Global Mid-Revenue Cycle Management/Clinical Documentation Improvement Market By Product and Service (Solutions, Consulting Services), By End-User (Healthcare Providers, Healthcare Payers), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 73406

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

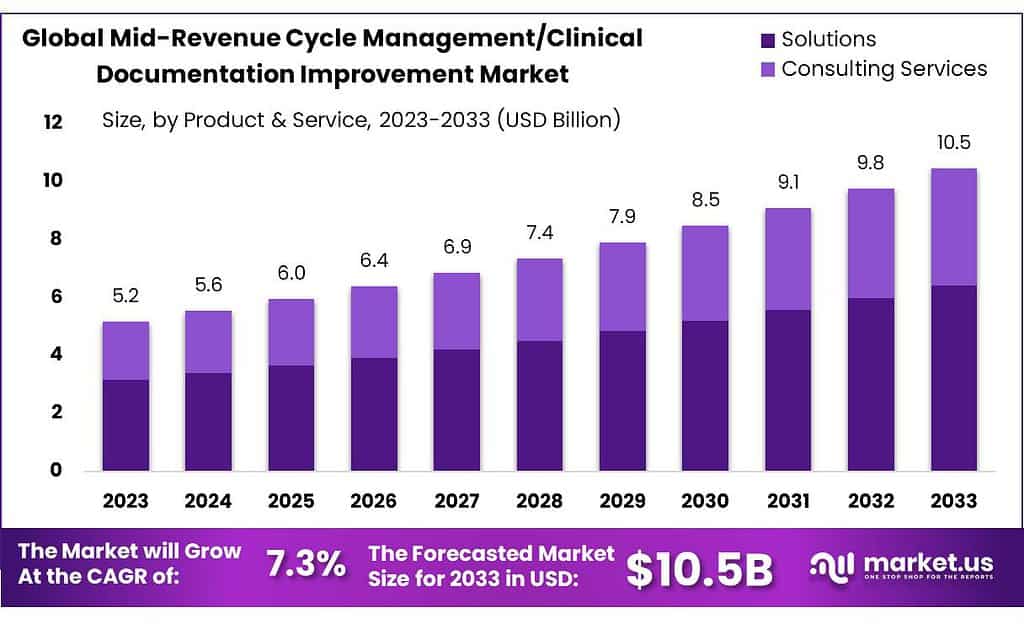

The Mid-Revenue Cycle Management/Clinical Documentation Improvement Market size is expected to be worth around USD 10.5 billion by 2033, from USD 5.2 Bn in 2023, growing at a CAGR of 7.3% during the forecast period from 2023 to 2033.

Mid-Revenue Cycle Management (MRCM) and Clinical Documentation Improvement (CDI) are integral components of healthcare operations, focusing on optimizing documentation practices and enhancing the revenue cycle within the middle stages of patient care. The market revolves around technologies, processes, and services designed to improve clinical documentation accuracy, coding efficiency, and overall financial outcomes for healthcare providers.

Revenue cycle management is the process used by healthcare systems to track revenues and collect cash for the treatment of patients, from their initial appointment or initial interaction with the healthcare system to their final payment of dues.

Key Takeaways

- Market Growth: The market is set to reach USD 10.5 billion by 2033, growing at a CAGR of 7.3% from USD 5.2 billion in 2023.

- Segment Dominance: Solutions hold a substantial 61.3% market share in 2023, offering features like clinical coding and charge capture to streamline processes.

