Global Mezzanine Floor Market Size, Share, Growth Analysis By Material (Steel, Concrete, Wood, Composite Materials), By Floor Type (Solid Panel, Open Grid, Combination), By Load Capacity (Lightweight (up to 150 lbs/sq ft), Medium (150-500 lbs/sq ft), Heavy (over 500 lbs/sq ft)), By End-Use (Warehousing and Distribution, Manufacturing, Retail, Automotive, Aerospace, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174301

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

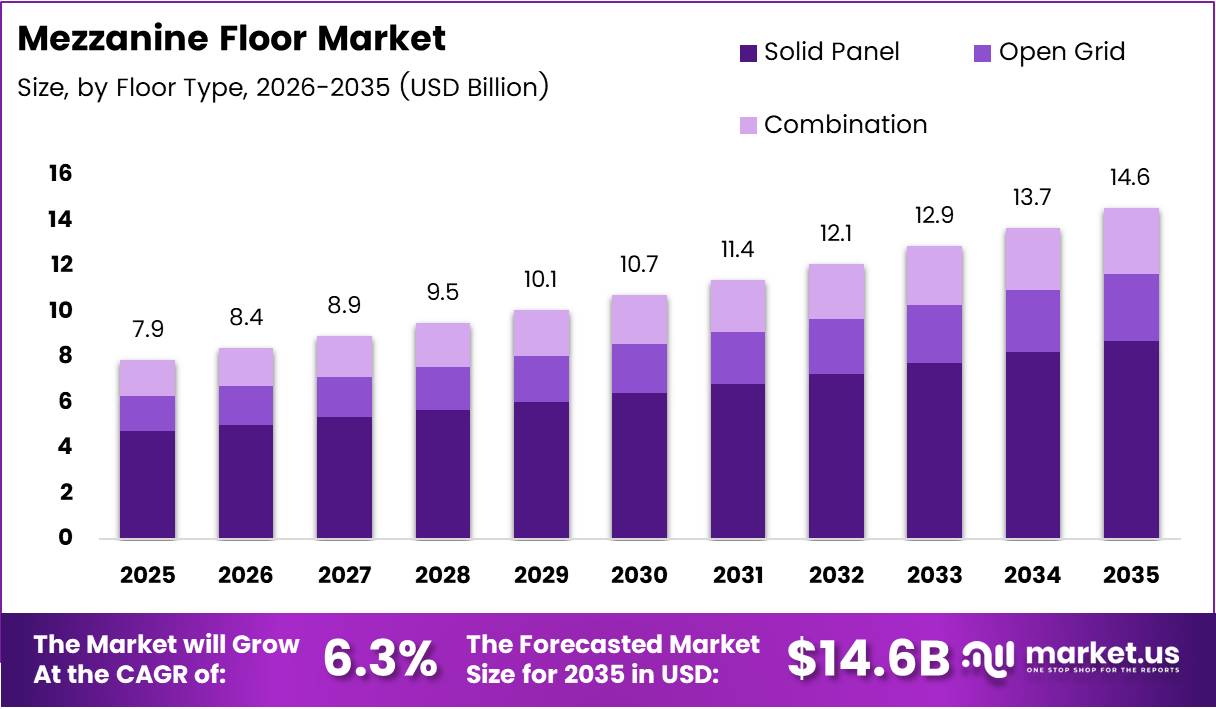

Global Mezzanine Floor Market size is expected to be worth around USD 14.6 Billion by 2035 from USD 7.9 Billion in 2025, growing at a CAGR of 6.3% during the forecast period 2026 to 2035.

A mezzanine floor is an intermediate level constructed between the main floors of a building. It maximizes vertical space without expanding the building footprint. Moreover, these structures provide cost-effective solutions for warehousing, manufacturing, and retail operations requiring additional floor area.

The mezzanine floor market is experiencing substantial growth driven by warehouse automation and e-commerce expansion. Industries are increasingly adopting these solutions to optimize space utilization. Consequently, demand for multi-tier storage systems continues to rise across manufacturing and distribution sectors globally.

Rapid expansion of e-commerce fulfillment centers significantly drives market growth. Additionally, industrial real estate cost inflation compels businesses to maximize existing space efficiently. Therefore, mezzanine floors offer practical alternatives to expensive building expansions or relocations for growing enterprises.

Manufacturing plant modernization across automotive and FMCG sectors further accelerates market development. However, structural load compliance barriers in older commercial buildings present notable challenges. Despite this, technological advancements in prefabricated and modular systems continue supporting industry momentum.

