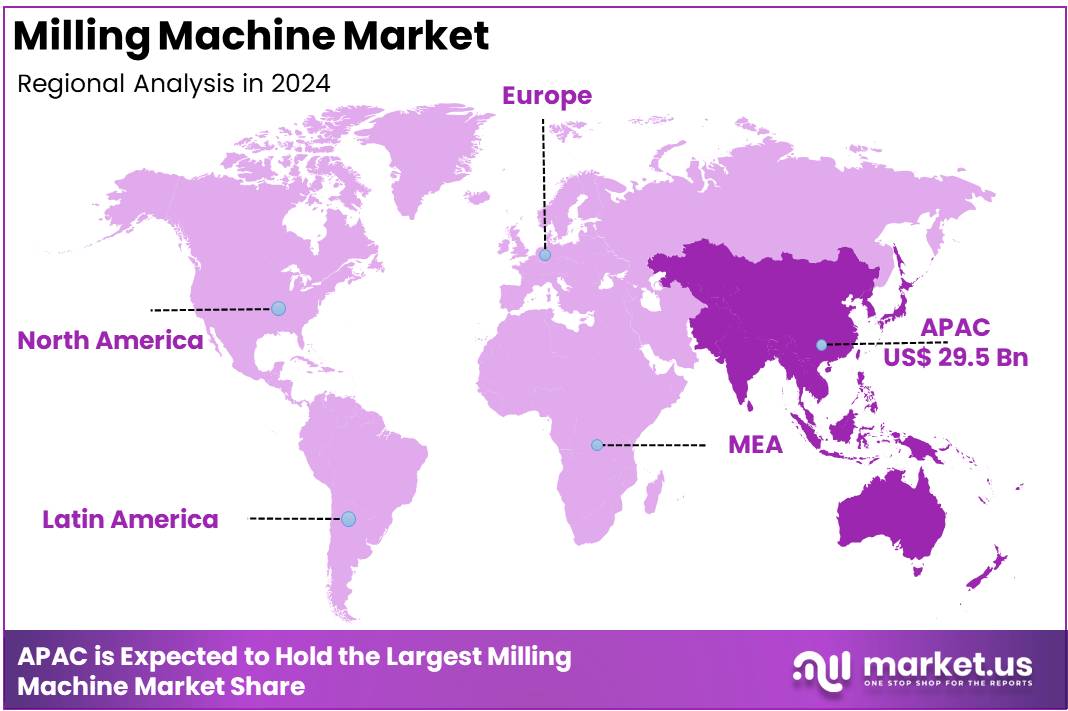

- The Asia-Pacific region is anticipated to be the largest market in 2024, commanding a substantial share of 40.6%, with a market value estimated at USD 29.5 billion.

By Product Analysis

Vertical Milling Machines Dominated the Milling Machine Market with Over 52.6% Share

In 2024, vertical milling machines held a dominant market position in the By Product segment of the Milling Machine Market, capturing more than 52.6% of the total market share. The widespread adoption of vertical milling machines is largely attributed to their ease of use, lower cost of installation, and suitability for a broad range of applications across manufacturing industries.

Their compact footprint and user-friendly configuration make them ideal for small- to medium-sized workshops and precision engineering operations. Moreover, vertical milling machines are widely preferred for die sinking, drilling, and slotting tasks, which continue to be in high demand within both automotive and general manufacturing sectors.

The increased deployment of CNC-enabled vertical milling machines has further accelerated market growth, offering improved automation, reduced labor dependency, and higher precision. With rising investments in automation and Industry 4.0 integration, vertical milling machines are being increasingly adopted for mass production with tighter tolerances.

Additionally, the growing demand from emerging economies in Asia-Pacific, particularly China and India, is expected to reinforce the dominance of this segment over the forecast period, supported by government-led industrial development initiatives.

In 2024, horizontal milling machines held a significant share in the Milling Machine Market due to their strength in heavy-duty applications and ability to handle large, complex parts. Preferred in aerospace, defense, and heavy equipment sectors, these machines offer stable performance and efficient material removal. Their ability to machine multiple sides in one setup boosts productivity, though high costs and space needs limit use in smaller facilities. Technological upgrades like CNC and multi-axis functions continue to enhance their industrial appeal.

