Global Micro Mobility Data Analytics Market Size, Share, Industry Analysis Report By Component (Software/Platform, Services), By Service Type (Vehicle Tracking & Telematics, Fleet Management Analytics, Ride & User Analytics, Predictive Maintenance Analytics, Others), By Deployment Mode (Cloud-based, On-premise), By Application (Demand & Supply Forecasting, Parking Management & Compliance, Safety & Incident Analysis, Vehicle Utilization & Rebalancing, Others), By End-User (Micro Mobility Service Providers, City Governments & Municipalities, Fleet Management Companies, Consulting Firms) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 163935

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Service Type Analysis

- Deployment Mode Analysis

- Application Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

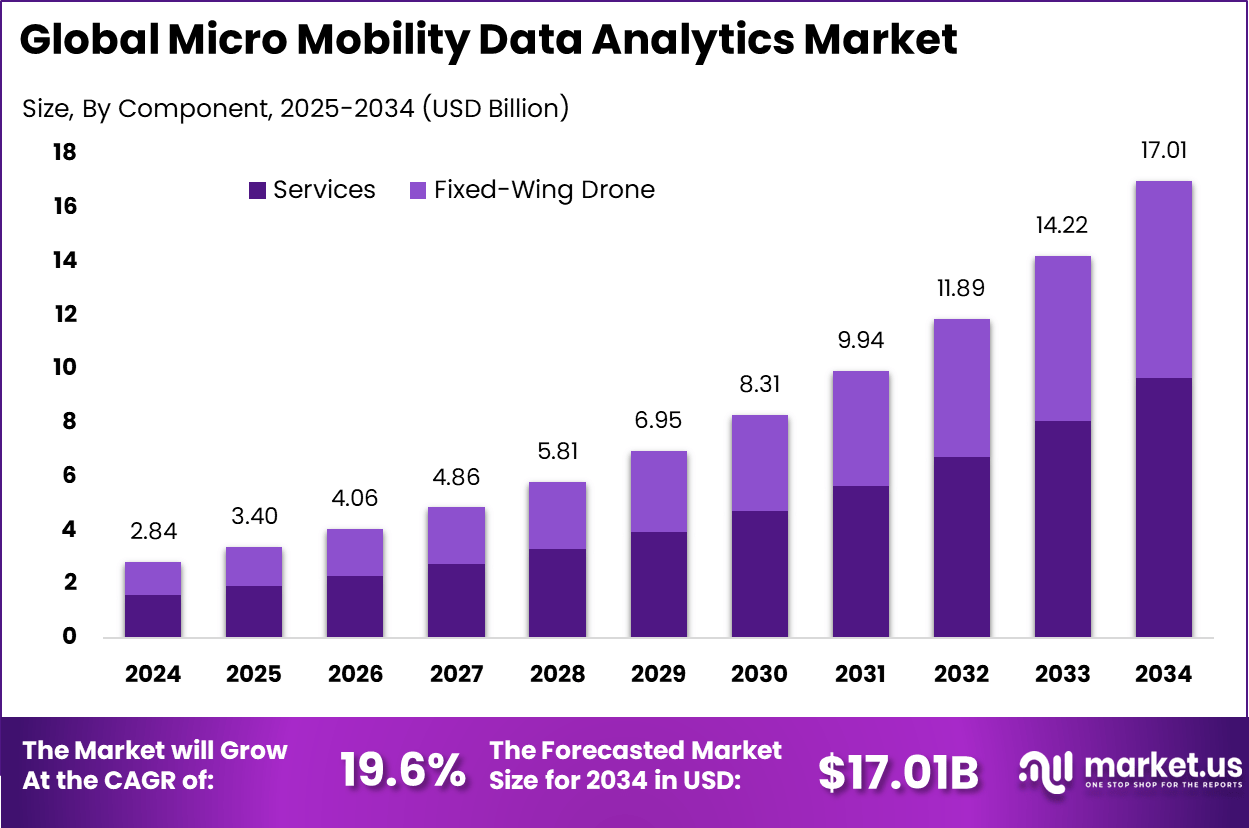

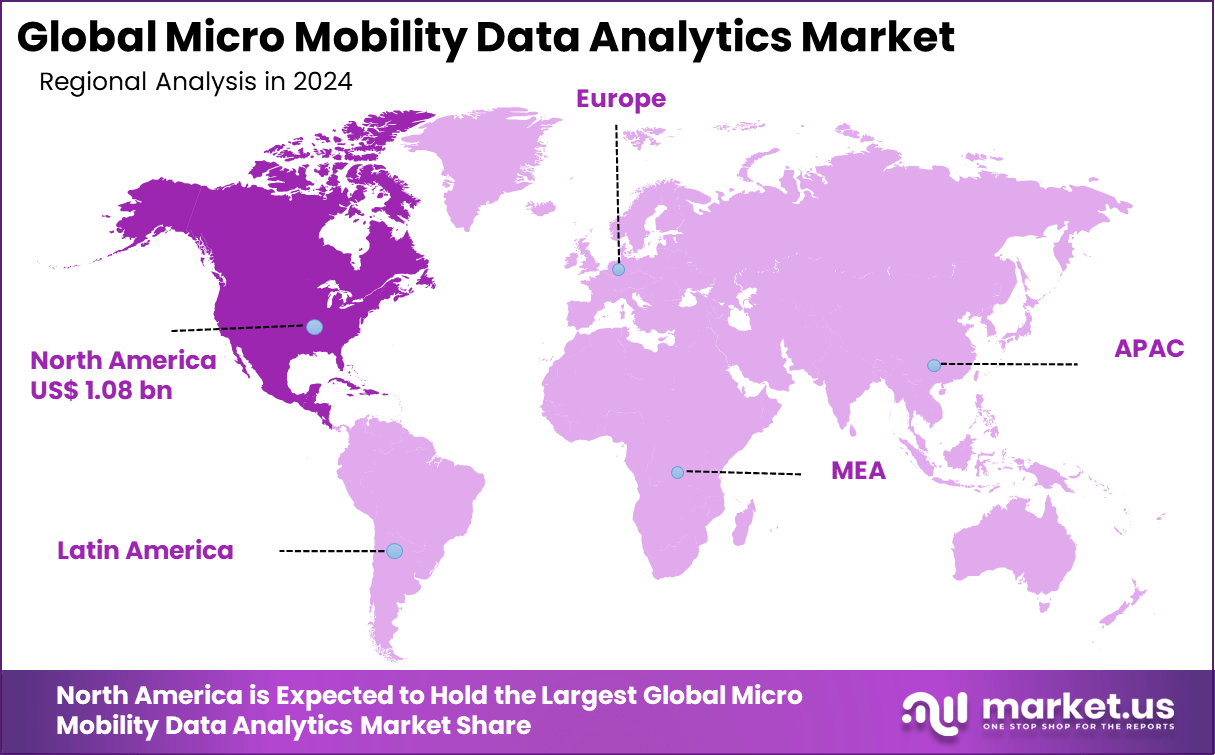

The Global Micro Mobility Data Analytics Market size is expected to be worth around USD 17.01 billion by 2034, from USD 2.84 billion in 2024, growing at a CAGR of 19.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.2% share, holding USD 1.08 billion in revenue.

The Micro Mobility Data Analytics Market centers on the collection and analysis of data generated from lightweight transport options like e-scooters, e-bikes, and similar vehicles used for short urban trips. This market is evolving swiftly due to the increasing use of digital tools and sensors integrated into micro mobility vehicles, which allow operators to better understand usage patterns, improve fleet management, and enhance rider experience.

Top driving factors include the rise in urban congestion and the growing need for cleaner transport alternatives. Traffic density has increased notably in many major cities, pushing commuters to seek more nimble and less polluting options. Cheaper battery technology and government incentives for electric vehicles support this demand further. The shift in commuter behavior post-pandemic, favoring personal or small vehicles over crowded public transit, has accelerated micro mobility adoption.

The market for Micro Mobility Data Analytics is primarily driven by the rapid urbanization and increasing demand for sustainable, efficient transportation options. Cities worldwide are seeking innovative ways to reduce congestion and pollution, which boosts the adoption of micro mobility solutions like e-scooters and bikes. Advances in connectivity, AI, and data management enable operators to optimize fleet performance and improve user experience, fueling the growth of data analytics in this sector.

