Global Milk Protein Market By Product Type(Concentrates, Hydrolyzed, Isolates, Others), By Form(Powder, Liquid, Paste/Spreadable, Others), By Application(Dairy Products, Infant Formula, Dietary Supplements, Others), By End-use(Food And Beverages, Nutraceuticals And Dietary Supplements, Pharmaceutical, Cosmetics And Personal Care, Pet Care Industry, Others) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 14200

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

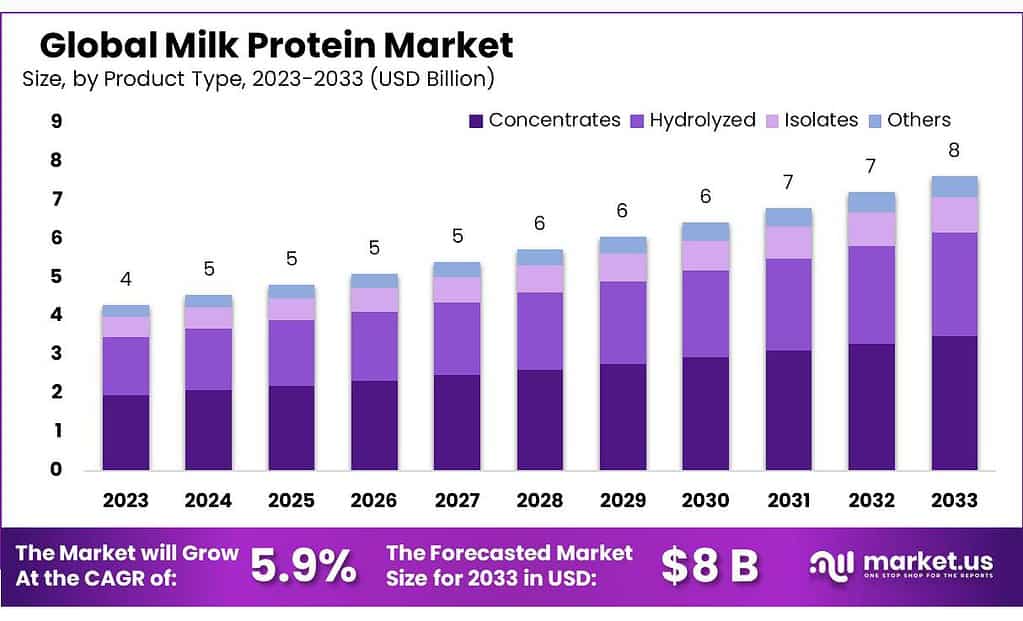

The global Milk Protein Market size is expected to be worth around USD 8 billion by 2033, from USD 4 billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2023 to 2033.

The Milk Protein Market encompasses the global industry focused on extracting and processing proteins from milk, primarily including casein and whey proteins. These proteins are highly valued for their nutritional content, versatility, and functional properties in various applications. Milk proteins are essential ingredients in numerous products across the food and beverage industry, utilized for their ability to enhance texture, flavor, and nutritional value.

They are widely used in sports nutrition products, such as protein powders and bars, due to their high-quality protein content that supports muscle repair and growth. Additionally, milk proteins are integral to the production of dairy products like cheese and yogurt, and are also used in infant formulas, offering essential amino acids crucial for early development. The market for milk proteins continues to grow, driven by increasing consumer awareness about protein-rich diets, health and wellness trends, and innovations in food technology that expand the applications of milk proteins in new product formulations.

Key Takeaways

- Market Projection: The milk Protein Market is set to reach USD 8 billion by 2033, with a 5.9% CAGR from 2023.

- Product Type Dominance: Concentrates hold the largest market share (45.8% in 2023), followed by hydrolyzed and isolates.

- Form Preference: Powdered milk proteins dominate the market (50.5% in 2023), owing to their convenience and versatility.

