Global Military Cyber Security Market Size, Share, Industry Analysis Report By Solution (Threat Intelligence and Response, Identity and Access Management, Data Loss Prevention, Security Information and Event Management, Unified Threat Management, Risk and Compliance Management, Managed Security Services, Others), By Security Layer (Endpoint Security, Network Security, Cloud Security, Application Security), By Deployment (On-Premise, Cloud), By Operation Domain (Land Forces, Air Forces, Naval Forces), By Component (Hardware Appliances, Software and Services), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159639

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of Generative AI

- Analysts’ Viewpoint

- Investment and Business Benefits

- North America Market Outlook

- By Solution

- By Security Layer

- By Deployment

- By Operation Domain

- By Component

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

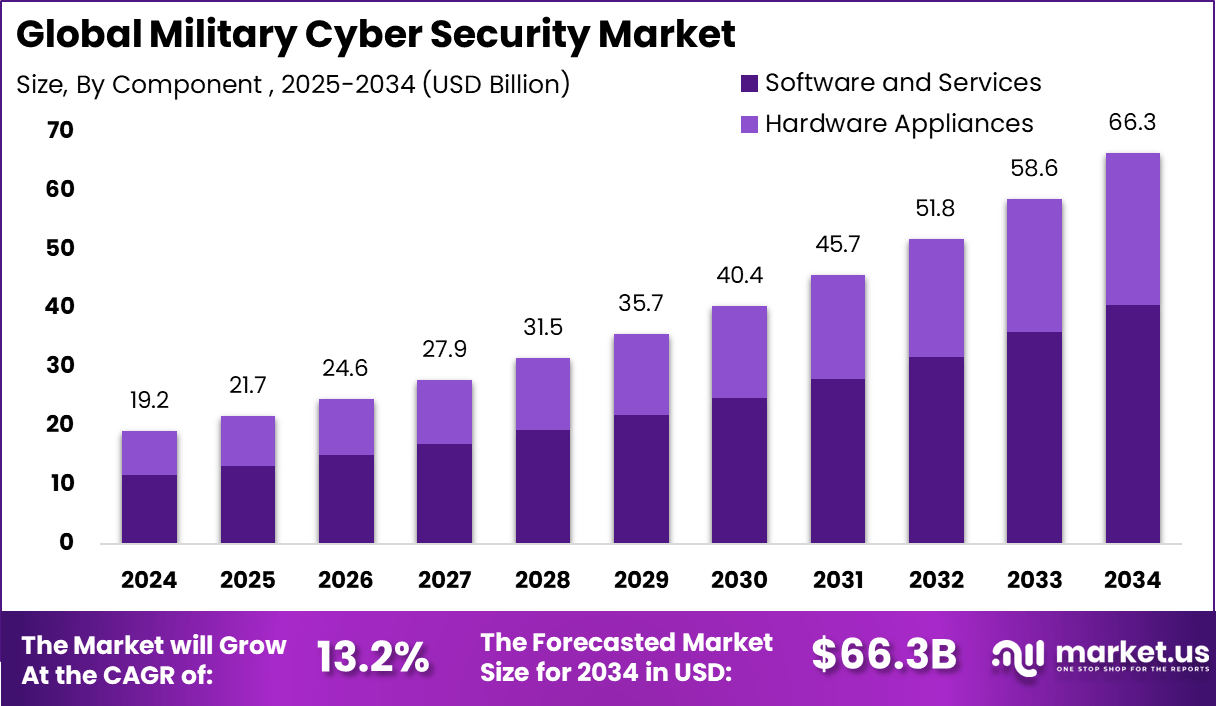

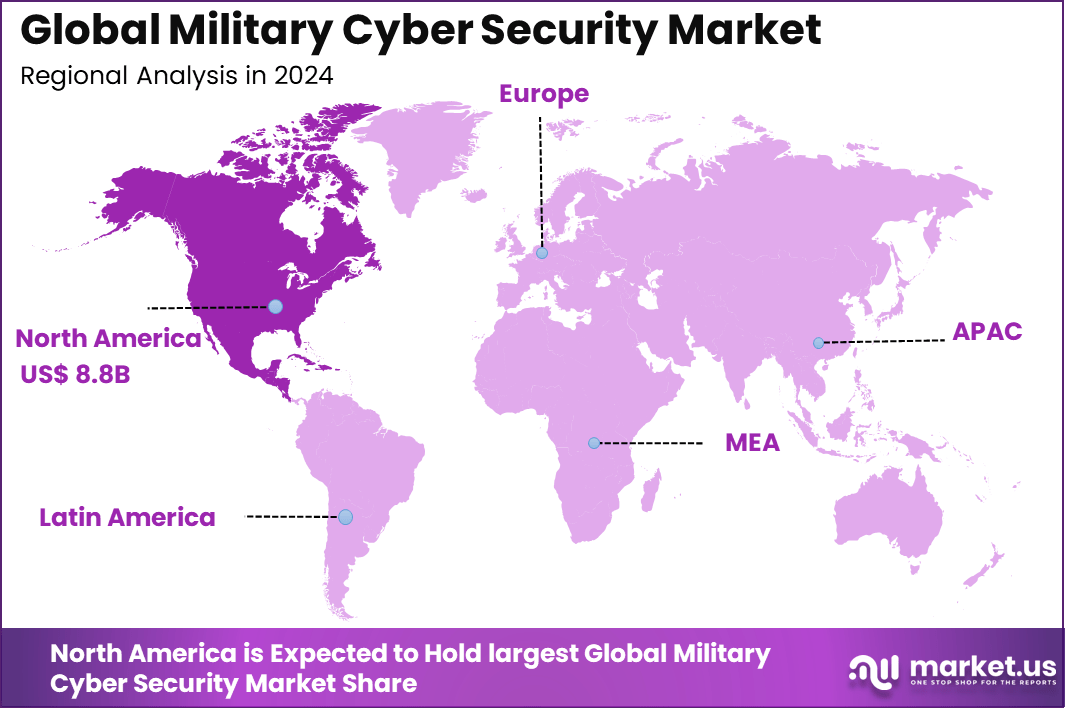

The Global Military Cyber Security Market size is expected to be worth around USD 66.3 Billion By 2034, from USD 19.2 billion in 2024, growing at a CAGR of 13.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 46.1% share, holding USD 8.8 Billion revenue.

The military cyber security market is expanding rapidly as countries invest in defending their digital military assets and critical command infrastructure against ever-more sophisticated cyber threats. Modern militaries are increasingly targeted by state-sponsored and organized cyber attackers, who seek to disrupt intelligence, communications, and defense systems.

