Global Metaverse Market Size Analysis Report By Product (Hardware (Holographic Displays, eXtended Reality (XR) Hardware [Haptic Sensors & Devices, Smart Glasses, Omni Treadmills], AR/VR Devices, Others), Software (Asset Creation Tools, Programming Engines, Virtual Platforms, Avatar Development, Others), Services (Professional Services, Managed Services), By Platform (Desktop, Mobile, Headsets), By Technology (Blockchain, Virtual Reality (VR) & Augmented Reality (AR), Mixed Reality (MR), Others), By Application (Gaming, Online Shopping, Content Creation & Social Media, Events & Conference, Digital Marketing (Advertising), Testing and Inspection, Others), By End Use (Aerospace & Defense, Education, Tourism and Hospitality, BFSI, Retail, Media & Entertainment, Automotive, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 101905

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

- Metaverse Market size

- Key Takeaways

- Market Overview

- Data and Statistics

- Analysts’ Viewpoint

- US Expansion

- North America Market Surge

- Role of AI in Metaverse

- Product Analysis

- Platform Analysis

- Technology Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Integration of Virtual and Physical Commerce

- Restraints

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Developments

- Report Scope

Metaverse Market size

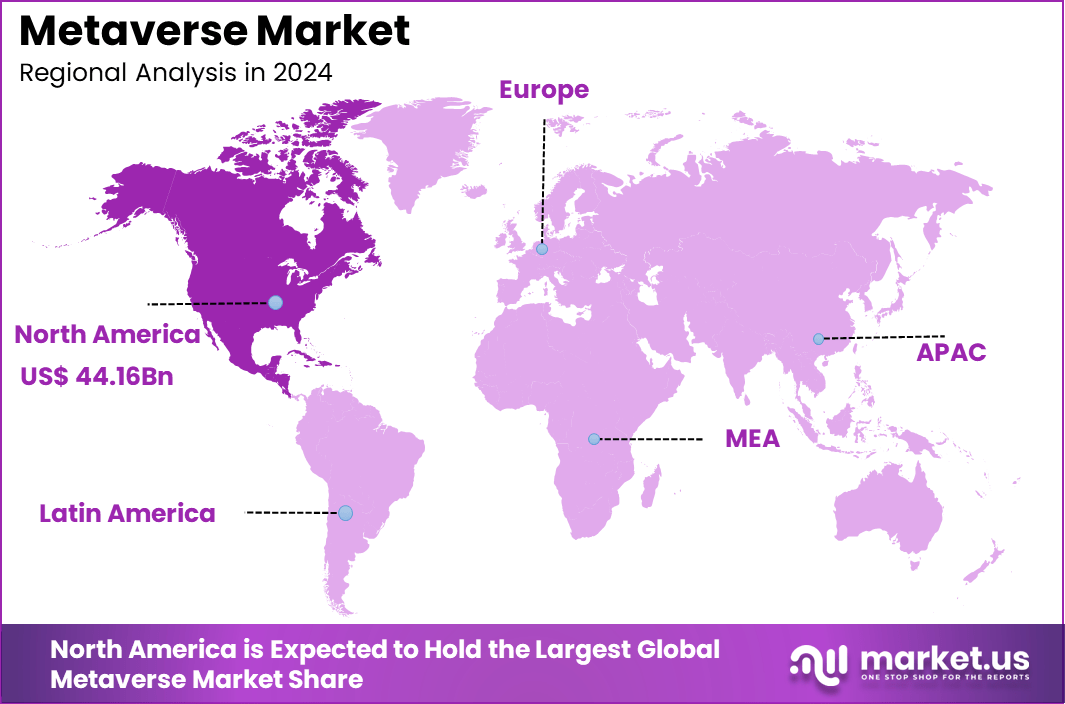