Smart mezzanine integration with robotics and conveyor systems represents significant growth opportunities. Furthermore, rapid penetration in cold storage and pharmaceutical warehousing expands market applications. Custom modular solutions for small urban warehouses also gain traction among space-constrained operations.

Infrastructure expansion across logistics parks and industrial corridors creates substantial market potential. Additionally, increasing adoption of fire-rated and seismic-resistant designs enhances safety compliance. The shift toward bolt-together prefabricated systems simplifies installation while reducing operational downtime.

Integration with automated storage and retrieval systems transforms warehouse efficiency standards. Moreover, demand for relocatable and reusable platforms grows among businesses requiring flexible space solutions. This trend particularly benefits industries experiencing seasonal volume fluctuations or frequent layout modifications.

Key Takeaways

- Global Mezzanine Floor Market valued at USD 7.9 Billion in 2025, projected to reach USD 14.6 Billion by 2035 at 6.3% CAGR.

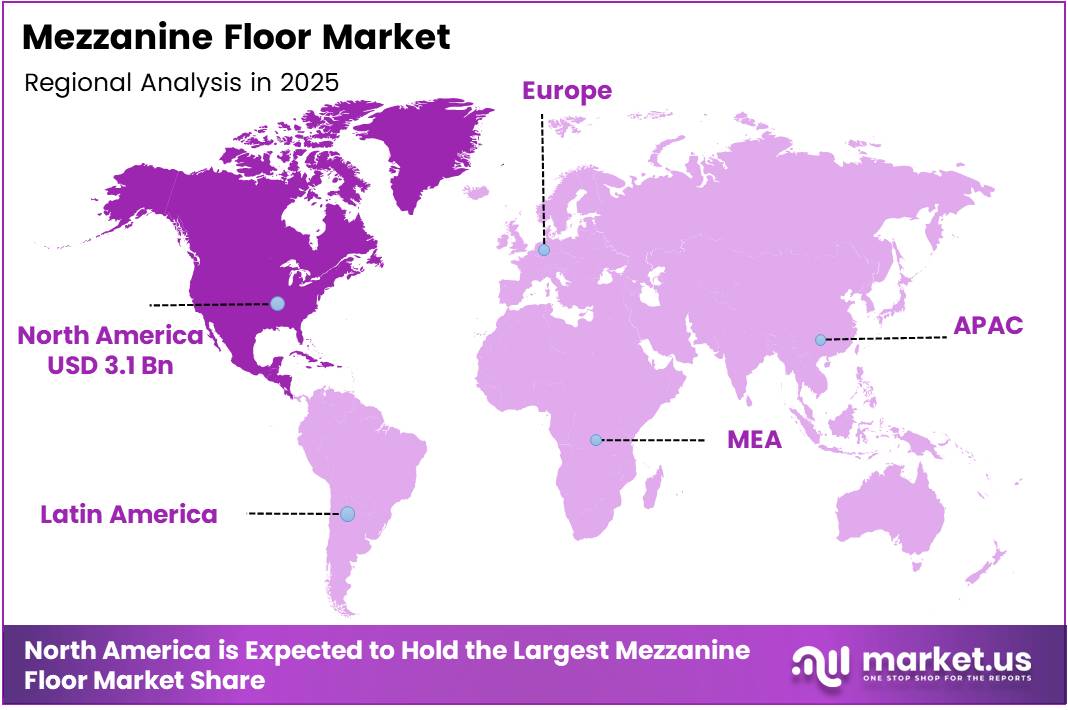

- North America dominates with 39.5% market share, valued at USD 3.1 Billion.

- Steel material segment leads with 69.3% market share.

- Solid Panel floor type holds 54.7% market dominance.

- Lightweight load capacity segment captures 51.2% share.