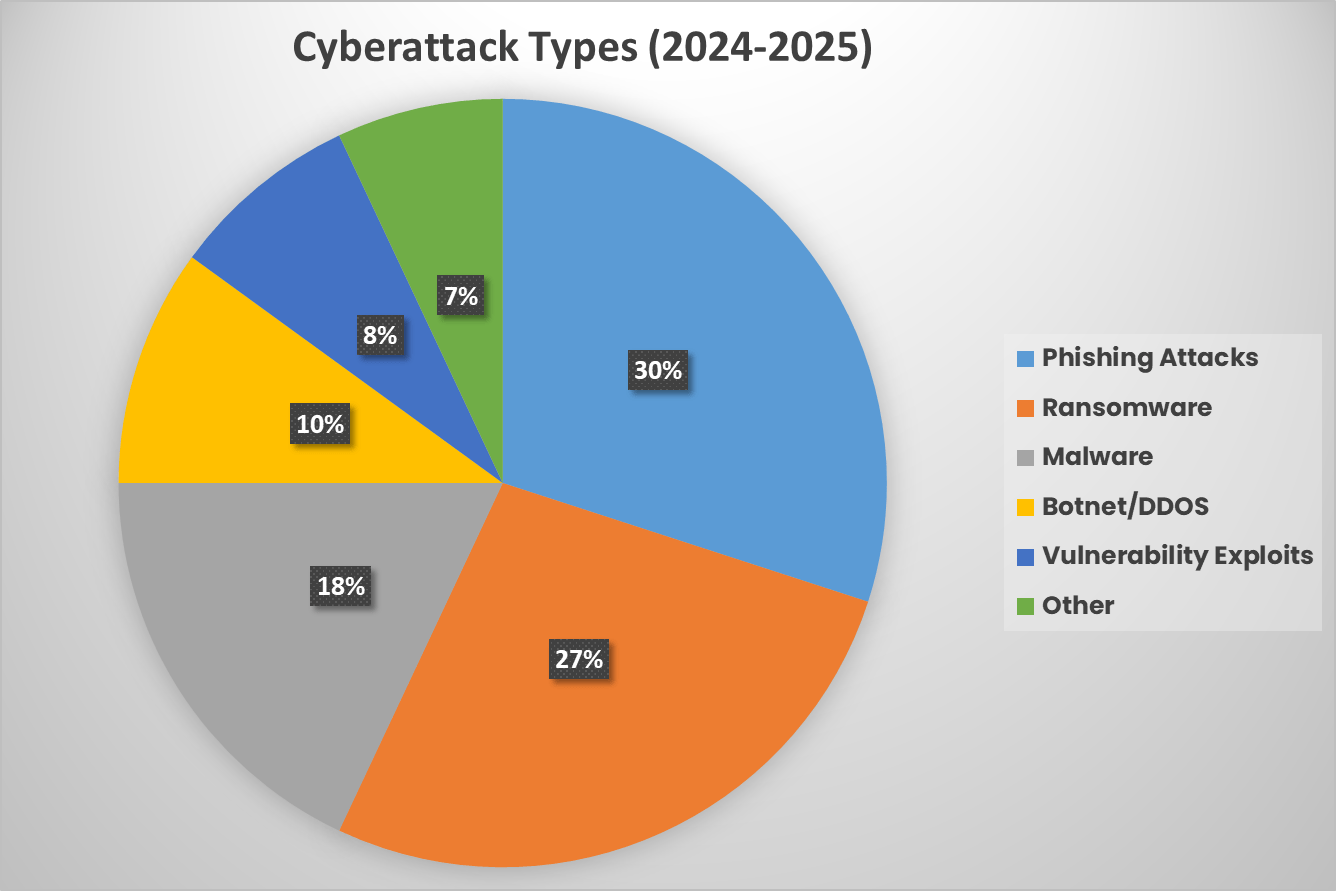

The heightened complexity of these threats has led to a consistent focus on robust cyber defense programs globally. Over the past year alone, highly sensitive attacks on military systems have surged by more than 250%, forcing defense organizations to boost investment in advanced security controls and vigilance protocols.

A primary driver is the growing frequency and sophistication of state-sponsored cyberattacks targeting critical defense systems, infrastructure, and military networks. Another driver is modernization of military systems that embed software and connectivity, expanding the attack surface. Adoption of networked and autonomous systems, drones, satellite links, and digital command systems also increases vulnerability.

According to VikingCloud, cybercrime could cost businesses up to $10.5 trillion by 2025 and may rise to $15.63 trillion by 2029. About 72% of business owners are worried about future risks linked to hybrid and remote work models. At the same time, 74% of businesses feel confident in detecting and responding to cyberattacks in real time, though confidence is higher among 81% of C-suite leaders compared to 66% of front-line managers.

Key Insight Summary

- By solution, Threat Intelligence and Response led with 29.5%, highlighting the focus on proactive detection and rapid countermeasures against cyber threats.

- By security layer, Network Security dominated with 40.5% revenue share, reflecting the importance of safeguarding critical communication channels and data flows in defense systems.