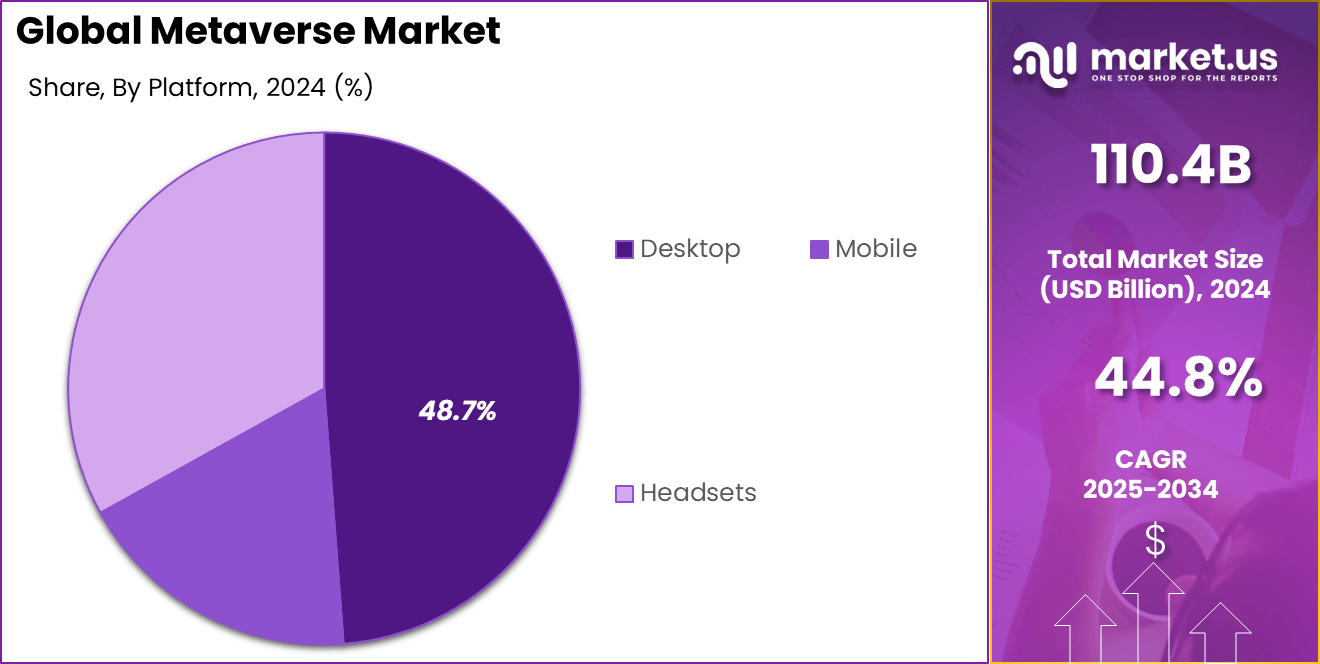

The Global Metaverse Market size is expected to be worth around USD 4,473.6 Billion By 2034, from USD 110.4 billion in 2024, growing at a CAGR of 44.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 44.16 Billion revenue. The U.S. Metaverse industry is witnessing sharp momentum, touching USD 34.4 billion in 2024, and projected to grow at 42.6% CAGR.

Key Takeaways

- In the Global Metaverse Market, the Hardware segment held a dominant position by product type in 2024, accounting for 52.8% of the total share, largely driven by demand for advanced headsets, sensors, and haptic devices.

- By platform, the Desktop segment led with a 48.7% share, indicating continued user preference for high-performance computing environments to access immersive virtual experiences.

- From a technological standpoint, Virtual Reality (VR) and Augmented Reality (AR) technologies together comprised 34.2% of the market, reflecting their foundational role in enabling interactive digital environments.

- In terms of application, Gaming remained the primary driver in 2024, capturing 25.3% of the global market, supported by the integration of multiplayer virtual worlds and user-generated content.

- By end use, the Aerospace & Defense sector held a significant 22.9% share, leveraging metaverse capabilities for simulation training, remote operations, and strategic planning modules.