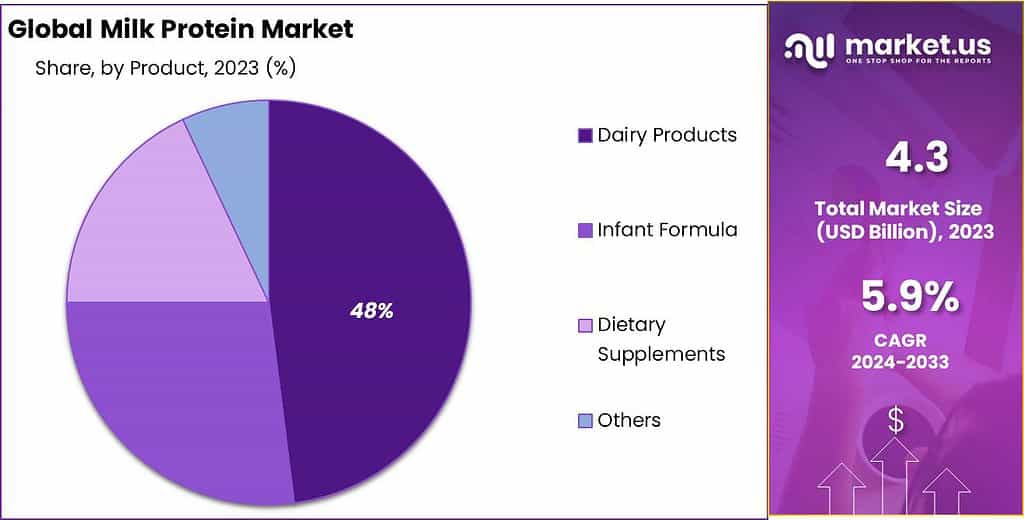

- Application Usage: Dairy products lead in the application (48.9% in 2023), emphasizing the importance of milk proteins in enhancing texture and nutritional value.

- End-use Utilization: Food & beverages account for the highest market share (41.8% in 2023), followed by nutraceuticals & dietary supplements.

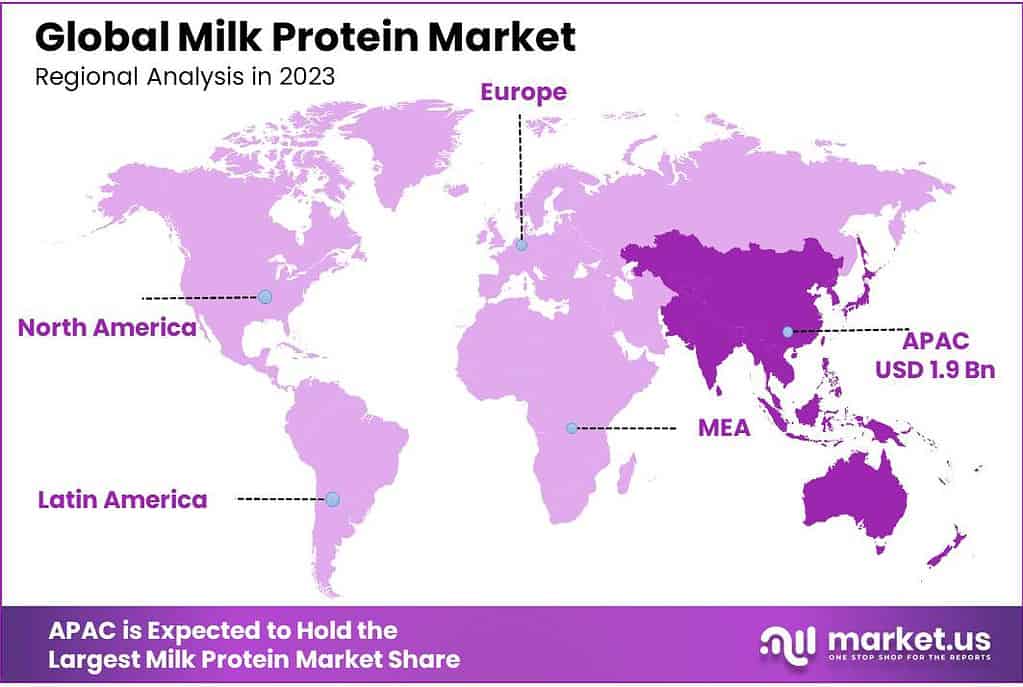

- Regional Insights: Asia Pacific leads with a 45% market share, followed by North America and Europe, driven by health trends and technological advancements.