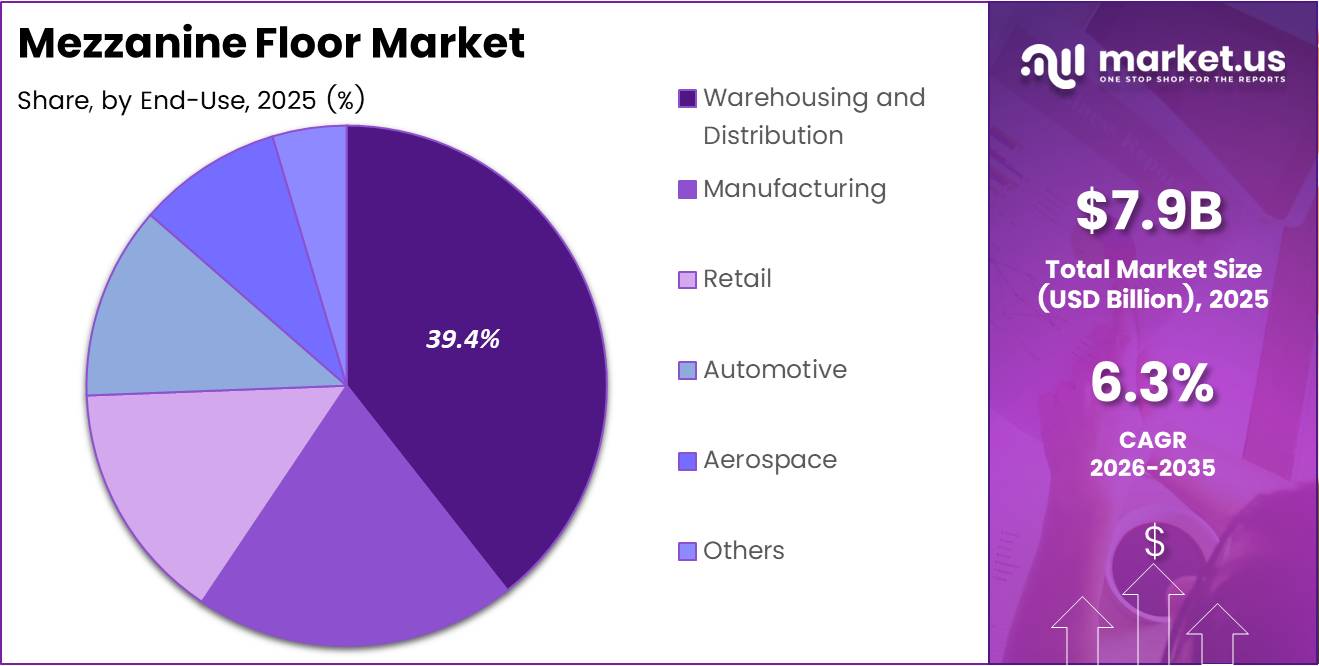

- Warehousing and Distribution end-use leads with 39.4% market share.

Material Analysis

Steel dominates with 69.3% due to superior structural strength and durability advantages.

In 2025, Steel held a dominant market position in the By Material Analysis segment of Mezzanine Floor Market, with a 69.3% share. Steel offers exceptional load-bearing capacity and resistance to wear. Moreover, it provides cost-effective long-term performance for industrial applications. Therefore, manufacturing and warehousing sectors prefer steel for heavy-duty installations.

Concrete provides excellent fire resistance and soundproofing capabilities for mezzanine installations. However, it requires more robust structural support due to heavier weight. Additionally, concrete suits applications demanding enhanced safety and thermal insulation. Construction complexity limits its adoption compared to lighter alternatives.

Wood offers aesthetic appeal and easier customization for retail environments. Furthermore, it provides adequate strength for lightweight applications at competitive costs. However, fire safety concerns and limited load capacity restrict its industrial usage. Consequently, wood primarily serves commercial and office space applications.

Composite materials combine multiple material benefits for specialized applications. Additionally, they offer corrosion resistance and reduced maintenance requirements. Moreover, composites provide design flexibility for unique architectural requirements. However, higher costs limit widespread adoption across standard industrial installations.

Floor Type Analysis

Solid Panel dominates with 54.7% due to versatile applications and enhanced safety features.

In 2025, Solid Panel held a dominant market position in the By Floor Type Analysis segment of Mezzanine Floor Market, with a 54.7% share. Solid panels provide complete coverage ensuring worker safety and material protection. Moreover, they prevent debris falling between levels in multi-tier operations. Therefore, warehousing and manufacturing facilities predominantly choose solid panel configurations.

Open Grid designs facilitate better ventilation and lighting penetration through floor levels. Additionally, they reduce structural weight while maintaining adequate load distribution. However, safety concerns regarding smaller items falling limit applications. Consequently, open grid suits specific industrial environments requiring airflow management.

Combination floor types merge solid panel and open grid benefits strategically. Furthermore, they optimize functionality by placing solid sections where needed. This flexibility accommodates diverse operational requirements within single installations. Therefore, combination systems gain popularity in complex warehouse operations.

