Global Microprocessor Chip Manufacturing Market Size, Share, Industry Analysis Report By Architecture (ARM MPU, x64, x86, MIPS), By Application (Smartphones, Personal Computers, Servers, Tablets, Embedded Devices, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158788

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- China Market Size

- By Architecture: ARM MPU

- By Application: Personal Computers

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

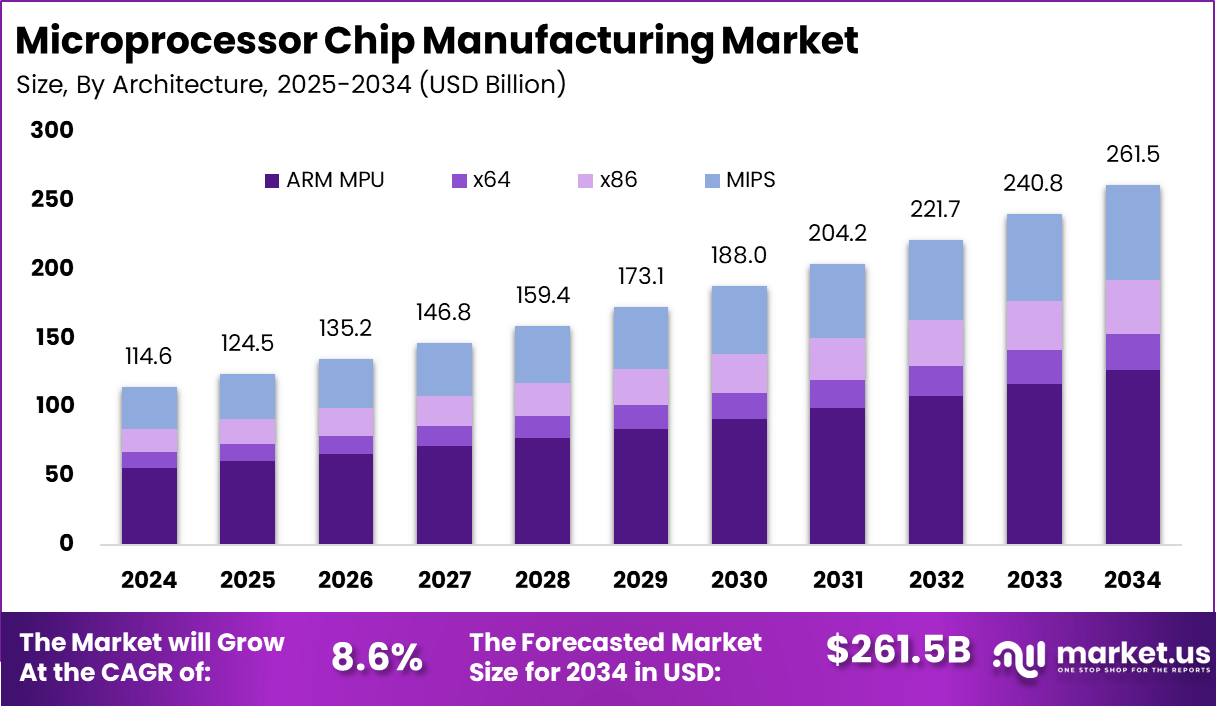

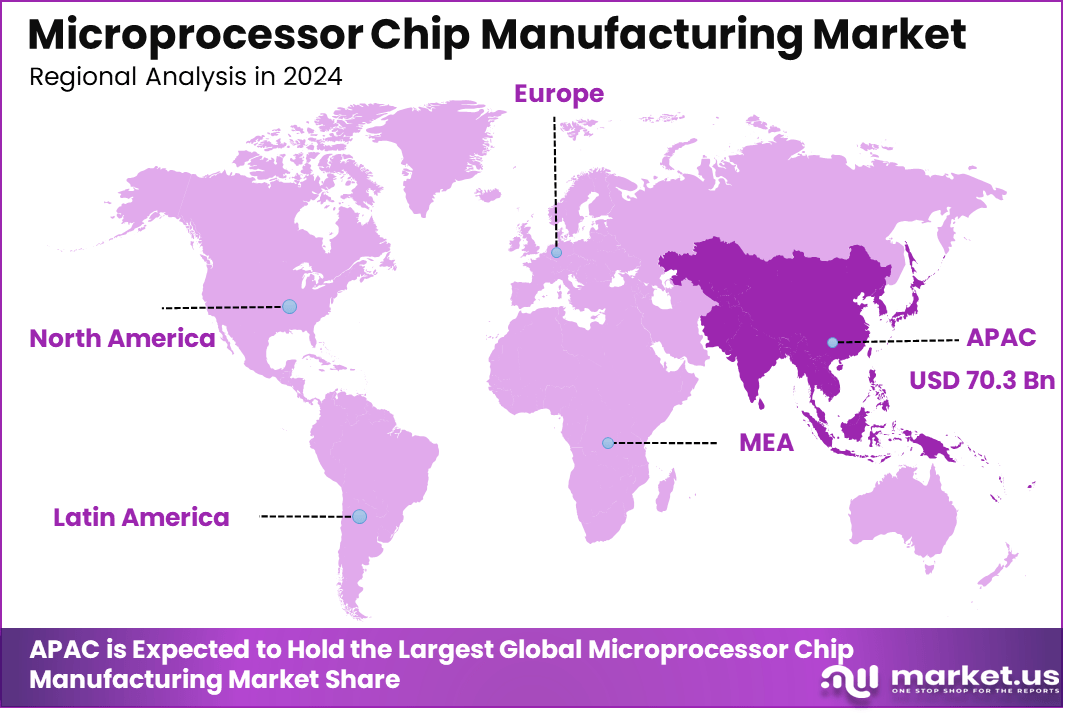

The Global Microprocessor Chip Manufacturing Market size is expected to be worth around USD 261.5 Billion By 2034, from USD 114.6 billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominan market position, capturing more than a 61.4% share, holding USD 70.3 Billion revenue.

The Microprocessor Chip Manufacturing Market refers to the industry engaged in designing, fabricating, and supplying microprocessor units (MPUs) that serve as the central processing unit of computing devices. Microprocessors are integrated circuits that perform arithmetic, logic, control, and input/output operations in electronic systems.

The market encompasses fabrication facilities, semiconductor foundries, design houses, testing, and packaging providers. These chips are critical to consumer electronics, automotive systems, industrial automation, data centers, and emerging technologies such as artificial intelligence and edge computing.

The market is driven by rising demand for high-performance computing, increasing adoption of connected devices, and the expansion of cloud infrastructure. Growth in artificial intelligence, machine learning, and advanced data analytics requires powerful processors, fueling innovation in microprocessor design. The automotive sector, with the rise of electric vehicles and autonomous driving, is significantly boosting demand for specialized chips.

Demand is strongest in consumer electronics, particularly smartphones, laptops, tablets, and gaming consoles, which represent the largest segment for microprocessors. Data centers and cloud providers are also major consumers, requiring powerful chips for handling massive workloads. Automotive demand is growing rapidly as vehicles integrate advanced driver assistance systems, infotainment, and connectivity features. Industrial automation, healthcare devices, and IoT platforms are additional contributors to rising demand.

Key Insight Summary

- By architecture, ARM MPU dominated the market with a 48.7% share, driven by energy efficiency and widespread use in mobile and embedded devices.