By Product Type

In 2023, Concentrates held a dominant market position, capturing more than a 45.8% share. Milk protein concentrates are popular due to their balanced content of proteins and other nutrients like minerals, which make them versatile for a range of applications from sports nutrition to fortified dairy products. Their moderate protein concentration makes them ideal for consumers looking for balanced nutrition without the intensity of higher protein products.

Hydrolyzed milk proteins, known for their enhanced digestibility, are another significant segment. These proteins undergo hydrolysis, breaking down the protein molecules into smaller peptides, which reduces the potential for allergic reactions and makes them easier to digest. This makes hydrolyzed milk proteins particularly suited for infant formulas and clinical nutrition products, catering to individuals with sensitive digestive systems or specific dietary needs.

Isolates represent a specialized segment, featuring milk proteins that have been isolated to provide higher protein content with very low fat and lactose levels. Milk protein isolates are particularly favored in the sports nutrition sector, where high protein intake with minimal extra calories is desirable. They are commonly used in protein bars, shakes, and other supplements aimed at muscle building and recovery.

Each segment caters to unique consumer needs and preferences, supporting the diverse applications of milk proteins in the food and beverage industry.

By Form

In 2023, Powder held a dominant market position, capturing more than a 50.5% share. Powdered milk proteins are highly favored for their convenience, long shelf life, and ease of use in various applications. They are extensively used in the dietary supplements industry for protein shakes and meal replacements, as well as in the food industry for baking and dairy product formulations due to their ability to dissolve easily and blend smoothly.

Liquid form follows, appreciated for its ready-to-use convenience which eliminates the need for reconstitution. Liquid milk proteins are primarily used in beverage applications, including sports drinks and ready-to-drink shakes, where they provide an immediate protein source without the need for mixing.

Paste/Spreadable forms are less common but serve unique niches in the market, such as in protein-enriched spreads or cheese products. These products appeal to consumers looking for alternative ways to incorporate protein into their diets, offering convenience and taste in a versatile form.

Each form of milk protein serves different consumer needs and preferences, contributing to the broad utility and growing demand for milk proteins across a diverse range of market sectors.

By Application

In 2023, Dairy Products held a dominant market position, capturing more than a 48.9% share. Milk proteins are essential in the dairy industry, where they are used to enhance the texture, nutritional value, and flavor of products such as yogurt, cheese, and milk beverages. Their ability to improve firmness and reduce syneresis makes them especially valuable in cultured dairy products.

Infant Formula is another significant application, relying on milk proteins for their closeness to human milk in terms of nutrient composition. Milk proteins provide essential amino acids critical for infant growth and development, making them a staple ingredient in formula production.

Dietary Supplements also represent a key segment, where milk proteins are prized for their high-quality protein content that supports muscle repair and growth. This application is particularly popular among athletes and those involved in fitness, who use milk protein-based supplements to aid recovery and enhance performance.

Each application utilizes the unique properties of milk proteins to meet specific market demands and consumer needs, driving the diverse and robust growth of the milk protein market.

By End-use

In 2023, Food & Beverages held a dominant market position, capturing more than a 41.8% share. Milk proteins are extensively utilized in this sector due to their ability to enhance texture, nutritional value, and flavor stability in products such as dairy beverages, baked goods, and processed foods. Their functional properties are highly valued for improving product consistency and satisfying consumer demand for high-protein, health-oriented food options.

Nutraceuticals and Dietary Supplements form another key segment, where milk proteins are integral for their high biological value and amino acid profile, supporting muscle growth and maintenance. This makes them popular in protein powders, bars, and meal replacement products, particularly among health-conscious consumers and fitness enthusiasts.

The Pharmaceutical sector also benefits from the inclusion of milk proteins in formulations, where they are used for their bioactive properties in medical nutrition products, aiding in recovery and nutritional support for patients.

