Global Methenamine Market Size, Share, Growth Analysis By Form (Tablets, Powder, and Granules), By Application (Urinary Tract Infection (UTI) Treatment, Industrial Use, Fuel Tablets, Rubber Vulcanization, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167800

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

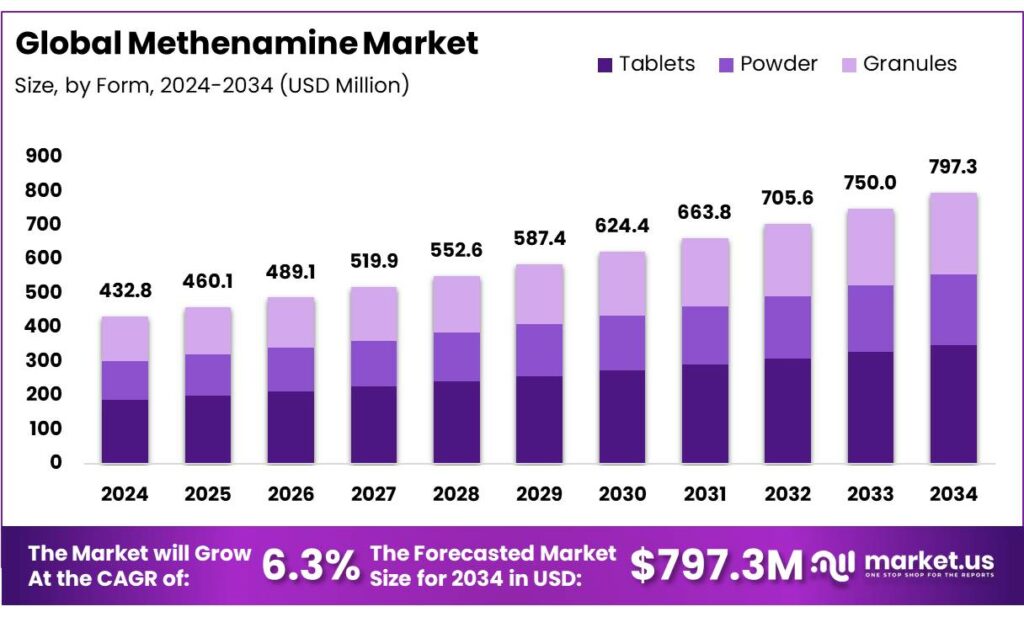

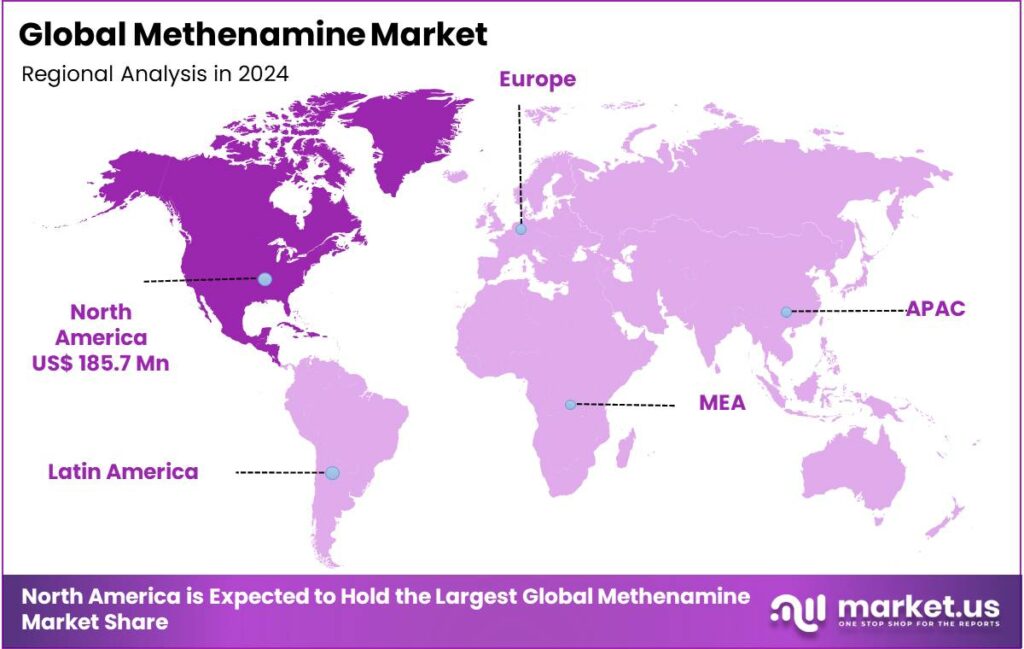

The Global Methenamine Market size is expected to be worth around USD 797.3 Million by 2034, from USD 432.8 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 42.9% share, holding USD 185.7 Million revenue.