Demand analysis indicates that the micro mobility segment serves diverse users, from daily commuters reducing reliance on personal cars to commercial operations seeking flexible delivery options. Ease of parking, affordability, and the bustling shift towards eco-friendly transportation options have driven the use of micro mobility data insights for smarter fleet allocation and enhanced urban mobility planning. Over 50 percent of micro mobility operators now adopt data-driven models to improve route planning and deployment efficiency.

For instance, in October 2025, Lime celebrated reaching 1 billion rides worldwide, a major milestone illustrating the widespread adoption of shared micromobility. The company’s growth reflects a cultural shift where micromobility moves from novelty to necessity. Lime continues to innovate with new vehicle designs improving comfort, stability, and safety, alongside expanding partnerships with cities for sustainable urban transport planning.

Key Takeaway

- In 2024, the Software/Platform segment held a dominant position, accounting for 56.8% of the Global Micro Mobility Data Analytics Market.

- During the same year, the Vehicle Tracking & Telematics segment secured a 38.4% share, highlighting its crucial role in optimizing fleet performance and operational efficiency.

- The Cloud-based deployment model dominated the market, representing 63.7% of the total share, reflecting growing preferences for scalable and cost-efficient data solutions.

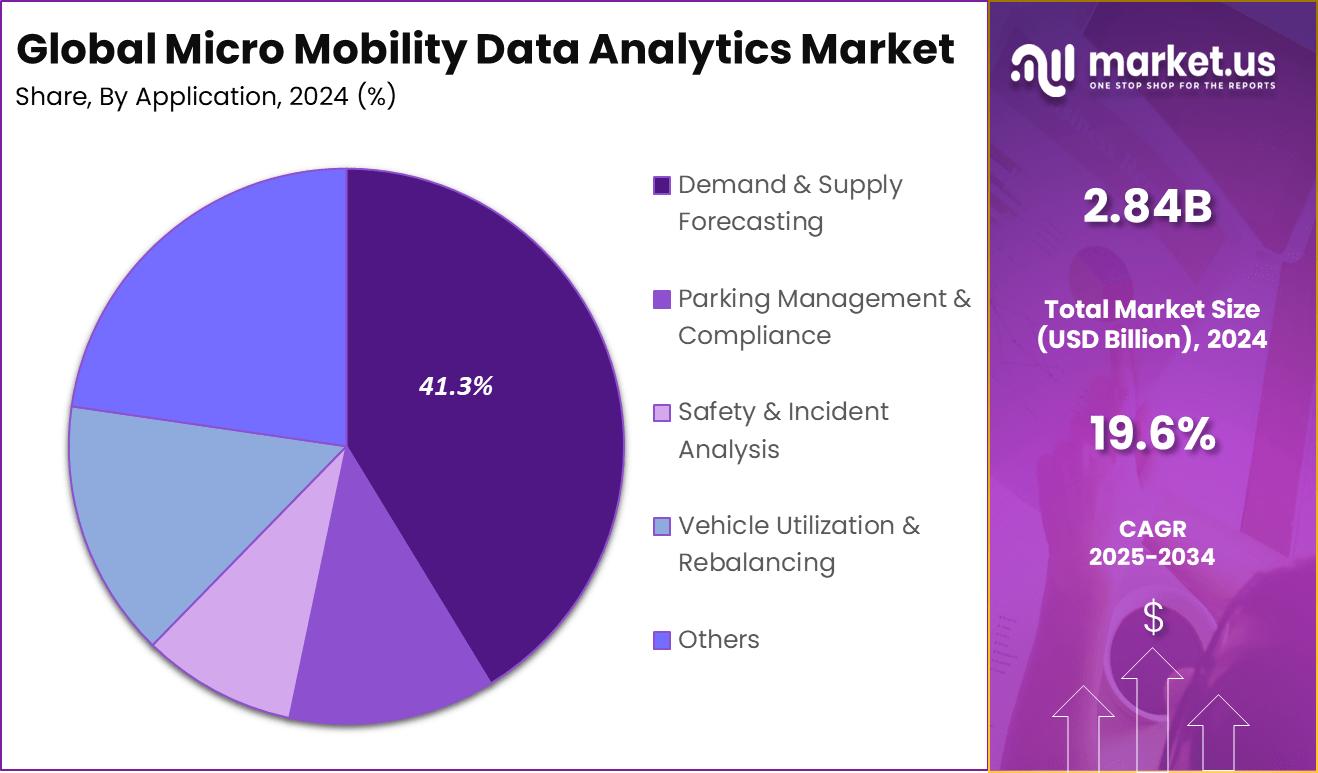

- The Demand & Supply Forecasting segment captured a 41.3% share, supported by increasing reliance on predictive analytics for ride allocation and route optimization.