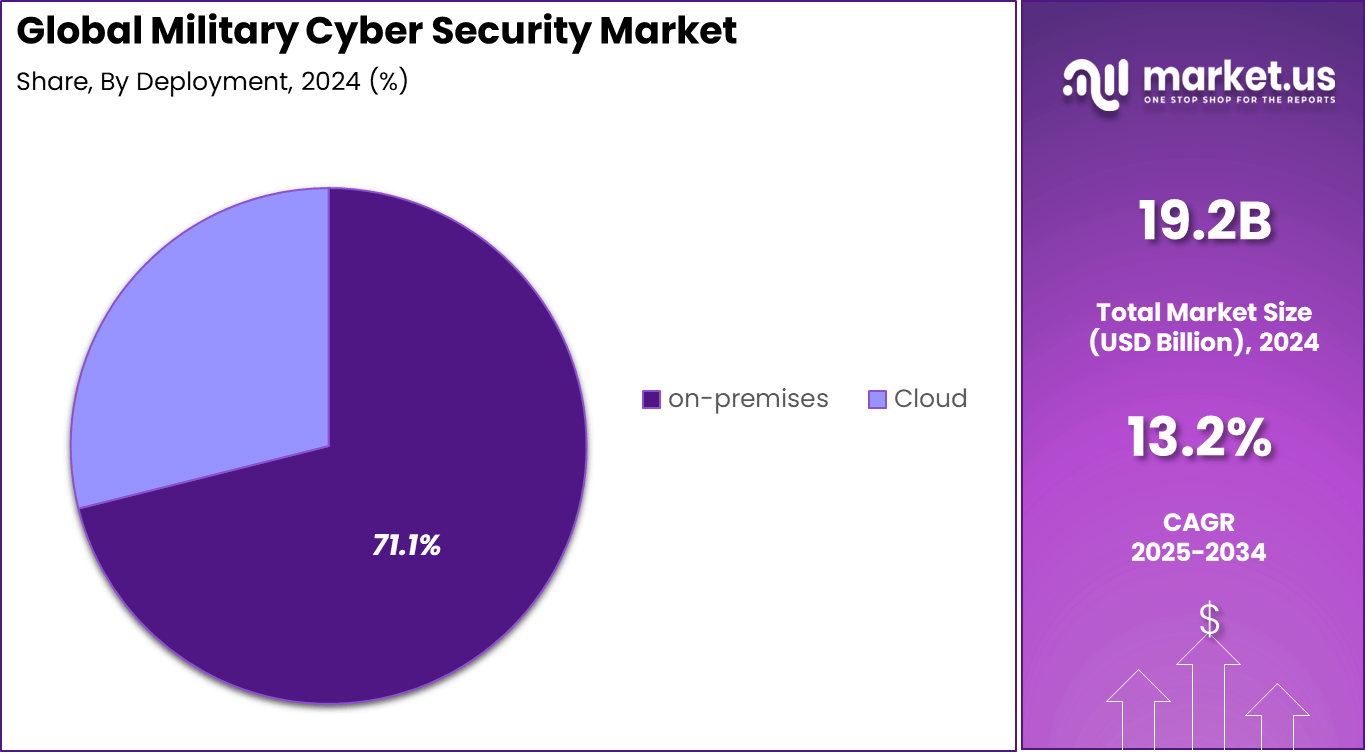

- By deployment, On-premises solutions accounted for 71.1%, showing the preference for in-house setups due to data sensitivity and high security requirements.

- By operation domain, Land Forces held the largest share at 43.2%, underscoring their reliance on cybersecurity to protect digital assets and tactical systems.

- By component, Software and Services contributed 61.3%, pointing to the growing demand for advanced platforms and managed security solutions.

- Regionally, North America commanded 46.1%, driven by strong defense budgets, advanced military infrastructure, and rising cybersecurity investments.

Role of Generative AI

Generative AI is transforming the way military organizations detect and respond to cyber threats. In 2025, about 44% of all organizations are now using generative AI specifically to identify and deter security intrusions, and 47% of defense professionals consider the growth of generative AI the biggest driver in the evolution of cybersecurity tactics.

Military teams rely on generative models for everything from intelligent decision support to AI-authored simulated attacks for training, with autonomous exploit generation systems appearing in close to 11 confirmed nation-state toolkits this year. As a result, generative AI today not only makes armies faster and more precise in their defenses but also poses new strategic risks as adversaries leverage similar technologies for attack and misinformation campaigns.