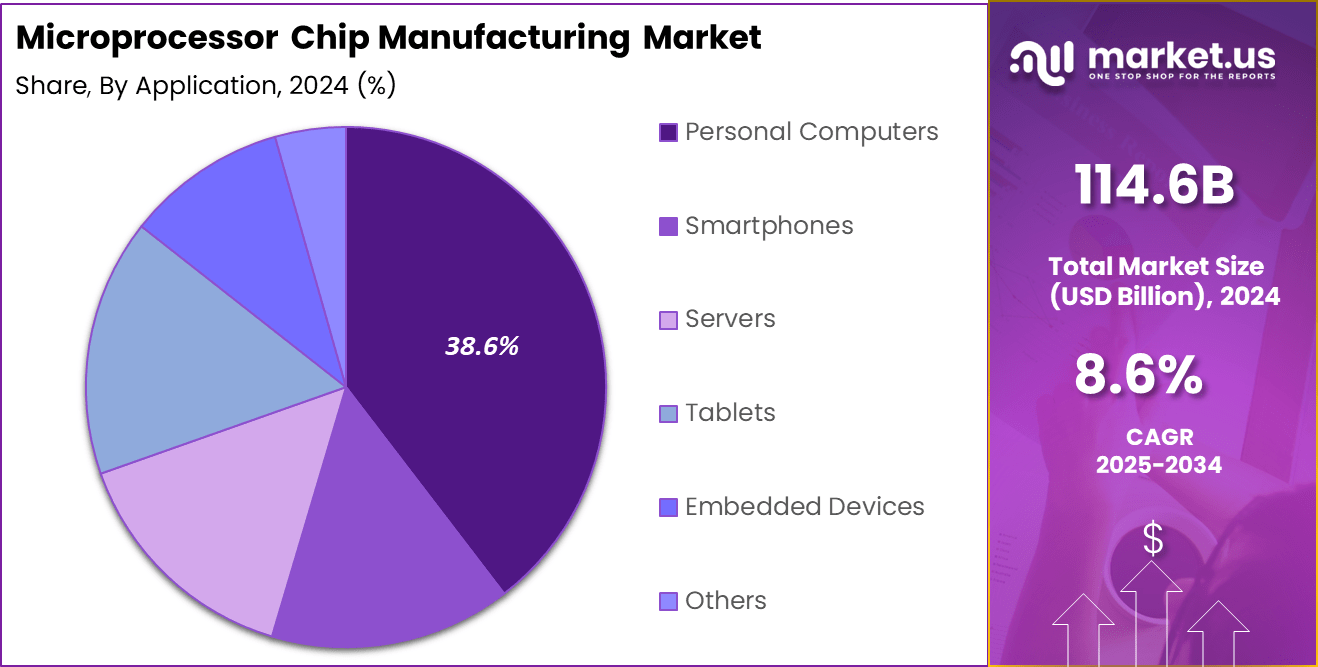

- By application, Personal Computers led the market with a 38.6% share, reflecting sustained demand in consumer and enterprise computing.

- Regionally, Asia Pacific captured 61.4% share, solidifying its position as the global hub for semiconductor production.

