Global Mobile Managed Services Market Size, Share, Statistics Analysis Report By Function (Mobile Device Management, Mobile Application Management, Mobile Security, Other Functions), By Deployment (Cloud, On-premise), By End-user Industry (IT and Telecom, BFSI, Healthcare, Manufacturing, Retail, Education, Other End-user Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140783

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

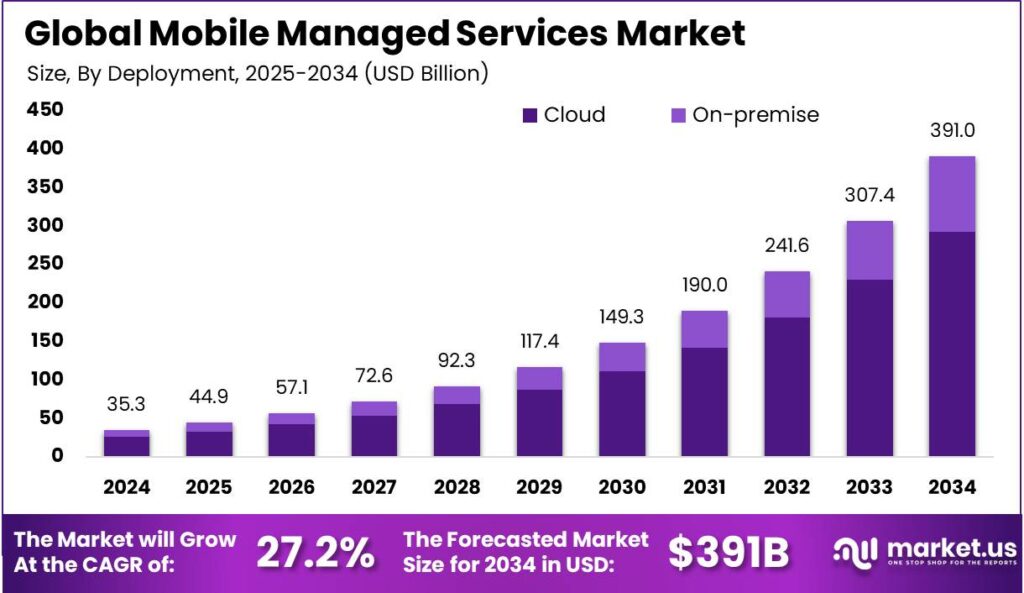

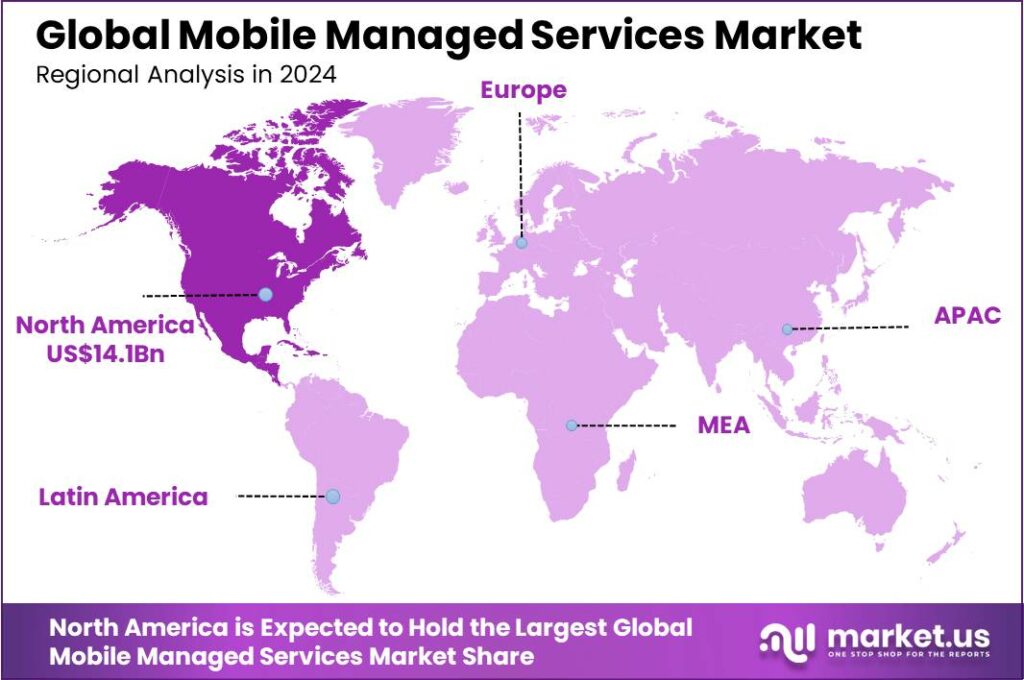

The Global Mobile Managed Services Market size is expected to be worth around USD 391 Billion By 2034, from USD 35.26 Billion in 2024, growing at a CAGR of 27.20% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position in the Mobile Managed Services market, capturing more than 40% of the global share, with revenues amounting to USD 14.1 billion.

The Mobile Managed Services market is growing due to several key factors such as the increasing reliance on mobile devices in the corporate sector drives demand for comprehensive management solutions to ensure smooth operations and security. Additionally, the rise of remote working models has heightened the need for robust mobile management to effectively support a dispersed workforce.

Advancements in mobile technology and the increasing complexity of mobile infrastructure require specialized expertise, which mobile managed services can provide. Additionally, the push for digital transformation across industries drives organizations to leverage mobile technologies for enhanced operational agility.

Emerging trends in Mobile Managed Services are reshaping the landscape. The rise of remote working has increased the demand for comprehensive mobile management solutions to support a distributed workforce. Additionally, the integration of AI and machine learning is becoming more common, providing smarter analytics and predictive maintenance capabilities.

Based on data from JumpCloud, nearly 90% of SMBs either currently rely on a Managed Service Provider (MSP) for some IT needs or are actively considering it. This highlights the growing trust in MSPs as businesses seek cost-effective and efficient IT solutions.

