Global Military Communication Market Size, Share, Industry Analysis Report By Platform (Land, Naval, Airborne, Unmanned), By Application (Command & Control, Intelligence, Surveillance, and Reconnaissance (ISR), Routine Operations, Combat), By System (Military Satcom System, Military Radio System, Military Security System, Communication Management System), By Point of Sale (New Installation, Upgrade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 156827

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- Role of Generative AI

- Emerging Trends

- U.S. Market Size

- Platform Analysis

- Application Analysis

- System Analysis

- Point of Sale Analysis

- Growth Factors

- Top Use Cases

- Key Market Segments

- By Application

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

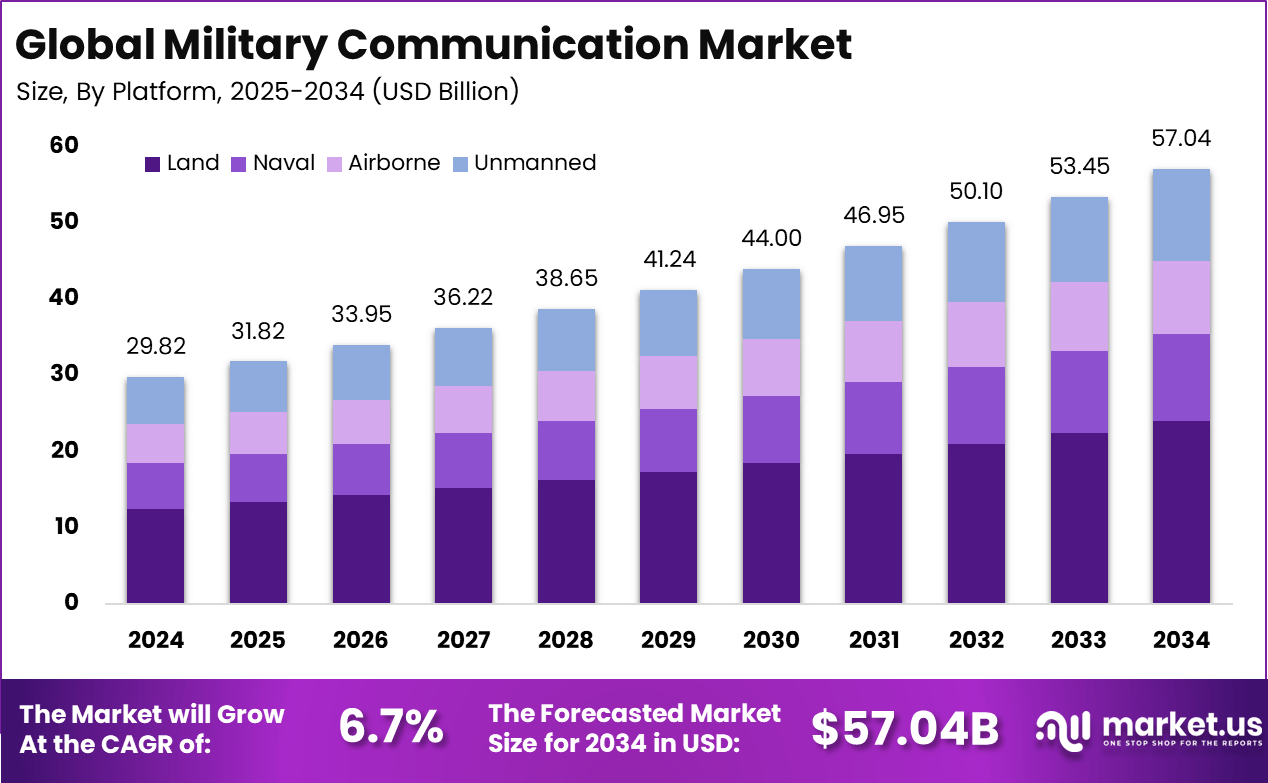

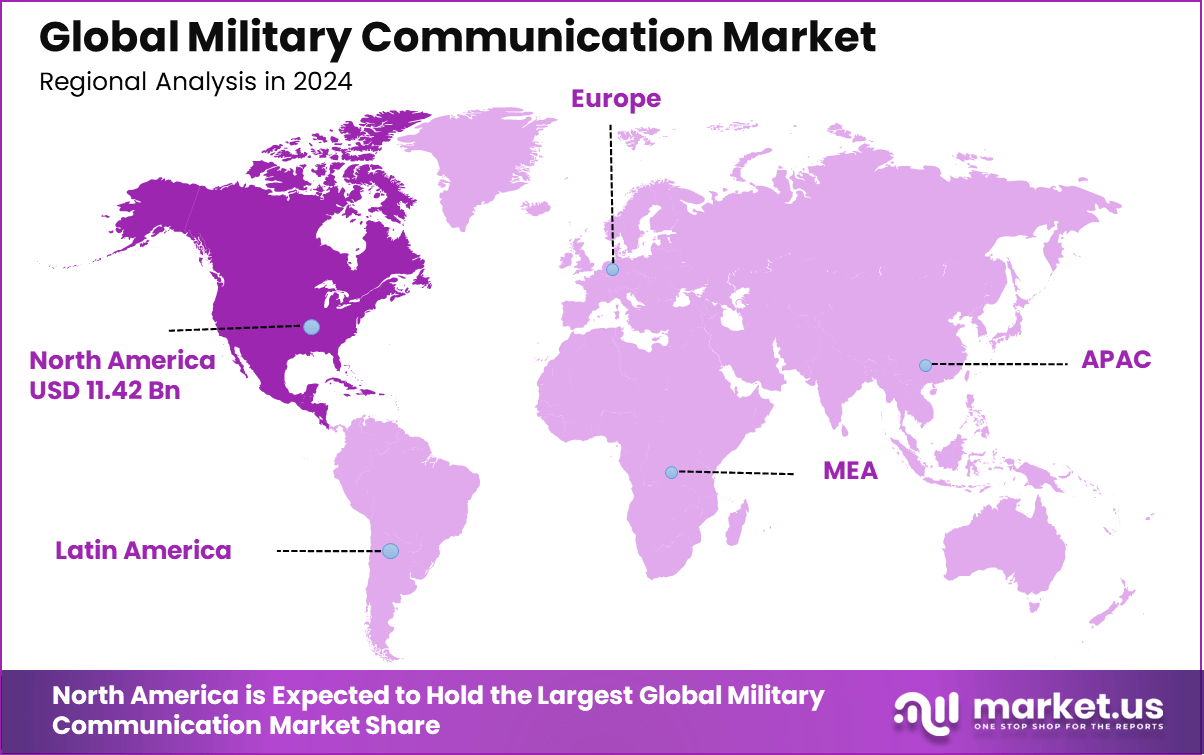

The Global Military Communication Market size is expected to be worth around USD 57.04 billion by 2034, from USD 29.82 billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.3% share, holding USD 11.42 billion in revenue.

The Military Communication Market is focused on systems and technologies that enable secure and reliable communication among military forces. These systems include satellite communication (SATCOM), radio communication, encryption security, and communication management systems adapted for land, naval, air, and unmanned platforms.

The market is driven by the need for real-time data exchange, improved situational awareness, and seamless coordination within and between armed forces, especially in complex and dynamic operational environments. Communication solutions are vital for transmitting intelligence, sensor data, and tactical information efficiently to support decision-making and combat operations

One of the top driving factors for the market is the rapid advancement and adoption of new technologies such as 5G networks, software-defined radios (SDRs), artificial intelligence (AI), and the Internet of Things (IoT). These innovations enhance data transmission speed, bandwidth capacity, encryption security, and interoperability among various military communication platforms.

The increasing geopolitical tensions and rising defense budgets globally also play a critical role in fueling demand for enhanced military communication capabilities. Furthermore, the growing need to safeguard military communication infrastructure against cyber threats is pushing militaries to invest in robust encryption methods including quantum cryptography

For instance, in May 2025, SES announced a demonstration of its new satellite orchestration technology for military communications, designed to enhance resiliency, flexibility, and efficiency across multi-orbit networks. The system enables seamless switching between GEO, MEO, and LEO satellites, ensuring uninterrupted connectivity in contested or degraded environments.

Key Takeaway

- In 2024, the Land segment led the Global Military Communication Market with a 42% share.

