Global Milk Thistle Products Market Size, Share Analysis Report By Form (Capsules, Tablets, Powder, Liquid Extract, Tea Bags), By Product Type (Milk Thistle Extract, Milk Thistle Supplements, Milk Thistle Tea, Milk Thistle Oil, Milk Thistle Seeds, Others), By Application (Liver Health, Antioxidant Support, Skin Health, Cardiovascular Health, Detoxification, Others), By Distribution Channel (Online Stores, Pharmacies, Health Food Stores, Hospitals, Clinics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169705

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

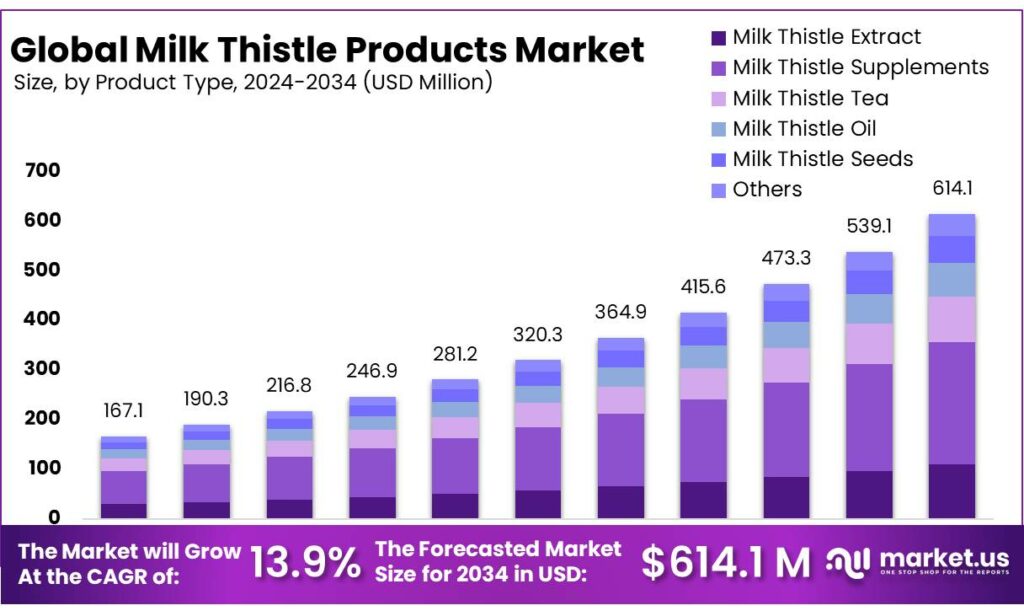

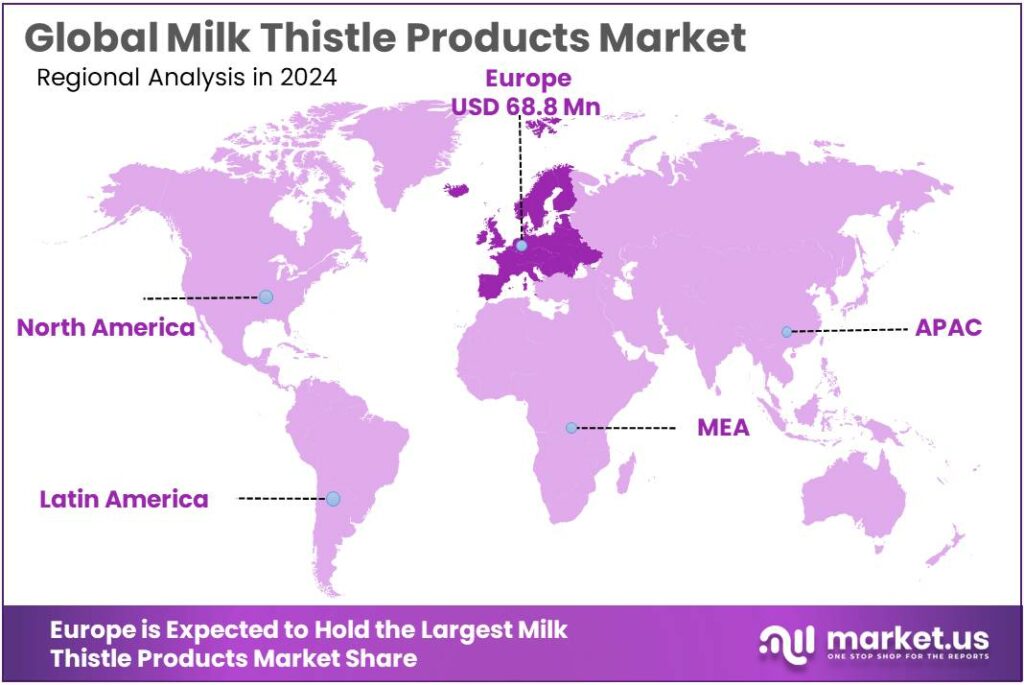

The Global Milk Thistle Products Market size is expected to be worth around USD 614.1 Million by 2034, from USD 167.1 Million in 2024, growing at a CAGR of 13.9% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 41.20% share, holding USD 68.8 Million revenue.

Milk thistle products form a specialized niche within the wider dietary supplements and herbal products industry. These products, based on Silybum marianum extracts standardized in silymarin, are sold mainly as capsules, tablets, liquids, and functional teas positioned for “liver support” and detoxification.

Industrial activity spans agricultural cultivation, specialized extraction, and global nutraceutical distribution. Milk thistle is grown in Europe, North Africa, and parts of Asia, then processed in GMP-compliant facilities into standardized silymarin extracts for use by supplement and over-the-counter (OTC) brands. The category benefits from high baseline supplement usage: in the United States, 57.6% of adults reported taking at least one dietary supplement in the past 30 days during 2017–2018, indicating a large, habitual user base for products such as liver-health botanicals.