Large organizations are also adopting this approach, with 60% of global enterprises using MSPs to streamline IT and cloud services. The demand for MSPs extends beyond traditional IT, as 78% of organizations see them as a key solution for Internet of Things (IoT) management.

Cybersecurity remains a top concern, with 60% of respondents citing it as their main challenge and a driving factor in choosing an MSP. Additionally, 48% of businesses believe MSPs manage device security and remote work transitions better than in-house IT teams. Beyond security, MSPs deliver measurable financial and operational benefits – companies can cut IT costs by 20-30%, boost productivity by 15-25%, and reduce cyberattack risks by up to 50%.

Technological innovations are driving the Mobile Managed Services market, with AI adoption being a key advancement. AI enables proactive mobile device management and security, identifying issues before they escalate. Cloud-based mobile management solutions are increasingly popular, providing scalable, flexible services for remote management of devices, apps, and content, essential for modern mobile and remote work.

The Mobile Managed Services market is expanding across sectors like healthcare, finance, and education, driven by the need for secure and efficient mobile management. As businesses recognize the value of mobile technology for productivity and consumer engagement, demand for these services grows. This expansion is supported by advancements in mobile technologies and the complexity of mobile apps, which require specialized expertise for effective management.

Key Takeaways

- The Global Mobile Managed Services Market is expected to be worth around USD 391 Billion by 2034, up from USD 35.26 Billion in 2024, growing at a CAGR of 27.20% during the forecast period from 2025 to 2034.

- In 2024, the Mobile Device Management (MDM) segment held a dominant position in the Mobile Managed Services market, capturing more than 40% of the market share.

- In 2024, the Cloud segment within the Mobile Managed Services market also held a dominant position, capturing more than 75% of the market share.

