Global Military Wearables Market By End User (Land Forces, Naval Forces, Air Forces), By Technology (Communication & Computing, Network and Connectivity Management, Navigation, Vision & Surveillance, Exoskeleton, Monitoring, Power and Energy Source, Smart Textiles), By Wearable Type (Headwear, Eyewear, Wristwear, Hearables, Bodywear), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 73128

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

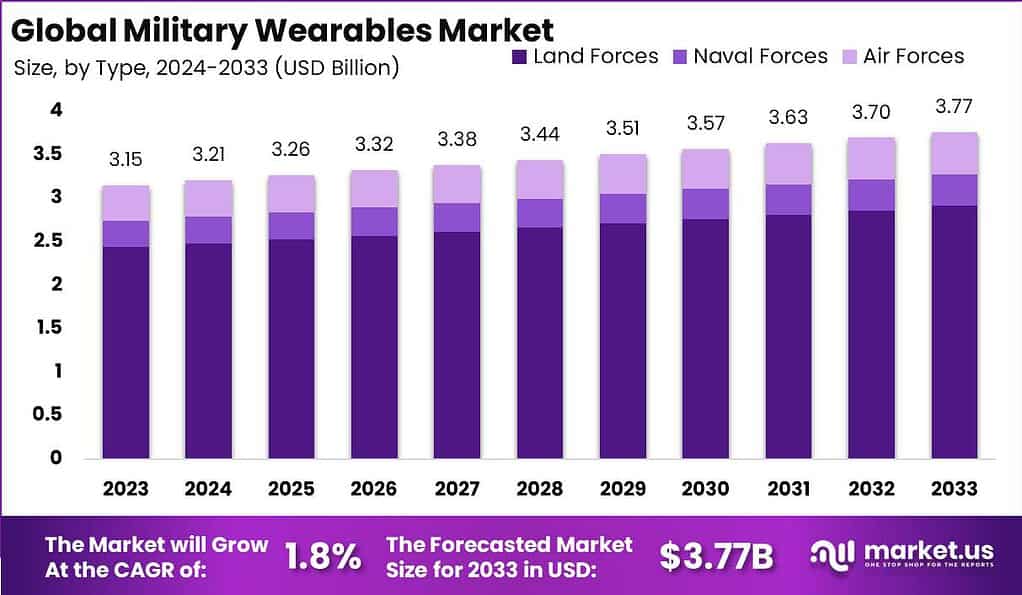

The Global Military Wearables Market is anticipated to be USD 3.77 billion by 2033. It is estimated to record a steady CAGR of 1.8% in the Forecast period 2024 to 2033. It is likely to total USD 3.15 billion in 2023.

The military wearables are electronic devices that are worn by soldiers and integrate computing and communication technologies into their uniforms and gear. These wearables can include augmented reality headsets, smartwatches, fitness trackers, sensors, exoskeletons, and more. The capabilities of military wearables include enabling real-time communication and data transfer, monitoring soldiers’ vital signs and location, providing navigation and mapping functions, and assisting with physical tasks.

The global military wearables market is expected to grow as nations continue to integrate advanced technologies into their armed forces. Key factors driving growth include the rising emphasis on soldier modernization programs, the increasing adoption of augmented reality and virtual reality for training and operations, and the need for monitoring and managing large numbers of distributed soldiers in the field.

Note: Actual Numbers Might Vary In the Final Report

Leading military powers like the United States, China and Russia are investing heavily in military wearables technology and are likely to be major adopters. However, technical challenges around reliability, security and interoperability will need to be overcome for the market to reach its full potential. Overall, military wearables promise to transform the battlefield by enhancing soldiers’ awareness, efficiency and safety.

Key Takeaways

- Market Growth and Size: The Global Military Wearables Market is expected to reach USD 3.77 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 1.8% from 2024 to 2033.

- Definition: Military wearables are electronic devices integrated into soldiers’ uniforms and gear, including augmented reality headsets, smartwatches, fitness trackers, sensors, exoskeletons, and more.