Analysts’ Viewpoint

Growing demand for military cyber security solutions is closely linked to increasing reliance on digital networks for battlefield operations, logistics, and mission communications. The use of cloud computing, big data, and connected command points has made cyber resilience a top priority. Demand has been especially prominent in regions undergoing defense modernization, as even a brief service disruption can cause strategic disadvantage during conflict.

Technology adoption is transforming the military cyber security landscape. Artificial intelligence now plays a central role in monitoring military networks, flagging anomalies, and mounting rapid responses to unauthorized intrusions. Automation, machine learning, and zero-trust network models are increasingly used for threat detection and response.

In 2024, automated incident response platforms reduced manual intervention requirements by over 40%, allowing faster mitigation across interconnected military assets. The need for these solutions is driven mainly by the sheer volume and complexity of cyber threats. With increasing attack frequency, real-time defense has become critical. Multilayered security utilizing AI and advanced analytics can detect novel threats that might evade traditional perimeter monitoring.

Investment and Business Benefits

Investment opportunities in this space are growing quickly, supported by expanding defense budgets and urgent national security mandates. More nations are channeling significant resources into defensive and offensive cyber capacity building. Initiatives focus on both building in-house cyber capabilities and integrating leading-edge technology from private industry.

As immersive simulation and cyber-wargaming training solutions are expanded, the share of digital security investment allocated to workforce upskilling grew by nearly 19% last year. The business benefits of adopting strong military cyber security protocols are substantial and measurable. Enhanced resilience reduces operational downtime, ensures mission continuity, and prevents costly breaches of sensitive information.

Military entities implementing advanced cyber defense frameworks reported an average of 60% lower incident remediation costs compared to those relying on legacy security in 2025. Data protection, operational assurance, and real-time intelligence integrity are now considered core enablers of defense mission success.