Load Capacity Analysis

Lightweight capacity dominates with 51.2% due to extensive retail and office applications.

In 2025, Lightweight (up to 150 lbs/sq ft) held a dominant market position in the By Load Capacity Analysis segment of Mezzanine Floor Market, with a 51.2% share. Lightweight systems provide cost-effective solutions for office and retail storage needs. Moreover, they require less structural reinforcement reducing installation complexity. Therefore, commercial applications extensively adopt lightweight capacity mezzanines.

Medium capacity systems (150-500 lbs/sq ft) serve light manufacturing and general warehouse operations. Additionally, they balance structural requirements with operational flexibility effectively. However, higher installation costs compared to lightweight options limit market penetration. Consequently, medium capacity suits mid-range industrial applications.

Heavy capacity installations (over 500 lbs/sq ft) support intensive industrial manufacturing operations. Furthermore, they accommodate heavy machinery and bulk material storage requirements. However, significant structural reinforcement demands increase project costs substantially. Therefore, heavy capacity remains limited to specialized automotive and aerospace applications.

End-Use Analysis

Warehousing and Distribution dominates with 39.4% due to exponential e-commerce growth.

In 2025, Warehousing and Distribution held a dominant market position in the By End-Use Analysis segment of Mezzanine Floor Market, with a 39.4% share. E-commerce expansion drives massive demand for multi-tier storage solutions. Moreover, logistics optimization requires maximizing vertical space in fulfillment centers. Therefore, warehousing operations represent the largest mezzanine floor application segment.

Manufacturing facilities utilize mezzanines for production floor expansion and equipment placement. Additionally, they create elevated work platforms for assembly line operations. However, production continuity concerns during installation sometimes delay adoption. Consequently, manufacturing represents substantial but secondary market demand.

Retail environments implement mezzanines for additional display areas and back-office operations. Furthermore, they enhance customer experience through improved store layouts. However, aesthetic considerations and building code compliance add complexity. Therefore, retail adoption grows steadily but faces unique implementation challenges.

Automotive industry employs mezzanines for parts storage and assembly line support. Additionally, they optimize factory floor layouts for efficient production workflows. Moreover, heavy-duty requirements demand specialized engineering and installation expertise. Consequently, automotive represents a premium but specialized market segment.

Aerospace facilities require mezzanines meeting stringent safety and load specifications. Furthermore, they support complex manufacturing processes and component storage needs. However, regulatory compliance requirements increase project timelines significantly. Therefore, aerospace applications represent niche but high-value market opportunities.

Other end-use applications include pharmaceutical, food processing, and logistics facilities. Additionally, these sectors demand specialized configurations meeting industry-specific regulations. Moreover, custom solutions drive innovation in mezzanine design and materials. Consequently, diverse applications continue expanding overall market scope.

Key Market Segments

By Material

- Steel

- Concrete

- Wood

- Composite Materials

By Floor Type

- Solid Panel

- Open Grid

- Combination

By Load Capacity

- Lightweight (up to 150 lbs/sq ft)

- Medium (150-500 lbs/sq ft)

- Heavy (over 500 lbs/sq ft)

By End-Use

- Warehousing and Distribution

- Manufacturing

- Retail

- Automotive

- Aerospace

- Others

Drivers

Surge in Warehouse Automation Requiring Vertical Space Optimization Drives Market Growth

Warehouse automation rapidly transforms logistics operations requiring efficient vertical space utilization. Moreover, automated systems demand multi-level configurations for optimal equipment placement. Consequently, mezzanine floors become essential infrastructure supporting robotics and conveyor integration throughout modern facilities.

E-commerce fulfillment centers expand aggressively to meet consumer delivery expectations nationwide. Additionally, multi-tier storage solutions maximize inventory capacity within existing building footprints. Therefore, distribution operators increasingly invest in mezzanine installations supporting rapid order processing capabilities.

Industrial real estate costs escalate significantly across major manufacturing and logistics hubs. Furthermore, building expansions prove prohibitively expensive compared to vertical space optimization. Consequently, businesses prioritize mezzanine installations delivering immediate capacity increases without property acquisition costs.

Manufacturing plant modernization initiatives across automotive and FMCG sectors drive infrastructure upgrades. Moreover, production efficiency demands require reorganized factory layouts with elevated work platforms. Therefore, mezzanine solutions support operational transformations while maintaining continuous production schedules.