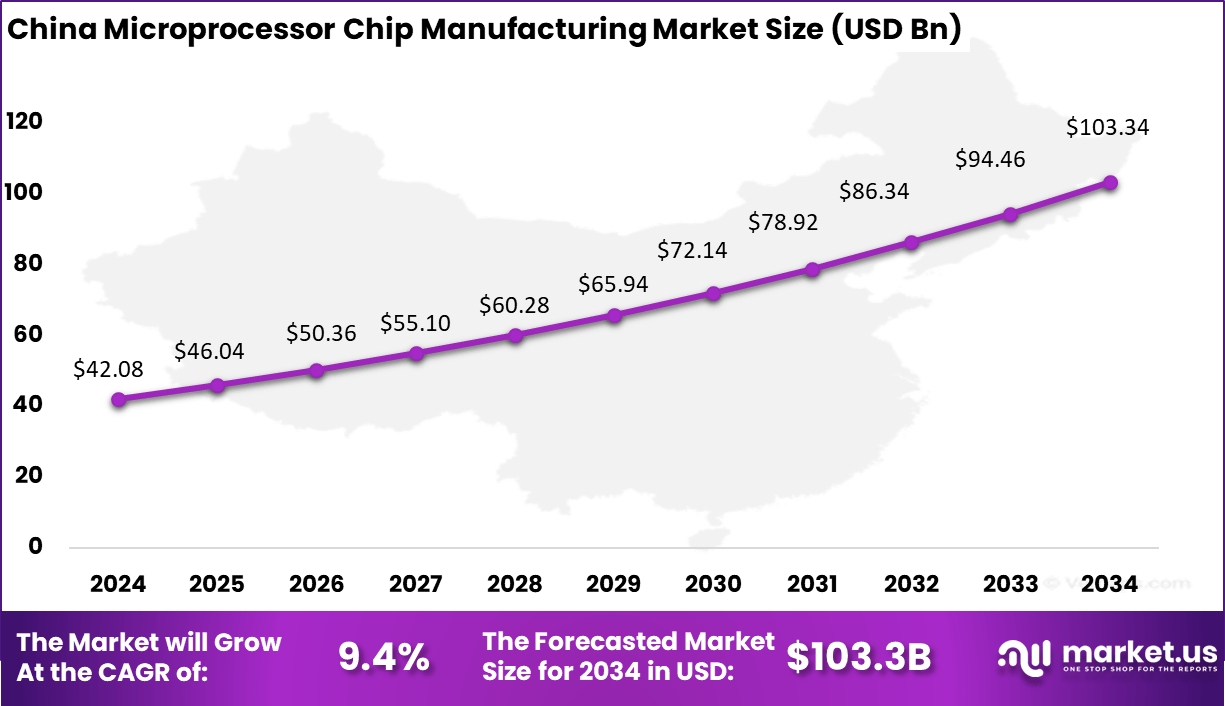

- Within Asia Pacific, China accounted for USD 42.08 Billion in 2024, expanding at a robust CAGR of 9.4%, supported by large-scale manufacturing capacity and government-backed semiconductor initiatives.

Analysts’ Viewpoint

Investment opportunities are huge supported by government incentives and large private funding to build next-generation fabrication plants. Countries are investing billions to secure supply chains and advance domestic chip production, adding thousands of skilled jobs to economies. These investments help increase production capacity and encourage R&D in cutting-edge technology.

Business benefits of producing microprocessors include greater supply control, faster innovation, and better customization, which are vital in a competitive market. Efficient, advanced chips allow companies to deliver new products suited for AI, IoT, and autonomous systems, increasing profitability and long-term cost effectiveness.

The regulatory environment is increasingly complex, with stricter standards on environmental impact, trade controls, and security, which influence manufacturing processes and global supply chains. Companies now focus on compliance and greener fabrication to avoid disruptions and maintain global market access.

Role of Generative AI

Generative AI is playing an increasingly critical role in microprocessor chip manufacturing by automating and enhancing various design and production processes. It supports design automation by creating optimized chip architectures that improve power efficiency and performance without extensive manual effort.

AI models also predict manufacturing defects and enable predictive maintenance, boosting yields and reducing downtime in production lines. These AI-driven improvements help cut design timelines from months to weeks and increase the overall quality of chips delivered to market.

Real-time data analysis through AI also optimizes production monitoring and supply chain logistics, ensuring resilient operations amid fluctuating demand and material shortages. The impact of generative AI manifests not just in chip design but in testing, material discovery, and manufacturing efficiency, fundamentally transforming the industry workflows in 2025.

China Market Size

The China Microprocessor Chip Manufacturing Market was valued at USD 42.08 Billion in 2024 and is anticipated to reach approximately USD 103.34 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 9.4% during the forecast period from 2025 to 2034.

Asia Pacific is the largest regional market with a dominant 61.4% share in the microprocessor manufacturing landscape. This region benefits from a robust semiconductor manufacturing ecosystem, aided by supportive government policies and investments in local production. Industrial hubs in countries such as China, Taiwan, and South Korea drive significant chip output and innovation.

The region’s rapid digitalization, expanding consumer electronics demand, and growth in automotive and industrial sectors further fuel microprocessor consumption. Moreover, the proliferation of technologies like 5G and AI support the continuous drive for advanced microprocessors tailored to regional market needs.