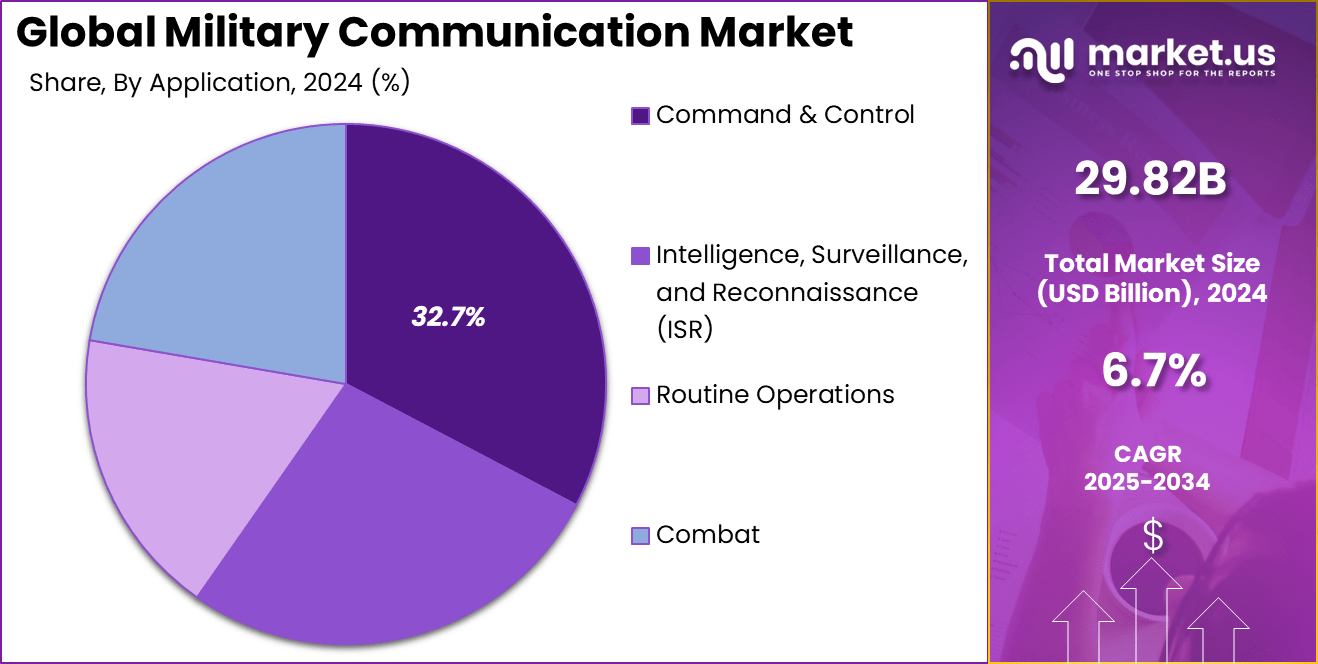

- The Command & Control segment dominated by application, securing 32.7% share.

- The Military Satcom System was the top system type, contributing 34.3% share.

- The New Installation segment held the leading position, capturing 58.2% share in 2024.