The primary demand driver is the rising global burden of liver disease, particularly metabolic dysfunction–associated steatotic liver disease (formerly NAFLD). Scientific statements from cardiovascular and liver experts estimate that nearly 1 in 4 adults worldwide has fatty liver disease, linking it to obesity, diabetes and increased cardiovascular risk.

- The growing share of older adults worldwide is strengthening demand for liver-support products such as milk thistle, encouraging manufacturers to prioritise high-quality and clinically aligned formulations. United Nations data indicate that the global population aged 65 years and above will rise from 10% in 2022 to 16% by 2050, reinforcing long-term market potential for liver-health supplements.

- According to findings published in the Journal of Hepatology, liver diseases cause more than two million deaths each year, accounting for nearly 4% of total global deaths. Although liver conditions rank only as the eleventh leading cause of mortality, experts suggest the actual impact is likely underreported. This rising disease burden is steadily increasing interest in supportive health solutions, including the use of milk thistle products for liver wellness.

Brands are improving efficacy, refining extraction processes, and expanding delivery formats to appeal to a wider consumer base. Continued scientific research is also helping validate the benefits of milk thistle, supporting trust and sustained category growth. In May 2023, Solgar’s partnership with The Great Run Company underscored this industry focus on innovation, combining enhanced product development with broader wellness engagement to strengthen its market position.

Key Takeaways

- Milk Thistle Products Market size is expected to be worth around USD 614.1 Million by 2034, from USD 167.1 Million in 2024, growing at a CAGR of 13.9%.

- Capsules held a dominant market position, capturing more than a 39.8% share.

- Milk Thistle Supplements held a dominant market position, capturing more than a 39.9% share.

- Liver Health held a dominant market position, capturing more than a 49.2% share.