- Growth Drivers: Emphasis on Soldier Modernization Programs

- End User Analysis: Land Forces dominated the market in 2023 (78% share) due to the extensive scope of land operations.

- Technology Analysis: Vision & Surveillance held the largest market share in 2023 (23%) due to the need for enhanced situational awareness.

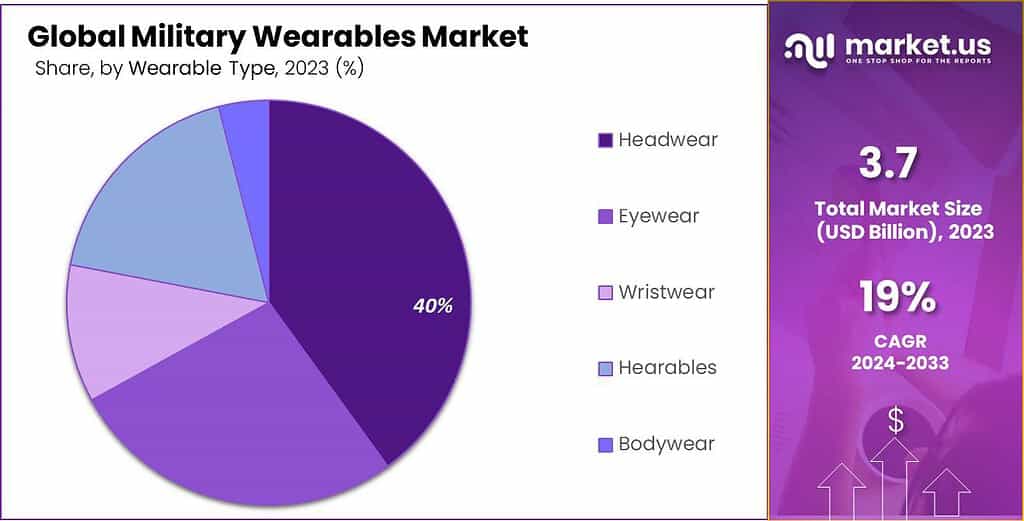

- Wearable Type Analysis: Headwear dominated the market in 2023 (40%) and includes helmets, head-up displays, and communication headsets.

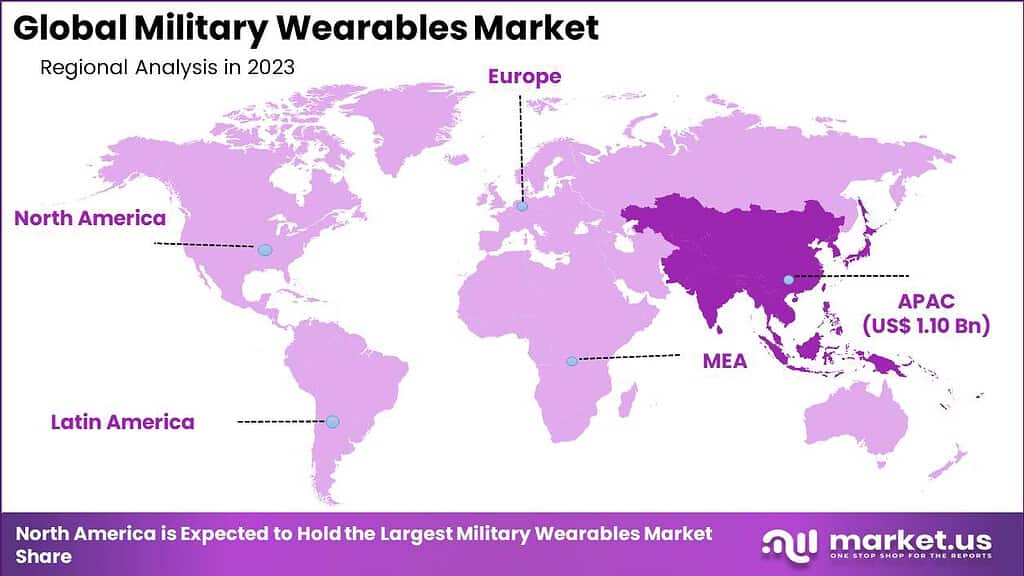

- Regional Analysis: APAC held a dominant market position in 2023 (35% share) due to military advancements and increasing defense budgets in countries like China and India.