- By end-user, Micro Mobility Service Providers led the market with a 44.6% share, driven by their adoption of data-driven tools for improved user engagement and fleet management.

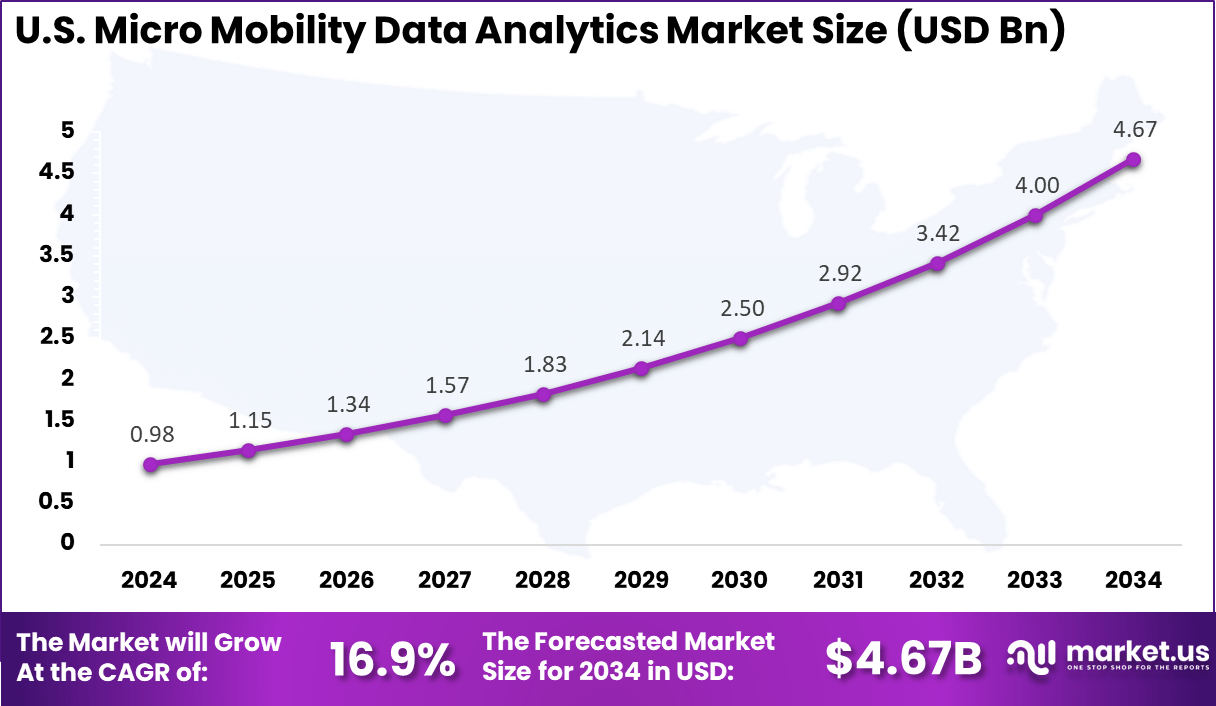

- The United States Micro Mobility Data Analytics Market was valued at USD 0.98 billion in 2024, recording a robust CAGR of 16.9% during the study period.

- Regionally, North America maintained a dominant position, accounting for over 38.2% of the global market share in 2024, owing to the strong presence of connected mobility infrastructure and high penetration of shared mobility services.

Role of Generative AI

The significance of generative AI in micro mobility data analytics is growing quickly, now powering smarter insights that lead to more effective city traffic and fleet planning. In 2025, around 43% of urban mobility providers have already woven generative AI into their data workflows, helping them automate route optimization and predict maintenance needs with surprising accuracy.

As generative AI continues its advance, it’s helping turn raw ride data into ready-to-act intelligence, boosting operational speed by about 55% for those early adopters. With these machine-crafted predictions, micro mobility operators are now cutting turnaround time for incident response by almost half, giving real meaning to data-driven urban navigation.