Market Overview

The Metaverse is an expansive digital environment where users interact through avatars within immersive 3D spaces. It integrates technologies such as virtual reality (VR), augmented reality (AR), blockchain, and artificial intelligence (AI) to create interconnected virtual worlds. These environments facilitate activities like social interaction, commerce, education, and entertainment, offering experiences that parallel real-world interactions.

The demand for Metaverse applications is surging, particularly in sectors like gaming, where immersive experiences are paramount, and in education, where virtual classrooms offer interactive learning. Healthcare is also exploring the Metaverse for telemedicine and virtual therapy sessions. This growing demand is indicative of a broader shift towards digital-first experiences.

For instance, in January 2024, Unity Technologies entered into a strategic collaboration with Apple Inc. to advance spatial experiences, with a focus on augmented reality (AR) and spatial computing. This partnership is intended to empower developers in creating immersive digital environments that blend the physical and virtual worlds

Businesses are adopting Metaverse technologies to enhance customer engagement, streamline operations, and explore new revenue streams. Virtual showrooms, for instance, allow customers to interact with products in a 3D space, while virtual meetings and training sessions offer cost-effective and flexible solutions for workforce development.

Data and Statistics

- Based on data from demandsage, The Metaverse has over 600 million active users globally. Around 51% of them are under 13 years old, showing strong youth adoption.

- The market is valued at USD 74.4 billion. By 2026, 25% of people are expected to spend at least one hour daily in the Metaverse.

- About 54% of experts believe it will become key to the lives of 500 million people by 2040. Nearly 24% of U.S. adults think it could replace social media.

- Roblox is the leading Metaverse platform. It has 70.2 million daily active users, though other reports mention 55 million.

- As per the report from explodingtopics, By 2030, the Metaverse may add USD 5 trillion to the global economy. But awareness is still low – 31% of U.S. adults have never heard of the term.

- Still, 68% of tech experts believe the Metaverse will grow sharply in the next five years. 17% of all investments in the Metaverse come from the computer and IT sectors.

- Also, 60% of gamers use the Metaverse for more than just games. They socialize, attend events, and shop virtually.

Analysts’ Viewpoint

Investment opportunities in the metaverse are diverse, encompassing virtual real estate, NFTs, and shares in companies developing metaverse technologies. Investors are capitalizing on the growth potential of this emerging market, recognizing the metaverse’s capacity to transform traditional business models and consumer interactions.

The regulatory environment for the metaverse is evolving, with considerations around data privacy, digital asset ownership, and content moderation coming to the forefront. Governments and regulatory bodies are beginning to address these issues to ensure user protection and the responsible development of metaverse platforms.

Top impacting factors include technological innovation, consumer behavior shifts, and regulatory developments. The interplay of these elements will shape the trajectory of the metaverse, influencing how it integrates into various aspects of daily life and business operations.