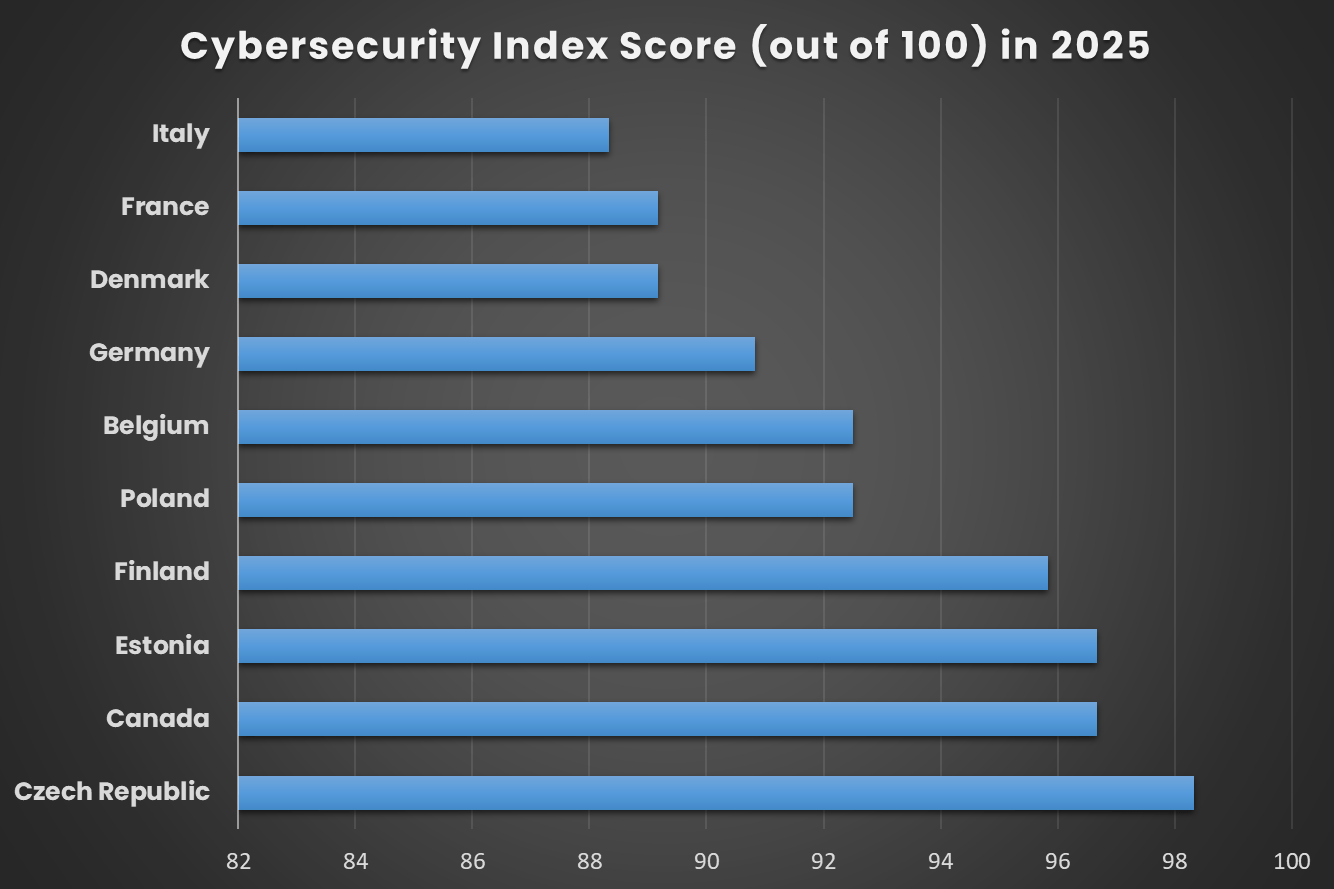

Globally, the regulatory landscape for military cyber security is becoming much more stringent. New frameworks, such as the Security Manual for Licensed Defence Industries (SMLDI 2025), have expanded the requirements for managing data, securing personnel, and verifying vendor compliance. Modern mandates now demand biometric access at sensitive locations and regular government-vetted reviews for security staff.

North America Market Outlook

North America commanded 46.1% of the market. The region benefits from strong defense budgets, advanced cybersecurity policies, and early adoption of military-grade digital protection systems. A focus on securing critical infrastructure and communication networks has made cybersecurity investments a central pillar of defense planning.

The dominance of North America also stems from the integration of emerging technologies. Artificial intelligence, cloud-backed defense systems, and advanced analytics are being deployed across military networks, strengthening the region’s cybersecurity posture and maintaining its leadership in global defense security.

By Solution

In 2024, The threat intelligence and response segment accounted for 29.5% of the market. This reflects the growing need among defense organizations to detect, analyze, and counter complex cyber threats in real time. Military networks are frequent targets of sophisticated attacks, which has pushed investment into intelligence-driven solutions that provide actionable insights and rapid remediation.

The segment’s strength also comes from its role in boosting preparedness. By collecting and analyzing threat data, militaries gain a clearer understanding of their adversaries’ strategies. This enhances overall resilience, allowing quicker decision-making and response in critical situations where information dominance is a decisive factor.

By Security Layer

In 2024, Network security led the market with 40.5% share in 2024. As military operations depend heavily on highly connected systems, safeguarding communication lines and data transmission has become the top priority. Securing networks ensures command, control, and communication channels remain uninterrupted even under hostile attempts.

Continuous upgrades in network monitoring, encryption, and intrusion prevention solutions have strengthened this area. The focus has shifted from merely building physical barriers around systems to establishing multi-layered defense mechanisms that adapt in real time to evolving cyber threats.

By Deployment

In 2024, On-premises solutions accounted for 71.1% of the deployment share. Defense agencies often prefer hosting critical cyber security systems internally to maintain full control of sensitive data and defense intelligence. This approach reduces dependency on external servers and minimizes exposure to third-party risks.

The dominance of on-premises deployment is also tied to compliance requirements. Military organizations operate under strict regulatory frameworks where retaining classified data within secured boundaries is non-negotiable. This keeps on-premises infrastructure as the cornerstone of defense cybersecurity architecture.