Restraints

Structural Load Compliance Barriers In Older Commercial Buildings Restrain Market Expansion

Older commercial buildings frequently lack structural capacity for supporting mezzanine installations safely. Moreover, retrofitting existing facilities requires expensive foundation reinforcements and engineering assessments. Consequently, building age significantly impacts project feasibility and increases overall implementation costs substantially.

Structural load compliance verification demands comprehensive engineering evaluations before installation approval. Additionally, building codes vary significantly across jurisdictions creating regulatory complexity. Therefore, compliance processes extend project timelines while adding professional consultation expenses for facility operators.

High installation downtime disrupts continuous production operations in active manufacturing facilities. Furthermore, businesses face revenue losses during mezzanine construction and equipment relocation phases. Consequently, operational continuity concerns delay adoption decisions despite long-term space optimization benefits.

Safety regulations require temporary shutdowns for structural modifications in occupied buildings. Moreover, coordination between construction crews and ongoing operations creates logistical challenges. Therefore, installation timing becomes critical factor influencing project approval and implementation schedules.

Growth Factors

Smart Mezzanine Integration With Robotics And Conveyor Systems Creates Growth Opportunities

Smart mezzanine systems integrate seamlessly with advanced robotics and automated material handling equipment. Moreover, IoT sensors enable real-time structural monitoring and predictive maintenance capabilities. Consequently, intelligent infrastructure attracts technology-forward logistics operators seeking competitive operational advantages.

Rapid penetration in cold storage and pharmaceutical warehousing expands specialized market applications. Additionally, temperature-controlled facilities require vertical space optimization due to high construction costs. Therefore, mezzanine solutions prove particularly valuable in regulated industries demanding environmental control.

Custom modular mezzanine solutions address space constraints in small urban warehouses effectively. Furthermore, prefabricated systems enable faster installation with minimal operational disruption. Consequently, small and medium enterprises access space optimization previously limited to large facilities.

Infrastructure expansion across logistics parks and industrial corridors generates substantial demand nationwide. Moreover, government initiatives supporting manufacturing growth accelerate industrial facility development. Therefore, new construction projects increasingly incorporate mezzanine designs from initial planning stages.

Emerging Trends

Shift Toward Bolt-Together Prefabricated Mezzanine Systems Transforms Industry Standards

Bolt-together prefabricated systems simplify installation while reducing construction timelines significantly. Moreover, modular designs enable future reconfiguration supporting evolving business requirements. Consequently, relocatable mezzanine platforms gain popularity among companies anticipating operational changes or facility relocations.

Fire-rated and seismic-resistant mezzanine designs address enhanced safety compliance standards nationwide. Additionally, building code evolution demands stronger structural specifications protecting workers and inventory. Therefore, manufacturers develop advanced engineering solutions meeting stringent regulatory requirements across jurisdictions.

Integration with automated storage and retrieval systems revolutionizes warehouse efficiency benchmarks. Furthermore, coordinated infrastructure design optimizes material flow between mezzanine levels and ground operations. Consequently, sophisticated installations deliver unprecedented productivity gains for high-volume distribution centers.

Relocatable and reusable mezzanine platforms provide flexibility for seasonal businesses and growing enterprises. Moreover, demountable systems protect capital investments during facility relocations or operational restructuring. Therefore, businesses increasingly prioritize adaptable infrastructure supporting long-term strategic flexibility.

Regional Analysis

North America Dominates the Mezzanine Floor Market with a Market Share of 39.5%, Valued at USD 3.1 Billion

North America leads the global mezzanine floor market with a dominant 39.5% share, valued at USD 3.1 Billion. The region benefits from extensive e-commerce infrastructure and advanced warehouse automation adoption. Moreover, established manufacturing sectors and stringent space optimization requirements drive substantial demand. Additionally, favorable industrial real estate conditions support continued market expansion throughout the forecast period.

Europe Mezzanine Floor Market Trends

Europe demonstrates strong market presence driven by logistics modernization and industrial facility upgrades. Moreover, stringent building regulations promote high-quality mezzanine installations across manufacturing sectors. Additionally, automotive and aerospace industries contribute significant demand for specialized heavy-duty systems. Therefore, European markets continue evolving with emphasis on safety and sustainability standards.