Methenamine, known as hexamethylenetetramine (HMT) or hexamine, is a white, crystalline, organic compound with the chemical formula (CH2)6N4. It is highly soluble in water and sublimes (turns directly into a gas) when heated. It is used in a wide range of applications, including as a precursor to plastics and resins, as a urinary tract antiseptic, and as a solid fuel in camping tablets.

The market is driven by its extensive use in preventing and treating recurring UTIs, where it acts as a non-antibiotic alternative. The methenamine tablets dominate the market due to their convenience, precise dosing, stability, and patient compliance, as it is often used in healthcare facilities. However, the market faces challenges from the antibiotic alternatives such as nitrofurantoin and fosfomycin, as healthcare facilities use methenamine as a second-line treatment after antibiotics.

Additionally, rising demand from the polymer industry is boosting methenamine usage as a rubber additive, adhesion promoter, textile treatment agent, and hardening agent for phenolic resins. Furthermore, North America remains the largest regional market, supported by a strong pharmaceutical sector and robust manufacturing industry in the United States.

Key Takeaways

- The global methenamine market was valued at USD 432.8 million in 2024.

- The global methenamine market is projected to grow at a CAGR of 6.3% and is estimated to reach USD 797.3 million by 2034.

- Based on the forms, methenamine in tablet form dominated the market, with a market share of around 43.8%.

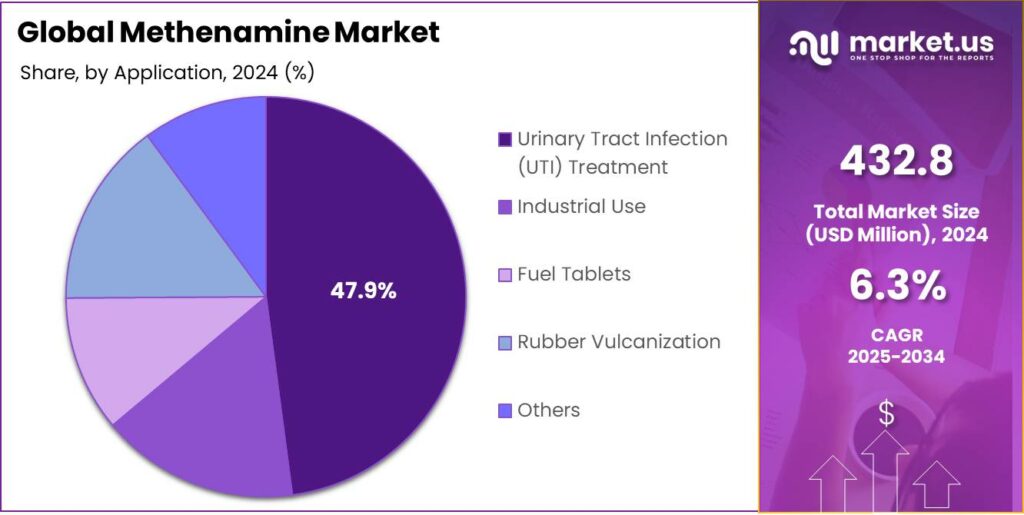

- Among the applications of methenamine, urinary tract infection (UTI) treatment held a major share in the market, 47.9% of the market share.

- In 2024, North America was the most dominant region in the methenamine market, accounting for around 42.9% of the total global consumption.

Form Analysis

Methenamine in Tablet Form Held the Largest Share in the Market.

The methenamine market is segmented based on forms into tablets, powder, and granules. The methenamine in tablet form dominated the market, comprising around 43.8% of the market share, as it is most used in healthcare facilities. It is more widely utilized than powder or granule forms primarily due to their convenience, precise dosing, stability, and patient compliance. Tablets ensure controlled and consistent release of the active compound, making them ideal for long-term urinary tract infection prophylaxis. In clinical settings, standardized dosages simplify administration and reduce dosing errors compared to powders that require manual measurement.

In addition, tablets have superior shelf stability, protecting methenamine from moisture and degradation, which is particularly important since it hydrolyzes in humid conditions. Moreover, patients prefer tablets for ease of use and portability, enhancing adherence to prescribed regimens. Hospitals and pharmacies favor tablets due to simpler storage, transport, and dispensing compared to bulk powder or granule formulations.

Application Analysis

The Methenamine Were Mostly Utilized for Urinary Tract Infection (UTI) Treatment.