Universal milling machines also maintained a notable presence, offering both vertical and horizontal capabilities in one unit. This flexibility makes them ideal for tool rooms, workshops, and educational institutes requiring multipurpose solutions. While their adoption is lower than other types, they remain valuable for custom and small-batch production. Advances in semi-automation and digital controls are improving their efficiency, ensuring ongoing demand from medium-scale operations.

By Axis Type Analysis

3-axis Dominated the Milling Machine Market with Over 62.4% Share

In 2024, 3-axis held a dominant market position in the By Axis Type segment of the Milling Machine Market, capturing more than 62.4% of the total market share. This dominance can be attributed to the widespread use of 3-axis machines across multiple end-use industries such as automotive, aerospace, and general manufacturing.

The cost-effectiveness, operational simplicity, and ease of integration into existing workflows have made 3-axis milling machines a preferred choice for precision cutting and machining of flat or shallow parts. Moreover, their compatibility with a broad range of materials, including metals and plastics, supports their adoption in both small-scale workshops and large-scale production units.

The growth of this segment is also being driven by continuous improvements in machine design and digital control systems, which enhance the accuracy and productivity of 3-axis milling machines. As manufacturers seek more efficient solutions to maintain competitive production cycles, the 3-axis configuration continues to offer a reliable and accessible entry point into CNC machining.

Additionally, the availability of advanced software support and training modules further facilitates the use of these machines across diverse geographies and skill levels, reinforcing their market leadership. In 2024, the 3-axis segment dominated the Milling Machine Market by Axis Type, accounting for a significant share. The 3-axis configuration is widely preferred due to its simplicity, cost-effectiveness, and ease of integration into existing workflows.

These machines are extensively used in a range of industries, including automotive and general manufacturing, for precise cutting and machining of flat or shallow parts. The widespread availability of advanced software and training further supports the global adoption of 3-axis milling machines.

The 4-axis segment has also established itself as a strong mid-tier category, driven by the added rotary movement that facilitates the machining of more complex parts compared to the 3-axis configuration. These machines are especially valuable in industries requiring multi-side machining, such as aerospace and precision tooling. Despite higher upfront costs, their capability to reduce cycle times and enhance production efficiency makes them a favored choice for manufacturers seeking increased automation and accuracy in machining processes.

The Others segment, comprising 5-axis and higher-axis milling machines, occupies a smaller share but is gaining traction in sectors requiring ultra-precision, such as medical device manufacturing and aerospace engineering. These machines excel at performing intricate contouring and machining tasks in a single setup, reducing cycle times and improving part accuracy. Although their high cost and complexity limit widespread adoption, advancements in automation, software, and training solutions are expected to increase their accessibility and contribute to steady growth in this segment.

By Application Analysis

Precision Engineering Dominated the Milling Machine Market with Over 35.4% Share

In 2024, Precision Engineering held a dominant position in the By Application segment of the Milling Machine Market, capturing more than 35.4% of the total market share. This dominance is primarily driven by the high precision and accuracy required in industries such as aerospace, medical device manufacturing, and high-tech electronics. Milling machines used in precision engineering are capable of producing intricate parts with tight tolerances, making them essential in the production of critical components that demand a high level of detail and quality.

The continued advancements in technology, including the integration of automation and smart manufacturing systems, are fueling the growth of this segment. Precision engineering applications rely heavily on CNC (Computer Numerical Control) milling machines to ensure consistency and precision in mass production and custom manufacturing, further bolstering the demand for advanced milling machinery in this field.

In 2024, the Automotive segment played a significant role in the Milling Machine Market by Application, driven by the demand for high-speed machining of engine components, transmission parts, and structural elements. The rise of lightweight materials like aluminum and composites has further propelled the need for advanced milling machines that can handle complex shapes and structures.

Additionally, the growing trend of electric vehicles and the push for automation and sustainability in the automotive sector has contributed to the adoption of milling technologies that support high-volume, low-tolerance manufacturing processes.

The General Machinery segment relies on milling machines to produce parts for industries such as industrial equipment, construction machinery, and consumer goods. Milling machines in this segment offer versatility, supporting a range of operations from basic cutting to high-precision tasks. The demand for durable and high-quality components drives the growth of this segment, while advancements in milling technology that improve speed, automation, and flexibility further enhance productivity in general machinery manufacturing.