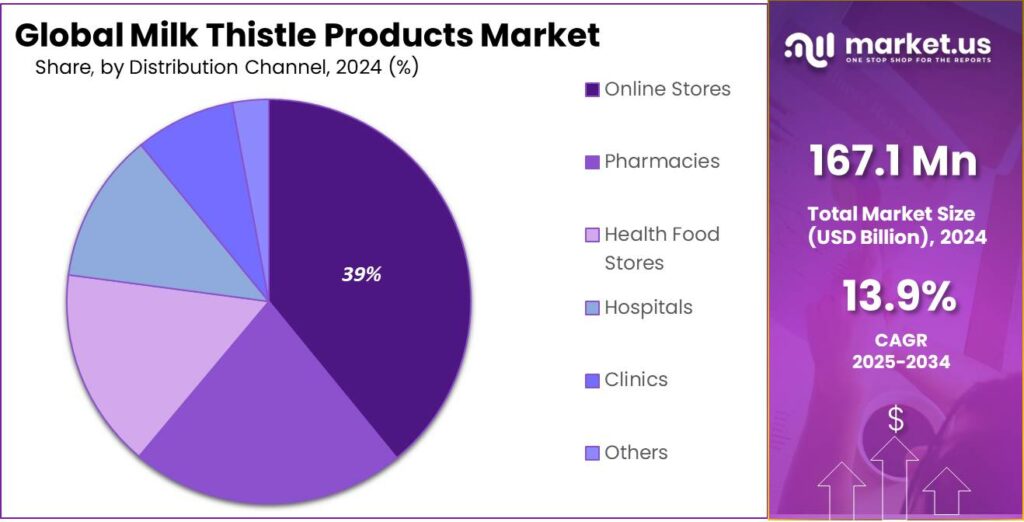

- Online Stores held a dominant market position, capturing more than a 39.1% share.

- Europe held a commanding regional position in the milk thistle products market, accounting for 41.20% of category revenues and approximately 68.8 million.

By Form Analysis

Capsules dominate with 39.8% owing to ease of use and consistent dosing.

In 2024, Capsules held a dominant market position, capturing more than a 39.8% share. The capsule form was preferred because it offers convenient dosing, longer shelf life, and straightforward manufacturing at scale, which together supported strong retail and online sales. Consumer preference for single-ingredient supplements and predictable bioavailability reinforced demand for capsules across age groups. Manufacturers focused on quality control, standardized extracts, and clear labelling to build trust and repeat purchase. By 2025, the capsule segment remained the leading format as product innovation (improved excipients and vegetarian shells) and established distribution channels sustained steady demand.

By Product Type Analysis

Milk Thistle Supplements lead with 39.9% as consumers favour targeted liver-support formulations.

In 2024, Milk Thistle Supplements held a dominant market position, capturing more than a 39.9% share. The segment was driven by consumer demand for single-ingredient, clinically positioned products that are perceived as effective for liver health; accordingly, retailers and online channels prioritized standardized-extract SKUs to meet consistent dosing expectations.

Production and quality-assurance processes were scaled to ensure batch consistency and label transparency, which supported repeat purchases and higher shelf turnover. Marketing was focused on evidence-based claims and clear usage guidance, reinforcing consumer trust. By 2025, the milk thistle supplement segment remained the largest contributor to category revenues, as manufacturers continued to improve extract standardization and expand distribution across pharmacy and e-commerce channels.

By Application Analysis

Liver Health leads with 49.2% as consumers prioritise targeted liver-support solutions.

In 2024, Liver Health held a dominant market position, capturing more than a 49.2% share. This leadership reflected strong consumer focus on preventive and restorative liver care, where standardized extracts and clinical positioning drove purchase decisions; product development emphasized consistent silymarin content, clear dosing guidance, and ingredient transparency to build trust. Retail and online channels concentrated shelf space on liver-focused SKUs, while healthcare professionals increasingly recommended evidence-backed formulations, supporting wider acceptance.

Manufacturing adapted by improving extract standardization and stability testing to ensure batch-to-batch consistency, and packaging emphasised usage instructions and safety information to reduce consumer uncertainty. By 2025, the liver-health application remained the primary revenue driver within the category as manufacturers continued to refine formulations, expand educational outreach, and strengthen distribution to meet sustained consumer demand.

By Distribution Channel Analysis

Online stores lead with 39.1% as shoppers favour convenience, variety and direct delivery.

In 2024, Online Stores held a dominant market position, capturing more than a 39.1% share. This outcome was driven by consumer preference for easy ordering, broad product choice and transparent user reviews, which supported higher conversion rates for milk thistle SKUs; subscription models and targeted digital marketing increased lifetime value and repeat purchases. Supply-chain and packaging processes were adapted to support smaller, direct shipments and to ensure product integrity during transit, while quality assurance and clear labelling were prioritised to reduce returns and build trust.