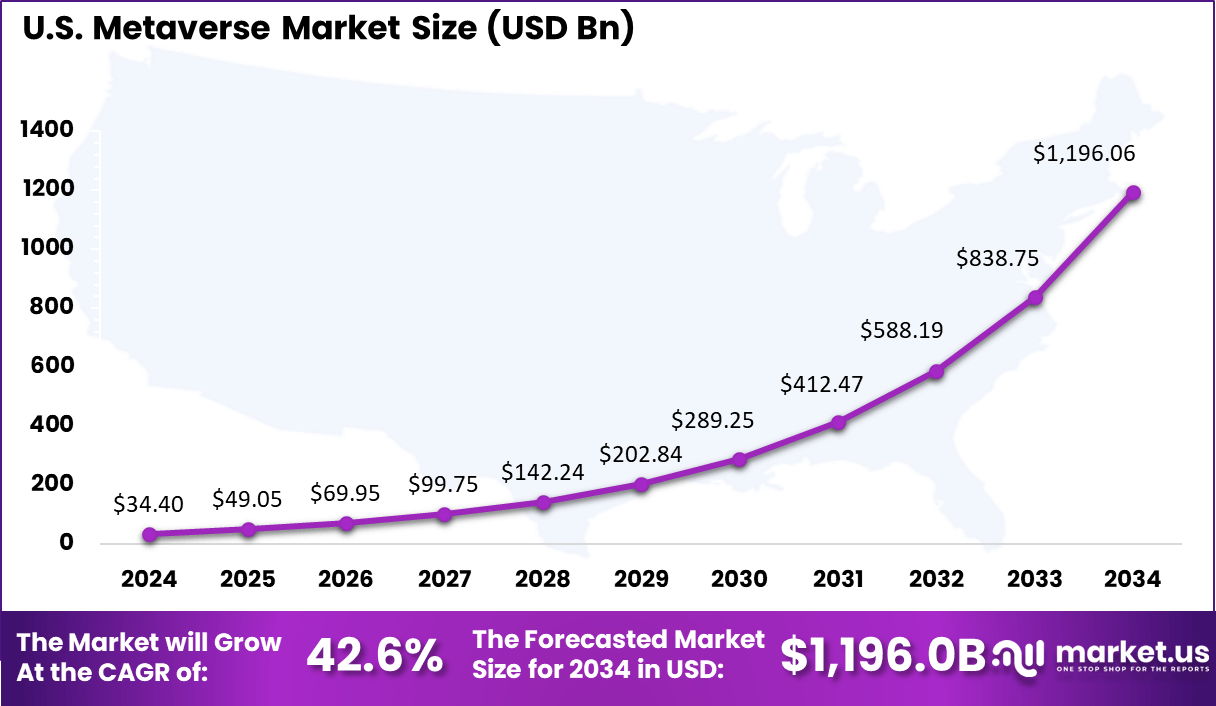

US Expansion

The US Metaverse Market is valued at approximately USD 34.40 Billion in 2024 and is predicted to increase from USD 49.05 Billion in 2025 to approximately USD 1,196.06 Billion by 2034, projected at a CAGR of 42.06% from 2025 to 2034.

North America Market Surge

In 2024, North America held a dominant position in the global metaverse market, capturing more than 42.8% of the total share and generating approximately USD 45.16 billion in revenue. This leadership is primarily attributed to the region’s advanced technological infrastructure, substantial investments in digital innovations, and the presence of leading tech companies.

The robust ecosystem in North America is further bolstered by a strong consumer base with a high propensity for adopting emerging technologies. The widespread availability of high-speed internet and the rapid rollout of 5G networks have facilitated seamless virtual experiences, encouraging greater user engagement within metaverse platforms.

Additionally, North America’s regulatory environment has been conducive to technological experimentation and commercialization. Policies supporting digital transformation and intellectual property rights have provided a stable foundation for companies to develop and deploy metaverse solutions.

Role of AI in Metaverse

Artificial Intelligence (AI) plays a pivotal role in shaping the Metaverse, transforming it from a static digital space into a dynamic, interactive, and personalized virtual environment. By integrating AI technologies, the Metaverse becomes more immersive and responsive, enhancing user experiences and enabling new forms of interaction.

One of the primary contributions of AI to the Metaverse is through the creation of intelligent virtual agents and avatars. These AI-driven entities can interact with users in real-time, providing personalized assistance, facilitating social interactions, and enhancing the overall sense of presence within virtual spaces.

For instance, AI algorithms analyze user behavior and preferences to tailor interactions, making the virtual experience more engaging and relevant. Furthermore, AI enhances content creation within the Metaverse by automating the generation of virtual environments, objects, and scenarios.

This not only accelerates the development process but also allows for the creation of more complex and diverse virtual worlds. Generative AI techniques enable the dynamic adaptation of content based on user interactions, ensuring that the virtual environment evolves in response to user behavior.