By Architecture: ARM MPU

In 2024, the ARM MPU architecture holds a significant share of 48.7% in the microprocessor chip manufacturing market. Its success is largely due to its energy efficiency and ability to deliver strong performance in compact, low-power devices. These qualities make ARM processors especially suitable for portable electronics and embedded systems, including smartphones and lightweight personal computing devices.

This architecture’s flexible design also allows manufacturers to customize and optimize processors for varied applications, which keeps ARM MPU preferred among chip makers aiming for a balance of power consumption and performance. Its growing adoption in sectors beyond traditional computing, such as IoT and edge devices, continues to drive its market dominance.

By Application: Personal Computers

In 2024, the Personal computers represent the leading application segment with a 38.6% share of microprocessor usage. The demand here is driven by the need for processors that handle multitasking, multimedia, and productivity efficiently. Both desktops and laptops rely on advanced microprocessors for processing speed and reliable performance, maintaining their relevance even with the rise of mobile devices.

The variety of personal computer users – from professionals requiring high-performance machines to general consumers seeking dependable everyday use – ensures steady innovation and demand for microprocessors. This segment continues to generate significant revenue, as processors evolve to meet advanced computing needs like gaming and content creation.

Emerging Trends

The microprocessor manufacturing sector is witnessing strong trends toward more advanced process nodes like 3nm, 2nm, and moving towards 1.4nm, which allow for higher transistor densities and energy efficiency. There is a shift toward heterogeneous architectures, where multiple chiplets are integrated into a single package, enhancing performance and flexibility.

Advanced packaging technologies including 3D stacking and fan-out wafer-level packaging are expanding rapidly to support growing chip complexity. Edge computing and AI acceleration capabilities are becoming standard features, with dedicated neural processing units integrated into chips for real-time AI workloads at the device level.

Growth Factors

Several factors drive the growth of microprocessor chip manufacturing in 2025. Rising demand for AI and high-performance computing substantially increases the need for faster, smaller, and more energy-efficient chips. Increasing adoption of AI across industries such as automotive, industrial electronics, and consumer devices fuels this demand.

Innovations in semiconductor materials and manufacturing processes also contribute to productivity improvements and cost reductions. The growing market for 5G chipsets and memory semiconductors supporting AI workloads adds to the expansion. Moreover, government incentives and large capital investments support both new fabrication plants and R&D in advanced chip technologies, creating a favorable growth environment.

Key Market Segments

By Architecture

- ARM MPU

- x64

- x86

- MIPS

By Application

- Personal Computers

- Smartphones

- Servers

- Tablets

- Embedded Devices

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Demand from AI and Data Centers

The increasing adoption of artificial intelligence and expansion of cloud data centers are powerful growth drivers for microprocessor chip manufacturing. Chips designed to accelerate AI workloads and handle massive data processing are in high demand.

For instance, demand for AI-focused processors and GPUs used in data centers is expected to account for a significant portion of chip sales in 2025, fueling investments in advanced manufacturing technologies. This demand surge is pushing manufacturers to innovate in chip speed, integration, and energy efficiency to support these complex workloads.

Restraint Analysis

Supply Chain and Capacity Constraints

Despite strong demand, supply chain disruptions and limited manufacturing capacity restrain growth in microprocessor production. Producing advanced chips requires cutting-edge equipment like extreme ultraviolet lithography machines, which are scarce and concentrated in a few suppliers. Geopolitical export restrictions complicate equipment access, especially for some regions, limiting the scale of advanced node production.

For instance, constraints in 3nm and sub-5nm chip manufacturing capacity create bottlenecks affecting yield and cost structures. These supply challenges increase production costs and delay time-to-market, making it harder for the industry to fully meet escalating demand despite heavy capital investments.

Opportunity Analysis

Growth in Specialized and Automotive Chips

A promising opportunity lies in developing microprocessors tailored for specialized markets such as automotive electronics and edge computing. The shift toward electric vehicles and autonomous driving is expanding the need for chips with real-time processing and robust safety features.