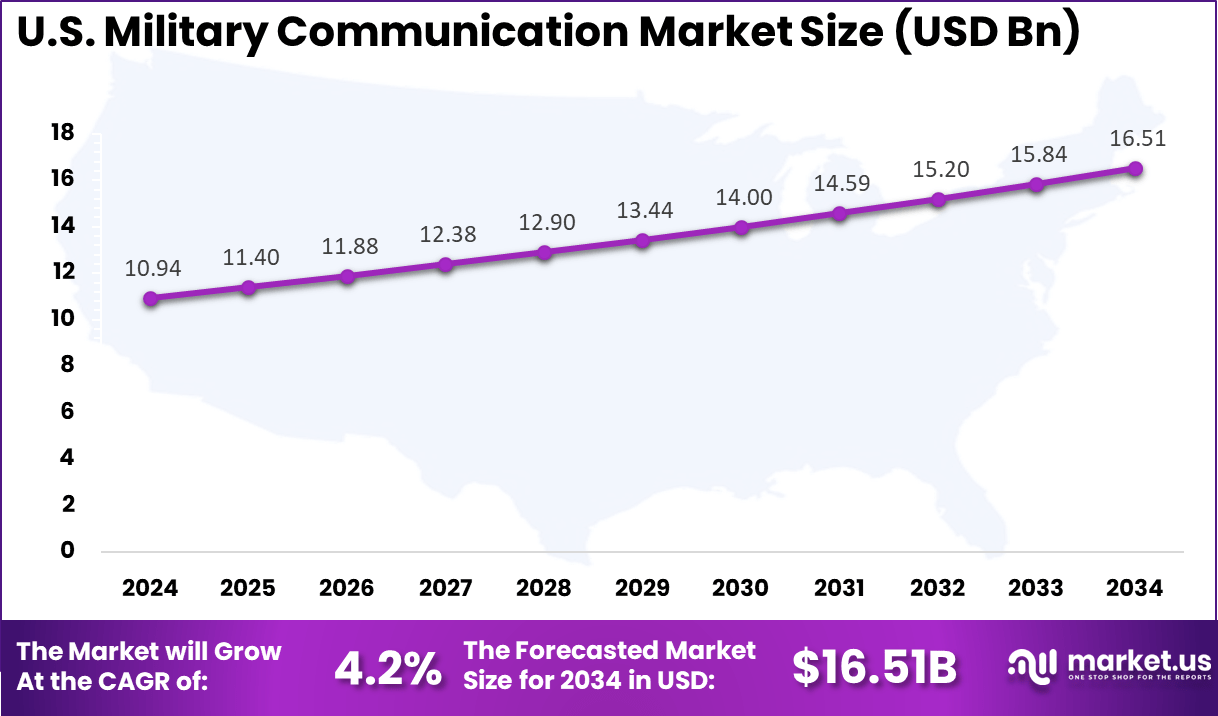

- The U.S. Military Communication Market reached USD 10.94 Billion in 2024, expanding at a 4.2% CAGR.

- North America was the top regional market, accounting for 38.3% share of global revenues in 2024.

Analysts’ Viewpoint

Investment opportunities in the military communication market arise from ongoing modernization programs which focus on upgrading aging communication infrastructure and integrating next-generation technologies. There is increasing interest in space-based communication assets such as low-earth orbit (LEO) satellite constellations that promise faster and more secure connectivity.

Defense digitalization initiatives and joint command systems aimed at interoperable communication among allied forces present further areas for investment. However, high capital costs and the complexity of integrating new technologies with legacy systems present challenges, offering opportunities for specialized technology providers and innovation.

The business benefits of investing in military communications lie primarily in enabling armed forces to maintain operational superiority and resilience. Advanced communication systems reduce reaction time, support multi-domain coordination, and improve intelligence sharing. They also contribute to force protection and mission success by providing secure, encrypted channels that defend against interception and jamming.

The regulatory environment governing military communication is complex, with national and international laws addressing encryption standards, spectrum allocation, and cross-border data-sharing. Compliance with these regulations is crucial since they influence system design, deployment timetables, and operational use. Governments must balance technological innovation with security policies and budgetary constraints.

Role of Generative AI

Key Points Description Enhancing Decision Support Generative AI aids in intelligent decision-making systems, reducing cognitive load on operators and enabling faster, more accurate battlefield decisions. Battlefield Simulations It creates realistic training environments and scenarios, helping soldiers prepare for diverse combat situations. Predictive Analytics AI generates predictive models for operational planning, threat detection, and risk mitigation in complex environments. Autonomous Systems Support Supports autonomous drones and weapons for target recognition, casualty care, and mission execution with ethical guidelines. Strategic and Ethical Integration AI influences military policy and strategy formulation, balancing technological advances with ethical and legal considerations. Emerging Trends

Key Trends Description Integration of AI and Machine Learning AI and ML enhance data analysis, automate protocols, and improve communication reliability and security in dynamic environments. Development of Quantum Communication Quantum key distribution offers next-level secure communications, preventing interception and eavesdropping. Expansion of Satellite Networks Use of low Earth orbit (LEO) satellites increases coverage and connectivity in frontline and remote operations. Adoption of 5G Technology 5G improves data rates, low latency, and real-time information sharing for enhanced situational awareness. Software-Defined Radios (SDRs) SDRs provide communication flexibility, interoperability, and adaptability across various frequencies and protocols. U.S. Market Size

The market for Military Communication within the U.S. is growing tremendously and is currently valued at USD 10.94 billion, the market has a projected CAGR of 4.2%. The market is growing due to increased defense spending, a focus on modernizing C4ISR capabilities, and the strategic shift toward multi-domain operations.

The U.S. Department of Defense is investing heavily in advanced communication technologies, including satellite systems, AI-driven networks, and secure mobile platforms, to enhance operational readiness. Heightened cyber threats and the need for interoperability across allied forces further drive demand, positioning the U.S. as a global leader.