Retail and brand strategies were adjusted to balance e-commerce listings with selective brick-and-mortar presence, and logistics partners were engaged to shorten delivery times. By 2025, the online channel remained the primary revenue driver for the category, with continued emphasis placed on customer experience enhancements, personalized promotions, and faster fulfilment to sustain growth.

Key Market Segments

By Form

- Capsules

- Tablets

- Powder

- Liquid Extract

- Tea Bags

By Product Type

- Milk Thistle Extract

- Milk Thistle Supplements

- Milk Thistle Tea

- Milk Thistle Oil

- Milk Thistle Seeds

- Others

By Application

- Liver Health

- Antioxidant Support

- Skin Health

- Cardiovascular Health

- Detoxification

- Others

By Distribution Channel

- Online Stores

- Pharmacies

- Health Food Stores

- Hospitals

- Clinics

- Others

Emerging Trends

Growing Preference for Preventive & Everyday Wellness – a Big Trend for Milk Thistle

In recent years, people around the world are becoming increasingly proactive about their health. Instead of waiting for illness to strike, many are seeking gentle, everyday ways to support their well-being — and that shift is creating a clear trend that works very much in favor of milk thistle products and similar liver‐support or wellness supplements.

- Data from the Centers for Disease Control and Prevention (CDC) shows that in the United States, the share of adults taking any dietary supplement rose steadily from 48.4% in 2007–2008 to 56.1% in 2017–2018. During 2017–2018, about 57.6% of adults reported using at least one supplement in the previous 30 days.

Another signs of this trend: globally, the dietary supplements market continues to expand rapidly. Recent estimates placed the market size at around USD 192.65 billion in 2024, with forecasts pointing to robust growth through the coming decade. This broad growth includes botanical and herbal supplements — categories in which milk thistle fits naturally — indicating that consumers are open to plant-based nutraceuticals, not just vitamins or minerals.

Finally, increasing acceptability of supplements in clinical and public discussion helps — more healthcare professionals and wellness advocates are acknowledging that preventive nutrition and liver-support supplements can play a supportive role alongside healthy lifestyle changes. As public health messaging embraces prevention and wellness, supplements that have reasonable safety profiles and are well-known — like milk thistle — stand to benefit.

Drivers

Rising Burden of Liver Disorders and Preventive Health Awareness Drives Milk Thistle Product Demand

One of the strongest driving factors for milk thistle products is the rapid increase in liver-related health problems worldwide, combined with growing awareness of preventive and supportive care. Liver disease is no longer limited to alcohol misuse; it is increasingly linked to obesity, diabetes, poor diet, and sedentary lifestyles. According to the Journal of Hepatology, liver diseases cause more than 2 million deaths annually, accounting for around 4% of global deaths, with many cases believed to be underreported.

Non-alcoholic fatty liver disease, now referred to as metabolic dysfunction–associated steatotic liver disease (MASLD), has emerged as a major concern. A global analysis published in Nature Metabolism estimated the worldwide prevalence of this condition at approximately 38% of the adult population between 2016 and 2019. This sharp rise has pushed health authorities to focus on early lifestyle management and non-prescription supportive options, where botanical ingredients like milk thistle are widely used.

Consumer preference for natural and food-derived supplements further strengthens this driver. Data from the U.S. Centers for Disease Control and Prevention shows that about 57.6% of adults used at least one dietary supplement during 2017–2018, with higher usage observed among older age groups who are more vulnerable to chronic conditions. Herbal supplements remain an important part of this trend, as they are generally viewed as gentler and suitable for long-term use.

- Government and international health initiatives also indirectly support demand for liver-support products. The World Health Organization reports that viral hepatitis alone causes nearly 1.3 million deaths per year, prompting national programs focused on screening, awareness, and long-term liver health management. While milk thistle is not positioned as a medical treatment, increased attention to liver well-being encourages individuals to adopt complementary solutions alongside medical advice.