Moreover, AI contributes to the safety and moderation of the Metaverse by detecting and mitigating harmful content and behaviors. AI-driven moderation tools can identify inappropriate language, images, or actions, ensuring that virtual environments remain safe and welcoming for all users.

Product Analysis

In 2024, the hardware segment held a dominant position in the global metaverse market, capturing more than a 52.8% share. This leadership is attributed to the essential role hardware plays in enabling immersive virtual experiences.

Devices such as augmented reality (AR) and virtual reality (VR) headsets, haptic sensors, smart glasses, and holographic displays are fundamental for users to access and interact within the metaverse. The increasing demand for these devices, driven by advancements in technology and growing consumer interest, has solidified the hardware segment’s prominence.

The growth of the hardware segment is further supported by substantial investments from leading technology companies. For instance, Meta Platforms has invested heavily in its Reality Labs division, focusing on the development of advanced VR and AR devices, including the Quest series of headsets and smart glasses. These investments aim to enhance user experience by improving device performance, comfort, and affordability.

Moreover, the integration of hardware with emerging technologies has expanded its applications beyond gaming into sectors like education, healthcare, and enterprise solutions. For example, VR headsets are being utilized for virtual training programs, remote medical consultations, and collaborative work environments. This diversification has increased the demand for specialized hardware tailored to various industry needs, contributing to the segment’s growth.

Platform Analysis

In 2024, the desktop segment held a dominant market position in the global metaverse market, capturing more than a 48.7% share. This leadership is attributed to the robust processing capabilities and superior display resolutions that desktop platforms offer, which are essential for rendering complex virtual environments and ensuring immersive user experiences.

The widespread adoption of desktop platforms is further supported by their compatibility with a range of peripherals and accessories, such as advanced graphics cards, high-definition monitors, and specialized input devices. These enhancements facilitate more interactive and engaging experiences within the metaverse, particularly in applications requiring precise control and high-fidelity visuals.

Moreover, desktop platforms serve as a critical foundation for the development and testing of metaverse applications. Developers rely on the stability and performance of desktops to create, simulate, and refine virtual environments before deploying them across other platforms. This central role in the development lifecycle underscores the importance of desktops in the metaverse ecosystem.

Technology Analysis

In 2024, the Virtual Reality (VR) and Augmented Reality (AR) segment held a dominant position in the global metaverse market, capturing more than a 34.2% share. This leadership is attributed to the increasing adoption of immersive technologies across various industries, including gaming, education, healthcare, and retail.

VR provides fully immersive experiences, while AR enriches the real world by adding digital elements, making both technologies integral to the metaverse ecosystem. The growth of the VR and AR segment is further supported by continuous advancements in hardware and software.

The development of more cost-effective and high-performance headsets has made these technologies more accessible to consumers and enterprises alike. Additionally, the integration of AI and 5G technologies has enhanced the capabilities of VR and AR applications, enabling real-time interactions and more realistic simulations.

Moreover, the application of VR and AR technologies has expanded beyond entertainment. In the healthcare sector, VR is being used for surgical simulations and patient therapy, while AR assists in diagnostics and treatment planning. In education, these technologies provide interactive learning experiences, and in retail, they offer virtual try-ons and immersive shopping experiences.

Application Analysis

In 2024, the gaming segment held a dominant position in the global metaverse market, capturing more than a 25.3% share. This leadership is attributed to the immersive experiences that gaming offers, which are central to the metaverse’s appeal. Games like Roblox, Fortnite, and Decentraland have pioneered virtual worlds where users can interact, create, and transact, setting the foundation for broader metaverse applications.

The growth of the gaming segment is further supported by the integration of technologies such as virtual reality (VR) and augmented reality (AR). These technologies enhance user engagement by providing more immersive and interactive experiences. Additionally, the rise of play-to-earn models and the use of non-fungible tokens (NFTs) have introduced new economic incentives, attracting a wider audience to metaverse gaming platforms.