For instance, in March 2025, the U.S. Army awarded Ultra Intelligence & Communications (Ultra I&C) an $87 million contract to deliver advanced communication systems supporting defense operations in Guam. The project focuses on providing secure, resilient, and long-range communication capabilities critical for strategic readiness in the Indo-Pacific.

In 2024, North America held a dominant market position in the Global Military Communication Market, capturing more than a 38.3% share, holding USD 11.42 billion in revenue. Due to its substantial defense budget, early adoption of advanced technologies, and robust defense infrastructure.

The United States, in particular, led in deploying next-generation communication systems, including AI-enhanced networks, secure SATCOM, and integrated C4ISR platforms. Strategic initiatives aimed at enhancing multi-domain operations and cyber resilience, combined with strong collaboration between defense agencies and private sector innovators, further solidified the region’s leadership in military communication capabilities.

For instance, in August 2025, SpaceX enhanced its Starshield satellite communication system, reinforcing North America in military communication technologies. Starshield integrates laser inter-satellite links, advanced encryption, and AI-driven network optimization, delivering faster, safer, and more efficient connectivity for defense operations.

Platform Analysis

The land platform segment accounted for 42.0% of the military communication market in 2024, making it the largest platform category. This dominance reflects the extensive need for secure and reliable communications in ground combat operations, where coordination between troops, commanders, and support units is critical.

On land, military communication systems enable effective battlefield management, real-time situational awareness, and seamless command control, which are vital for executing complex tactical maneuvers. Land forces employ various tactical radios, satellite communication terminals, and networked communication devices to maintain connectivity under challenging environments.

Increasing investment in modernizing army communication infrastructure drives the growth in this segment. Governments prioritize upgrading legacy systems with advanced, secure, and interoperable platforms capable of supporting data, voice, and video communications. The rising use of unmanned ground vehicles (UGVs) and integration with AI-based systems further augment communication needs in this domain, improving operational efficiency and battlefield safety

For Instance, in March 2024, Orbit Communication Systems unveiled its new range of multi-purpose SATCOM terminals specifically designed for armoured vehicles, strengthening land-based military communication capabilities. These terminals provide high-capacity, secure, and resilient connectivity for mobile battlefield operations, even in GPS-denied or contested environments.

Application Analysis

The command and control application held a 32.7% share in the military communication market in 2024, highlighting its critical role in defense operations. Command and control systems are essential for planning, directing, and monitoring military activities across all domains. They facilitate efficient communication between commanders and units, enabling rapid decision-making and coordinated responses on the battlefield.

The integration of AI and machine learning enhances these systems by automating threat detection, improving situational analysis, and supporting real-time strategic adjustments. Growing military spending and modernization programs across key countries are primary factors boosting demand for advanced command and control solutions.

Additionally, the evolving nature of warfare involving cyber threats, unmanned systems, and network-centric operations increases reliance on secure, integrated communication systems that provide reliable command oversight and operational continuity in diverse combat scenarios

For instance, in August 2025, Boeing introduced an advanced satellite communication (SATCOM) solution designed to support strategic communications and nuclear command and control for the U.S. military. The system provides secure, resilient, and jam-resistant connectivity, ensuring reliable communication in highly contested environments.

System Analysis

The military satellite communication (Satcom) system segment dominated with a 34.3% market share in 2024. Satcom systems are vital for establishing secure, long-distance communication links in military operations, especially in environments where terrestrial communication infrastructure is unavailable or compromised.

Military Satcom enables command and control, intelligence sharing, logistics, and real-time data transmission essential for situational awareness and mission success. Modern military Satcom systems employ advanced encryption and multi-orbit capabilities to ensure secure and uninterrupted communication even in contested regions.

Continuous innovation in satellite technology, including the deployment of wideband and multi-waveform SATCOM terminals, supports the growing needs of modern warfare. Investments by key defense agencies are fueling the adoption of next-generation Satcom solutions to enhance global communication coverage and resilience.

For Instance, in June 2025, Thales announced that it would supply Airbus Defence and Space with its latest SafeSat SATCOM solution for integration into the A400M military transport aircraft. This system provides secure, high-bandwidth, and globally available communications, enabling crews to maintain reliable connectivity in both routine operations and contested environments.

Point of Sale Analysis

In terms of point of sale, the new installation segment accounted for 58.2% of the market in 2024, indicating a strong focus on deploying new communication infrastructure rather than upgrading existing systems. This trend is driven by expanding defense budgets and the modernization of military communication networks worldwide. Many countries are investing in the initial installation of advanced communication systems to replace legacy technologies and increase operational capabilities.

