Global Military Cloud Computing Market Size, Share and Analysis Report By Deployment Model (Private Cloud, Public Cloud (GovCloud / Sovereign Cloud), Hybrid Cloud, Community Cloud (Multi-Nation), By Service Model (Infrastructure as a Service, Platform as a Service, Software as a Service), By Application (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance, Cybersecurity & Cyber Warfare, Logistics & Supply Chain Management, Health IT & Personnel Management, Training & Simulation, Others), By End-User (Army, Navy, Air Force, Space Force, Defense Agencies & Joint Commands, Others), By Security Classification (Unclassified / Official Use Only, Sensitive but Unclassified, Classified (Secret, Top Secret), Multi-Level Security), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173420

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Military Cloud Computing Insights

- Key Insights Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Demand Analysis

- Increasing Adoption Technologies

- By Deployment Model

- By Service Model

- By Application

- By End User

- By Security Classification

- By Region

- Investment Opportunities

- Business Benefits

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

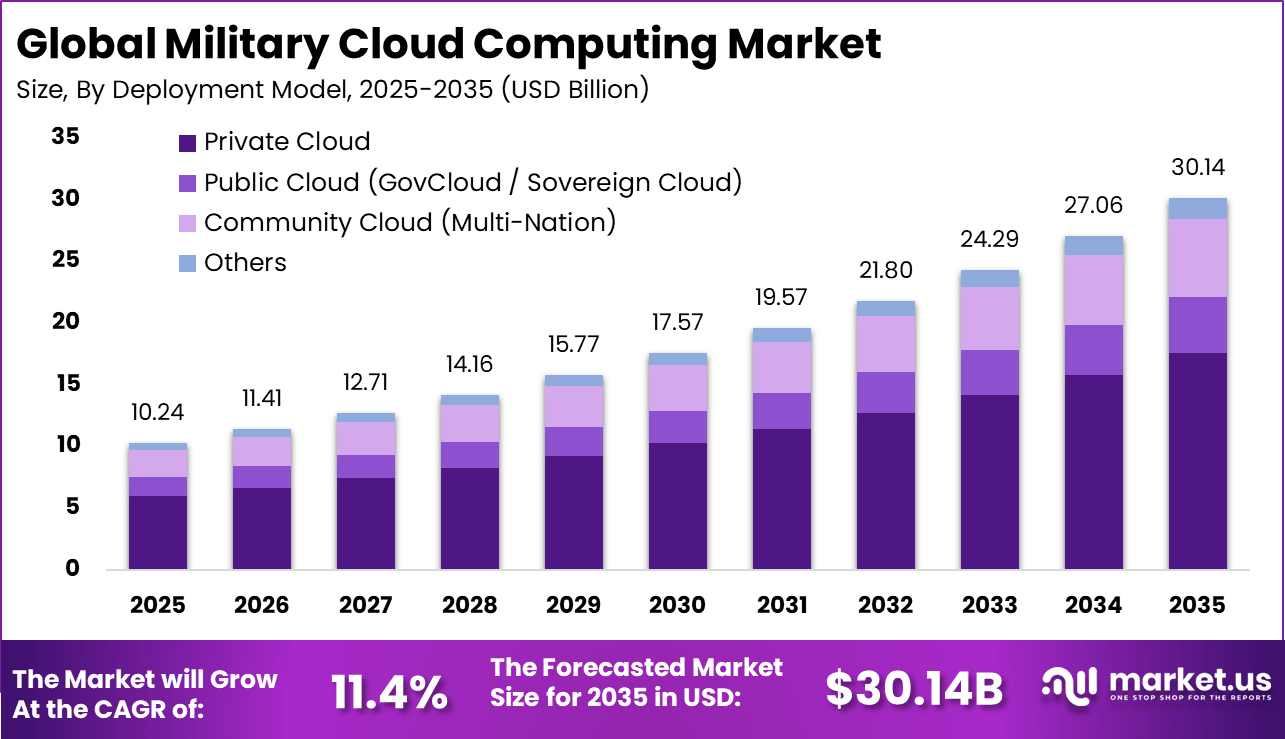

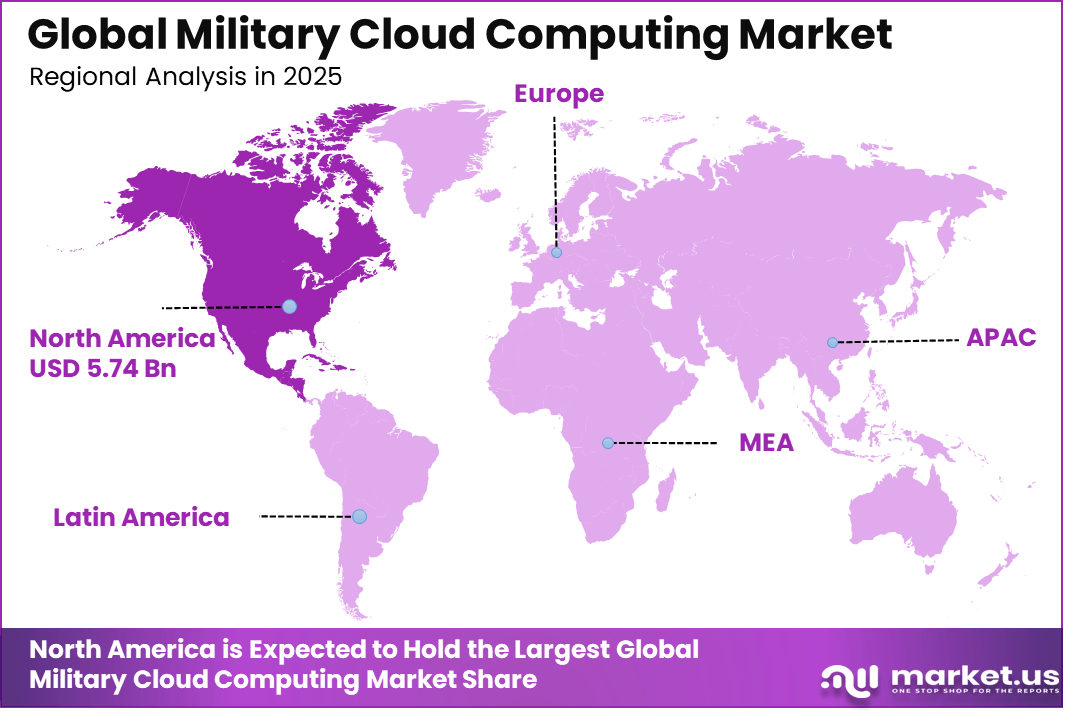

The Global Military Cloud Computing Market size is expected to be worth around USD 30.14 billion by 2035, from USD 10.24 billion in 2025, growing at a CAGR of 11.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 56.15% share, holding USD 5.74 billion in revenue.

The military cloud computing market refers to cloud based technologies and services designed to support defense operations, secure data storage, command and control systems, and mission critical applications. These solutions include infrastructure as a service, platform as a service, and software as a service that enable scalable, secure computing for defense agencies. They support real time data sharing, simulation, logistics planning, and intelligence analysis across distributed forces.

Adoption is driven by the need for resilient architectures that can handle large volumes of sensitive data with high availability. Growth in this market has been influenced by modernization efforts within armed forces to improve operational agility and reduce reliance on legacy systems. Cloud computing enables faster deployment of new applications and supports joint operations by connecting disparate systems.

For instance, in November 2025, Hewlett Packard Enterprise Company landed a $931 million DISA contract for GreenLake Private Cloud, delivering hybrid multi-cloud across DoD data centers with zero-trust security. A 10-year follow-on underscores HPE’s on-prem edge strength.