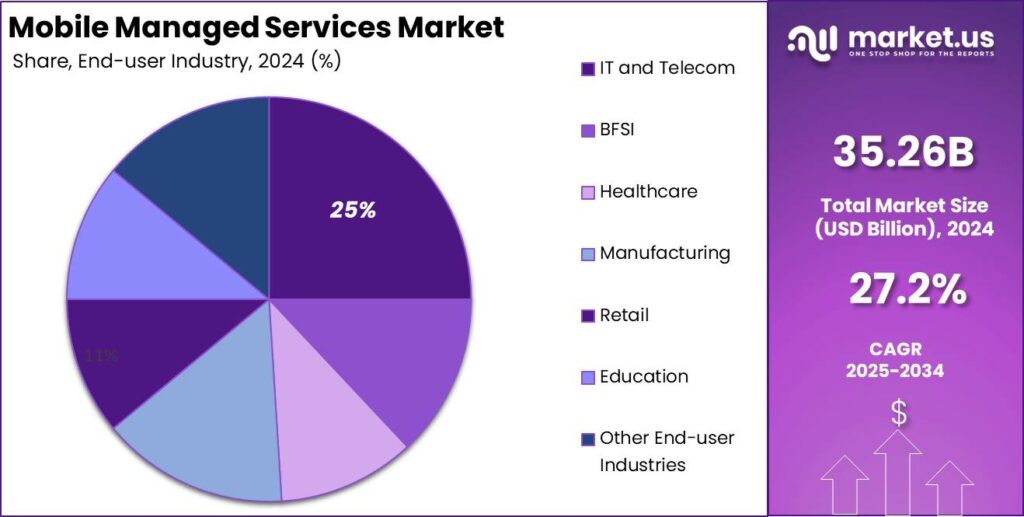

- The IT and Telecom segment held a dominant market position within the Mobile Managed Services market in 2024, capturing more than 25% of the global share.

- In 2024, North America held a dominant market position in the Mobile Managed Services market, capturing more than 40% of the global share, with revenues amounting to USD 14.1 billion.

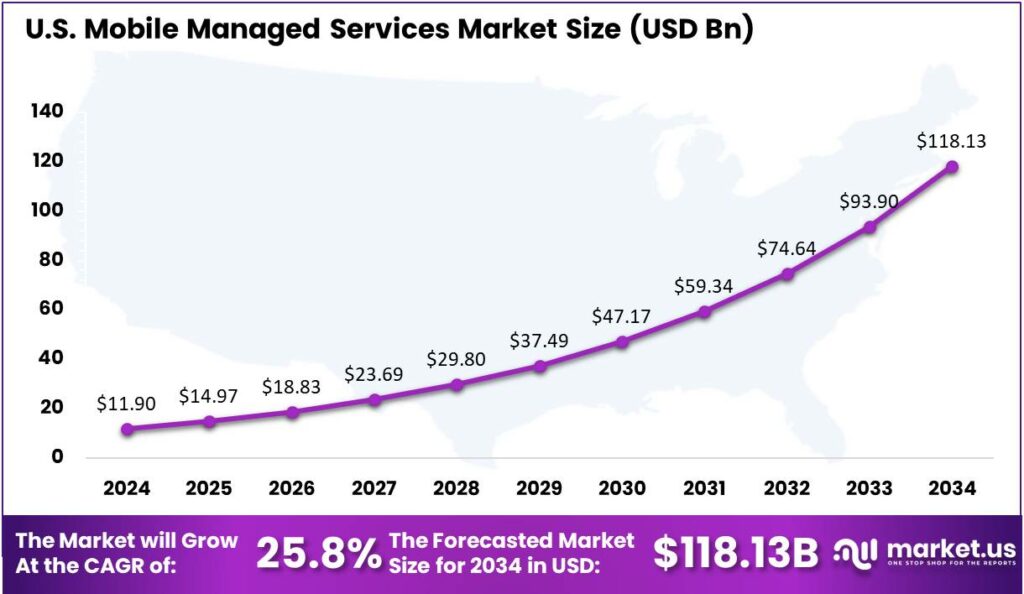

- The U.S. Mobile Managed Services Market was estimated to be valued at USD 11.9 billion in 2024. It is projected to expand at a CAGR of 25.8%.

U.S. Market Size

In 2024, the U.S. Mobile Managed Services Market was estimated to be valued at USD 11.9 billion. It is projected to expand at a Compound Annual Growth Rate (CAGR) of 25.8%.

The robust growth of the U.S. Mobile Managed Services Market can be attributed to the increasing reliance on mobile technology across various business sectors, coupled with the escalating need for enhanced operational efficiency and security in mobile operations. Enterprises are progressively adopting mobile managed services to streamline their mobile operations, manage device lifecycle, ensure data security, and comply with regulatory requirements.

Furthermore, the evolution of mobile technology and the advent of 5G are set to fuel the demand for more sophisticated mobile managed services. As businesses transition towards more integrated and technology-driven operations, the need for comprehensive services that can support high-speed data services and cloud-based applications will drive market growth.