For example, automotive applications require microchips that manage everything from battery systems to advanced driver-assistance technologies. This sector is forecasted to outpace broader industry growth rates, presenting a lucrative space for manufacturers.

Additionally, growth in edge AI devices opens new use cases, encouraging innovation in low-latency, power-efficient chip designs. These emerging segments offer expansive revenue growth potential beyond traditional consumer electronics.

Challenge Analysis

High Capital Costs and Talent Shortage

The microprocessor chip manufacturing industry faces the critical challenge of high capital investment requirements alongside a shortage of skilled professionals. Building next-generation fabrication plants demands multi-billion-dollar investments, which only a few global players can afford.

For instance, establishing fabs capable of producing 3nm or smaller node chips can cost between $10 billion and $20 billion. At the same time, the industry is grappling with a shortage of specialized engineers skilled in chip design, photolithography, and manufacturing operations.

This skills gap is slowing innovation and hindering operational scale-up. Together, these financial and human resource constraints create barriers that can restrict the pace of technological advancement and market expansion.

Competitive Analysis

In the microprocessor chip manufacturing market, Intel, Advanced Micro Devices (AMD), NVIDIA, and Qualcomm are the dominant players. Their leadership is driven by strong portfolios in CPUs, GPUs, and mobile processors that power consumer electronics, servers, and advanced computing systems.

Other leading semiconductor firms such as Samsung, Broadcom, MediaTek, and NXP Semiconductors strengthen the market with diversified chip solutions. They focus on mobile devices, automotive applications, and IoT-enabled technologies. These companies provide competitive alternatives with a balance of performance and affordability, making them critical suppliers for both mass-market devices and specialized applications.

Additional contributors including Texas Instruments, STMicroelectronics, Renesas Electronics, Microchip Technology, Analog Devices, and Nuvoton Technology play important roles in niche and embedded processor markets. Their chips are widely used in automotive electronics, industrial automation, and consumer devices.

Top Key Players in the Market

- NXP Semiconductors

- Renesas Electronics Corporation

- MediaTek Inc.

- NVIDIA Corporation

- Analog Devices, Inc.

- Broadcom

- Nuvoton Technology Corporation

- Samsung

- Advanced Micro Devices, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Texas Instruments Incorporated

- STMicroelectronics

- Microchip Technology Inc.

- Others

Recent Developments

- In August 2024, Kaynes Semicon in India invested nearly $400 million to establish a chip manufacturing facility in Gujarat aimed at producing over 6 million chips daily mainly for automotive and industrial sectors.

- In May 2024, Polar Semiconductor in Minnesota, USA, received more than $820 million funding including state and federal grants to expand its 200mm wafer foundry with automation and AI-enabled manufacturing capabilities, elevating U.S.-owned chip production.

Report Scope

Report Features Description Market Value (2024) USD 114.6 Bn Forecast Revenue (2034) USD 261.5 Bn CAGR(2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Architecture (ARM MPU, x64, x86, MIPS), By Application (Smartphones, Personal Computers, Servers, Tablets, Embedded Devices, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NXP Semiconductors, Renesas Electronics Corporation, MediaTek Inc., NVIDIA Corporation, Analog Devices, Inc., Broadcom, Nuvoton Technology Corporation, Samsung, Advanced Micro Devices, Inc., Intel Corporation, Qualcomm Technologies, Inc., Texas Instruments Incorporated, STMicroelectronics, Microchip Technology Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Microprocessor Chip Manufacturing MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Microprocessor Chip Manufacturing MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NXP Semiconductors

- Renesas Electronics Corporation

- MediaTek Inc.

- NVIDIA Corporation

- Analog Devices, Inc.

- Broadcom

- Nuvoton Technology Corporation

- Samsung

- Advanced Micro Devices, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Texas Instruments Incorporated

- STMicroelectronics

- Microchip Technology Inc.

- Others