In the Transport Machinery segment, milling machines are critical for producing precise parts for rail, ship, and aircraft components. These machines play a key role in manufacturing large and complex components, such as frames, axles, and engine parts, where accuracy is vital for safety and reliability. The growing demand for efficient and eco-friendly transport solutions is expected to further drive the need for sophisticated milling machines that can handle advanced materials and machining tasks.

The Others segment, including applications in medical device manufacturing, electronics, and custom tooling, represents a smaller portion of the market but is seeing growth due to the rising demand for high-precision, custom-made components. Technological advancements and the shift toward micro-manufacturing are boosting the adoption of specialized milling machines capable of working with unique materials and achieving fine tolerances, supporting growth in this niche market.

Key Market Segments

By Product

- Vertical Milling Machines

- Horizontal Milling Machines

- Universal Milling Machines

By Axis Type

- 3-Axis

- 4-Axis

- Others

By Application

- Automotive

- General Machinery

- Precision Engineering

- Transport Machinery

- Others

Driver

Rising Demand for Precision Manufacturing in Aerospace and Automotive Sectors

The global milling machine market in 2024 is experiencing significant growth, primarily driven by the increasing demand for precision components in the aerospace and automotive industries. These sectors require high accuracy, repeatability, and complex geometries in their parts, necessitating the deployment of advanced milling technologies. As fuel efficiency, safety, and regulatory compliance become paramount, manufacturers are investing in CNC milling machines that provide consistent quality and reduced cycle times.

The shift toward lightweight materials such as composites and titanium alloys further enhances the need for precise machining capabilities, as traditional equipment often falls short in handling such materials effectively. This has spurred adoption across developed and emerging markets alike, contributing positively to the expansion of the milling machine industry.

Additionally, manufacturers are increasingly opting for multi-axis milling machines to achieve higher production efficiency and better surface finishes. The widespread automation of production lines, particularly in automotive plants, supports the integration of computer-controlled milling systems, thereby reducing manual errors and improving output. According to current estimates, the automotive industry alone accounts for over 30% of the demand for industrial milling machines globally.

This demand is expected to sustain momentum, driven by trends in electric vehicle (EV) manufacturing, which requires precision-engineered components such as battery enclosures, drive systems, and heat sinks. Thus, precision manufacturing requirements are not only fueling the demand but are also reshaping technological innovation within the milling machine market.

Restraint

High Capital Investment and Maintenance Costs Hindering SME Adoption

Despite technological advancements, the global milling machine market faces a significant constraint in the form of high initial capital investments and ongoing maintenance costs. These machines, particularly multi-axis CNC variants, involve substantial procurement costs ranging from tens of thousands to several hundred thousand dollars. Such costs pose a considerable barrier for small and medium-sized enterprises (SMEs), which often operate under tight budget constraints.

In addition to the purchase cost, expenses related to installation, training, and infrastructure modifications contribute to the total cost of ownership. This financial burden discourages widespread adoption among SMEs, particularly in developing economies where capital access remains limited.

Moreover, the operational costs associated with regular maintenance, calibration, and software updates further impact profitability. Skilled technicians are required to maintain these machines and troubleshoot issues, adding to labor costs. In the event of downtime, production losses can be significant, especially in high-output manufacturing environments. These factors collectively deter smaller players from investing in milling machines despite the long-term benefits of automation and precision.

This restraint is particularly evident in regions with underdeveloped industrial bases, where the return on investment may take longer to materialize. As a result, while large corporations continue to invest in milling technologies, the broader market penetration remains uneven, thereby slowing the overall market growth trajectory.

Opportunity

Integration of AI and IoT for Smart Milling Enhancing Market Potential

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into milling machines presents a substantial growth opportunity for the global market in 2024. Smart milling systems equipped with real-time data analytics, condition monitoring, and predictive maintenance capabilities are gaining prominence across advanced manufacturing sectors.

These intelligent systems enhance operational efficiency by automatically adjusting machining parameters, detecting tool wear, and optimizing cutting conditions. This capability significantly reduces material waste, energy consumption, and downtime factors that directly improve return on investment and productivity. Consequently, industries are increasingly shifting toward smart factories, where AI-enabled milling plays a central role in achieving operational excellence.

Furthermore, IoT-enabled milling machines facilitate remote diagnostics and cloud-based data management, allowing manufacturers to make informed decisions swiftly. By leveraging data from connected machines, predictive analytics can anticipate failures and suggest maintenance schedules before breakdowns occur. This not only extends machine life but also reduces unplanned downtime, which is critical in high-throughput environments.