Key Military Cloud Computing Insights

- The Private Cloud deployment model led adoption with a 58.3% share. This dominance reflects strong requirements for data sovereignty, mission control, and secure network isolation across defense operations.

- Infrastructure as a Service emerged as the primary service model, capturing 52.7% of usage. This trend highlights demand for flexible computing power that can scale rapidly during missions, training simulations, and intelligence processing.

- C4ISR applications held a leading 41.8% share. Cloud platforms were widely used to support real-time intelligence analysis, secure communications, and coordinated command decision-making.

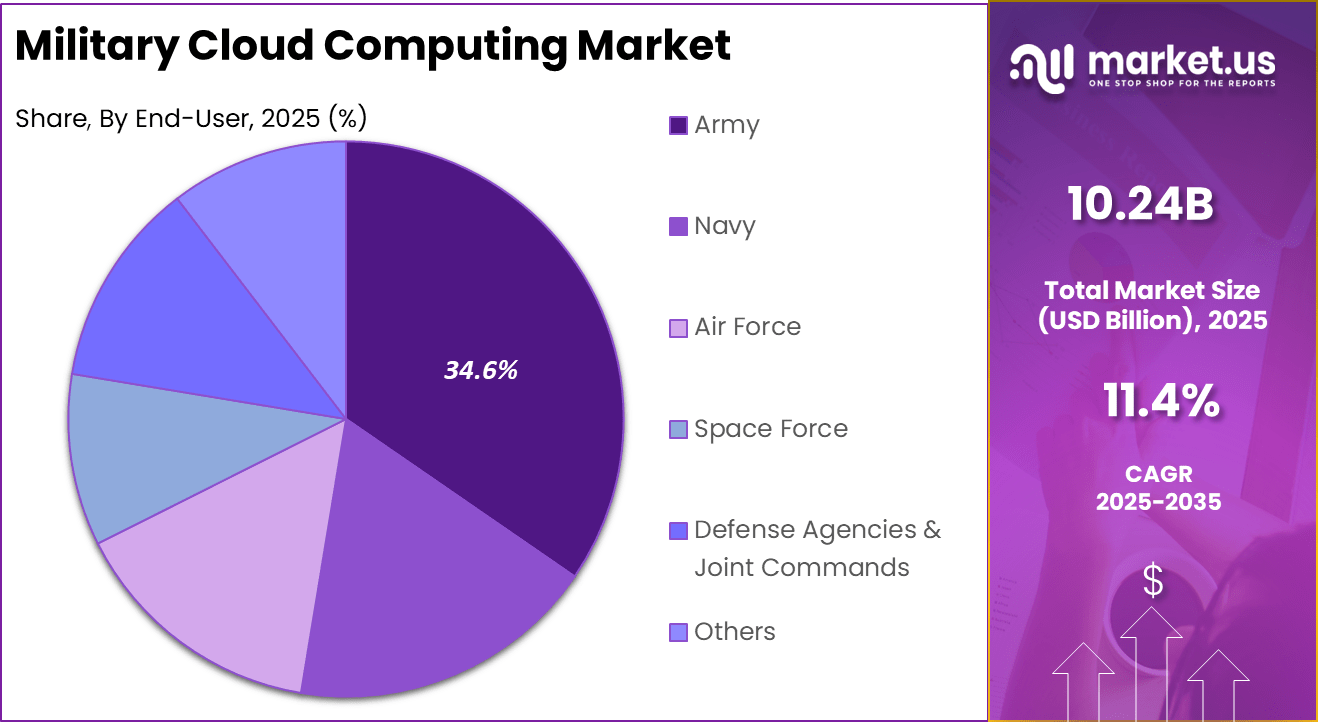

- The Army represented the largest end-user group with a 34.6% share. This leadership was driven by extensive ground operations, logistics coordination, and continuous modernization programs.