Investment and Business Benefits

Key investment opportunities lie in infrastructure development supporting charging and parking, advanced AI analytics for fleet optimization, and partnerships with city administrations for data sharing. Emerging business models include subscription services and strategic alliances with e-commerce firms for last-mile delivery, opening lucrative avenues. Investors focus on technologies that improve vehicle longevity and user experience to enhance profitability in a competitive ecosystem.

Business benefits from data analytics range from improved operational efficiency with predictive maintenance, reducing downtime by up to 30 percent, to enhanced customer satisfaction through personalized ride recommendations and seamless app integration. Analytics-driven micro mobility contributes to reduced carbon emissions by promoting alternatives to conventional cars, aiding cities in meeting climate goals. Data insights also help detect and prevent misuse or vandalism, lowering costs for operators.

U.S. Market Size

The market for Micro Mobility Data Analytics within the U.S. is growing tremendously and is currently valued at USD 0.98 billion, the market has a projected CAGR of 16.9%. The expansion is fueled by increasing urban congestion and a rising focus on environmentally friendly transportation solutions. Cities are enhancing infrastructure, such as dedicated bike lanes, to support safe, efficient micro mobility options.

Government policies encouraging sustainability and investments in smart fleet management technologies also boost adoption. Additionally, the growing consumer preference for cost-effective, convenient last-mile connectivity strongly drives demand for advanced data analytics solutions in micro mobility services.

For instance, in June 2025, Lime, headquartered in San Francisco, is preparing for a U.S. IPO, aiming to capitalize on its established leadership with 270,000 rentable vehicles across 30 countries. Lime reported four consecutive years of 30%+ growth with strong profitability and strategic partnerships in North America, including Uber, boosting its footprint in key cities.

In 2024, North America held a dominant market position in the Global Micro Mobility Data Analytics Market, capturing more than a 38.2% share, holding USD 1.08 billion in revenue. This dominance is driven by rapid urbanization and increasing efforts to reduce traffic congestion in major cities. The region’s strong focus on sustainability and emission reduction encourages the adoption of eco-friendly transportation alternatives like micro mobility.

Government initiatives to expand infrastructure, such as dedicated bike lanes and smart city projects, further support market growth. Additionally, the high penetration of smartphones and seamless integration of micro mobility with public transit networks enhance user convenience, driving broader adoption and market expansion in North America.

For instance, in October 2025, Joyride has solidified its leadership in North America by enabling fleet operators to accelerate deployment speed by up to 80% through its advanced connected mobility platform. Joyride’s turnkey software solution offers real-time fleet analytics, predictive maintenance, and automated rentals, driving significant operational efficiencies for U.S. and Canadian markets.

Component Analysis

In 2024, The Software/Platform segment held a dominant market position, capturing a 56.8% share of the Global Micro Mobility Data Analytics Market. This prominence highlights the importance of software solutions in gathering, processing, and analyzing big data from micro mobility vehicles. Such platforms help operators manage fleets, enable real-time vehicle monitoring, and enhance user services through integrated applications.

The emphasis on robust software ensures smoother operations and data-driven decision-making. Providers lean heavily on scalable software that supports multiple functionalities, including user engagement, payment processing, and compliance management. The evolving landscape requires these platforms to be adaptable and secure, matching the pace of growing urban micro mobility deployment.

For Instance, in October 2024, Joyride launched Revii, a backend fleet solution and vehicle rental app for lightweight electric vehicles. This software platform includes fleet management dashboards with real-time GPS tracking, analytics, operational tools, and automated workflows, helping operators optimize fleet usage and revenue streams efficiently. Joyride’s software capabilities enable faster market entry and enhanced data insights.

Service Type Analysis

In 2024, the Vehicle Tracking & Telematics segment held a dominant market position, capturing a 38.4% share of the Global Micro Mobility Data Analytics Market. This service type is essential for continuous location tracking, trip monitoring, and vehicle diagnostics. Telematics data enables operators to optimize fleet utilization, preemptively address maintenance needs, and improve overall safety and efficiency.