In 2024, North America held a dominant market position in the Mobile Managed Services Market, capturing more than 40% of the global share, with revenues amounting to USD 14.1 billion. This leading stance is primarily attributed to the high adoption rates of mobile technologies and digital transformation strategies across various sectors, including healthcare, finance, and retail.

The concentration of large enterprises and the increasing trend of bring-your-own-device (BYOD) policies further fuel demand in this region. These enterprises are leveraging mobile managed services to enhance their operational efficiencies and secure corporate data on mobile devices, which is pivotal given the growing concerns regarding data breaches and cybersecurity threats.

The expansion of 5G technology and IoT in North America are set to offer new growth opportunities for the mobile managed services market. The rapid deployment of 5G networks is expected to enhance mobile connectivity and enable more sophisticated mobile applications, which in turn will increase the complexity of mobile operations.

North America’s advanced technological landscape, combined with regulatory and security requirements, positions it as a leader in the global mobile managed services market. Its continued growth is supported by the increasing complexity of mobile and digital environments that require sophisticated management and security solutions.

Function Analysis

In 2024, the Mobile Device Management (MDM) segment held a dominant position in the Mobile Managed Services market, capturing more than a 40% share. This segment leads primarily due to the escalating need for enterprises to enhance security and manage a growing array of mobile devices efficiently.

MDM solutions facilitate centralized control of all mobile devices within an organization, encompassing smartphones, tablets, and laptops, thus ensuring consistent application of security policies and updates. This is crucial for organizations aiming to safeguard their corporate data against unauthorized access and cyber threats.

The Mobile Application Management (MAM) segment plays a key role in the Mobile Managed Services market. It focuses on managing and securing mobile apps, enabling IT administrators to control and protect app data. MAM solutions are crucial for businesses using custom applications to enhance productivity while safeguarding the data these apps handle.

Mobile security is a vital area focused on addressing the security challenges of mobile computing. It includes services like threat defense, malware protection, and secure mobile gateways. As cyber threats grow and mobile device breaches rise, mobile security becomes essential in protecting corporate networks and sensitive data. Companies invest in this to reduce risks associated with mobile access.

Deployment Analysis

In 2024, the Cloud segment within the Mobile Managed Services market held a dominant position, capturing more than a 75% share. This substantial market share is largely due to the flexibility and scalability offered by cloud-based solutions.

As businesses increasingly adopt remote working models and digital transformation strategies, the demand for cloud services that can be scaled up or down based on usage has surged. Moreover, cloud deployment reduces the need for substantial upfront capital investment in IT infrastructure, making it a cost-effective solution for organizations of all sizes.

The leadership of the Mobile Cloud segment in the market can also be attributed to its inherent operational advantages. Cloud-based mobile managed services provide businesses with the ability to manage their mobile assets and security from any location, which is invaluable in today’s global and mobile workforce environment.

The Cloud segment’s dominance is strengthened by advanced security features essential for companies managing sensitive data on mobile devices. Cloud providers invest significantly in cutting-edge security protocols and infrastructure, offering stronger protection than many individual companies can afford or manage independently.

End-user Industry Analysis

In 2024, the IT and Telecom segment held a dominant market position within the Mobile Managed Services Market, capturing more than a 25% share. This segment’s leadership is primarily driven by the critical need for robust mobile communication and data services within these industries.

The rapid evolution of telecom standards and the rollout of technologies like 5G require continuous upgrades and maintenance of mobile infrastructure. Mobile managed services are essential in supporting these upgrades by offering expertise and resources, ensuring seamless integration with existing technologies, and managing the lifecycle of deployed services.

Additionally, cybersecurity remains a top priority for the IT and Telecom industries, given the sensitive nature of the data they handle. Mobile managed services offer comprehensive security solutions that include regular updates, threat monitoring, and compliance management, which are vital for protecting against data breaches and cyber attacks.

The adoption of cloud-based solutions in IT and Telecom drives the demand for mobile managed services. These services ensure high availability, performance, and security management for cloud solutions. Mobile managed services providers offer tailored solutions, helping IT and Telecom sectors optimize costs, improve efficiencies, and manage mobile and cloud resources effectively.