- Classified workloads accounted for 48.9% of deployments. This indicates that cloud systems are increasingly trusted for handling sensitive and high-security defense data.

- North America remained the dominant region with a 56.15% share. This position was supported by advanced defense digitization, early cloud adoption, and strong integration of secure computing architectures within military operations.

Key Insights Summary

Adoption and Transformation Insights

- Defense organizations accelerated cloud adoption to support digital battlefield operations, secure data sharing, and faster decision cycles. This transition was driven by mission modernization mandates rather than voluntary IT upgrades.

- By late 2025, around 94% of general enterprises had adopted cloud workloads, while defense adoption increased rapidly through formal migration programs. This narrowed the digital gap between civilian and military cloud maturity.

- System readiness improved steadily, with 50% of non service specific defense systems targeted to become cloud ready by the end of 2025. This milestone reflected structured progress in legacy system modernization.

- Application migration advanced at scale, as 923 systems across 14 defense agencies were scheduled for optimized cloud hosting by the end of the fiscal year. This shift supported interoperability and centralized data governance.

- Long term digital commitment remained strong, supported by an expected growth pace of 10.52%, indicating sustained investment in secure and resilient cloud architectures.

Usage and Spending Patterns

- Military cloud usage was marked by high concentration of spending on multi platform environments designed for redundancy and operational continuity. These investments focused on compute, storage, and secure networking layers.

- Cumulative cloud service orders exceeded USD 3.9 billion by late 2025, reflecting rapid onboarding by air and ground forces. This spending trend highlighted rising operational dependence on cloud infrastructure.

- Infrastructure as a Service remained the dominant consumption model, projected to represent 76.34% of total usage over time. Its role as the foundation for mission systems and analytics reinforced its strategic importance.

- Hybrid cloud deployments emerged as the preferred architecture, expected to account for 68.34% of adoption as they balance classified data control with scalable external resources.

- The Army continued to be the largest cloud user, representing over 48.56% of total usage. This dominance was linked to extensive logistics networks and command and control workloads.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Defense IT modernization Migration from legacy systems to secure cloud platforms ~3.1% North America, Europe Short to Mid Term Demand for real time intelligence Need for faster data processing in operations ~2.6% North America Short Term Growth in joint force operations Interoperable data sharing across military branches ~2.2% Global Mid Term Rising cybersecurity requirements Secure data storage and access control ~1.9% Global Long Term AI enabled defense analytics Cloud based AI for threat detection ~1.6% North America, Asia Pacific Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Cyberattack threats Targeted attacks on military cloud infrastructure ~2.8% Global Short Term Data sovereignty constraints Restrictions on data hosting locations ~2.1% Europe, Asia Pacific Mid Term Vendor concentration Dependence on limited defense certified providers ~1.8% Global Long Term System integration complexity Legacy defense system compatibility issues ~1.4% Global Mid Term Budget allocation uncertainty Shifts in defense spending priorities ~1.1% Global Short Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Strict compliance requirements Lengthy certification and approval cycles ~2.9% Global Short to Mid Term High deployment cost Secure infrastructure investment needs ~2.3% Emerging Markets Mid Term Limited cloud readiness Skill gaps within military IT teams ~1.9% Global Mid Term Latency concerns Real time battlefield processing needs ~1.5% Global Long Term Interoperability challenges Integration across defense platforms ~1.2% Global Mid Term Demand Analysis

Demand for military cloud computing is shaped by defense digital transformation programs that seek to modernize information technology infrastructures. Governments and defense agencies allocate budgets to replace aging systems with agile, cloud enabled platforms. These investments support interoperability, rapid deployment of capabilities, and reduced hardware dependencies. As digital technologies evolve, militaries prioritize cloud solutions that support future operational concepts.

Demand is also influenced by multi domain operations that require coordination across land, sea, air, space, and cyber environments. Cloud computing provides a common data layer that supports integrated planning and execution. This unified infrastructure enhances cross domain communication and reduces latency in information exchange. As joint and coalition operations become more prevalent, cloud adoption aligns with strategic interoperability goals.