As shared micro mobility fleets grow, the reliance on telematics intensifies to ensure smooth operations in urban environments. Integration with IoT networks and cloud analytics allows operators to enhance theft prevention, route planning, and customer service, making telematics a cornerstone of effective fleet management.

For instance, in October 2025, Lime introduced Pulse Pro, an advanced IoT telematics device enabling real-time tracking and monitoring of batteries and vehicles. This GPS-enabled device supports continuous data transfer for fleet and battery health analytics, helping micro mobility operators ensure vehicle availability and optimize maintenance schedules.

Deployment Mode Analysis

In 2024, The Cloud-based segment held a dominant market position, capturing a 63.7% share of the Global Micro Mobility Data Analytics Market. This preference supports the high scalability and flexibility required to handle the enormous data inflows from micro mobility networks.

Cloud solutions enable operators to dynamically adjust resources according to demand, reducing infrastructure costs while ensuring quick access to data analytics. The cloud also enhances collaborative data sharing with city planners and transit agencies, fostering smarter urban mobility ecosystems. Its security features and easy integration with emerging technologies make it a preferred mode for many service providers.

For Instance, in August 2024, TIER Mobility implemented a cloud-based data analytics infrastructure to manage over 350,000 e-scooters and e-bikes across 560 cities. Their data team uses cloud platforms for supply-demand balancing, fleet compliance, and operational efficiency, leveraging on-demand resource scaling for rapid growth.

Application Analysis

In 2024, the Demand & Supply Forecasting segment held a dominant market position, capturing a 41.3% share of the Global Micro Mobility Data Analytics Market. Accurate predictions of user demand and vehicle availability are crucial for maintaining efficient operations. Forecasting models analyze patterns related to time, location, weather, and special events to optimize fleet distribution and maximize utilization.

This application reduces downtime and waiting periods for users, while controlling operational costs for providers. It plays a vital role in managing peak usage and ensuring a balanced supply of vehicles across service areas.

For Instance, in August 2024, TIER Mobility uses data-driven forecasting models to allocate vehicles across locations efficiently. Their predictive supply-demand approach increases fleet utilization and enhances user satisfaction by ensuring vehicles are available where and when needed, directly contributing to profitability.

End-User Analysis

In 2024, The Micro Mobility Service Providers segment held a dominant market position, capturing a 44.6% share of the Global Micro Mobility Data Analytics Market. These operators rely on data analytics to optimize fleet management, drive operational efficiencies, and enhance customer experience. Data insights from vehicle usage, maintenance, and rider behavior support continuous service improvements and regulatory compliance.

With the increasing adoption of shared micro mobility in urban areas, service providers are investing heavily in analytics capabilities to stay competitive and scalable. Their strategic use of data is essential to achieving operational sustainability and expanding service networks.

For Instance, in October 2025, Dott, a leading micro mobility operator in Europe, renewed its contract for delivering a next-generation e-bike fleet in Paris. Dott leverages comprehensive data analytics for managing service reliability and expanding operational footprint, demonstrating the critical role of data in sustaining service quality and urban mobility transitions.

Emerging trends

Emerging Trends in Micro Mobility Data Analytics reveal a strong shift toward integrating AI and IoT technologies for smarter fleet management and user interaction. Currently, about 44% of micromobility platforms employ AI or machine learning tools to enhance ride safety, optimize routes, and predict maintenance needs.

Connected devices provide real-time updates on vehicle availability, battery levels, and more, fostering a seamless and personalized experience for users. The rise in smartphone and wearable app integrations is also driving frictionless access to micromobility services. Another key trend is the growing adoption of Mobility-as-a-Service (MaaS) platforms, combining multiple transport modes into unified apps that simplify trip planning and payments.

About 38% of operators are exploring autonomous and robotic technologies to reduce operational costs, such as automated vehicle charging and maintenance. Sustainable vehicle design focusing on durability and eco-friendliness further underscores user demand for long-lasting, green mobility options. These trends collectively shape a future of highly efficient, user-centric urban transit.

Growth Factors

Growth Factors behind micro mobility data analytics are largely driven by urbanization and rising demand for sustainable transportation alternatives. More than 50% of global urban populations now seek flexible and eco-friendly transport modes to navigate traffic congestion and reduce carbon emissions.