Moreover, the gaming industry’s existing infrastructure and user base have facilitated the rapid adoption of metaverse concepts. With a large, diverse user base across various demographics and geographic regions, gaming platforms offer a broad audience for metaverse applications to engage. This widespread adoption is further driven by the continuous development of gaming content and the community-driven nature of many gaming platforms.

End-User Analysis

In 2024, the Aerospace & Defense segment held a dominant position in the global metaverse market, capturing more than a 22.9% share. This leadership is attributed to the sector’s early adoption of immersive technologies, such as virtual reality (VR) and augmented reality (AR), to enhance training, simulation, and operational efficiency.

The growth of the Aerospace & Defense segment is further supported by significant investments in digital transformation initiatives. For instance, the U.S. Department of Defense has allocated substantial funding towards the development of VR-based training programs, aiming to reduce costs and improve readiness.

Moreover, the application of metaverse technologies in aerospace and defense extends beyond training and simulation. Digital twins, for example, allow for real-time monitoring and predictive maintenance of aircraft and other critical systems, reducing downtime and improving operational efficiency.

Key Market Segments

By Product

- Hardware

- Holographic Displays

- eXtended Reality (XR) Hardware

- Haptic Sensors & Devices

- Smart Glasses

- Omni Treadmills

- AR/VR Devices

- Others

- Software

- Asset Creation Tools

- Programming Engines

- Virtual Platforms

- Avatar Development

- Others

- Services

- Professional Services

- Managed Services

Based on Platform

- Desktop

- Mobile

- Other Platforms

Based on Technology

- Virtual Reality (VR) & Augmented Reality (AR)

- Mixed Reality (MR)

- Blockchain

- Other Technologies

By Application

- Gaming

- Online Shopping

- Content Creation & Social Media

- Events & Conference

- Digital Marketing (Advertising)

- Testing and Inspection

- Others

By End Use

- Aerospace & Defense

- Education

- Tourism and Hospitality

- BFSI

- Retail

- Media & Entertainment

- Automotive

- Others

Driver

Integration of Virtual and Physical Commerce

The metaverse is increasingly bridging the gap between virtual experiences and physical commerce, creating new avenues for consumer engagement. Platforms like Roblox have pioneered this integration by allowing users to purchase real-world products within virtual environments.

For instance, as of May 15, 2025, Roblox introduced a feature enabling brands to sell physical goods directly through its platform, enhancing the shopping experience by providing digital replicas for in-game use. This development not only enriches user interaction but also opens up novel monetization strategies for businesses, particularly in fashion and beauty sectors.

This seamless blend of digital and physical retail experiences caters to the preferences of younger demographics, especially Gen Z, who value immersive and interactive shopping. By offering tangible products alongside virtual counterparts, brands can foster deeper connections with consumers, driving loyalty and expanding their market reach.

Restraints

High Costs of Infrastructure and Maintenance

Despite its potential, the metaverse faces significant financial barriers that hinder widespread adoption. The development and maintenance of advanced metaverse components, such as extended reality (XR) hardware and high-fidelity virtual environments, entail substantial expenses. These costs can be prohibitive for many organizations, particularly small and medium-sized enterprises, limiting their ability to participate fully in the metaverse ecosystem.

Moreover, the ongoing need for technological upgrades and the scarcity of skilled professionals in this niche field exacerbate the financial burden. As a result, only well-capitalized entities can afford to invest in and sustain metaverse initiatives, potentially leading to a concentration of power among a few dominant players and stifling innovation and diversity within the space.

Opportunity

Expansion in Healthcare Applications

The metaverse presents significant opportunities in the healthcare sector, particularly in areas like surgical planning and medical training. By leveraging digital twins and immersive simulations, healthcare professionals can enhance precision in surgical procedures and improve patient outcomes. The growth is driven by the increasing demand for advanced medical technologies and the need for efficient training methods.