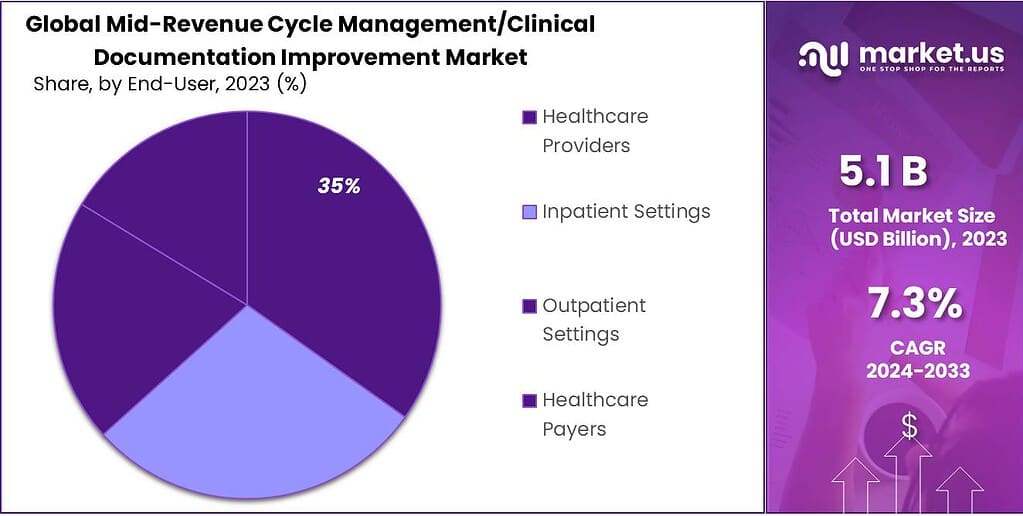

- Healthcare Providers’ Share: Healthcare providers hold a dominant 35% market share in 2023, relying on solutions to optimize coding accuracy and enhance revenue capture.

- APAC’s Market Dominance: Asia-Pacific claims an impressive 61.5% revenue share in 2023, driven by rapid urbanization, construction activities, and a thriving automotive industry.

By Product and Service

In 2023, Solutions held a dominant market position, capturing more than a 61.3% share. This segment encompasses a wide range of software solutions designed to streamline and optimize mid-revenue cycle management and clinical documentation improvement processes. These solutions offer comprehensive features such as clinical coding, charge capture, diagnosis-related grouping (DRG), pre-bill review, and clinical documentation enhancements.

They enable healthcare organizations to improve coding accuracy, ensure compliance with regulatory requirements, and enhance revenue capture by identifying and addressing documentation gaps and coding errors. The strong market position of Solutions reflects its critical role in supporting efficient and effective revenue cycle management practices across healthcare facilities. Clinical Coding emerged as another significant product and service segment in the mid-revenue cycle management market.

Clinical coding services involve the accurate translation of medical diagnoses, procedures, and services into universally recognized codes for billing and reimbursement purposes. With the increasing complexity of healthcare coding systems and regulations, healthcare providers rely on clinical coding services to ensure accurate and timely claims submission, minimize coding errors, and maximize revenue capture. This segment is essential for maintaining compliance with coding guidelines and standards while optimizing revenue cycle performance.

Clinical Documentation Improvements (CDI) represent a crucial aspect of mid-revenue cycle management, focusing on enhancing the quality and completeness of clinical documentation. CDI services help healthcare providers capture accurate and comprehensive clinical data to support appropriate code assignment, improve clinical documentation integrity, and facilitate accurate reimbursement.

By addressing documentation deficiencies and clarifying ambiguous or incomplete clinical notes, CDI services contribute to better coding accuracy, reduced denials, and increased revenue integrity. Charge Capture is another vital component of mid-revenue cycle management, involving the accurate capture and recording of billable services and procedures provided to patients.

Charge capture solutions streamline the charge entry process, automate charge capture workflows, and minimize revenue leakage by identifying missed charges or discrepancies in charge capture processes. Healthcare organizations rely on charge capture solutions to improve revenue cycle efficiency, reduce billing errors, and enhance revenue capture from patient encounters and services rendered.

By End-User

In 2023, Healthcare Providers held a dominant market position, capturing more than a 35% share. This segment encompasses a wide range of healthcare facilities, including hospitals, clinics, physician practices, and specialty care centers. Healthcare providers are the primary end-users of mid-revenue cycle management and clinical documentation improvement solutions and services, as they are responsible for delivering patient care, documenting clinical encounters, and managing revenue cycle processes. Healthcare providers rely on these solutions and services to optimize coding accuracy, ensure compliance with regulatory requirements, and enhance revenue capture from patient encounters and services rendered.

Inpatient Settings emerged as another significant end-user segment in the mid-revenue cycle management market. Inpatient settings include hospitals, long-term care facilities, and rehabilitation centers where patients receive treatment and care that require admission to a healthcare facility. These settings often involve complex medical cases and procedures, necessitating robust mid-revenue cycle management and clinical documentation improvement processes to ensure accurate coding, billing, and reimbursement. Inpatient settings rely on solutions and services tailored to their specific needs, such as diagnosis-related grouping (DRG) services, charge capture solutions, and clinical documentation improvement (CDI) services, to optimize revenue cycle performance and compliance.