The priority on new installations reflects the military’s strategic emphasis on establishing cutting-edge networks that support emerging technologies such as AI, unmanned systems, and cyber defense. These installations provide robust, scalable, and interoperable communication frameworks designed to meet future operational demands and geopolitical security challenges, ensuring military forces maintain superior situational awareness and coordination.

For Instance, in January 2025, South Korea launched a new program to develop and deploy an Army Mobile Ad Hoc Network (MANET), marking a significant step in new installations of advanced military communication systems. The initiative focuses on creating self-forming, self-healing networks that provide secure, high-speed, and resilient connectivity for troops in dynamic battlefield environments.

Growth Factors

Key Factors Description Rising Defense Budgets Increased military spending enables investment in advanced communication infrastructure and technologies. Geopolitical Tensions Escalating conflicts drive the demand for secure, real-time communication to improve operational effectiveness. Technological Advances Innovations like AI, 5G, quantum cryptography, and SDRs boost capabilities and market demand. Demand for Interoperability Need for seamless communication among military branches and allied forces promotes standardization adoption. Cybersecurity Needs Growing cyber threats require advanced encryption and AI-powered cyber defense in communication networks. Top Use Cases

Key Points Description Secure Command and Control Reliable, encrypted communication for leadership to coordinate battlefield operations and strategies. Real-Time Situational Awareness Transmission of live intelligence, sensor data, and surveillance feeds to frontline units. Autonomous System Coordination Communication networks enable synchronized operation of unmanned vehicles and robotic systems. Electronic Warfare and Signal Intelligence Support for jamming, interception, and countermeasures against enemy communication. Training and Simulation Virtual battlefield environments enable realistic combat training through AI-powered simulations. Key Market Segments

By Platform

- Land

- Command & Control/Ground Station

- Armored Vehicle

- Combat Vehicles

- Combat Support Vehicles

- Soldiers

- Naval

- Ships

- Destroyers

- Frigates

- Corvettes

- Amphibious Vessels

- Survey Vessels

- Patrol & Mine Countermeasure Vessels

- Offshore Support Vessels (OSVs)

- Others

- Airborne

- Fixed Wing

- Fighter Aircraft

- Transport Aircraft

- Special Mission Aircraft

- Rotary Wing

- Attack Helicopters

- Maritime Helicopters

- Multi-Role Helicopters

- Unmanned

- Unmanned Aerial Vehicles (UAVs)

- Unmanned Ground Vehicles (UGVs)

- Unmanned Underwater Vehicles (UUVs)

By Application

- Command & Control

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Routine Operations

- Combat

By System

- Military Satcom System

- Military Radio System

- Military Security System

- Communication Management System

By Point of Sale

- New Installation

- Upgrade

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Technological Advancements in Encryption and Cybersecurity

As military communication systems become increasingly digital and interconnected, robust cybersecurity measures have become critical. Advanced encryption techniques and AI-driven threat detection are now integral to securing sensitive battlefield data and preventing unauthorized access.

These technologies ensure the confidentiality, integrity, and availability of communication networks, especially during multi-domain operations. As cyber threats grow in sophistication, militaries are prioritizing investments in resilient, adaptive cybersecurity frameworks to safeguard mission-critical communications and maintain strategic advantage.

For instance, in February 2025, Synergy Quantum and MP3 International Edge Group signed a landmark agreement to advance military cybersecurity and quantum technologies in the Gulf Cooperation Council (GCC) region. The collaboration aims to integrate quantum encryption, AI-driven threat detection, and advanced cybersecurity frameworks into defense communication infrastructures.

Restraint

High Costs of Advanced Communication Infrastructure

The deployment of cutting-edge military communication systems entails significant capital expenditure, spanning procurement, integration, and lifecycle maintenance. For many nations, particularly those with constrained defense budgets, these costs limit the scale and speed of adoption.

Complex technologies like SATCOM, SDR, and secure mesh networks require high upfront investments and specialized personnel, making it challenging for emerging economies or non-priority defense segments to justify or sustain such modernization efforts.

For instance, in November 2024, IIT Indore unveiled intelligent receivers designed to enhance 6G connectivity and military communication security, marking a breakthrough in secure, high-speed data transmission. While these innovations promise superior performance in encryption, resilience, and spectrum efficiency, they also highlight the high costs associated with advanced military communication infrastructure.