In 2024, the adoption of such technologies is particularly evident in regions prioritizing Industry 4.0 practices, such as Europe and East Asia. The global market is poised to benefit from the growing investments in digital transformation initiatives across manufacturing sectors. The demand for smart, automated milling solutions is expected to accelerate, offering long-term scalability and a competitive edge to adopters.

Trends

Increasing Shift Toward Hybrid Milling Machines Supporting Multi-Functionality

A notable trend shaping the global milling machine market in 2024 is the increasing preference for hybrid milling machines capable of performing multiple operations within a single setup. These systems combine additive and subtractive manufacturing or integrate turning, drilling, and milling functions into a single machine.

This consolidation streamlines production workflows, reduces the need for multiple setups, and improves part accuracy by minimizing repositioning errors. The adoption of hybrid milling technology is particularly advantageous for high-mix, low-volume production environments where flexibility and efficiency are critical. Industries such as defense, medical devices, and mold making are adopting these systems to reduce lead times and increase design complexity.

Moreover, hybrid machines support mass customization by enabling rapid prototyping and quick transitions between product variants. The market is witnessing increasing R&D investments in the development of compact, energy-efficient hybrid milling solutions that can be deployed across a wide range of applications.

This trend is also aligned with the global movement toward sustainable manufacturing practices, as hybrid machines reduce energy consumption and material wastage. In 2024, the market is seeing an upsurge in demand for these systems from technologically mature regions, as manufacturers seek competitive advantages through equipment versatility. The trend toward multifunctional and hybrid machining solutions is expected to redefine equipment procurement strategies, influencing the market’s evolution in the coming years.

Regional Analysis

Asia-Pacific to Dominate Milling Machine Market with Largest Market Share of 40.6% in 2024

The Asia-Pacific region is expected to dominate the global Milling Machine Market in 2024, commanding a significant share of 40.6%, with a market value estimated at USD 29.5 billion. This dominance can be attributed to the region’s robust industrial manufacturing sector, which continues to expand across countries like China, Japan, and India.

The presence of large-scale manufacturing units and the rising demand for precision engineering in sectors such as automotive, aerospace, and electronics have significantly driven the adoption of advanced milling machines. Additionally, the growing trend of automation and technological advancements in machinery is further fueling the market’s growth in this region.

In terms of market growth, Asia-Pacific remains the focal point due to its vast industrial landscape and investment in infrastructure development. As countries in this region continue to industrialize and modernize their manufacturing processes, the demand for high-precision milling machines is expected to rise steadily.

The government’s initiatives and favorable policies aimed at boosting manufacturing capabilities are also contributing to the expansion of the milling machine market. The integration of smart technologies, such as IoT and artificial intelligence in milling machine systems, further enhances productivity and efficiency, attracting significant investments in the region.

North America holds a considerable share of the global Milling Machine Market, driven primarily by technological advancements in the manufacturing sector. The U.S. and Canada have been early adopters of automation and precision machinery, leading to continuous growth in the demand for milling machines. The emphasis on advanced manufacturing processes and the high standards of production in industries such as aerospace, defense, and automotive continue to support this growth.

Europe represents another significant market for milling machines, with countries like Germany, Italy, and France driving the demand. The region’s focus on high-precision manufacturing and a strong aerospace and automotive sector contribute to the steady growth of milling machine adoption. The presence of key automotive manufacturers and a well-established aerospace industry ensures a consistent demand for advanced machining tools.

In the Middle East and Africa, the milling machine market is witnessing gradual growth. The increasing focus on diversifying economies and industrializing sectors like oil and gas, automotive, and construction is creating opportunities for milling machine manufacturers. While this region currently holds a smaller share of the global market, it is expected to experience growth due to infrastructure development projects and industrial expansion.

Latin America represents a developing market with moderate growth potential in the milling machine industry. The region is seeing a gradual increase in manufacturing activity, driven by automotive and construction sectors. However, the market remains smaller in comparison to other regions due to economic constraints and infrastructure challenges. The demand for milling machines is expected to rise as the region’s industrial capabilities continue to expand.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global milling machine market in 2024 is significantly shaped by the strategic operations and technological advancements introduced by key players such as DATRON Dynamics, Inc., Haas Automation, Inc., and YAMAZAKI MAZAK CORPORATION. DATRON Dynamics, Inc. continues to lead in high-speed milling solutions with a strong emphasis on precision and energy efficiency. Its product innovations are designed to serve high-tech industries such as dental, aerospace, and electronics, thus positioning the company as a premium player.