Outpatient Settings represent another key end-user segment in the mid-revenue cycle management market. Outpatient settings include ambulatory care centers, outpatient clinics, urgent care facilities, and physician offices where patients receive medical care without being admitted to a hospital. Outpatient settings often handle a high volume of patient encounters and services, requiring efficient coding, documentation, and billing processes to capture revenue accurately and timely. Outpatient settings leverage solutions and services such as clinical coding, charge capture, and pre-bill review to streamline revenue cycle workflows, minimize coding errors, and maximize revenue capture from outpatient services.

Healthcare Payers comprise another important end-user segment in the mid-revenue cycle management market. Healthcare payers, including health insurance companies, government payers, and third-party administrators, play a crucial role in reimbursing healthcare providers for services rendered to patients. Payers rely on accurate and complete clinical documentation and coding to adjudicate claims, determine reimbursement amounts, and ensure compliance with payment policies and regulations.

Payers may utilize solutions and services such as claims processing software, coding audits, and fraud detection tools to validate claims accuracy, prevent payment errors, and mitigate fraud and abuse. As stakeholders in the healthcare reimbursement ecosystem, payers contribute to driving demand for mid-revenue cycle management and clinical documentation improvement solutions and services to optimize claims processing efficiency, reduce costs, and improve payment accuracy and transparency.

Key Market Segmentation

By Product and Service

- Solutions

- Clinical Coding

- Clinical Documentation Improvements

- Charge Capture

- Clinical Documentation

- Diagnosis-related Grouping

- Pre-bill Review

- Consulting Services

By End-User

- Healthcare Providers

- Inpatient Settings

- Outpatient Settings

- Healthcare Payers

Drivers

One significant driver is the increasing focus on healthcare quality and regulatory compliance. With stringent regulations and guidelines governing healthcare documentation and coding, healthcare providers are under pressure to ensure accurate and comprehensive clinical documentation. CDI solutions help healthcare organizations enhance the quality and completeness of clinical documentation, leading to improved coding accuracy, better quality metrics, and enhanced compliance with regulatory requirements.

Moreover, the growing adoption of electronic health records (EHRs) and health information technology (IT) solutions is driving demand for mid-revenue cycle management and CDI solutions. EHR systems provide a platform for capturing and managing patient health information, facilitating documentation improvement processes, and streamlining coding workflows. Integration with CDI solutions enhances EHR functionality, enabling real-time clinical documentation review, coding validation, and compliance monitoring, thereby improving overall revenue cycle efficiency and accuracy.

Another driver is the increasing complexity of healthcare reimbursement and payment models. As healthcare reimbursement shifts towards value-based care and alternative payment models, healthcare providers face greater pressure to accurately document and code patient encounters to reflect the complexity and severity of illness.

CDI solutions play a critical role in supporting accurate code assignment, ensuring appropriate reimbursement, and mitigating compliance risks associated with value-based payment arrangements. The rise of data analytics and artificial intelligence (AI) technologies is driving innovation in mid-revenue cycle management and CDI solutions.

Advanced analytics and AI algorithms enable predictive modeling, natural language processing (NLP), and machine learning (ML) capabilities that enhance clinical documentation review, coding accuracy, and revenue integrity. These technologies enable healthcare organizations to identify documentation gaps, coding errors, and compliance issues proactively, leading to improved financial performance and operational efficiency.

Restraints

One big problem is how complicated and always changing the rules are for healthcare documentation and coding. Healthcare providers have to deal with lots of rules and standards, and they have to make sure their documentation and coding follow all of them. This can be tough for CDI solutions because they have to keep changing to keep up with the rules.

Also, CDI solutions cost a lot of money to set up and keep running. This can be a big issue for smaller healthcare places or doctor’s offices that don’t have a lot of money. They need to pay for software, hardware, training, and support, and it can add up fast. Sometimes, the cost is just too much for them, so they can’t use CDI solutions.

Another problem is not having enough people with the right skills to work on CDI. There’s a high demand for people who know about CDI, coding, and clinical documentation, but there aren’t enough of them to go around. This makes it hard for healthcare places to find and keep the right people, which can lead to problems with the quality of documentation, coding accuracy, and making sure they get paid correctly.