Restraints

Regulatory Uncertainty and Limited Clinical Consensus Restrains Wider Adoption of Milk Thistle Products

One of the most significant restraining factors for milk thistle products is the lack of consistent regulatory classification and limited clinical consensus across countries. While milk thistle is widely used as a herbal supplement, it is not approved as a medical treatment for liver disease in most regions. Health authorities often emphasize that evidence supporting its therapeutic effectiveness remains mixed when evaluated against pharmaceutical standards.

The U.S. National Center for Complementary and Integrative Health (NCCIH) states that current research results on milk thistle for liver conditions are inconsistent, and benefits seen in small studies have not always been confirmed in large, well-designed clinical trials.

- Regulatory barriers further restrain market expansion. In the European Union, herbal products marketed under the Traditional Herbal Medicinal Products Directive 2004/24/EC must demonstrate at least 30 years of traditional use, including 15 years within the EU, and are restricted to minor health claims. These products cannot advertise treatment or prevention of liver diseases, limiting marketing flexibility and reducing appeal in clinical settings.

Quality inconsistency is another major concern. Studies cited by the U.S. Food and Drug Administration highlight that dietary supplements may vary significantly in active compound concentration. In testing programs, the FDA has repeatedly noted labeling inaccuracies across herbal supplements, where actual ingredient levels differed from declared values. This variability impacts trust, particularly in milk thistle products that rely on standardized silymarin content for perceived effectiveness.

In addition, strong public-health messaging around medically approved treatments can indirectly restrain herbal supplement use. For example, the World Health Organization’s global hepatitis strategy prioritizes vaccination, antiviral therapy, and early diagnosis to reduce the 1.3 million annual deaths linked to viral hepatitis. As emphasis grows on proven medical interventions, policymakers and clinicians are cautious about products that may distract patients from evidence-based care.

Opportunity

Growing Focus on Metabolic Health Creates New Space for Milk Thistle Products

This pattern is not limited to a few countries. The World Heart Federation estimates that almost 2.3 billion children and adults are already living with overweight or obesity, and if current trends continue, that number could reach 2.7 billion adults by 2025. Such numbers translate directly into a huge pool of people at risk of fatty liver, type 2 diabetes, and cardiovascular disease. These consumers are increasingly open to food-based and herbal products that support liver function alongside medical care and lifestyle change.

Non-communicable diseases (NCDs) are now the dominant health burden worldwide. WHO data show that NCDs killed over 43 million people in 2021, roughly three-quarters of all non-pandemic-related deaths. Many of these deaths are linked to metabolic problems where the liver plays a central role. As governments push national NCD strategies and risk-reduction campaigns, there is space for industry to align milk thistle products with official messages on healthy weight, better nutrition, and reduced alcohol intake.

- Alcohol consumption remains another structural driver behind this opportunity. Global data compiled by Our World in Data using WHO sources suggest that average adults consume around 6 litres of pure alcohol per year, equivalent to roughly 67 bottles of wine per person annually. Even when alcohol use is “social” rather than heavy, many people are conscious of the long-term strain on their liver and are interested in simple, routine support such as milk thistle capsules, teas, or fortified drinks.

At the same time, supplement-taking has become normal behaviour in many markets. A CDC analysis of U.S. adults found that 57.6% of people aged 20 and over used at least one dietary supplement in the past 30 days during 2017–2018, with usage rising to 80.2% among women aged 60 and above. This shows that the idea of adding a daily pill or powder for specific health goals is already well accepted; milk thistle can naturally plug into this habit as part of “liver and metabolic health” bundles.

Regional Insights

Europe leads with 41.2% (≈ 68.8 Mn) as the principal market for milk thistle products.

In 2024, Europe held a commanding regional position in the milk thistle products market, accounting for 41.20% of category revenues and approximately 68.8 million in reported sales units/value. This leadership can be attributed to well-established consumer awareness of botanical liver-support supplements, strong retail penetration across pharmacies and health stores, and a well-developed e-commerce ecosystem that supports specialist brands and private-label SKUs.