Key Market Segments

By Function

- Mobile Device Management

- Mobile Application Management

- Mobile Security

- Other Functions

By Deployment

- Cloud

- On-premise

By End-user Industry

- IT and Telecom

- BFSI

- Healthcare

- Manufacturing

- Retail

- Education

- Other End-user Industries

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Adoption of BYOD Policies

The rise of Bring Your Own Device (BYOD) policies has significantly influenced the demand for Mobile Managed Services (MMS). Organizations are increasingly allowing employees to use personal devices for work purposes, aiming to enhance flexibility and productivity. This shift necessitates robust management solutions to ensure security and efficiency across diverse devices and operating systems.

MMS providers offer comprehensive services that address these needs, including device management, application support, and security measures. By outsourcing these functions, companies can maintain control over their IT environment while accommodating the varied device preferences of their workforce. This trend is particularly prominent in sectors like IT and telecommunications, where mobility and rapid access to information are critical.

Restraint

Security Concerns with Corporate Data on Personal Devices

While BYOD policies offer numerous benefits, they also introduce significant security challenges. Allowing personal devices to access corporate networks increases the risk of data breaches, as these devices may lack standardized security protocols. Managed Mobility Services aim to mitigate these risks by implementing security measures such as encryption, remote wiping, and secure access controls.

However, ensuring consistent security across a multitude of personal devices remains a complex task. Variations in device types, operating systems, and user behaviors can create vulnerabilities that are difficult to manage. Additionally, employees may resist security policies that they perceive as intrusive, leading to potential compliance issues. These factors can hinder the adoption of MMS, as organizations weigh the benefits of mobility against the imperative of protecting sensitive information.

Opportunity

Emergence of Cloud-Based Solutions

The proliferation of cloud computing presents a significant opportunity for the expansion of Mobile Managed Services. Cloud-based MMS solutions offer scalable and flexible management of mobile devices and applications, enabling organizations to adapt quickly to changing technological landscapes. These services facilitate seamless updates, centralized management, and improved collaboration, all while reducing the need for substantial on-premises infrastructure investments.

As businesses increasingly migrate to cloud environments, MMS providers can capitalize on this trend by offering integrated services that enhance mobile productivity and security. The ability to manage devices and applications through the cloud also supports remote workforces, a growing segment in the modern business world. This alignment with current technological advancements positions cloud-based MMS as a strategic asset for organizations aiming to maintain competitiveness and operational efficiency.

Challenge

Complexity of Managing Diverse Mobile Device Landscape

The diverse range of mobile devices and operating systems in use today presents a significant challenge for Mobile Managed Services. Organizations must manage a multitude of device types, each with its own specifications, security requirements, and compatibility issues. This complexity is compounded by frequent updates and the rapid introduction of new devices into the market.

Managed Mobility Service providers must develop adaptable solutions that can accommodate this diversity without compromising security or user experience. Achieving this requires continuous investment in technology and expertise, as well as the development of standardized protocols that can be applied across various platforms. The ability to effectively manage this complexity is crucial for the success of MMS, as it directly impacts the efficiency and security of an organization’s mobile operations.

Emerging Trends

One significant trend is the integration of Artificial Intelligence (AI) and automation into mobile device management. AI enhances efficiency and security by automating routine tasks and identifying potential threats, allowing businesses to manage their mobile assets more effectively.

The adoption of cloud-based solutions is also on the rise, offering scalability and flexibility. Cloud-managed networks enable organizations to oversee their wireless infrastructure without on-premises controllers, facilitating seamless management of mobile devices.

The rise of the Internet of Things (IoT) has expanded the scope of MMS. Businesses are now managing a diverse array of connected devices, from sensors to smart appliances, necessitating comprehensive MMS solutions that can handle the complexity and scale of IoT ecosystems.

Edge computing is another emerging trend, bringing data processing closer to the source. This approach reduces latency and enhances real-time data handling, which is crucial for applications requiring immediate responses, such as augmented reality and real-time analytics.

Business Benefits

One primary advantage is cost savings. By outsourcing mobile device management, companies can reduce expenses related to device procurement, maintenance, and support. Managed services provide expertise and oversight, ensuring that resources are utilized efficiently and effectively.

Enhanced security is another significant benefit. MMS providers offer advanced security measures, including real-time threat detection and compliance monitoring, which help protect sensitive data and reduce business risks associated with mobile device usage.

Improved productivity is achieved through streamlined device management. With professional support, employees experience minimized downtime and receive prompt assistance, allowing them to focus on core business activities without technical interruptions.