Opportunities

Adoption of AI and Machine Learning in Communication Systems

Artificial Intelligence (AI) and Machine Learning (ML) are redefining the dynamics of military communications. By enabling automated data analysis, threat detection, and real-time prioritization, AI enhances command decision-making and battlefield awareness.

These technologies reduce latency, improve situational intelligence, and support dynamic mission planning, particularly in complex, multi-domain operations. Their integration offers defense forces a transformative edge in achieving faster, more efficient, and adaptive communication networks in high-stakes combat environments.

For instance, in July 2025, One Meta Inc. announced a collaboration with the United States Armed Forces to advance next-generation military communication and training solutions. The partnership focuses on leveraging One Meta’s expertise in extended reality (XR), AI-driven simulation, and immersive communication platforms to enhance defense readiness.

Challenges

Interoperability Issues among Military Communication Systems

Interoperability among different military communication systems and units poses a major challenge in the market. Military forces often use a variety of communication devices, platforms, and protocols that can be difficult to integrate seamlessly. This can hinder effective communication and coordination during joint operations involving multiple branches of the military or allied forces.

Ensuring that diverse communication systems work together securely and reliably requires extensive standardization efforts, updated protocols, and continuous technological upgrades. The lack of interoperability not only affects operational efficiency but also compromises real-time data sharing and decision-making.

Key Players Analysis

In the military communication market, large defense contractors play a central role in shaping advanced technologies and securing global contracts. BAE Systems, Northrop Grumman, RTX Corporation, and General Dynamics are recognized for their strong expertise in secure tactical networks, satellite communications, and electronic warfare systems.

Lockheed Martin and L3Harris Technologies also remain key due to their long-standing defense partnerships and continuous focus on modernizing battlefield connectivity. Their sustained investments and proven defense programs provide them with a dominant influence on market direction and adoption.

European and Israeli firms also strengthen the global landscape. Thales Group, Leonardo, Elbit Systems, and Israel Aerospace Industries provide advanced command-and-control systems, encrypted radios, and satellite-based solutions. ASELSAN from Turkey and Viasat from the United States contribute with reliable secure communication platforms, particularly in satellite and airborne networks.

Rohde & Schwarz and Saab AB enhance the technological scope by supplying software-defined radios and surveillance systems, creating a competitive environment for cross-border defense collaborations. Other significant contributors include Airbus, Curtiss-Wright, Frequentis, and Honeywell International, each offering specialized communication and avionics solutions.

Top Key Players in the Market

- BAE Systems plc

- Northrop Grumman Corporation

- RTX Corporation

- General Dynamics Corporation

- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Thales Group

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- ASELSAN A.Ş.

- Viasat Inc.

- Rohde & Schwarz USA, Inc.

- Saab AB

- Airbus SE

- Curtiss-Wright Corporation

- Frequentis AG

- Honeywell International Inc.

- Other Key Players

Recent Developments

- In August 2025, SpaceX announced significant enhancements to its Starshield platform, an evolution of Starlink tailored specifically for military and government use. The upgraded system promises faster, more secure, and more efficient satellite-based communication for defense operations.

- In February 2025, June 2025, BAE Systems signed a Memorandum of Understanding (MoU) with South Korea’s Hanwha Systems to co-develop a multi-sensor satellite system.

Report Scope

Report Features Description Market Value (2024) USD 29.82 Bn Forecast Revenue (2034) USD 57.04 Bn CAGR(2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Land, Naval, Airborne, Unmanned), By Application (Command & Control, Intelligence, Surveillance, and Reconnaissance (ISR), Routine Operations, Combat), By System (Military Satcom System, Military Radio System, Military Security System, Communication Management System), By Point of Sale (New Installation, Upgrade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BAE Systems plc, Northrop Grumman Corporation, RTX Corporation, General Dynamics Corporation, Lockheed Martin Corporation, L3Harris Technologies, Inc., Thales Group, Leonardo S.p.A., Elbit Systems Ltd., Israel Aerospace Industries Ltd., ASELSAN A.Ş., Viasat Inc., Rohde & Schwarz USA, Inc., Saab AB, Airbus SE, Curtiss-Wright Corporation, Frequentis AG, Honeywell International Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Military Communication MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Military Communication MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-