Asia Pacific Mezzanine Floor Market Trends

Asia Pacific exhibits rapid growth potential fueled by manufacturing expansion and warehousing infrastructure development. Furthermore, e-commerce penetration drives fulfillment center construction requiring vertical space solutions. Additionally, industrial corridor development across China and India creates substantial opportunities. Consequently, regional markets attract significant investment from global mezzanine system providers.

Latin America Mezzanine Floor Market Trends

Latin America shows emerging demand driven by industrial modernization and logistics infrastructure improvements. Moreover, manufacturing sector growth particularly in automotive and consumer goods supports adoption. Additionally, urbanization increases warehouse space constraints requiring optimization solutions. Therefore, regional markets present opportunities despite economic volatility challenges.

Middle East & Africa Mezzanine Floor Market Trends

Middle East and Africa demonstrate steady growth supported by logistics hub development and industrial diversification. Furthermore, free trade zones and manufacturing initiatives drive warehouse construction requiring space optimization. Additionally, retail expansion in urban centers creates commercial mezzanine applications. Consequently, regional infrastructure investments support long-term market development prospects.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Mezzanine Floor Company Insights

Daifuku Co. Ltd. maintains strong global presence through comprehensive material handling solutions including advanced mezzanine systems. The company leverages automation expertise to deliver integrated warehouse infrastructure supporting modern logistics operations. Moreover, continuous innovation in smart storage solutions strengthens market positioning. Therefore, Daifuku remains influential in shaping industry standards and technological advancement.

Mezz Floors UK specializes in customized mezzanine floor design and installation across diverse industrial applications. The company emphasizes quality engineering and rapid project delivery meeting strict client specifications. Additionally, extensive UK market experience provides competitive advantages in regulatory compliance. Consequently, Mezz Floors UK maintains solid reputation for reliable commercial and industrial installations.

MiTek Mezzanine Systems, Inc. offers engineered structural solutions with emphasis on prefabricated modular systems. The company focuses on cost-effective installations minimizing operational disruption during construction phases. Furthermore, comprehensive design capabilities accommodate complex warehouse and manufacturing requirements. Therefore, MiTek continues expanding market share through customer-focused innovation.

Mecalux S.A delivers integrated storage solutions combining mezzanine floors with automated material handling equipment. The company’s global footprint enables large-scale logistics projects across multiple regions simultaneously. Moreover, technological integration capabilities attract customers seeking comprehensive warehouse modernization. Consequently, Mecalux maintains leadership position in sophisticated industrial storage markets.

Key Companies

- Daifuku Co. Ltd.

- Mezz Floors UK

- MiTek Mezzanine Systems, Inc.

- Mecalux S.A

- STILL GmbH

- Gonvarri Material Handling

- Avanta UK

- SSI Schaefer Group

- Jungheinrich AG

- Wildeck Inc

Recent Developments

- In March 2025, QTS Ltd acquired HiStore representing Whittan Group’s brand and expertise for mezzanine floor design and supply. This strategic acquisition expands QTS Ltd’s capabilities in delivering comprehensive storage solutions. Moreover, it strengthens market position through enhanced technical expertise and expanded product portfolio.

- In February 2025, Mezzanine Safeti-Gates, Inc. launched RobotGate specifically designed for automated safety applications in modern warehouses. This innovative product addresses growing demand for robotics-compatible infrastructure solutions. Additionally, RobotGate enhances worker safety while facilitating seamless automation integration throughout multi-level facilities.

Report Scope

Report Features Description Market Value (2025) USD 7.9 Billion Forecast Revenue (2035) USD 14.6 Billion CAGR (2026-2035) 6.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Steel, Concrete, Wood, Composite Materials), By Floor Type (Solid Panel, Open Grid, Combination), By Load Capacity (Lightweight (up to 150 lbs/sq ft), Medium (150-500 lbs/sq ft), Heavy (over 500 lbs/sq ft)), By End-Use (Warehousing and Distribution, Manufacturing, Retail, Automotive, Aerospace, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Daifuku Co. Ltd., Mezz Floors UK, MiTek Mezzanine Systems, Inc., Mecalux S.A, STILL GmbH, Gonvarri Material Handling, Avanta UK, SSI Schaefer Group, Jungheinrich AG, Wildeck Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Daifuku Co. Ltd.

- Mezz Floors UK

- MiTek Mezzanine Systems, Inc.

- Mecalux S.A

- STILL GmbH

- Gonvarri Material Handling

- Avanta UK

- SSI Schaefer Group

- Jungheinrich AG

- Wildeck Inc