Distribution channels were diversified, with a balanced mix of brick-and-mortar pharmacy sales and online direct-to-consumer models; subscription and bundle offers were introduced to raise customer lifetime value. Product innovation was observed in the form of vegetarian capsule shells, improved excipients for stability, and combined formulations positioned for ageing consumers, all of which supported higher average selling prices in key markets.

Manufacturing and quality-assurance processes were refined to meet regional compliance requirements, and logistics networks were adjusted to ensure rapid replenishment across multi-country markets. By 2025, Europe continued to be the dominant region, with market momentum sustained by targeted educational campaigns, growing endorsement by healthcare professionals, and incremental format diversification that expanded the addressable consumer base while preserving regulatory alignment and product safety.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arkopharma focuses on plant-based nutraceuticals, offering organic milk thistle capsules standardized for silymarin content to support liver function. Manufacturing follows phytopharmaceutical practices with organic sourcing and documentation, which aids regulatory compliance across European markets. Marketing highlights traditional herbal use and clinically familiar extract profiles, supporting pharmacy and health-store placement. Product lines are tailored for digestive and liver health niches, and operations emphasise traceability and certified organic claims to build consumer trust and premium positioning.

Bio-Botanica supplies specialty botanical extracts and formulations, providing alcohol-free and standardized milk thistle extracts suitable for capsules, liquids, and topical applications. The company’s technical focus is on gentle extraction methods and formulation support for manufacturers seeking clean-label and high-potency formats. Services extend to customized extract grades and stability testing, enabling brands to enter liver-health segments with validated raw materials. This supplier role positions Bio-Botanica as a B2B partner for product developers and contract manufacturers.

Divine Bounty competes in value and potency tiers, offering concentrated milk thistle capsules marketed for liver detox and general wellness. Product strategy emphasises high-strength extracts, vegetarian capsules, and repeat-purchase incentives such as subscriptions and bundled offers. Distribution is primarily e-commerce driven, with price-led promotions to attract cost-sensitive consumers. Quality claims are supported by extract ratios and third-party testing where available, positioning the brand for online visibility in competitive supplement categories.

Top Key Players Outlook

- Amway Corp.

- Arkopharma Laboratories

- Bio Botanica Inc.

- Blackmores Ltd.

- Divine Bounty

- Euromed SA

- Gaia Herbs Inc.

- Indena S.p.A.

- Jarrow Formulas Inc.

- Nested Naturals Inc

Recent Industry Developments

In 2024, Divine Bounty offers “Pure Milk Thistle” capsules, each containing a 4:1 concentrated extract — 300 mg of extract per capsule, which the company states corresponds to the equivalent of 1,200 mg of raw milk thistle seed extract per serving.

In 2024, Arkopharma maintains a broad footprint: its products are distributed to more than 20,000 pharmacies and parapharmacies across Europe, supported by seven subsidiaries in core European markets (France, Spain, Italy, Netherlands, Belgium, Switzerland, Portugal) plus over 30 distribution partners globally spanning Asia, Africa, the Americas and the Middle East.

Report Scope

Report Features Description Market Value (2024) USD 167.1 Mn Forecast Revenue (2034) USD 614.1 Mn CAGR (2025-2034) 13.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Capsules, Tablets, Powder, Liquid Extract, Tea Bags), By Product Type (Milk Thistle Extract, Milk Thistle Supplements, Milk Thistle Tea, Milk Thistle Oil, Milk Thistle Seeds, Others), By Application (Liver Health, Antioxidant Support, Skin Health, Cardiovascular Health, Detoxification, Others), By Distribution Channel (Online Stores, Pharmacies, Health Food Stores, Hospitals, Clinics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amway Corp., Arkopharma Laboratories, Bio Botanica Inc., Blackmores Ltd., Divine Bounty, Euromed SA, Gaia Herbs Inc., Indena S.p.A., Jarrow Formulas Inc., Nested Naturals Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Milk Thistle Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Milk Thistle Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amway Corp.

- Arkopharma Laboratories

- Bio Botanica Inc.

- Blackmores Ltd.

- Divine Bounty

- Euromed SA

- Gaia Herbs Inc.

- Indena S.p.A.

- Jarrow Formulas Inc.

- Nested Naturals Inc