Increasing Adoption Technologies

Artificial intelligence and machine learning technologies are increasingly integrated with military cloud computing to support predictive analysis and autonomous systems. These technologies enable advanced pattern recognition, threat detection, and decision support tools. Cloud platforms provide the scale and processing power required to train and deploy AI models for defense applications. This integration enhances operational effectiveness and supports data driven strategies.

Edge computing technologies are also being adopted to support low latency requirements in distributed environments. Edge nodes process data closer to sensors, vehicles, and deployed forces while maintaining connectivity with central cloud resources. This hybrid architecture supports mission critical tasks where network connectivity may be limited or intermittent. The combination of cloud and edge computing strengthens performance and responsiveness in the field.

One key reason defense organizations adopt cloud computing is improved operational efficiency and scalability. Cloud platforms allow rapid provisioning of computing resources based on mission needs without large upfront investment in hardware. This flexibility reduces infrastructure costs and supports scalable workloads. Organizations can adjust resource allocation in response to evolving operational demands.

Another reason for adoption is enhanced collaboration and information sharing across units and partners. Cloud computing provides a common environment for data exchange that supports coordinated planning and execution. This shared access enables personnel at all levels to work with consistent and current information. Improved collaboration supports faster decision making and unified action in complex operations.

By Deployment Model

In 2025, Private cloud deployment accounts for 58.3%, showing its importance in military cloud adoption. Defense organizations require controlled environments for sensitive operations. Private clouds offer higher levels of data isolation and access control. These environments support mission-critical workloads. Security and reliability remain key priorities.

The dominance of private cloud is driven by strict defense security requirements. Military agencies prefer full control over infrastructure and data. Private deployments reduce exposure to external risks. They also support compliance with internal security protocols. This sustains strong preference for private cloud models.

For Instance, in November 2025, HPE wins a major DoD contract. Hewlett Packard Enterprise secured a $931 million, 10-year deal from the Defense Information Systems Agency for its GreenLake Private Cloud. This deploys private cloud across sensitive datacenters, offering public cloud features like unified management while keeping data on-premises for full control.

By Service Model

Infrastructure as a Service holds 52.7%, making it the leading service model. IaaS provides scalable computing, storage, and networking resources. Military organizations use IaaS to support flexible operations. Rapid provisioning improves response capability. Infrastructure-level control supports customization.

Adoption of IaaS is driven by the need for adaptable computing resources. Defense operations often require rapid scaling. IaaS supports deployment across different mission scenarios. It also reduces reliance on fixed infrastructure. This keeps IaaS central to military cloud strategies.

For instance, in October 2024, Oracle powers the US Army IPPS-A on IaaS. Oracle was selected to migrate the Army’s Integrated Personnel and Pay System-Army to its U.S. Defense Cloud Infrastructure as a Service. This supports over one million users, cutting costs and boosting security for HR and payroll operations.

By Application

C4ISR applications account for 41.8%, highlighting their critical role. These systems rely on real-time data processing and communication. Cloud computing supports data integration across units. Enhanced situational awareness improves decision-making. Reliability is essential for operational success.

Growth in this application is driven by increasing data complexity. Military operations generate large volumes of information. Cloud platforms support analytics and coordination. Secure data access improves operational efficiency. This sustains strong demand for cloud-enabled C4ISR systems.

For Instance, in January 2026, GDIT earned the AWS award for C4ISR innovation. General Dynamics Information Technology won AWS Global Defense Consulting Partner of the Year for solutions like DOGMA, which integrates AI and cloud for air defense systems. It speeds data processing at the tactical edge for faster decisions.

By End User

The army accounts for 34.6%, making it the leading end-user segment. Ground forces depend on cloud systems for coordination and planning. Cloud computing supports logistics and operational intelligence. Centralized access improves command efficiency. Reliability remains essential for field operations.