Advances in battery technology and power efficiency, supported by data-driven fleet optimization, are fueling the adoption of electric scooters, bikes, and other light vehicles. Shifting consumer preferences toward on-demand, shared mobility solutions enhance the appeal of micro mobility.

Studies indicate that 60% of users prefer flexible, short-distance transport via shared vehicles for first- and last-mile connectivity. The increasing use of data analytics to personalize services, optimize resource allocation, and ensure safety is are additional growth drivers that enhance operational scalability and customer retention in competitive markets.

Key Market Segments

By Component

- Software/Platform

- Services

- Professional Services

- Managed Services

By Service Type

- Vehicle Tracking & Telematics

- Fleet Management Analytics

- Ride & User Analytics

- Predictive Maintenance Analytics

- Others

By Deployment Mode

- Cloud-based

- On-premise

By Application

- Demand & Supply Forecasting

- Parking Management & Compliance

- Safety & Incident Analysis

- Vehicle Utilization & Rebalancing

- Others

By End-User

- Micro Mobility Service Providers

- City Governments & Municipalities

- Fleet Management Companies

- Consulting Firms

Drivers

Growing Urban Congestion and Need for Efficient Transportation

Traffic congestion in cities continues to put pressure on traditional transportation systems, leading commuters to seek faster and more flexible alternatives. Micro mobility offers a convenient solution by providing compact vehicles that can weave through crowded streets and cover short distances efficiently. This creates a growing need for data analytics to optimize fleet deployment, track usage patterns, and improve overall service quality for riders and operators.

Data analytics enables operators to understand real-time demand fluctuations and reposition vehicles accordingly, reducing wait times and making services more reliable. The ability to analyze rider behavior and traffic trends helps cities and companies ease urban congestion while promoting eco-friendly transport options. Thus, the increasing urban congestion directly drives the adoption of micro mobility data analytics as a vital tool for smarter, sustainable transportation.

For instance, in October 2025, Joyride upgraded its connected mobility platform with instant fleet analytics and automated management tools to improve operational efficiency. The update enhances urban micro mobility by enabling smarter vehicle allocation, reducing wait times, and supporting data-driven decision-making for optimized fleet performance amid growing urban congestion.

Restraint

Inadequate Charging and Parking Infrastructure

A significant constraint hindering micro mobility uptake and analytics utility is the lack of sufficient charging stations and parking spots, especially in dense urban areas. Without adequate infrastructure, vehicles face downtime due to limited battery recharge options, and users struggle to find convenient parking, limiting the use frequency and overall service reach. This reduces the effectiveness of fleet management data because operational realities restrict vehicle availability.

Additionally, the challenge of integrating micro mobility into crowded cityscapes where sidewalk space is limited makes scaling services difficult. Infrastructure shortfalls cause operational disruptions that data systems alone cannot overcome, restricting market growth and undermining the returns on investment in analytics platforms designed to boost efficiency.

For instance, in August 2025, the merged entity of TIER and Dott faced operational challenges due to limited urban infrastructure, including insufficient charging stations and parking for their large e-scooter and e-bike fleets operating in over 400 cities. Although battery swapping has been introduced to minimize downtime, infrastructure constraints continue to hinder fleet efficiency and restrict service expansion, underscoring a major limitation affecting the real-time potential of data analytics in mobility management.

Opportunities

AI and Connectivity to Enhance Fleet Management

The convergence of artificial intelligence and connectivity technologies presents a major growth opportunity for micro mobility data analytics. AI algorithms can analyze vast fleets’ operational data to predict maintenance needs, adjust vehicle positioning, and personalize rider experiences. Connectivity tech allows continuous real-time data transmission, enabling smart dashboards and automated responses to changing conditions.

These advances reduce costs, improve safety, and enhance customer satisfaction, creating competitive advantages for early adopters. Integrating AI-powered analytics with connected vehicles fosters proactive operations and allows companies to scale services efficiently. This technological synergy opens new horizons for growth and innovation within micro mobility ecosystems.

For instance, in July 2025, Lime shared its commitment to data analytics and smart mobility by collaborating with cities and research institutions. Their sharing of detailed operational data helps cities better understand travel patterns and improve infrastructure planning. Lime’s integration of IoT sensors and connectivity technologies to gather comprehensive usage data opens new possibilities for AI-driven fleet optimization, predictive maintenance, and enhanced safety.