- Key Players: Notable companies in the military wearables market include BAE Systems PLC, Elbit Systems Ltd., Thales Group, Saab AB, General Dynamics Corporation, Rheinmetall AG, L3Harris Corporation, Aselsan A.S., Teledyne Flir LLC, and Lockheed Martin Corporation.

By End User Analysis

In 2023, the Land forces segment held a dominant market position in the Military Wearables Market, capturing more than a 78% share. This predominance is primarily due to the extensive size and scope of land operations, which require a vast range of wearable technologies for enhanced soldier performance, protection, and communication. The integration of advanced wearables, including augmented reality systems, health monitoring sensors, and exoskeletons, has significantly improved the operational efficiency and safety of land forces. The demand for these technologies is driven by the continuous push to modernize infantry, making soldiers more resilient and situationally aware in diverse terrains and combat scenarios.

Conversely, the Naval forces segment, while smaller in market share, plays a crucial role in the Military Wearables Market. Specialized wearables designed for maritime environments, such as dive computers, smart helmets, and navigation aids, are vital for enhancing the capabilities of naval personnel. This segment’s growth is bolstered by the increasing focus on maritime security, anti-piracy measures, and the technological modernization of naval fleets. The integration of wearables in naval operations aims to improve mission effectiveness, personnel safety, and strategic communication both above and below the sea.

The Air Forces segment, known for its rapid adoption of cutting-edge technologies, also forms a significant part of the Military Wearables Market. Pilot helmets with heads-up displays, G-suits, and advanced flight suits equipped with biometric sensors are among the key wearables enhancing the capabilities of air personnel. Despite its smaller share compared to land forces, this segment is characterized by a high level of investment in research and development, focusing on enhancing pilot safety, performance, and endurance.

As air forces worldwide continue to evolve with stealth and combat technologies, the demand for advanced wearable systems is expected to see substantial growth, driven by the need for superior situational awareness and survivability in increasingly complex aerial environments.

By Technology Analysis

In 2023, the Vision & Surveillance segment held a dominant market position in the Military Wearables Market, capturing more than a 23% share. This prominence is largely due to the critical need for enhanced situational awareness and target acquisition in modern warfare.

Technologies in this segment, such as night vision goggles, thermal imaging devices, and advanced reconnaissance systems, have become indispensable tools for soldiers across various terrains and operations. The integration of wearable cameras and sensors has not only improved real-time data collection but also enhanced decision-making capabilities on the battlefield.

Communication & Computing is another vital segment, providing the backbone for seamless and secure operations. Wearables with integrated communication devices, heads-up displays, and portable computing capabilities enable troops to stay connected and informed, which is essential for coordinated missions and immediate response strategies. The demand for robust and reliable communication systems continues to drive innovation in this sector, focusing on reducing the weight and improving the functionality of these essential gadgets.

Network and Connectivity Management wearables are crucial for establishing and maintaining a cohesive operational network. Devices that manage and secure data flow between soldiers, command centers, and various military assets ensure that operations are conducted smoothly and securely. As cyber threats become more sophisticated, the importance of secure and resilient connectivity is more pronounced than ever, prompting significant investment in this segment.

Navigation wearables, including GPS and advanced geomapping tools, are indispensable for precision in movement and strategy. These devices not only provide real-time location data but also assist in mission planning and troop deployment, making them a staple in modern military operations.

The Exoskeleton segment, while still emerging, shows significant promise with its potential to enhance soldier strength, endurance, and load-carrying capabilities. Research and development in this area are focused on creating more agile and energy-efficient systems that can be widely adopted in the field.