Adoption within the army is driven by modernization initiatives. Digital systems improve responsiveness and coordination. Cloud platforms support training and simulations. Integration across units enhances effectiveness. This sustains steady adoption within army operations.

Use Case Adoption by Industry Vertical

Military Branch Primary Use Case Adoption Share (%) Adoption Maturity Army Battlefield data and logistics systems 34.6% Advanced Air Force Mission planning and flight analytics 26.8% Advanced Navy Fleet coordination and surveillance 22.4% Developing Cyber defense units Threat monitoring and response 10.1% Developing Joint command Cross force data integration 6.1% Developing For Instance, in January 2023, the US Army adopted Google Workspace. The Army rolled out Google Workspace to over 180,000 personnel after IL4 authorization. It boosts collaboration for army-wide command and logistics tasks.

By Security Classification

Classified workloads represent 48.9%, reflecting the need to protect sensitive information. Military cloud systems handle confidential and strategic data. Classified environments require strict access controls. Encryption and monitoring are essential. Security classification drives infrastructure design.

Preference for classified cloud environments is driven by national security concerns. Defense agencies prioritize protection against cyber threats. Cloud systems are designed to meet classification standards. Controlled access ensures data integrity. This keeps classified workloads dominant.

For Instance, in January 2026, Leidos won an Air Force classified cloud task. Leidos secured a $455 million contract for US Air Force Cloud One, delivering architecture and shared services for classified environments through 2031.

By Region

North America accounts for 56.15%, supported by advanced defense infrastructure. The region invests heavily in secure digital systems. Military modernization programs support cloud adoption. Strong technology ecosystems enable deployment. The region remains a key market.

For instance, in December 2025, Leidos secured $455 million Air Force contract for cloud architecture modernization, building on NATO cloud wins. Their edge AI demos keep Leidos central to tactical cloud deployment.

The United States reached USD 5.17 Billion with a CAGR of 10.21%, reflecting steady growth. Expansion is driven by defense digitalization efforts. Cloud computing improves operational efficiency. Security remains a central focus. Market growth continues at a stable pace.

For instance, in November 2025, AWS announced a $50 billion investment to expand AI and supercomputing infrastructure for U.S. federal agencies, providing access to Amazon SageMaker, Bedrock, and Nova services through AWS GovCloud. This reinforces U.S. dominance in secure military cloud computing.

Regional Driver Comparison

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Advanced defense cloud initiatives 56.15% USD 5.75 Bn Advanced Europe NATO aligned digital defense programs 22.8% USD 2.33 Bn Advanced Asia Pacific Military digitization and modernization 14.6% USD 1.49 Bn Developing Middle East Secure command and control systems 4.2% USD 0.43 Bn Developing Latin America Gradual defense IT upgrades 2.3% USD 0.24 Bn Early Investment Opportunities

Investment opportunities in the military cloud computing market exist in secure cloud platforms tailored to defense requirements. Solutions that combine high performance computing, advanced encryption, and compliance with defense standards may attract significant interest from defense agencies. Investors may also explore services that support migration of legacy systems to cloud native architectures. These investments can help defense organizations modernize with reduced risk.

Another opportunity lies in cloud security and governance services that ensure compliance with regulatory and operational standards. Military cloud environments require stringent access controls, monitoring, and incident response capabilities. Providers that offer secure, managed services can support defense organizations that lack in house expertise. Investing in these services enhances adoption by reducing complexity and improving trust.

Business Benefits

Adoption of military cloud computing solutions can improve resource utilization and reduce total cost of ownership. By shifting from traditional data centers to cloud based platforms, defense agencies can lower maintenance costs and avoid costly hardware refresh cycles. This supports more efficient budget allocations toward strategic programs. Over time, these financial benefits contribute to sustainable modernization.