The metaverse enables interactive and risk-free environments for medical education, allowing practitioners to hone their skills without compromising patient safety. As the technology matures, its integration into healthcare systems is expected to become more prevalent, offering innovative solutions to longstanding challenges in the industry.

Challenge

Regulatory and Legal Uncertainties

The decentralized and immersive nature of the metaverse introduces complex regulatory and legal challenges. Traditional legal frameworks often struggle to address issues arising in virtual environments, such as jurisdictional ambiguities and the enforcement of laws across digital borders. This lack of clear regulations can lead to difficulties in addressing misconduct and protecting users’ rights within the metaverse.

Furthermore, the anonymity afforded by virtual platforms can complicate the identification and prosecution of offenders, potentially fostering environments where unethical behavior goes unchecked. To ensure the metaverse develops into a safe and equitable space, it is imperative for policymakers and industry stakeholders to collaborate on establishing comprehensive legal standards that address the unique challenges of virtual interactions.

Growth Factors

- Technological Advancements: The continuous development and enhancement of technologies like AR, VR, and MR are driving the expansion of the Metaverse by enabling more immersive experiences.

- Increased Digital Interaction: The COVID-19 pandemic has accelerated the shift towards virtual environments for work, education, and social interactions, significantly boosting the need for Metaverse platforms.

- Gaming and Entertainment Demand: The growing demand within the gaming and entertainment sectors for innovative and engaging digital experiences is propelling the market forward.

- Expansion of Digital Assets and Cryptocurrencies: The use of the Metaverse for buying and trading digital assets like NFTs, facilitated by blockchain technology, is opening new economic avenues and attracting a broader audience.

- Government and Corporate Investments: Increasing investments from governments and corporations in Metaverse infrastructure and platforms are catalyzing market growth. This includes initiatives like virtual embassies and enterprise metaverse solutions.

Emerging Trends

- Integration with Social Media: The convergence of social media platforms with gaming is creating a seamless, interactive space for users, contributing to social and entertainment dimensions in the Metaverse.

- Advancements in Hardware and Networking: Improvements in networking capabilities and the development of sophisticated VR/AR hardware are enhancing the user experience, making the Metaverse more accessible and enjoyable.

- Educational and Corporate Training Applications: There is an increasing adoption of the Metaverse for innovative educational purposes and corporate training, utilizing its capabilities to simulate real-world scenarios for better learning and training outcomes.

- Healthcare Applications: Mixed reality technologies are being increasingly utilized in healthcare for training, surgical applications, and patient care, indicating a growing sector within the Metaverse market.

- Virtual Tourism and Real Estate: The Metaverse is expanding into tourism and real estate, allowing users to explore virtual properties and locations, which is enhancing customer engagement and opening new marketing opportunities.

Business Benefits

The metaverse offers businesses innovative avenues for customer engagement and operational efficiency. Virtual showrooms and immersive advertising campaigns enable companies to showcase products in interactive environments, enhancing customer experience and brand loyalty.

In the retail sector, the metaverse enables the creation of virtual stores, providing customers with a unique shopping experience that combines the convenience of online shopping with the interactivity of physical stores. This approach not only attracts tech-savvy consumers but also opens new revenue streams through the sale of digital goods and experiences.

Key Players Analysis

In 2025, leading technology companies have emerged as key players in shaping the Metaverse. Microsoft Corporation, Meta Platforms, Inc., and Apple Inc. are driving innovation through hardware, cloud services, and immersive software tools. Meta continues to dominate VR with Quest devices, while Apple’s entry into spatial computing has intensified competition.

Microsoft integrates Metaverse tools into its enterprise platforms, enhancing collaboration in virtual environments. These firms are investing in digital twins, avatars, and AI-based interactions to create more lifelike and productive Metaverse experiences. Gaming and content companies also play a central role in advancing the Metaverse ecosystem.