Additionally, MMS provides real-time insights into device usage and location, facilitating better decision-making and resource allocation. Access to detailed analytics allows businesses to monitor performance and optimize operations effectively.

Key Player Analysis

AT&T is a major player in the mobile managed services market. With its vast experience in telecommunications, AT&T provides a range of mobile solutions, including managed mobility services, network security, and mobile device management. AT&T’s global reach and strong infrastructure allow businesses to streamline their mobile operations and ensure secure, reliable connectivity.

Fujitsu stands out for its comprehensive mobile managed services, combining its IT expertise with cutting-edge mobile technology solutions. Known for its robust cloud services, Fujitsu offers customized mobile management solutions that cater to different industries, from healthcare to manufacturing.

Kyndryl, a spin-off from IBM, is an emerging force in the mobile managed services sector. The company provides a full suite of mobile management services, with a strong emphasis on digital transformation and cloud integration. Kyndryl helps businesses optimize their mobile operations through strategic management of mobile devices, networks, and applications.

Top Key Players in the Market

- AT&T Intellectual Property

- Fujitsu

- Kyndryl Inc.

- Wipro

- Orange SA

- Telefónica SA

- Samsung Electronics Co. Ltd

- Hewlett Packard Enterprise

- Vodafone Group PLC

- Microsoft Corporation

- Tech Mahindra

- Other Key Players

Top Opportunities Awaiting for Players

The Mobile Managed Services market is poised for significant growth and transformation, offering a range of opportunities for players in the industry to capitalize on emerging trends and technologies.

- AI-Driven Managed Services: As artificial intelligence (AI) continues to mature, its integration into managed services is becoming a critical differentiator for service providers. Companies that advance their AI capabilities can offer more automated, efficient, and personalized services, enhancing client satisfaction and operational efficiency.

- Cybersecurity Services Expansion: With the increasing frequency and sophistication of cyber threats, there is a growing demand for managed security services. Companies can capitalize on this need by offering advanced cybersecurity solutions, such as multi-factor authentication and endpoint detection and response, to protect clients’ digital assets.

- Cloud-Based Mobility Solutions: The shift towards cloud-based solutions continues to dominate, providing scalability and flexibility that traditional IT infrastructure cannot match. Providers that offer robust cloud-based managed mobility services, including mobile application management and device security, will attract more clients looking to enhance their operational agility.

- Customized and Industry-Specific Solutions: There is a rising demand for tailored solutions that cater specifically to the needs of different industries such as healthcare, retail, and manufacturing. Providers that can deliver industry-specific capabilities and integrations will distinguish themselves from competitors and lock in customer loyalty.

- Sustainability and ESG Compliance: As sustainability becomes a more pressing concern, managed service providers that incorporate eco-friendly practices and solutions into their offerings will likely see increased demand. This includes optimizing energy usage in data centers and supporting clients’ environmental, social, and governance (ESG) compliance efforts.

Recent Developments

- In October 2024, AT&T is focusing on expanding its wireless and 5G services to reach more small and midsize business customers. This shift is part of its strategy to boost business revenue through next-generation connectivity services.

- Fujitsu strengthened its Open RAN collaboration with AT&T in December 2024, supplying radio units for AT&T’s network modernization. The partnership highlights Fujitsu’s growing role in 5G infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 35.26 Bn Forecast Revenue (2034) USD 391 Bn CAGR (2025-2034) 27.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Function (Mobile Device Management, Mobile Application Management, Mobile Security, Other Functions), By Deployment (Cloud, On-premise), By End-user Industry (IT and Telecom, BFSI, Healthcare, Manufacturing, Retail, Education, Other End-user Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AT&T Intellectual Property, Fujitsu, Kyndryl Inc., Wipro, Orange SA, Telefónica SA, Samsung Electronics Co. Ltd, Hewlett Packard Enterprise, Vodafone Group PLC, Microsoft Corporation, Tech Mahindra, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Managed Services MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Managed Services MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AT&T Intellectual Property

- Fujitsu

- Kyndryl Inc.

- Wipro

- Orange SA

- Telefónica SA

- Samsung Electronics Co. Ltd

- Hewlett Packard Enterprise

- Vodafone Group PLC

- Microsoft Corporation

- Tech Mahindra

- Other Key Players