And then there’s the issue of different computer systems not being able to talk to each other. Healthcare places often use different systems for things like keeping records, coding, and managing money. But these systems don’t always work together well. It can make it hard for CDI to work smoothly because the information doesn’t flow between systems as it should. This can cause problems with communication, teamwork, and mistakes in the data.

Opportunities

A big chance comes from the growing demand for better healthcare quality and following the rules. Healthcare places want to make sure patients get the best care and they meet all the rules. That’s where CDI solutions come in handy. These solutions can help make sure that all the paperwork and coding are accurate, making it easier for healthcare providers to meet quality standards and follow the rules.

CDI solutions that can quickly check documents, validate codes, and monitor rules are in a good spot to help healthcare providers meet their goals. Also, as more places use electronic health records (EHRs) and other tech tools, there’s a chance for CDI solutions to work together with these systems.

CDI solutions that can fit well with EHRs, coding systems, and money management tools can make things run smoother. By working together, these tools can make sure the paperwork and, data are correct, and healthcare teams can work together better. This can help healthcare places save time and money while doing a better job with paperwork and coding.

As healthcare payment models change, there’s a chance for CDI solutions to help out. With more focus on paying for quality care instead of just how much is done, CDI solutions that can show the value of care can be useful. These solutions can help healthcare places prove they’re giving good care and get paid properly. By making sure the paperwork is accurate and the codes are right, CDI solutions can help healthcare places get more money for the care they give.

New tech like data analytics and artificial intelligence (AI) can help CDI solutions do even more. These tools can look at lots of data, find mistakes in documents and codes, and give advice to healthcare teams. CDI solutions that use these tools can help make sure the paperwork is good, codes are right, and the money side of things works well. This can lead to better money outcomes for healthcare places and better care for patients.

Challenges

One big challenge is the constant changes and complexity in healthcare rules and coding requirements. Healthcare providers have to keep up with a lot of rules and standards, and it’s tough to make sure all the documentation and coding are accurate and follow the rules. This makes it hard for CDI solutions to keep up because they have to keep changing to stay effective and follow all the rules.

Also, the cost of setting up and running CDI solutions is a major barrier for many healthcare places, especially smaller ones or doctor’s offices with limited money. CDI solutions need a lot of money upfront for things like software, hardware, training, and ongoing support. For some healthcare places, the cost is just too much, so they can’t use CDI solutions, which can lead to problems with accurate documentation and coding.

Another challenge is not having enough people with the right skills to work on CDI. There’s a high demand for people who know about CDI, coding, and clinical documentation, but there aren’t enough of them to go around. This makes it hard for healthcare places to find and keep the right people, which can lead to problems with the quality of documentation, coding accuracy, and making sure they get paid correctly.

There are problems with different computer systems not being able to talk to each other. Healthcare places often use different systems for things like keeping records, coding, and managing money. But these systems don’t always work together well. It can make it hard for CDI to work smoothly because the information doesn’t flow between systems as it should. This can cause problems with communication, teamwork, and mistakes in the data.