Cosmetics and Personal Care is an emerging segment for milk proteins, utilizing their hydrating and film-forming abilities to enhance the quality of skincare products, such as creams and lotions, which they contribute to skin moisture retention and repair.

The Pet Care Industry leverages milk proteins to improve the nutritional content of pet food, especially in formulations aimed at younger animals that require protein-rich diets for growth and development.

Key Market Segments

By Product Type

- Concentrates

- Hydrolyzed

- Isolates

- Others

By Form

- Powder

- Liquid

- Paste/Spreadable

- Others

By Application

- Dairy Products

- Infant Formula

- Dietary Supplements

- Others

By End-use

- Food & Beverages

- Nutraceuticals & Dietary Supplements

- Pharmaceutical

- Cosmetics & Personal Care

- Pet Care Industry

- Others

Drivers

Rising Demand for Protein-Rich Diets

A major driver of the Milk Protein Market is the rising demand for protein-rich diets among global consumers. As awareness of health and nutrition increases, more people are recognizing the importance of protein in their daily diets for muscle health, weight management, and overall wellness. Milk proteins, particularly whey and casein, are highly valued for their complete amino acid profile, making them some of the most sought-after sources of dietary protein available.

Milk proteins are known for their high-quality, bioavailable protein, which is essential for building and repairing tissues, making them especially popular among athletes, bodybuilders, and fitness enthusiasts. These proteins support muscle recovery and growth, contributing to their widespread use in sports nutrition products like protein powders, bars, and ready-to-drink shakes. The sports nutrition market has seen robust growth, driven by an increasing number of recreational athletes and fitness-conscious consumers who use these products as part of their regular health and exercise routines.

Moreover, the general population is also increasingly drawn to the benefits of high-protein diets for weight management and satiety. Milk proteins are incorporated into a variety of food products, including meal replacements, fortified snack bars, and dairy products, which appeal to consumers looking to increase protein intake without significantly altering their eating habits. This trend is complemented by the rising popularity of functional foods, where consumers seek additional health benefits from everyday eating experiences.

The versatility of milk proteins extends beyond nutritional supplements into the realms of infant nutrition and medical foods, where they are valued for their digestibility and nutrient richness. Infant formulas, which aim to mimic the nutritional profile of human milk, rely heavily on milk proteins to provide critical nutrients that support early growth and development. In the medical field, milk proteins are utilized in products designed to meet the specific dietary needs of patients recovering from surgery, illness, or managing chronic diseases, providing essential proteins in easily consumable formats.

Additionally, the global expansion of the health and wellness trend continues to open new markets for milk proteins. As more consumers in developing regions gain access to and interest in nutritional supplements and fortified foods, the demand for milk proteins is expected to increase further, reinforcing its role as a key component of health-focused diets worldwide.

Restraints

Dietary Restrictions and Allergies

A significant restraint in the Milk Protein Market is the prevalence of dietary restrictions and allergies associated with milk and dairy products. Lactose intolerance and milk allergies are common conditions that affect a substantial portion of the global population, particularly adults, who may experience adverse reactions when consuming milk-based products. These conditions can range from mild lactose intolerance, where individuals have difficulty digesting lactose—a sugar found in milk—to severe allergic reactions to milk proteins, which can be life-threatening.

This dietary limitation poses a challenge to the milk protein market as it restricts a segment of potential consumers from using products containing milk proteins. As awareness and diagnosis of lactose intolerance and milk allergies increase, more consumers are opting for plant-based and non-dairy alternatives. This shift has spurred growth in alternative protein sources such as soy, pea, and rice proteins, which are perceived as more digestible and less likely to cause allergic reactions. These alternatives are gaining popularity not only among those with allergies or intolerances but also with consumers following vegan or vegetarian diets, further compounding the challenge for the milk protein market.

Additionally, the perception of milk proteins as potential allergens affects their marketability and consumer acceptance, even among those who do not suffer from these conditions. The demand for clean label products, which are free from allergens and other additives, is growing, and products containing milk proteins often do not fit this category. Producers of milk proteins must therefore navigate market dynamics that increasingly favor hypoallergenic and plant-based options.