By Operation Domain

In 2024, Land forces captured 43.2% of the market share. The reliance of ground operations on digital systems, field communication tools, and battlefield management platforms has made cybersecurity a critical need for land-based missions. Protecting tactical information during active operations plays a vital role in mission success.

The segment’s growth is also influenced by the increasing digitization of land combat systems, from vehicles to surveillance assets. As land forces modernize their infrastructure with connected technologies, their exposure to cyber vulnerabilities rises, fueling higher security investment.

By Component

In 2024, Software and services collectively accounted for 61.3% of the share. These components address critical requirements such as authentication, access management, threat analytics, and incident response. The adaptability of software-driven solutions makes them suitable for rapidly evolving defense environments.

Services complement this by providing expertise, integration, and maintenance. With growing complexity in defense cyber systems, specialized service providers play a vital role in ensuring readiness and operational continuity. Together, software and services reinforce the backbone of military cyber resilience.

Emerging Trends

Emerging trends in military cyber security are defined by the shift toward real-time network analysis and AI-enabled response. Machine learning is now accelerating threat detection and helping defensive networks adapt 41% faster to new threats. In 2025, around 60% of military cyber operations teams already report deploying AI routinely for both offensive and defensive missions.

Automated tools using deep learning and natural language processing are also powering new waves of misinformation, with at least 14 documented influence campaigns traced back to AI-generated deepfakes this year. The transition to quantum-safe AI cyber defense is picking up pace in NATO-aligned countries, showing a proactive stance against next-generation cyber threats.

Growth Factors

Military cyber security growth is being powered by the convergence of advanced networked systems, rising digital sophistication, and increased reliance on cloud platforms within defense operations. Integration of artificial intelligence and automation is now cited as a core factor, helping these organizations respond more quickly and accurately to a rising flood of cyberattacks.

Geopolitical tensions and the push to digitize military infrastructure have led to a global expansion in cyber defense investment, with North America and Europe leading in technology adoption. AI-authored phishing attacks alone have achieved a click-through rate of 43% in military cyber-exercises, underlining the urgency for advanced threat intelligence and behavioral firewalls.

Key Market Segments

By Solution

- Threat Intelligence and Response

- Identity and Access Management

- Data Loss Prevention

- Security Information and Event Management

- Unified Threat Management

- Risk and Compliance Management

- Managed Security Services

- Others

By Security Layer

- Endpoint Security

- Network Security

- Cloud Security

- Application Security

By Deployment

- On-Premise

- Cloud

By Operation Domain

- Land Forces

- Air Forces

- Naval Forces

By Component

- Hardware Appliances

- Software and Services

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Cyber Threats Targeting Military Systems

The military cyber security market is primarily driven by the growing frequency and complexity of cyberattacks targeting defense systems worldwide. Military operations increasingly rely on digital infrastructure and interconnected networks, which makes them vulnerable to sophisticated cyber warfare tactics.

For instance, state-sponsored cyber intrusions have surged, with significant attacks reported on critical military assets over recent years. This escalation forces militaries to adopt advanced cybersecurity measures that can detect, deter, and respond to rapidly evolving threats, leading to increased investment and development in military-specific cybersecurity solutions.

The rising geopolitical tensions and digitization of defense frameworks intensify the need to safeguard sensitive military information and command systems, making cybersecurity a crucial priority. This driver is reinforced by the increasing use of AI and machine learning technologies to counter threats in real time, significantly advancing defense capabilities against cyber intrusions.

Restraint Analysis

High Costs of Cybersecurity Implementation

One significant restraint on the military cyber security market is the high cost associated with acquiring, installing, and maintaining advanced cybersecurity systems. Defense organizations face considerable financial pressure to protect increasingly complex digital infrastructure.

The investment needed goes beyond just procurement, involving costs for continuous upgrading, integrating new solutions with existing legacy systems, and training specialized personnel to operate these systems effectively. Smaller and developing nations, in particular, may find these costs prohibitive, limiting their ability to adopt state-of-the-art cybersecurity technologies.