Cloud based systems also enable faster development and deployment of new applications and capabilities. Development teams can test, iterate, and release software updates without lengthy hardware procurement processes. This responsiveness supports continuous improvement of defense tools and services. Enhanced agility in technology delivery reinforces operational readiness.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Defense ministries Very High ~41% Mission critical infrastructure Long term procurement Army and ground forces High ~34.6% Tactical and operational data access Program based spending Defense contractors Moderate to High ~14% Secure platform integration Contract driven investment Intelligence agencies Moderate ~7% Data analytics and surveillance Selective deployment Research units Low to Moderate ~3% Defense innovation Pilot programs Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Secure cloud infrastructure Classified data storage and compute ~3.6% Mature Hybrid and edge cloud Low latency battlefield processing ~2.9% Growing AI driven analytics Threat detection and decision support ~2.3% Developing Zero trust security Identity and access management ~1.6% Growing Encrypted data fabrics Secure data transfer ~1.0% Developing Emerging Trends

In the military cloud computing market, one notable trend is the deployment of resilient and secure multi-domain cloud infrastructures that support operations across land, air, sea, space, and cyber domains. Military forces are adopting cloud environments designed to maintain continuity of command and control, intelligence processing, and mission support even under contested or degraded network conditions. This approach emphasises adaptability and ensures that key services remain available in dynamic operational contexts.

Another emerging trend is the integration of edge computing with cloud architectures to enable rapid, distributed decision making. Tactical edge nodes located closer to operational forces are being coupled with centralised cloud services to provide low-latency processing of sensor data, targeting information, and situational awareness feeds. This hybrid model helps military units make faster decisions while balancing the need for central coordination and secure data aggregation.

Growth Factors

A primary growth factor in the military cloud computing market is the demand for enhanced data sharing and interoperability across allied forces and defence systems. Modern military operations generate vast volumes of intelligence, surveillance, and operational data from diverse platforms. Cloud computing provides standardised frameworks that support unified access, streamlined data exchange, and collaborative planning among units and partners.

Another important growth factor is the accelerating adoption of artificial intelligence and machine learning capabilities within defence operations. Cloud platforms offer scalable computational power to support advanced analytics, predictive modelling, and autonomous systems development. These capabilities assist in threat detection, mission planning, logistics optimisation, and cyber defence, reinforcing the need for robust cloud infrastructures.

Opportunity

A strong opportunity exists in developing cloud environments specifically designed for mission critical defence workloads. Secure cloud architectures that support encrypted communication, controlled access, and operational resilience can address unique military requirements. These tailored environments can improve confidence in cloud adoption across defence agencies.

Another opportunity lies in using cloud platforms to support training and simulation activities. Cloud based simulation systems allow forces to train together in realistic virtual environments without extensive physical infrastructure. This approach can improve readiness while reducing cost and logistical complexity.

Challenge

One key challenge for the military cloud computing market is defending cloud systems against advanced cyber threats. Defence cloud environments are attractive targets and require continuous monitoring, threat detection, and rapid response capabilities. Maintaining a strong security posture demands constant investment and skilled personnel.

Another challenge is balancing ease of access with strict control over who can view or modify information. Military personnel must access data quickly during operations, but access must remain tightly controlled. Designing systems that support both speed and security remains a complex task.

Key Market Segments

By Deployment Model

- Private Cloud

- On-Premises Private Cloud

- Hosted Private Cloud

- Public Cloud (GovCloud / Sovereign Cloud)

- Hybrid Cloud

- Community Cloud (Multi-Nation)