Monitoring wearables are increasingly vital for ensuring the health and well-being of soldiers. These devices track vital signs, fatigue levels, and other health indicators to prevent injuries and ensure peak performance during missions.

The Power and Energy Source segment is crucial for the sustained operation of all wearable technologies. Innovations in lightweight, long-lasting power sources are essential to keep devices running during extended missions, with a growing focus on renewable and rechargeable options.

Finally, Smart Textiles represent a groundbreaking sector, integrating electronic components directly into military uniforms. These textiles can monitor health, change camouflage, and even harvest energy, representing the future of multifunctional military wear.

By Wearable Type Analysis

In 2023, the Headwear segment held a dominant market position in the Military Wearables Market, capturing more than a 40% share. This significant presence is primarily due to the essential nature of headwear in military operations, encompassing helmets, head-up displays, and communication headsets.

Enhanced headwear provides critical protection while integrating advanced technologies for communication, navigation, and situational awareness. The development of lightweight, durable materials has further propelled the adoption of advanced headwear, ensuring soldiers are equipped with the best protection and technological capabilities.

The Eyewear segment also represents a substantial portion of the market, offering solutions like augmented reality glasses and night vision goggles. These devices are crucial for enhancing vision in various combat scenarios, providing real-time data overlay, and enabling soldiers to see in low light conditions. Continuous innovations aimed at improving clarity, reducing weight, and integrating additional functionalities are driving the growth of this segment.

Wristwear, encompassing smartwatches and wrist-mounted devices, is gaining traction due to its convenience and multifunctional capabilities. These wearables offer features such as navigation, health monitoring, and communication, all accessible from the soldier’s wrist. The compact nature and ease of use make wristwear an increasingly popular choice for military personnel seeking streamlined and accessible technology.

Hearables, or advanced earpieces, are critical for clear and secure communication in the field. These devices often come with noise-canceling features, language translation, and connectivity to other devices. The demand for hearables that provide crisp communication while protecting the user’s hearing in loud environments continues to grow, reflecting the importance of effective communication in military operations.

Lastly, the Bodywear segment, which includes smart textiles, vests, and exoskeletons, is set to expand as technology advances. These wearables are designed to enhance soldier performance, provide ballistic protection, and monitor health. The development of smart textiles that can adapt to environmental changes, monitor vitals, and even harvest energy is driving the interest and investment in this sector.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- Technological Advancements: Continuous innovations in wearable technology, such as improved battery life, miniaturization of components, and enhanced connectivity, are driving the adoption of military wearables, offering soldiers advanced tools to improve their effectiveness and safety on the battlefield.

- Increasing Demand for Situational Awareness: The need for real-time data and improved situational awareness in complex combat scenarios is pushing militaries worldwide to invest in wearables that can provide critical information and communication links.

- Focus on Soldier Health and Performance: There’s a growing emphasis on monitoring and enhancing soldier health and performance through wearables that can track vitals, fatigue levels, and overall well-being, ensuring that soldiers are at peak readiness.

- Modernization Programs: Many countries are undergoing military modernization programs, where upgrading the individual soldier’s gear with the latest wearables is a key component, driving the market forward.

Restraining Factors

- Budget Constraints: High costs associated with the development and procurement of advanced military wearables can be a significant barrier for many nations, limiting the market’s growth potential.

- Technological Integration Challenges: Integrating new wearable technologies with existing military systems and ensuring compatibility can be complex and time-consuming.

- Security Concerns: The increased use of connected devices raises concerns about data security and the potential for hacking, making some militaries cautious about widespread adoption.

- Resistance to Change: Traditional military structures may resist adopting new technologies due to the comfort with established routines and skepticism about new gear’s effectiveness.

Growth Opportunities

- Emerging Markets: Developing nations looking to modernize their military forces represent a significant growth opportunity for the military wearables market, as they seek to enhance their defense capabilities.

- Customization and Personalization: There’s an increasing demand for customizable and personalized wearables that can cater to specific mission requirements and individual soldier needs, opening new avenues for market growth.