This financial barrier can delay or restrict the implementation of necessary cybersecurity coverage in many military operations worldwide. For instance, the United States allocated USD 13.5 billion for cyberspace activities in 2024, which reflects the substantial financial commitment required

Opportunity Analysis

Growth in Defense Budgets

Global increases in defense budgets are creating fresh opportunities for the military cyber security market. Many countries are recognizing that investment in digital resilience is a critical part of their national defense strategy.

This trend is clear in both developed and emerging markets, where governments are allocating substantial funds to modernize their military infrastructure and equip their armed forces with better digital threat detection and response capabilities. As an instance, there has been notable investment in upgrading surveillance and communication networks in response to new security risks.

This surge in funding has opened the door for providers of advanced cyber solutions, especially those offering scalable, AI-driven systems that can be tailored for military needs. New contracts for network security and cloud-based threat intelligence are now more common, and military agencies are eager for innovative tools to secure everything from tactical networks to critical data hubs.

Challenge Analysis

Skills Shortage and Cost Pressure

One of the biggest restraints in the military cyber security market is the ongoing shortage of skilled cybersecurity professionals and the high cost of adopting advanced technologies. Implementing cybersecurity solutions in the defense sector can be prohibitively expensive, especially as systems become more sophisticated and require specialized knowledge to manage and maintain.

The financial strain is even more pronounced when legacy military networks must be upgraded or integrated with modern cyber defense systems. For example, smaller and developing nations often struggle to dedicate enough resources to both recruit top talent and invest in state-of-the-art technologies.

Skilled personnel are in short supply worldwide, causing plans for new security rollouts to be delayed or limited in scope. In effect, this slows down the pace at which some defense organizations can respond to new threats, since even well-funded militaries face a real challenge in keeping up with evolving cyberattack strategies and maintaining up-to-date defenses.

Competitive Analysis

The Military Cybersecurity Market is primarily driven by leading defense contractors such as Lockheed Martin Corporation and Northrop Grumman Corporation. These firms provide advanced cyber defense solutions tailored for military applications, including secure communication networks, cyber threat intelligence, and real-time defense systems.

BAE Systems plc and RTX Corporation (formerly Raytheon Technologies) are also key contributors, offering cyber tools that support electronic warfare, data protection, and secure cloud operations for armed forces. These companies develop both offensive and defensive cyber capabilities, aligning with evolving military doctrines and threat landscapes.

Thales Group plays a central role in securing defense communications and battlefield data systems through encryption, secure satellite links, and tactical network protection. A growing number of other key players support national defense agencies with specialized cyber risk management, simulation environments, and AI-powered threat monitoring tools. These partnerships strengthen the layered security framework required in modern digital warfare.

Top Key Players in the Market

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- RTX Corporation

- Thales Group Source

- Others

Recent Developments

- In May 2025, Lockheed Martin intensified its focus on AI and machine learning to transform military cybersecurity operations. Its Artificial Intelligence Center is driving real-time threat detection and cloud transformation solutions that enhance situational awareness and rapid response to cyber threats.

- In February 2025, Northrop Grumman announced the planned acquisition of its Mission Training and Satellite Ground Network Communications (MT&S) software business by Serco for $327 million, expected to close mid-2025. This move expands Serco’s capabilities in U.S. defense, providing advanced mission training services and software that enhance satellite ground network efficiency.

Report Scope

Report Features Description Market Value (2024) USD 19.2 Bn Forecast Revenue (2034) USD 66.3 Bn CAGR(2025-2034) 13.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Threat Intelligence and Response, Identity and Access Management, Data Loss Prevention, Security Information and Event Management, Unified Threat Management, Risk and Compliance Management, Managed Security Services, Others), By Security Layer (Endpoint Security, Network Security, Cloud Security, Application Security), By Deployment (On-Premise, Cloud), By Operation Domain (Land Forces, Air Forces, Naval Forces), By Component (Hardware Appliances, Software and Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lockheed Martin Corporation, Northrop Grumman Corporation, BAE Systems plc, RTX Corporation, Thales Group Source and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Military Cyber Security MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Military Cyber Security MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- RTX Corporation

- Thales Group Source

- Others