By Service Model

- Infrastructure as a Service

- Secure Compute & Storage

- Networking & Cybersecurity

- Platform as a Service

- Development & Analytics Platforms

- Software as a Service

- Command & Control Applications

- Logistics & Maintenance Systems

- Intelligence, Surveillance, and Reconnaissance

- Training & Simulation

- Others

By Application

- Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance

- Cybersecurity & Cyber Warfare

- Logistics & Supply Chain Management

- Health IT & Personnel Management

- Training & Simulation

- Others

By End-User

- Army

- Navy

- Air Force

- Space Force

- Defense Agencies & Joint Commands

- Others

By Security Classification

- Unclassified / Official Use Only

- Sensitive but Unclassified

- Classified (Secret, Top Secret)

- Multi-Level Security

Key Players Analysis

Amazon Web Services, Inc., Microsoft Corporation, and Google LLC lead the military cloud computing market through secure and scalable cloud platforms. Their services support data storage, mission planning, and real-time analytics. Strong investment in cybersecurity and compliance strengthens trust among defense agencies. Global infrastructure improves system resilience. These providers enable rapid deployment of digital capabilities.

International Business Machines Corporation, Oracle Corporation, Dell Technologies, Inc., Hewlett Packard Enterprise Company, and Cisco Systems, Inc. provide mission-critical infrastructure and hybrid cloud solutions. Their strengths include secure servers, networking, and data management systems. Focus is placed on reliability and edge computing. These vendors support classified workloads and legacy system integration. Long-standing relationships with defense organizations enhance credibility.

Leidos Holdings, Inc., Booz Allen Hamilton Holding Corporation, General Dynamics Information Technology, Inc., Science Applications International Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, and Raytheon Technologies Corporation focus on defense-specific cloud integration. Their expertise covers secure networks and intelligence systems. These companies support mission readiness and modernization programs. Other players address specialized and emerging defense needs.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation

- Oracle Corporation

- Dell Technologies, Inc.

- Hewlett Packard Enterprise Company

- Cisco Systems, Inc.

- Leidos Holdings, Inc.

- Booz Allen Hamilton Holding Corporation

- General Dynamics Information Technology, Inc.

- Science Applications International Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Others

Recent Developments

- In October 2025, International Business Machines Corporation (IBM) unveiled a defense-focused AI model on its cloud platform to accelerate U.S. and Canadian military mission planning. The tool integrates with hybrid clouds for real-time decision support, bolstering North America’s AI-cloud edge.

- In April 2025, Oracle Corporation and, U.S. Army expanded Oracle Defense Cloud under JWCC for IL6 workloads, adding Exadata for resilient data management. Oracle’s multi-cloud wins highlight U.S. innovation in secure, cost-efficient military computing.

Report Scope

Report Features Description Market Value (2025) USD 10.2 Bn Forecast Revenue (2035) USD 30.1 Bn CAGR(2026-2035) 11.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Model (Private Cloud, Public Cloud (GovCloud / Sovereign Cloud), Hybrid Cloud, Community Cloud (Multi-Nation), By Service Model (Infrastructure as a Service, Platform as a Service, Software as a Service), By Application (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance, Cybersecurity & Cyber Warfare, Logistics & Supply Chain Management, Health IT & Personnel Management, Training & Simulation, Others), By End-User (Army, Navy, Air Force, Space Force, Defense Agencies & Joint Commands, Others), By Security Classification (Unclassified / Official Use Only, Sensitive but Unclassified, Classified (Secret, Top Secret), Multi-Level Security) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Microsoft Corporation, Google LLC, International Business Machines Corporation, Oracle Corporation, Dell Technologies, Inc., Hewlett Packard Enterprise Company, Cisco Systems, Inc., Leidos Holdings, Inc., Booz Allen Hamilton Holding Corporation, General Dynamics Information Technology, Inc., Science Applications International Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, Raytheon Technologies Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Military Cloud Computing MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Military Cloud Computing MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation

- Oracle Corporation

- Dell Technologies, Inc.

- Hewlett Packard Enterprise Company

- Cisco Systems, Inc.

- Leidos Holdings, Inc.

- Booz Allen Hamilton Holding Corporation

- General Dynamics Information Technology, Inc.

- Science Applications International Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Others