Haas Automation, Inc., by contrast, emphasizes affordability and scalability, offering a wide range of CNC milling machines that appeal to small and mid-sized enterprises worldwide. YAMAZAKI MAZAK CORPORATION remains at the forefront through continuous investment in smart manufacturing technologies and Industry 4.0 integration, which enhances automation and connectivity in machine tool operations.

Simultaneously, companies like Amera-Seiki, FANUC CORPORATION, and ANDERSON EUROPE GMBH strengthen market competitiveness by expanding their product portfolios and global footprint. FANUC CORPORATION is a notable contributor to automation and robotics integration in milling operations, offering technologically advanced systems that enhance operational efficiency. Amera-Seiki and ANDERSON EUROPE GMBH are focused on delivering robust heavy-duty machines tailored for industrial-scale manufacturing.

Meanwhile, Hurco Companies, Inc. and Okuma Corporation are leveraging their software innovations and customer-centric design philosophies to gain market traction. KNUTH Werkzeugmaschinen GmbH and EMCO Group also play important roles in serving European markets with reliable, high-performance milling solutions. Collectively, these companies are fostering technological evolution, regional expansion, and competitive pricing strategies, which are expected to drive the overall growth of the global milling machine market in 2024.

Top Key Players in the Market

- DATRON Dynamics, Inc.

- Haas Automation, Inc.

- YAMAZAKI MAZAK CORPORATION

- Amera-Seiki

- FANUC CORPORATION

- ANDERSON EUROPE GMBH

- Hurco Companies, Inc.

- Okuma Corporation

- KNUTH Werkzeugmaschinen GmbH

- EMCO group

Recent Developments

- In April 2023, Okuma America Corporation introduced a new business division dedicated to automation solutions for manufacturers. This strategic move aims to provide tailored recommendations, sales, and support for manufacturing production line systems, utilizing Okuma’s CNC machine tools and integrated automation technologies. This new segment officially began its operations at Okuma’s headquarters in Charlotte, North Carolina.

- In 2024, Hardinge Inc., a manufacturer of metal-working machines for industries like aerospace and automotive, filed for bankruptcy. The company cited challenges with Chinese regulators, who delayed its efforts to sell operations in China. The company is now seeking to sell itself through a bankruptcy process, with Centre Lane Partners, a private equity firm, positioned as a potential lead bidder in the court-supervised auction.

- In 2024, ModuleWorks, a leading provider of CAD/CAM software, announced a partnership with DN Solutions, a prominent player in CNC machine tool manufacturing. This partnership, which includes equity investment, aims to strengthen the collaboration between the two companies and accelerate the development of advanced machine tool software, driving digital transformation within the manufacturing sector.

- In 2025, Makino Milling Machine revealed that it had received multiple acquisition proposals, including from MBK Partners and Nippon Sangyo Suishin Kiko Group (NSSK). These offers compete with an unsolicited buyout bid from the Japanese giant, Nidec. The proposals are currently under negotiation, with a final decision pending.

Report Scope

Report Features Description Market Value (2024) USD 69.4 Billion Forecast Revenue (2034) USD 114.1 Billion CAGR (2025-2034) 5.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Vertical Milling Machines, Horizontal Milling Machines, Universal Milling Machines), By Axis Type (3-Axis, 4-Axis, Others), By Application (Automotive, General Machinery, Precision Engineering, Transport Machinery, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DATRON Dynamics Inc., Haas Automation Inc., YAMAZAKI MAZAK CORPORATION, Amera-Seiki, FANUC CORPORATION, ANDERSON EUROPE GMBH, Hurco Companies Inc., Okuma Corporation, KNUTH Werkzeugmaschinen GmbH, EMCO group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DATRON Dynamics, Inc.

- Haas Automation, Inc.

- YAMAZAKI MAZAK CORPORATION

- Amera-Seiki

- FANUC CORPORATION

- ANDERSON EUROPE GMBH

- Hurco Companies, Inc.

- Okuma Corporation

- KNUTH Werkzeugmaschinen GmbH

- EMCO group