Based on the applications of methenamine, the market is divided into urinary tract infection (UTI) treatment, industrial use, fuel tablets, rubber vulcanization, and other applications. The urinary tract infection (UTI) treatment dominated the market, with a market share of 47.9%. Methenamine is more widely utilized for urinary tract infection (UTI) treatment than for industrial or fuel-related applications due to its proven clinical efficacy, safety profile, and regulatory approval as a non-antibiotic urinary antiseptic.

In acidic urine, methenamine decomposes to release formaldehyde, which acts as a potent bactericidal agent without promoting antimicrobial resistance, a growing global concern. UTIs affect over 150 million people annually, creating substantial medical demand for effective prophylactic options. In contrast, its industrial applications in resins, rubber vulcanization, or solid fuel tablets are niche and often replaced by more specialized or cost-efficient chemicals. The pharmaceutical-grade use of methenamine also benefits from strong clinical validation and patient safety standards, further driving its predominance in healthcare over industrial applications.

Key Market Segments

By Form

- Tablets

- Powder

- Granules

By Application

- Urinary Tract Infection (UTI) Treatment

- Industrial Use

- Fuel Tablets

- Rubber Vulcanization

- Other Applications

Drivers

The High Prevalence of Urinary Tract Infections (UTIs) Drives the Methenamine Market.

According to the National Institutes of Health, urinary tract infections (UTIs) are the most common outpatient infections, with a lifetime incidence of 50-60% in adult women. One in five women has at least one UTI in their lifetime. Nearly 20% of these women have a second recurrence, 30% of those have a third recurrence, and 80% of those have more recurrences. The growing prevalence of urinary tract infections (UTIs) has significantly driven demand for alternative preventive and therapeutic options such as methenamine.

- According to the World Health Organization, it is estimated that bacterial antimicrobial resistance (AMR) is directly responsible for over 1.2 million global deaths annually. With increasing antibiotic resistance, traditional antibiotic treatments are becoming less effective, prompting renewed interest in non-antibiotic urinary antiseptics.

Methenamine, which releases formaldehyde in acidic urine to inhibit bacterial growth, is gaining clinical importance, particularly for recurrent UTIs in both hospital and community settings. A study by the National Institutes of Health has shown that methenamine significantly reduced the recurrence of bacteriuria at up to 25 months when compared with placebo, offering an effective and resistance-free prophylactic option. Its role is especially relevant among elderly patients, catheter users, and women prone to recurrent infections. As global health authorities emphasize antimicrobial stewardship, methenamine’s proven safety and ability to curb antibiotic dependency make it a critical component in UTI management strategies.

Restraints

Availability of Effective Alternatives Poses a Challenge to the Methenamine Market.

The methenamine market faces considerable challenges due to the availability of effective alternatives. In medical applications, newer prophylactic agents and improved antibiotic formulations such as nitrofurantoin and fosfomycin are often preferred due to broader-spectrum activity and easier administration, which reduces reliance on methenamine for urinary tract infection prevention.

Similarly, in industrial uses, alternative cross-linking and curing agents, such as hexamethylene tetramine substitutes and advanced phenolic resin systems, offer comparable performance with lower environmental impact. Moreover, according to a study by the National Institutes of Health, the methenamine hippurate should be considered as an alternative treatment to antibiotics for women with recurrent UTI.

The committee discussed that methenamine hippurate should be considered as a second-line treatment when single-dose antibiotic prophylaxis, behavioral and personal hygiene measures, and vaginal estrogen are not effective or appropriate. As industries shift toward safer and more sustainable chemicals, methenamine producers must adapt through innovation and compliance to remain competitive.

Opportunity

Application of Methenamine in the Industrial Production of Phenolic Resins Creates Opportunities in the Market.

Methenamine plays a vital role in the industrial production of phenolic resins, which are extensively used in molding compounds, adhesives, coatings, and insulation materials. Acting as a hardening or cross-linking agent, methenamine reacts with phenol and formaldehyde to produce thermosetting resins known for their high mechanical strength, heat resistance, and dimensional stability. The global production of phenolic resins exceeds several million tons annually, with key applications in automotive brake pads, circuit boards, and construction laminates.

China alone produces over 1.4 million tons of phenolic resins, and its phenolic resin production capacity is over 1.8 million tons. For instance, in the automotive sector, phenolic molding compounds reinforced with methenamine provide superior thermal resistance and durability, critical for components such as clutch facings and brake linings. In the electronics industry, methenamine-derived phenolic resins enhance the performance of printed circuit boards by improving electrical insulation.

Trends

Applications in the Polymer Industry.

Methenamine has found diverse applications in the polymer industry, particularly as a rubber additive, adhesion promoter, and textile treatment agent, reflecting its growing industrial relevance. In rubber manufacturing, methenamine is used as a vulcanization accelerator, enhancing cross-linking and improving elasticity, tensile strength, and thermal stability in products such as tires, hoses, and seals. There is production of over 2.5 billion tires annually, many of which rely on methenamine-based additives to meet performance and durability standards.