Moreover, regulatory issues also impact the market for milk proteins. In many regions, food products must clearly label the presence of allergens, including milk, which could deter consumers who are cautious about dietary sensitivities. This creates a necessity for producers to implement stringent cross-contamination measures during manufacturing processes, adding to production costs and complexity.

Opportunity

Expansion into Specialized Nutritional Products

A significant opportunity for the Milk Protein Market lies in the expansion into specialized nutritional products. As consumers increasingly seek personalized nutrition solutions to address specific health concerns, such as aging, weight management, and sports performance, milk proteins can play a pivotal role due to their high nutritional quality and functional properties.

Milk proteins, including whey and casein, are renowned for their excellent amino acid profiles, making them ideal for developing products targeted at muscle recovery, strength building, and endurance. This positions them well within the sports nutrition industry, which is rapidly growing as more individuals participate in fitness activities and professional sports. Developing formulations that cater to the specific needs of athletes, such as fast-absorbing whey proteins for post-workout recovery or slow-releasing casein for muscle maintenance, can capture a substantial market segment.

Additionally, the aging global population presents a vast opportunity for milk proteins in the health and wellness sector. Older adults require higher protein intake to counteract age-related muscle loss and ensure strong bone health. Milk proteins can be incorporated into senior-specific nutritional supplements and functional foods designed to be easy to consume and digest, thus meeting the dietary needs of this demographic.

There is also growing interest in weight management products formulated with milk proteins due to their ability to promote satiety and aid in fat loss. These products can range from meal replacement shakes to protein-enhanced snacks, catering to consumers looking to maintain or reduce weight through a balanced diet.

Beyond these traditional markets, milk proteins have potential applications in the infant formula industry. They are crucial for formulating infant nutrition that closely mimics the nutrient profile of human breast milk, providing essential proteins necessary for growth and development. Innovating safe and effective infant formulas with milk proteins can tap into the global demand for premium baby nutrition products.

Furthermore, there is a trend towards more clean label and natural products in the food industry, and milk proteins can align well with this shift. By developing natural and minimally processed milk protein products that maintain their nutritional integrity, companies can appeal to health-conscious consumers who scrutinize product labels for artificial additives and preservatives.

Trends

Increasing Integration of Milk Proteins into Functional Foods

A significant trend in the Milk Protein Market is the increasing integration of milk proteins into functional foods, catering to the growing consumer demand for food products that offer specific health benefits beyond basic nutrition. As awareness of the importance of protein in maintaining overall health and wellness grows, consumers are seeking convenient and tasty ways to incorporate high-quality protein into their diets. Milk proteins, known for their superior nutritional profile and functional properties, are becoming key ingredients in a wide array of functional food products.

Milk proteins such as whey and casein are particularly valued for their ability to enhance the texture and sensory properties of foods while also providing substantial health benefits. They are being incorporated into products ranging from protein-enriched bakery items and snacks to fortified beverages and dairy products. This versatility makes them ideal for use in a variety of dietary formats, appealing to a broad audience, including athletes, health-conscious individuals, and those with specific dietary needs like elderly consumers and pregnant women.

The trend is also driven by the consumer shift towards more natural and wholesome ingredients. Milk proteins are perceived as a more natural protein source compared to synthetic or highly processed proteins. This perception aligns well with the clean label movement, where consumers favor products with easily recognizable and minimal ingredients. Manufacturers are responding by formulating products with milk proteins that not only boast high protein content but also adhere to clean label standards.

Furthermore, innovations in food technology have enabled the development of new forms of milk protein that enhance their application in functional foods. Microencapsulation, for example, allows milk proteins to be incorporated into non-traditional products like fruit juices or soups without impacting the taste or texture, thereby broadening their use in the functional food sector.

Additionally, the market is seeing a surge in demand for personalized nutrition, where foods are tailored to meet individual health requirements. Milk proteins are being studied and utilized for their potential roles in managing conditions such as diabetes, obesity, and cardiovascular diseases through personalized food products.