Challenges

Regulatory Fragmentation and Safety Issues

Regulatory inconsistency across regions remains a major hurdle for micro mobility data analytics adoption. Different cities and countries impose varying rules on vehicle types, speed limits, and usage restrictions, forcing operators to customize solutions locally. This creates complexity for standardizing data collection and analytics applications across broader geographies.

Safety concerns, including battery fires, theft, and vandalism, add another layer of difficulty, causing higher insurance premiums and operational risks. These factors slow innovation and investment in analytics tools, as companies must first overcome fragmented regulatory landscapes and ensure secure, compliant operations to unlock the full benefits of data-driven insights.

For instance, in October 2025, Bird reiterated its active role in responsible data sharing with cities through the Open Mobility Foundation. Bird’s commitment to privacy and data security is critical amid varied local regulations governing micro mobility operations. The regulatory patchwork and safety concerns, like theft or improper parking, create complexity for Bird’s data analytics implementations, requiring tailored compliance efforts that slow broader scalability.

Key Players Analysis

The Micro Mobility Data Analytics Market is led by global and regional mobility innovators such as Lime, Bird, Tier Mobility, and Dott. These companies integrate advanced analytics, IoT sensors, and AI-driven platforms to optimize fleet management, route efficiency, and user experience. Their data solutions help improve vehicle availability, reduce maintenance downtime, and enhance operational transparency across shared e-scooter and e-bike networks.

Prominent players including Joyride, Movatic, Superpedestrian, and Zipp Mobility focus on data platforms that enable operators and cities to analyze rider behavior, traffic flow, and carbon emission reduction. Their technologies support predictive maintenance, smart parking, and performance tracking to improve safety and sustainability within urban mobility ecosystems.

Additional participants such as RidePanda, Bolt, Spin, Helbiz, Swiftmile, Voi Technology, and other market contributors are advancing real-time analytics and data-sharing frameworks between public and private stakeholders. Their emphasis on interoperability, predictive modeling, and city-integrated analytics continues to shape the future of connected micro-mobility infrastructure worldwide.

Top Key Players in the Market

- LMTS

- Joyride

- Movatic

- Tier Mobility

- Lime

- Bird

- Superpedestrian

- Dott

- RidePanda

- Zipp Mobility

- Bolt

- Spin

- Helbiz

- Swiftmile

- Voi Technology

- Others

Recent Developments

- In October 2025, Joyride continues to strengthen its position as one of the most advanced connected mobility platforms, delivering automated vehicle rentals, live fleet analytics, and predictive maintenance features. The company claims that its platforms can accelerate fleet deployment speed by up to 80%, transforming vehicles into smart, data-driven assets efficiently.

- In June 2025, Bird unveiled an enhanced fleet of electric scooters and e-bikes across major North American cities such as Denver, Los Angeles, and Austin, focusing on improved safety features and performance to better meet urban commuters’ demands. Bird’s new fleet is designed to reinforce its leadership in shared micromobility and ecosystem intelligence with continued investment in smart vehicle technology.

Report Scope

Report Features Description Market Value (2024) USD 2.84 Bn Forecast Revenue (2034) USD 17.01 Bn CAGR(2025-2034) 19.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platform, Services), By Service Type (Vehicle Tracking & Telematics, Fleet Management Analytics, Ride & User Analytics, Predictive Maintenance Analytics, Others), By Deployment Mode (Cloud-based, On-premise), By Application (Demand & Supply Forecasting, Parking Management & Compliance, Safety & Incident Analysis, Vehicle Utilization & Rebalancing, Others), By End-User (Micro Mobility Service Providers, City Governments & Municipalities, Fleet Management Companies, Consulting Firms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LMTS, Joyride, Movatic, Tier Mobility, Lime, Bird, Superpedestrian, Dott, RidePanda, Zipp Mobility, Bolt, Spin, Helbiz, Swiftmile, Voi Technology, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Micro Mobility Data Analytics MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Micro Mobility Data Analytics MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LMTS

- Joyride

- Movatic

- Tier Mobility

- Lime

- Bird

- Superpedestrian

- Dott

- RidePanda

- Zipp Mobility

- Bolt

- Spin

- Helbiz

- Swiftmile

- Voi Technology

- Others