As an adhesion promoter, methenamine facilitates strong bonding between rubber and metal components in automotive and mechanical applications. In the textile sector, methenamine-based resins are employed to impart wrinkle resistance and dimensional stability to cotton and synthetic fabrics, improving fabric performance and longevity. Its multifunctional role across these sectors underscores methenamine’s importance in enhancing polymer properties and supporting innovation in high-performance materials.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Methenamine Market by Shifting Trade Flows.

The geopolitical tensions have had a notable impact on the methenamine market by disrupting global supply chains, increasing raw material costs, and influencing trade dynamics. Methenamine production relies heavily on key feedstocks such as ammonia, methanol, and formaldehyde, chemicals whose availability and pricing are closely tied to the stability of natural gas and petrochemical markets. Conflicts in regions that are major producers of natural gas, such as Eastern Europe and the Middle East, have led to supply shortages and price volatility, directly affecting methenamine manufacturing costs.

Additionally, trade restrictions and sanctions have complicated the cross-border movement of chemical intermediates, forcing producers to seek alternative suppliers or regionalize production. For instance, the European chemical manufacturers have faced higher energy prices and logistical bottlenecks, while North American producers have benefited from relatively stable domestic energy supplies. Similarly, in the Asia Pacific, disruptions in shipping routes have delayed exports, affecting downstream industries such as resins, textiles, and pharmaceuticals.

Moreover, heightened geopolitical uncertainty has encouraged countries to strengthen domestic chemical production capabilities, potentially reshaping the global methenamine supply network. These factors collectively contribute to market instability, production delays, and shifting regional trade flows within the methenamine industry.

Regional Analysis

North America Held the Largest Share of the Global Methenamine Market.

In 2024, North America dominated the global methenamine market, holding about 42.9% of the total global consumption. The region holds a dominant position in the global methenamine market due to its advanced industrial base, strong pharmaceutical sector, and robust chemical manufacturing infrastructure. The region reports a high incidence of urinary tract infections, with millions of cases annually in the United States alone, driving the demand for methenamine as a preventive therapeutic. In the United States, UTIs result in approximately 10.5 million office visits, about 3 million emergency department (ED) encounters, and around 400,000 hospitalizations annually, with an estimated annual cost of US$4.8 billion.

Additionally, the well-established automotive, construction, and electronics industries in the U.S. and Canada create steady demand for methenamine-based phenolic resins used in brake linings, laminates, and circuit boards. The region’s emphasis on research and development fosters innovation in polymer processing and resin technologies, where methenamine serves as a key cross-linking and curing agent. Furthermore, stringent quality standards and regulatory compliance in North America have encouraged the use of high-purity methenamine in both medical and industrial applications. This combination of strong end-use industries and technological advancement reinforces North America’s leadership in methenamine production and consumption.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major market players in the methenamine market are Sanofi, Teva Pharmaceutical, Sun Pharma, Cipla, Aspen Pharmacare, Aurobindo Pharma, and Sandoz. These players focus on several strategic activities to enhance their sales and competitiveness. These include expanding production capacities and optimizing manufacturing efficiency to ensure consistent supply and cost control.

Many companies invest in product innovation, such as developing high-purity pharmaceutical-grade methenamine tablets. Additionally, firms emphasize compliance with international safety and environmental standards to strengthen their market credibility. Similarly, the companies form strategic distribution partnerships and collaborations with pharmaceutical and chemical manufacturers for further market expansion and customer retention.

The Major Players in The Industry

- Sanofi

- Teva Pharmaceutical

- Sun Pharma

- Cipla Ltd.

- Aspen Pharmacare

- Aurobindo Pharma

- Sandoz

- Other Key Players

Key Development

- In September 2025, Cipla, a drug firm, introduced a non-antibiotic treatment for patients suffering from recurrent urinary tract infections in India. The company launched methenamine hippurate under the brand name HUENA.

Report Scope

Report Features Description Market Value (2024) USD 432.8 Mn Forecast Revenue (2034) USD 797.3 Mn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Tablets, Powder, and Granules), By Application (Urinary Tract Infection (UTI) Treatment, Industrial Use, Fuel Tablets, Rubber Vulcanization, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Sanofi, Teva Pharmaceutical, Sun Pharma, Cipla, Aspen Pharmacare, Aurobindo Pharma, Sandoz, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

- Sanofi

- Teva Pharmaceutical

- Sun Pharma

- Cipla Ltd.

- Aspen Pharmacare

- Aurobindo Pharma

- Sandoz

- Other Key Players