Regional Analysis

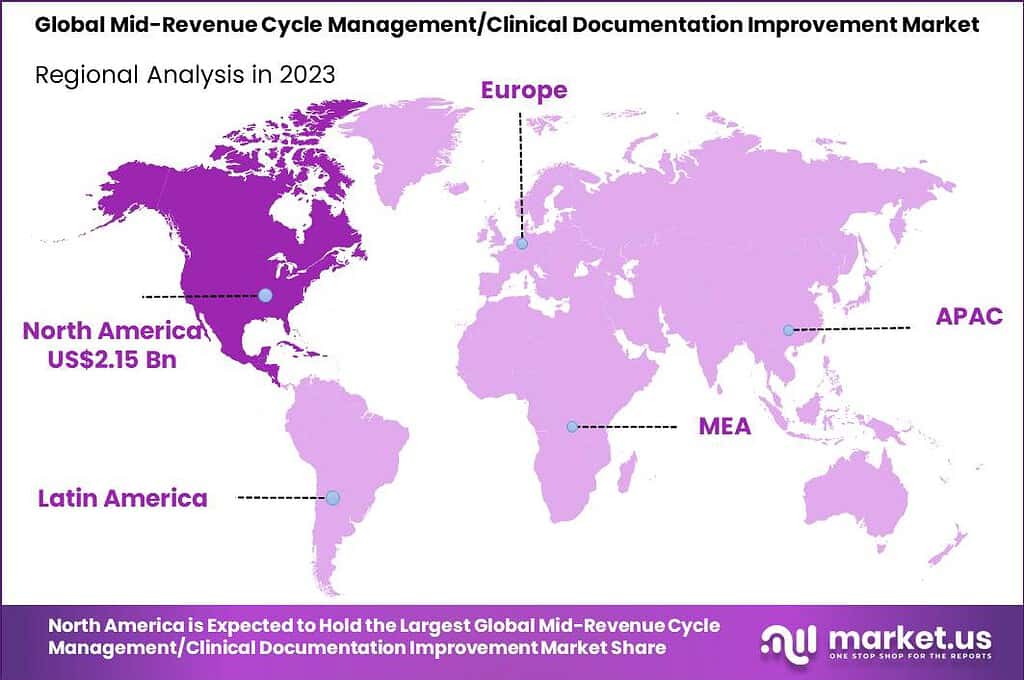

In 2023, North America claimed the highest revenue share, surpassing 41.5%. The global Mid-Revenue Cycle Management/Clinical Documentation Improvement market saw significant shifts, with Asia-Pacific (APAC) emerging as a frontrunner, securing an impressive revenue share exceeding 61.5%.

APAC’s dominance stems from rapid urbanization, robust construction, and a thriving automotive industry. Countries like China and India experienced substantial growth in residential and commercial projects, driving the demand for Mid-Revenue Cycle Management and Clinical Documentation Improvement solutions.

The automotive manufacturing hubs in the APAC region played a crucial role in the increased adoption of Mid-Revenue Cycle Management and Clinical Documentation Improvement practices in the Automotive & Transportation sector. As emphasis grows on energy efficiency and safety in APAC, these solutions have become integral to ongoing developments.

Furthermore, the expanding solar energy sector in the region has added to the demand for Mid-Revenue Cycle Management and Clinical Documentation Improvement, especially in solar panel installations and collectors.

The convergence of these factors positions APAC as a significant player in the global Mid-Revenue Cycle Management/Clinical Documentation Improvement market, with its dominance anticipated to endure amid the continuous expansion of infrastructure and industrialization.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Mid-Revenue Cycle Management/Clinical Documentation Improvement (CDI) market features key players driving advancements and innovations in healthcare documentation and revenue optimization. Here is an analysis of some prominent companies in this sector

Key players

- Nuance Communications Inc.

- Chartwise Medical Systems Inc.

- Craneware

- 3M Company

- Streamline Health Solutions LLC

- Nthrive Inc.

- Dolbey Systems

- Optum Inc.

- Cerner Corporation

- Vitalware LLC.

Recent Developments

3M Company: Invested in Repairify Inc., a platform for connecting patients with auto repair services, potentially impacting patient financial workflows.

Report Scope

Report Features Description Market Value (2023) US$ 5.18 Bn Forecast Revenue (2032) US$ 10.5 Bn CAGR (2023-2032) 7.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Basic Float Glass, Toughened Glass, Coated Glass, Laminated Glass, Extra Clear Glass, Pattern Glass, Mirror Glass and Others), By Technology (Float, Rolled, Sheet), By End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Solar Energy, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Nuance Communications Inc., Chartwise Medical Systems Inc., Craneware, 3M Company, Streamline Health Solutions LLC, Nthrive Inc., Dolbey Systems, Optum Inc., Cerner Corporation, Vitalware LLC. Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Mid-Revenue Cycle Management/Clinical Documentation Improvement Market?Mid-Revenue Cycle Management/Clinical Documentation Improvement Market size is expected to be worth around USD 10.5 billion by 2033, from USD 5.2 Bn in 2023

Mid-Revenue Cycle Management/Clinical Documentation Improvement MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Mid-Revenue Cycle Management/Clinical Documentation Improvement MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Nuance Communications Inc.

- Chartwise Medical Systems Inc.

- Craneware

- 3M Company

- Streamline Health Solutions LLC

- Nthrive Inc.

- Dolbey Systems

- Optum Inc.

- Cerner Corporation

- Vitalware LLC.