Sony Group Corporation, HTC Corporation, Epic Games, Inc., and Unity Technologies are focusing on content creation, XR hardware, and game engines. Unity and Epic power a majority of real-time 3D worlds. Sony and HTC expand the VR hardware segment through advanced display and sensory technologies. Their platforms support immersive storytelling and social experiences that help retain user engagement in virtual spaces.

Top Key Players in the Market

- Microsoft Corporation

- Sony Group Corporation

- Meta Platforms, Inc.

- HTC Corporation

- Google LLC

- Apple Inc.

- Qualcomm Technologies, Inc.

- Samsung Electronics

- Activision Blizzard, Inc.

- NetEase, Inc.

- Electronic Arts Inc.

- Take-Two Interactive Software, Inc.

- Tencent

- Epic Games, Inc.

- Unity Technologies

- Accenture plc

- Adobe Inc.

- Hewlett Packard Enterprise Development LP

- Tech Mahindra Limited

- ANSYS, Inc.

- Autodesk, Inc.

- Nvidia Corporation

- Others

Recent Developments

- In May 2024, Grand Cayman-based Mai Labs launched its metaverse platform, ‘Mayaaverse’, in India, signaling its entry into the expanding intersection of AI, blockchain, and immersive virtual experiences. The launch event in Delhi also featured the debut of Lumyn XR, a virtual reality headset designed for heightened digital immersion.

- In March 2024, U.S. based software company Cornerstone acquired TALESPIN REALITY LABS, INC., a developer of virtual, augmented, and mixed reality solutions. The acquisition is aimed at embedding spatial computing and generative AI into immersive learning environments.

- In February 2024, the Royal Government of Bhutan introduced a virtual platform called Bhutanverse, offering global users a digitally reconstructed view of Bhutan’s cultural and architectural heritage. The metaverse initiative brings to life the nation’s art, philosophy, and historical landmarks in a virtual setting, enabling interactive exploration from anywhere in the world.

Report Scope

Report Features Description Market Value (2024) USD 110.4 Bn Forecast Revenue (2034) USD 4,473.6 Bn CAGR (2025-2034) 44.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product (Hardware (Holographic Displays, eXtended Reality (XR) Hardware [Haptic Sensors & Devices, Smart Glasses, Omni Treadmills], AR/VR Devices, Others), Software (Asset Creation Tools, Programming Engines, Virtual Platforms, Avatar Development, Others), Services (Professional Services, Managed Services), By Platform (Desktop, Mobile, Headsets), By Technology (Blockchain, Virtual Reality (VR) & Augmented Reality (AR), Mixed Reality (MR), Others), By Application (Gaming, Online Shopping, Content Creation & Social Media, Events & Conference, Digital Marketing (Advertising), Testing and Inspection, Others), By End Use (Aerospace & Defense, Education, Tourism and Hospitality, BFSI, Retail, Media & Entertainment, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Sony Group Corporation, Meta Platforms, Inc., HTC Corporation, Google LLC, Apple Inc., Qualcomm Technologies, Inc., Samsung Electronics, Activision Blizzard, Inc., NetEase, Inc., Electronic Arts Inc., Take-Two Interactive Software, Inc., Tencent, Epic Games, Inc., Unity Technologies, Accenture plc, Adobe Inc., Hewlett Packard Enterprise Development LP, Tech Mahindra Limited, ANSYS, Inc., Autodesk, Inc., Nvidia Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Microsoft Corporation

- Sony Group Corporation

- Meta Platforms, Inc.

- HTC Corporation

- Google LLC

- Apple Inc.

- Qualcomm Technologies, Inc.

- Samsung Electronics

- Activision Blizzard, Inc.

- NetEase, Inc.

- Electronic Arts Inc.

- Take-Two Interactive Software, Inc.

- Tencent

- Epic Games, Inc.

- Unity Technologies

- Accenture plc

- Adobe Inc.

- Hewlett Packard Enterprise Development LP

- Tech Mahindra Limited

- ANSYS, Inc.

- Autodesk, Inc.

- Nvidia Corporation

- Others