- Integration with Other Technologies: Opportunities exist for wearables that can seamlessly integrate with other emerging military technologies like unmanned systems and artificial intelligence, creating more comprehensive and effective combat solutions.

- Health and Wellbeing Initiatives: As focus shifts to the long-term health and performance of soldiers, wearables offering advanced health monitoring and enhancement features are likely to see increased demand.

Challenges

- Reliability in Harsh Conditions: Ensuring that wearables can reliably function in the diverse and often harsh conditions of military operations remains a significant challenge.

- Balancing Weight and Functionality: Creating wearables that offer advanced features while not overburdening the soldier with additional weight is a critical and ongoing design challenge.

- Ensuring User Acceptance: Soldiers need to feel confident in the reliability and usefulness of wearables, requiring extensive testing and training to ensure widespread acceptance and proper use.

- Regulatory Hurdles: Meeting the stringent regulatory standards for military equipment can delay the introduction of new wearables and add to development costs.

Key Market Trends

- Augmented Reality (AR) for Enhanced Situational Awareness: The use of AR in head-up displays and goggles to provide soldiers with real-time data and insights directly in their line of sight is a growing trend.

- Wearable Exoskeletons: There’s an increasing interest in exoskeletons to enhance soldier strength, endurance, and load-carrying capabilities, potentially revolutionizing foot soldier capabilities.

- Smart Textiles: The development of uniforms integrated with sensors and other electronic components to monitor health, adjust to environmental conditions, and even generate power is a key trend.

- Focus on Energy Efficiency: As wearables become more prevalent, there’s a growing focus on developing energy-efficient devices and energy-harvesting technologies to ensure they can operate for extended periods in the field.

Key Market Segments

By End User

- Land Forces

- Naval Forces

- Air Forces

By Technology

- Communication & Computing

- Network and Connectivity Management

- Navigation

- Vision & Surveillance

- Exoskeleton

- Monitoring

- Power and Energy Source

- Smart Textiles

By Wearable Type

- Headwear

- Eyewear

- Wristwear

- Hearables

- Bodywear

Regional Analysis

In 2023, APAC held a dominant market position in the Military Wearables Market, capturing more than a 35% share. This prominence is largely attributed to the significant military advancements and increasing defense budgets of countries like China and India. The demand for Military Wearables in APAC was valued at US$ 1.10 billion in 2023 and is anticipated to grow significantly in the forecast period.

The region’s focus on modernizing its military capabilities, coupled with ongoing territorial disputes and the need for enhanced soldier efficiency and safety, has driven the demand for advanced wearable technology. Additionally, the growing technological base and manufacturing capabilities within APAC have made it a hub for the production and development of military wearables.

North America, particularly the United States, also represents a substantial portion of the market. With its well-established defense sector and continuous investment in military technology, North America is at the forefront of adopting cutting-edge wearable solutions. The region’s focus on soldier safety, performance, and the integration of new technologies like augmented reality and exoskeletons into military operations drives its significant market share.

Europe, with its advanced technology infrastructure and strong focus on NATO and defense collaboration, is another key player in the Military Wearables Market. Countries like the UK, France, and Germany are heavily investing in military modernization programs that include the adoption of new wearable technologies. The region’s stringent focus on soldier health and the high importance placed on research and development activities contribute to its market share.

Latin America, while holding a smaller share compared to other regions, is experiencing growth in the military wearables market due to increasing security concerns and the need for modernized military equipment. Countries in this region are gradually adopting new technologies to enhance their defense capabilities.

The Middle East and Africa, with their ongoing security challenges and increasing defense expenditures, are recognizing the value of advanced military wearables. The demand in these regions is driven by the need for improved soldier protection and performance in challenging environments. Investments in modern military equipment, including wearables, are expected to rise, reflecting a growing awareness of the benefits these technologies can bring to military operations.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The military wearables market is comprised of several key players who are at the forefront of developing and supplying advanced wearable technologies to military organizations. These companies specialize in the design, manufacturing, and integration of military wearables, providing innovative solutions to enhance the capabilities and safety of soldiers on the battlefield.