Regional Analysis

The Asia Pacific region is poised to dominate the global market for milk proteins, capturing a significant share of 45%. This growth is driven by increasing consumer awareness of health and wellness, particularly in key sectors such as sports nutrition, functional foods, and infant nutrition. Significant investments in food technology and dairy development in countries like China, India, and various Southeast Asian nations are expected to propel market growth across the region, supported by strong agricultural capabilities and a focus on innovative dairy products.

In North America, economic prosperity and the expansion of health-focused industries, such as dietary supplements and specialized nutrition, are forecasted to drive market demand. The region’s commitment to fitness and health trends, along with environmental sustainability in food production, further enhances this demand, positioning North America as a prominent market for milk proteins.

Similarly, Europe is set to experience substantial growth in the milk protein market. This growth is driven by the increasing consumer preference for high-protein diets and locally sourced dairy products, coupled with the rising demand from sectors such as aging population health management and premium health foods. Europe’s emphasis on health-conscious living and sustainable agriculture underscores the growing adoption of milk proteins in the region, making it a significant market for these products.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Analyzing the key players in the milk protein market reveals a landscape characterized by intense competition, innovation, and strategic partnerships. Leading companies such as Fonterra Co-operative Group, Arla Foods Ingredients Group, and Kerry Group PLC dominate the market with their extensive product portfolios and global presence.

Fonterra Co-operative Group, a major player in the milk protein industry, leverages its vertically integrated supply chain and technological expertise to offer a wide range of milk protein products, including whey protein concentrates, isolates, and hydrolysates.

Market Key Players

- Amco Protein

- Arla Foods

- Fonterra Co-operative Group Limited

- Frieslandcampina

- Glanbia PLC

- Groupe Lactalis S.A.

- Havero Hoogwewt

- Hoogwegt Groep B.V.

- Kerry Group plc

- Koninklijke FrieslandCampina N.V.

- Lactalis

- Sachsenmilch Leppersdorf GmbH

- Saputo Inc.

Recent Development

January 2023, Amco Protein expanded its product portfolio by introducing innovative milk protein ingredients tailored to meet the diverse needs of food and beverage manufacturers.

January 2023, Arla Foods launched a new line of milk protein ingredients, leveraging its expertise in dairy processing to offer high-quality protein solutions for various applications.

Report Scope

Report Features Description Market Value (2023) USD 4 Bn Forecast Revenue (2033) USD 8 Bn CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Concentrates, Hydrolyzed, Isolates, Others), By Form(Powder, Liquid, Paste/Spreadable, Others), By Application(Dairy Products, Infant Formula, Dietary Supplements, Others), By End-use(Food And Beverages, Nutraceuticals And Dietary Supplements, Pharmaceutical, Cosmetics And Personal Care, Pet Care Industry, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Amco Protein, Arla Foods, Fonterra Co-operative Group Limited, Frieslandcampina, Glanbia PLC, Groupe Lactalis S.A., Havero Hoogwewt, Hoogwegt Groep B.V., Kerry Group plc, Koninklijke FrieslandCampina N.V., Lactalis, Sachsenmilch Leppersdorf GmbH, Saputo Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Milk Protein Market?Milk Protein Market size is expected to be worth around USD 8 billion by 2033, from USD 4 billion in 2023

What CAGR is projected for the Milk Protein Market?The Milk Protein Market is expected to grow at 5.9% CAGR (2023-2033).Name the major industry players in the Milk Protein Market?Amco Protein, Arla Foods, Fonterra Co-operative Group Limited, Frieslandcampina, Glanbia PLC, Groupe Lactalis S.A., Havero Hoogwewt, Hoogwegt Groep B.V., Kerry Group plc, Koninklijke FrieslandCampina N.V., Lactalis, Sachsenmilch Leppersdorf GmbH, Saputo Inc.

-

-

- Amco Protein

- Arla Foods

- Fonterra Co-operative Group Limited

- Frieslandcampina

- Glanbia PLC

- Groupe Lactalis S.A.

- Havero Hoogwewt

- Hoogwegt Groep B.V.

- Kerry Group plc

- Koninklijke FrieslandCampina N.V.

- Lactalis

- Sachsenmilch Leppersdorf GmbH

- Saputo Inc.