Top Key Players

- BAE Systems PLC

- Elbit Systems Ltd.

- Thales Group

- Saab AB

- General Dynamics Corporation

- Rheinmetall AG

- L3Harris Corporation

- Aselsan A.S.

- Teledyne Flir LLC

- Lockheed Martin Corporation

- Other key players

Recent Development

- In August 2023, Hanwha, a partner of Elbit Systems, secured the contract for the Australian Land 400 Phase 3 Project. This selection highlights Hanwha’s position as a key player in defense and military projects.

- Also in August 2023, General Dynamics Information Technology (GDIT) announced a significant advancement by increasing the computational capability of its Dogwood and Cactus supercomputers by 20%. This development underscores GDIT’s commitment to enhancing technological infrastructure and computing power.

- In July 2023, Honeywell revealed its intent to acquire SCADAfence, a move aimed at strengthening its cybersecurity software portfolio. This strategic acquisition positions Honeywell to further enhance its capabilities in safeguarding critical infrastructure against cyber threats.

Report Scope

Report Features Description Market Value (2023) USD 3.15 Bn Forecast Revenue (2033) USD 3.77 Bn CAGR (2024-2033) 1.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By End User (Land Forces, Naval Forces, Air Forces), By Technology (Communication & Computing, Network and Connectivity Management, Navigation, Vision & Surveillance, Exoskeleton, Monitoring, Power and Energy Source, Smart Textiles), By Wearable Type (Headwear, Eyewear, Wristwear, Hearables, Bodywear) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape BAE Systems PLC, Elbit Systems Ltd., Thales Group, Saab AB, General Dynamics Corporation, Rheinmetall AG, L3Harris Corporation, Aselsan A.S., Teledyne Flir LLC, Lockheed Martin Corporation, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are military wearables?Military wearables are advanced technological devices and equipment designed for use by military personnel. These wearables are integrated into uniforms, gear, or accessories to enhance capabilities, improve situational awareness, and provide valuable data for tactical decision-making.

How big a Global Military Wearables Market?The Global Military Wearables Market is anticipated to be USD 3.77 billion by 2033. It is estimated to record a steady CAGR of 1.8% in the Forecast period 2024 to 2033. It is likely to total USD 3.15 billion in 2023.

Which companies are notable players in the Military Wearables Market?Notable companies in the Military Wearables Market include BAE Systems PLC (UK), Elbit Systems Ltd. (Israel), Thales Group (France), Saab AB (Sweden), General Dynamics Corporation (US), Rheinmetall AG (Germany), L3Harris Corporation (US) among others

Why is the Asia-Pacific region dominating the Military Wearables Market in 2023?The Asia-Pacific region's dominance in the Military Wearables Market in 2023 can be attributed to increased defense spending, technological advancements, and a focus on modernizing military capabilities. Countries like China, India, and South Korea are at the forefront, investing significantly in cutting-edge military wearables.

What are the 5 wearable technologies today?Popular wearable technologies include smartwatches, fitness trackers, smart clothing, augmented reality (AR) glasses, and hearables (smart audio devices)

What are the applications of wearables in the military?Wearables in the military serve various applications, including enhancing communication, monitoring soldiers' health and performance, providing situational awareness through augmented reality, and integrating advanced technologies for improved tactical decision-making on the battlefield.

What is wearable technology in the army?Wearable technology in the army involves the integration of advanced devices into soldiers' uniforms, gear, or accessories. This technology aims to enhance soldiers' capabilities, improve communication, monitor health, and provide real-time data for strategic decision-making in military operations. Examples include wearable sensors, smart helmets, and communication systems integrated into clothing.

Military Wearables MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Military Wearables MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BAE Systems PLC

- Elbit Systems Ltd.

- Thales Group

- Saab AB

- General Dynamics Corporation

- Rheinmetall AG

- L3Harris Corporation

- Aselsan A.S.

- Teledyne Flir LLC

- Lockheed Martin Corporation

- Other key players